#WhyAreGoldStocksandBTCFallingTogether? In early 2026, investors are witnessing an unusual market dynamic: gold mining stocks and Bitcoin are declining simultaneously, even as physical gold continues to attract institutional demand. This divergence has raised questions, especially given Bitcoin’s long-standing “digital gold” narrative. The reality is that during periods of systemic stress, markets prioritize liquidity over ideology — and both BTC and gold equities are highly liquid, leveraged, and vulnerable to forced selling.

1. Risk-Off Shock and Forced Deleveraging

Markets have entered a phase of extreme risk aversion, driven by geopolitical tensions, escalating trade disputes, hawkish monetary speculation, weakness in AI and technology stocks, and tightening global liquidity. In such environments, investors rush to reduce exposure and preserve capital.

When margin pressure rises, forced selling cascades across asset classes. Funds and leveraged traders liquidate whatever can be sold quickly — regardless of long-term fundamentals. Bitcoin is often hit first due to its high beta and 24/7 liquidity, while gold miners follow because they trade like leveraged equities. Physical gold, supported by central banks and institutional inflows, typically absorbs demand and stabilizes faster.

2. Bitcoin’s “Digital Gold” Narrative Under Stress

During this downturn, Bitcoin is behaving less like a hedge and more like a high-risk growth asset. Recent data shows weak or negative correlation with gold and strong correlation with Nasdaq-style risk assets.

Bitcoin tracks credit availability and liquidity cycles. When financing tightens, leverage unwinds, and risk appetite falls, BTC becomes a primary source of cash. In panic phases, investors sell volatility first — and Bitcoin is one of the most volatile liquid assets available.

Gold, by contrast, benefits from sovereign demand, inflation hedging, and crisis-driven inflows. This structural difference explains why BTC underperforms during systemic shocks.

3. Gold Miners: High-Beta Exposure to Volatility

Gold mining stocks are not pure proxies for gold. They carry operational, financial, and equity-market risks that amplify downside moves.

Miners typically move two to three times more than the metal itself. Rising energy costs, labor expenses, debt servicing, and supply chain pressures compress margins during volatile periods. After strong gains in 2025, many mining stocks were technically overextended, making them vulnerable to sharp mean-reversion pullbacks.

In broad equity sell-offs, miners are treated as risk assets — not safe havens — regardless of gold’s underlying strength.

4. Key Triggers Behind the Joint Decline

Several overlapping forces are fueling the synchronized sell-off:

• Escalating trade tensions and tariff threats

• Weakness in AI and technology leaders

• Volatility in precious metals markets

• Large-scale crypto liquidations

• Margin calls and portfolio rebalancing

• Position squaring and fund redemptions

Together, these factors create a “sell everything” environment where correlations rise and diversification temporarily fails.

5. Liquidity, Volume, and Correlation Dynamics

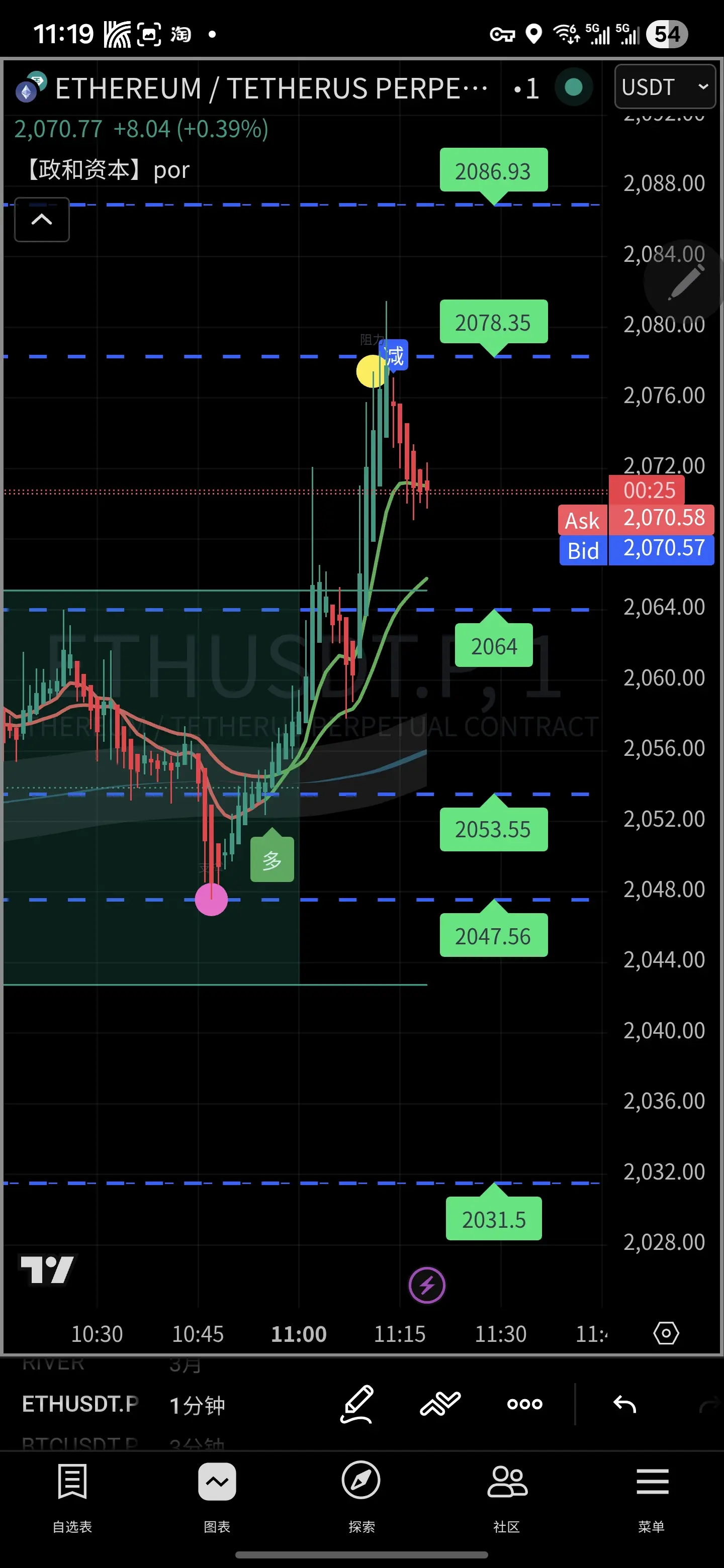

Bitcoin

BTC continues to show extreme volume spikes during fear-driven sessions, reflecting large-scale liquidation events. While liquidity is deep, cascading leverage makes price moves violent.

Physical Gold

Gold remains supported by central banks, ETFs, and sovereign buyers. Its deep global market acts as a shock absorber during crises.

Gold Miners

Mining equities suffer from thinner liquidity and higher beta. Outflows translate into disproportionately large percentage declines.

This structural setup explains why BTC and miners fall together, while spot gold diverges.

6. Outlook: What Happens Next?

The current joint decline appears driven primarily by deleveraging rather than fundamental deterioration.

Historically, physical gold stabilizes first as institutional demand reasserts itself. Bitcoin may recover if liquidity conditions improve, policy signals soften, or risk appetite returns — but its “digital gold” status remains fragile in crisis environments.

Gold miners remain leveraged instruments. They offer strong upside in sustained gold rallies but remain vulnerable to equity weakness and cost inflation.

Volatility is likely to persist until leverage is fully reset and macro uncertainty fades. Key catalysts to watch include central bank guidance, trade negotiations, and global liquidity indicators.

Bottom Line

Gold stocks and Bitcoin are falling together because both are leveraged, liquid, and risk-sensitive assets that are sold aggressively during panic-driven deleveraging. Physical gold is diverging because it is backed by deep institutional demand and sovereign flows.

The 2026 market reality is clear:

BTC behaves like a liquidity-driven risk asset.

Miners behave like high-beta equities.

Neither functions as a universal hedge in every crisis.

Understanding this distinction is critical for navigating volatile macro cycles.

1. Risk-Off Shock and Forced Deleveraging

Markets have entered a phase of extreme risk aversion, driven by geopolitical tensions, escalating trade disputes, hawkish monetary speculation, weakness in AI and technology stocks, and tightening global liquidity. In such environments, investors rush to reduce exposure and preserve capital.

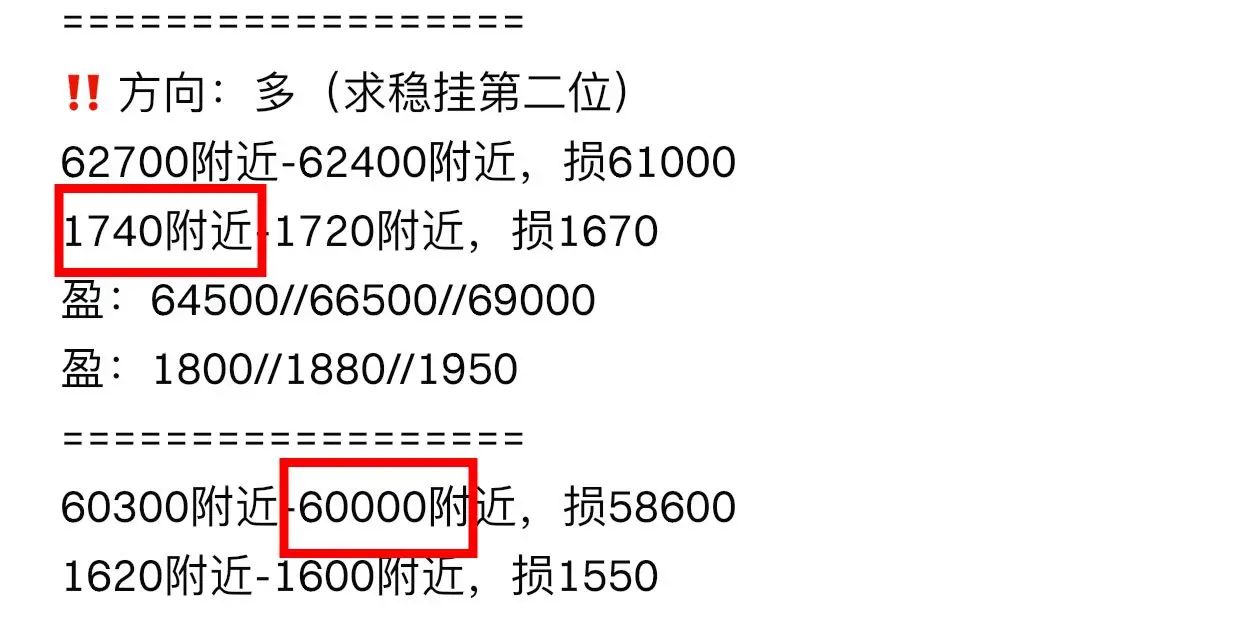

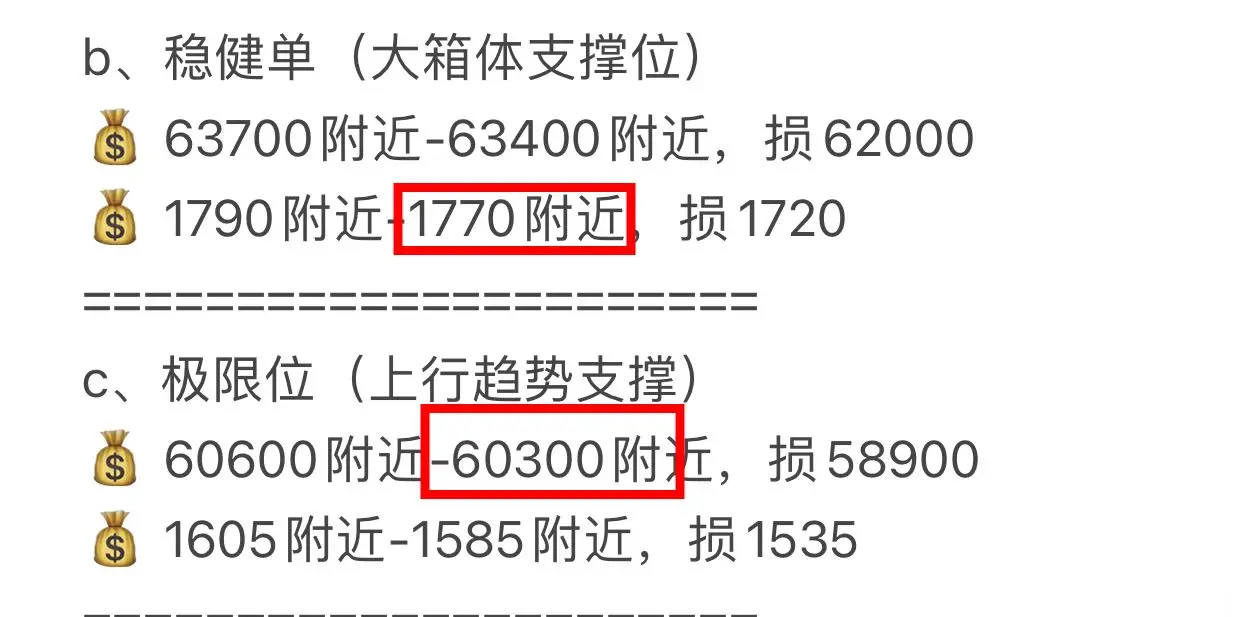

When margin pressure rises, forced selling cascades across asset classes. Funds and leveraged traders liquidate whatever can be sold quickly — regardless of long-term fundamentals. Bitcoin is often hit first due to its high beta and 24/7 liquidity, while gold miners follow because they trade like leveraged equities. Physical gold, supported by central banks and institutional inflows, typically absorbs demand and stabilizes faster.

2. Bitcoin’s “Digital Gold” Narrative Under Stress

During this downturn, Bitcoin is behaving less like a hedge and more like a high-risk growth asset. Recent data shows weak or negative correlation with gold and strong correlation with Nasdaq-style risk assets.

Bitcoin tracks credit availability and liquidity cycles. When financing tightens, leverage unwinds, and risk appetite falls, BTC becomes a primary source of cash. In panic phases, investors sell volatility first — and Bitcoin is one of the most volatile liquid assets available.

Gold, by contrast, benefits from sovereign demand, inflation hedging, and crisis-driven inflows. This structural difference explains why BTC underperforms during systemic shocks.

3. Gold Miners: High-Beta Exposure to Volatility

Gold mining stocks are not pure proxies for gold. They carry operational, financial, and equity-market risks that amplify downside moves.

Miners typically move two to three times more than the metal itself. Rising energy costs, labor expenses, debt servicing, and supply chain pressures compress margins during volatile periods. After strong gains in 2025, many mining stocks were technically overextended, making them vulnerable to sharp mean-reversion pullbacks.

In broad equity sell-offs, miners are treated as risk assets — not safe havens — regardless of gold’s underlying strength.

4. Key Triggers Behind the Joint Decline

Several overlapping forces are fueling the synchronized sell-off:

• Escalating trade tensions and tariff threats

• Weakness in AI and technology leaders

• Volatility in precious metals markets

• Large-scale crypto liquidations

• Margin calls and portfolio rebalancing

• Position squaring and fund redemptions

Together, these factors create a “sell everything” environment where correlations rise and diversification temporarily fails.

5. Liquidity, Volume, and Correlation Dynamics

Bitcoin

BTC continues to show extreme volume spikes during fear-driven sessions, reflecting large-scale liquidation events. While liquidity is deep, cascading leverage makes price moves violent.

Physical Gold

Gold remains supported by central banks, ETFs, and sovereign buyers. Its deep global market acts as a shock absorber during crises.

Gold Miners

Mining equities suffer from thinner liquidity and higher beta. Outflows translate into disproportionately large percentage declines.

This structural setup explains why BTC and miners fall together, while spot gold diverges.

6. Outlook: What Happens Next?

The current joint decline appears driven primarily by deleveraging rather than fundamental deterioration.

Historically, physical gold stabilizes first as institutional demand reasserts itself. Bitcoin may recover if liquidity conditions improve, policy signals soften, or risk appetite returns — but its “digital gold” status remains fragile in crisis environments.

Gold miners remain leveraged instruments. They offer strong upside in sustained gold rallies but remain vulnerable to equity weakness and cost inflation.

Volatility is likely to persist until leverage is fully reset and macro uncertainty fades. Key catalysts to watch include central bank guidance, trade negotiations, and global liquidity indicators.

Bottom Line

Gold stocks and Bitcoin are falling together because both are leveraged, liquid, and risk-sensitive assets that are sold aggressively during panic-driven deleveraging. Physical gold is diverging because it is backed by deep institutional demand and sovereign flows.

The 2026 market reality is clear:

BTC behaves like a liquidity-driven risk asset.

Miners behave like high-beta equities.

Neither functions as a universal hedge in every crisis.

Understanding this distinction is critical for navigating volatile macro cycles.