# BitcoinDropsBelow$65K

3.74K

MrThanks77

#BitcoinDropsBelow$65K #BitcoinDropsBelow$65K – MARKET UPDATE 🚨

Bitcoin has plunged below the $65,000 level, marking one of the most significant downturns in its price in over a year. The drop is not just a minor pullback — it reflects deepening selling pressure, broader risk‑off market sentiment, and a shift in investor confidence across crypto markets.

Here’s what’s happening:

📉 Sharp Price Decline

• Bitcoin has slid below $65 K, with intraday trading dropping toward around $62,500–$64,000, the lowest levels since late 2024.

• This drop has erased nearly half of its value from the recent

Bitcoin has plunged below the $65,000 level, marking one of the most significant downturns in its price in over a year. The drop is not just a minor pullback — it reflects deepening selling pressure, broader risk‑off market sentiment, and a shift in investor confidence across crypto markets.

Here’s what’s happening:

📉 Sharp Price Decline

• Bitcoin has slid below $65 K, with intraday trading dropping toward around $62,500–$64,000, the lowest levels since late 2024.

• This drop has erased nearly half of its value from the recent

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 2

- Repost

- Share

ybaser :

:

HOLD HOLDView More

#BitcoinDropsBelow$65K 🚨

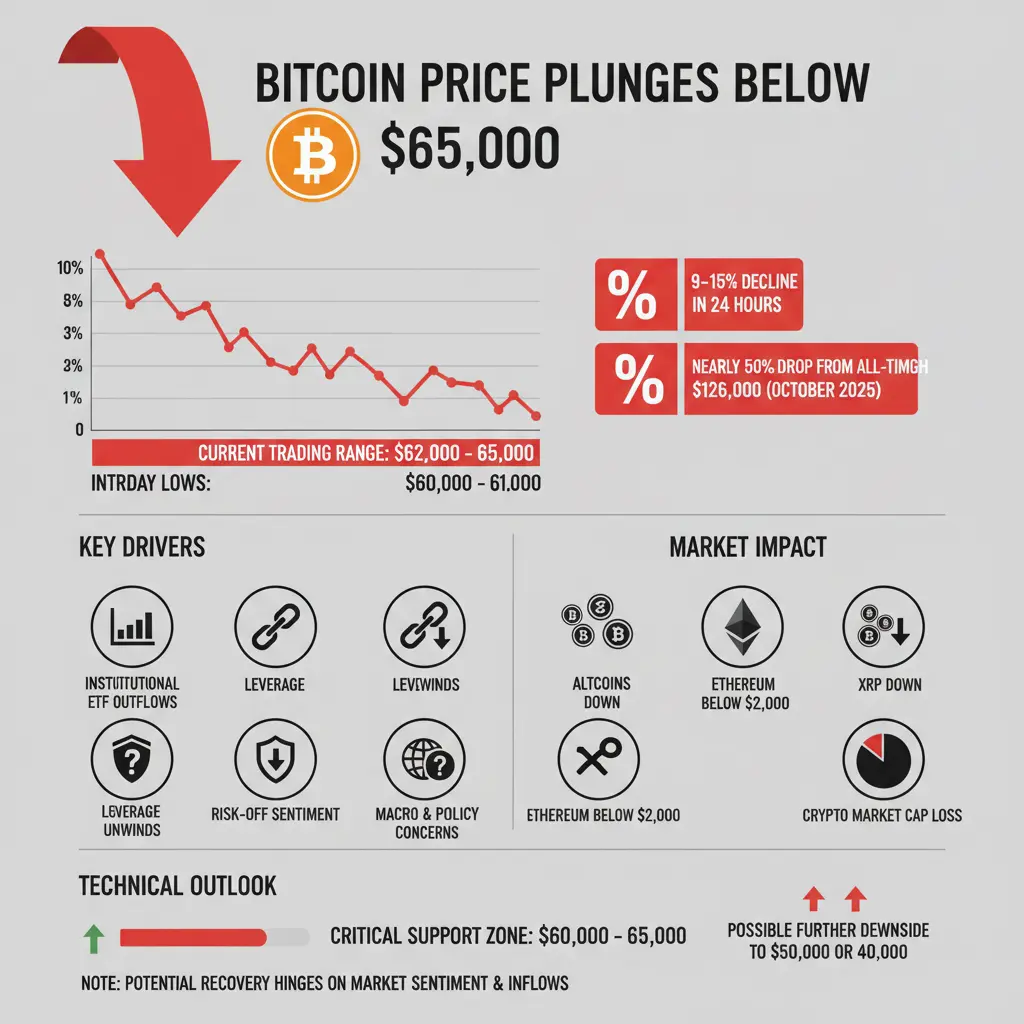

Bitcoin has recently slipped below the $65,000 mark, trading in the $62,000–$65,000 range, with intraday lows touching $60,000–$61,000. This represents a sharp decline of 9–15% in just 24 hours and marks Bitcoin's lowest level since October 2024. From its all-time high of $126,000 in October 2025, BTC has now lost nearly 50% of its value in only a few months.

Key Drivers of the Drop:

Institutional ETF Outflows: Spot Bitcoin ETFs have seen massive redemptions, removing a critical source of buying pressure.

Leverage Unwinds: Margin calls and forced liquidations are casc

Bitcoin has recently slipped below the $65,000 mark, trading in the $62,000–$65,000 range, with intraday lows touching $60,000–$61,000. This represents a sharp decline of 9–15% in just 24 hours and marks Bitcoin's lowest level since October 2024. From its all-time high of $126,000 in October 2025, BTC has now lost nearly 50% of its value in only a few months.

Key Drivers of the Drop:

Institutional ETF Outflows: Spot Bitcoin ETFs have seen massive redemptions, removing a critical source of buying pressure.

Leverage Unwinds: Margin calls and forced liquidations are casc

- Reward

- 6

- 12

- Repost

- Share

NovaCryptoGirl :

:

Ape In 🚀View More

#BitcoinDropsBelow$65K

What It Means for the Market

Bitcoin has recently slipped below the $65,000 mark, reigniting discussions across the crypto community about its short-term trajectory and the broader implications for digital assets. This correction comes after a period of sustained bullish momentum, during which BTC had reclaimed much of its previous highs. While dips are a natural part of any market cycle, the speed and timing of this decline have caught the attention of traders, investors, and analysts alike.

The drop below $65K can be attributed to a combination of factors. Firstly, pr

What It Means for the Market

Bitcoin has recently slipped below the $65,000 mark, reigniting discussions across the crypto community about its short-term trajectory and the broader implications for digital assets. This correction comes after a period of sustained bullish momentum, during which BTC had reclaimed much of its previous highs. While dips are a natural part of any market cycle, the speed and timing of this decline have caught the attention of traders, investors, and analysts alike.

The drop below $65K can be attributed to a combination of factors. Firstly, pr

BTC-8,07%

- Reward

- like

- Comment

- Repost

- Share

🚨 It’s official.

Bitcoin just recorded its first ever daily drop of OVER -$10,000.

Even the -$19.5B liquidation event on October 10 didn’t match today’s impact.

Something BIG just happened.

Was this:

• A whale liquidation?

• Over-leveraged longs getting wiped?

• A cascading futures domino effect?

• Smart money exiting before news?

When price drops this violently, it’s rarely retail.

This smells like forced liquidation.

What do you think caused it?

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

👇 Drop your theory.

#BuyTheDipOrWaitNow? #GateJanTransparencyReport

Bitcoin just recorded its first ever daily drop of OVER -$10,000.

Even the -$19.5B liquidation event on October 10 didn’t match today’s impact.

Something BIG just happened.

Was this:

• A whale liquidation?

• Over-leveraged longs getting wiped?

• A cascading futures domino effect?

• Smart money exiting before news?

When price drops this violently, it’s rarely retail.

This smells like forced liquidation.

What do you think caused it?

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

👇 Drop your theory.

#BuyTheDipOrWaitNow? #GateJanTransparencyReport

- Reward

- like

- Comment

- Repost

- Share

#BitcoinDropsBelow$65K

Bitcoin slipping below the $65K level has instantly reignited debate across the crypto market. For some, this move feels like a warning sign; for others, it looks like a textbook shakeout. Psychological price levels like $65K matter not just because of charts, but because of market behavior. When such levels break, emotions often react faster than logic.

From a technical lens, Bitcoin’s drop below $65K appears to be a short-term loss of momentum rather than a structural breakdown. Price had been consolidating near resistance for weeks, and this pullback is easing overhe

Bitcoin slipping below the $65K level has instantly reignited debate across the crypto market. For some, this move feels like a warning sign; for others, it looks like a textbook shakeout. Psychological price levels like $65K matter not just because of charts, but because of market behavior. When such levels break, emotions often react faster than logic.

From a technical lens, Bitcoin’s drop below $65K appears to be a short-term loss of momentum rather than a structural breakdown. Price had been consolidating near resistance for weeks, and this pullback is easing overhe

BTC-8,07%

- Reward

- 4

- 6

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K In early February 2026, Bitcoin has fallen below the critical $65,000 level, signaling renewed volatility and raising questions about market direction, investor confidence, and overall structural stability in the crypto ecosystem. This decline marks a decisive transition from the bullish expansion seen during late 2025, when BTC reached all-time highs above $120,000, into a corrective consolidation phase that has erased nearly half of the cycle gains. Over recent trading sessions, Bitcoin has hovered in the $63,000–$64,000 range, a level not seen since late 2024, reflect

BTC-8,07%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#BitcoinDropsBelow$65K In early February 2026, Bitcoin has fallen below the critical $65,000 level, signaling renewed volatility and raising questions about market direction, investor confidence, and overall structural stability in the crypto ecosystem. This decline marks a decisive transition from the bullish expansion seen during late 2025, when BTC reached all-time highs above $120,000, into a corrective consolidation phase that has erased nearly half of the cycle gains. Over recent trading sessions, Bitcoin has hovered in the $63,000–$64,000 range, a level not seen since late 2024, reflect

BTC-8,07%

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#BitcoinDropsBelow$65K

#BitcoinDropsBelow$65K In early February 2026, the global crypto market is facing renewed volatility as Bitcoin (BTC) the world’s largest cryptocurrency has fallen below the critical $65,000 level, triggering widespread discussion about market direction, investor confidence, and structural stability. This breakdown follows months of declining momentum after Bitcoin reached record highs above $120,000 in late 2025, marking a decisive shift from bullish expansion to corrective consolidation.

Recent trading sessions have seen Bitcoin slide into the $63,000–$64,000 range, l

#BitcoinDropsBelow$65K In early February 2026, the global crypto market is facing renewed volatility as Bitcoin (BTC) the world’s largest cryptocurrency has fallen below the critical $65,000 level, triggering widespread discussion about market direction, investor confidence, and structural stability. This breakdown follows months of declining momentum after Bitcoin reached record highs above $120,000 in late 2025, marking a decisive shift from bullish expansion to corrective consolidation.

Recent trading sessions have seen Bitcoin slide into the $63,000–$64,000 range, l

BTC-8,07%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 6

- 13

- Repost

- Share

ybaser :

:

Stay strong and HODL💎View More

Bitcoin Analysis 📉

$BTC is currently trading around 65k. We entered our short from 97k, and as discussed earlier, 72k was the major target. Congratulations, BTC is now trading below 72k.

As planned, I closed 50% of my short position at 72k and opened a small long position. That long is currently in a loss, so I have DCA’d, bringing my average long entry to around 67k.

I strongly believed that 72k would act as a bounce level, which is why I took partial profits on the short at that level. There are still 2 days and 22 hours left for the weekly candle to close. If BTC closes the weekly candle b

$BTC is currently trading around 65k. We entered our short from 97k, and as discussed earlier, 72k was the major target. Congratulations, BTC is now trading below 72k.

As planned, I closed 50% of my short position at 72k and opened a small long position. That long is currently in a loss, so I have DCA’d, bringing my average long entry to around 67k.

I strongly believed that 72k would act as a bounce level, which is why I took partial profits on the short at that level. There are still 2 days and 22 hours left for the weekly candle to close. If BTC closes the weekly candle b

BTC-8,07%

- Reward

- 6

- 8

- Repost

- Share

CryptoEagleStar :

:

2026 GOGOGO 👊View More

🔵 7. Cryptocurrency Panic Index drops to 12, "Extreme Fear" sentiment deepens

#当前行情抄底还是观望? On February 5th, according to Alternative data, today's cryptocurrency fear and greed index fell to 12 (yesterday was 14), and the market has further fallen into "Extreme Fear." Note: The panic index threshold is 0-100, including indicators: volatility (25%) + market trading volume (25%) + social media heat (15%) + market surveys (15%) + Bitcoin's proportion in the overall market (10%) + Google hot search analysis (10%).

💡 Extreme fear is a typical contrarian buy signal, aligning with users' needs

View Original#当前行情抄底还是观望? On February 5th, according to Alternative data, today's cryptocurrency fear and greed index fell to 12 (yesterday was 14), and the market has further fallen into "Extreme Fear." Note: The panic index threshold is 0-100, including indicators: volatility (25%) + market trading volume (25%) + social media heat (15%) + market surveys (15%) + Bitcoin's proportion in the overall market (10%) + Google hot search analysis (10%).

💡 Extreme fear is a typical contrarian buy signal, aligning with users' needs

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

100.63K Popularity

15.83K Popularity

386.9K Popularity

3.74K Popularity

2.1K Popularity

1.86K Popularity

1.51K Popularity

1.78K Popularity

1.14K Popularity

3.18K Popularity

11.44K Popularity

7.46K Popularity

19.53K Popularity

27.72K Popularity

22.9K Popularity

News

View MoreBitcoin Core developer Gloria Zhao has resigned from her maintainer position.

1 m

Is the XRP price rebound a false signal? On-chain data warns: the real bottom may still be in a lower zone

2 m

The Web3 AI tool platform has been acquired by Amadeus Protocol for $1.7 million. This strategic move aims to enhance the development of decentralized applications and promote innovation within the blockchain ecosystem. The acquisition will enable the platform to expand its capabilities, integrate new AI features, and better serve its growing user base. Both companies are committed to advancing Web3 technologies and fostering a more open and accessible digital economy.

4 m

Swedish publicly listed company H100 Group increases holdings by 4.39 BTC, bringing total holdings to 1051 BTC.

6 m

The probability of Ethereum falling below $1600 by the end of February on Polymarket has dropped to 44%.

6 m

Pin