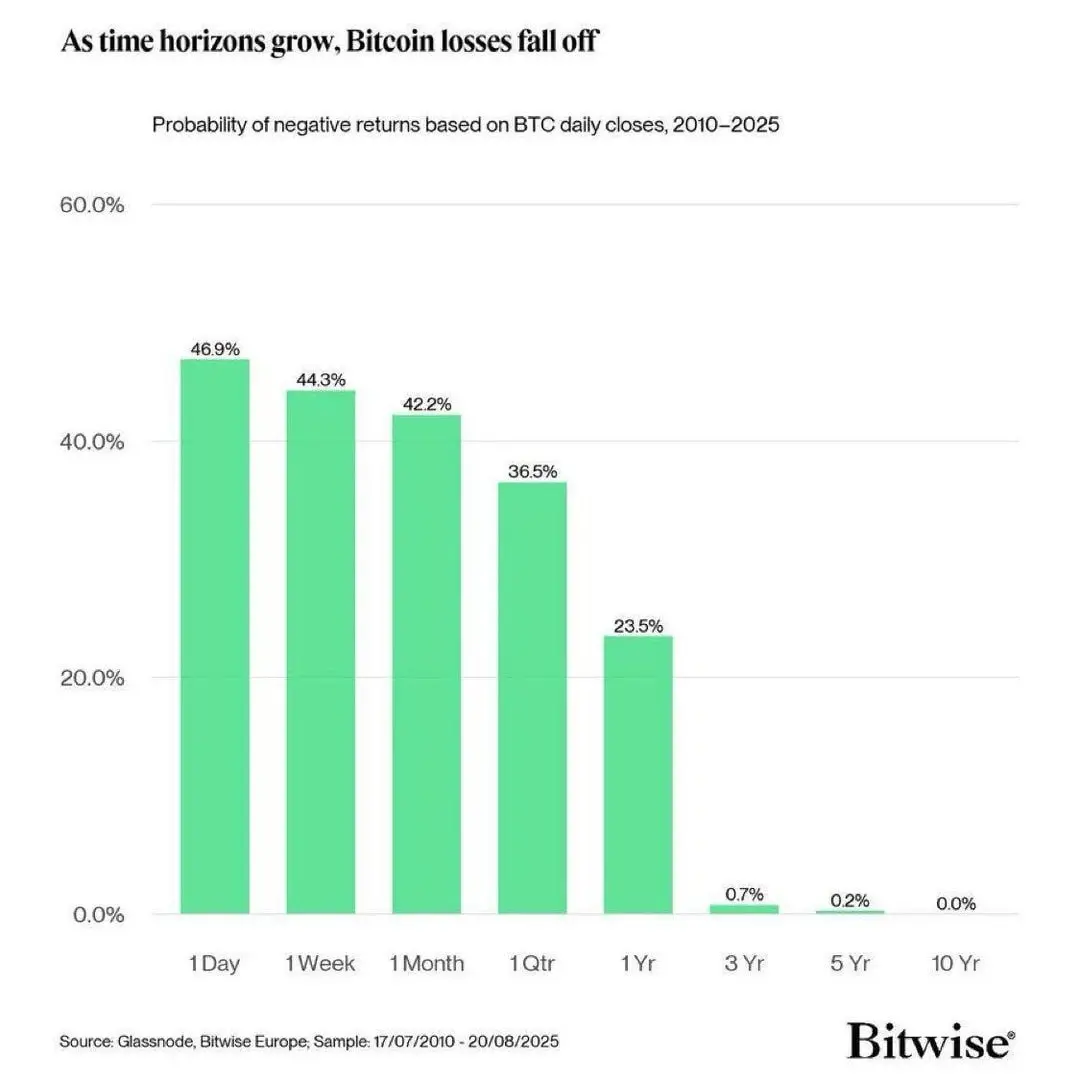

Bitcoin may face further fall risks.

Odaily News K 33 analysts indicate that the recent market weakness may not yet be over, with leverage spiking and a significant amount of funds shifting towards Ether, potentially putting Bitcoin at further risk of falling. K 33 research director Vetle Lunde stated in a report on Tuesday that the nominal open interest in Bitcoin perpetual futures has surged to its highest point in two years, exceeding 310,000 BTC (34 billion USD), with an increase of 41,607 BTC in just the past two months, and a substantial rise of 13,472 BTC over the weekend, marking a p

Odaily News K 33 analysts indicate that the recent market weakness may not yet be over, with leverage spiking and a significant amount of funds shifting towards Ether, potentially putting Bitcoin at further risk of falling. K 33 research director Vetle Lunde stated in a report on Tuesday that the nominal open interest in Bitcoin perpetual futures has surged to its highest point in two years, exceeding 310,000 BTC (34 billion USD), with an increase of 41,607 BTC in just the past two months, and a substantial rise of 13,472 BTC over the weekend, marking a p

BTC-0,49%