Post content & earn content mining yield

placeholder

MrThanks77

#JapanBondMarketSell-Off #JapanBondMarketSellOff

📯 Japan Bond Market Sell-Off: A Global Warning Shot My Forward View

What we’re witnessing in Japan right now is more than just another bond market correction.

It’s a structural turning point for global finance.

For decades, Japanese Government Bonds were treated like sacred ground — stable, protected, untouchable. Now that illusion is shattered. With 40-year JGB yields pushing beyond historic levels, investors are finally confronting a reality many ignored:

Sovereign debt is no longer risk-free.

Central banks can’t suppress markets forever.

📯 Japan Bond Market Sell-Off: A Global Warning Shot My Forward View

What we’re witnessing in Japan right now is more than just another bond market correction.

It’s a structural turning point for global finance.

For decades, Japanese Government Bonds were treated like sacred ground — stable, protected, untouchable. Now that illusion is shattered. With 40-year JGB yields pushing beyond historic levels, investors are finally confronting a reality many ignored:

Sovereign debt is no longer risk-free.

Central banks can’t suppress markets forever.

- Reward

- 1

- Comment

- Repost

- Share

🌈 #GateLiveStreamingInspiration - JAN.27

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Gold prices high + stock market overvaluations, funds have quietly flowed into crypto

🔹 Precious metals surge masks the strengthening crypto fundamentals, ETH and BTC gains are just a matter of time

🔹 Institutions quietly accumulate: BitMine buys an additional 20,000 ETH, valued at $58.22 million

🔹 “Maji” increases position! ETH long + HYPE long combination, account position has surged to $8.58 million

🔹 A new dark ho

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Gold prices high + stock market overvaluations, funds have quietly flowed into crypto

🔹 Precious metals surge masks the strengthening crypto fundamentals, ETH and BTC gains are just a matter of time

🔹 Institutions quietly accumulate: BitMine buys an additional 20,000 ETH, valued at $58.22 million

🔹 “Maji” increases position! ETH long + HYPE long combination, account position has surged to $8.58 million

🔹 A new dark ho

- Reward

- 3

- 3

- Repost

- Share

Yunna :

:

Happy New Year! 🤑View More

m

币牛牛

Created By@币安心

Listing Progress

0.00%

MC:

$3.4K

Create My Token

Yesterday early morning, buying pressure appeared, causing Ethereum's price to break through the 2900 level. However, in the short term, the one-hour structure shows that the resistance at 2950 remains strong, and multiple attempts to break through overnight have failed. According to the attached indicator chart, the KDJ three lines are turning downward, and the MACD indicator's bullish momentum is shrinking. The previous bullish outlook of 2913 can now be reconsidered. Short-term small profit at 2926!

Within the day, go short at 2926 and look for a move down to 2846. Defensive stop 40 points

View OriginalWithin the day, go short at 2926 and look for a move down to 2846. Defensive stop 40 points

- Reward

- like

- Comment

- Repost

- Share

📅 Cryptocurrency Market Watch (January 27)

1. Market Trends

BTC follows the US stock rebound, leading to a general rise in altcoins.

BlackRock continues to sell off cryptocurrencies.

US stocks rise, and silver experiences a significant upward spike.

Macro News: The Republican Party's chances of taking the House have dropped to 22%, and crypto-friendly policies may be abolished or re-evaluated.

2. Market Hotspots

Game token AXS: Rebound due to modifications in the economic model reducing selling pressure.

Privacy coin ZEC: Rebound, as the privacy sector remains highly active.

Perp token HYPE:

View Original1. Market Trends

BTC follows the US stock rebound, leading to a general rise in altcoins.

BlackRock continues to sell off cryptocurrencies.

US stocks rise, and silver experiences a significant upward spike.

Macro News: The Republican Party's chances of taking the House have dropped to 22%, and crypto-friendly policies may be abolished or re-evaluated.

2. Market Hotspots

Game token AXS: Rebound due to modifications in the economic model reducing selling pressure.

Privacy coin ZEC: Rebound, as the privacy sector remains highly active.

Perp token HYPE:

- Reward

- like

- Comment

- Repost

- Share

First give up. An AI Design software that can't even handle the registration process probably isn't that great either. Are there any recommended AI Design tools? Except for Figma. Every time I recharge, I only use it for two days. Just calculating ARR for it, I'm exhausted.

View Original

- Reward

- like

- Comment

- Repost

- Share

Market Analysis for the Morning of January 27

Current trading is around 2920, with a relatively strong trend and a firm hold above the 2900 support level. It is approaching the key resistance at 2950. The short-term trend is upward, with volume increasing in tandem with the price rise. The bullish momentum is strong but not overheated, providing support for further upward movement.

Strategy

Bitcoin (BTC)

Entry Range: 87000-87800

Target Range: 89000-90000

Altcoin

Entry Range: 2880-2910

Target Range: 2950-2985#内容挖矿焕新公测开启

View OriginalCurrent trading is around 2920, with a relatively strong trend and a firm hold above the 2900 support level. It is approaching the key resistance at 2950. The short-term trend is upward, with volume increasing in tandem with the price rise. The bullish momentum is strong but not overheated, providing support for further upward movement.

Strategy

Bitcoin (BTC)

Entry Range: 87000-87800

Target Range: 89000-90000

Altcoin

Entry Range: 2880-2910

Target Range: 2950-2985#内容挖矿焕新公测开启

- Reward

- like

- Comment

- Repost

- Share

$DEFI /USDT ⚡ 15M MARKET PULSE

📉 Price: 0.0003947 USDT

🔻 24H Change: -1.18%

📊 24H Range: 0.0003824 → 0.0004096

📈 Volume: 46.93M DEFI | 18.43K USDT

🔥 Technical Snapshot

MA(5): 0.0003929

MA(10): 0.0003926

MA(30): 0.0003929

Explosive spike rejected at 0.0004096

Price compressing tightly around MAs → volatility loading

⚠️ Key Levels

Support: 0.0003900 → 0.0003859

Resistance: 0.0004000 → 0.0004096

💥 Calm before the storm — range-bound consolidation after a sharp pump.

Break above 0.00040 could ignite momentum again; loss of 0.00039 risks a deeper pullback.

#TheWorldEconomicForum

📉 Price: 0.0003947 USDT

🔻 24H Change: -1.18%

📊 24H Range: 0.0003824 → 0.0004096

📈 Volume: 46.93M DEFI | 18.43K USDT

🔥 Technical Snapshot

MA(5): 0.0003929

MA(10): 0.0003926

MA(30): 0.0003929

Explosive spike rejected at 0.0004096

Price compressing tightly around MAs → volatility loading

⚠️ Key Levels

Support: 0.0003900 → 0.0003859

Resistance: 0.0004000 → 0.0004096

💥 Calm before the storm — range-bound consolidation after a sharp pump.

Break above 0.00040 could ignite momentum again; loss of 0.00039 risks a deeper pullback.

#TheWorldEconomicForum

DEFI-2,16%

- Reward

- like

- Comment

- Repost

- Share

$DM Interesting chart .The important thing is that the price stays above the support level.#memecoin

MEME3,03%

- Reward

- 1

- 5

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

My timeline right now 😂

- Reward

- like

- Comment

- Repost

- Share

【$ETH Signal】Long Breakout and Retest Confirmation

$ETH After a volume-driven surge, the price is healthy retracing, and the price action shows that buying pressure is continuously absorbing in the key zone. This is a typical cooling-off after a breakout, not a top signal.

🎯 Direction: Long

🎯 Entry: 2925 - 2945

🛑 Stop Loss: 2885 ( Rigid Stop Loss )

🚀 Target 1: 3020

🚀 Target 2: 3080

$ETH After breaking through the key resistance, the price and open interest are rising in sync, indicating that main capital is entering rather than a short squeeze. The retracement has now reached above the

$ETH After a volume-driven surge, the price is healthy retracing, and the price action shows that buying pressure is continuously absorbing in the key zone. This is a typical cooling-off after a breakout, not a top signal.

🎯 Direction: Long

🎯 Entry: 2925 - 2945

🛑 Stop Loss: 2885 ( Rigid Stop Loss )

🚀 Target 1: 3020

🚀 Target 2: 3080

$ETH After breaking through the key resistance, the price and open interest are rising in sync, indicating that main capital is entering rather than a short squeeze. The retracement has now reached above the

ETH2,07%

- Reward

- like

- Comment

- Repost

- Share

【$SOL Signal】Long Breakout and Pullback Confirmation

$SOL After a volume-driven rally, the price consolidates tightly below the key resistance zone, which is a healthy reset before a breakout. The market shows continuous absorption of selling pressure on lower timeframes, with no signs of large-scale profit-taking.

🎯 Direction: Long

🎯 Entry: 124.50 - 125.50

🛑 Stop Loss: 122.00 ( Rigid Stop Loss )

🚀 Target 1: 128.50

🚀 Target 2: 132.00

$SOL On the daily chart, the price consolidates above the breakout structure, with open interest rising simultaneously, indicating accumulation by the mai

$SOL After a volume-driven rally, the price consolidates tightly below the key resistance zone, which is a healthy reset before a breakout. The market shows continuous absorption of selling pressure on lower timeframes, with no signs of large-scale profit-taking.

🎯 Direction: Long

🎯 Entry: 124.50 - 125.50

🛑 Stop Loss: 122.00 ( Rigid Stop Loss )

🚀 Target 1: 128.50

🚀 Target 2: 132.00

$SOL On the daily chart, the price consolidates above the breakout structure, with open interest rising simultaneously, indicating accumulation by the mai

SOL1,85%

- Reward

- like

- Comment

- Repost

- Share

Good morning, I am Daidai. @TermMaxFi's true moat—the "structural correctness." In the DeFi world, the competitiveness of many protocols often manifests in two dimensions: higher yields or stronger incentives. But both have a common problem—they are short-term variables. Today’s higher returns can be copied, surpassed, or diluted tomorrow. Protocols that can truly exist long-term are often not because they "earn the most," but because their underlying structure is sufficiently correct and difficult to replace. From this perspective, @TermMaxFi, you'll find that its moat doesn't come from APY b

View Original

- Reward

- like

- Comment

- Repost

- Share

星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$3.9K

Create My Token

#DOGEETFListsonNasdaq Mainstream with Nasdaq Listing

The cryptocurrency world reached a historic milestone with the listing of the 21Shares Dogecoin ETF (TDOG) on Nasdaq. On January 22, 2026, this SEC-approved spot ETF officially began trading, giving investors direct exposure to Dogecoin without the need to hold the token itself.

This launch bridges the gap between meme culture and mainstream finance, marking a moment where the once-jocular cryptocurrency DOGE is treated as a serious, regulated asset. Social media erupted, highlighting the cultural significance and market excitement surroundi

The cryptocurrency world reached a historic milestone with the listing of the 21Shares Dogecoin ETF (TDOG) on Nasdaq. On January 22, 2026, this SEC-approved spot ETF officially began trading, giving investors direct exposure to Dogecoin without the need to hold the token itself.

This launch bridges the gap between meme culture and mainstream finance, marking a moment where the once-jocular cryptocurrency DOGE is treated as a serious, regulated asset. Social media erupted, highlighting the cultural significance and market excitement surroundi

DOGE0,62%

- Reward

- 5

- 1

- Repost

- Share

楚老魔 :

:

May everything go smoothly for you today, be relaxed and happy, and may good mood accompany every moment! 🌟😊#JapanBondMarketSell-Off

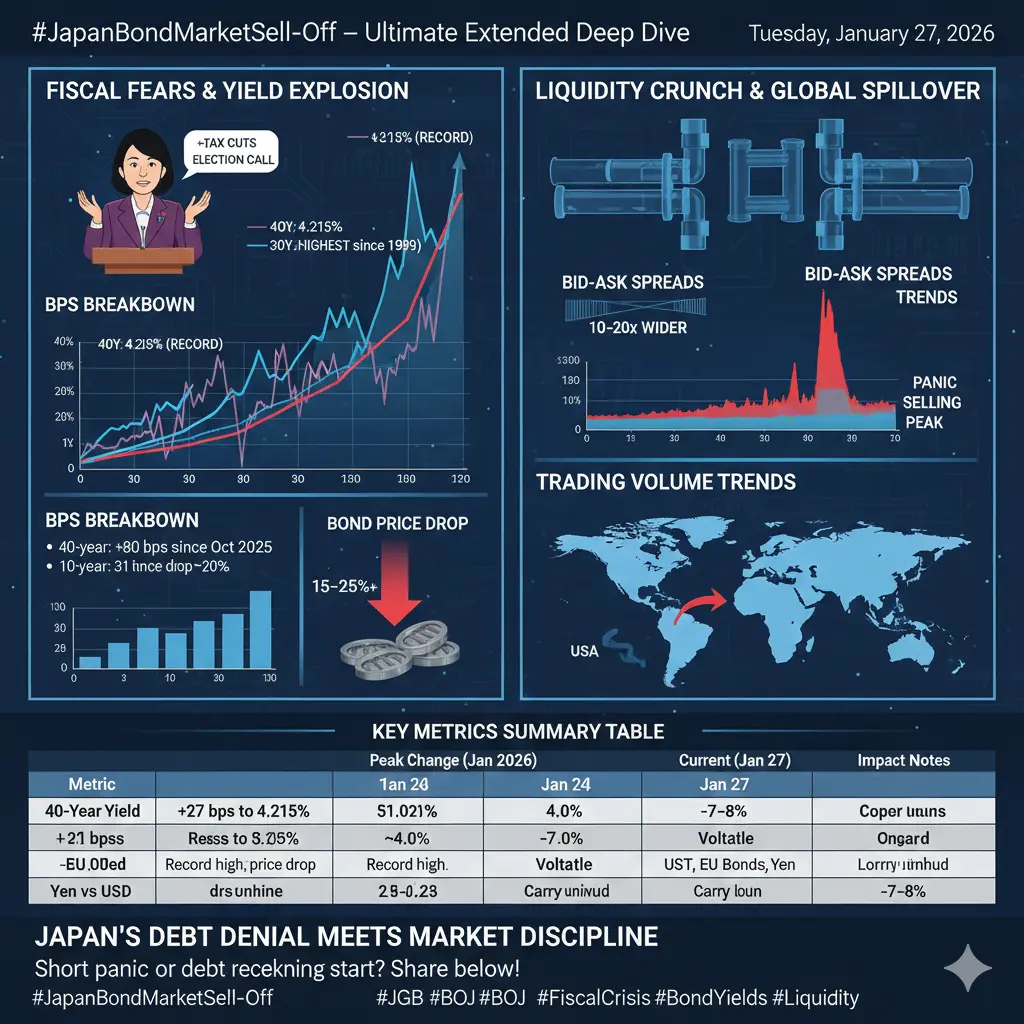

Japan Bond Market Sell-Off – Ultimate Extended Deep Dive with Full Quantitative Breakdown (January 27, 2026)

The Japanese Government Bond (JGB) market is experiencing its most severe sell-off in decades, with ultra-long yields soaring to historic highs amid fiscal concerns triggered by Prime Minister Sanae Takaichi’s snap election call and aggressive tax-cut promises. This turmoil exposes vulnerabilities in Japan’s $7.3 trillion bond market—the world’s second largest—and is sending shockwaves globally across yields, currencies, and equities. Below is a fully data-driv

Japan Bond Market Sell-Off – Ultimate Extended Deep Dive with Full Quantitative Breakdown (January 27, 2026)

The Japanese Government Bond (JGB) market is experiencing its most severe sell-off in decades, with ultra-long yields soaring to historic highs amid fiscal concerns triggered by Prime Minister Sanae Takaichi’s snap election call and aggressive tax-cut promises. This turmoil exposes vulnerabilities in Japan’s $7.3 trillion bond market—the world’s second largest—and is sending shockwaves globally across yields, currencies, and equities. Below is a fully data-driv

ETH2,07%

- Reward

- 4

- 5

- Repost

- Share

User_any :

:

2026 GOGOGO 👊View More

#ContentMiningRevampPublicBeta #BitcoinWeakensVsGold #RIVERUp50xinOneMonth nggk gygyyybyuht. ygtjrj rnjrtt ritug fg7k f5t7br5r6 f5tjj7t 5d6r f5d6r f5d6r f5d6r f5jf6 f6ftcuc. chc uc cuy vy cy cy cy c

- Reward

- like

- Comment

- Repost

- Share

1.27 Tuesday Intraday Bitcoin Analysis

Although the four-hour level price comparison has rebounded from a low, it still remains below the MA144 and MA169 medium to long-term moving averages. The pressure from the moving average system remains unchanged. While the MACD indicator shows short-term recovery signals, the DIF and DEA are still operating in the negative zone. Combined with the lack of effective volume expansion, this rebound is more likely a technical correction after a downward correction. If it cannot break through the 90000 resistance level, the price comparison is likely to conti

Although the four-hour level price comparison has rebounded from a low, it still remains below the MA144 and MA169 medium to long-term moving averages. The pressure from the moving average system remains unchanged. While the MACD indicator shows short-term recovery signals, the DIF and DEA are still operating in the negative zone. Combined with the lack of effective volume expansion, this rebound is more likely a technical correction after a downward correction. If it cannot break through the 90000 resistance level, the price comparison is likely to conti

BTC0,94%

- Reward

- like

- Comment

- Repost

- Share

February 22nd, 2017

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More27.22K Popularity

103.6K Popularity

72.91K Popularity

21.06K Popularity

40.66K Popularity

Hot Gate Fun

View More- MC:$3.44KHolders:20.04%

- MC:$3.41KHolders:20.00%

- MC:$3.39KHolders:10.00%

- MC:$3.4KHolders:10.00%

- MC:$3.5KHolders:20.33%

News

View MoreHYPE (Hyperliquid) up 16.25% in the past 24 hours

3 m

Sentient announces Franklin Templeton has become its strategic investor

10 m

"DASH's largest short seller" continues to increase short positions, with a floating profit of $1.35 million.

10 m

North Korean hackers use AI deepfake video calls to attack crypto professionals

12 m

PI (Pi) decreased by 0.79% in the past 24 hours

14 m

Pin