# StrategyBitcoinPositionTurnsRed

17.28K

Major BTC-holding companies like Strategy now show unrealized losses amid recent price drops. Do you think this will change institutional accumulation strategies?

JehanBhai

BREAKING: Bitcoin falls below $75,000 and $ETH falls below $2,200 as the crypto selloff accelerates.

$BTC is now down -15% YTD.

#StrategyBitcoinPositionTurnsRed

$BTC is now down -15% YTD.

#StrategyBitcoinPositionTurnsRed

- Reward

- like

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Bitcoin Market Alert — Managing Red Positions

Bitcoin positions turning red is a natural part of market cycles, but it’s also a critical signal for strategic decision-making. Traders and investors must distinguish between temporary pullbacks and signs of sustained weakness.

🔍 What “Red Positions” Means

Short-term Losses: Positions showing negative returns indicate BTC has pulled back from recent highs.

Market Sentiment: Widespread red positions often trigger fear, but can also create opportunities for accumulation.

Risk Management Trigger: Turning red is a ke

Bitcoin Market Alert — Managing Red Positions

Bitcoin positions turning red is a natural part of market cycles, but it’s also a critical signal for strategic decision-making. Traders and investors must distinguish between temporary pullbacks and signs of sustained weakness.

🔍 What “Red Positions” Means

Short-term Losses: Positions showing negative returns indicate BTC has pulled back from recent highs.

Market Sentiment: Widespread red positions often trigger fear, but can also create opportunities for accumulation.

Risk Management Trigger: Turning red is a ke

BTC-3,38%

- Reward

- 5

- 5

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#StrategyBitcoinPositionTurnsRed

Seeing a Bitcoin position turn red is never just a moment of loss it’s a critical signal that demands attention, analysis, and strategy. In crypto trading, red doesn’t always mean panic; it’s often a reminder that markets are dynamic, liquidity moves fast, and risk management is your first line of defense. When a position shows negative returns, especially during periods of heightened volatility, experienced traders shift focus from emotion to actionable insights: Why did the move happen? Is this temporary noise, or a structural trend shift?

Short-term dips in

Seeing a Bitcoin position turn red is never just a moment of loss it’s a critical signal that demands attention, analysis, and strategy. In crypto trading, red doesn’t always mean panic; it’s often a reminder that markets are dynamic, liquidity moves fast, and risk management is your first line of defense. When a position shows negative returns, especially during periods of heightened volatility, experienced traders shift focus from emotion to actionable insights: Why did the move happen? Is this temporary noise, or a structural trend shift?

Short-term dips in

BTC-3,38%

- Reward

- 2

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Understanding the Shift and What It Means for Traders

The world of cryptocurrency trading is as exhilarating as it is volatile, and Bitcoin, as the pioneer of digital assets, often sets the pace. Recently, many traders and analysts have been observing a concerning trend: certain Bitcoin positions have started to turn red, signaling losses on trades that were once profitable. This development, highlighted by the hashtag #StrategyBitcoinPositionTurnsRed, has sparked debates across trading communities about market behavior, risk management, and strategic adjustme

Understanding the Shift and What It Means for Traders

The world of cryptocurrency trading is as exhilarating as it is volatile, and Bitcoin, as the pioneer of digital assets, often sets the pace. Recently, many traders and analysts have been observing a concerning trend: certain Bitcoin positions have started to turn red, signaling losses on trades that were once profitable. This development, highlighted by the hashtag #StrategyBitcoinPositionTurnsRed, has sparked debates across trading communities about market behavior, risk management, and strategic adjustme

BTC-3,38%

- Reward

- 6

- 12

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#StrategyBitcoinPositionTurnsRed

Seeing a Bitcoin position turn red is never just a moment of loss it’s a critical signal that demands attention, analysis, and strategy. In crypto trading, red doesn’t always mean panic; it’s often a reminder that markets are dynamic, liquidity moves fast, and risk management is your first line of defense. When a position shows negative returns, especially during periods of heightened volatility, experienced traders shift focus from emotion to actionable insights: Why did the move happen? Is this temporary noise, or a structural trend shift?

Short-term dips in

Seeing a Bitcoin position turn red is never just a moment of loss it’s a critical signal that demands attention, analysis, and strategy. In crypto trading, red doesn’t always mean panic; it’s often a reminder that markets are dynamic, liquidity moves fast, and risk management is your first line of defense. When a position shows negative returns, especially during periods of heightened volatility, experienced traders shift focus from emotion to actionable insights: Why did the move happen? Is this temporary noise, or a structural trend shift?

Short-term dips in

BTC-3,38%

- Reward

- 7

- 10

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#StrategyBitcoinPositionTurnsRed 🏦 Institutional BTC Accumulation – Strategy Under Review?

Major BTC-holding companies like Strategy are now reporting unrealized losses following recent price declines. While this looks concerning on the surface, it doesn’t necessarily signal panic among institutions.

🔍 Will this change institutional accumulation behavior?

Probably not a full stop, but a shift in approach.

📊 What’s likely to change:

✔️ Slower, more staggered accumulation

✔️ Increased focus on cost-averaging zones

✔️ Higher sensitivity to macro & liquidity signals

✔️ More emphasis on balance-

Major BTC-holding companies like Strategy are now reporting unrealized losses following recent price declines. While this looks concerning on the surface, it doesn’t necessarily signal panic among institutions.

🔍 Will this change institutional accumulation behavior?

Probably not a full stop, but a shift in approach.

📊 What’s likely to change:

✔️ Slower, more staggered accumulation

✔️ Increased focus on cost-averaging zones

✔️ Higher sensitivity to macro & liquidity signals

✔️ More emphasis on balance-

BTC-3,38%

- Reward

- 3

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Major Bitcoin-holding companies such as Strategy entering unrealized loss territory has become a focal point for market discussion, but this situation needs to be viewed through a strategic, structural, and institutional lens, not an emotional or short-term price lens. Unrealized losses do not automatically signal failure, capitulation, or a breakdown of institutional conviction. Instead, they often mark critical transition phases within long-duration accumulation cycles.

To begin with, institutions that hold BTC on balance sheets operate under a very differen

Major Bitcoin-holding companies such as Strategy entering unrealized loss territory has become a focal point for market discussion, but this situation needs to be viewed through a strategic, structural, and institutional lens, not an emotional or short-term price lens. Unrealized losses do not automatically signal failure, capitulation, or a breakdown of institutional conviction. Instead, they often mark critical transition phases within long-duration accumulation cycles.

To begin with, institutions that hold BTC on balance sheets operate under a very differen

BTC-3,38%

- Reward

- 8

- 11

- Repost

- Share

EagleEye :

:

Such a great postView More

#StrategyBitcoinPositionTurnsRed 🌏Bitcoin’s early-February pullback has quietly marked a rare moment in this cycle: Strategy Inc.’s enormous Bitcoin position briefly turning red. This is less about one company’s PnL and more about what happens when price collides with a widely known institutional cost basis. The market tends to react differently when such reference levels are tested, because psychology, liquidity, and positioning all converge in one narrow zone.🚀

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acc

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acc

BTC-3,38%

- Reward

- like

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

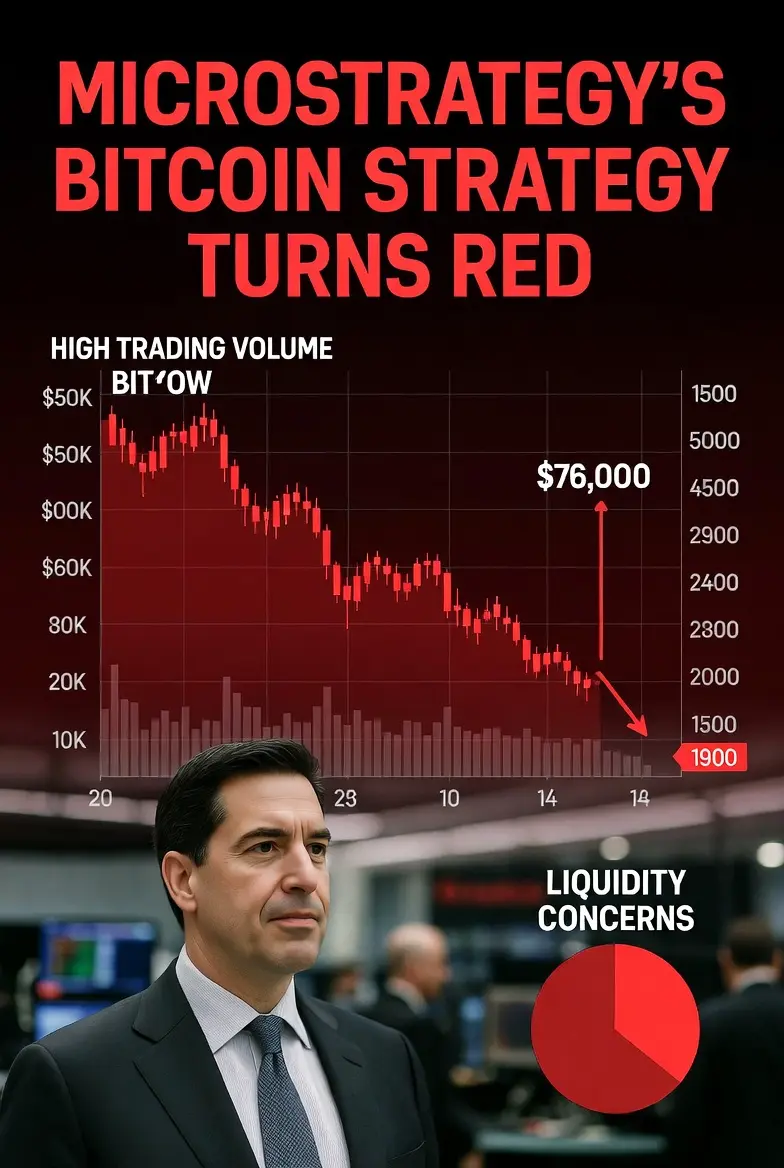

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

BTC-3,38%

- Reward

- 22

- 21

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#StrategyBitcoinPositionTurnsRed StrategyBitcoinPositionTurnsRed Institutional BTC Under Pressure

Bitcoin has entered a phase where even the largest institutional holders are under visible stress. With BTC trading in the $74,500–$75,500 range, Strategy’s average acquisition cost of $76,052 has pushed its position into unrealized loss territory. Holding approximately 713,502 BTC with a total cost basis of $54.2B, the market value has now slipped below the acquisition floor, creating both psychological and strategic pressure.

The primary catalyst behind BTC falling below Strategy’s cost lies in

Bitcoin has entered a phase where even the largest institutional holders are under visible stress. With BTC trading in the $74,500–$75,500 range, Strategy’s average acquisition cost of $76,052 has pushed its position into unrealized loss territory. Holding approximately 713,502 BTC with a total cost basis of $54.2B, the market value has now slipped below the acquisition floor, creating both psychological and strategic pressure.

The primary catalyst behind BTC falling below Strategy’s cost lies in

BTC-3,38%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

17.44K Popularity

10.94K Popularity

10.4K Popularity

3.49K Popularity

6.31K Popularity

5.99K Popularity

6.83K Popularity

28.37K Popularity

17.28K Popularity

10.21K Popularity

1.43K Popularity

9.47K Popularity

22.26K Popularity

19.05K Popularity

229.81K Popularity

News

View MoreBessent: Foreign capital continues to flow into U.S. Treasury bonds and the stock market

4 m

The US stock market continues its decline, with the Nasdaq down over 2%, and Tesla's decline expanding to 5%

7 m

ETH drops below 2100 USDT

8 m

BTC drops below 73,000 USDT

37 m

The U.S. Bureau of Labor Statistics delays the January non-farm payroll report to February 11 for release

46 m

Pin