Satoshitalks

No content yet

Satoshitalks

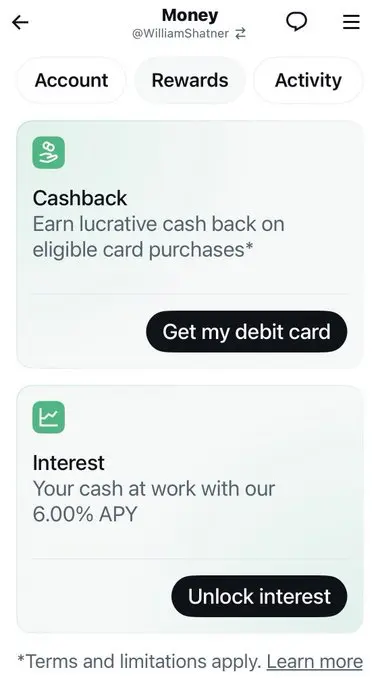

First look at the X Money app.

The app shows:

• 6.00% APY on cash

• Cashback on debit card purchases

• Direct deposit support

• FDIC insurance via partner bank (Cross River Bank)

The average APY in crypto is around 2-4% 🤭

The app shows:

• 6.00% APY on cash

• Cashback on debit card purchases

• Direct deposit support

• FDIC insurance via partner bank (Cross River Bank)

The average APY in crypto is around 2-4% 🤭

- Reward

- like

- Comment

- Repost

- Share

🚨 U.S. government just moved 0.0378 BTC ($2,520).

Small transfer — but notable.

Treasury reshuffle?

Test transaction?

Pre-sale signal?

Source: @lookonchain

Small transfer — but notable.

Treasury reshuffle?

Test transaction?

Pre-sale signal?

Source: @lookonchain

BTC-0,62%

- Reward

- 3

- Comment

- Repost

- Share

Oil production just halted at Rumaila — Iraq’s largest oil field.

Why this matters:

One of the world’s biggest producers

Major supply disruption risk

Immediate impact on crude volatility

Energy markets on alert.

Why this matters:

One of the world’s biggest producers

Major supply disruption risk

Immediate impact on crude volatility

Energy markets on alert.

- Reward

- like

- Comment

- Repost

- Share

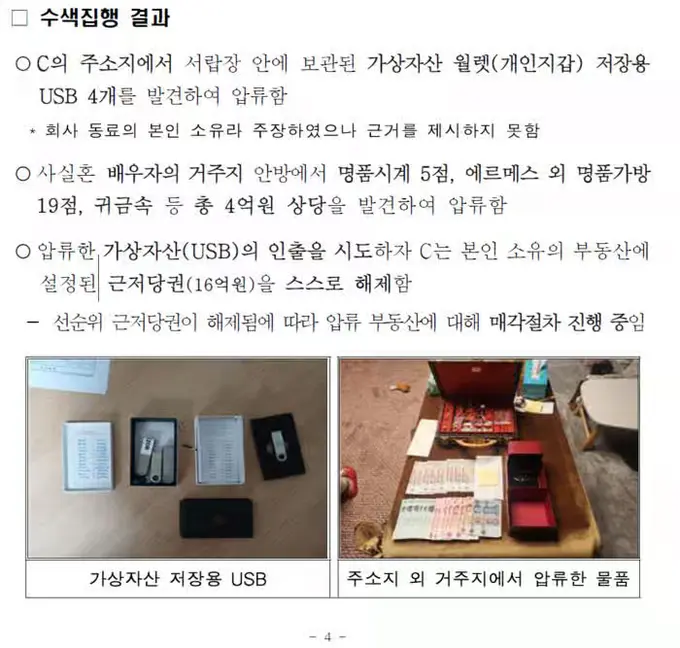

You had one job.

South Korean officials seized $5.6M in crypto — then posted high-res photos of the hardware wallets.

The seed phrases were visible.

$4.8M was drained.

OpSec fail

Costly mistake

Crypto is unforgiving

South Korean officials seized $5.6M in crypto — then posted high-res photos of the hardware wallets.

The seed phrases were visible.

$4.8M was drained.

OpSec fail

Costly mistake

Crypto is unforgiving

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Monitoring the situation

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: State media now reports the wife of Ali Khamenei, Mansoureh Khojasteh Bagherzadeh, has died from wounds sustained in the US-Israel strikes that also killed him and key family members.

Key points:

She was injured and in a coma after the attack

Succumbed to her wounds today

Adds to mounting civilian & leadership casualties

Key points:

She was injured and in a coma after the attack

Succumbed to her wounds today

Adds to mounting civilian & leadership casualties

- Reward

- like

- Comment

- Repost

- Share

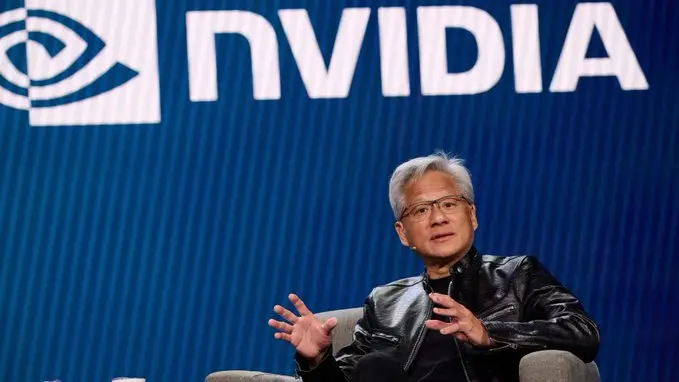

🚨 Nvidia $NVDA is deploying $4B into photonics.

Here’s the breakdown:

$2B into Lumentum Holdings

$2B into Coherent Corp.

AI infrastructure goes optical

The next chip war is about light.

Here’s the breakdown:

$2B into Lumentum Holdings

$2B into Coherent Corp.

AI infrastructure goes optical

The next chip war is about light.

- Reward

- 2

- Comment

- Repost

- Share

🚨 Former CIA Director says regime change isn’t won from the sky.

“You can't take down a regime through the air in most cases.” — David Petraeus

Why this matters:

Air power ≠ political control

Ground reality shapes outcomes

History keeps proving it

“You can't take down a regime through the air in most cases.” — David Petraeus

Why this matters:

Air power ≠ political control

Ground reality shapes outcomes

History keeps proving it

- Reward

- like

- Comment

- Repost

- Share

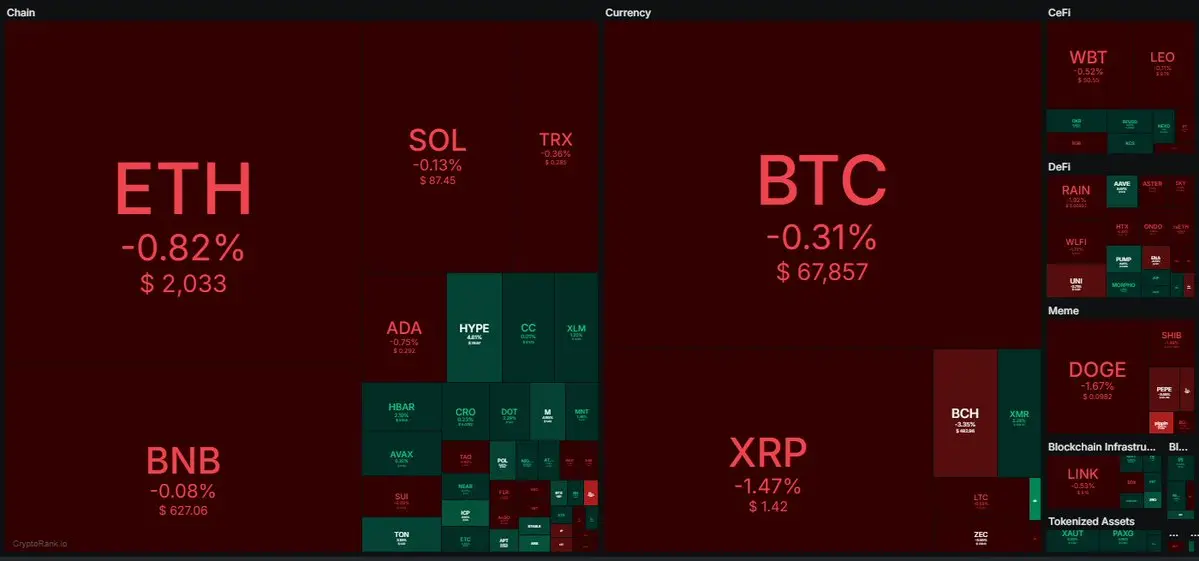

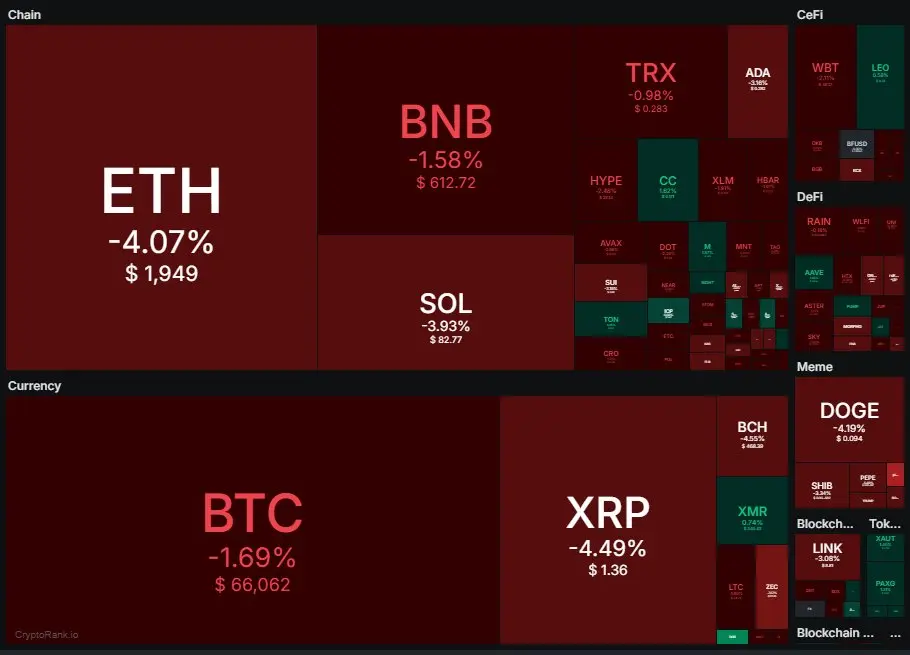

#Bitcoin just printed 5 straight red months.

History check:

2018 bear market → 5-month slide

2022 bear → ~64% drawdown, no 5-month streak

2025–26 → $126K ➝ $65K

Capitulation… or setup?

History check:

2018 bear market → 5-month slide

2022 bear → ~64% drawdown, no 5-month streak

2025–26 → $126K ➝ $65K

Capitulation… or setup?

BTC-0,62%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

🚨 UPDATE: Strategy raises its STRC dividend to 11.50% for March 2026 (+25bps).

What this signals:

1. Strong cash flow confidence

2. Shareholder-friendly stance

3. Yield competition heating up

#Strategy #STRC

What this signals:

1. Strong cash flow confidence

2. Shareholder-friendly stance

3. Yield competition heating up

#Strategy #STRC

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

I was told that there was no more Jane Street 😭

- Reward

- like

- Comment

- Repost

- Share

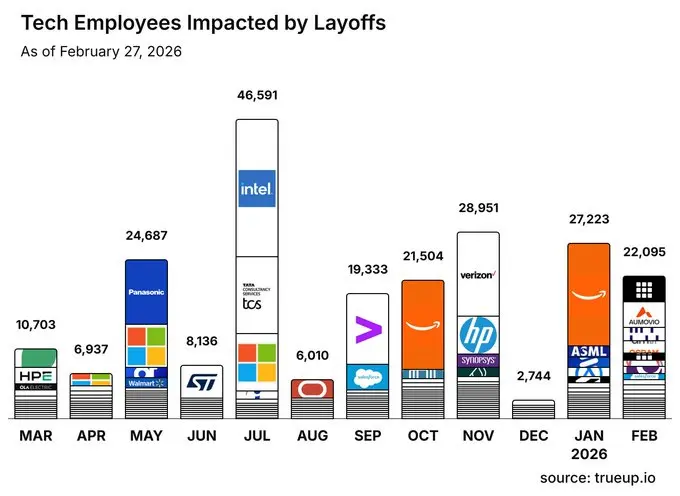

2026 LAYOFFS:

Amazon - 16,000

Aumovio - 4,000

Block - 4,000

WiseTech Global - 2,000

ams OSRAM - 2,000

ASML - 1,700

Ericsson - 1,600

Meta - 1,500

Salesforce - 1,000

Livspace - 1,000

Ocado - 1,000

Autodesk - 1,000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

Expedia - 162

Remitly - 110

Amazon - 16,000

Aumovio - 4,000

Block - 4,000

WiseTech Global - 2,000

ams OSRAM - 2,000

ASML - 1,700

Ericsson - 1,600

Meta - 1,500

Salesforce - 1,000

Livspace - 1,000

Ocado - 1,000

Autodesk - 1,000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

Expedia - 162

Remitly - 110

- Reward

- 1

- Comment

- Repost

- Share