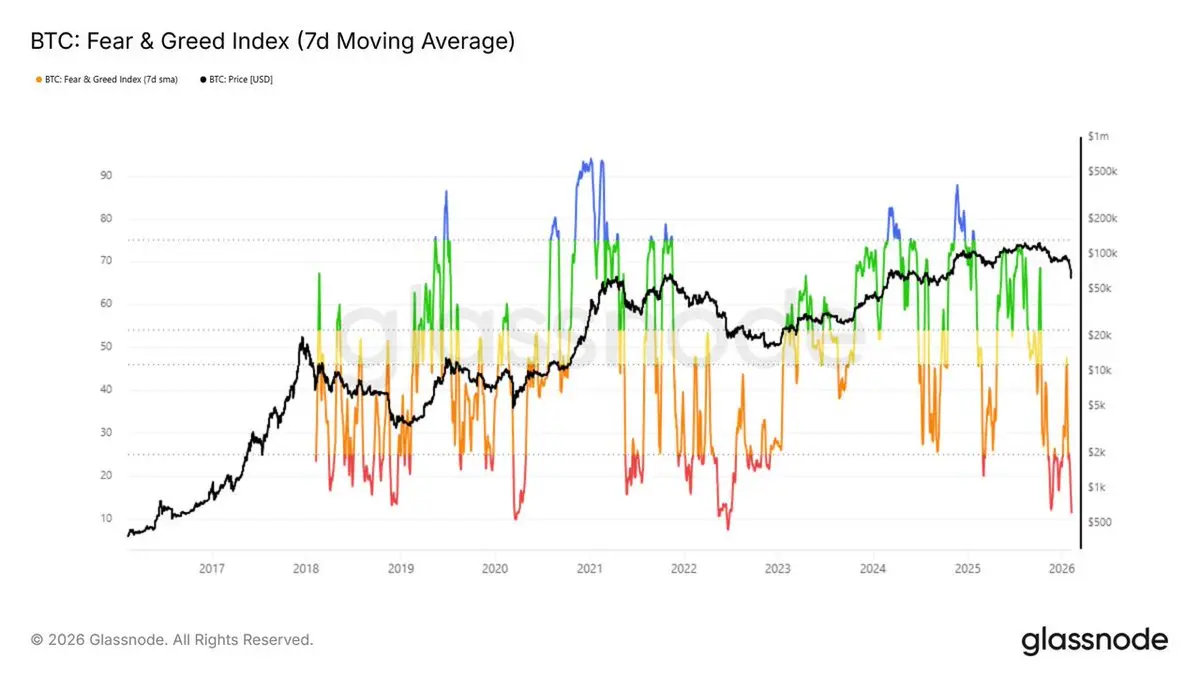

Cryptocurrency sales continue as market capitalization drops by 10%

The cryptocurrency sector has been generally bearish since Bitcoin hit its all-time high of $126,199 on October 6, when the total market value reached $4.38 trillion.

The collapse on October 10 significantly dampened sentiment, making it difficult to sustain a recovery, while the Federal Reserve's decision to pause the monetary easing cycle in late January accelerated the sell-off.

In February alone, the market capitalization of cryptocurrencies decreased by about 10% to $2.4 trillion from $2.74 trillion, negatively impacting investor sentiment. At the same time, Bitcoin's price plummeted, testing the $60,000 level on Friday before briefly rebounding above $70,000.

Market Cap of Digital Assets | Source: CoinGecko

Bitcoin, Ethereum, and XRP attract institutional interest

Institutional investors continue to show interest in spot ETFs for Bitcoin, Ethereum, and XRP, as evidenced by the cash flows recorded on Monday.

US-listed Bitcoin spot ETFs continued their cash inflows for the second consecutive day, attracting $145 million from investors on Monday. According to SoSoValue data, inflows of $371 million were recorded on Friday.

Total inflows reached $54.83 billion, while net assets under management stood at $90.05 billion. Continued investment inflows in the coming days could support positive sentiment and increase the likelihood of Bitcoin rising above $70,000.

Bitcoin ETF Inflows | Source: SoSoValue

Meanwhile, Ethereum ETFs resumed capital inflows on Monday, receiving about $57 million. With this inflow, these ETFs end three consecutive outflows, which had negatively impacted the smart contract coin. Total inflows amount to $11.87 billion, with net assets under management at $12.42 billion.

Ethereum ETF Inflows | Source: SoSoValue

Cash inflows into US-listed spot XRP ETFs reached $6.3 million on Monday, bringing total inflows to $1.23 billion and net assets under management to $1.04 billion. Institutional investors continued their interest in XRP ETFs, marking four consecutive days of cash inflows.

XRP ETF Inflows | Source: SoSoValue

The cryptocurrency sector has been generally bearish since Bitcoin hit its all-time high of $126,199 on October 6, when the total market value reached $4.38 trillion.

The collapse on October 10 significantly dampened sentiment, making it difficult to sustain a recovery, while the Federal Reserve's decision to pause the monetary easing cycle in late January accelerated the sell-off.

In February alone, the market capitalization of cryptocurrencies decreased by about 10% to $2.4 trillion from $2.74 trillion, negatively impacting investor sentiment. At the same time, Bitcoin's price plummeted, testing the $60,000 level on Friday before briefly rebounding above $70,000.

Market Cap of Digital Assets | Source: CoinGecko

Bitcoin, Ethereum, and XRP attract institutional interest

Institutional investors continue to show interest in spot ETFs for Bitcoin, Ethereum, and XRP, as evidenced by the cash flows recorded on Monday.

US-listed Bitcoin spot ETFs continued their cash inflows for the second consecutive day, attracting $145 million from investors on Monday. According to SoSoValue data, inflows of $371 million were recorded on Friday.

Total inflows reached $54.83 billion, while net assets under management stood at $90.05 billion. Continued investment inflows in the coming days could support positive sentiment and increase the likelihood of Bitcoin rising above $70,000.

Bitcoin ETF Inflows | Source: SoSoValue

Meanwhile, Ethereum ETFs resumed capital inflows on Monday, receiving about $57 million. With this inflow, these ETFs end three consecutive outflows, which had negatively impacted the smart contract coin. Total inflows amount to $11.87 billion, with net assets under management at $12.42 billion.

Ethereum ETF Inflows | Source: SoSoValue

Cash inflows into US-listed spot XRP ETFs reached $6.3 million on Monday, bringing total inflows to $1.23 billion and net assets under management to $1.04 billion. Institutional investors continued their interest in XRP ETFs, marking four consecutive days of cash inflows.

XRP ETF Inflows | Source: SoSoValue