Yusfirah

No content yet

Yusfirah

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref=VLJNBLTXUG&ref_type=132

- Reward

- 7

- 10

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

#FedLeadershipImpact

Federal Reserve Signals, Crypto Dynamics, and My Trading Insights

The influence of Federal Reserve leadership and monetary policy guidance on global markets has never been more pronounced. Every statement, every tone shift, and every policy decision shapes interest rates, liquidity flows, and market confidence factors that now directly affect cryptocurrencies alongside traditional risk assets.

For traders, investors, and analysts, understanding Fed influence is no longer optional. It is now a core component of market analysis, strategic positioning, and risk management. I

Federal Reserve Signals, Crypto Dynamics, and My Trading Insights

The influence of Federal Reserve leadership and monetary policy guidance on global markets has never been more pronounced. Every statement, every tone shift, and every policy decision shapes interest rates, liquidity flows, and market confidence factors that now directly affect cryptocurrencies alongside traditional risk assets.

For traders, investors, and analysts, understanding Fed influence is no longer optional. It is now a core component of market analysis, strategic positioning, and risk management. I

- Reward

- 10

- 13

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets

February 2026 has kicked off with a striking global market correction, led squarely by the technology sector. What initially appeared as a normal profit-taking phase has evolved into a broad risk-off rotation impacting equities, cryptocurrencies, and commodities. Investor confidence in the long-term payoff from massive AI investments is being tested, and the market’s focus has decisively shifted from innovation hype to profitability, liquidity, and macroeconomic resilience.

1. Technology Giants Under the Microscope

The epicenter of this sell-off lies in recor

February 2026 has kicked off with a striking global market correction, led squarely by the technology sector. What initially appeared as a normal profit-taking phase has evolved into a broad risk-off rotation impacting equities, cryptocurrencies, and commodities. Investor confidence in the long-term payoff from massive AI investments is being tested, and the market’s focus has decisively shifted from innovation hype to profitability, liquidity, and macroeconomic resilience.

1. Technology Giants Under the Microscope

The epicenter of this sell-off lies in recor

- Reward

- 8

- 7

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

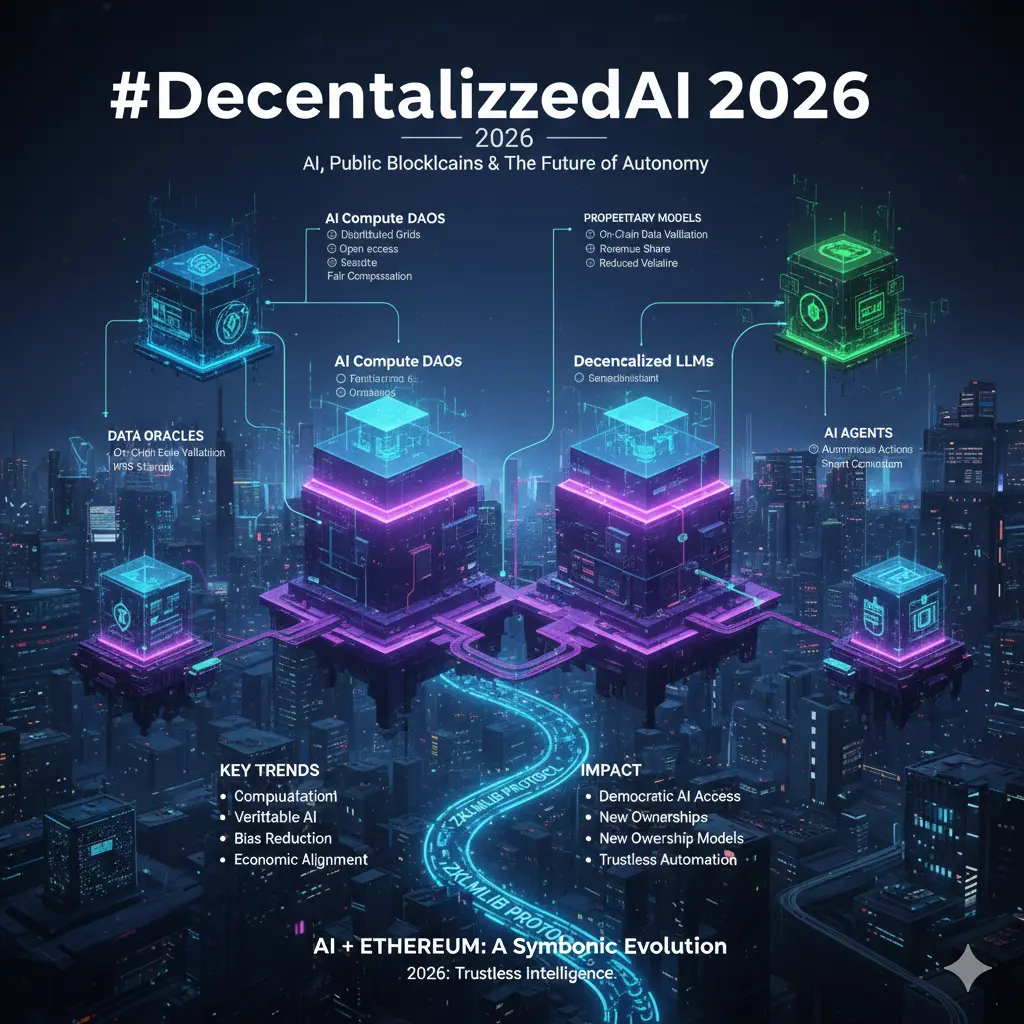

#Web3FebruaryFocus

Web3 has entered a period that may appear quiet on the surface but is, in reality, a critical inflection point. The days when narratives, hype, or viral attention could sustain entire ecosystems are ending. The question is no longer whether ideas are novel or exciting, but whether they can survive scrutiny—regulatory, technical, economic, and human. February is less about another speculative cycle and more about endurance: can the architectures and concepts of the last decade function as real, lasting infrastructure? Decentralization is no longer a slogan; it has become a s

Web3 has entered a period that may appear quiet on the surface but is, in reality, a critical inflection point. The days when narratives, hype, or viral attention could sustain entire ecosystems are ending. The question is no longer whether ideas are novel or exciting, but whether they can survive scrutiny—regulatory, technical, economic, and human. February is less about another speculative cycle and more about endurance: can the architectures and concepts of the last decade function as real, lasting infrastructure? Decentralization is no longer a slogan; it has become a s

- Reward

- 12

- 14

- 1

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#PartialGovernmentShutdownEnds

The partial U.S. federal government shutdown that began after funding lapsed at midnight ET on January 31, 2026 officially concluded on February 3, 2026, after President Donald Trump signed a large-scale funding bill into law, ending a brief but market-sensitive disruption that, while short in duration, carried outsized implications for risk sentiment, liquidity behavior, and crypto market volatility. The shutdown lasted roughly three to four days, affecting close to half of federal agencies after a prior continuing resolution expired over the weekend, making it

The partial U.S. federal government shutdown that began after funding lapsed at midnight ET on January 31, 2026 officially concluded on February 3, 2026, after President Donald Trump signed a large-scale funding bill into law, ending a brief but market-sensitive disruption that, while short in duration, carried outsized implications for risk sentiment, liquidity behavior, and crypto market volatility. The shutdown lasted roughly three to four days, affecting close to half of federal agencies after a prior continuing resolution expired over the weekend, making it

- Reward

- 13

- 13

- 1

- Share

Luna_Star :

:

Happy New Year! 🤑View More

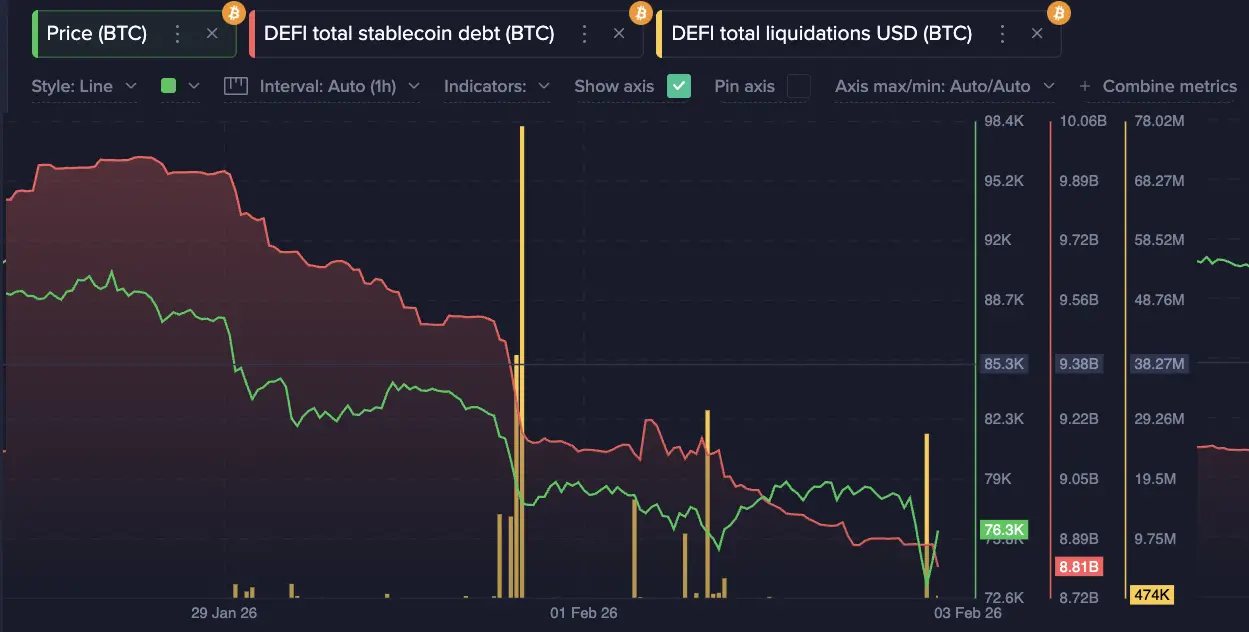

#CryptoMarketStructureUpdate

The crypto market in 2026 is operating under a fundamentally different structural regime compared to previous cycles. Price action is no longer dominated by hype-driven momentum or short-lived narrative rotations. Instead, the market is being shaped by liquidity availability, positioning behavior, and structural capital allocation. This shift marks a clear transition from speculative expansion to selective consolidation, where capital efficiency and durability matter more than raw upside promises. Bitcoin is no longer behaving as a simple risk-on asset that rallie

The crypto market in 2026 is operating under a fundamentally different structural regime compared to previous cycles. Price action is no longer dominated by hype-driven momentum or short-lived narrative rotations. Instead, the market is being shaped by liquidity availability, positioning behavior, and structural capital allocation. This shift marks a clear transition from speculative expansion to selective consolidation, where capital efficiency and durability matter more than raw upside promises. Bitcoin is no longer behaving as a simple risk-on asset that rallie

- Reward

- 14

- 14

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

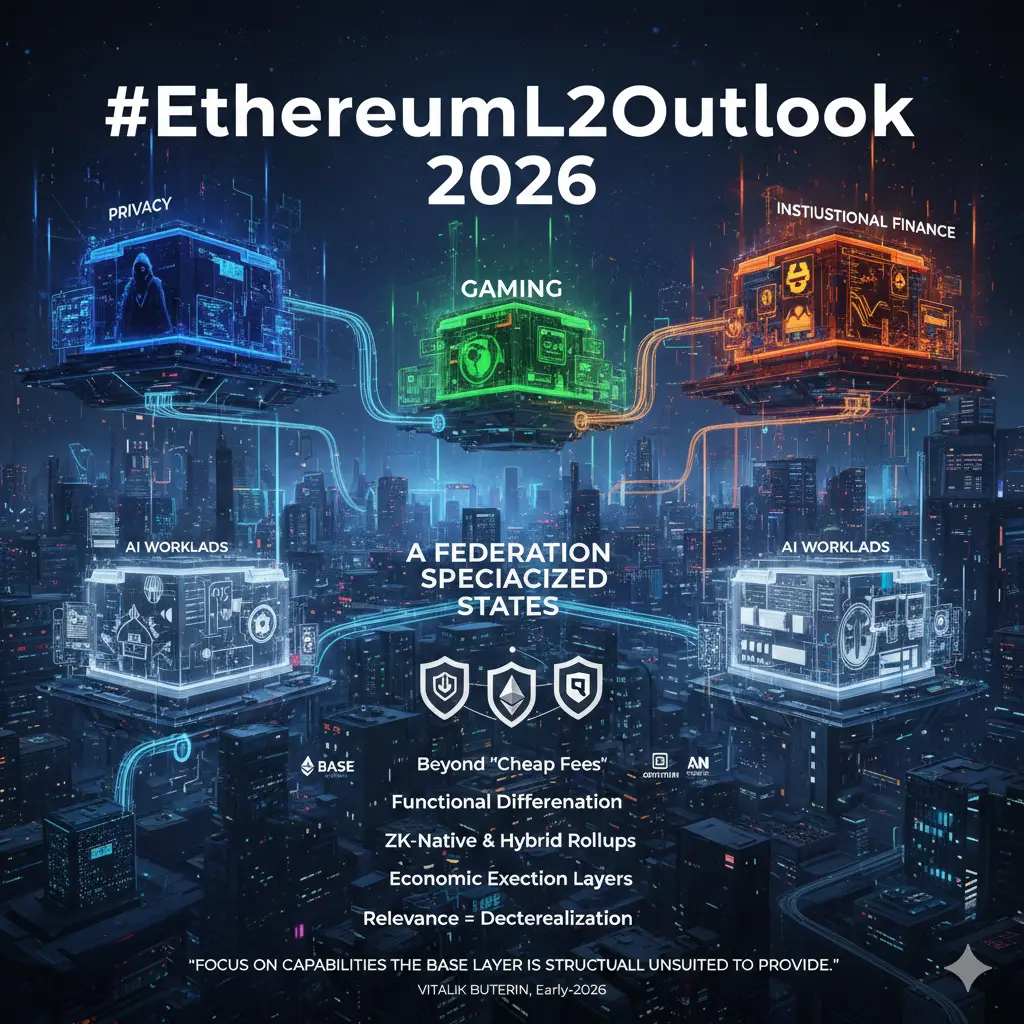

#EthereumL2Outlook

By 2026, Ethereum has clearly moved beyond the narrative of “scaling Ethereum cheaply.” The ecosystem is no longer debating whether Layer 2s are needed; that question was answered years ago. The real evolution now unfolding is far more strategic. Ethereum is transitioning into a multi-layered system of specialized execution environments, where each Layer 2 functions less like an auxiliary chain and more like a purpose-built digital jurisdiction optimized for specific use cases.

For most of the past cycle, L2s were valued primarily on throughput and fee reduction. Speed and

By 2026, Ethereum has clearly moved beyond the narrative of “scaling Ethereum cheaply.” The ecosystem is no longer debating whether Layer 2s are needed; that question was answered years ago. The real evolution now unfolding is far more strategic. Ethereum is transitioning into a multi-layered system of specialized execution environments, where each Layer 2 functions less like an auxiliary chain and more like a purpose-built digital jurisdiction optimized for specific use cases.

For most of the past cycle, L2s were valued primarily on throughput and fee reduction. Speed and

- Reward

- 12

- 10

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

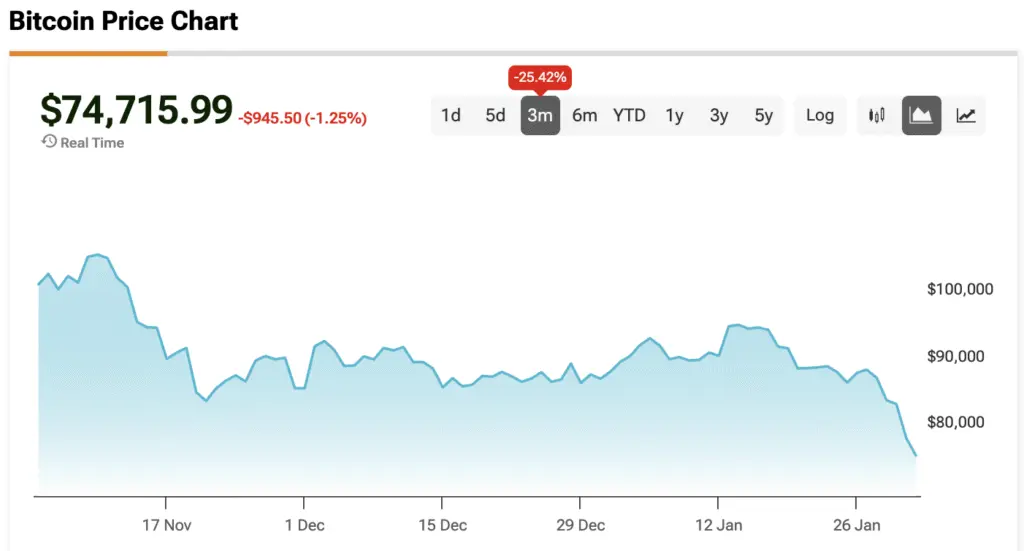

#BTC

whyis everything falling simultaneously? Gold, silver, equities, and cryptocurrencies declining together is confusing for many participants because these assets are traditionally expected to hedge one another. However, the current move is not driven by fundamentals or narrative failure. It is driven by a Mechanical Liquidity Crunch, a phase where markets stop responding to valuation logic and instead respond to funding pressure and balance-sheet stress. In such environments, correlation assumptions collapse and liquidity becomes the only variable that matters.

The core issue is that gl

whyis everything falling simultaneously? Gold, silver, equities, and cryptocurrencies declining together is confusing for many participants because these assets are traditionally expected to hedge one another. However, the current move is not driven by fundamentals or narrative failure. It is driven by a Mechanical Liquidity Crunch, a phase where markets stop responding to valuation logic and instead respond to funding pressure and balance-sheet stress. In such environments, correlation assumptions collapse and liquidity becomes the only variable that matters.

The core issue is that gl

BTC-0,69%

- Reward

- 13

- 13

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#USIranNuclearTalksTurmoil

The nuclear negotiations between the United States and Iran, held indirectly in Muscat, Oman, on February 6, 2026, represent one of the most consequential diplomatic events in recent Middle Eastern history. These talks occur in the shadow of the June 2025 U.S.-Israeli military strikes on Iranian nuclear facilities, which escalated tensions in the region to unprecedented levels. Following those strikes, both Tehran and Washington have maintained a high-alert military posture, with U.S. aircraft carriers and strategic assets deployed in the Persian Gulf, and Iran rein

The nuclear negotiations between the United States and Iran, held indirectly in Muscat, Oman, on February 6, 2026, represent one of the most consequential diplomatic events in recent Middle Eastern history. These talks occur in the shadow of the June 2025 U.S.-Israeli military strikes on Iranian nuclear facilities, which escalated tensions in the region to unprecedented levels. Following those strikes, both Tehran and Washington have maintained a high-alert military posture, with U.S. aircraft carriers and strategic assets deployed in the Persian Gulf, and Iran rein

- Reward

- 12

- 14

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#TopCoinsRisingAgainsttheTrend

The crypto market in early February 2026 is experiencing a notable divergence. While major assets like Bitcoin and Ethereum have retraced after strong 2025 gains, a select group of cryptocurrencies is rising against the broader downward trend. These outliers are not performing randomly; their strength reflects underlying utility, adoption, and liquidity flows that are increasingly driving market behavior, rather than pure speculation. Understanding which assets are outperforming and why is critical for strategic positioning in this environment.

Layer-1 networks

The crypto market in early February 2026 is experiencing a notable divergence. While major assets like Bitcoin and Ethereum have retraced after strong 2025 gains, a select group of cryptocurrencies is rising against the broader downward trend. These outliers are not performing randomly; their strength reflects underlying utility, adoption, and liquidity flows that are increasingly driving market behavior, rather than pure speculation. Understanding which assets are outperforming and why is critical for strategic positioning in this environment.

Layer-1 networks

- Reward

- 10

- 13

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#WhyAreGoldStocksandBTCFallingTogether?

Ultra-Detailed Market Analysis and Strategic Insights

The simultaneous decline in gold, gold-related equities, and Bitcoin is a phenomenon that has puzzled many investors, because these assets are traditionally considered uncorrelated or even oppositely correlated. Gold is viewed as a safe-haven hedge against macro uncertainty and inflation, while Bitcoin is often framed as a digital store of value or “digital gold.” Yet, in the current market environment, all three are declining together, revealing deeper macro, liquidity, and structural dynamics at p

Ultra-Detailed Market Analysis and Strategic Insights

The simultaneous decline in gold, gold-related equities, and Bitcoin is a phenomenon that has puzzled many investors, because these assets are traditionally considered uncorrelated or even oppositely correlated. Gold is viewed as a safe-haven hedge against macro uncertainty and inflation, while Bitcoin is often framed as a digital store of value or “digital gold.” Yet, in the current market environment, all three are declining together, revealing deeper macro, liquidity, and structural dynamics at p

BTC-0,69%

- Reward

- 9

- 11

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#BitwiseFilesforUNISpotETF

Comprehensive Analysis and Market Implications

Bitwise’s filing for a UNI Spot ETF represents a landmark development in the evolution of decentralized finance (DeFi) adoption within regulated financial markets. Unlike derivative-based ETFs, which rely on futures contracts and synthetic exposure, a spot ETF directly holds the underlying asset in this case, Uniswap’s UNI token. This distinction is significant because it provides investors with true price tracking, greater transparency, and reduced counterparty risk, making it a more attractive vehicle for institution

Comprehensive Analysis and Market Implications

Bitwise’s filing for a UNI Spot ETF represents a landmark development in the evolution of decentralized finance (DeFi) adoption within regulated financial markets. Unlike derivative-based ETFs, which rely on futures contracts and synthetic exposure, a spot ETF directly holds the underlying asset in this case, Uniswap’s UNI token. This distinction is significant because it provides investors with true price tracking, greater transparency, and reduced counterparty risk, making it a more attractive vehicle for institution

UNI0,36%

- Reward

- 9

- 13

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#CMEGroupPlansCMEToken

Deep Dive Into CME’s Move Towards Digital Assets

CME Group’s announcement to explore the launch of its own digital asset, CME Token, marks a significant evolution in the intersection of traditional finance (TradFi) and crypto markets. As one of the world’s largest derivatives exchanges, CME has historically provided institutional-grade trading infrastructure and risk management solutions. Their move into a proprietary digital token signals not only a shift in strategy but also the growing legitimacy and adoption of blockchain-based financial instruments.

At a strategic

Deep Dive Into CME’s Move Towards Digital Assets

CME Group’s announcement to explore the launch of its own digital asset, CME Token, marks a significant evolution in the intersection of traditional finance (TradFi) and crypto markets. As one of the world’s largest derivatives exchanges, CME has historically provided institutional-grade trading infrastructure and risk management solutions. Their move into a proprietary digital token signals not only a shift in strategy but also the growing legitimacy and adoption of blockchain-based financial instruments.

At a strategic

- Reward

- 6

- 9

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#GlobalTechSell-OffHitsRiskAssets

Comprehensive Market Analysis and Strategic Insights

The ongoing global tech sell-off is far more than a sector-specific event it is a broad market recalibration that is affecting multiple asset classes, from equities to crypto, and even risk-sensitive commodities. This phase highlights how interconnected modern markets have become, and it underscores the importance of viewing individual declines through a macro, structural, and liquidity lens rather than as isolated events.

At the heart of this sell-off is the sensitivity of technology stocks to interest ra

Comprehensive Market Analysis and Strategic Insights

The ongoing global tech sell-off is far more than a sector-specific event it is a broad market recalibration that is affecting multiple asset classes, from equities to crypto, and even risk-sensitive commodities. This phase highlights how interconnected modern markets have become, and it underscores the importance of viewing individual declines through a macro, structural, and liquidity lens rather than as isolated events.

At the heart of this sell-off is the sensitivity of technology stocks to interest ra

- Reward

- 5

- 8

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#BitcoinDropsBelow$65K

An In-Depth, Structural Perspective on the Current Market Phase

Bitcoin breaking below the $65,000 mark is more than a mere technical milestone—it reflects a deeper shift in market psychology, liquidity dynamics, and risk positioning. For years, levels like $65K have acted as both a psychological and structural anchor for traders and institutional participants. When such anchors fail, it is not just price that reacts; sentiment, positioning, and capital flow begin to recalibrate in tandem. Understanding this move requires looking beyond the headline and analyzing the u

An In-Depth, Structural Perspective on the Current Market Phase

Bitcoin breaking below the $65,000 mark is more than a mere technical milestone—it reflects a deeper shift in market psychology, liquidity dynamics, and risk positioning. For years, levels like $65K have acted as both a psychological and structural anchor for traders and institutional participants. When such anchors fail, it is not just price that reacts; sentiment, positioning, and capital flow begin to recalibrate in tandem. Understanding this move requires looking beyond the headline and analyzing the u

BTC-0,69%

- Reward

- 8

- 13

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#CryptoMarketPullback

A Deep, Structural Breakdown of the Current Market Reset

The current crypto market pullback should be understood as a structural reset rather than a simple short-term correction. Markets move in cycles, and every sustained expansion phase eventually requires a period where excess optimism, leverage, and weak positioning are flushed out. This pullback is serving that purpose. What makes it more complex is that it is happening in an environment where global liquidity is tightening and risk appetite is already fragile, amplifying both fear and uncertainty.

One of the most

A Deep, Structural Breakdown of the Current Market Reset

The current crypto market pullback should be understood as a structural reset rather than a simple short-term correction. Markets move in cycles, and every sustained expansion phase eventually requires a period where excess optimism, leverage, and weak positioning are flushed out. This pullback is serving that purpose. What makes it more complex is that it is happening in an environment where global liquidity is tightening and risk appetite is already fragile, amplifying both fear and uncertainty.

One of the most

- Reward

- 7

- 11

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#GateJanTransparencyReport

A Comprehensive, In-Depth Perspective on Gate’s January 2026 Disclosure

Gate’s January 2026 Transparency Report should be viewed as a structural progress update rather than a routine monthly announcement. In a period where the crypto industry is still rebuilding trust and redefining operational standards, consistent transparency has become one of the strongest indicators of platform quality. Gate’s approach reflects an understanding that long-term credibility is built through repetition, data clarity, and accountability not one-time statements.

A major highlight of

A Comprehensive, In-Depth Perspective on Gate’s January 2026 Disclosure

Gate’s January 2026 Transparency Report should be viewed as a structural progress update rather than a routine monthly announcement. In a period where the crypto industry is still rebuilding trust and redefining operational standards, consistent transparency has become one of the strongest indicators of platform quality. Gate’s approach reflects an understanding that long-term credibility is built through repetition, data clarity, and accountability not one-time statements.

A major highlight of

- Reward

- 7

- 10

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#BuyTheDipOrWaitNow?

An Extended, In-Depth Market Perspective

The debate around buying the dip versus waiting has intensified because the market is no longer operating in a straightforward trend environment. This phase is psychologically demanding, as prices look “cheap” compared to recent highs, yet conviction remains weak. What many participants are struggling to accept is that markets do not move purely on price attraction; they move on liquidity, confidence, and alignment across multiple time frames. Without those elements, dips can continue to deepen far longer than expected.

What stand

An Extended, In-Depth Market Perspective

The debate around buying the dip versus waiting has intensified because the market is no longer operating in a straightforward trend environment. This phase is psychologically demanding, as prices look “cheap” compared to recent highs, yet conviction remains weak. What many participants are struggling to accept is that markets do not move purely on price attraction; they move on liquidity, confidence, and alignment across multiple time frames. Without those elements, dips can continue to deepen far longer than expected.

What stand

- Reward

- 7

- 11

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3998?ref=VLJNBLTXUG&ref_type=132&utm_cmp=SEz74YgP

- Reward

- 11

- 17

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref_type=132

- Reward

- 10

- 13

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More