Manglu

No content yet

manglu

I used to think that,

Slowness was because people weren't ruthless enough.

It wasn't until later that I realized it's not.

It's that those who truly get things done are slowed down by the system.

Slow payments, slow settlements, slow market switching,

It's not a capability issue, it's the underlying system you're standing on that simply can't run fast.

The biggest problem in the market now is actually one sentence:

Everything exists, but all are scattered.

One set for payments, one set for data, one set for custody,

Every time you connect to a new place, it's like starting a new business.

The

Slowness was because people weren't ruthless enough.

It wasn't until later that I realized it's not.

It's that those who truly get things done are slowed down by the system.

Slow payments, slow settlements, slow market switching,

It's not a capability issue, it's the underlying system you're standing on that simply can't run fast.

The biggest problem in the market now is actually one sentence:

Everything exists, but all are scattered.

One set for payments, one set for data, one set for custody,

Every time you connect to a new place, it's like starting a new business.

The

SEI1,58%

- Reward

- like

- Comment

- Repost

- Share

Grab gold on the Gate App, receive 1g every 10 minutes @Gate_zh #GateTradFi

View Original

- Reward

- like

- Comment

- Repost

- Share

Get gold on Gate App, receive 1g every 10 minutes

View Original

- Reward

- like

- Comment

- Repost

- Share

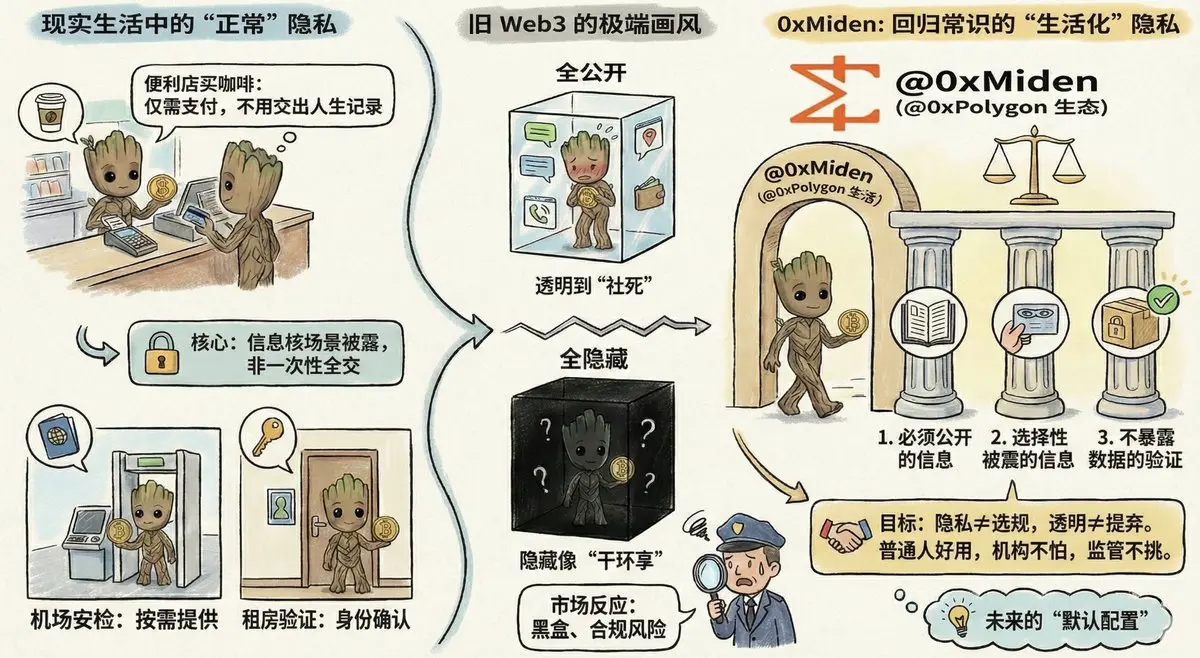

I originally wanted to register for an overseas wealth management app.

But I was confused right from the first step—passport, selfie, blinking, turning head, reading numbers—a whole process to complete,

and I only had one thought: “I just want to save some money, do I really need to hand over my entire identity?”

But if you don’t hand it over, they won’t let you use it.

On-chain identity over the past few years has actually been stuck in this awkward situation:

Either learn from anonymous projects, where no one knows you—it's cool, but money can’t flow in;

or follow traditional finance, where

But I was confused right from the first step—passport, selfie, blinking, turning head, reading numbers—a whole process to complete,

and I only had one thought: “I just want to save some money, do I really need to hand over my entire identity?”

But if you don’t hand it over, they won’t let you use it.

On-chain identity over the past few years has actually been stuck in this awkward situation:

Either learn from anonymous projects, where no one knows you—it's cool, but money can’t flow in;

or follow traditional finance, where

RWA1,52%

- Reward

- like

- Comment

- Repost

- Share

@metaio102 @ConfidentialLyr Good morning, bro

View Original- Reward

- like

- Comment

- Repost

- Share

Buying coffee at a convenience store and suddenly hesitating while swiping the card. It’s not about the money; it’s that feeling—the system seems to intuitively know: who I am, which store I frequent, what time I made a purchase, what I bought, and even what I might want to drink next. In real life, we’ve long accepted one thing: not all information needs to be disclosed all at once. When swiping at a community access control, there’s no need to report your bank balance; at airport security, no one cares about your chat history; renting a house and verifying identity doesn’t require revealing

View Original

- Reward

- like

- Comment

- Repost

- Share

I just saw “Xabi Alonso has left Real Madrid”

Surely someone will say “It's over, the World Cup in June is going to change.”

My first reaction at the time was:

Are you overthinking it a bit?

Let’s start with a cold shower.

Basically, this is:

Real Madrid doesn’t want to continue, and Alonso isn’t stubbornly holding on.

The club’s affairs,

are not the national team’s buttons.

And definitely not “press once, and the World Cup roster immediately refreshes.”

At this stage,

the main storyline of the World Cup hasn’t moved at all.

But why are people so sensitive?

Honestly, there’s only one reason:

View OriginalSurely someone will say “It's over, the World Cup in June is going to change.”

My first reaction at the time was:

Are you overthinking it a bit?

Let’s start with a cold shower.

Basically, this is:

Real Madrid doesn’t want to continue, and Alonso isn’t stubbornly holding on.

The club’s affairs,

are not the national team’s buttons.

And definitely not “press once, and the World Cup roster immediately refreshes.”

At this stage,

the main storyline of the World Cup hasn’t moved at all.

But why are people so sensitive?

Honestly, there’s only one reason:

- Reward

- like

- Comment

- Repost

- Share

There was a period when I basically stopped touching LPs. It’s not that I didn’t want to make money; I was just afraid of the torture. In the past, adding liquidity on-chain was like watching K-lines at night, with a bunch of parameters and terminology. After setting everything up, I didn’t even know what I was betting on. Until a few days ago, I casually clicked into Ferra Protocol @ferra_protocol, originally just to take a look. But I found out this isn’t really for engineers; once I got started, it felt like choosing an investment plan: it asks how you want to earn, then recommends a reason

View Original

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

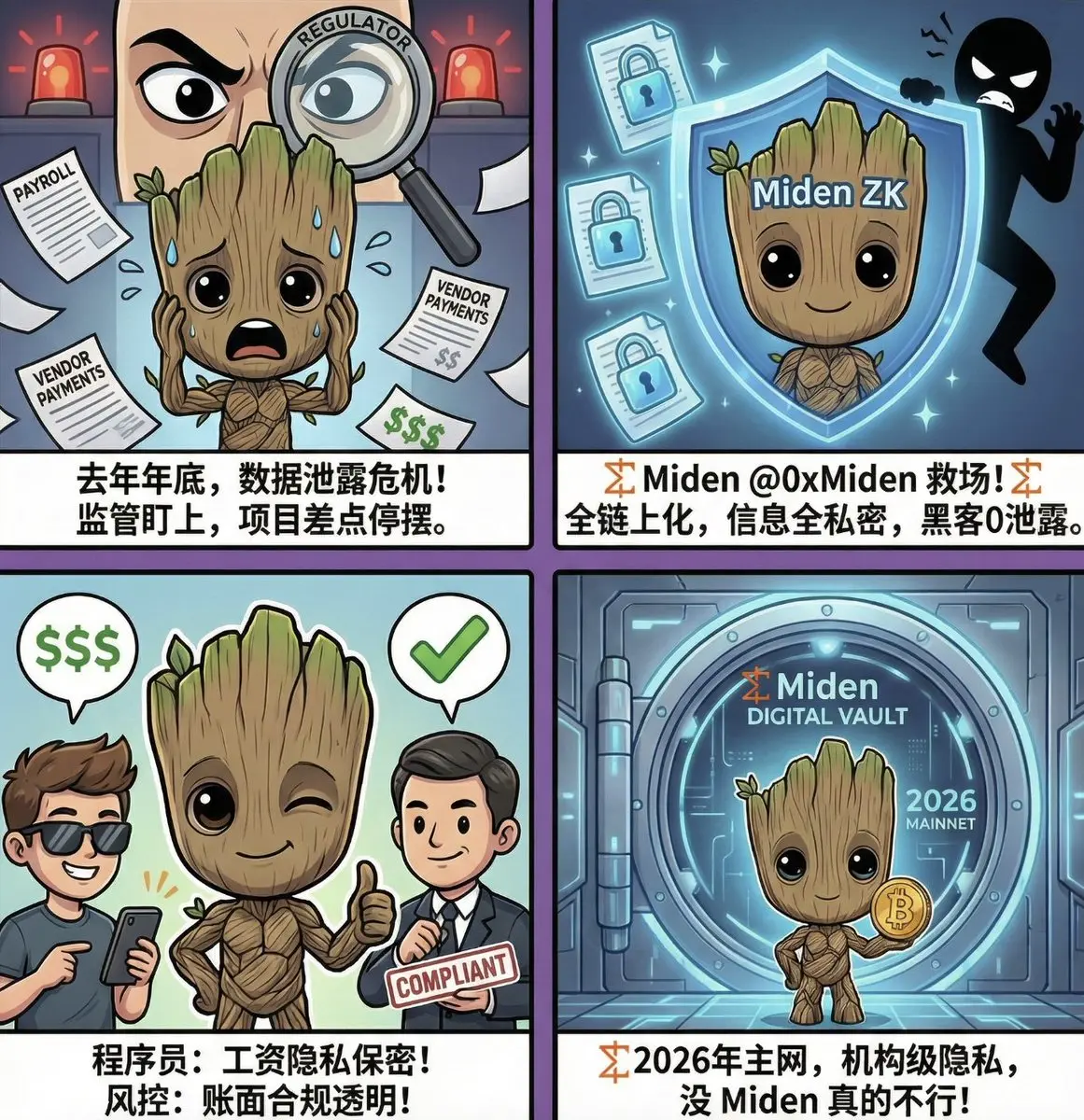

2026 GOGOGO 👊Have you heard the story about the "large hedge fund almost crashing"? Here's what happened—late last year, an institution was handling cross-border payroll and vendor payments. Unfortunately, a small portion of internal data was leaked due to an outsourced auditing tool, immediately drawing regulatory attention. The entire team was so tense that they almost shut down the project.

Just when everyone was at their wit's end, Miden @0xMiden stepped in. Using Zero-Knowledge Sharing (ZK) technology, it made transactions, payroll, vendor payments, and even family asset management all on-chain, while

Just when everyone was at their wit's end, Miden @0xMiden stepped in. Using Zero-Knowledge Sharing (ZK) technology, it made transactions, payroll, vendor payments, and even family asset management all on-chain, while

ZK1,24%

- Reward

- like

- Comment

- Repost

- Share

My friend complained to me that what he's most afraid of now isn't market fluctuations, but "systems making decisions for you." He said he's already used to losing money, but he can't stand one situation:

The money is gone, and you don't even know why.

It's not hacking, not operational mistakes, but a single sentence:

"AI model automatically makes judgments."

In the context of blockchain, this is actually very dangerous.

We've all experienced the early days of DeFi.

Black-box contracts, mysterious parameters, founders saying "trust the code," and when something goes wrong, the entire network s

View OriginalThe money is gone, and you don't even know why.

It's not hacking, not operational mistakes, but a single sentence:

"AI model automatically makes judgments."

In the context of blockchain, this is actually very dangerous.

We've all experienced the early days of DeFi.

Black-box contracts, mysterious parameters, founders saying "trust the code," and when something goes wrong, the entire network s

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More155.83K Popularity

15.37K Popularity

395.17K Popularity

5.81K Popularity

17.67K Popularity

Pin