Agent8

No content yet

Agent8

In 2026, the U exchange rate for soft girl currency will continue to depreciate, currently falling below 7. This is just the beginning; at least for the next one or two years, it will experience oscillating decline. If you are a person from Dongda, and your final consumption is RMB-denominated, then now is not the time to stockpile U in large quantities.

Overall, the US dollar will depreciate in the future, especially once it reaches a certain threshold, which will accelerate depreciation. Therefore, Bitcoin will definitely continue to rise, and breaking through 1 million may just be the begin

Overall, the US dollar will depreciate in the future, especially once it reaches a certain threshold, which will accelerate depreciation. Therefore, Bitcoin will definitely continue to rise, and breaking through 1 million may just be the begin

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

Of course, the current market is sluggish, with Bitcoin experiencing oscillations and declines. One of the main reasons is that institutions and large holders are still accumulating coins. It is said that they need to accumulate 5 million Bitcoins, and so far, only over 1 million have been accumulated. Meanwhile, the exchange wallet balances are continuously decreasing, currently only 2.45 million.

In this situation, institutions will not make large-scale purchases. They will buy gradually, like iceberg orders. Under these circumstances, the market will continue to fluctuate, and they will fin

In this situation, institutions will not make large-scale purchases. They will buy gradually, like iceberg orders. Under these circumstances, the market will continue to fluctuate, and they will fin

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin continues to lead the market downward. Currently, the first support level is at $89,000, then $85,000, and more aggressively, as previously mentioned, let the market see Bitcoin starting with 7;

The support levels for ETH are at 3050–2750–2400; for altcoins, it’s ✖, calculated at 3-5 times the decline of Bitcoin;

The current market situation is like today’s solar term—Major Cold—reaching the coldest part of the year, so cold that only the sound of sickles clashing can be heard, with no sign of the greens. But after the coldest winter, spring is slowly beginning to revive.

View OriginalThe support levels for ETH are at 3050–2750–2400; for altcoins, it’s ✖, calculated at 3-5 times the decline of Bitcoin;

The current market situation is like today’s solar term—Major Cold—reaching the coldest part of the year, so cold that only the sound of sickles clashing can be heard, with no sign of the greens. But after the coldest winter, spring is slowly beginning to revive.

- Reward

- like

- Comment

- Repost

- Share

Why are the big players in Dubai and Singapore's crypto circles everywhere now? Because here, you can solve all your gray industry and identity grounding issues;

Tax avoidance is just a drop in the bucket. The legitimate realization of crypto assets here has already formed a complete industry chain:

1. First, through legal, widespread U exchange shops (I’ve noticed many Dubai Longcheng restaurants have U payment codes), you can exchange for USD, EUR, and other fiat currencies within minutes. Even if you have billions in assets, the exchange cycle won't exceed 24 hours;

2. Then, a professional

View OriginalTax avoidance is just a drop in the bucket. The legitimate realization of crypto assets here has already formed a complete industry chain:

1. First, through legal, widespread U exchange shops (I’ve noticed many Dubai Longcheng restaurants have U payment codes), you can exchange for USD, EUR, and other fiat currencies within minutes. Even if you have billions in assets, the exchange cycle won't exceed 24 hours;

2. Then, a professional

- Reward

- 1

- Comment

- Repost

- Share

X (Twitter) will launch Smart Cashtag next month, which means that in the future, you can not only view market prices on X, but also embed on-chain smart contract addresses (to prevent scams from fake coins with the same name), and you can also buy and sell directly.

As a platform with 200 million daily active users, this is definitely a long-term benefit. It will help more people worldwide learn about Bitcoin and other cryptocurrencies, and will greatly promote activity among crypto projects and KOLs on the X platform, as well as attract new retail investors to the entire crypto space.

The X

As a platform with 200 million daily active users, this is definitely a long-term benefit. It will help more people worldwide learn about Bitcoin and other cryptocurrencies, and will greatly promote activity among crypto projects and KOLs on the X platform, as well as attract new retail investors to the entire crypto space.

The X

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

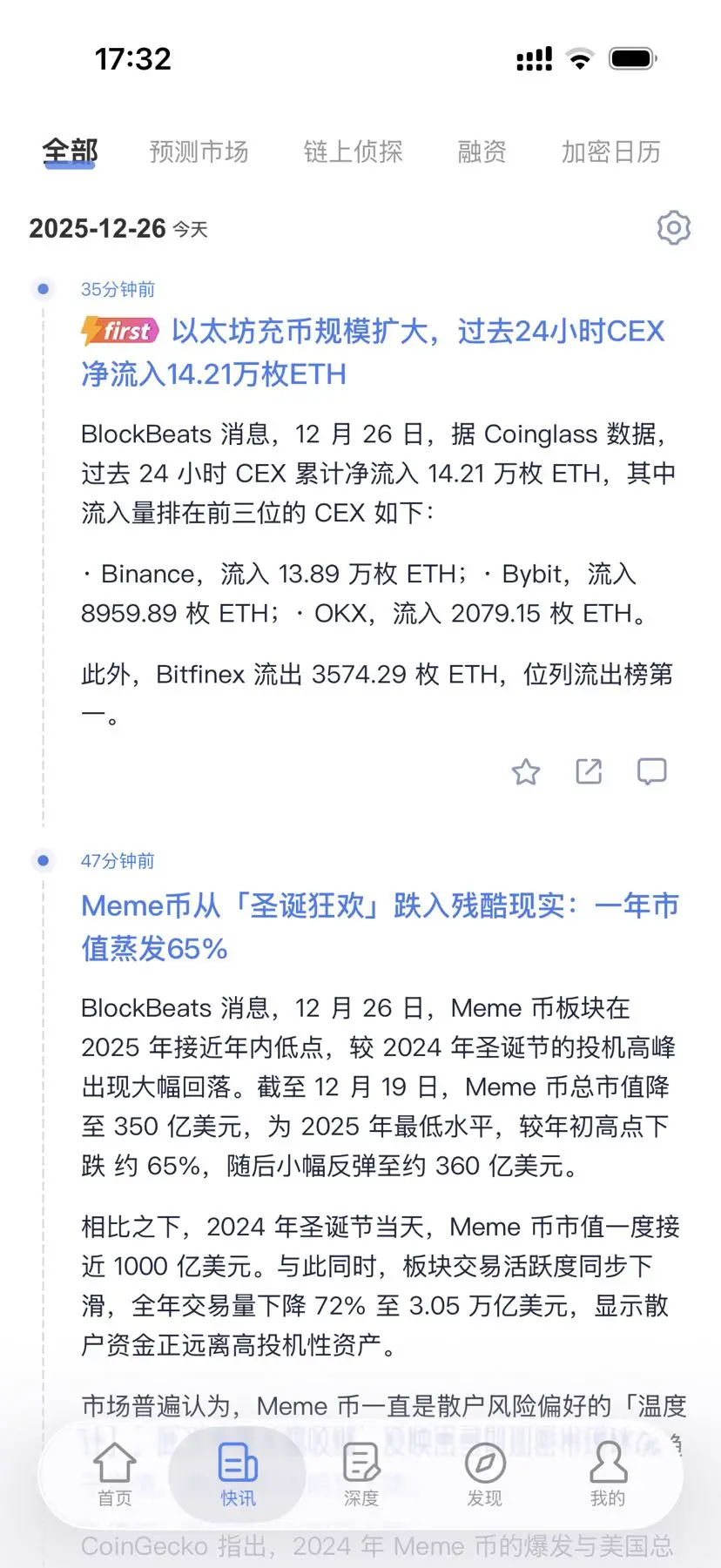

Are institutions and big players also unable to hold on? They are starting to deposit Bitcoin and ETH into exchanges!

In just 24 hours, there was a net inflow of 1930 Bitcoins, which means nearly 200 million USD worth of Bitcoin might be used to sell off!

Is this to cut losses or for holiday spending? Actually, you can't trust institutions too much; many times, institutions are also just bigger little guys.

The European and American Christmas holidays will end gradually from January 4-6. During this period, without capital support, even a small sell-off can cause a big drop. During this period

View OriginalIn just 24 hours, there was a net inflow of 1930 Bitcoins, which means nearly 200 million USD worth of Bitcoin might be used to sell off!

Is this to cut losses or for holiday spending? Actually, you can't trust institutions too much; many times, institutions are also just bigger little guys.

The European and American Christmas holidays will end gradually from January 4-6. During this period, without capital support, even a small sell-off can cause a big drop. During this period

- Reward

- like

- 1

- Repost

- Share

MorningSun :

:

Waiting for 30,000The rebound of BTC and ETH may be coming to an end, as the weekly level decline continues, and the market has not improved, but the data is already overbought.

Already occurred / Market digested: US CPI → No further deterioration, European & UK central banks → Neutral stance, Bank of Japan → No sudden hawkish turn.

There is a possibility of a rebound after a period of consolidation at a high level, but the current upward movements are opportunities for shorting and profit-taking. BTC is first looking at 85,000, then 80,000, while ETH is at 2,740 and 2,500, unless BTC can break through and stab

View OriginalAlready occurred / Market digested: US CPI → No further deterioration, European & UK central banks → Neutral stance, Bank of Japan → No sudden hawkish turn.

There is a possibility of a rebound after a period of consolidation at a high level, but the current upward movements are opportunities for shorting and profit-taking. BTC is first looking at 85,000, then 80,000, while ETH is at 2,740 and 2,500, unless BTC can break through and stab

- Reward

- like

- Comment

- Repost

- Share

Christmas is coming soon, and it looks like a Christmas crash is inevitable, with a plunge brewing.

Bitcoin has already broken through $85,000, just waiting for $80,000. Where will the deadly dip occur? Can the previous low of $74,000 hold?

Most altcoins have already been wiped out, and the next 90% of coins will go to zero. When Bitcoin falls below $85,000 and it's not a leading coin, just cut your losses and sell.

Bitcoin has already broken through $85,000, just waiting for $80,000. Where will the deadly dip occur? Can the previous low of $74,000 hold?

Most altcoins have already been wiped out, and the next 90% of coins will go to zero. When Bitcoin falls below $85,000 and it's not a leading coin, just cut your losses and sell.

BTC-2,22%

- Reward

- 1

- Comment

- Repost

- Share

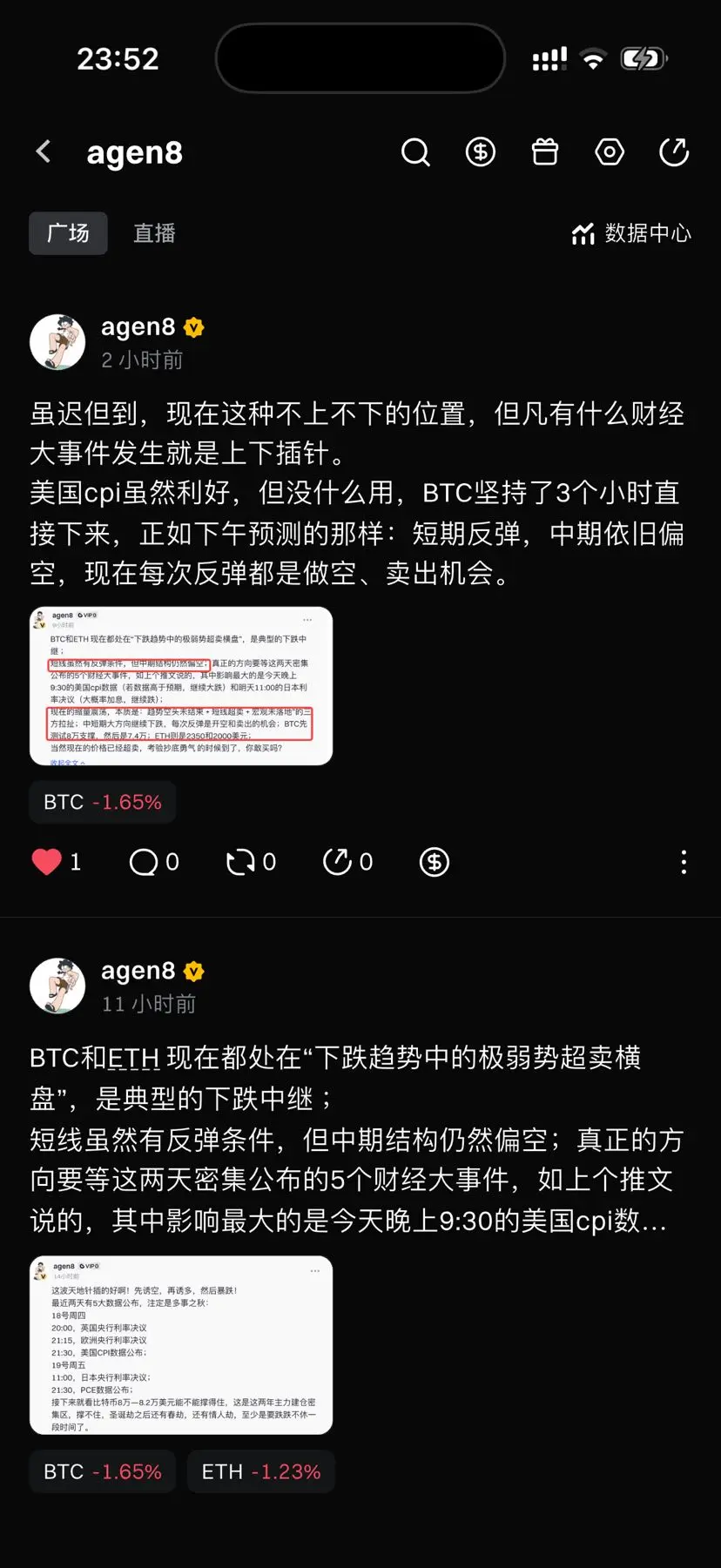

Although late, but finally here. Currently in a position that is neither here nor there, any major financial event triggers sharp fluctuations.

Although the US CPI is positive, it’s of little use. BTC held for 3 hours and then dropped, just as predicted this afternoon: short-term rebound, medium-term still bearish. Now every rebound is an opportunity to short and sell.

The market here still needs a violent shakeout to completely crush hope! No one dares to call for a big bull run.

Although the US CPI is positive, it’s of little use. BTC held for 3 hours and then dropped, just as predicted this afternoon: short-term rebound, medium-term still bearish. Now every rebound is an opportunity to short and sell.

The market here still needs a violent shakeout to completely crush hope! No one dares to call for a big bull run.

BTC-2,22%

- Reward

- 1

- Comment

- Repost

- Share

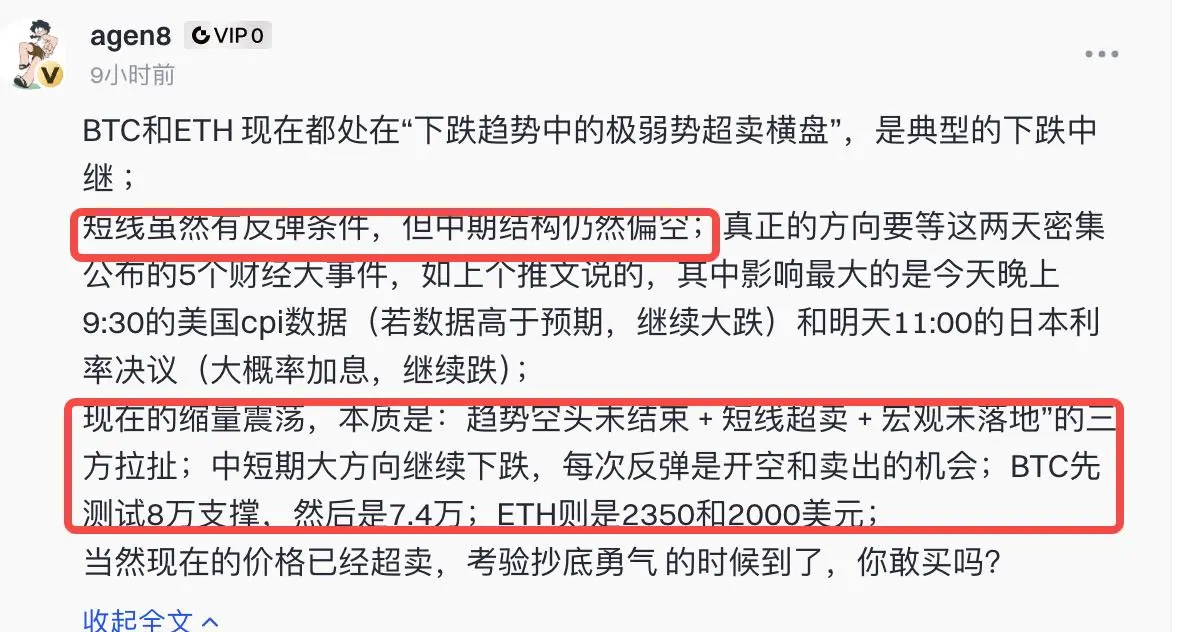

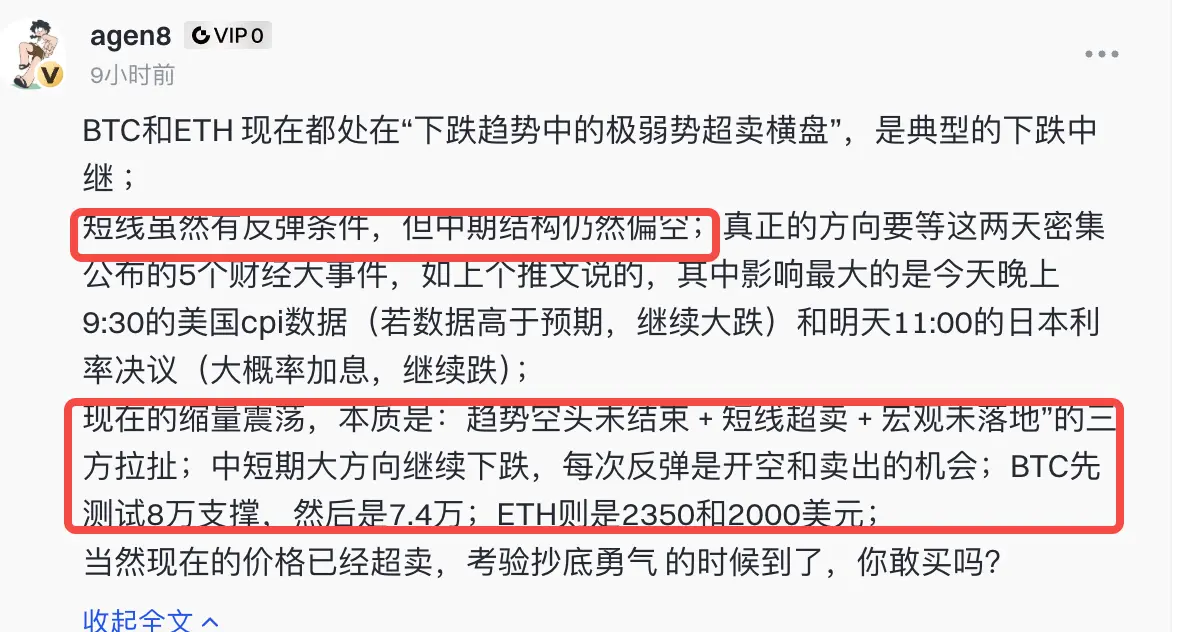

BTC and ETH are now in a "weak oversold sideways consolidation in a downtrend," which is a typical downtrend continuation;

Although there are short-term rebound conditions, the medium-term structure remains bearish; the true direction depends on the five major economic events announced intensively over the next two days, as mentioned in the previous tweet. The most influential are tonight at 9:30 PM US CPI data (if the data exceeds expectations, expect further decline) and tomorrow at 11:00 AM Japan interest rate decision (likely rate hike, continue to fall);

The current volume-consolidation i

View OriginalAlthough there are short-term rebound conditions, the medium-term structure remains bearish; the true direction depends on the five major economic events announced intensively over the next two days, as mentioned in the previous tweet. The most influential are tonight at 9:30 PM US CPI data (if the data exceeds expectations, expect further decline) and tomorrow at 11:00 AM Japan interest rate decision (likely rate hike, continue to fall);

The current volume-consolidation i

- Reward

- like

- Comment

- Repost

- Share

This wave of the Heaven and Earth Needle insertion is well done! First lure the short, then lure the long, and then a sharp drop!

In the past two days, five major data releases have been announced, making it a tumultuous autumn:

Thursday the 18th

20:00, Bank of England interest rate decision

21:15, European Central Bank interest rate decision

21:30, US CPI data release;

Friday the 19th

11:00, Bank of Japan interest rate decision;

21:30, PCE data release;

Next, it depends on whether Bitcoin can hold at 80,000–82,000 USD. This has been the main accumulation zone for the past two years. If it can

View OriginalIn the past two days, five major data releases have been announced, making it a tumultuous autumn:

Thursday the 18th

20:00, Bank of England interest rate decision

21:15, European Central Bank interest rate decision

21:30, US CPI data release;

Friday the 19th

11:00, Bank of Japan interest rate decision;

21:30, PCE data release;

Next, it depends on whether Bitcoin can hold at 80,000–82,000 USD. This has been the main accumulation zone for the past two years. If it can

- Reward

- like

- Comment

- Repost

- Share

#交易机器人# I am using the ETHUSDT contract grid bot on Gate, with a total return since creation of +153.38%

View Original

- Reward

- like

- Comment

- Repost

- Share

Continues to big dump! The only question now is: when will Bitcoin fall below 100,000?

On September 5th, when the non-farm data was released, I mentioned: interest rate cuts and big dumps are two different things!

Even after the interest rate cuts take effect, there may be another fall until no one dares to call it a bull market, which is the true beginning of a big dump!

Bitcoin is about to fall to the first support level mentioned earlier: 108500 USD, while ETH is set to fall to the second support level: 3830 USD;

There has been talk of a fall this month, but now it has really continued to b

View OriginalOn September 5th, when the non-farm data was released, I mentioned: interest rate cuts and big dumps are two different things!

Even after the interest rate cuts take effect, there may be another fall until no one dares to call it a bull market, which is the true beginning of a big dump!

Bitcoin is about to fall to the first support level mentioned earlier: 108500 USD, while ETH is set to fall to the second support level: 3830 USD;

There has been talk of a fall this month, but now it has really continued to b

- Reward

- 1

- Comment

- Repost

- Share

ETH daily chart, breaking down, showing weakness, plunging below the lower band of the Bollinger Bands and the lower edge of the range, which is a weaker trend than BTC. The MACD death cross is widening, indicating very strong downward momentum.

The daily chart has already shown a head pattern risk, and the previous high-level fluctuations now have the risk of evolving into a "head and shoulders top" or "M top" pattern, which is a potential medium-term bearish formation.

On the 4-hour level, there is a waterfall-like fall, the pattern is similar to BTC, but steeper, showing extremely heavy sel

View OriginalThe daily chart has already shown a head pattern risk, and the previous high-level fluctuations now have the risk of evolving into a "head and shoulders top" or "M top" pattern, which is a potential medium-term bearish formation.

On the 4-hour level, there is a waterfall-like fall, the pattern is similar to BTC, but steeper, showing extremely heavy sel

- Reward

- like

- Comment

- Repost

- Share

The market has now fallen below the trend, and the reasons have been mentioned: although the Fed has lowered interest rates, its "hawkish rate cut" stance (implying a slowdown in future rate cuts) has shattered the market's fantasy of continuous and significant liquidity easing.

The recent market fall is typical of being triggered by changes in macro sentiment, followed by a significant drop below key support levels that triggered programmatic selling and leveraged liquidations, forming a negative feedback loop of "fall-explosion-further fall," which exacerbated the downward trend.

From a

The recent market fall is typical of being triggered by changes in macro sentiment, followed by a significant drop below key support levels that triggered programmatic selling and leveraged liquidations, forming a negative feedback loop of "fall-explosion-further fall," which exacerbated the downward trend.

From a

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

ETH is currently weakly following the fluctuations of BTC, making it difficult to have an independent market trend. On the daily chart, the Bollinger Bands are narrowing and flattening, and after the MACD golden cross, it has become consolidated with consecutive small bearish lines, indicating a lack of active buying funds. The rebound is weak and requires strong market support to get out of the mire; on the 4-hour chart, short positions are dominant, with the MACD death cross below the zero axis, and the Bollinger Bands are narrowing downwards, clearly indicating that the short-term trend is

View Original- Reward

- like

- Comment

- Repost

- Share

In less than 9 hours, the Fed's interest rate decision and press conference will arrive, which is the most crucial event determining the direction of the global market for the foreseeable future, without exception.

The market has almost fully priced in a rate cut in September, with the focus on three aspects:

Interest Rate Decision: A cut of 25 basis points or 50 basis points? In line with expectations or exceeding expectations?

Dot Matrix: What guidance is there for interest rate cuts this year and beyond?

Powell's speech: Is the tone "dovish" (implying continued rate cuts) or "hawkis

The market has almost fully priced in a rate cut in September, with the focus on three aspects:

Interest Rate Decision: A cut of 25 basis points or 50 basis points? In line with expectations or exceeding expectations?

Dot Matrix: What guidance is there for interest rate cuts this year and beyond?

Powell's speech: Is the tone "dovish" (implying continued rate cuts) or "hawkis

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

ETH has been relatively weak recently, and the ETH/BTC Exchange Rate is under continued pressure. Looking at the daily chart, the consecutive two days of higher trade volumes with long upper shadow bullish doji is a strong hesitation signal.

The short-term market is anchored to the US CPI data to be released tomorrow at 8:30 PM. Before the data is announced, it is expected to fluctuate between $4,250 and $4,380. If the data is positive, it may push ETH to attempt a breakout at $4,400, but the $4,450 - $4,500 range is a stronger resistance area that requires significantly higher trade volumes t

View OriginalThe short-term market is anchored to the US CPI data to be released tomorrow at 8:30 PM. Before the data is announced, it is expected to fluctuate between $4,250 and $4,380. If the data is positive, it may push ETH to attempt a breakout at $4,400, but the $4,450 - $4,500 range is a stronger resistance area that requires significantly higher trade volumes t

- Reward

- like

- Comment

- Repost

- Share

At 8:30 PM tonight and 8:30 PM tomorrow, the US August PPI and CPI will be released in succession, along with the European Central Bank interest rate decision announcement tomorrow at 8:15 PM. The market may be at a point of direction selection.

At that time, the oscillation range of $110,000 - $113,500 may be broken; in the past two weeks, Bitcoin has continuously hovered around $113,500, forming three daily upper shadows, indicating strong selling pressure in this area, which is an important resistance zone.

If tomorrow night's CPI data is higher than expected or remains stable, the mark

At that time, the oscillation range of $110,000 - $113,500 may be broken; in the past two weeks, Bitcoin has continuously hovered around $113,500, forming three daily upper shadows, indicating strong selling pressure in this area, which is an important resistance zone.

If tomorrow night's CPI data is higher than expected or remains stable, the mark

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share