# ETHTrendWatch

173.34K

How do you view ETH’s recent price action? What’s your trading strategy? Share your thoughts in a post!

MrFlower_XingChen

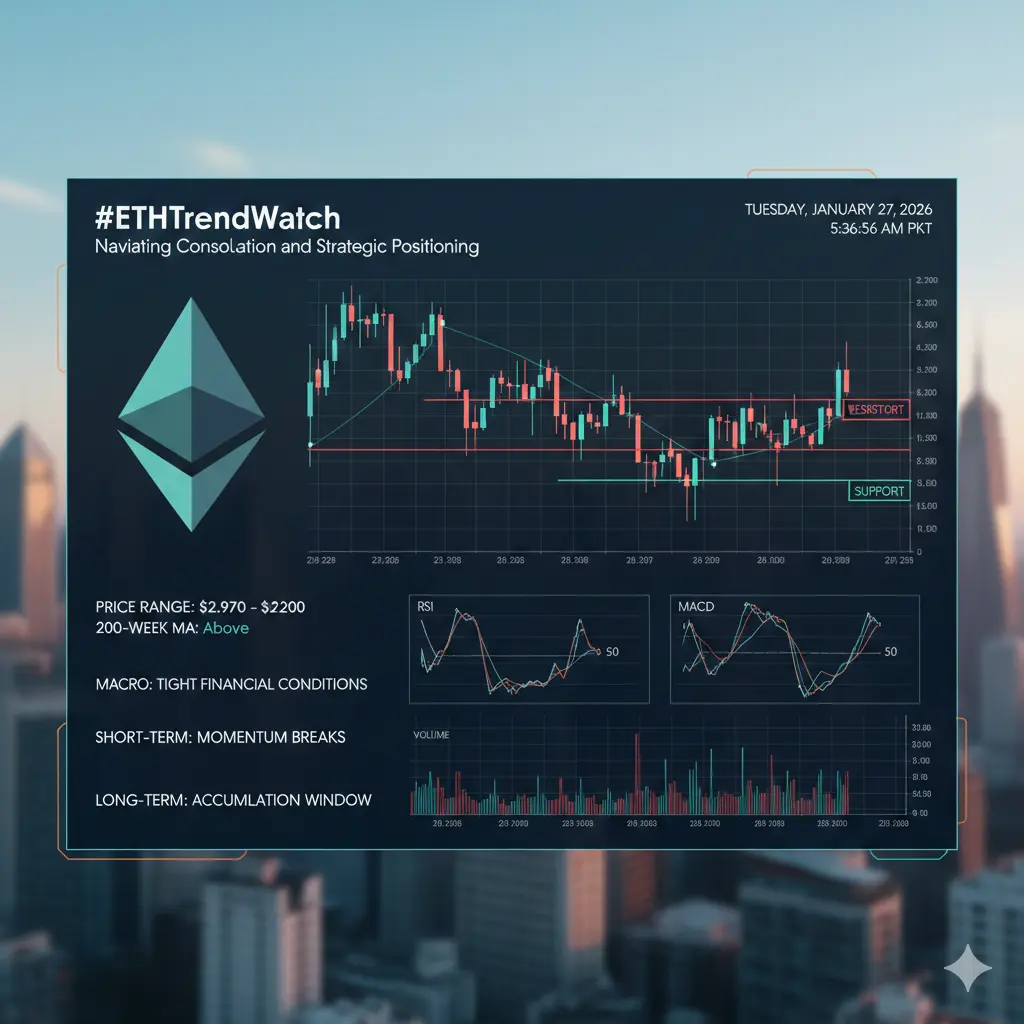

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

- Reward

- 22

- 17

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

#ETHTrendWatch #ETHTrendWatch – This Is Where Smart Traders Separate Themselves

Ethereum isn’t pumping.

It isn’t crashing.

It’s building pressure.

Right now ETH is moving between $3.1K support and $3.3K–$3.4K resistance. Every dip attracts buyers. Every push higher meets profit-taking. That’s not weakness — that’s a market in consolidation, quietly preparing for its next real move.

This is the phase most traders lose patience. They overtrade, chase small candles, and get caught in fakeouts.

Smart traders do the opposite.

They understand that consolidation phases are where strong positions are

Ethereum isn’t pumping.

It isn’t crashing.

It’s building pressure.

Right now ETH is moving between $3.1K support and $3.3K–$3.4K resistance. Every dip attracts buyers. Every push higher meets profit-taking. That’s not weakness — that’s a market in consolidation, quietly preparing for its next real move.

This is the phase most traders lose patience. They overtrade, chase small candles, and get caught in fakeouts.

Smart traders do the opposite.

They understand that consolidation phases are where strong positions are

- Reward

- 2

- Comment

- Repost

- Share

#ETHTrendWatch

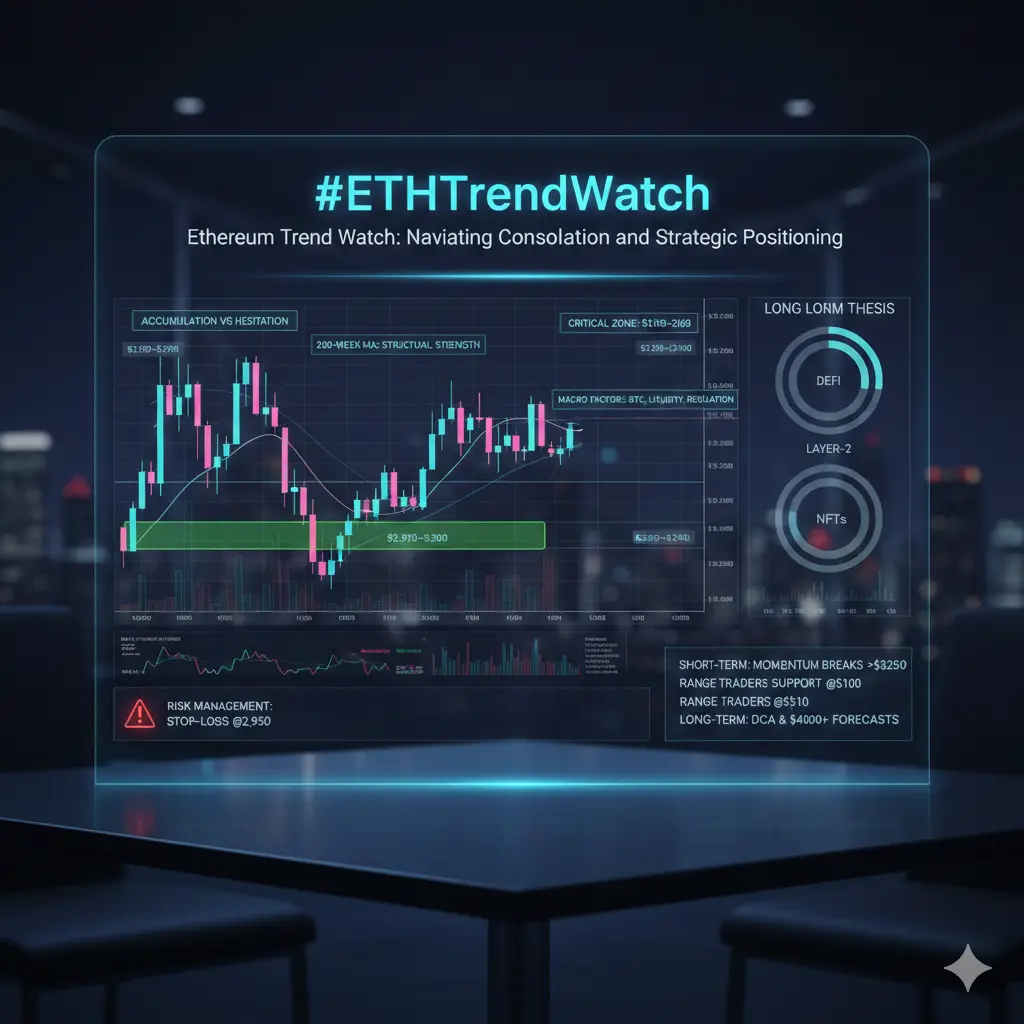

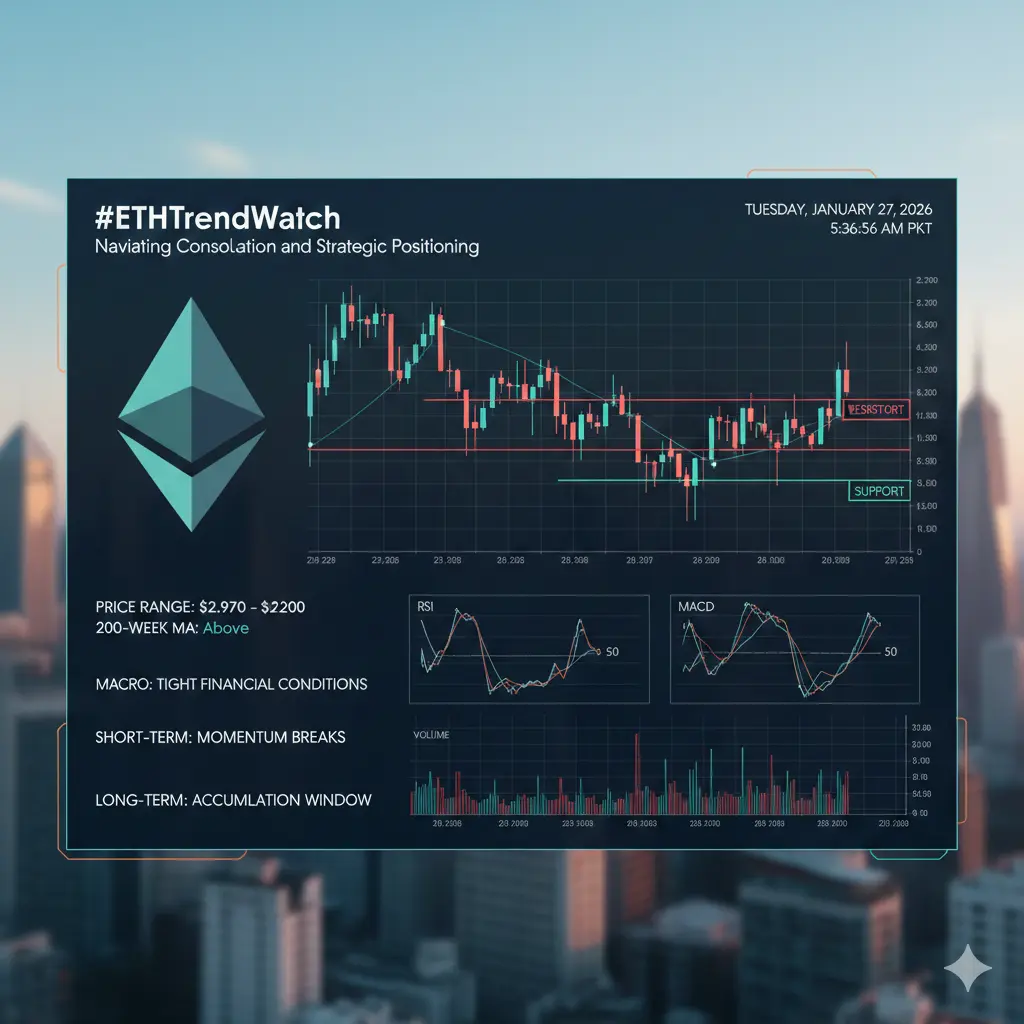

Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a phase of consolidation marked by heightened volatility, as market participants weigh technical signals against evolving macroeconomic conditions. At present, ETH is trading within the $2,970–$3,200 range, reflecting a market caught between accumulation and hesitation. Over the past month, the price has oscillated mostly between $2,950 and $3,260, indicating that traders are balancing short-term positioning with caution. D

Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a phase of consolidation marked by heightened volatility, as market participants weigh technical signals against evolving macroeconomic conditions. At present, ETH is trading within the $2,970–$3,200 range, reflecting a market caught between accumulation and hesitation. Over the past month, the price has oscillated mostly between $2,950 and $3,260, indicating that traders are balancing short-term positioning with caution. D

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑#ETHTrendWatch

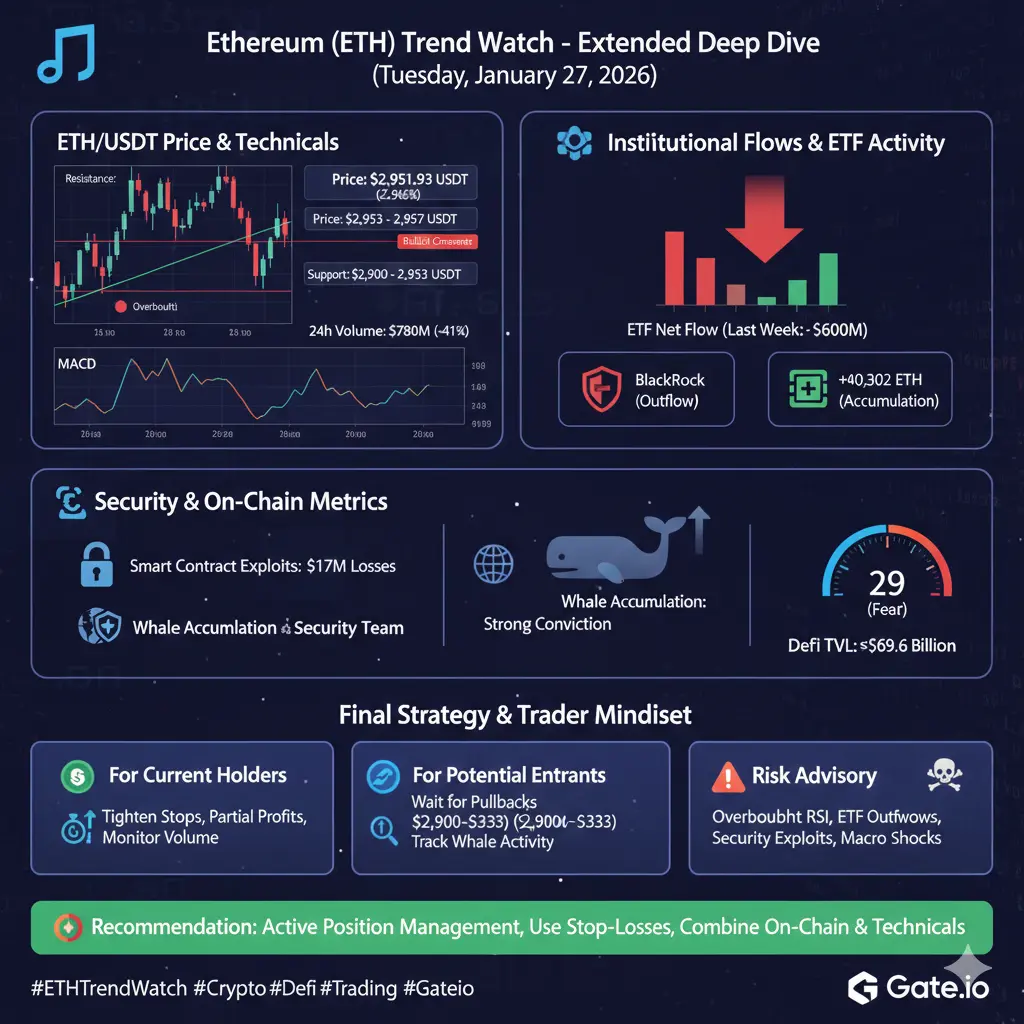

As of 27 January 2026, the Ethereum market remains at a pivotal inflection point, with price action, sentiment and on‑chain dynamics all signaling a mixed but actively contested trend that traders and long‑term observers are watching closely. After a period of decline from cyclical highs seen in late 2025, ETH has struggled to find consistent upside, with recent data showing prices dipping below key support levels and extending a weekly decline of nearly 11 % as sellers have pushed the market lower and bearish momentum strengthened. On‑chain whale activity has been a double‑edg

As of 27 January 2026, the Ethereum market remains at a pivotal inflection point, with price action, sentiment and on‑chain dynamics all signaling a mixed but actively contested trend that traders and long‑term observers are watching closely. After a period of decline from cyclical highs seen in late 2025, ETH has struggled to find consistent upside, with recent data showing prices dipping below key support levels and extending a weekly decline of nearly 11 % as sellers have pushed the market lower and bearish momentum strengthened. On‑chain whale activity has been a double‑edg

- Reward

- 7

- 8

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

#ETHTrendWatch The Current Setup: ETH at Critical Inflection Point

Ethereum is consolidating in a historically significant zone between $3,200 and $3,450. This isn't just another trading range—it's a macro decision point that will determine whether ETH:

1. Breaks out to retest all-time highs ahead of spot ETF trading

2. Breaks down into a deeper correction toward $2,800

3. Extends consolidation through summer (bullish for altcoins)

Current Technical State:

· Price: $3,315 (-2.4% 24h)

· Market Cap Rank: #2, but dominance slipping (15.8%)

· Against BTC: ETH/BTC ratio at critical 0.052 support (m

Ethereum is consolidating in a historically significant zone between $3,200 and $3,450. This isn't just another trading range—it's a macro decision point that will determine whether ETH:

1. Breaks out to retest all-time highs ahead of spot ETF trading

2. Breaks down into a deeper correction toward $2,800

3. Extends consolidation through summer (bullish for altcoins)

Current Technical State:

· Price: $3,315 (-2.4% 24h)

· Market Cap Rank: #2, but dominance slipping (15.8%)

· Against BTC: ETH/BTC ratio at critical 0.052 support (m

- Reward

- 12

- 10

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#ETHTrendWatch After Consolidation — Where Ethereum’s Next Direction May Form

As 2026 progresses, Ethereum’s extended consolidation is beginning to take on greater strategic meaning. What initially appeared as hesitation now increasingly resembles preparation — a phase where capital reorganizes rather than exits.

Sideways markets do not signal weakness by default.

They signal negotiation.

Ethereum continues to absorb supply within a clearly defined structure, suggesting that both buyers and sellers are waiting not for price confirmation alone, but for liquidity alignment across the broader mar

As 2026 progresses, Ethereum’s extended consolidation is beginning to take on greater strategic meaning. What initially appeared as hesitation now increasingly resembles preparation — a phase where capital reorganizes rather than exits.

Sideways markets do not signal weakness by default.

They signal negotiation.

Ethereum continues to absorb supply within a clearly defined structure, suggesting that both buyers and sellers are waiting not for price confirmation alone, but for liquidity alignment across the broader mar

- Reward

- 21

- 14

- Repost

- Share

AnnaCryptoWriter :

:

Happy New Year! 🤑View More

#ETHTrendWatch

Ethereum (ETH) is currently navigating a technically bullish trend, with the latest Gate.io price at $2,951.93 USDT, yet signs of caution are emerging as it nears key resistance levels. ETH has sustained upward momentum after breaking above $2,900 USDT, supported by favorable moving average alignment and a bullish MACD crossover. However, technical indicators like the 15-minute RSI at 70.1 (overbought) and declining trading volumes suggest the rally could pause or retrace in the near term. Traders should closely manage positions, consider partial profit-taking near resistance,

Ethereum (ETH) is currently navigating a technically bullish trend, with the latest Gate.io price at $2,951.93 USDT, yet signs of caution are emerging as it nears key resistance levels. ETH has sustained upward momentum after breaking above $2,900 USDT, supported by favorable moving average alignment and a bullish MACD crossover. However, technical indicators like the 15-minute RSI at 70.1 (overbought) and declining trading volumes suggest the rally could pause or retrace in the near term. Traders should closely manage positions, consider partial profit-taking near resistance,

- Reward

- 27

- 11

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

📊 #ETHTrendWatch | Market at a Crossroads

As of 27 January 2026, Ethereum (ETH) sits at a decisive inflection point, with price action, sentiment, and on-chain data sending mixed but highly active signals. After retreating from late-2025 cycle highs, ETH has struggled to reclaim upside momentum, posting a near-11% weekly decline as sellers maintained pressure and bearish structures strengthened.

🐋 Whale activity remains a double-edged signal

• Large deposits to exchanges have increased sell-side pressure

• Selective accumulation by long-term holders suggests growing conviction at lower level

As of 27 January 2026, Ethereum (ETH) sits at a decisive inflection point, with price action, sentiment, and on-chain data sending mixed but highly active signals. After retreating from late-2025 cycle highs, ETH has struggled to reclaim upside momentum, posting a near-11% weekly decline as sellers maintained pressure and bearish structures strengthened.

🐋 Whale activity remains a double-edged signal

• Large deposits to exchanges have increased sell-side pressure

• Selective accumulation by long-term holders suggests growing conviction at lower level

- Reward

- 3

- 2

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

- Reward

- 5

- 1

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊#ETHTrendWatch

ETH price action is tightening, and compression like this often leads to a strong breakout.

I’m watching how ETH reacts to key support while tracking BTC dominance and altcoin rotation.

Volume behavior here matters more than small candles.

If momentum returns, ETH usually leads the next leg for alts.

Position size small, entries near structure, and patience for confirmation.

Are you accumulating ETH here or waiting for a clear breakout?

ETH price action is tightening, and compression like this often leads to a strong breakout.

I’m watching how ETH reacts to key support while tracking BTC dominance and altcoin rotation.

Volume behavior here matters more than small candles.

If momentum returns, ETH usually leads the next leg for alts.

Position size small, entries near structure, and patience for confirmation.

Are you accumulating ETH here or waiting for a clear breakout?

- Reward

- 23

- 30

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

355.67K Popularity

21.44K Popularity

62.97K Popularity

15.32K Popularity

465.24K Popularity

3.55K Popularity

3.49K Popularity

1.84K Popularity

1.06K Popularity

80.14K Popularity

41.99K Popularity

96.88K Popularity

14.42K Popularity

102.09K Popularity

2.82K Popularity

News

View MoreLobster increased by 872.32% after launching Alpha, current price 0.0018772 USDT

5 m

Data: If BTC breaks through $68,773, the total liquidation strength of mainstream CEX short positions will reach $1.759 billion.

57 m

Data: If ETH breaks through $2,020, the total liquidation strength of short positions on mainstream CEXs will reach $758 million.

57 m

Traditional Finance Alert: NFLX Surges Over 12%

1 h

Lobster rose by 620.27% after going live on Alpha; current price is 0.0013907 USDT

2 h

Pin