Search results for "RIVER"

"All-in" signal? Arthur Hayes is calling signals with full force, RIVER's 12% daily increase is just the appetizer?

Emerging token RIVER experienced a remarkable start to 2026, surging another 12% in the past 24 hours, breaking through $18, with a market cap approaching $366 million. Its nearly one-month increase exceeds 340%, and the year-to-date gain has reached nearly 469%, making it the most eye-catching short-term target in the market.

This wave of frenzy was directly triggered by a public call from BitMEX co-founder Arthur Hayes and was strongly boosted by massive leveraged trading in the derivatives market, with daily trading volume on Binance futures alone reaching up to $2 billion. This "perfect storm" driven by opinion leaders, technological breakthroughs, and leveraged funds vividly demonstrates the emotional and highly volatile speculative nature of the crypto market.

MarketWhisper·8h ago

RIVER Weekly Increase 216% Ignore Overbought! Open Interest Soars to 108 Million, RSI Red Light Rages

RIVER rose 12% in a single day to $18.69, a 216% increase from the $7 low point over the week. RSI has been in the overbought zone above 70 for a long time, and the bulls are ignoring the warning signals. Open interest surged from 75 million to 108 million, with Binance perpetual contracts accounting for $20 billion in trading volume. The 24-hour trading volume decreased by 10%, and the shrinking volume with rising prices indicates hidden risks. Support levels are at $17.35 and $14.28, resistance at $21.71.

MarketWhisper·8h ago

Bitcoin Tests $94K Amid Whale Buying and Market Volatility

Bitcoin tests $94K, boosted by institutional buying and risk-on sentiment after US economic contraction.

Altcoins and memecoins soar, with XRP up 29% and $RIVER surging 600% on whale activity and retail trading.

Security and geopolitical risks persist, including Ledger data breach and

CryptoFrontNews·01-06 14:41

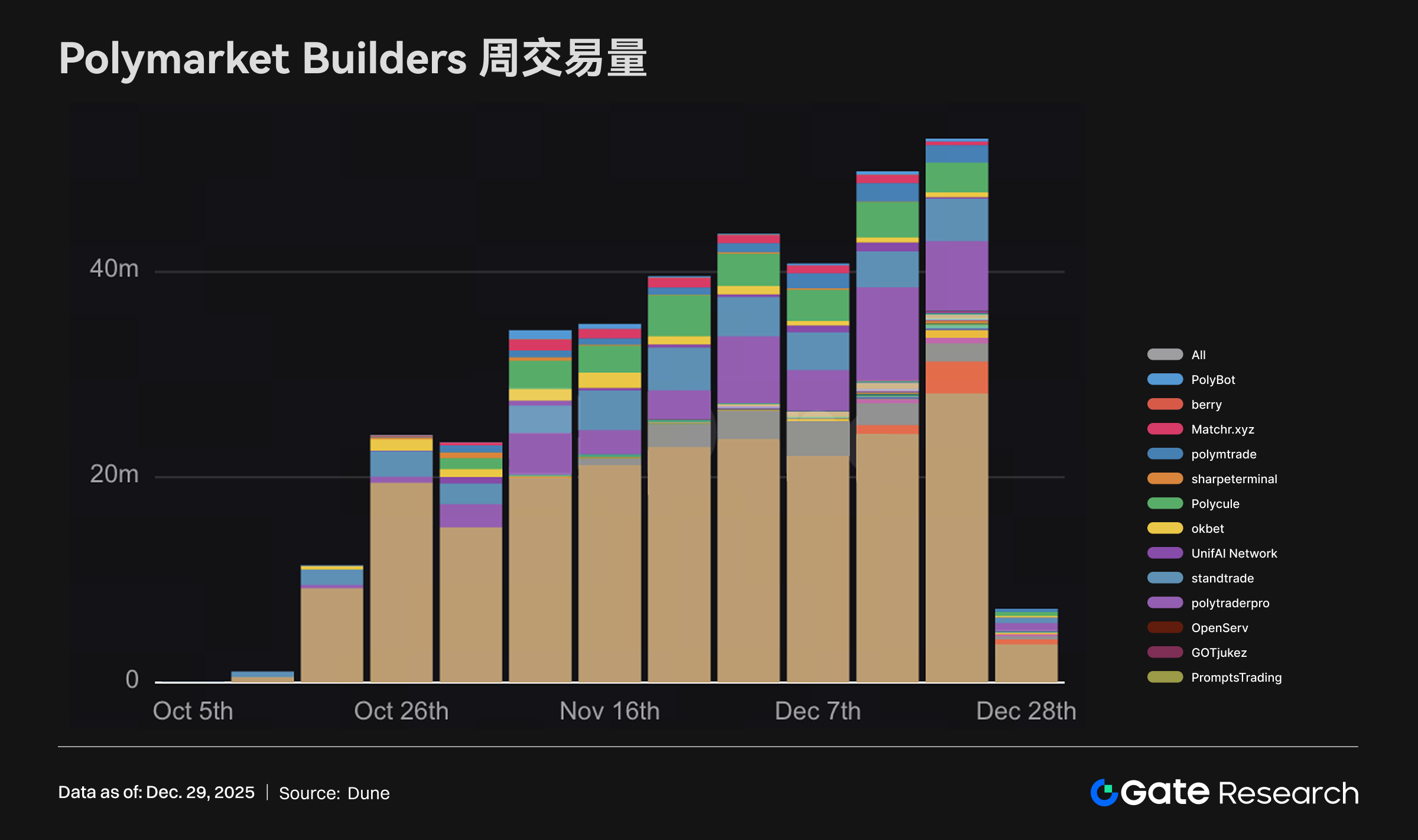

Gate Research Institute: Holiday window leads market rhythm | Polymarket Builders hit new high

Gate Research Institute Daily Report: On December 29, under the combined effects of the Christmas holiday and the low liquidity environment before and after New Year's Day, the crypto market continued its structural recovery trend. BTC rebounded above $88,000, while ETH hovered around the $3,000 mark, with market sentiment remaining cautious. In terms of daily hot topics, TOKEN, TAKE, and RIVER showed active performance driven by speculation, staking incentives, and product mechanisms. On the Alpha side, Polymarket Builders' weekly trading volume surpassed $50 million, reaching a new high, Uniswap completed the historic burn of 100 million UNI tokens and advanced the fee rebate mechanism, and Solana co-founder Toly expressed optimism with a prediction that the stablecoin market cap will surpass one trillion dollars.

GateResearch·2025-12-29 06:56

Token Unlocks December 2025 – Full Analysis and Impact

This week, leading up to December 29, 2025, the cryptocurrency market is poised for a notable shift, with numerous major blockchain projects set to unveil substantial token supplies. Nine different projects (including SPACE ID, 0G Labs and River) will collectively launch tokens to the tune of

BlockChainReporter·2025-12-22 15:13

Hut 8 Secures $7B AI Data Center Lease Backed by Google

Hut 8 Secures $7 Billion AI Data Center Lease in Louisiana with Heavyweight Backing

Bitcoin mining firm Hut 8 has announced a landmark 15-year, $7 billion lease for a significant artificial intelligence (AI) data center capacity at its River Bend campus in Louisiana. This move positions Hut 8 at th

CryptoDaily·2025-12-19 01:23

Visa partners with Circle and Solana to provide USDC settlement services to US banks

Global payments giant Visa announced on Tuesday the official launch of stablecoin settlement services in the United States, symbolizing that traditional financial institutions' interest in blockchain payment channels has shifted from "wait-and-see" to "practical application."

According to Visa's statement, this service allows U.S. financial institutions to use the USD stablecoin USDC issued by Circle for backend cash flow and clearing operations on the Solana blockchain. The initial participating banks include Cross River Bank, known for its fintech services, and Lead Bank, which has received investment from well-known venture capital firm a16z.

Visa also announced that this service will continue to expand in scale through 2026. Rubail Birwadker, Head of Global Growth Products and Strategic Partnerships at Visa, stated:

> The reason Visa is expanding its stablecoin settlement business is because

区块客·2025-12-18 05:54

Visa Opens USDC Stablecoin Settlement: Traditional Payment Giants Embrace the New Era of the U.S. "Digital Dollar"

Global payments giant Visa announced on December 17th that it will open its network’s stablecoin settlement capabilities to US financial institutions, allowing transactions and settlements using USDC issued by Circle via the Solana blockchain. This move marks the first time stablecoins have achieved full commercial application within the mainstream banking system in the United States, representing a key market breakthrough following the signing of the federal stablecoin framework by the Trump administration in July 2025, which provided a clear regulatory pathway. Cross River Bank and Lead Bank have become the first institutions to adopt this service. Although Visa’s network annualized stablecoin settlement volume has exceeded $3.5 billion, compared to the $17 trillion in total transactions processed last year, this emerging business line has enormous potential, indicating that the integration of traditional finance and crypto assets is accelerating rapidly.

USDC0,05%

MarketWhisper·2025-12-18 03:16

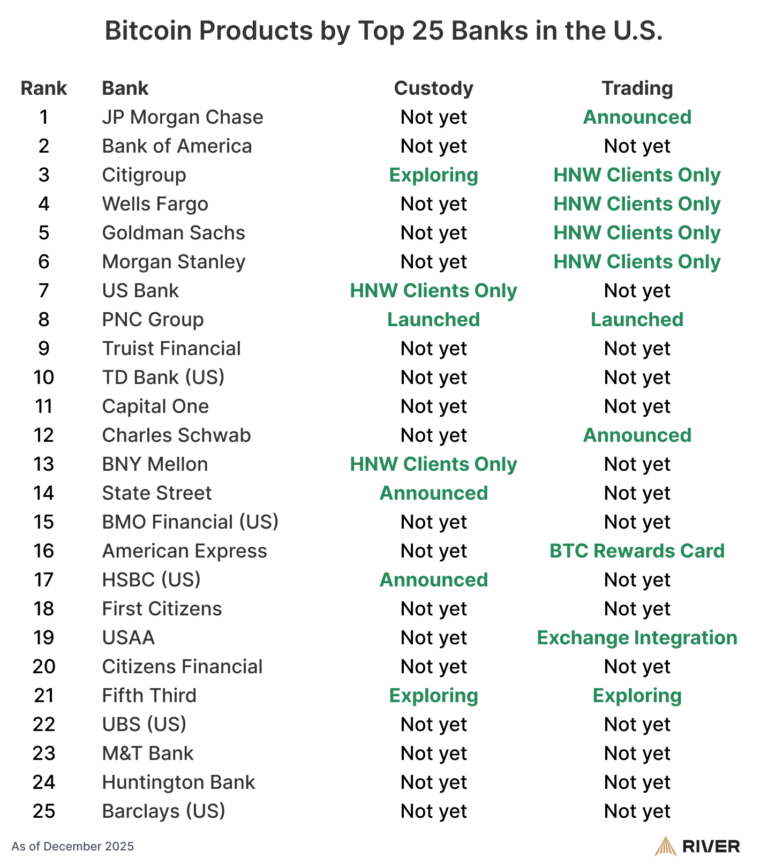

60% of American banks secretly deploying Bitcoin! After years of denial, they are collectively shifting to insider information

According to River data, nearly 60% of the 25 largest banks in the United States are currently in some stage of direct sales, custody, or offering Bitcoin advisory services. This figure marks a historic shift in the attitude of American banks, which for years have regarded Bitcoin as a risk asset to be avoided, citing reasons such as capital rules, custody issues, and reputational risks.

ETH-2,88%

MarketWhisper·2025-12-18 02:45

Visa partners with U.S. banks to enable USDC settlement! A seven-day window revolutionizes traditional payments

Visa announces that US banks issuing cards and acquiring banks can now settle VisaNet debts using Circle's USDC stablecoin, marking the first time this functionality has been implemented in the United States. Cross River Bank and Lead Bank become the first US banks to settle with Visa using USDC via the Solana blockchain. This service extends the traditional five-business-day settlement cycle to a seven-day window.

USDC0,05%

MarketWhisper·2025-12-18 01:40

Bitcoin mining company Hut 8 secures a $7 billion AI leasing deal with Fluidstack, with $HUT jumping 25% pre-market.

Bitcoin mining company Hut 8 Corp. (HUT) announced today (17th) that it has signed a 15-year lease agreement valued at $7 billion with AI cloud platform Fluidstack, leasing 245 MW of IT computing capacity at the River Bend data center campus in Louisiana.

(Background: Breaking News » Bitcoin miner Hut 8 collaborates with Trump's son to establish a new mining company "American Bitcoin")

(Additional context: AI is killing miners: "Energy squeeze" opens a new cycle, what kind of fate do mining companies stand at the crossroads of?)

Table of Contents

Agreement details

What is Fluidstack?

Hut 8 stock price surges

BTC-1,72%

動區BlockTempo·2025-12-17 13:30

Visa launches USDC stablecoin settlement in the United States, with two banks cooperating to break the weekend vacuum.

Under the protection of the GENIUS Act, Visa has officially introduced USDC settlement into the US banking system, breaking the weekend liquidity gap. Stablecoin settlements worth $3.5 billion annually can now directly run on Solana.

(Background: a16z's major crypto report: 2025, the Year of Institutional Explosion, Stablecoin Trading Volume Rivaling Visa, Saying Goodbye to Adolescence and Entering Adulthood)

(Additional context: What will the world look like when Visa and Mastercard fully adopt stablecoin payments?)

Table of Contents

On-chain settlement breaks weekend vacuum

From payment network to validator

The next step for banks

Payment giant Visa announced yesterday that USDC stablecoin settlement services are now officially live in the US. The first partner bank is Cross River

USDC0,05%

動區BlockTempo·2025-12-17 03:45

Discussing the "Redbook" phenomenon of fallen beauty in the US, starting from the incident where a Taiwanese internet celebrity in New York was repeatedly detained for dining and dashing

34-year-old Taiwanese influencer Pei Yun Chung repeatedly dined and dashed at high-end restaurants in New York and was eventually arrested by the police. She is now being held at Rikers Island jail. (Source: World Journal). Rikers Island, located in New York City's East River between Manhattan and Queens, is one of the city's largest detention centers, typically housing inmates awaiting trial or sentencing. Rikers Island has long been notorious for its harsh, violent environment. Due to its large inmate population and outdated facilities, prisoners are forced to stay in overcrowded cells that are not only cramped but also have poor sanitation and frequent issues with prison violence. The stark contrast between the glamorous influencer on Instagram and her current detention in such harsh conditions highlights the bizarre events of recent years.

ChainNewsAbmedia·2025-12-09 07:26

A young police officer in Taiwan who lost money in cryptocurrency trading borrowed money to invest in Bitcoin and is unable to repay it, facing fraud charges and being searched and questioned.

A young police officer in Hsinchu, Taiwan, is suspected of losing money during a previous Bitcoin fall and unable to repay the borrowed principal, leading to charges of fraud. He was recently summoned and searched, and has been released on bail of 250,000 yuan. (Previous context: A Thai homeowner sold a river-view luxury house for 3.88 Bitcoins, is it now 31% off if bought directly?) (Background: SpaceX transferred 100 million dollars in Bitcoin, is Musk cashing out?) On the 26th of this month, the lights were on in the standby room of the Hukou Police Station in Hsinchu County as investigators searched for documents and mobile phones belonging to a 24-year-old officer with the surname Dai. Just a few months ago, he was on duty on the streets, but now he has been released on bail and is awaiting further questioning. This outcome is familiar in the crypto world: contracts, Bitcoin, loans. The leverage in cryptocurrency trading has severed the funding chain. According to reports from the Central News Agency and police sources, Officer Dai was optimistic about Bitcoin in early 2025, initially using his savings and later borrowing hundreds of thousands from friends to enter the market.

動區BlockTempo·2025-11-28 09:42

Hotcoin Research | Macroeconomic policies under pressure, crypto market bottoming out

crypto market performance

Currently, the total market value of cryptocurrencies is $2.89 trillion, with BTC accounting for 58.3%, which is $1.68 trillion. The market value of stablecoins is $302.8 billion, having decreased by 0.68% in the last 7 days. Notably, the number of stablecoins has shown negative growth for 4 consecutive weeks, with USDT accounting for 60.93%.

Among the top 200 projects on CoinMarketCap, most have declined while a small portion have risen, including: CC down 32.32%, IP down 29.88% in 7 days, ICP down 29.03% in 7 days, BTC down 13.15% in 7 days, and ETH down 14.13% in 7 days. The crypto market has once been a river of blood, a sight too tragic to behold.

This week, the net outflow of Bitcoin spot ETFs in the US was $1.211 billion; the net outflow of Ethereum spot ETFs in the US was $500 million.

Market Forecast

DeepFlowTech·2025-11-23 13:35

CEO of Sora Ventures becomes the largest shareholder of AsiaStrategy

AsiaStrategy's CEO, Jason Fang, has become the largest shareholder after changes in Pride River Limited's ownership structure. Despite this shift, management, operations, and strategy remain unchanged. The company is now offering Bitcoin gift cards to VIP clients in luxury watch retail, connecting retail business with Bitcoin initiatives.

BTC-1,72%

TapChiBitcoin·2025-11-11 02:19

River: Recently, the RIVER price experienced severe fluctuations due to a planned attack, and point redemption has been suspended while the mechanism is being upgraded.

The stablecoin protocol River recently stated that its price has encountered serious fluctuations, claiming that this is an organized attack on its ecosystem. To prevent a collapse, River has suspended point redemption and conducted market buybacks. The team will upgrade the mechanism, disclose data, and plans to hold an AMA event to share follow-up plans.

PTS-0,63%

MarsBitNews·2025-11-10 06:25

RIVER is available for trading!

We’re thrilled to announce that RIVER is available for trading on Kraken!

Funding and trading

RIVER trading is live as of November 4, 2025.

To add an asset to your Kraken account, navigate to Funding, select the asset you’re after, and hit ‘Deposit’

Make sure to deposit your tokens into

BitcoinInsider·2025-11-05 10:09

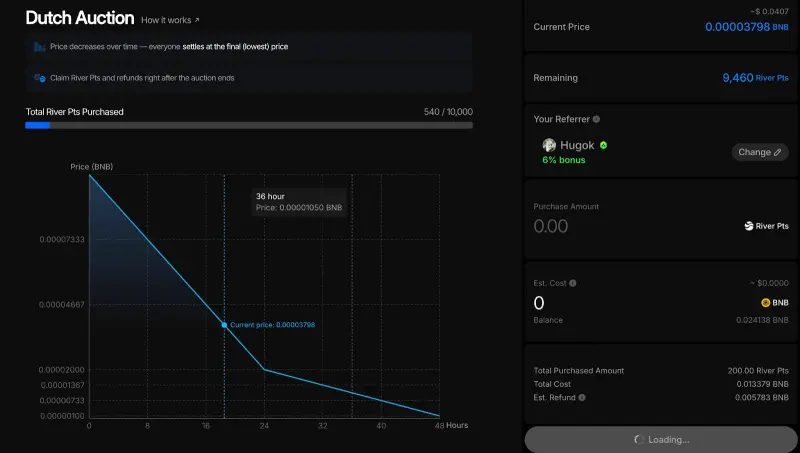

River Public Sale - 48-Hour Dutch Auction Lowest Price Settlement, Claim and Refund Instantly After End

Press Release

Singapore, Singapore, October 27th, 2025, Chainwire

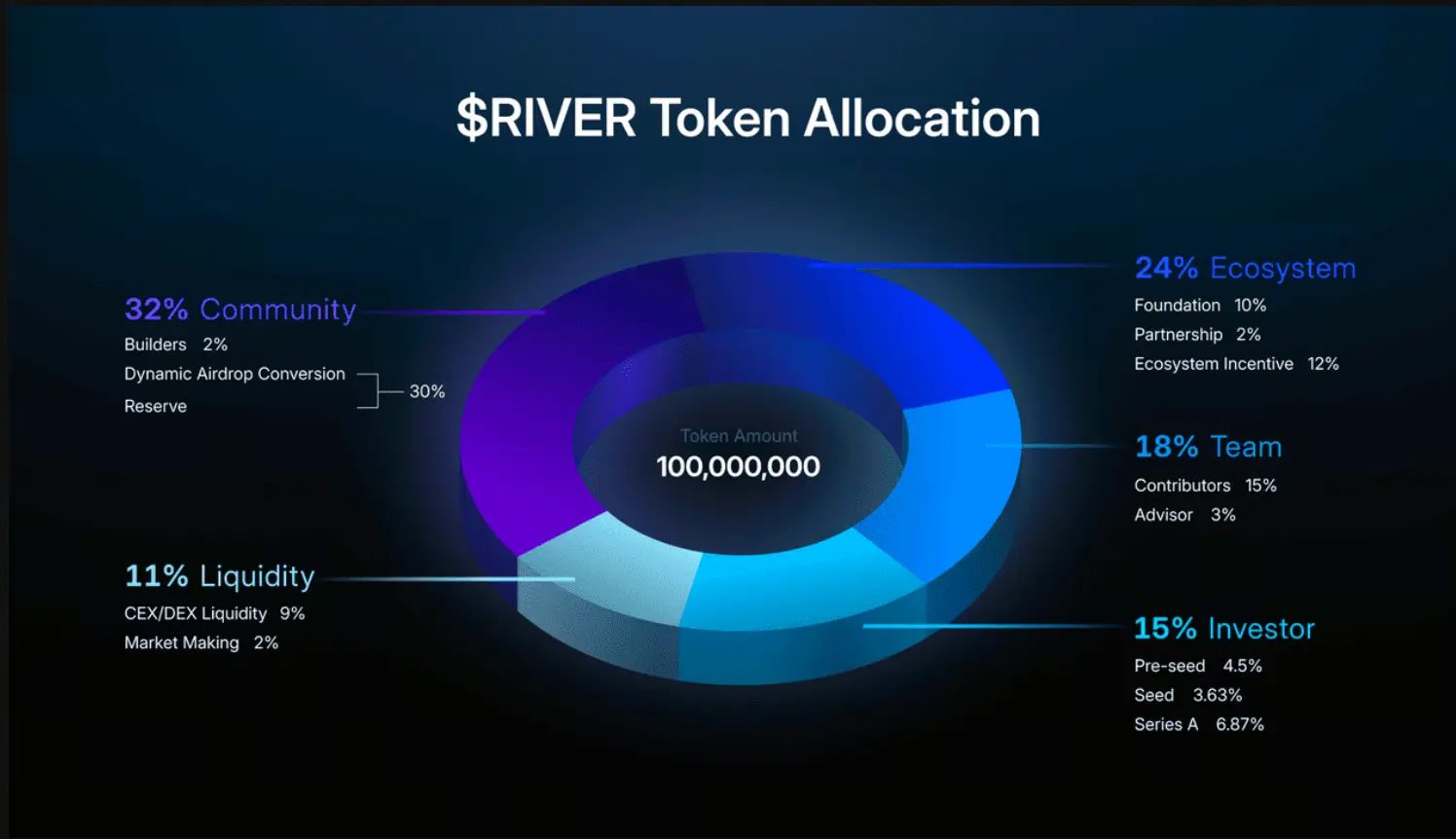

River has announced the River Pts Public Sale, extending its Dynamic Airdrop Conversion — the first time-encoded tokenomics where time became a measurable dimension of value.

In traditional token launches, price is fixed by

BNB-2,52%

BitcoinInsider·2025-10-27 21:39

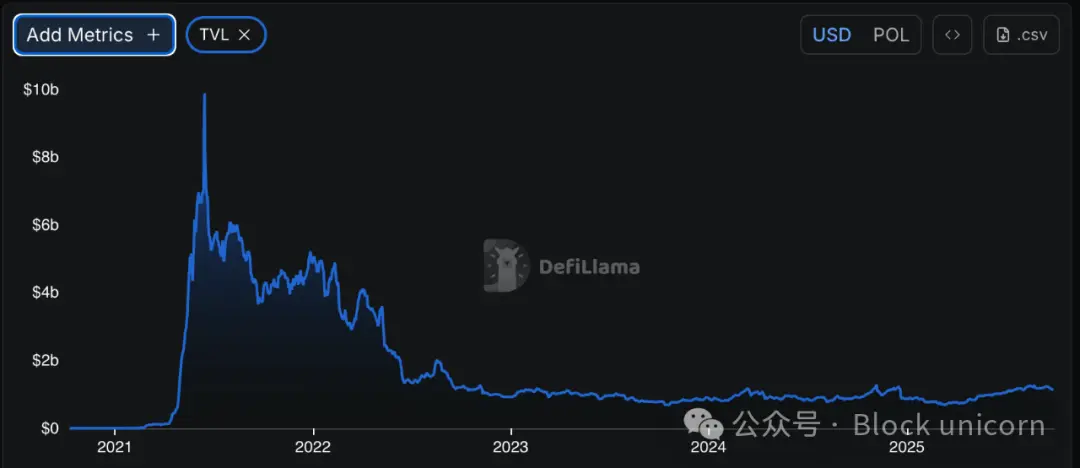

Gate Decentralized Finance Daily ( October 27 ): TVL returns to $159 billion; River public sale starts on October 29.

On October 27, the crypto market experienced a significant rebound after BTC and ETH both broke through key price levels, with the total DeFi TVL rising to $159.085 billion, a daily growth of 4.35%. Although DEX volume decreased week-on-week, leading protocols such as Aave, Lido, and EigenLayer all achieved strong rebounds. Analysts pointed out that this round of recovery may be an early signal of liquidity returning in the fourth quarter.

MarketWhisper·2025-10-27 10:25

RIVER突破9美元创历史新高,tokenomics迎来AMM时刻

The RIVER Token reached a historic high of $9 on October 22, with a 24-hour rise of 100%. Its pump is related to being listed on Binance and the innovative "dynamic Airdrop conversion" mechanism. Users can exchange RIVER Tokens within 180 days, with the exchange rate increasing over time. The River Pts ecological points also surged significantly, with the community calling it the AMM moment of tokenomics.

MarsBitNews·2025-10-22 04:56

Binance Charity United Blockchain Enthusiasts Association donated over 3.5 million TWD to the virtual asset charity program in Hualien.

October 21, 2025, Taipei, Taiwan — In response to the severe disaster caused by the collapse of the dam at the Matouan River landslide lake in Hualien County on Guangfu Township, Binance, the world's largest virtual asset ecosystem, announced that its charity foundation, Binance Charity, has launched a virtual asset charity donation program in collaboration with the Taiwan Blockchain Enthusiasts Association. The program raised a total of 117,210 USDT in stablecoins, which is equivalent to 3,571,631 New Taiwan Dollars after conversion, and has been fully donated to the disaster relief foundation "0923 Hualien Matouan River Landslide Lake Disaster Project Fund" under the Ministry of Health and Welfare of Taiwan to assist with post-disaster rescue and reconstruction efforts.

Within a week of the disaster, Binance began collaborating and communicating with the Blockchain Enthusiasts Association. As one of the main initiators of the project, Binance Charity donated 100,000 USDT in funds, hoping to provide for

ChainNewsAbmedia·2025-10-21 09:24

"On-Chain Delivery of Love" Binance Charity United Blockchain Enthusiasts Association donated over 3.5 million TWD to support Hualien's reconstruction.

Binance Charity announced a joint initiative with the Taiwan Blockchain Enthusiasts Association to launch a virtual asset charity donation plan, raising a total of 117,210 USD in stablecoin USDT, which will be fully donated to the Taiwan Ministry of Health and Welfare's Disaster Relief Foundation for the "0923 Hualien Mataian River Blockage Disaster Fundraising" account. (Background: Binance: Recently, Alpha cheating using "score brushing tools" will be dealt with as a violation) (Supplementary background: Binance Alpha Research: What is the limit of the score effect? Did the Fur Studio take everything?) In response to the severe disaster caused by the dam breach of Mataian River in Hualien County affecting Guangfu Township, Binance, the world's largest virtual asset ecosystem, through its charity foundation Binance Charity, announced a joint initiative with the Taiwan Blockchain Enthusiasts Association to launch a virtual asset charity donation plan.

BNB-2,52%

動區BlockTempo·2025-10-21 08:21

River Project: Chain-Abstraction Stablecoin System Revolutionizing DeFi in 2025

In the fast-evolving landscape of decentralized finance (DeFi), River emerges as an innovative chain-abstraction stablecoin system designed to enable seamless cross-chain collateral, yield generation, and liquidity without the hassles of bridging or wrapped assets.

CryptopulseElite·2025-10-20 09:19

What is RIVER? Chain-Abstraction Stablecoin System Revolutionizing DeFi in 2025

In the fragmented landscape of decentralized finance (DeFi), RIVER emerges as a groundbreaking chain-abstraction stablecoin system designed to enable seamless cross-chain collateral, yield generation, and liquidity—without the complexities of bridging.

CryptopulseElite·2025-10-20 09:18

What is River Protocol? Understand the mechanism risks and governance challenges of "chain abstraction" stablecoins in one article.

As security incidents in cross-chain bridges and fragmented Liquidity have become the biggest pain points in the DeFi space, River Protocol has quickly attracted market attention with its grand narrative of "chain abstraction" stablecoin and unique dynamic Airdrop model. Its core product, satUSD, allows users to mint assets directly on the target chain without the need for cross-chain bridges, and this innovative concept has attracted $525 million TVL in a short period. However, behind its seemingly perfect technical solution, the complicated liquidation mechanism risks and the governance structure that is not yet fully transparent pose the main challenges the project faces.

MarketWhisper·2025-10-20 05:44

What is River Token? Minting satUSD without bridge cross-chain disrupts the stablecoin gameplay.

What is the River Token? River (RIVER) is a chain-abstract stablecoin protocol that achieves cross-chain liquidity and yield strategies through its native stablecoin satUSD. The core innovation lies in allowing users to collateralize assets on one blockchain and mint satUSD on another blockchain without the need for any bridging.

MarketWhisper·2025-10-20 02:45

Encryption 三国杀 Side Story: When Wall Street's Compliance Fleet Sails into the DeFi Yangtze River Estuary

This article uses the metaphor of "Three Kingdoms Kill" to analyze the three major forces in the Crypto industry: the native narrative faction corresponds to Shu Kingdom, emphasizing ideals and Decentralization but facing challenges; the CEX exchange alliance resembles Wei Kingdom, relying on market Liquidity but with hidden risks; Wall Street financial capital symbolizes Eastern Wu, flexibly responding and collaborating with other forces, ultimately potentially dominating the future of Crypto.

DEFI18,24%

PANews·2025-10-17 05:08

Sandeep Nailwal: From the slums of Delhi to building Polygon

Article Author: Thejaswini M A

Article compiled by: Block unicorn

Preface

Sandeep Nailwal's father often does not come home for days.

By the time he returned, the monthly salary of 80 dollars was gone, squandered on alcohol and gambling debts.

This family lives in a settlement along the banks of the Yamuna River, which locals contemptuously refer to as "Jamna-Paar," roughly meaning "the other side of the river." But this is not a compliment.

Sandeep always stood outside the classroom when he was a child because his parents did not pay the tuition fee, so he couldn't enter the classroom. When he was ten years old, his younger brother had a serious accident, and his childhood ended. His father's drug addiction meant that someone had to step up. That person was Sandeep.

Today, Nairval operates Polygon, a company that processes millions daily.

BTC-1,72%

PANews·2025-10-08 09:12

The first phase of the Binance Wallet BuildKey TGE project RIVER was oversubscribed by 770 times within 1 hour, with $77 million BNB already deposited.

The Binance Wallet launched the first phase of the $RIVER BuildKey TGE project on September 19, where users can subscribe through the Aspecta platform within 2 hours, with BNB oversubscription reaching 770 times. BuildKey can be traded before TGE, and can then be exchanged proportionally for RIVER tokens.

BNB-2,52%

MarsBitNews·2025-09-19 09:04

PA Daily | BNB breaks $1000 to set a new all-time high, market capitalization surpasses companies like BYD and Pfizer; APX personal holdings top address unrealized gains of $3.78 million overnight.

Today's News Reminder:

The Federal Reserve cut interest rates by 25 basis points, and Powell stated that this is a risk management rate cut.

The first phase of the TGE for the Binance Aspecta BuildKey model project is River (RIVER).

The market value of BNB surpasses that of companies like BYD and Pfizer, rising to 155th place globally.

The top 1 address of APX personal holdings, which has been held for three years, gained a floating profit of $3.783 million overnight.

BNB broke through $1000, rising 4.97% in 24 hours.

Bio Protocol raised $6.9 million in funding, led by Maelstrom Fund.

DeFi

BNB-2,52%

PANews·2025-09-18 09:53

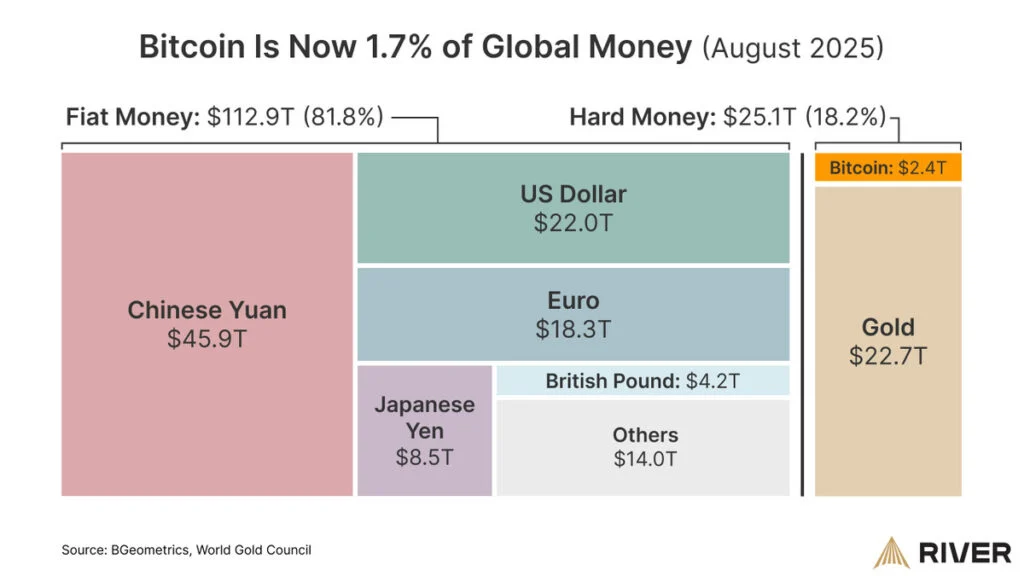

In 2025, Bitcoin corporate holdings soar past 1.3 million! River: The driving force of the bull run has changed to companies.

The Bitcoin (BTC) bull run of 2025 is quietly shifting its driving force. According to the latest report from River Financial, corporations are rapidly becoming the core buyers in the market, currently holding over 6% of the total Bitcoin supply, with holdings reaching 1.3 million BTC—an increase of 21 times compared to 2020. This influx of corporate capital is rewriting the market structure and price movement of Bitcoin.

BTC-1,72%

MarketWhisper·2025-09-05 05:42

Report: In 2025, corporate Bitcoin holdings will exceed 1.3 million coins, accounting for 6% of the total supply.

According to a new report released by River Financial, enterprises have become the core driving force behind the Bitcoin bull run in 2025, with corporate Bitcoin holdings now accounting for more than 6% of its total supply.

The report found that in just the first eight months of 2025, corporate Bitcoin inflows exceeded $12.5 billion compared to the entire previous year, with total holdings reaching 1.3 million BTC.

This scale has increased 21 times compared to 2020. In contrast, individuals remain the primary holders of Bitcoin, accounting for 65.9% of the total supply, with the remaining portion held by funds, governments, and other entities.

According to data from River, since January 2024, Bitcoin Treasury companies (businesses established primarily to hold large reserves of Bitcoin) have accounted for 76% of Bitcoin purchases. These companies collectively manage over $100 billion in stocks, bonds, and other securities related to Bitcoin exposure.

BTC-1,72%

金色财经_·2025-09-05 04:39

Small Businesses Quietly Fuel Bitcoin Adoption, Says River

BTC price surge to new highs may not be driven solely by Wall Street. According to Bitcoin financial services firm River, small and midsize businesses across the United States are increasingly reinvesting their profits into the digital asset, creating what analysts describe as a quiet but powerful w

BitcoinInsider·2025-09-04 10:47

PA Daily | Over $4.5 billion in Bitcoin and Ether options are about to expire; WLFI falls below $0.18, Cumberland is suspected to join WLFI as a market maker after DWF and Jump.

Today's news highlights:

Guofu Quantum establishes the RWA8 fund to help Hong Kong compete for global RWA pricing power.

River claims that its customer base reinvests an average of 22% of their profits into Bitcoin.

Etherealize completes $40 million financing, led by Electric Capital and Paradigm.

CryptoQuant: The key monthly support for BTC is $107,600, and the market is in a recovery phase.

Deribit: Over $4.5 billion in Bitcoin and Ethereum options are about to expire, with Ethereum call options concentrated above $4,500.

Moca Network has launched a $20 million MocaPortfolio, providing the community with the opportunity to engage with the Animoca ecosystem.

Bitwise analysts: The Pokémon card market is undergoing a transformation towards RWA cryptoization.

PANews·2025-09-04 09:53

Bitcoin "Secret of the Surge" Research Report: Corporate Procurement Speed is Four Times the Output of Mining

Companies and ETFs are absorbing Bitcoin daily at a rate far exceeding miner production, reshaping the Bitcoin market structure due to supply and demand gaps. (Background: Santiment analyst: The clamor for buying the dip is increasing, and the bottom for Bitcoin may be further away.) (Additional background: Bitcoin has returned to 109,000, Ethereum has broken through $4,400, and next week to watch: non-farm payroll report, unemployment claims, Fed officials' remarks.) In the landscape of crypto assets in 2025, Bitcoin (Bitcoin) once again becomes the focus. According to River's latest report, companies, ETFs, and governments are currently buying a total amount daily that far exceeds the average daily output of miners, which is about 450 BTC. As the buying speed approaches four times the mining capacity, the supply-demand balance has clearly tilted, and the market begins to worry about when the "supply shock" will officially arrive. Companies and institutions are buying four times more: how is the gap formed? River data shows.

ETH-2,88%

動區BlockTempo·2025-09-01 03:59

Regulatory Breakthrough: Institutions Get On Board as Crypto Assets Penetrate Wall Street After a Decade of Trials and Tribulations

Host: Ryan, Bankless; Guest: Eric Peters; Compiler: Janna, ChainCatcher

Eric Peters is the CEO of Coinbase Asset Management and also the founder of One River Asset Management. This article is based on an interview with him on the Bankless podcast, where the main topic revolves around Eric's entry into cryptocurrency to the present day, detailing the full transformation of the crypto market from a gray area that institutions avoided to its gradual acceptance by Wall Street, providing historical perspective for more crypto enthusiasts to understand the industry's development. ChainCatcher

BTC-1,72%

金色财经_·2025-08-31 07:33

Businesses Are Acquiring Bitcoin Four Times Faster Than It’s Being Mined, River Finds

A study by River highlights a significant disparity in Bitcoin supply and demand, with businesses acquiring 1,755 BTC daily versus 450 BTC mined. This trend indicates that institutional demand may significantly impact the Bitcoin market's supply dynamics.

BTC-1,72%

CryptometerIo·2025-08-31 04:02

Businesses Are Absorbing Bitcoin at 4x the Rate It Is Mined, According to River’s Research

River says companies are taking in far more bitcoin each day than miners create.

The U.S.-based bitcoin financial services firm, which runs brokerage and mining operations and publishes research, released a Sankey-style flow infographic dated Aug. 25 in a post on X. In this layout, outflows are

BTC-1,72%

YahooFinance·2025-08-30 18:55

"Building a road in the open while secretly crossing the river, will Yield Basis make crvUSD great again?"

In the DeFi world, few projects have garnered widespread attention like Yield Basis since its launch. This new protocol, launched by Curve Finance founder Michael Egorov in 2025, carries multiple technological innovations - eliminating Impermanent Loss, circular leverage, creating stablecoin demand, releasing BTC Liquidity, and capturing governance token value, among others.

Its complex mechanism design and multi-layer narrative structure are both exciting and thought-provoking. On one hand, the protocol attempts to address the core issue that has long existed in AMM Liquidity pools—Impermanent Loss, which is considered a "holy grail" breakthrough for liquidity providers; on the other hand, the project's strategic intentions and the historical controversies surrounding the founder have also sparked market discussions. For example, Egorov previously faced near liquidation due to huge borrowing positions, which raised community concerns about

CRVUSD-0,96%

PANews·2025-08-26 13:36

Bitcoin accounts for 1.7% of the global currency! Powell hints at interest rate cuts, BTC is quietly rewriting the financial landscape.

Bitcoin (BTC) is quietly changing the global financial landscape. According to the latest data from Bitcoin service company River, at the beginning of this month, BTC's market capitalization accounted for 1.7% of the total global money supply, reaching an all-time high. This milestone comes at a time when Federal Reserve Chairman Powell is hesitant about interest rate policy and even hints at a new round of monetary easing on the horizon.

BTC-1,72%

MarketWhisper·2025-08-25 03:16

Is Satoshi’s Current Location Known? Max Keiser Hints It Is

Max Keiser claims Satoshi Nakamoto should metaphorically reside in El Salvador, referred to as "Bitcoin country," akin to a fantasy character. Meanwhile, a statue of Satoshi in Switzerland temporarily went missing before being found in a river.

MAX0,24%

UToday·2025-08-05 15:17

River protocol TVL突破 3 亿美元,生态产品 River4FUN 聚焦 BNB Chain

CoinVoice latest news, the TVL of the River protocol has surpassed 300 million USD within 2 weeks. The ecological product River4FUN has attracted 18,000 creators within 30 days, with over 20 cooperative projects. The core product Omni-CDP offers an annualized return of 7-10% and has been integrated with Pendle.

CoinVoice·2025-07-11 05:30

Exclusive interview with Resupply victims: Who should be held accountable for the 9.6 million dollars?

A week has passed since the Resupply hack. On June 26, the stablecoin "wstUSR market" of the DeFi protocol Resupply experienced a security vulnerability, resulting in a loss of approximately 9.6 million USD in encryption assets. "Those who often walk by the river will inevitably get their shoes wet," DeFi OG player 3D posted a series of rights protection videos on his YouTube channel for three consecutive days. BlockBeats reached out to 3D to discuss his experience as a victim of the loss and a series of reflections after the hack.

3D is one of the early users participating in this protocol mining. His identity is both a mining player and a content creator. In this interview, we heard his doubts, emotions, and some unwritten rules in this industry that people are reluctant to speak about. He mentioned

CRV-1,47%

星球日报·2025-07-02 07:38

Is the Spring River water warm Meme a prophet? A quick overview of recent hot Meme Tokens.

> With the recovery of market sentiment, Meme Tokens have started to lead the market once again.

Written by: Deep Tide TechFlow

The stock market outside is crazily attracting traffic with the concept of cryptocurrency, while BTC is independently following its own trend. The much-anticipated "altcoin season" in the crypto market seems to still be building momentum and has not truly returned.

However, with the recovery of market sentiment, Meme Tokens have begun to lead the market once again. $USELESS continues to rise, driving the revival of sentiment in the Meme sector, while the old ETH Meme coins are collectively rebounding. Perhaps we will see a wave of Meme Token rebounds in the short term.

We have compiled some recently performing Meme Tokens with decent price trends to help you understand the current market hotspots.

Note: The price of Meme tokens is highly volatile, with significant risks.

MEME-4,78%

ForesightNews·2025-07-01 13:59

The gold rush of alts ETF

> How 72 applications reshape investment in crypto assets other than Bitcoin?

Written by: Thejaswini MA

Compilation: Block unicorn

Introduction

January 2024 feels like another era. It’s only been eighteen months, but looking back it seems very distant. For Crypto Assets, it's an epic like "The Bridge on the River Kwai."

On January 11, 2024, spot Bitcoin ETFs began trading on Wall Street. About six months later, on July 23, 2024, spot Ethereum ETFs made their debut. Fast forward to eighteen months later, the US Securities and Exchange Commission (SEC) is inundated with applications—72 Crypto Assets ETF applications, and the number is still increasing.

From So

BTC-1,72%

ForesightNews·2025-07-01 09:47

Load More