# rwa

1.59M

Crypto_Exper

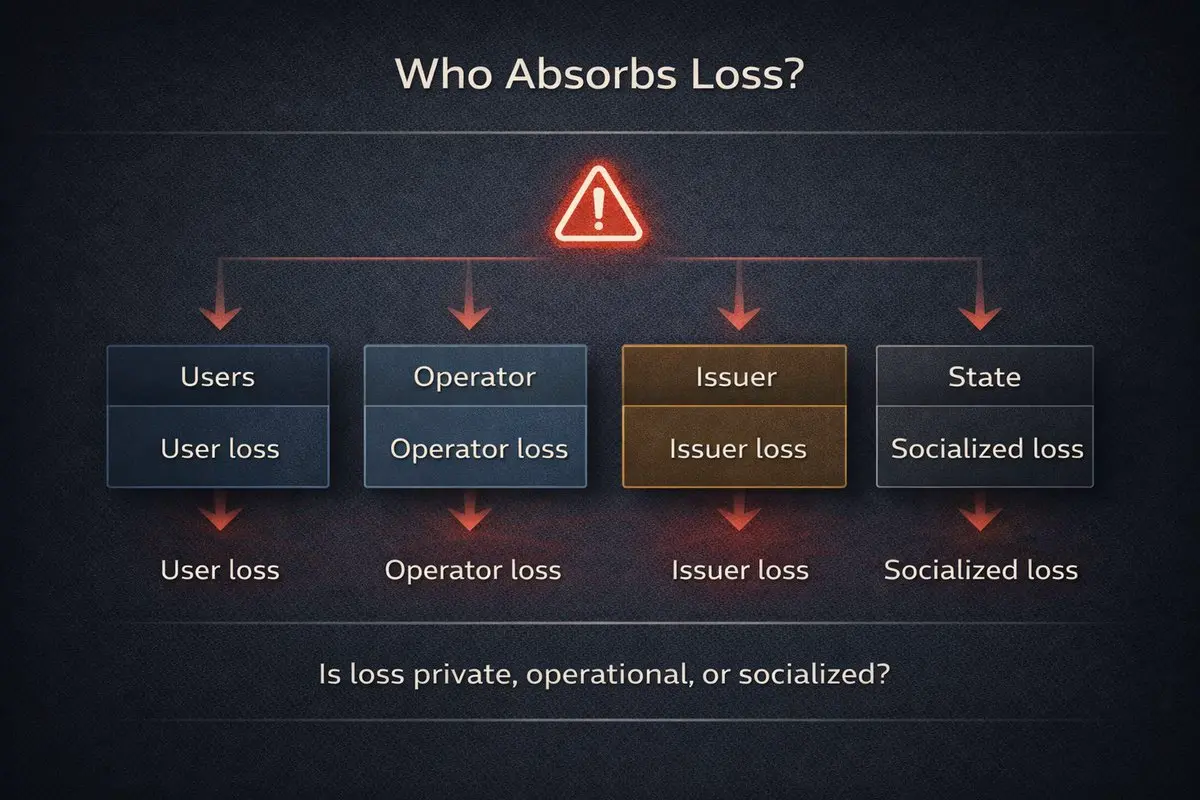

Every financial system hides a simple truth:

loss always lands somewhere.

In tokenized models, this is often left implicit — or deliberately vague.

• Is the loss borne by users?

• Absorbed by the operator?

• Assigned to the issuer?

• Or quietly socialized?

If a system cannot answer this before scale,

it is not infrastructure — it’s a risk transfer mechanism.

#Risk #Tokenization #RWA #Finance #GovernanceMatters

loss always lands somewhere.

In tokenized models, this is often left implicit — or deliberately vague.

• Is the loss borne by users?

• Absorbed by the operator?

• Assigned to the issuer?

• Or quietly socialized?

If a system cannot answer this before scale,

it is not infrastructure — it’s a risk transfer mechanism.

#Risk #Tokenization #RWA #Finance #GovernanceMatters

- Reward

- 2

- Comment

- Repost

- Share

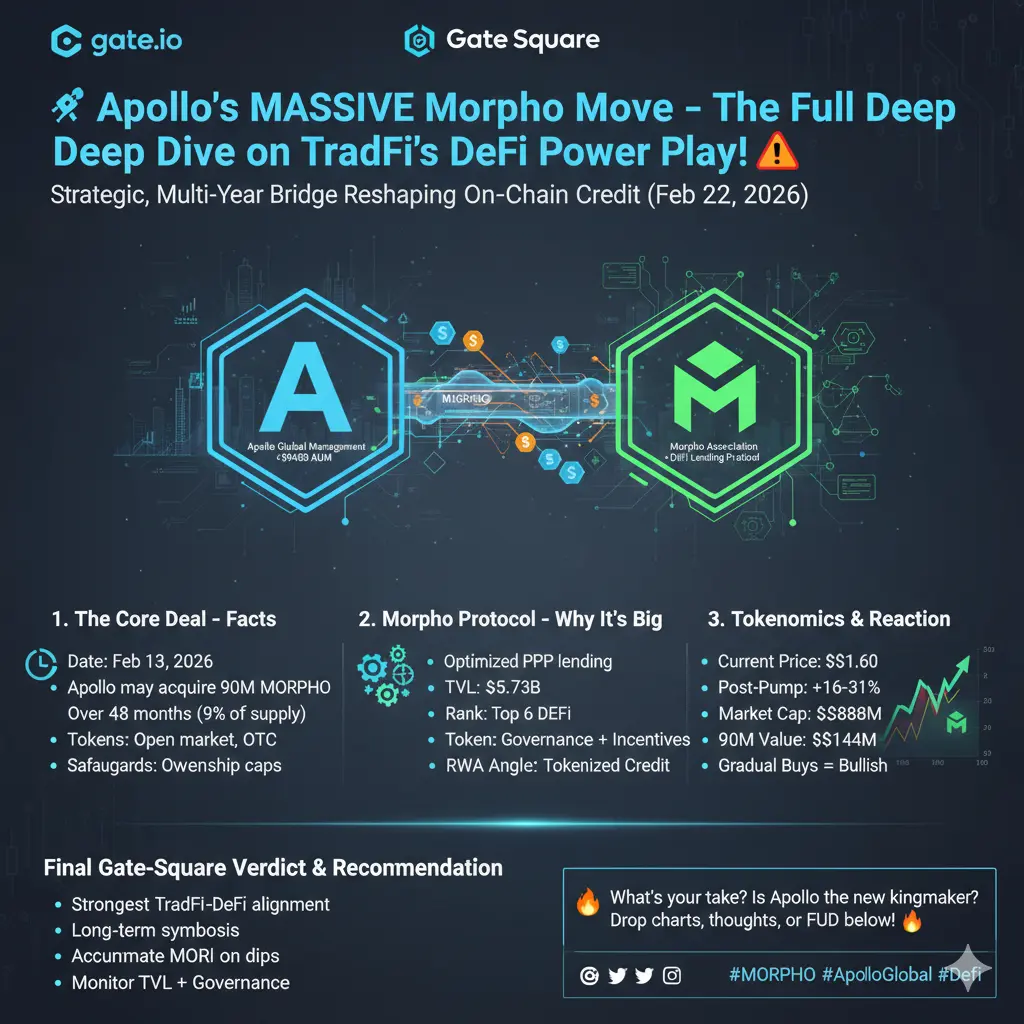

#ApollotoBuy90MMORPHOin4Years 🚀

Apollo Commits to Up to 90M MORPHO Tokens – A Major TradFi × DeFi Moment (Feb 2026)

This isn’t a rumor. It’s confirmed.

On February 13, 2026, Apollo Global Management announced a long-term commitment involving Morpho Association and its native token, MORPHO.

Let’s break it down clearly.

1️⃣ The Core Deal – Straight Facts

• Apollo may acquire up to 90 million MORPHO tokens over 4 years (48 months).

• That equals ~9% of the 1B max supply.

• The deal is structured as an option/right — not a forced purchase.

• Purchases may happen via open market buys, OTC deals, o

Apollo Commits to Up to 90M MORPHO Tokens – A Major TradFi × DeFi Moment (Feb 2026)

This isn’t a rumor. It’s confirmed.

On February 13, 2026, Apollo Global Management announced a long-term commitment involving Morpho Association and its native token, MORPHO.

Let’s break it down clearly.

1️⃣ The Core Deal – Straight Facts

• Apollo may acquire up to 90 million MORPHO tokens over 4 years (48 months).

• That equals ~9% of the 1B max supply.

• The deal is structured as an option/right — not a forced purchase.

• Purchases may happen via open market buys, OTC deals, o

- Reward

- 5

- 19

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

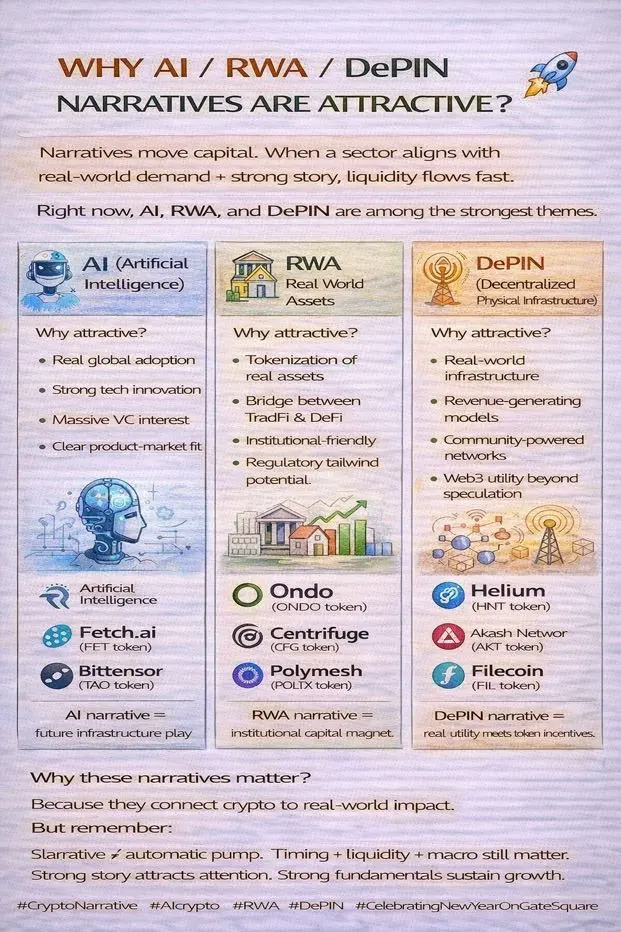

WHY AI / RWA / DePIN NARRATIVES ARE ATTRACTIVE? 🚀

Narratives move capital.

When a sector aligns with real-world demand and strong long-term vision, liquidity flows fast.

Right now, AI, RWA, and DePIN are among the strongest themes in the market.

⸻

AI

Why attractive?

• Real global adoption

• Rapid technological innovation

• Strong venture capital interest

• Clear product-market fit

AI narrative = future digital infrastructure.

⸻

RWA

Why attractive?

• Tokenization of real-world assets

• Bridge between traditional finance and crypto

• Institutional-friendly structure

• Potential regulatory suppo

Narratives move capital.

When a sector aligns with real-world demand and strong long-term vision, liquidity flows fast.

Right now, AI, RWA, and DePIN are among the strongest themes in the market.

⸻

AI

Why attractive?

• Real global adoption

• Rapid technological innovation

• Strong venture capital interest

• Clear product-market fit

AI narrative = future digital infrastructure.

⸻

RWA

Why attractive?

• Tokenization of real-world assets

• Bridge between traditional finance and crypto

• Institutional-friendly structure

• Potential regulatory suppo

- Reward

- 5

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Real-world asset tokenization is increasingly bridging traditional capital markets and DeFi. Assets like $ONDO often draw attention when investors seek yield outside purely crypto-native strategies.

Unlike short-lived narratives, RWAs spark structural allocation conversations. Institutional participants look at transparency, collateral design, and redemption clarity moving the focus from hype to fundamentals.

Capital mobility remains crucial. As yield spreads shift, investors need to rebalance efficiently between tokenized assets and other DeFi opportunities. Within $TON , STONfi supports thi

Unlike short-lived narratives, RWAs spark structural allocation conversations. Institutional participants look at transparency, collateral design, and redemption clarity moving the focus from hype to fundamentals.

Capital mobility remains crucial. As yield spreads shift, investors need to rebalance efficiently between tokenized assets and other DeFi opportunities. Within $TON , STONfi supports thi

- Reward

- 3

- Comment

- Repost

- Share

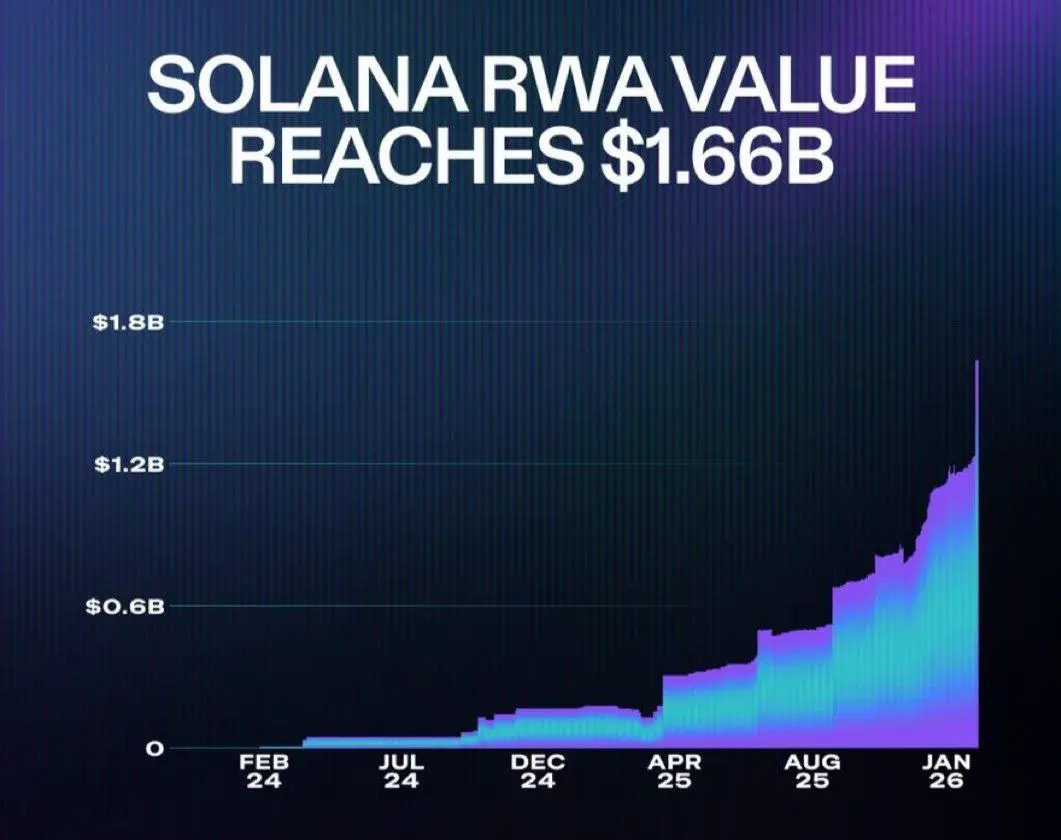

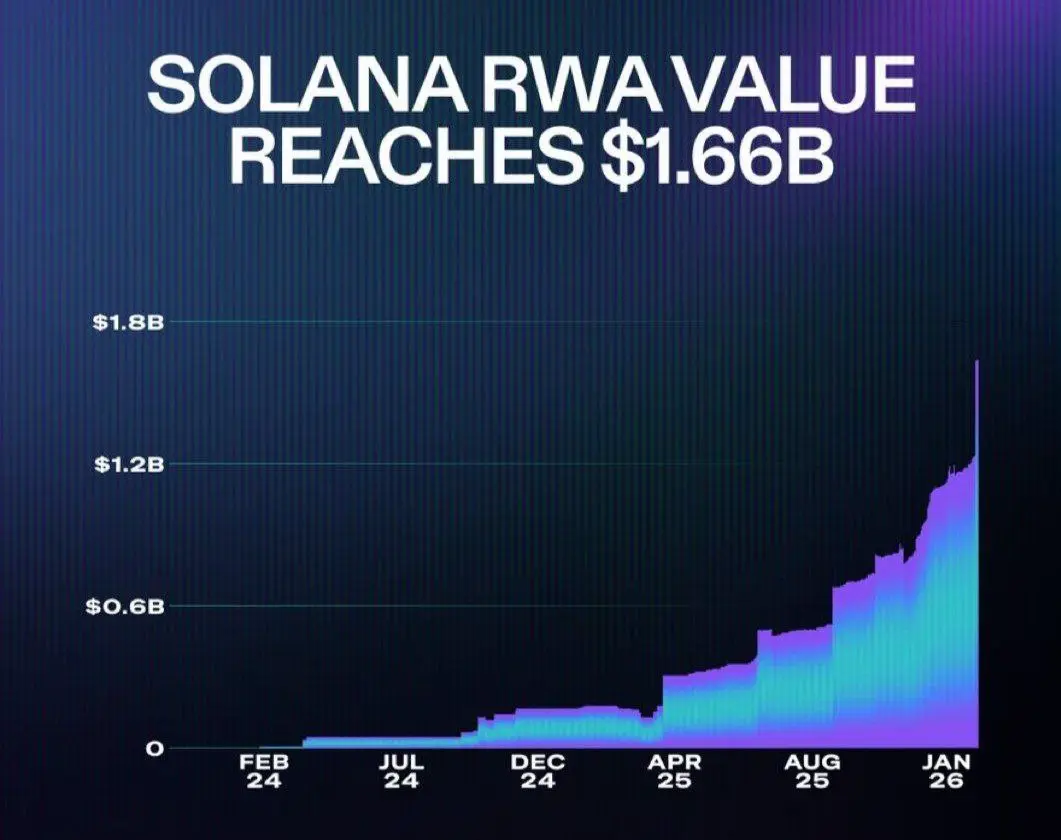

#RWA on #SOL is accelerating.

Solana’s real-world asset ecosystem just hit a new all-time high of $1.66B in tokenized value — up 42% in the last 30 days.

That’s not speculative TVL rotation. That’s capital flowing into on-chain representations of treasuries, credit, and yield-bearing instruments.

While most watch memecoin cycles, infrastructure quietly compounds.

RWA growth on Solana signals one thing: institutional-grade use cases are no longer theoretical — they’re scaling.

$SOL

Solana’s real-world asset ecosystem just hit a new all-time high of $1.66B in tokenized value — up 42% in the last 30 days.

That’s not speculative TVL rotation. That’s capital flowing into on-chain representations of treasuries, credit, and yield-bearing instruments.

While most watch memecoin cycles, infrastructure quietly compounds.

RWA growth on Solana signals one thing: institutional-grade use cases are no longer theoretical — they’re scaling.

$SOL

SOL-4,56%

- Reward

- 4

- Comment

- Repost

- Share

👍 #Robinhood has introduced "Robinhood Chain," a Layer 2 solution leveraging Arbitrum technology, designed specifically for financial services and tokenized real assets (#RWA ). Developers can now access the testnet to experiment with and validate financial applications.

✏️ In other news, Robinhood's fourth-quarter financial results did not meet expectations, largely due to a decline in cryptocurrency revenue.

#GateSquare$50KRedPacketGiveaway

✏️ In other news, Robinhood's fourth-quarter financial results did not meet expectations, largely due to a decline in cryptocurrency revenue.

#GateSquare$50KRedPacketGiveaway

ARB2,02%

- Reward

- 1

- Comment

- Repost

- Share

Why $4 Trillion is the magic number for 2026. 🏦

While volatility shakes weak hands, the RWA sector is quietly expanding. Tokenization of US stocks and treasuries is accelerating.

Projects like $LINK and $ONDO are positioning themselves as bridges between traditional finance and DeFi.

If you're ignoring RWAs, you're ignoring one of the biggest structural shifts in crypto.

#RWA #Tokenization #DeFi #GateioSquare

$LINK / $ONDO #GateSquare$50KRedPacketGiveaway

While volatility shakes weak hands, the RWA sector is quietly expanding. Tokenization of US stocks and treasuries is accelerating.

Projects like $LINK and $ONDO are positioning themselves as bridges between traditional finance and DeFi.

If you're ignoring RWAs, you're ignoring one of the biggest structural shifts in crypto.

#RWA #Tokenization #DeFi #GateioSquare

$LINK / $ONDO #GateSquare$50KRedPacketGiveaway

- Reward

- like

- Comment

- Repost

- Share

Traditional renting often means continuous payments without long-term ownership. Over time, this limits financial stability and wealth creation.

ATEG introduces a different approach through its Rent-to-Own model. Each rent payment contributes toward eventual home ownership, creating a clear and transparent path from usage to equity.

This model is supported by real infrastructure, housing and energy systems that generate measurable cashflows. These fundamentals help anchor ATEG’s Hybrid Stability Tokens (HST), aligning sustainability, accountability, and long-term value.

By combining real-world

ATEG introduces a different approach through its Rent-to-Own model. Each rent payment contributes toward eventual home ownership, creating a clear and transparent path from usage to equity.

This model is supported by real infrastructure, housing and energy systems that generate measurable cashflows. These fundamentals help anchor ATEG’s Hybrid Stability Tokens (HST), aligning sustainability, accountability, and long-term value.

By combining real-world

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

355.65K Popularity

21.44K Popularity

62.97K Popularity

15.32K Popularity

465.22K Popularity

3.55K Popularity

3.45K Popularity

1.82K Popularity

1.02K Popularity

80.14K Popularity

41.99K Popularity

96.88K Popularity

14.42K Popularity

101.87K Popularity

2.82K Popularity

News

View MoreData: If BTC breaks through $68,773, the total liquidation strength of mainstream CEX short positions will reach $1.759 billion.

50 m

Data: If ETH breaks through $2,020, the total liquidation strength of short positions on mainstream CEXs will reach $758 million.

50 m

Traditional Finance Alert: NFLX Surges Over 12%

1 h

Lobster rose by 620.27% after going live on Alpha; current price is 0.0013907 USDT

2 h

The yield on the 30-year U.S. Treasury bond drops to 4.63%, the lowest level since October 2022.

2 h

Pin