# Bitcoin,

4.97K

CryptoZeno

ETF Outflows Reshape Institutional Demand Dynamics

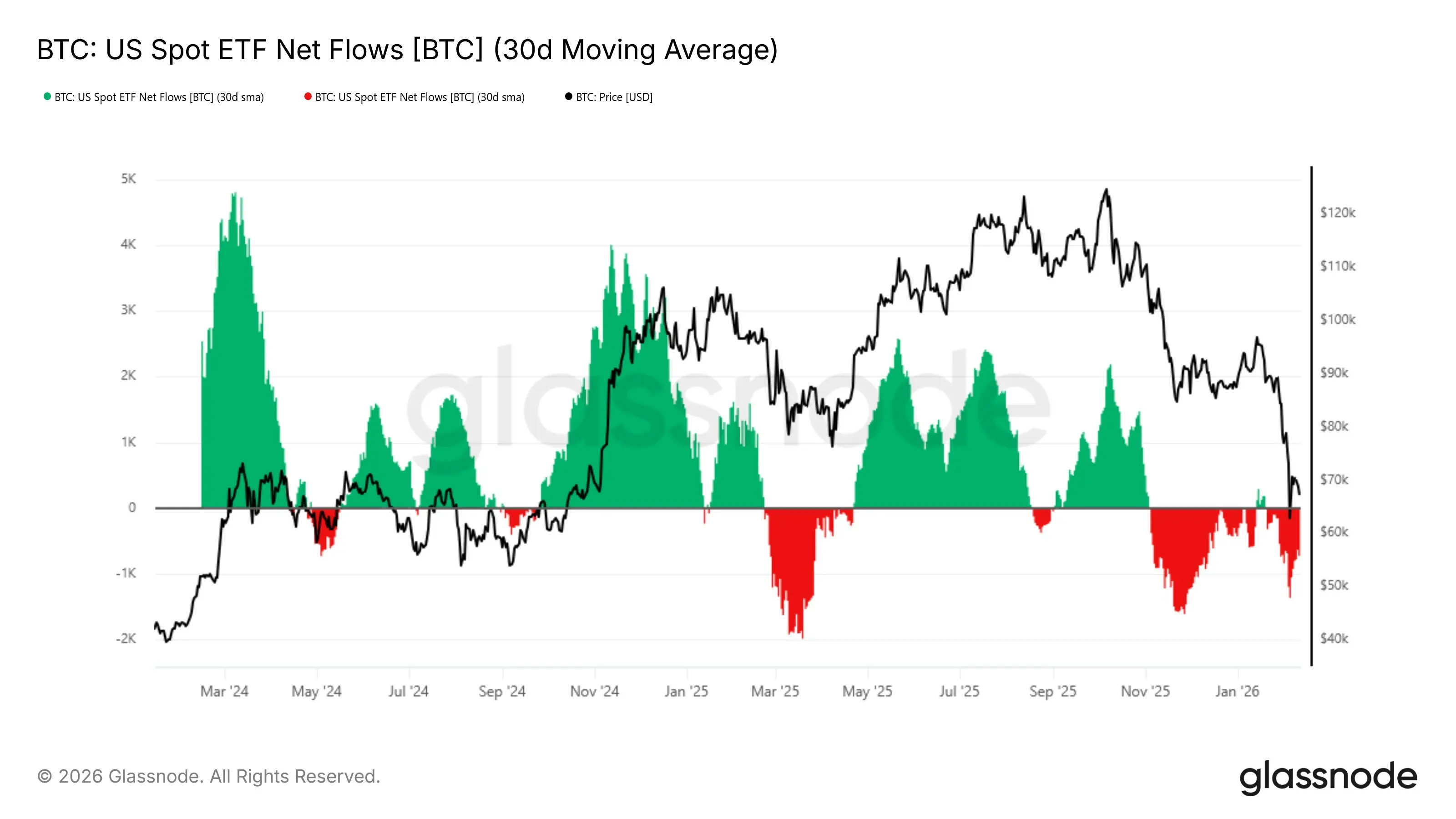

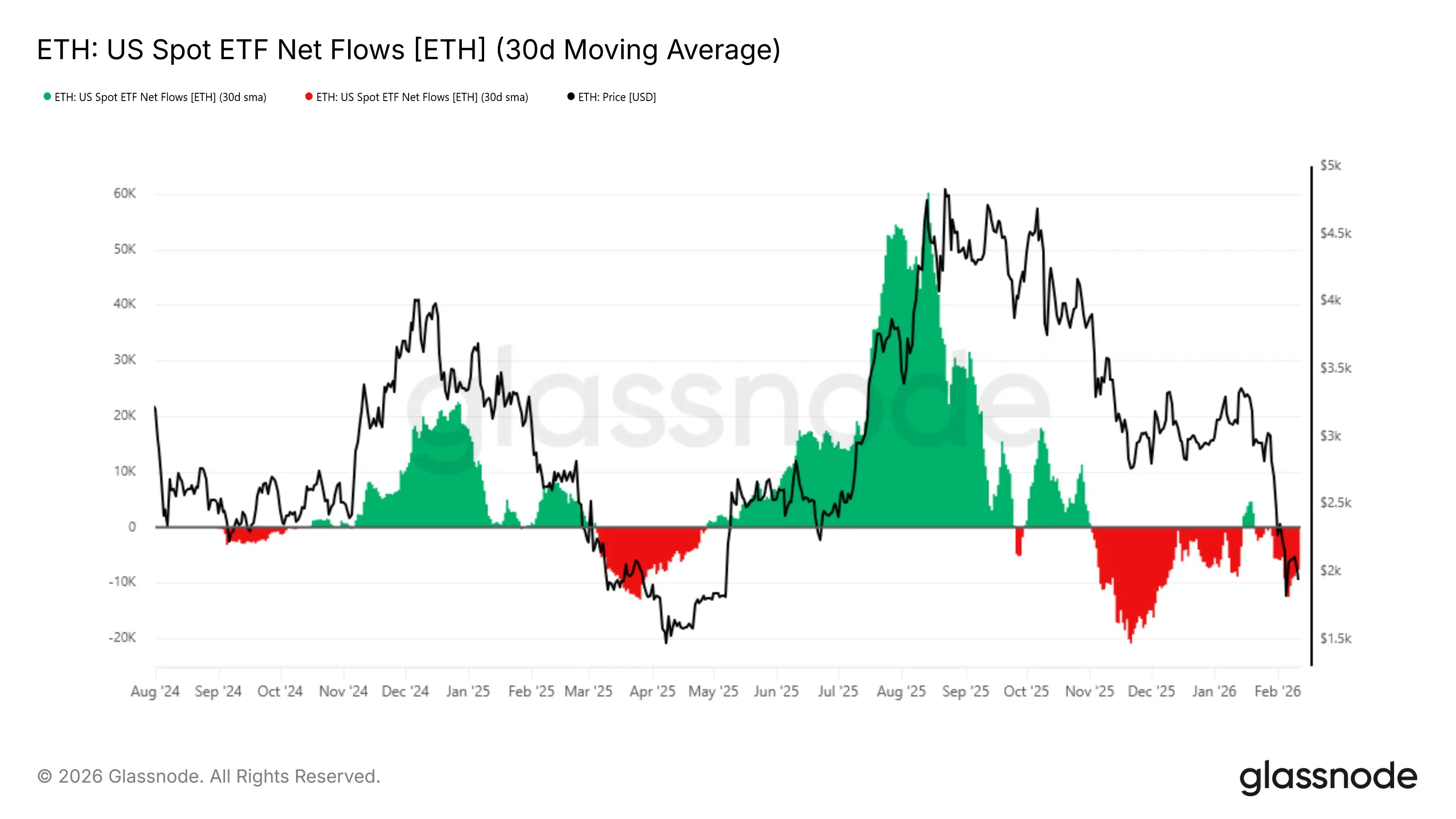

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

The market is heating up again! #Bitcoin, #Ethereum, and top #Altcoins are showing fresh momentum as traders watch key liquidity zones and breakout levels 👀🔥

Smart traders are focusing on short-term volatility while keeping an eye on major resistance zones. Whether you trade futures or spot, always ride the trend — not the noise.

Stay sharp, stay early, and stay profitable. 🚀

#Cryptocurrency #CryptoNews

Smart traders are focusing on short-term volatility while keeping an eye on major resistance zones. Whether you trade futures or spot, always ride the trend — not the noise.

Stay sharp, stay early, and stay profitable. 🚀

#Cryptocurrency #CryptoNews

- Reward

- 3

- 2

- Repost

- Share

Yusfirah :

:

Ape In 🚀View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

ALPHA LEAK: The silent titans of Bitcoin mining just pulled an ELEVEN BILLION DOLLAR power move, and if you're not paying attention, you're NGMI. This isn't just about blocks and hash rates anymore; it's about the brutal evolution of capital in the digital frontier. The game just changed, apes. HARD.

**TL;DR: The Miners Are Pivoting, And They're Not Asking For Permission** 🚀

Bitcoin miners, post-halving, are facing an existential threat to their core business model. In a seismic shift, they've raised a staggering $11 BILLION in convertible debt over the last year, not just to survive, but to

**TL;DR: The Miners Are Pivoting, And They're Not Asking For Permission** 🚀

Bitcoin miners, post-halving, are facing an existential threat to their core business model. In a seismic shift, they've raised a staggering $11 BILLION in convertible debt over the last year, not just to survive, but to

BTC0,03%

- Reward

- 2

- 2

- Repost

- Share

GreeG :

:

HODL Tight 💪View More

- Reward

- like

- Comment

- Repost

- Share

🌏 BREAKING: Major Shift in U.S.–China Policy 🇺🇸🇨🇳

💬 U.S. Treasury Secretary Bessent just confirmed —

👉 “The U.S. no longer plans to impose 100% tariffs on China.”

⚡ Markets are reacting fast — risk appetite is rising, global stocks & crypto breathe a sigh of relief.

💹 Investors see this as a cooling of trade tensions — a potential spark for renewed market optimism.

📊 A softer trade stance could strengthen global liquidity and fuel assets like #Bitcoin, #Gold, and Tech Stocks.

🌐 When giants ease friction, money flows freer — and that’s where opportunities rise.

🔥 Calm policy = Hot ma

💬 U.S. Treasury Secretary Bessent just confirmed —

👉 “The U.S. no longer plans to impose 100% tariffs on China.”

⚡ Markets are reacting fast — risk appetite is rising, global stocks & crypto breathe a sigh of relief.

💹 Investors see this as a cooling of trade tensions — a potential spark for renewed market optimism.

📊 A softer trade stance could strengthen global liquidity and fuel assets like #Bitcoin, #Gold, and Tech Stocks.

🌐 When giants ease friction, money flows freer — and that’s where opportunities rise.

🔥 Calm policy = Hot ma

BTC0,03%

- Reward

- 3

- 1

- Repost

- Share

Rus35 :

:

Hold on tight 💪🌏 BREAKING: Major Shift in U.S.–China Policy 🇺🇸🇨🇳

💬 U.S. Treasury Secretary Bessent just confirmed —

👉 “The U.S. no longer plans to impose 100% tariffs on China.”

⚡ Markets are reacting fast — risk appetite is rising, global stocks & crypto breathe a sigh of relief.

💹 Investors see this as a cooling of trade tensions — a potential spark for renewed market optimism.

📊 A softer trade stance could strengthen global liquidity and fuel assets like #Bitcoin, #Gold, and Tech Stocks.

🌐 When giants ease friction, money flows freer — and that’s where opportunities rise.

🔥 Calm policy = Hot ma

💬 U.S. Treasury Secretary Bessent just confirmed —

👉 “The U.S. no longer plans to impose 100% tariffs on China.”

⚡ Markets are reacting fast — risk appetite is rising, global stocks & crypto breathe a sigh of relief.

💹 Investors see this as a cooling of trade tensions — a potential spark for renewed market optimism.

📊 A softer trade stance could strengthen global liquidity and fuel assets like #Bitcoin, #Gold, and Tech Stocks.

🌐 When giants ease friction, money flows freer — and that’s where opportunities rise.

🔥 Calm policy = Hot ma

BTC0,03%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

18.85K Popularity

8.19K Popularity

3.38K Popularity

35.39K Popularity

250.19K Popularity

148.38K Popularity

3.95K Popularity

3.9K Popularity

2.09K Popularity

3.16K Popularity

121.18K Popularity

25.6K Popularity

22.02K Popularity

16.29K Popularity

1.58K Popularity

News

View MoreSwedish Bitcoin Treasury Company H100 completes the acquisition of Future Holdings

12 m

Traditional Finance Drop Alert: XAGUSD Falls Over 6%

12 m

Analyst: The reason for the short-term sharp decline in spot gold is unknown

17 m

Over the past hour, the entire network has liquidated over $80 million, with BTC liquidations totaling $31.52 million.

18 m

ETH drops below 1900 USDT

22 m

Pin