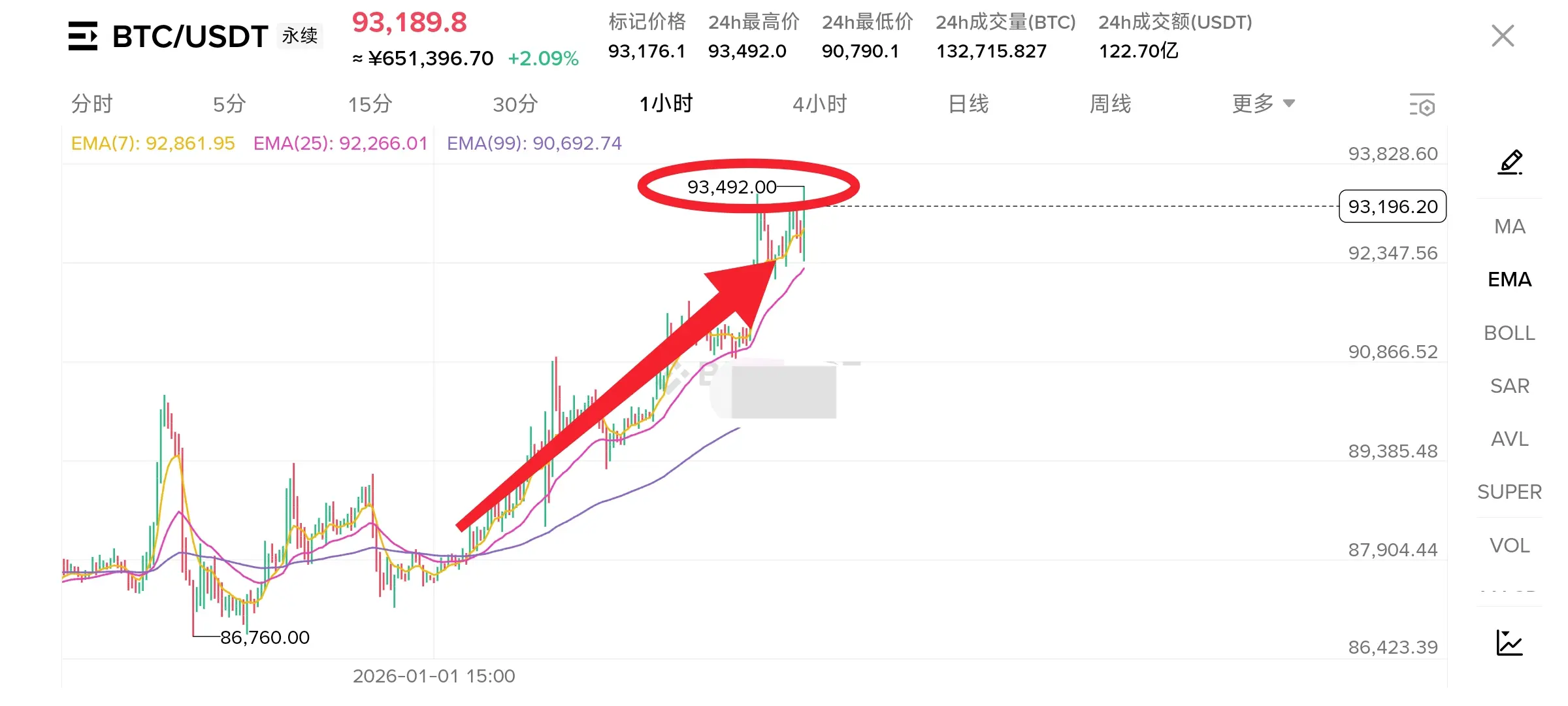

Tonight, the cryptocurrency market remains hot. After Bitcoin and Ethereum surged higher, they have begun a phase of consolidation and correction.

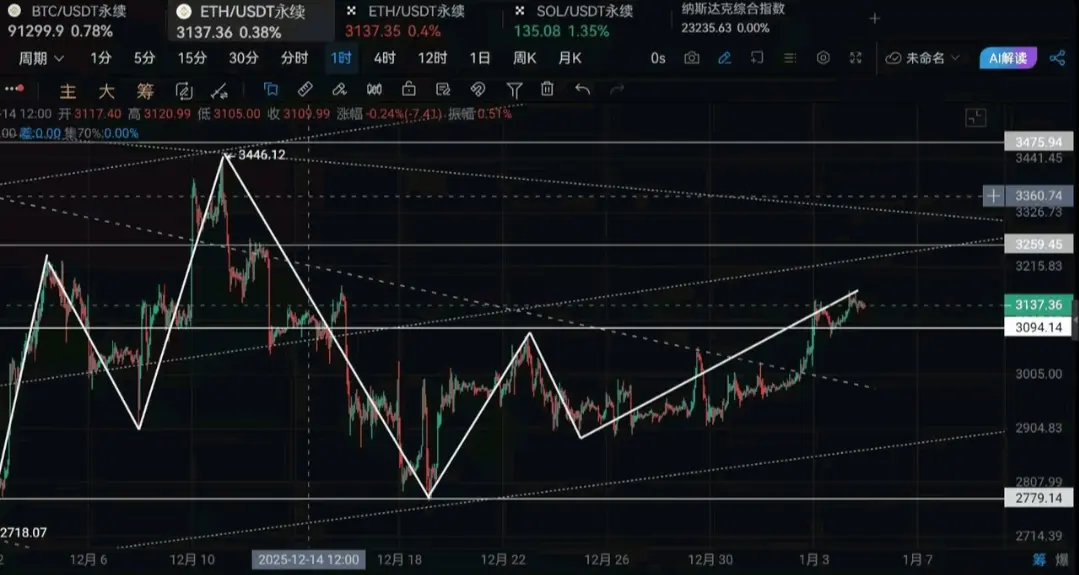

Bitcoin opened with a rally, reaching a short-term high of 93,359. The buying momentum slightly weakened afterward, but the price was immediately supported when it dropped to 92,102, with no significant decline. Currently, it is fluctuating slightly around 92,900, still showing overall strength. Ethereum is moving in sync with Bitcoin, starting to rise at the open, reaching a high of 3,219. It then retraced with Bitcoin to 3,134, stabilized, and reb

Bitcoin opened with a rally, reaching a short-term high of 93,359. The buying momentum slightly weakened afterward, but the price was immediately supported when it dropped to 92,102, with no significant decline. Currently, it is fluctuating slightly around 92,900, still showing overall strength. Ethereum is moving in sync with Bitcoin, starting to rise at the open, reaching a high of 3,219. It then retraced with Bitcoin to 3,134, stabilized, and reb

BTC0,74%