inertia_A1

No content yet

inertia_A1

Smart money is waking up again.

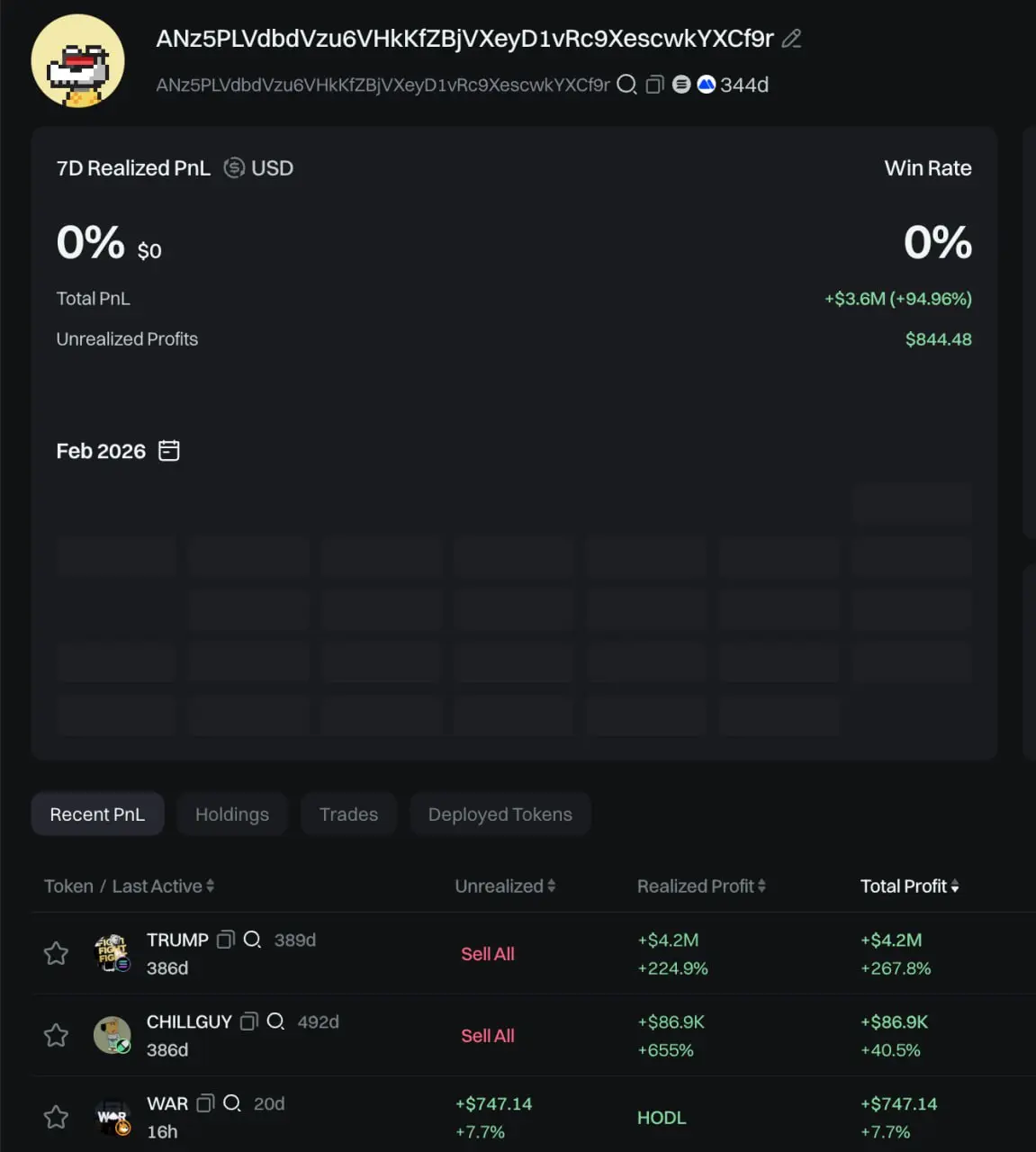

Trader ANz5PL, who famously pulled $4.2M in profit on $TRUMP , just made his first move after 8 months of complete inactivity.

Today, he spent 112 $SOL (~$9.7K) to scoop up 307,159 $WAR.

Dormant wallets don’t move without conviction. When experienced traders re-enter the market, it’s rarely noise — it’s positioning.

Worth keeping $WAR on the radar.

#BuyTheDipOrWaitNow?

Trader ANz5PL, who famously pulled $4.2M in profit on $TRUMP , just made his first move after 8 months of complete inactivity.

Today, he spent 112 $SOL (~$9.7K) to scoop up 307,159 $WAR.

Dormant wallets don’t move without conviction. When experienced traders re-enter the market, it’s rarely noise — it’s positioning.

Worth keeping $WAR on the radar.

#BuyTheDipOrWaitNow?

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

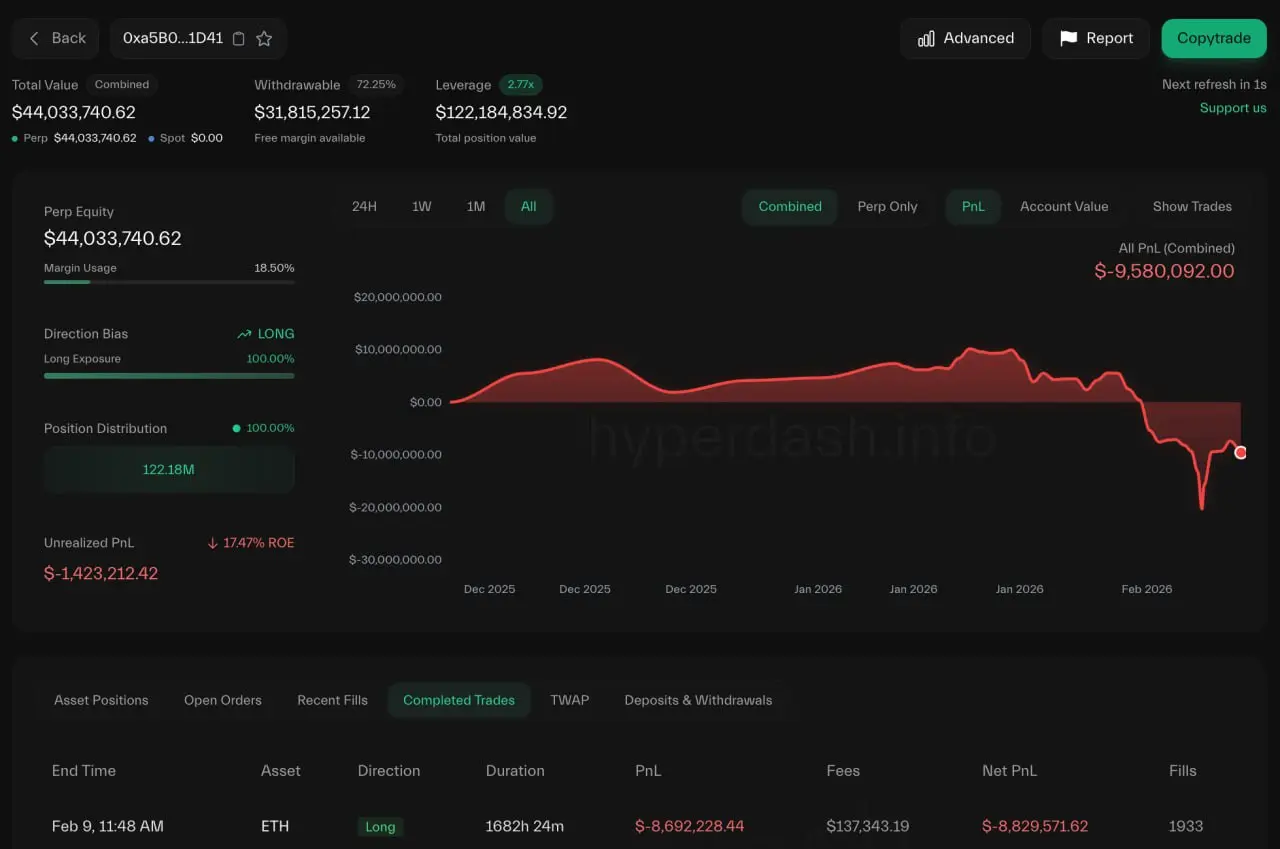

Conviction vs. Leverage a real-time lesson in $ETH trading

A known $ETH bull, 0xa5B0, just closed a 70+ day long at an $8.8M loss only to re-enter immediately with a 20× leveraged long on 60,000 ETH (~$122M).

Within hours, that position is already down another $1.4M.

This isn’t just a whale trade it’s a reminder:

Strong conviction doesn’t cancel timing risk

High leverage compresses patience

Even seasoned players get tested when markets chop

Markets don’t reward belief. They reward positioning.

A known $ETH bull, 0xa5B0, just closed a 70+ day long at an $8.8M loss only to re-enter immediately with a 20× leveraged long on 60,000 ETH (~$122M).

Within hours, that position is already down another $1.4M.

This isn’t just a whale trade it’s a reminder:

Strong conviction doesn’t cancel timing risk

High leverage compresses patience

Even seasoned players get tested when markets chop

Markets don’t reward belief. They reward positioning.

ETH-1,85%

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

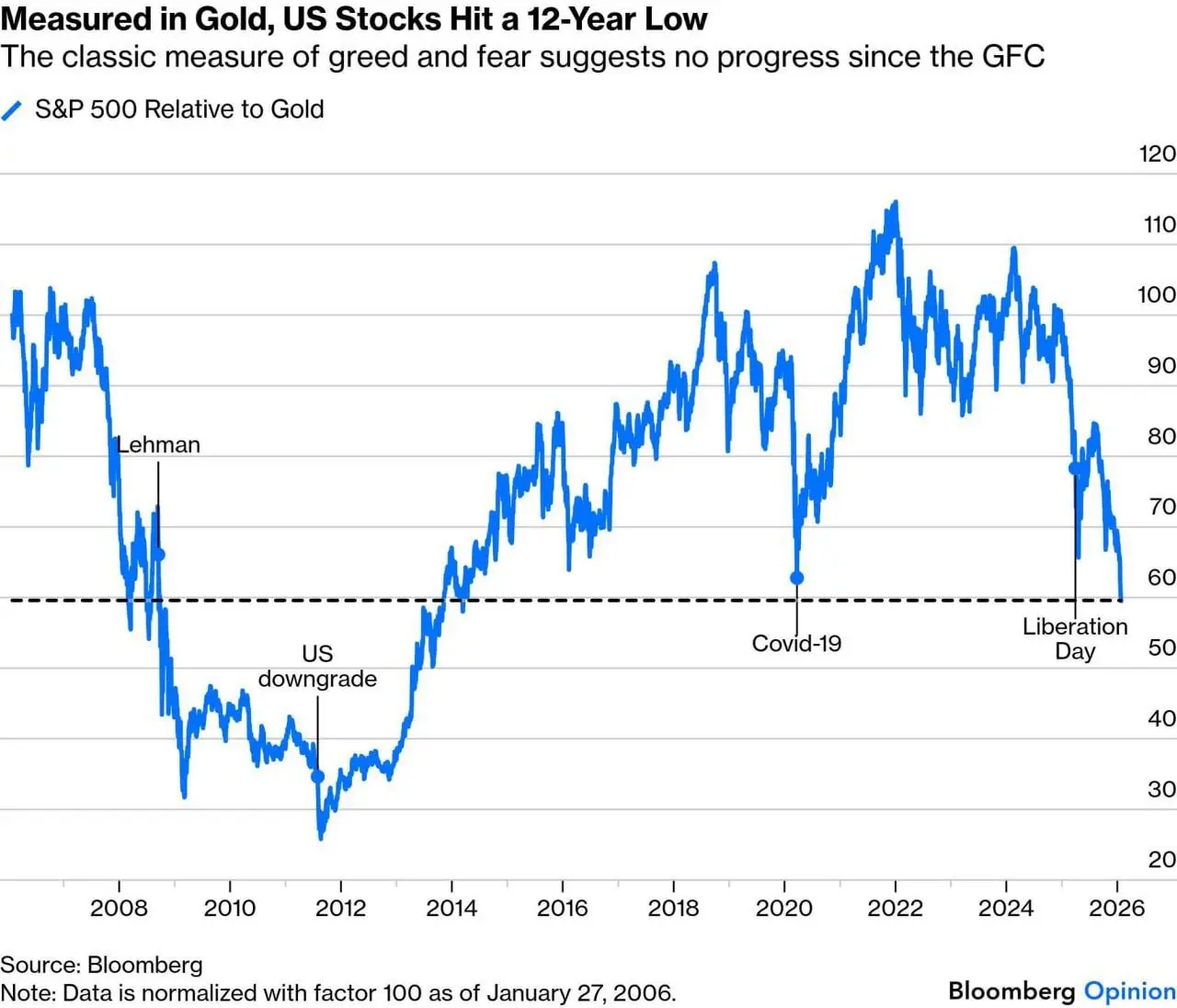

If you stop measuring the U.S. stock market in dollars and measure it in gold, the picture changes completely.

In gold terms, U.S. equities haven’t been compounding wealth — they’ve been losing purchasing power. The apparent “all-time highs” are largely a reflection of dollar debasement, not real value creation. Gold doesn’t care about rate cuts, earnings narratives, or CPI optics. It measures truth in scarcity.

This is why long-cycle investors track stocks priced in hard assets, not fiat. When stocks rise but gold rises faster, real wealth is quietly rotating — not growing.

Nominal gains can

In gold terms, U.S. equities haven’t been compounding wealth — they’ve been losing purchasing power. The apparent “all-time highs” are largely a reflection of dollar debasement, not real value creation. Gold doesn’t care about rate cuts, earnings narratives, or CPI optics. It measures truth in scarcity.

This is why long-cycle investors track stocks priced in hard assets, not fiat. When stocks rise but gold rises faster, real wealth is quietly rotating — not growing.

Nominal gains can

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Leverage reset in real time.

Nearly $167M in long positions were liquidated across the crypto market in the past hour.

Overcrowded trades met volatility a sharp reminder that momentum cuts both ways.

Risk didn’t disappear; it repriced fast.

$BTC $ETH

#PreciousMetalsPullBack

Nearly $167M in long positions were liquidated across the crypto market in the past hour.

Overcrowded trades met volatility a sharp reminder that momentum cuts both ways.

Risk didn’t disappear; it repriced fast.

$BTC $ETH

#PreciousMetalsPullBack

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

DYOR 🤓View More

Policy risk back on the table.

Donald Trump says he will announce the new Federal Reserve Chair next week.

Markets are already recalibrating — rate expectations, dollar strength, and risk assets will all take cues from this decision.

#FedKeepsRatesUnchanged

$BTC $ETH

Donald Trump says he will announce the new Federal Reserve Chair next week.

Markets are already recalibrating — rate expectations, dollar strength, and risk assets will all take cues from this decision.

#FedKeepsRatesUnchanged

$BTC $ETH

- Reward

- 4

- 2

- Repost

- Share

dragon_fly2 :

:

Watching Closely 🔍️View More

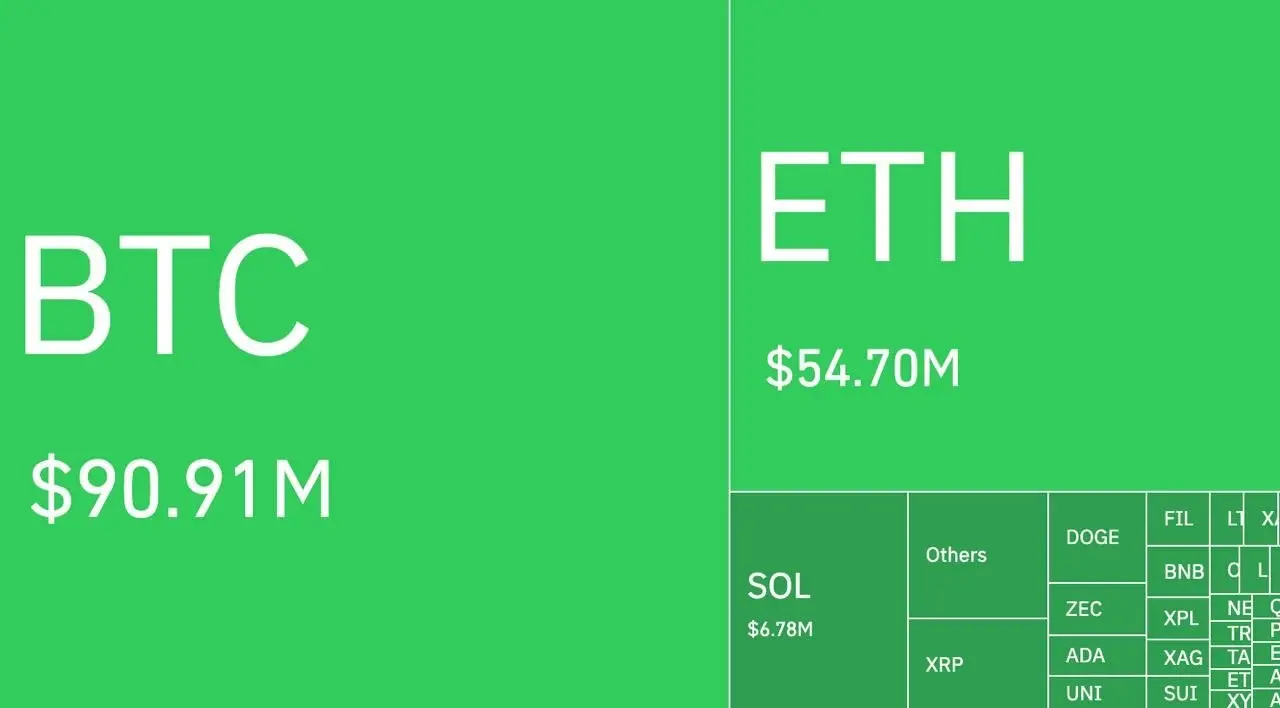

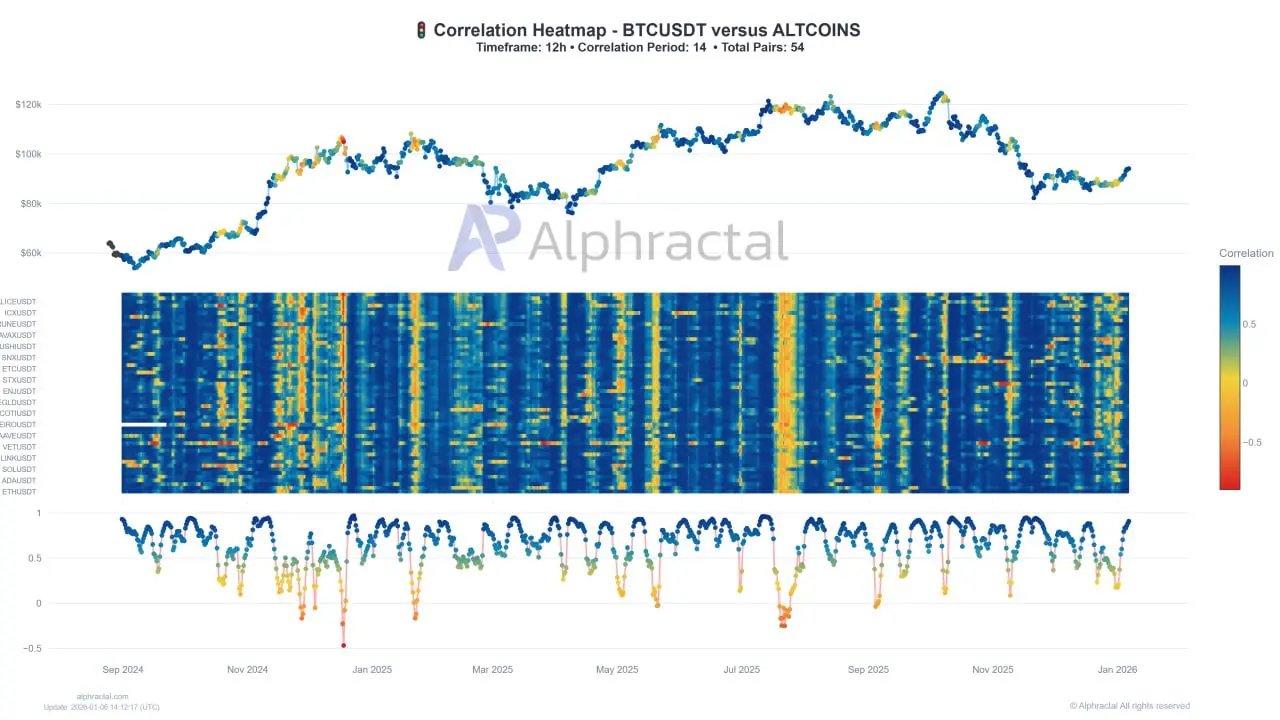

$BTC sets the tempo for the entire market.

The correlation between Bitcoin and altcoins remains high. When BTC moves, liquidity, sentiment, and risk appetite shift across the board—and altcoins usually follow the same direction, often with higher volatility.

This is why BTC isn’t just another asset. It’s the benchmark.

Track Bitcoin first, understand the move, then position on alts accordingly.

#BitcoinSix-DayRally

The correlation between Bitcoin and altcoins remains high. When BTC moves, liquidity, sentiment, and risk appetite shift across the board—and altcoins usually follow the same direction, often with higher volatility.

This is why BTC isn’t just another asset. It’s the benchmark.

Track Bitcoin first, understand the move, then position on alts accordingly.

#BitcoinSix-DayRally

BTC-1,48%

- Reward

- 4

- 8

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

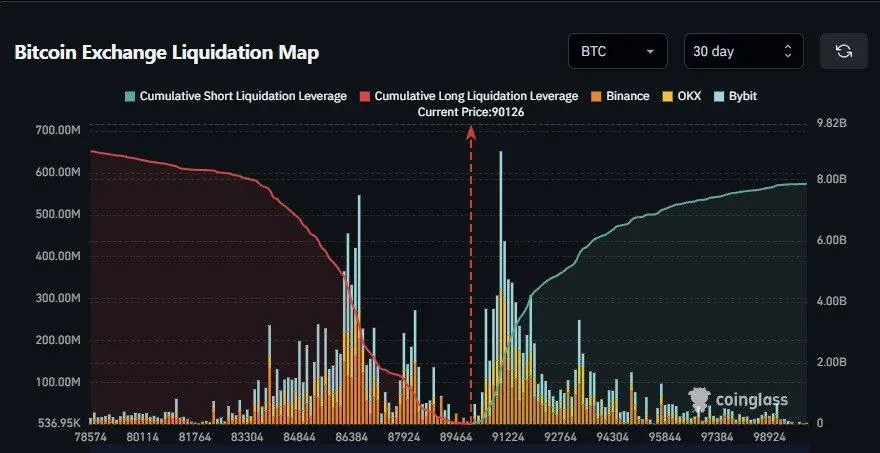

$BTC needs to drop $2,000 to wipe out $1.1B in longs, but it only needs to go up $770 to wipe out $1.1B in shorts.

#Bitcoin2026PriceOutlook

#Bitcoin2026PriceOutlook

BTC-1,48%

- Reward

- 5

- 8

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

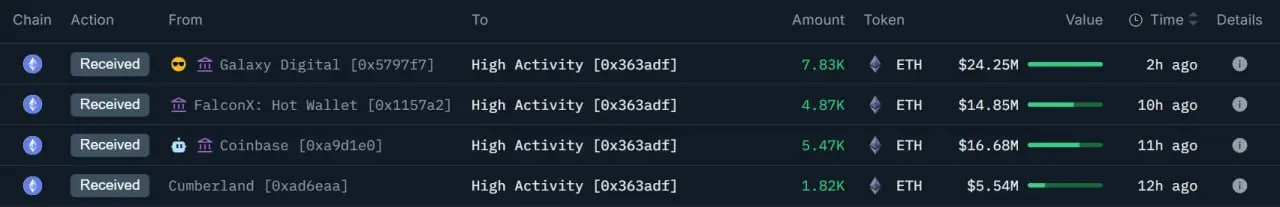

Whale Alert: Major $ETH Accumulation

A whale/institution has withdrawn 20,000 $ETH (~$62.3M) in the past 12 hours from Galaxy Digital, Coinbase, FalconX, and Cumberland.

Large off-exchange movements typically signal long-term custody or strategic positioning, not short-term trading. Worth watching closely as liquidity tightens and sentiment firms up around ETH.

#CryptoMarketPrediction

A whale/institution has withdrawn 20,000 $ETH (~$62.3M) in the past 12 hours from Galaxy Digital, Coinbase, FalconX, and Cumberland.

Large off-exchange movements typically signal long-term custody or strategic positioning, not short-term trading. Worth watching closely as liquidity tightens and sentiment firms up around ETH.

#CryptoMarketPrediction

ETH-1,85%

- Reward

- 5

- 9

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

Happy New Year, Fam.

A new year means a new execution cycle. Less noise, more fundamentals.

I think in 2026, Web3 stops proving it can work and starts proving it matters real users, real assets, real automation, real ownership.

Build through volatility. Educate through clarity. Ship through conviction.

Decentralization is no longer an idea phase — it’s an infrastructure phase.

Here’s to a year of scalable protocols, sustainable token models, and products that earn trust, not hype.

Let’s turn vision into traction.

Happy New Year. The real work starts now.

#MyFirstPost2026

#My2026FirstPost

A new year means a new execution cycle. Less noise, more fundamentals.

I think in 2026, Web3 stops proving it can work and starts proving it matters real users, real assets, real automation, real ownership.

Build through volatility. Educate through clarity. Ship through conviction.

Decentralization is no longer an idea phase — it’s an infrastructure phase.

Here’s to a year of scalable protocols, sustainable token models, and products that earn trust, not hype.

Let’s turn vision into traction.

Happy New Year. The real work starts now.

#MyFirstPost2026

#My2026FirstPost

- Reward

- 5

- 7

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

Hyperliquid just recorded more than $430 million in net outflows this week, marking the third-largest weekly outflow in its history. The move is hard to ignore, especially given where the platform stood only a few months ago. At its peak in mid-September, Hyperliquid’s AUM crossed $6 billion. Today, that figure has compressed to roughly $4 billion, reflecting a clear shift in capital behavior.

This isn’t a collapse story, but it is a signal. As competition in perpetuals and high-performance trading venues intensifies, capital is becoming more selective and more mobile. Traders are increasingly

This isn’t a collapse story, but it is a signal. As competition in perpetuals and high-performance trading venues intensifies, capital is becoming more selective and more mobile. Traders are increasingly

HYPE-2,44%

- Reward

- 7

- 7

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

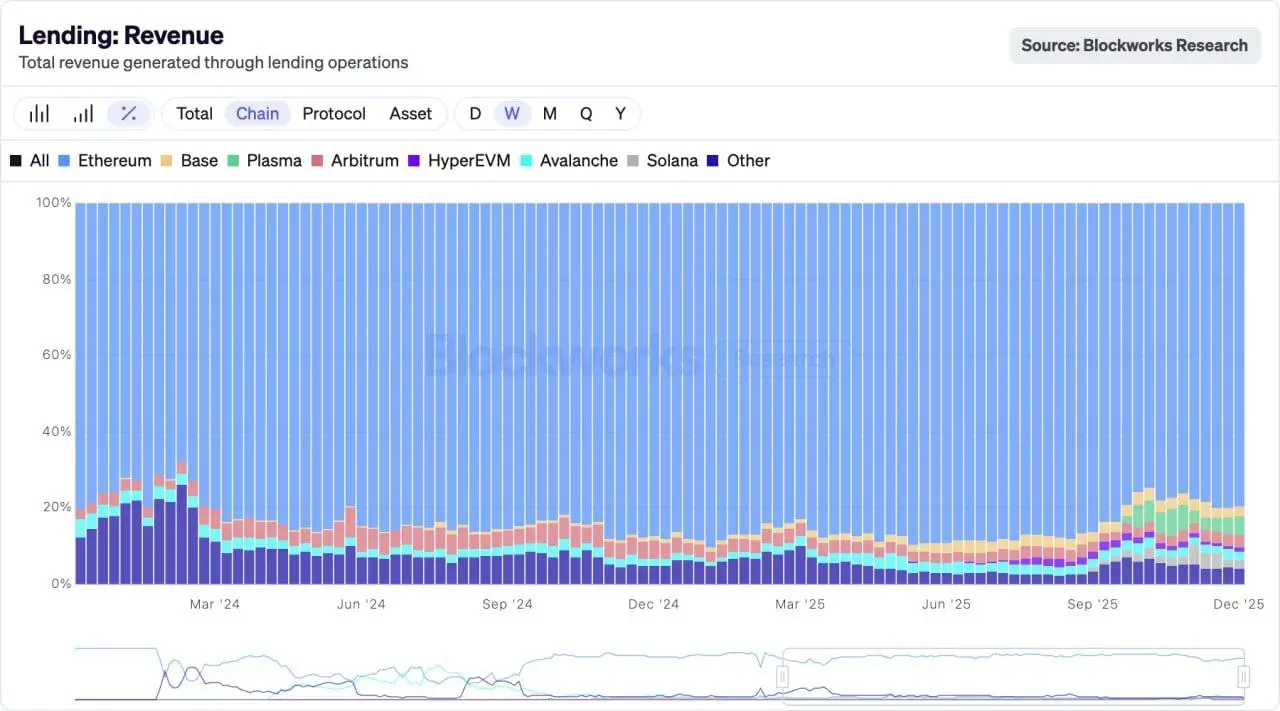

Ethereum is quietly dominating one of DeFi’s most important verticals.

According to David from the Ethereum Foundation, nearly 90 percent of all crypto lending revenue is now generated on Ethereum and its Layer 2 networks. This is not a temporary spike. It reflects where real capital, real borrowers, and real liquidity are concentrating.

Lending is the backbone of DeFi. It requires deep liquidity, reliable infrastructure, composability, and risk aware users. Ethereum continues to win here because institutions, funds, and serious onchain participants trust its security model and execution envir

According to David from the Ethereum Foundation, nearly 90 percent of all crypto lending revenue is now generated on Ethereum and its Layer 2 networks. This is not a temporary spike. It reflects where real capital, real borrowers, and real liquidity are concentrating.

Lending is the backbone of DeFi. It requires deep liquidity, reliable infrastructure, composability, and risk aware users. Ethereum continues to win here because institutions, funds, and serious onchain participants trust its security model and execution envir

ETH-1,85%

- Reward

- 6

- 6

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

PancakeSwap is expanding deeper into onchain primitives.

PancakeSwap has announced it will co incubate Probable, a new onchain prediction market protocol set to launch on BNB Chain. This move signals a clear push beyond traditional DEX activity and into high engagement financial applications.

Prediction markets thrive on speed, liquidity, and low fees, making BNB Chain a natural fit. With PancakeSwap involved at the incubation level, Probable gains immediate ecosystem credibility, access to liquidity, and distribution that most new protocols struggle to build from scratch.

What makes this nota

PancakeSwap has announced it will co incubate Probable, a new onchain prediction market protocol set to launch on BNB Chain. This move signals a clear push beyond traditional DEX activity and into high engagement financial applications.

Prediction markets thrive on speed, liquidity, and low fees, making BNB Chain a natural fit. With PancakeSwap involved at the incubation level, Probable gains immediate ecosystem credibility, access to liquidity, and distribution that most new protocols struggle to build from scratch.

What makes this nota

BNB-3,22%

- Reward

- 6

- 6

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

PIPPIN Bubblemaps data keeps raising serious red flags.

Onchain analysis shows insiders controlling nearly 80 percent of the entire PIPPIN supply from a 380 million dollar offering. That level of concentration alone creates extreme imbalance and risk for public participants.

More concerning is the discovery of a coordinated cluster of 11 Bitget linked wallets holding roughly 9 percent of the total supply. This is not organic distribution. It points to tight control and potential coordination around liquidity and price behavior.

This follows earlier observations that cannot be ignored. Token pr

Onchain analysis shows insiders controlling nearly 80 percent of the entire PIPPIN supply from a 380 million dollar offering. That level of concentration alone creates extreme imbalance and risk for public participants.

More concerning is the discovery of a coordinated cluster of 11 Bitget linked wallets holding roughly 9 percent of the total supply. This is not organic distribution. It points to tight control and potential coordination around liquidity and price behavior.

This follows earlier observations that cannot be ignored. Token pr

PIPPIN19,32%

- Reward

- 4

- 2

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

Polygon activity is quietly heating up again.

Polygon transaction count just hit a two year high, with 43.25 million transactions recorded last week. Network usage has fully returned to December 2023 levels, confirming that this is real demand, not short term noise.

One of the biggest drivers behind this surge is Polymarket. The prediction market has been setting fresh transaction highs almost every week, consistently pushing onchain volume and user activity. This is the kind of usage Polygon was built for, high frequency, low cost, real utility.

What matters most here is sustainability. This

Polygon transaction count just hit a two year high, with 43.25 million transactions recorded last week. Network usage has fully returned to December 2023 levels, confirming that this is real demand, not short term noise.

One of the biggest drivers behind this surge is Polymarket. The prediction market has been setting fresh transaction highs almost every week, consistently pushing onchain volume and user activity. This is the kind of usage Polygon was built for, high frequency, low cost, real utility.

What matters most here is sustainability. This

POL-0,59%

- Reward

- 5

- 4

- Repost

- Share

JEENA :

:

Watching Closely 🔍️View More

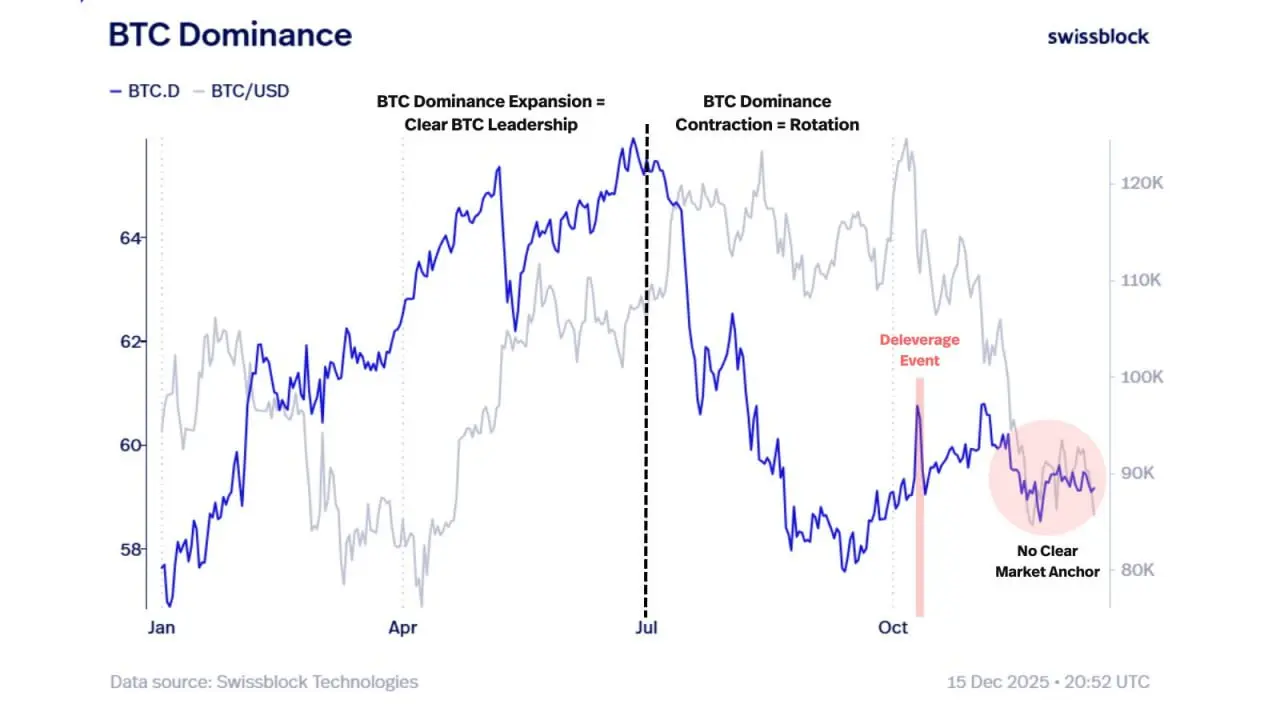

$BTC dominance tells the story of this year better than price alone.

The first half was clearly BTC-led. Dominance rose steadily, marked major bottoms, and drove rotations across the market. Bitcoin was the anchor and capital followed with conviction.

The second half flipped that structure. BTC dominance trended lower, opening room for $ETH rotation, but Bitcoin never truly reclaimed leadership. Instead of clean handoffs, we saw fragmented flows and shorter-lived moves.

Recent attempts to rebuild dominance after the deleverage event have weakened again into year-end. That signals low convict

The first half was clearly BTC-led. Dominance rose steadily, marked major bottoms, and drove rotations across the market. Bitcoin was the anchor and capital followed with conviction.

The second half flipped that structure. BTC dominance trended lower, opening room for $ETH rotation, but Bitcoin never truly reclaimed leadership. Instead of clean handoffs, we saw fragmented flows and shorter-lived moves.

Recent attempts to rebuild dominance after the deleverage event have weakened again into year-end. That signals low convict

- Reward

- 6

- 4

- Repost

- Share

JEENA :

:

Watching Closely 🔍️View More

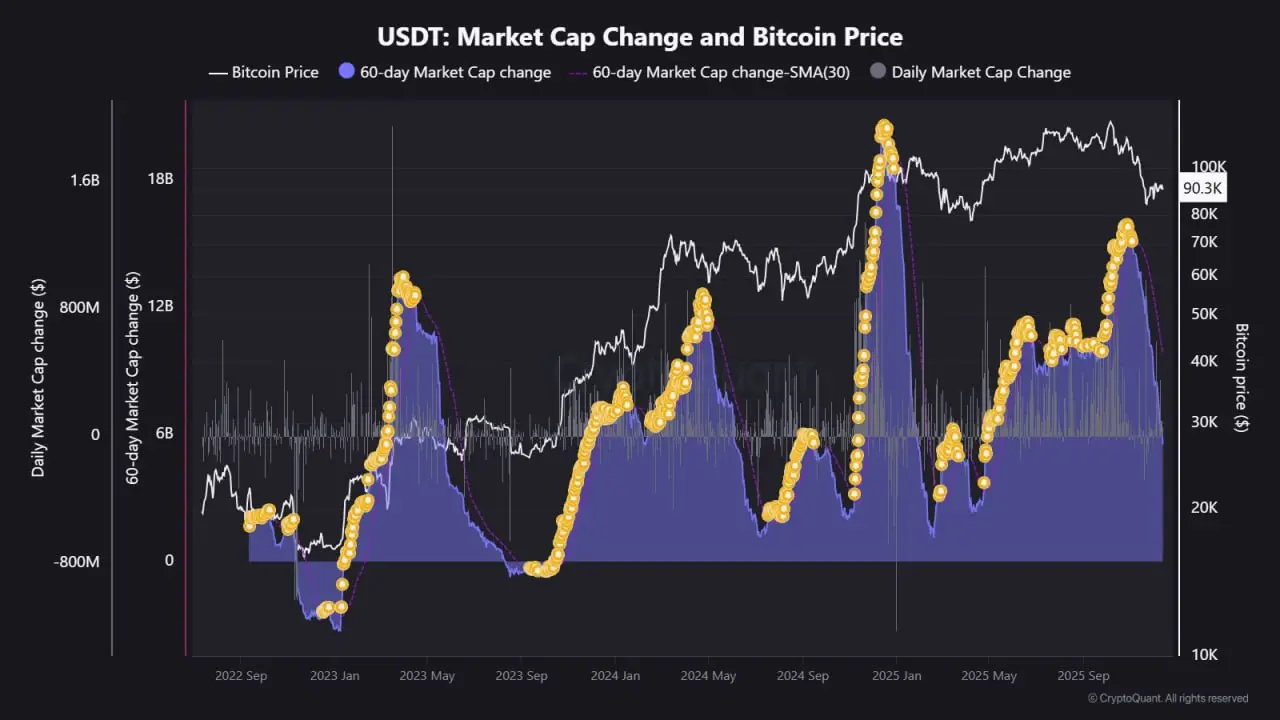

$USDT market cap keeps shrinking.

That is not a bullish liquidity signal.

When stablecoin supply contracts, it usually means capital is stepping back, not rotating aggressively into risk. Less USDT in circulation means less dry powder waiting on the sidelines and weaker follow through on rallies.

In this environment, chasing high beta alts and oversized leverage rarely pays. Moves can happen, but they fade quickly because liquidity is thin and conviction is low.

This is a phase for capital protection, patience, and selective positioning. Focus on strength, strong structures, and clear invalida

That is not a bullish liquidity signal.

When stablecoin supply contracts, it usually means capital is stepping back, not rotating aggressively into risk. Less USDT in circulation means less dry powder waiting on the sidelines and weaker follow through on rallies.

In this environment, chasing high beta alts and oversized leverage rarely pays. Moves can happen, but they fade quickly because liquidity is thin and conviction is low.

This is a phase for capital protection, patience, and selective positioning. Focus on strength, strong structures, and clear invalida

- Reward

- 5

- 4

- Repost

- Share

JEENA :

:

Watching Closely 🔍️View More

The market is still in a corrective and uncertain phase. Major coins are pulling back, liquidity is thin, and momentum remains weak on higher timeframes. This does not look like a confirmed bottom yet, but more like a digestion phase after strong moves earlier.

Right now, patience matters more than aggression. I am focusing on key support zones, watching for volume expansion and clear structure shifts. No heavy leverage, mostly spot accumulation on strong projects, and capital preserved for when the trend actually turns.

Buying the dip only makes sense with a plan. Blind entries get punished i

Right now, patience matters more than aggression. I am focusing on key support zones, watching for volume expansion and clear structure shifts. No heavy leverage, mostly spot accumulation on strong projects, and capital preserved for when the trend actually turns.

Buying the dip only makes sense with a plan. Blind entries get punished i

- Reward

- 6

- 5

- Repost

- Share

JEENA :

:

1000x VIbes 🤑View More

- Reward

- 6

- 4

- Repost

- Share

JEENA :

:

2026 GOGOGO 👊View More

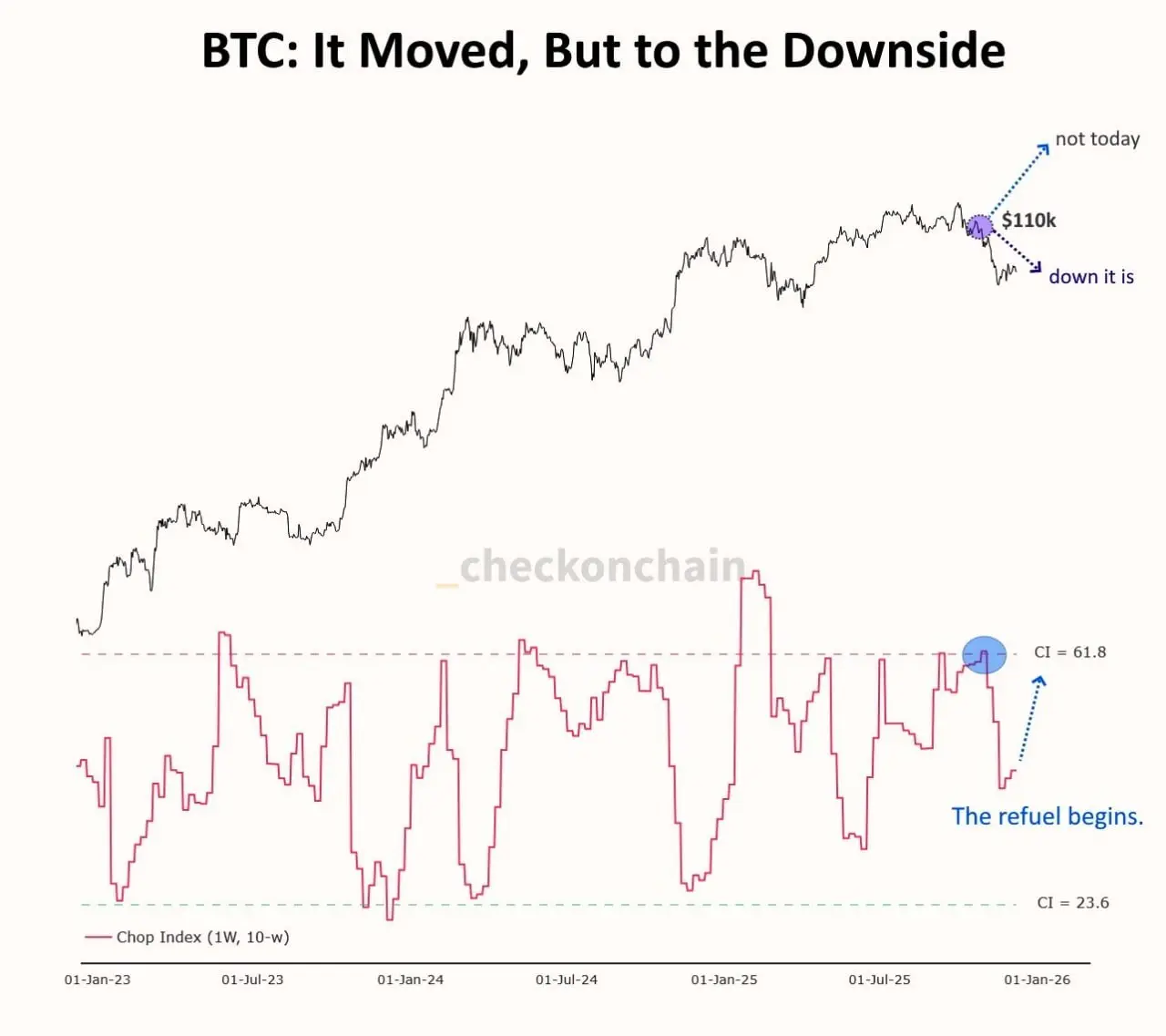

When BTC was trading around 110k last month, the Choppiness Index was flashing a familiar signal. Price had spent enough time compressing to build energy for a decisive move.

That move eventually resolved to the downside. Liquidity was taken, momentum cooled, and late positioning was cleared out.

Now BTC looks to be entering a phase of chopsolidation. This is not weakness. It is the market resetting its structure, absorbing supply, and allowing indicators to unwind after a directional move.

Choppy ranges are where fuel is rebuilt. If $BTC can hold key support and continue compressing, the nex

That move eventually resolved to the downside. Liquidity was taken, momentum cooled, and late positioning was cleared out.

Now BTC looks to be entering a phase of chopsolidation. This is not weakness. It is the market resetting its structure, absorbing supply, and allowing indicators to unwind after a directional move.

Choppy ranges are where fuel is rebuilt. If $BTC can hold key support and continue compressing, the nex

BTC-1,48%

- Reward

- 6

- 3

- Repost

- Share

JEENA :

:

1000x VIbes 🤑View More

- Reward

- 7

- 5

- Repost

- Share

JEENA :

:

2026 GOGOGO 👊View More

Trending Topics

View More231.01K Popularity

51.66K Popularity

22.44K Popularity

17.58K Popularity

16.93K Popularity

Pin