#GateJanTransparencyReportGate 📊 Gate’s January 2026 Transparency Report — Key Highlights

In January 2026, the global digital asset exchange Gate released its most recent transparency report, offering a detailed look into its trading growth, technological upgrades, financial reserves, and product expansion. This report shows that Gate is making measurable progress across several major areas of business.

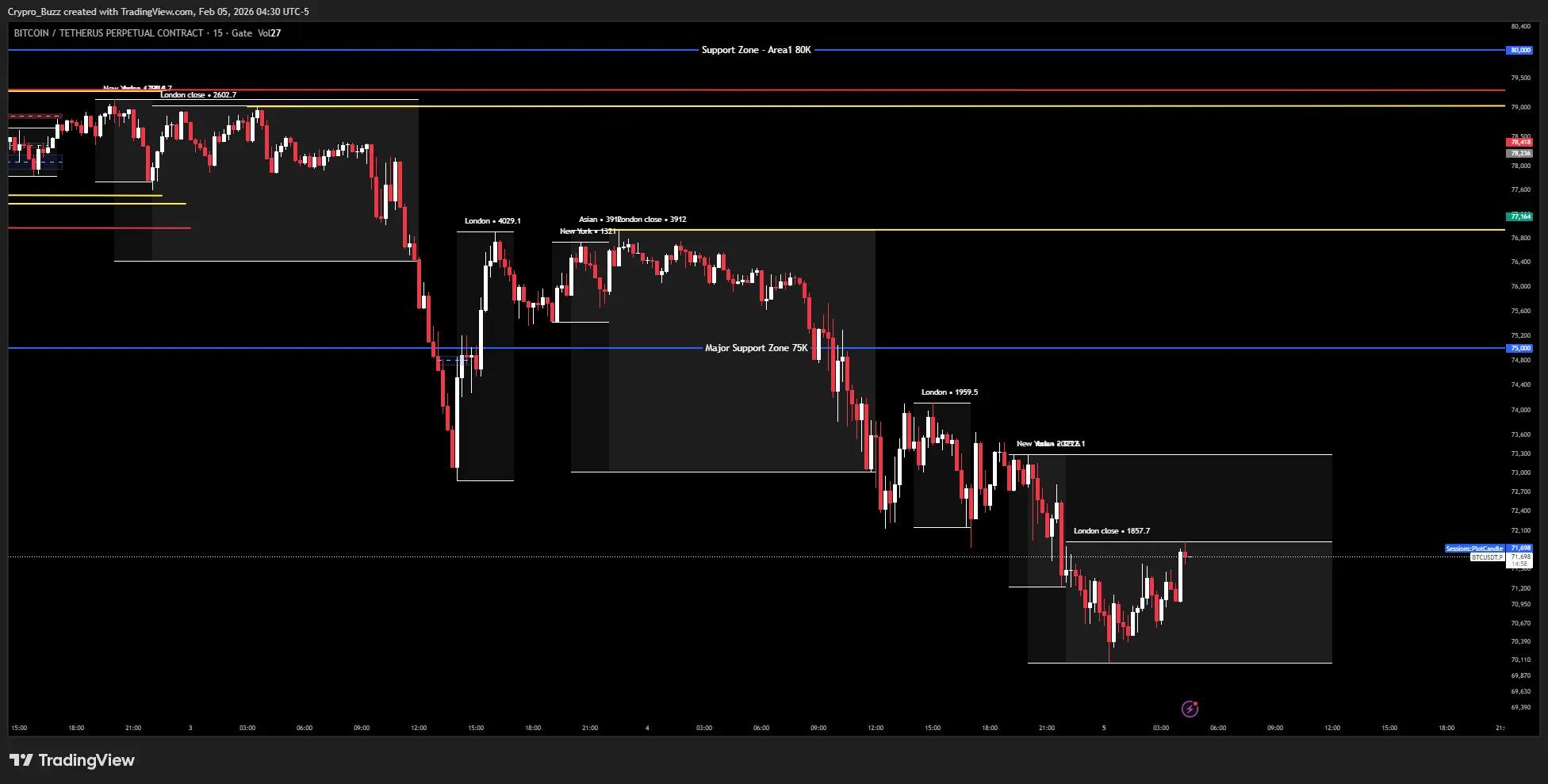

One of the most notable developments is the expansion of Gate’s derivatives market share, which has grown to around 11% of the market. The platform’s perpetual contract trading volume increased significantly compared to earlier quarters of 2025, demonstrating high activity and user engagement in leveraged products.

💹 Growth Across TradFi and On‑Chain Infrastructure

Gate’s report also highlighted the exchange’s expansion beyond traditional crypto markets into traditional finance (TradFi) products. These now include trading in metals, forex, indices, commodities, and select stocks, with combined trading volume exceeding $20 billion since launch — a strong signal of diversification and broader market integration.

In the realm of on‑chain and blockchain technologies, Gate has been actively developing infrastructure. The launch of GateAI in January 2026 focused on automated market analysis and asset interpretation, earning user satisfaction of approximately 88% in its first month. Upgrades to Perpetual DEX (Perp DEX) contributed to monthly trading volumes exceeding $5.5 billion, and the growth of Gate Layer’s on‑chain ecosystem surpassed 100 million unique addresses.

🔐 Reserve Transparency and Financial Strength

Transparency reports also cover Gate’s Proof of Reserves and asset backing — one of the most important trust signals in the industry. As of early January 2026, Gate’s overall reserve coverage ratio increased to 125%, meaning the platform holds more assets than user liabilities. The exchange supports nearly 500 different user assets, and its total reserves were reported at approximately $9.478 billion, placing it among the top centralized exchanges globally.

Gate was among the first major exchanges to adopt zero‑knowledge proof (ZKP) technology combined with cold and hot wallet verification and Merkle tree audit structures, enhancing users’ ability to independently verify that the platform genuinely holds assets backing all user balances.

📈 Ongoing Ecosystem and Strategic Developments

Beyond the monthly transparency report, Gate has been steadily upgrading its ecosystem throughout 2025. This included a brand refresh with a consolidated international domain and logo to strengthen global recognition. Gate’s ecosystem now supports a large number of assets (over 3,800), and features like decentralized perpetual trading and on‑chain liquidity pools are part of its broader “All in Web3” strategy.

Additionally, Gate has reported milestones such as the completion of on‑chain burns for its native GateToken (GT), reducing total supply significantly and reinforcing token utility within the Gate ecosystem.

🧠 Summary: What This Means for Users and the Market

The January 2026 transparency report underscores Gate’s focus on:

Stronger market performance in derivatives and TradFi products.

Rapid growth in on‑chain usage and infrastructure.

High financial transparency and reserve strength, exceeding industry benchmarks.

Commitment to technological innovation and ecosystem expansion.

Overall, these developments reflect Gate’s strategy to solidify its position as a comprehensive digital asset platform with both traditional and Web3‑oriented services, while maintaining transparency and financial robustness.

In January 2026, the global digital asset exchange Gate released its most recent transparency report, offering a detailed look into its trading growth, technological upgrades, financial reserves, and product expansion. This report shows that Gate is making measurable progress across several major areas of business.

One of the most notable developments is the expansion of Gate’s derivatives market share, which has grown to around 11% of the market. The platform’s perpetual contract trading volume increased significantly compared to earlier quarters of 2025, demonstrating high activity and user engagement in leveraged products.

💹 Growth Across TradFi and On‑Chain Infrastructure

Gate’s report also highlighted the exchange’s expansion beyond traditional crypto markets into traditional finance (TradFi) products. These now include trading in metals, forex, indices, commodities, and select stocks, with combined trading volume exceeding $20 billion since launch — a strong signal of diversification and broader market integration.

In the realm of on‑chain and blockchain technologies, Gate has been actively developing infrastructure. The launch of GateAI in January 2026 focused on automated market analysis and asset interpretation, earning user satisfaction of approximately 88% in its first month. Upgrades to Perpetual DEX (Perp DEX) contributed to monthly trading volumes exceeding $5.5 billion, and the growth of Gate Layer’s on‑chain ecosystem surpassed 100 million unique addresses.

🔐 Reserve Transparency and Financial Strength

Transparency reports also cover Gate’s Proof of Reserves and asset backing — one of the most important trust signals in the industry. As of early January 2026, Gate’s overall reserve coverage ratio increased to 125%, meaning the platform holds more assets than user liabilities. The exchange supports nearly 500 different user assets, and its total reserves were reported at approximately $9.478 billion, placing it among the top centralized exchanges globally.

Gate was among the first major exchanges to adopt zero‑knowledge proof (ZKP) technology combined with cold and hot wallet verification and Merkle tree audit structures, enhancing users’ ability to independently verify that the platform genuinely holds assets backing all user balances.

📈 Ongoing Ecosystem and Strategic Developments

Beyond the monthly transparency report, Gate has been steadily upgrading its ecosystem throughout 2025. This included a brand refresh with a consolidated international domain and logo to strengthen global recognition. Gate’s ecosystem now supports a large number of assets (over 3,800), and features like decentralized perpetual trading and on‑chain liquidity pools are part of its broader “All in Web3” strategy.

Additionally, Gate has reported milestones such as the completion of on‑chain burns for its native GateToken (GT), reducing total supply significantly and reinforcing token utility within the Gate ecosystem.

🧠 Summary: What This Means for Users and the Market

The January 2026 transparency report underscores Gate’s focus on:

Stronger market performance in derivatives and TradFi products.

Rapid growth in on‑chain usage and infrastructure.

High financial transparency and reserve strength, exceeding industry benchmarks.

Commitment to technological innovation and ecosystem expansion.

Overall, these developments reflect Gate’s strategy to solidify its position as a comprehensive digital asset platform with both traditional and Web3‑oriented services, while maintaining transparency and financial robustness.