# FederalReserve

13.32K

Luna_Star

#FedRateDecisionApproaches

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

- Reward

- 5

- 10

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

🏦📊 #FedKeepsRatesUnchanged | Policy Update

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

- Reward

- 3

- Comment

- Repost

- Share

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC-6,58%

- Reward

- 13

- 16

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC-6,58%

- Reward

- 1

- Comment

- Repost

- Share

#FederalReserveRateCutsAndPersonnelChanges

Markets are closely watching the Federal Reserve as expectations grow around potential rate cuts alongside possible personnel changes within the central bank.

Together, these factors could reshape policy direction, market sentiment, and risk appetite in the months ahead.

🏦 What’s Driving the Focus

Rate Cut Expectations: Cooling inflation and softer economic data are increasing speculation about policy easing

Leadership & Personnel Shifts: Any changes in key Fed positions may influence future policy tone

Forward Guidance: Markets are highly sensitive

Markets are closely watching the Federal Reserve as expectations grow around potential rate cuts alongside possible personnel changes within the central bank.

Together, these factors could reshape policy direction, market sentiment, and risk appetite in the months ahead.

🏦 What’s Driving the Focus

Rate Cut Expectations: Cooling inflation and softer economic data are increasing speculation about policy easing

Leadership & Personnel Shifts: Any changes in key Fed positions may influence future policy tone

Forward Guidance: Markets are highly sensitive

- Reward

- 7

- 5

- Repost

- Share

QueenOfTheDay :

:

Buy To Earn 💎View More

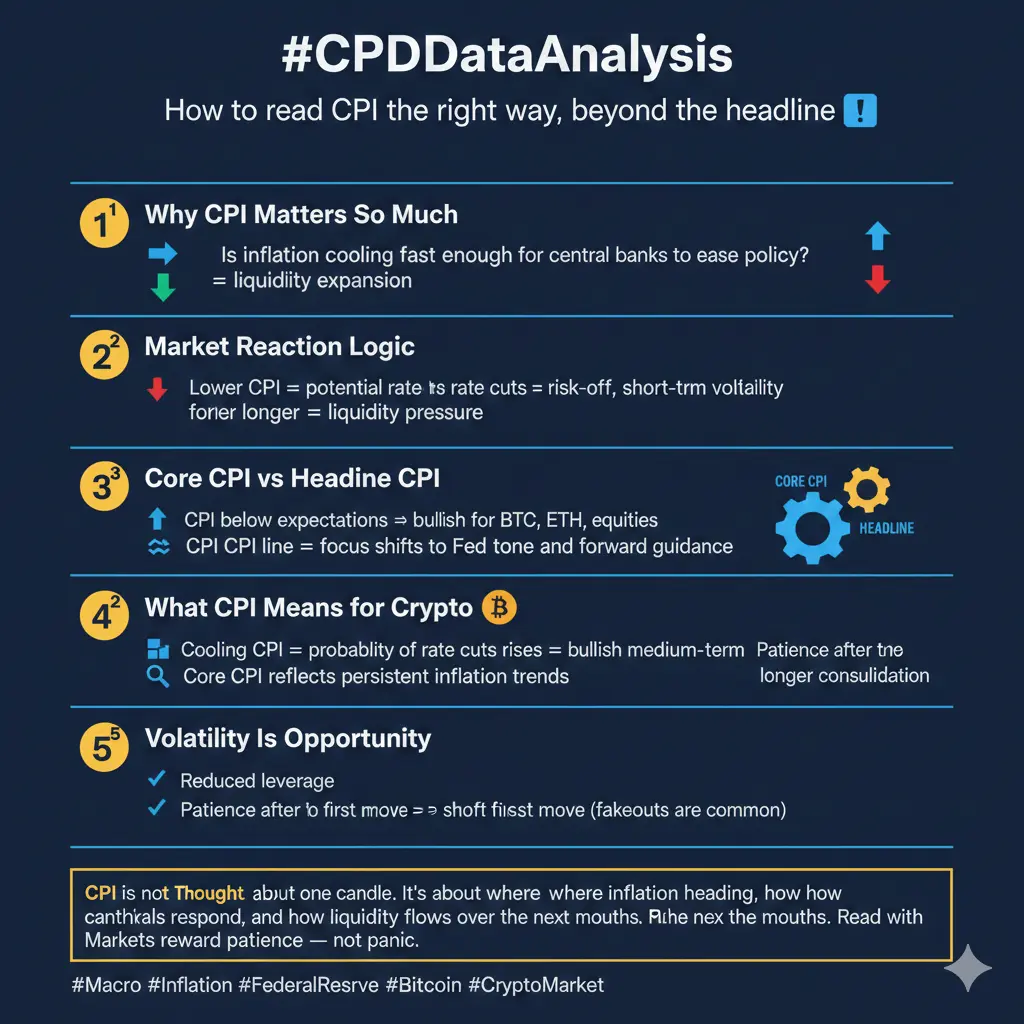

#CPIDataAnalysis

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

- Reward

- 7

- 2

- Repost

- Share

Next Federal Reserve interest rate decision will be announced at 3:00 AM on January 29th, Beijing time!

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

- Reward

- 8

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

Next Federal Reserve interest rate decision will be announced at 3:00 AM on January 29th, Beijing time!

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

- Reward

- like

- Comment

- Repost

- Share

#FOMCMeeting 🚨🌟👑🔥🔥

🔥 The FOMC meeting just delivered a🚨 market-shaking moment traders won’t forget. Every word, pause, and projection sent instant ripples🪙 through stocks, bonds, and crypto as expectations flipped in real time. Rates may have stayed steady, but the tone didn’t—signals hinted at a tighter path than markets were pricing in, triggering fast volatility and sharp positioning shifts. Insiders are calling this a “setup meeting”—the kind that quietly sets the stage for a powerful next move. Eyes locked on the Fed… the real reaction may only be starting. ⚡📊

🔥🚀🚨🚨🌟

#FOMC #F

🔥 The FOMC meeting just delivered a🚨 market-shaking moment traders won’t forget. Every word, pause, and projection sent instant ripples🪙 through stocks, bonds, and crypto as expectations flipped in real time. Rates may have stayed steady, but the tone didn’t—signals hinted at a tighter path than markets were pricing in, triggering fast volatility and sharp positioning shifts. Insiders are calling this a “setup meeting”—the kind that quietly sets the stage for a powerful next move. Eyes locked on the Fed… the real reaction may only be starting. ⚡📊

🔥🚀🚨🚨🌟

#FOMC #F

BTC-6,58%

- Reward

- 8

- 4

- Repost

- Share

I_am_ready :

:

Christmas to the Moon! 🌕View More

🇺🇸 All Eyes on Fed Chair Powell. 👀

The Fed Chair Jerome Powell, speaks today, and global markets are on edge.

With growing expectations of rate cuts and the looming U.S. government shutdown, this isn’t just a speech it’s a potential market catalyst.

The market is waiting to hear Jerome Powell’s music,and what he plays today will set the tempo for Q4.

💵 Dollar Index #DXY is rising from last 4 days

💱 #USDINR awaiting cues

💰 #Gold Silver tightening range

🪙 #Crypto bracing for volatility

Stocks, commodities, currencies all watching.

The tone Powell sets today could define Q4.

#JeromePo

The Fed Chair Jerome Powell, speaks today, and global markets are on edge.

With growing expectations of rate cuts and the looming U.S. government shutdown, this isn’t just a speech it’s a potential market catalyst.

The market is waiting to hear Jerome Powell’s music,and what he plays today will set the tempo for Q4.

💵 Dollar Index #DXY is rising from last 4 days

💱 #USDINR awaiting cues

💰 #Gold Silver tightening range

🪙 #Crypto bracing for volatility

Stocks, commodities, currencies all watching.

The tone Powell sets today could define Q4.

#JeromePo

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

239 Popularity

17.34K Popularity

15.24K Popularity

6.31K Popularity

48.17K Popularity

4.15K Popularity

17.83K Popularity

4.72K Popularity

81.7K Popularity

28.62K Popularity

88.31K Popularity

23.79K Popularity

18.05K Popularity

14.65K Popularity

203.82K Popularity

News

View MoreCrypto-friendly bank Nubank has received conditional approval from the US OCC to establish a US national bank

12 m

GameStop CEO plans major mergers and acquisitions aimed at driving the company's market capitalization to $100 billion

14 m

All short positions of a giant whale are now floating about $16 million

18 m

RootData: BERA will unlock approximately $36.51 million worth of tokens in a week

19 m

The top three popular coins on January 30, 2026 are: Bitcoin, Ethereum, and XRP

19 m

Pin