User_any

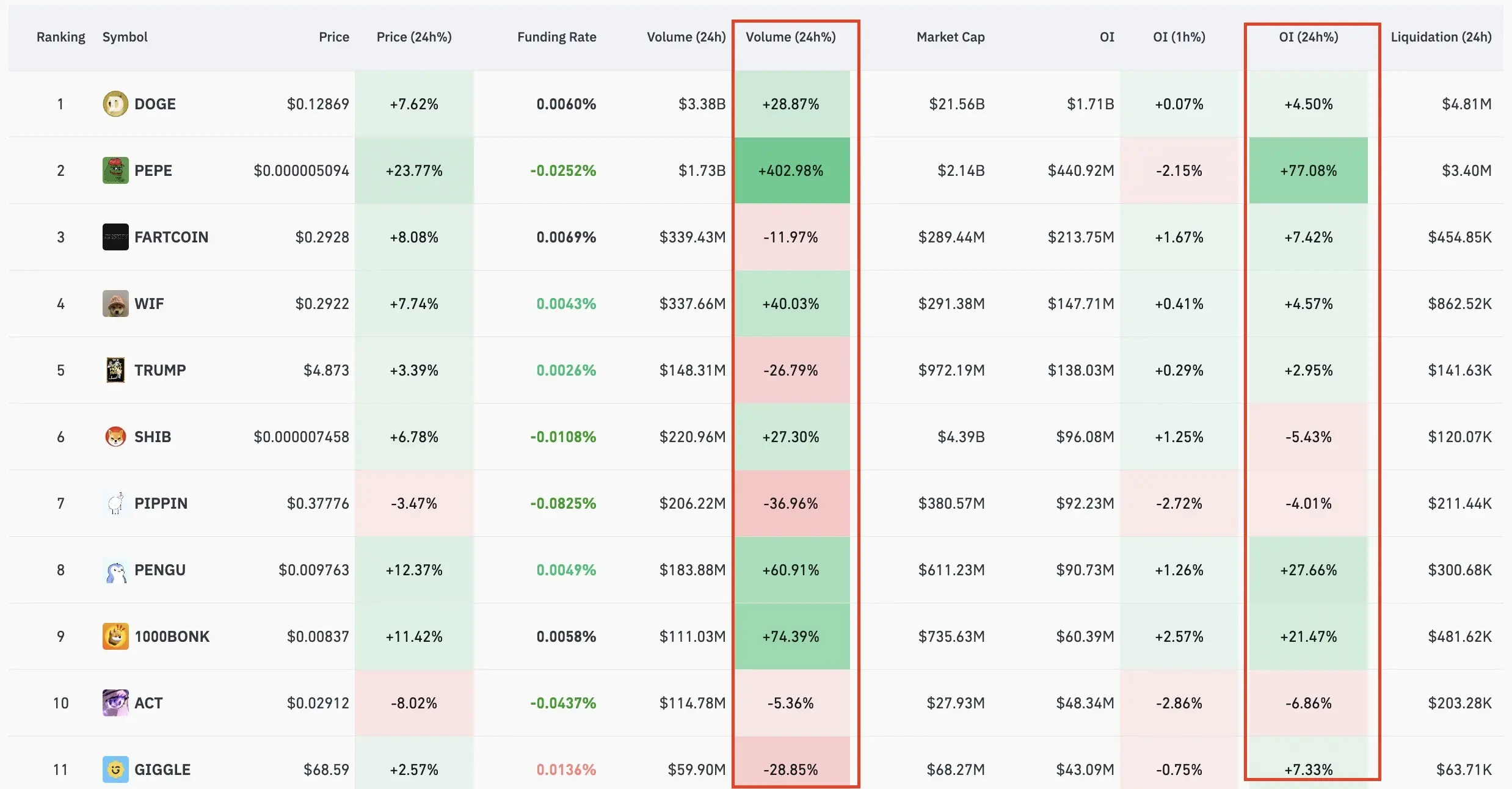

⚠️ The Fed's ON RRP facility is nearing depletion, shrinking to approximately $106 billion by the end of 2025. With this "shock-absorbing" buffer gone, new Treasury issuances are drawing liquidity directly from bank reserves – making the system more fragile.

The Fed stopped QT in December 2025 and had to intervene with repo operations. 10-year bond yields are around 4.1-4.2%; high borrowing and liquidity pressures present a tough test for the Fed.

Volatility and potential funding stress risk are high in 2026.⏳⏳⏳

👀 In other words, the shock absorber in the system has completely disappeared.

Cu

The Fed stopped QT in December 2025 and had to intervene with repo operations. 10-year bond yields are around 4.1-4.2%; high borrowing and liquidity pressures present a tough test for the Fed.

Volatility and potential funding stress risk are high in 2026.⏳⏳⏳

👀 In other words, the shock absorber in the system has completely disappeared.

Cu