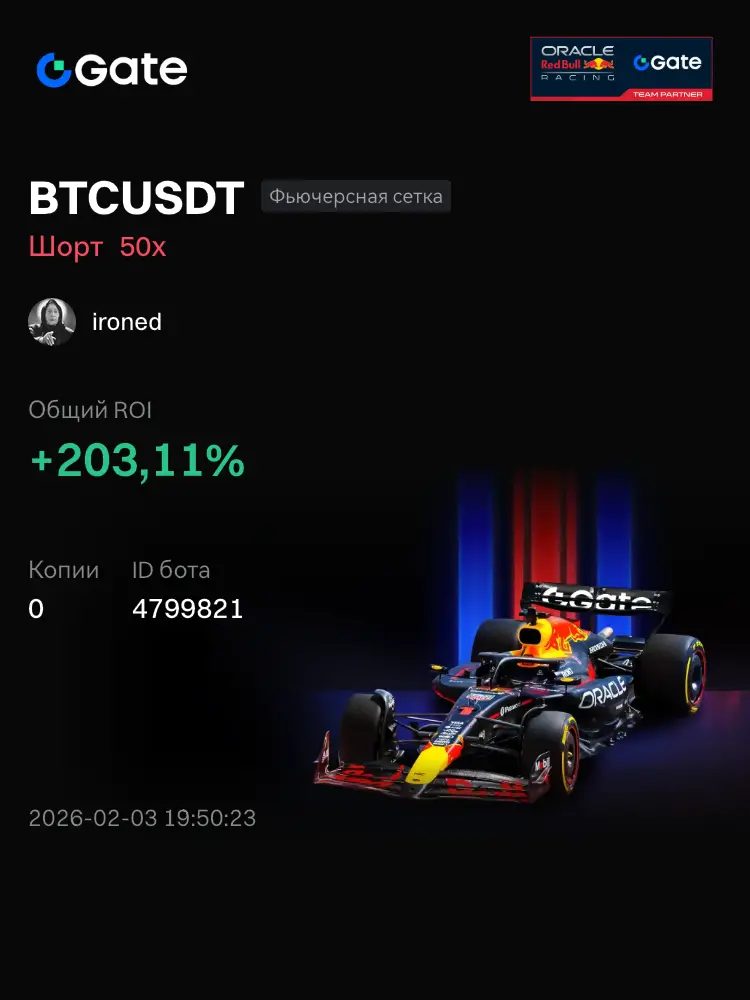

Ironed

No content yet

Ironed

$BTC Until recently, there were no institutional investors in Bitcoin; crypto enthusiasts with an HODL strategy simply weathered the dips, which could reach 80%, says Radchenko. Now, according to him, phenomena such as institutional "stops" and forced sell-offs have appeared in the market. While "institutions are now hesitating," the question arises: where will the next demand come from, the expert ponders.

He pointed out that negative factors are accumulating in the crypto industry: miners are operating at a loss, Michael Saylor is "below the waterline," investors have just been "burned" on s

He pointed out that negative factors are accumulating in the crypto industry: miners are operating at a loss, Michael Saylor is "below the waterline," investors have just been "burned" on s

BTC-2,05%

- Reward

- like

- Comment

- Repost

- Share

Everything is just beginning.

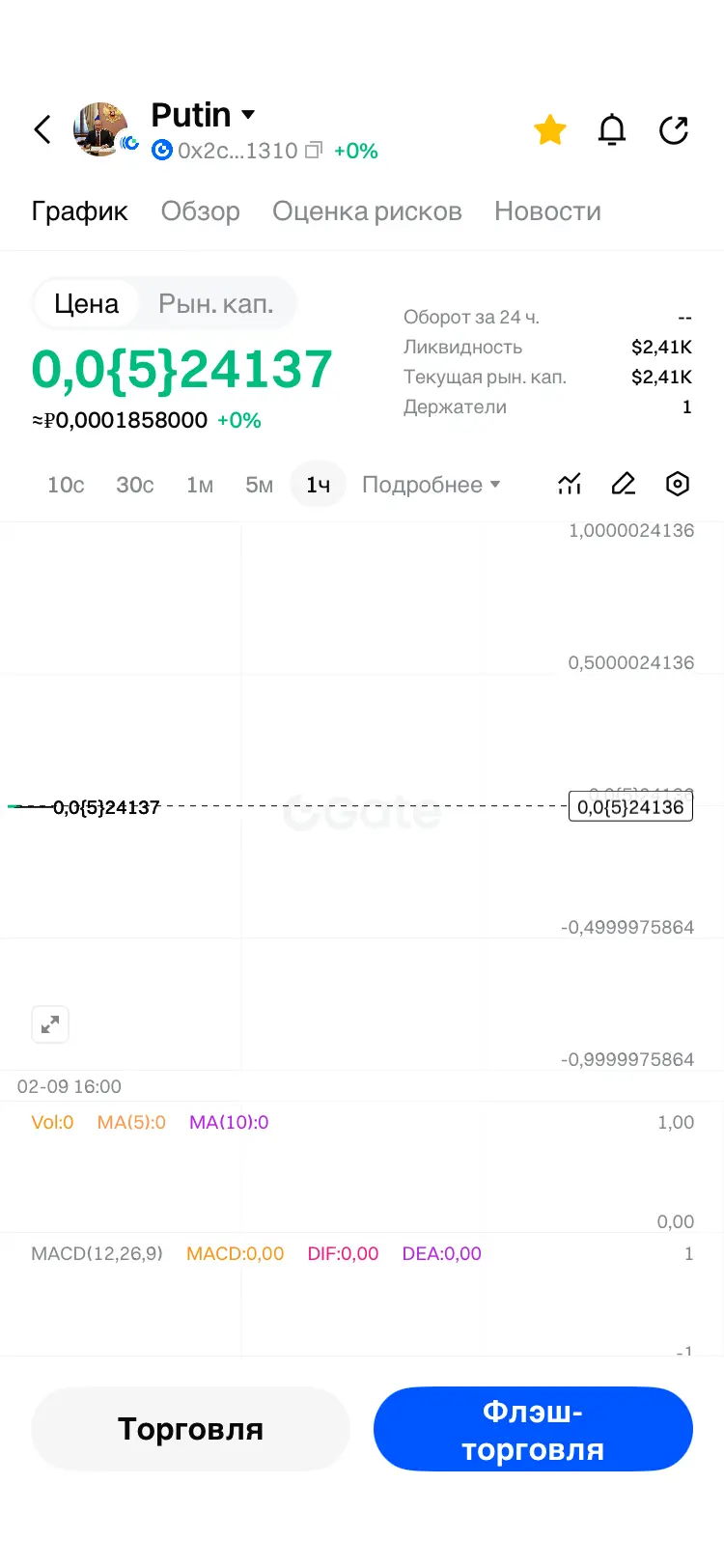

MC:$2.41KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

Everything is just beginning.

- Reward

- like

- Comment

- Repost

- Share

$BTC Текущая коррекция показывает хрупкость этого рынка и продолжающуюся подверженность его паническим распродажам. Объяснить происходящее можно лишь двумя логичными умозаключениями: либо кто-то из очень крупных игроков (фонды, банки, страны) готовит колоссальную по объемам покупку, о чем могут свидетельствовать резкие скачки курсов в последние недели. Тогда понижение курса носит искусственный характер и после временного понижения курс вновь продолжит расти. Либо же рынок перенасыщен и из-за ослабления доллара от постоянно раздувающегося госдолга США снизился спрос на криптовалюты как на высок

BTC-2,05%

- Reward

- like

- Comment

- Repost

- Share

$BTC Bitcoin currently has several support levels, says independent IT technology consultant Roman Nekrasov. The first level is around $68–$69 thousand: here, those who were waiting for its decline below the psychological mark of $70 thousand will start buying it back, the expert explains. According to him, at this level, Bitcoin will "stay put for a few days."

"Usually, after breaking through such psychologically significant levels, Bitcoin begins to recover — some investors reduce their positions, while others, on the contrary, increase their exposure to the asset, expecting further growth

"Usually, after breaking through such psychologically significant levels, Bitcoin begins to recover — some investors reduce their positions, while others, on the contrary, increase their exposure to the asset, expecting further growth

BTC-2,05%

- Reward

- like

- 1

- Repost

- Share

saratau :

:

Bull run 🐂- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Watching Closely 🔍️Trending Topics

View More200.25K Popularity

2.17K Popularity

3.15K Popularity

6.61K Popularity

1.15K Popularity

Pin