MingDragonX

No content yet

MingDragonX

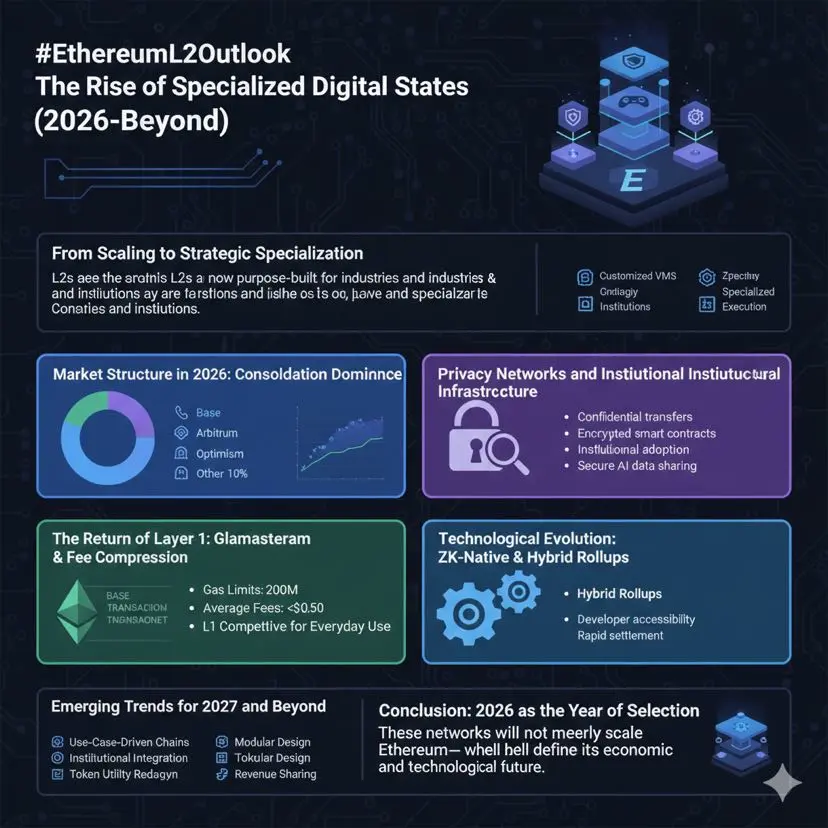

#EthereumL2Outlook EthereumL2OutlookTheRiseOfSpecializedDigitalStates2026Beyond

By2026 the Ethereum ecosystem has moved far beyond early scalability struggles what once revolved around cheaper transactions has evolved into specialized digital states where Layer2 L2 networks operate as independent economic and technological zones within Ethereum’s broader framework L2s are no longer simple extensions of mainnet they are purpose-built platforms optimized for industries user groups and institutional requirements

FromScalingToStrategicSpecialization in early 2026 Vitalik Buterin emphasized that sc

By2026 the Ethereum ecosystem has moved far beyond early scalability struggles what once revolved around cheaper transactions has evolved into specialized digital states where Layer2 L2 networks operate as independent economic and technological zones within Ethereum’s broader framework L2s are no longer simple extensions of mainnet they are purpose-built platforms optimized for industries user groups and institutional requirements

FromScalingToStrategicSpecialization in early 2026 Vitalik Buterin emphasized that sc

- Reward

- 5

- 12

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#CryptoMarketStructureUpdate CryptoMarketStructureUpdateStructuralEvolutionAndStrategicContext2026Outlook

The crypto market is undergoing a profound structural transformation driven by growing institutional participation shifting liquidity regimes macroeconomic pressure and unprecedented transparency in on-chain data in this environment price action alone is no longer sufficient deeper structural forces including capital rotation leverage dynamics and long-term positioning dominate trend formation Bitcoin remains the central anchor while altcoins increasingly differentiate based on real utilit

The crypto market is undergoing a profound structural transformation driven by growing institutional participation shifting liquidity regimes macroeconomic pressure and unprecedented transparency in on-chain data in this environment price action alone is no longer sufficient deeper structural forces including capital rotation leverage dynamics and long-term positioning dominate trend formation Bitcoin remains the central anchor while altcoins increasingly differentiate based on real utilit

- Reward

- 4

- 13

- Repost

- Share

MrThanks77 :

:

hold tightView More

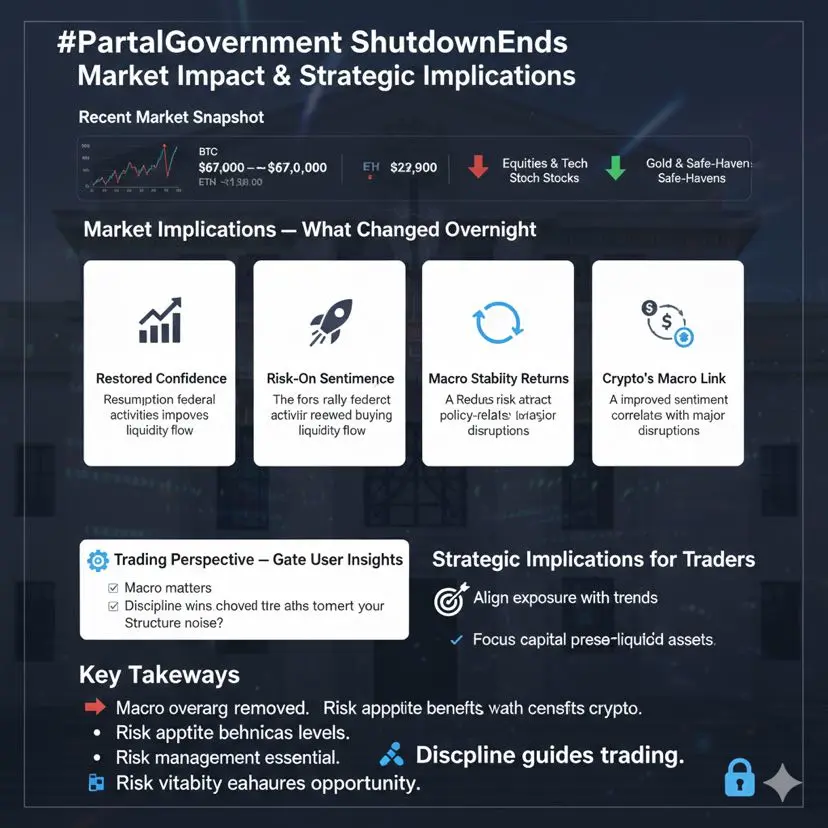

#PartialGovernmentShutdownEnds PartialGovernmentShutdownEndsMarketImpactAndStrategicImplications

The recent partial government shutdown in the United States has officially concluded restoring normal federal operations and removing a key source of macro uncertainty while the direct economic impact was limited its resolution has already influenced investor psychology and capital flows particularly across risk assets such as equities and crypto

RecentMarketSnapshot Bitcoin BTC trades around 67000 to 68000 showing moderate recovery after recent volatility Ethereum ETH ranges near 1950 to 2000 stab

The recent partial government shutdown in the United States has officially concluded restoring normal federal operations and removing a key source of macro uncertainty while the direct economic impact was limited its resolution has already influenced investor psychology and capital flows particularly across risk assets such as equities and crypto

RecentMarketSnapshot Bitcoin BTC trades around 67000 to 68000 showing moderate recovery after recent volatility Ethereum ETH ranges near 1950 to 2000 stab

- Reward

- 6

- 11

- Repost

- Share

MrThanks77 :

:

1000x vibesView More

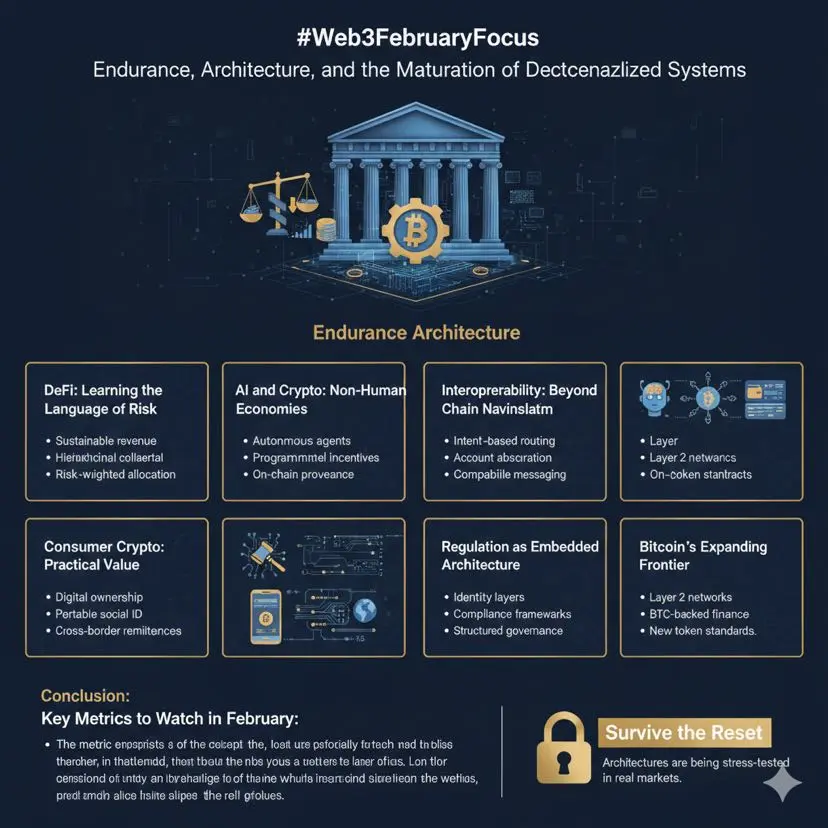

#Web3FebruaryFocus Web3FebruaryFocusEnduranceArchitectureAndTheMaturationOfDecentralizedSystems

Web3 has entered a phase that appears quiet on the surface yet represents a critical inflection point beneath it the era where narratives hype and viral attention could sustain entire ecosystems is fading the central question is no longer whether ideas are novel but whether they can withstand regulatory technical economic and human scrutiny February is less about another speculative cycle and more about endurance testing whether architectures built over the last decade can function as durable infras

Web3 has entered a phase that appears quiet on the surface yet represents a critical inflection point beneath it the era where narratives hype and viral attention could sustain entire ecosystems is fading the central question is no longer whether ideas are novel but whether they can withstand regulatory technical economic and human scrutiny February is less about another speculative cycle and more about endurance testing whether architectures built over the last decade can function as durable infras

- Reward

- 2

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#FedLeadershipImpact FedLeadershipImpactMonetarySignalsAndCryptoMarketDynamics

Recent developments surrounding Federal Reserve leadership and monetary policy guidance continue to shape global financial markets changes in tone policy direction or leadership structure influence interest rates liquidity conditions and investor confidence factors that directly affect risk assets including cryptocurrencies as crypto becomes more integrated with traditional financial systems understanding the Federal Reserve’s role is no longer optional it is now a core component of effective market analysis and ris

Recent developments surrounding Federal Reserve leadership and monetary policy guidance continue to shape global financial markets changes in tone policy direction or leadership structure influence interest rates liquidity conditions and investor confidence factors that directly affect risk assets including cryptocurrencies as crypto becomes more integrated with traditional financial systems understanding the Federal Reserve’s role is no longer optional it is now a core component of effective market analysis and ris

- Reward

- 4

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#BuyTheDipOrWaitNow? BuyTheDipOrWaitNowEthereumL2PowerShiftAndMarketPositioning2026Outlook

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth it is now shaped by distribution power institutional infrastructure and settlement-layer efficiency for investors and traders this reframes the core question is this a dip worth buying or a phase requiring patience and structural confirmation understanding the evolving L2 hierarchy is essential before making allocation decisions

TheBaseTakeoverWhenDistributionWins while Arbitrum and Optimism spent years c

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth it is now shaped by distribution power institutional infrastructure and settlement-layer efficiency for investors and traders this reframes the core question is this a dip worth buying or a phase requiring patience and structural confirmation understanding the evolving L2 hierarchy is essential before making allocation decisions

TheBaseTakeoverWhenDistributionWins while Arbitrum and Optimism spent years c

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#CryptoMarketPullback #CryptoMarketPullback—StructureDecidesEmotionsDont

This pullback has only one real judge Bitcoin’s structural levels not your feelings BTC losing momentum near major resistance was not random price advanced but open interest expanded faster than spot demand that is leverage leading price and leverage-led rallies always end the same way funding remained positive while upside momentum slowed that was not confidence that was crowding when too many traders lean in the same direction the market does not reward them it resets them

ThisPullbackDidntBreakTheTrendItExposedPosition

This pullback has only one real judge Bitcoin’s structural levels not your feelings BTC losing momentum near major resistance was not random price advanced but open interest expanded faster than spot demand that is leverage leading price and leverage-led rallies always end the same way funding remained positive while upside momentum slowed that was not confidence that was crowding when too many traders lean in the same direction the market does not reward them it resets them

ThisPullbackDidntBreakTheTrendItExposedPosition

BTC1,03%

- Reward

- 5

- 10

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

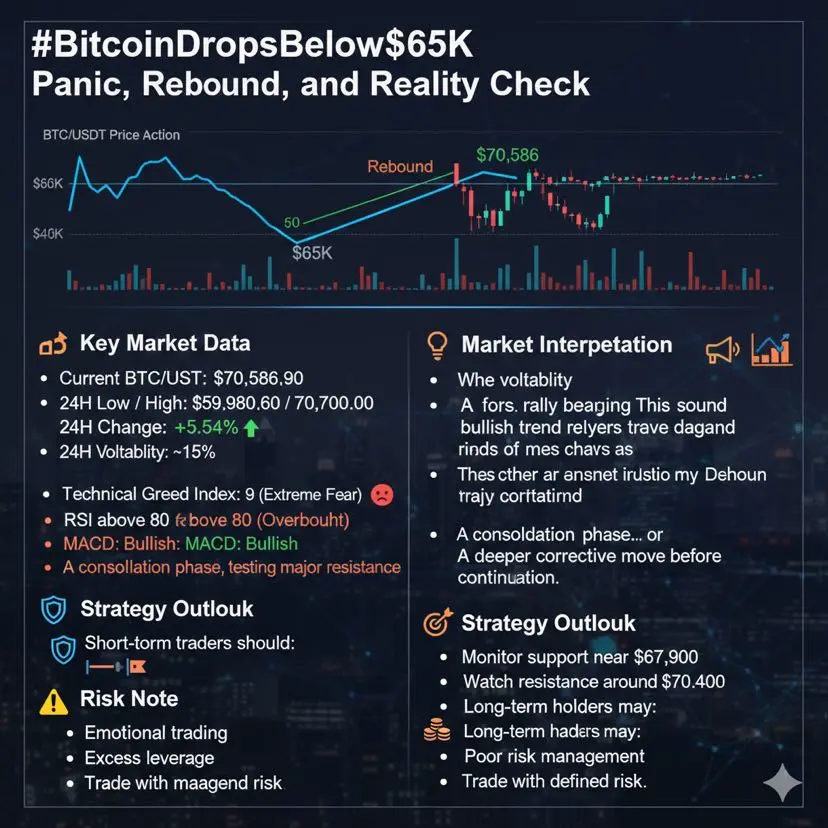

#BitcoinDropsBelow$65K BitcoinDropsBelow65KPanicReboundAndRealityCheck

Bitcoin’s recent dip below 65000 triggered extreme fear across the market however the sharp rebound that followed tells a deeper story BTC has now recovered near 70586 accompanied by strong intraday volatility a clear sign of aggressive positioning on both sides

📈KeyMarketData current BTCUSDT 70586.90 24H low high 59980.60 70700.00 24H change +5.54 percent 24H volatility approximately 15 percent Fear and Greed Index 9 extreme fear technical signals RSI above 80 indicating overbought conditions MACD remains bullish price is

Bitcoin’s recent dip below 65000 triggered extreme fear across the market however the sharp rebound that followed tells a deeper story BTC has now recovered near 70586 accompanied by strong intraday volatility a clear sign of aggressive positioning on both sides

📈KeyMarketData current BTCUSDT 70586.90 24H low high 59980.60 70700.00 24H change +5.54 percent 24H volatility approximately 15 percent Fear and Greed Index 9 extreme fear technical signals RSI above 80 indicating overbought conditions MACD remains bullish price is

BTC1,03%

- Reward

- 3

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#GlobalTechSell-OffHitsRiskAssets GlobalTechSell-OffHitsRiskAssets—CryptoInTheCrossfire

The recent global tech sell-off isn’t just Nasdaq pain its shockwaves are hitting all risk assets including crypto understanding these dynamics is critical for strategic positioning

📉DriversOfTheSell-Off rising interest rate pressure growth-oriented and leveraged tech stocks are highly sensitive to rates higher bond yields lead to heavier discounting of future cash flows pushing valuations lower risk-off sentiment spreads as investors rotate from equities into safe havens like USD bonds and gold crypto as

The recent global tech sell-off isn’t just Nasdaq pain its shockwaves are hitting all risk assets including crypto understanding these dynamics is critical for strategic positioning

📉DriversOfTheSell-Off rising interest rate pressure growth-oriented and leveraged tech stocks are highly sensitive to rates higher bond yields lead to heavier discounting of future cash flows pushing valuations lower risk-off sentiment spreads as investors rotate from equities into safe havens like USD bonds and gold crypto as

- Reward

- 4

- 11

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

🌈#GateLive直播灵感 February 7 Officially Launching: Choose an official recommended theme to start streaming and win exclusive traffic exposure. Seize market sentiment and capture the hotness window.

Ethereum privacy narrative heats up again. Vitalik Buterin's introduction of Zcash privacy technology—does this mean Ethereum will re-embrace the privacy track? A new balance between privacy and compliance is taking shape.

The US crypto banking era officially begins. Five major financial giants obtain federal licenses. Trillions of dollars in clearing and settlement power are being redistributed, whic

View OriginalEthereum privacy narrative heats up again. Vitalik Buterin's introduction of Zcash privacy technology—does this mean Ethereum will re-embrace the privacy track? A new balance between privacy and compliance is taking shape.

The US crypto banking era officially begins. Five major financial giants obtain federal licenses. Trillions of dollars in clearing and settlement power are being redistributed, whic

- Reward

- 3

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#ADPJobsMissEstimates ADPJobsMissEstimates

In the United States, private sector employment in January 2026 came in significantly weaker than anticipated. According to the ADP National Employment Report, private companies added only 22,000 new jobs during the month. This figure fell well short of economists’ consensus forecast of around 45,000 (with some estimates as high as 48,000), signaling ongoing softness in hiring activity.

The report also included a downward revision to December 2025 data, which was adjusted from an initial 41,000 to 37,000 added jobs. This revision reinforces the broade

In the United States, private sector employment in January 2026 came in significantly weaker than anticipated. According to the ADP National Employment Report, private companies added only 22,000 new jobs during the month. This figure fell well short of economists’ consensus forecast of around 45,000 (with some estimates as high as 48,000), signaling ongoing softness in hiring activity.

The report also included a downward revision to December 2025 data, which was adjusted from an initial 41,000 to 37,000 added jobs. This revision reinforces the broade

- Reward

- 5

- 11

- Repost

- Share

Peacefulheart :

:

Watching Closely 🔍️View More

#GlobalTechSell-OffHitsRiskAssets GlobalTechSell-OffHitsRiskAssets

Global Tech Sell-Off Hits Risk Assets

The sharp wave of selling echoing through global financial corridors has impacted a wide spectrum from tech giants to crypto assets, initiating a challenging period for “risk assets.” This deepening trend since the beginning of the week is causing investors to re-examine the excessive valuations in the artificial intelligence and software sectors, which have been the focus of high hopes in recent years.

The Trial of Tech Giants and the AI Scrutiny

At the center of this market turbulence lie

Global Tech Sell-Off Hits Risk Assets

The sharp wave of selling echoing through global financial corridors has impacted a wide spectrum from tech giants to crypto assets, initiating a challenging period for “risk assets.” This deepening trend since the beginning of the week is causing investors to re-examine the excessive valuations in the artificial intelligence and software sectors, which have been the focus of high hopes in recent years.

The Trial of Tech Giants and the AI Scrutiny

At the center of this market turbulence lie

BTC1,03%

- Reward

- 4

- 6

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#BuyTheDipOrWaitNow? 当前行情抄底还是观望? #BTC

Bottom Fishing Signals: Will the Market Continue to Fall?

While the current atmosphere in the markets suggests we are approaching a stage of “capitulation,” a clear reversal signal has not yet emerged.

Technical Outlook: The completion of a “Head and Shoulders” pattern in Bitcoin and the breach of critical support levels are pushing technical analysts toward caution. Although the RSI (Relative Strength Index) on weekly charts has entered the oversold zone, past cycles demonstrate that this signal can appear several weeks before the actual bottom is reached

Bottom Fishing Signals: Will the Market Continue to Fall?

While the current atmosphere in the markets suggests we are approaching a stage of “capitulation,” a clear reversal signal has not yet emerged.

Technical Outlook: The completion of a “Head and Shoulders” pattern in Bitcoin and the breach of critical support levels are pushing technical analysts toward caution. Although the RSI (Relative Strength Index) on weekly charts has entered the oversold zone, past cycles demonstrate that this signal can appear several weeks before the actual bottom is reached

BTC1,03%

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

#BuyTheDipOrWaitNow? #BTC

#当前行情抄底还是观望?

Why Is Everything Falling Simultaneously?

The real factor behind the simultaneous collapse of gold, silver, and cryptocurrencies—which are normally expected to show an inverse correlation—is a “Mechanical Liquidity Crunch.”

The Fed and “Hawkish” Expectations: The nomination of figures like Kevin Warsh, known for favoring restrictive monetary policies, to the Federal Reserve leadership in the US has triggered fears that “there may be no rate cuts in 2026, and perhaps even increases.” This situation strengthened the dollar while exerting pressure across all

#当前行情抄底还是观望?

Why Is Everything Falling Simultaneously?

The real factor behind the simultaneous collapse of gold, silver, and cryptocurrencies—which are normally expected to show an inverse correlation—is a “Mechanical Liquidity Crunch.”

The Fed and “Hawkish” Expectations: The nomination of figures like Kevin Warsh, known for favoring restrictive monetary policies, to the Federal Reserve leadership in the US has triggered fears that “there may be no rate cuts in 2026, and perhaps even increases.” This situation strengthened the dollar while exerting pressure across all

BTC1,03%

- Reward

- 4

- 5

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#BuyTheDipOrWaitNow? 当前行情抄底还是观望? #BTC

Trading Evaluation and Strategy

Over the past week, a dominant “bearish” trend has taken full control of the market. A significant portion of investors has shifted from a “HODL” strategy to a capital preservation mode.

Leverage Flush: In just the last 24 hours, $2.8 billion worth of long positions were liquidated. This indicates that the market is being purged of excessive leverage, though the process has been undeniably “bloody.”

Short Position Strategy: Many professional traders are maintaining their short positions, confirming Bitcoin’s sustained stay b

Trading Evaluation and Strategy

Over the past week, a dominant “bearish” trend has taken full control of the market. A significant portion of investors has shifted from a “HODL” strategy to a capital preservation mode.

Leverage Flush: In just the last 24 hours, $2.8 billion worth of long positions were liquidated. This indicates that the market is being purged of excessive leverage, though the process has been undeniably “bloody.”

Short Position Strategy: Many professional traders are maintaining their short positions, confirming Bitcoin’s sustained stay b

BTC1,03%

- Reward

- 4

- 8

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? Global markets remain under pressure as risk assets continue to struggle for stability. Bitcoin is hovering near critical support zones, U.S. futures remain weak, and precious metals are failing to provide their usual safety net. This is not a normal pullback — it reflects a broader shift in market behavior driven by tightening liquidity and reduced risk appetite.

What makes this phase different is the synchronized decline across crypto, equities, and commodities. When all major asset classes fall together, it usually signals institutional de-risking a

What makes this phase different is the synchronized decline across crypto, equities, and commodities. When all major asset classes fall together, it usually signals institutional de-risking a

BTC1,03%

- Reward

- 5

- 8

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

#GateJanTransparencyReport GateJanTransparencyReport

Gate’s January 2026 Transparency Report marks a major strategic evolution — transforming from a traditional crypto exchange into a fully integrated DeTraFi (Decentralized + Traditional Finance) ecosystem. This shift positions Gate not just as a trading venue, but as a multi-layer financial infrastructure bridging on-chain and off-chain capital.

At the foundation of this expansion is financial security. Gate continues to set industry benchmarks in transparency and reserve management. With an overall reserve ratio of 125% and total reserves ne

Gate’s January 2026 Transparency Report marks a major strategic evolution — transforming from a traditional crypto exchange into a fully integrated DeTraFi (Decentralized + Traditional Finance) ecosystem. This shift positions Gate not just as a trading venue, but as a multi-layer financial infrastructure bridging on-chain and off-chain capital.

At the foundation of this expansion is financial security. Gate continues to set industry benchmarks in transparency and reserve management. With an overall reserve ratio of 125% and total reserves ne

- Reward

- 4

- 6

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#CryptoMarketPullback CryptoMarketPullback

As 2026 unfolds, the cryptocurrency market is navigating a phase of elevated uncertainty. Bitcoin and major digital assets have undergone sharp corrections, triggering renewed debate over whether this decline represents the beginning of a prolonged bear cycle or the final phase of a broader market reset. While short-term sentiment remains fragile, Fundstrat’s Tom Lee maintains a constructive outlook, viewing the current pullback as a technical and psychological correction rather than a structural breakdown.

Despite Bitcoin declining nearly 20% year-to

As 2026 unfolds, the cryptocurrency market is navigating a phase of elevated uncertainty. Bitcoin and major digital assets have undergone sharp corrections, triggering renewed debate over whether this decline represents the beginning of a prolonged bear cycle or the final phase of a broader market reset. While short-term sentiment remains fragile, Fundstrat’s Tom Lee maintains a constructive outlook, viewing the current pullback as a technical and psychological correction rather than a structural breakdown.

Despite Bitcoin declining nearly 20% year-to

BTC1,03%

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More