DropToZeroDon'tCry

In the next 10 years, what is truly valuable as a money-making ability?

In the past couple of years, I’ve become increasingly certain of one thing:

In the next five to ten years, the most valuable assets won’t be in your name, but in yourself.

Housing, stocks, positions—they seem like assets,

but they have one common point—

they can be wiped out at any time by policies, cycles, or accidents.

And some things, once cultivated,

even if the world restarts,

they will stay with you.

The changes I’ve observed over these years are broken down into a hierarchy with extremely important sequencing.

1️⃣ F

In the past couple of years, I’ve become increasingly certain of one thing:

In the next five to ten years, the most valuable assets won’t be in your name, but in yourself.

Housing, stocks, positions—they seem like assets,

but they have one common point—

they can be wiped out at any time by policies, cycles, or accidents.

And some things, once cultivated,

even if the world restarts,

they will stay with you.

The changes I’ve observed over these years are broken down into a hierarchy with extremely important sequencing.

1️⃣ F

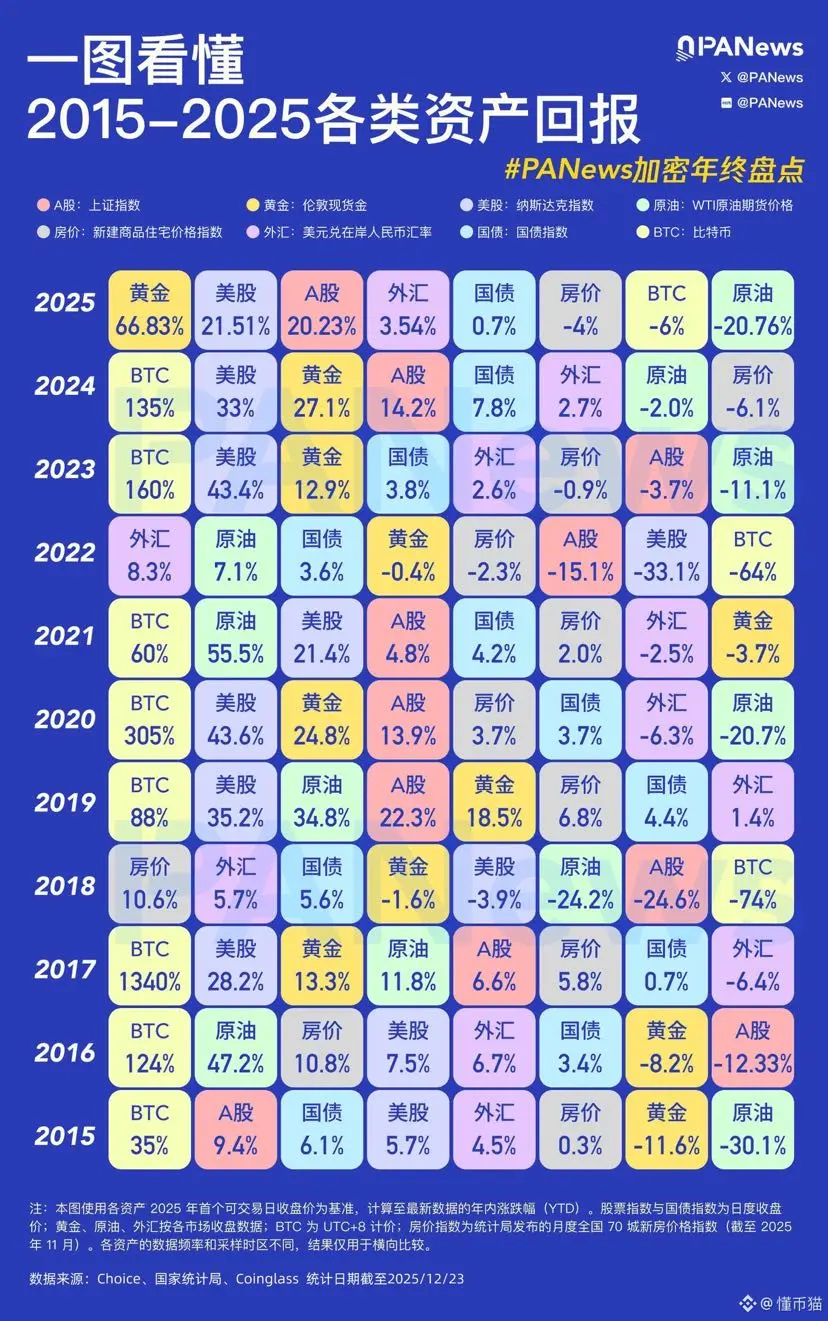

BTC-0,61%