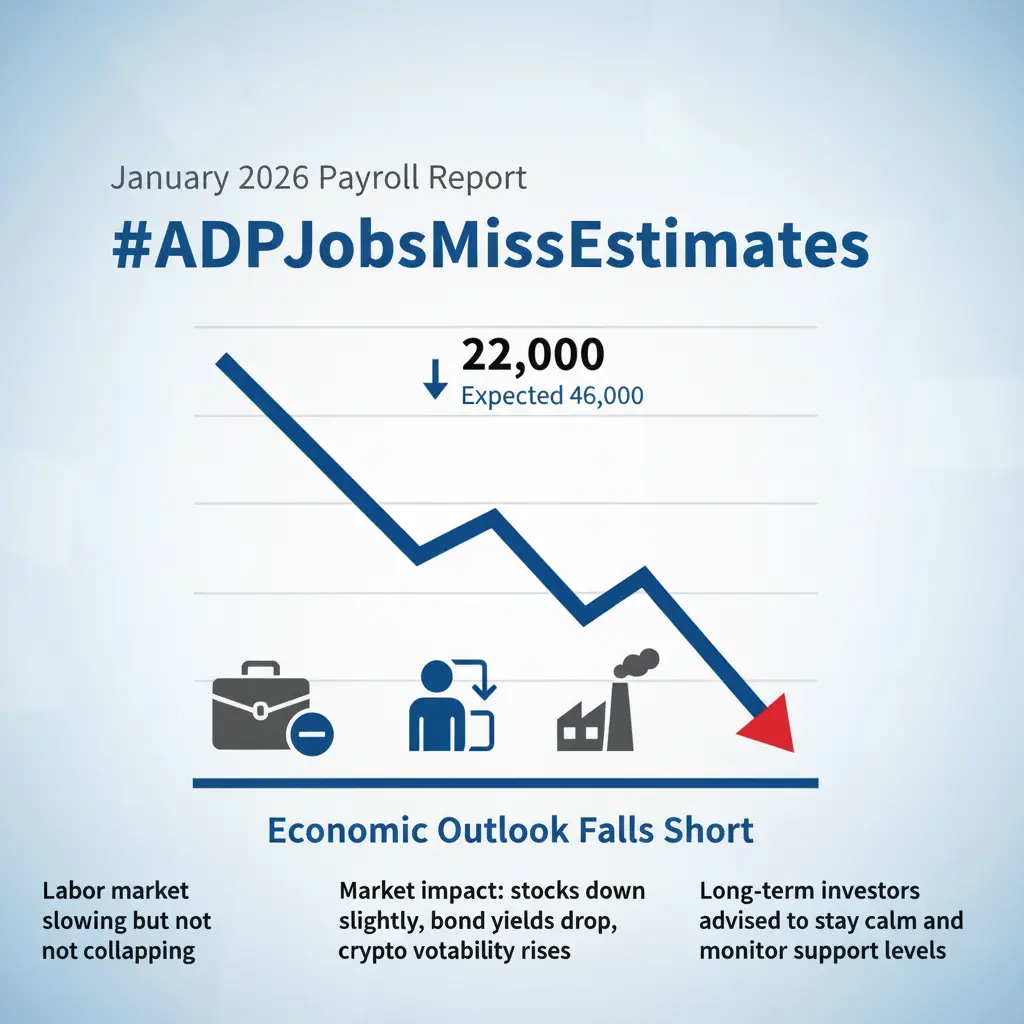

#ADPJobsMissEstimates What Weak Labor Data Means for Crypto Markets

Today’s ADP private payroll report surprised markets by missing expectations, signaling slower-than-forecast job growth in the private sector. While this may appear to be just another economic statistic, its implications extend far beyond employment. Labor data plays a central role in shaping macro sentiment, interest rate expectations, and global liquidity conditions — all of which directly influence crypto market behavior.

🔹 Risk Appetite Under Pressure

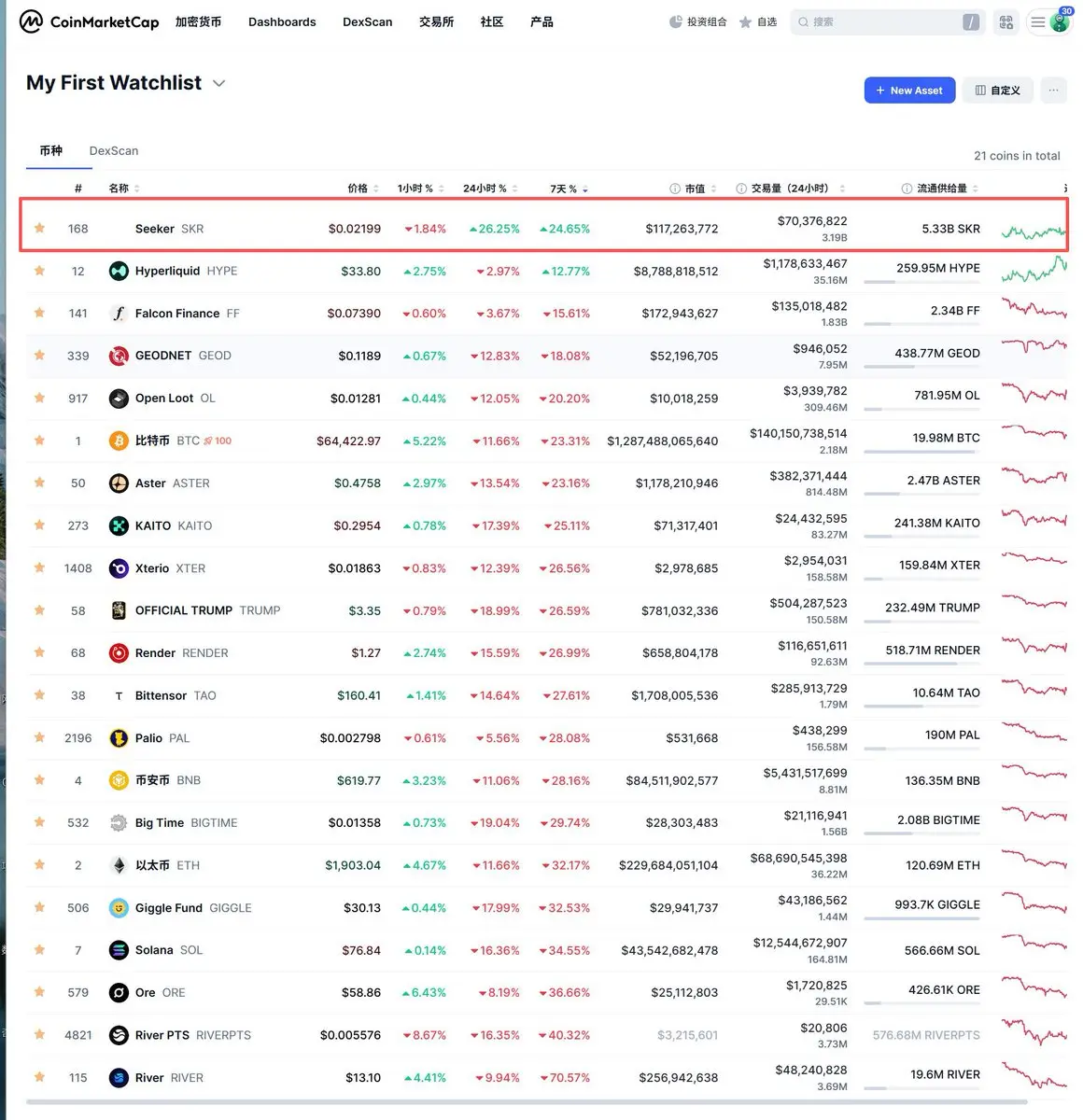

Weaker job growth increases uncertainty about economic momentum. When growth signals soften, investors often shift toward defensive positioning and safer assets. This rotation reduces capital allocation to high-volatility instruments such as Bitcoin, Ethereum, and altcoins. As a result, crypto markets frequently experience short-term pressure following disappointing labor reports.

🔹 Federal Reserve Policy Expectations Shift

Soft employment data complicates the Federal Reserve’s policy outlook. On one hand, weaker labor conditions may reduce the urgency for aggressive rate hikes. On the other hand, they introduce uncertainty about economic resilience. This mixed signal clouds liquidity expectations, and markets typically react negatively to unclear policy direction.

🔹 Bond Yields, Dollar Strength & Liquidity

Jobs data directly influences bond yields and the U.S. dollar. A weak report often leads to falling yields and fluctuating dollar strength, both of which affect capital flows into risk assets. If liquidity tightens or becomes unpredictable, speculative markets like crypto tend to lose momentum until conditions stabilize.

🔹 Crypto’s Macro Connection

Bitcoin and Ethereum no longer operate in isolation. They are increasingly integrated into the global macro framework alongside equities, commodities, and currencies. Employment data shapes investor behavior across all asset classes. When job numbers miss expectations, it often weakens overall risk sentiment before any meaningful trend reversal occurs.

🔹 Market Psychology & Positioning

Disappointing labor reports can trigger short-term emotional reactions — sudden selling, hedging, or de-risking. However, experienced traders focus less on headlines and more on how institutions reposition around liquidity, rates, and yields. This difference in behavior often separates long-term winners from reactive participants.

🔹 Data vs. Narrative

One weak report does not define a trend. It represents a single data point within a broader economic narrative. Smart traders evaluate how it fits into inflation trends, consumer demand, and central bank policy rather than treating it as an isolated signal.

🔹 What Traders Should Watch Next

The key focus now shifts to: • Follow-up labor reports

• Inflation releases

• Central bank commentary

• Changes in funding rates and on-chain flows

• Institutional positioning

These elements reveal whether the ADP miss becomes part of a larger slowdown story or remains a temporary deviation.

🔹 Opportunity Within Volatility

Periods of macro uncertainty often produce short-term mispricing. For disciplined traders and long-term investors, these moments can create strategic entry opportunities — provided risk is managed properly and capital is allocated patiently.

🔹 Bottom Line

The ADP jobs miss is not a direct buy or sell signal. It is a signal about shifting expectations, liquidity dynamics, and economic confidence. Markets do not move on headlines alone — they move on how reality compares to forecasts.

Those who understand this relationship trade with structure, not emotion.

📌 When jobs numbers miss, liquidity reacts — and price often follows.

Today’s ADP private payroll report surprised markets by missing expectations, signaling slower-than-forecast job growth in the private sector. While this may appear to be just another economic statistic, its implications extend far beyond employment. Labor data plays a central role in shaping macro sentiment, interest rate expectations, and global liquidity conditions — all of which directly influence crypto market behavior.

🔹 Risk Appetite Under Pressure

Weaker job growth increases uncertainty about economic momentum. When growth signals soften, investors often shift toward defensive positioning and safer assets. This rotation reduces capital allocation to high-volatility instruments such as Bitcoin, Ethereum, and altcoins. As a result, crypto markets frequently experience short-term pressure following disappointing labor reports.

🔹 Federal Reserve Policy Expectations Shift

Soft employment data complicates the Federal Reserve’s policy outlook. On one hand, weaker labor conditions may reduce the urgency for aggressive rate hikes. On the other hand, they introduce uncertainty about economic resilience. This mixed signal clouds liquidity expectations, and markets typically react negatively to unclear policy direction.

🔹 Bond Yields, Dollar Strength & Liquidity

Jobs data directly influences bond yields and the U.S. dollar. A weak report often leads to falling yields and fluctuating dollar strength, both of which affect capital flows into risk assets. If liquidity tightens or becomes unpredictable, speculative markets like crypto tend to lose momentum until conditions stabilize.

🔹 Crypto’s Macro Connection

Bitcoin and Ethereum no longer operate in isolation. They are increasingly integrated into the global macro framework alongside equities, commodities, and currencies. Employment data shapes investor behavior across all asset classes. When job numbers miss expectations, it often weakens overall risk sentiment before any meaningful trend reversal occurs.

🔹 Market Psychology & Positioning

Disappointing labor reports can trigger short-term emotional reactions — sudden selling, hedging, or de-risking. However, experienced traders focus less on headlines and more on how institutions reposition around liquidity, rates, and yields. This difference in behavior often separates long-term winners from reactive participants.

🔹 Data vs. Narrative

One weak report does not define a trend. It represents a single data point within a broader economic narrative. Smart traders evaluate how it fits into inflation trends, consumer demand, and central bank policy rather than treating it as an isolated signal.

🔹 What Traders Should Watch Next

The key focus now shifts to: • Follow-up labor reports

• Inflation releases

• Central bank commentary

• Changes in funding rates and on-chain flows

• Institutional positioning

These elements reveal whether the ADP miss becomes part of a larger slowdown story or remains a temporary deviation.

🔹 Opportunity Within Volatility

Periods of macro uncertainty often produce short-term mispricing. For disciplined traders and long-term investors, these moments can create strategic entry opportunities — provided risk is managed properly and capital is allocated patiently.

🔹 Bottom Line

The ADP jobs miss is not a direct buy or sell signal. It is a signal about shifting expectations, liquidity dynamics, and economic confidence. Markets do not move on headlines alone — they move on how reality compares to forecasts.

Those who understand this relationship trade with structure, not emotion.

📌 When jobs numbers miss, liquidity reacts — and price often follows.