GregMiller

No content yet

GregMiller

🇺🇸 Paul Atkins says the crypto market bill is ready and claims up to $3T could be injected 🚨Important to read this correctly That $3T is potential, spread over time conditional on adoption, structure, and enforcement Send Everything.

- Reward

- like

- Comment

- Repost

- Share

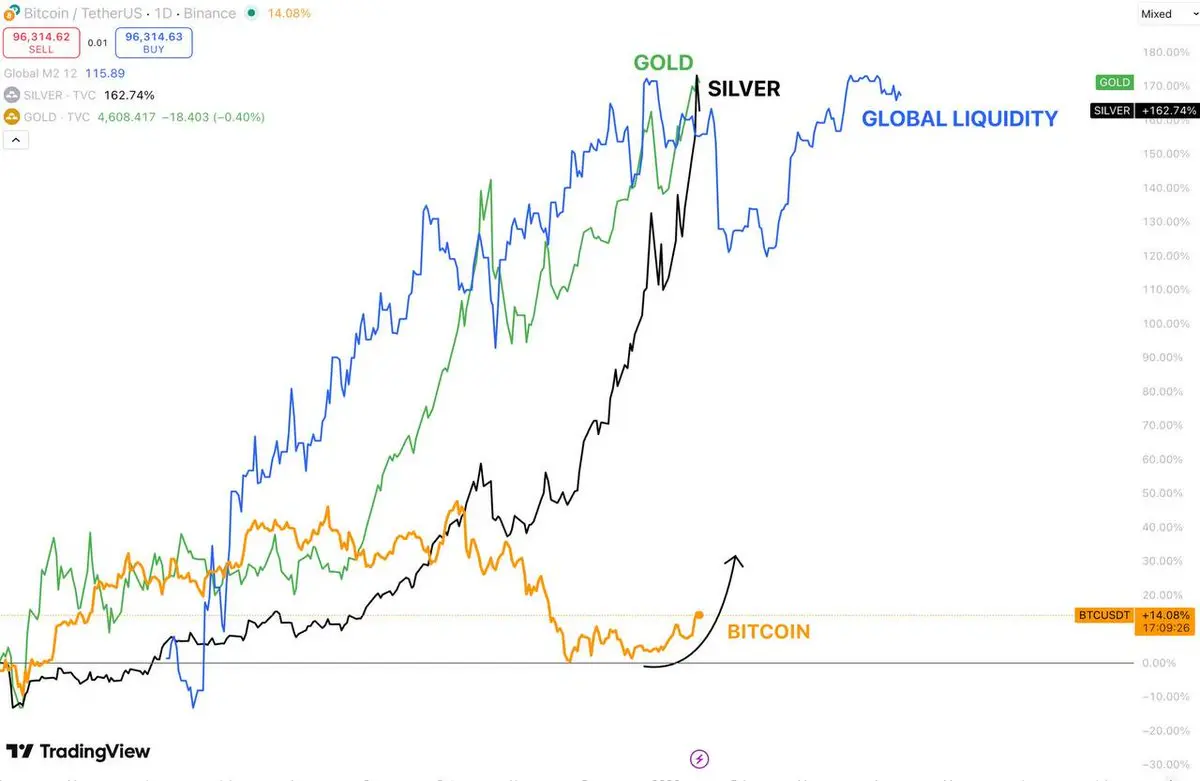

Gold added $4.5T in market cap in 2026 alone.\nSilver followed with $1.5T.\n\nMeanwhile, crypto sits near $3T total, less than the capital absorbed by metals.\n\nHard assets still protect wealth in uncertainty.\n\nBut capital eventually rotates to what scales, innovates, and builds the future.\n\nCrypto still looks deeply undervalued from here.

- Reward

- like

- Comment

- Repost

- Share

Altcoins are holding multi-year trend support while the weekly bullish ascending triangle remains intact.\n\nOver 4 years of accumulation, patience building strength.\n\nThe setup is clear.\n\nOur time is coming.

- Reward

- 1

- Comment

- Repost

- Share

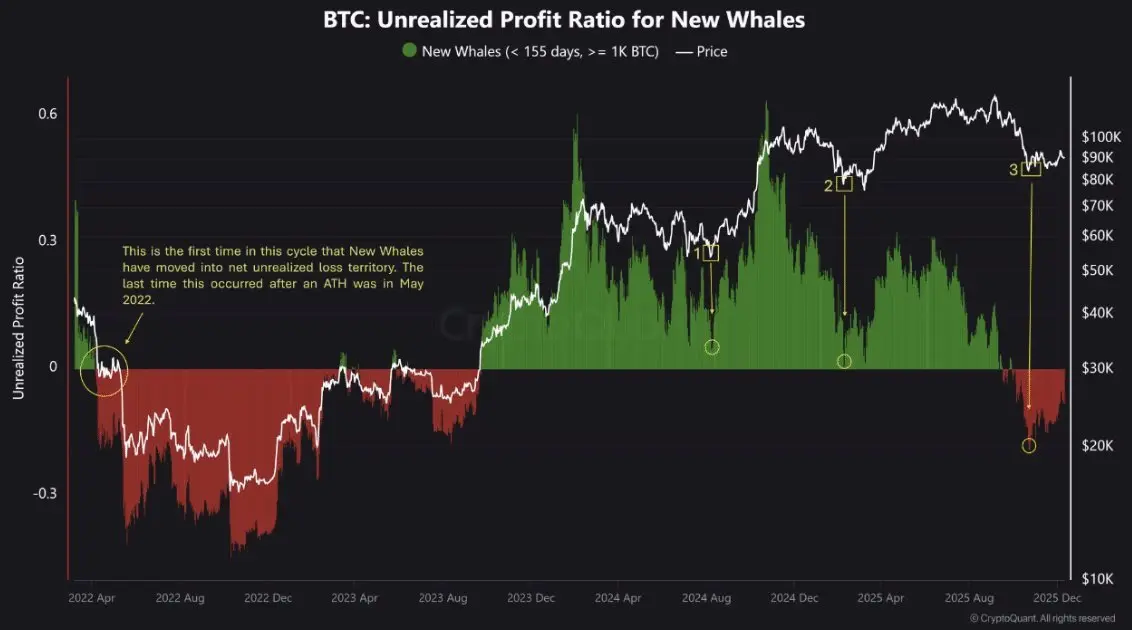

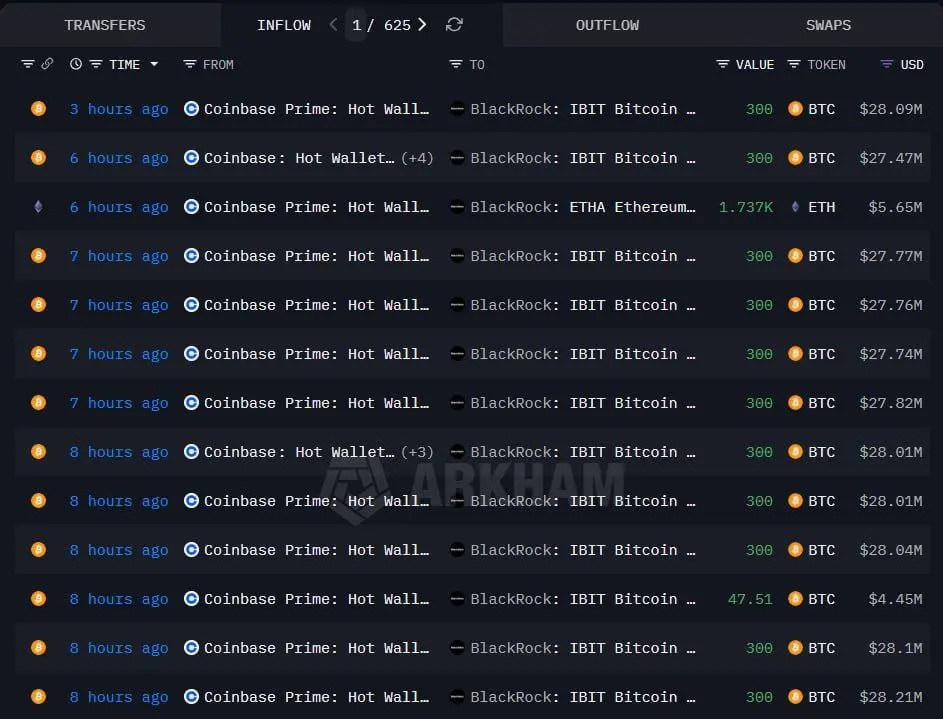

$BTC is dumping despite massive buying.\n\n• Strategy: $2.13B BTC\n• Spot ETFs: $1.55B\n• 30k BTC left exchanges\n\nSo who’s selling?\n\n👉 Leveraged traders. Not holders. Not institutions.\n\nIn the last 24h, $1.07B in leverage was liquidated.\n\nPrice dips → leverage breaks → forced selling → more liquidations.\n\nThis is why short-term price ignores ETF inflows.\n\nBitcoin didn’t fail.\nLeverage did.\n\nRecovery comes when liquidity returns. Until then: volatility and shakeouts.

BTC-0,6%

- Reward

- like

- Comment

- Repost

- Share

Gate CrossEx Account is LIVE.

Built for pro traders, institutions & quant teams, CrossEx unifies multi-exchange trading & clearing to boost capital efficiency and execution speed.

~ Spot, Cross Margin & USDT Perps

~ Up to 20× leverage with unified risk control

~ API-only trading for professionals

Jan 19 (8 UTC) – Feb 19 (8 UTC)

Open now 👇

Learn more 👇

Built for pro traders, institutions & quant teams, CrossEx unifies multi-exchange trading & clearing to boost capital efficiency and execution speed.

~ Spot, Cross Margin & USDT Perps

~ Up to 20× leverage with unified risk control

~ API-only trading for professionals

Jan 19 (8 UTC) – Feb 19 (8 UTC)

Open now 👇

Learn more 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BULLISH 🚀

The Fed is set to inject $55.36B in liquidity over the next 3 weeks.

More liquidity historically means more risk-on appetite, and crypto tends to benefit first.

The Fed is set to inject $55.36B in liquidity over the next 3 weeks.

More liquidity historically means more risk-on appetite, and crypto tends to benefit first.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC long term cycle may not be over yet.

According to Willy Woo, network capital flows are still declining, consistent with behavior seen in previous four-year cycles.

The data does not yet signal a structural cycle break.

Price can move ahead of fundamentals, but flows tend to lead over time.

According to Willy Woo, network capital flows are still declining, consistent with behavior seen in previous four-year cycles.

The data does not yet signal a structural cycle break.

Price can move ahead of fundamentals, but flows tend to lead over time.

BTC-0,6%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Watching Closely 🔍️Volatility ahead in the next few hours

• U.S. jobs data at 8:30 AM ET

• Supreme Court tariff ruling at 10:00 AM ET

Higher unemployment fuels recession concerns.

Stronger jobs data could delay rate cuts.

Adding to the mix, Trump has ordered $200B in mortgage bond purchases, a QE-like move aimed at easing mortgage rates, signaling fresh stimulus.

Markets are heading into a headline driven, high volatility Friday.

• U.S. jobs data at 8:30 AM ET

• Supreme Court tariff ruling at 10:00 AM ET

Higher unemployment fuels recession concerns.

Stronger jobs data could delay rate cuts.

Adding to the mix, Trump has ordered $200B in mortgage bond purchases, a QE-like move aimed at easing mortgage rates, signaling fresh stimulus.

Markets are heading into a headline driven, high volatility Friday.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

Ape In 🚀View More

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

DYOR 🤓View More

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

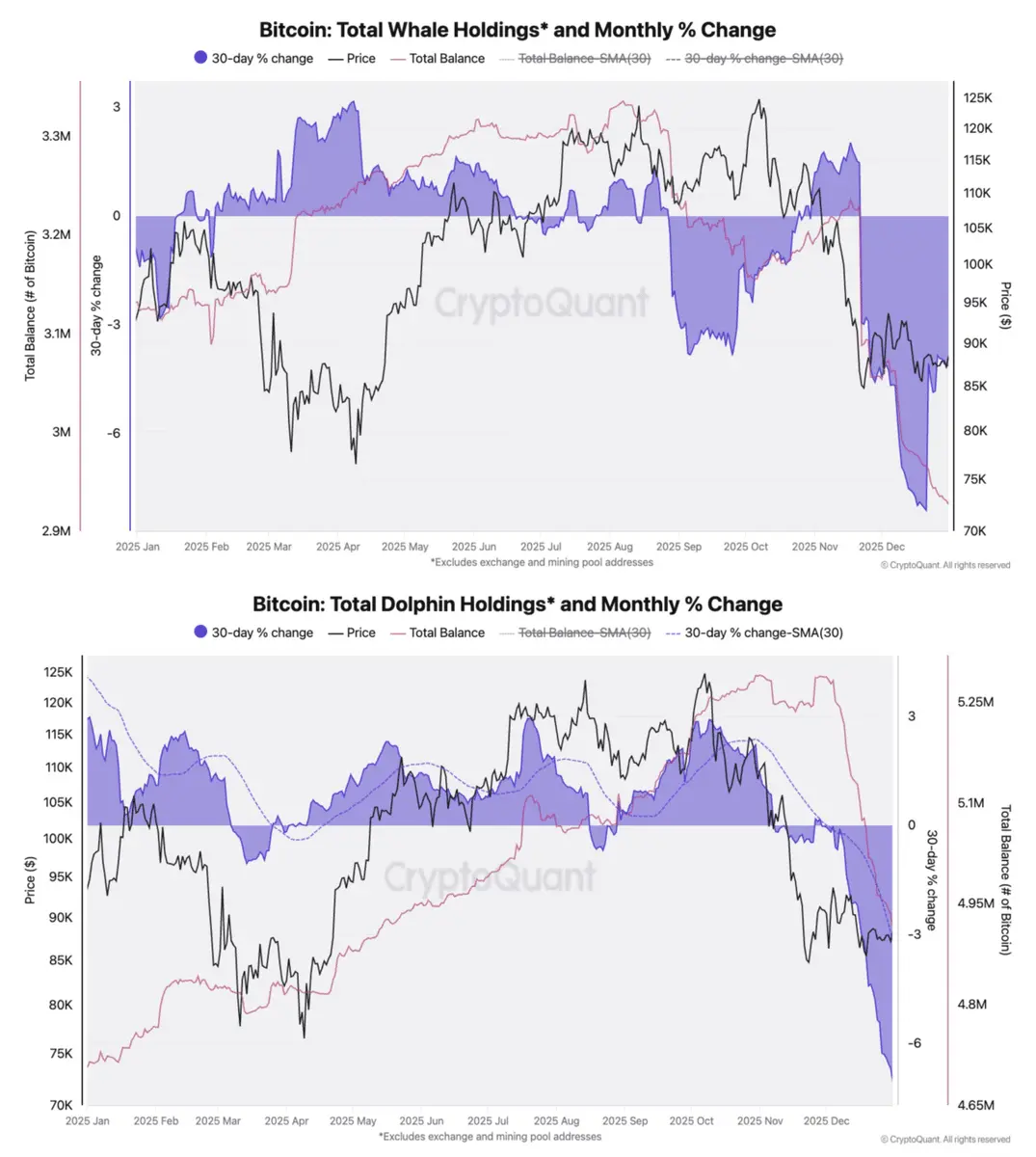

Watching Closely 🔍️Strategic positioning vs. rising optimism in $BTC .

Market sentiment is improving, Fear & Greed is rising and funding rates have turned positive. Traders are leaning bullish.

But on-chain data tells a more cautious story.

When exchange addresses are excluded, whale balances are declining, and 100–1,000 $BTC holders (including ETFs) show the same trend.

With ETF AUM down to $67.6B, near June 2025 lows, bid support remains uncertain.

Sentiment can shift fast. On-chain signals matter more than ever.

Market sentiment is improving, Fear & Greed is rising and funding rates have turned positive. Traders are leaning bullish.

But on-chain data tells a more cautious story.

When exchange addresses are excluded, whale balances are declining, and 100–1,000 $BTC holders (including ETFs) show the same trend.

With ETF AUM down to $67.6B, near June 2025 lows, bid support remains uncertain.

Sentiment can shift fast. On-chain signals matter more than ever.

BTC-0,6%

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

Trending Topics

View More137.95K Popularity

32.37K Popularity

392.11K Popularity

13.5K Popularity

12.49K Popularity

Pin