BITCOIN VS GOLD RATIO CRASHES 55%: RARE BUYING OPPORTUNITY OR MORE PAIN AHEAD? (JANUARY 2026)

The Bitcoin-to-Gold ratio (BTC/XAU), which measures how many ounces of gold one Bitcoin can buy, is sending strong warning signals for Bitcoin investors. As of late January 2026, the ratio is trading around 18.46–18.52, sharply down from its December 2024 peak near 40.9. This represents a decline of roughly 55%, placing Bitcoin in a deep bear market relative to gold.

More critically, the ratio has fallen below its 200-week moving average, estimated around 21.9–22. Bitcoin is now trading about 17% below its long-term trend versus gold, a condition that historically has preceded extended periods of weakness before a meaningful recovery.

CURRENT MARKET SNAPSHOT (JANUARY 2026)

Bitcoin price is trading around 89,500–89,800 USD, struggling to reclaim the 90,000 level after recent pullbacks.

Gold price is hovering between 4,900 and 4,990 USD per ounce, making fresh all-time highs driven by safe-haven demand.

BTC/Gold ratio is near 18.5, a two-year low last seen in late 2023 and early 2024.

From the December 2024 peak, the ratio has declined by approximately 55%, showing a clear divergence between Bitcoin and gold performance.

HISTORICAL CONTEXT: WHAT PAST CYCLES SHOW

History suggests that extreme BTC/Gold drawdowns often create opportunity, but not without volatility.

In the 2022 bear market, the ratio dropped to around 12–13, a 70–80% drawdown from highs.

During the 2018 crypto winter, the ratio fell by more than 80% before finally bottoming.

In the current cycle, the 55% decline is severe but still above previous cycle lows.

The breakdown below the 200-week moving average is notable. In prior cycles, similar breaks often led to additional downside before a long-term bottom formed, with the ratio sometimes testing the 14–16 zone.

TECHNICAL VIEW: BELOW THE 200-WEEK MOVING AVERAGE

The 200-week moving average remains one of the most important long-term indicators.

Current BTC/Gold ratio is near 18.5.

200-week moving average sits around 22.

This places the ratio roughly 17% below its long-term mean.

Historically, such deep deviations have marked long-term accumulation zones for Bitcoin relative to gold, often followed by strong mean-reversion rallies. However, price action since late 2024 remains bearish, with a clear descending channel and repeated failed rebounds.

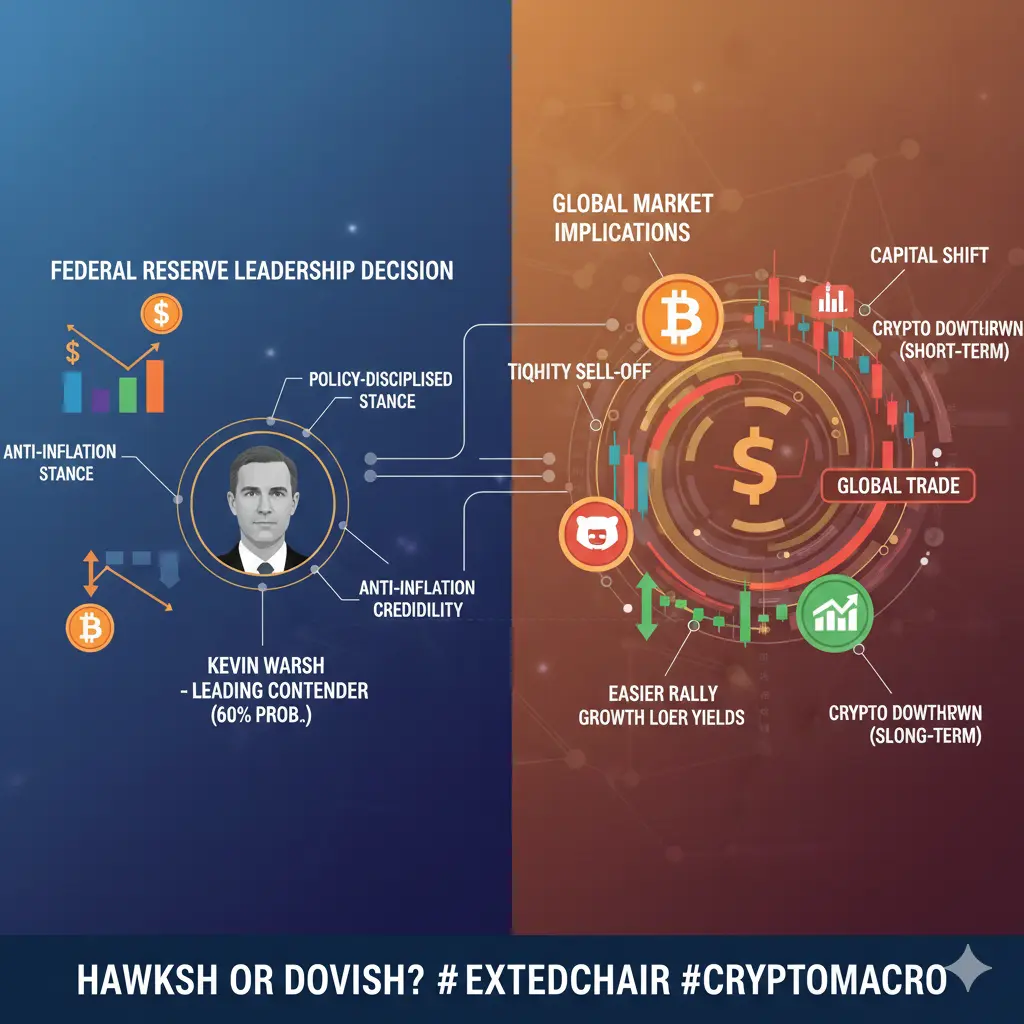

MACRO DRIVERS: WHY GOLD IS OUTPERFORMING

Gold continues to outperform due to central bank accumulation, geopolitical risks, rising debt concerns, and persistent inflation fears. In contrast, Bitcoin is facing ETF outflows, regulatory uncertainty, and broader risk-off sentiment. Over the past five years, gold has slightly outperformed Bitcoin, challenging the short-term “digital gold” narrative.

FINAL TAKE

The BTC/Gold ratio is historically oversold and approaching levels that have previously offered strong long-term opportunities for patient investors. However, history also shows that such conditions can persist, and further downside remains possible before a true reversal.

This setup favors disciplined accumulation over aggressive positioning.

QUESTION FOR THE COMMUNITY

Are you accumulating Bitcoin at these levels, or waiting for confirmation while gold continues to dominate?

The Bitcoin-to-Gold ratio (BTC/XAU), which measures how many ounces of gold one Bitcoin can buy, is sending strong warning signals for Bitcoin investors. As of late January 2026, the ratio is trading around 18.46–18.52, sharply down from its December 2024 peak near 40.9. This represents a decline of roughly 55%, placing Bitcoin in a deep bear market relative to gold.

More critically, the ratio has fallen below its 200-week moving average, estimated around 21.9–22. Bitcoin is now trading about 17% below its long-term trend versus gold, a condition that historically has preceded extended periods of weakness before a meaningful recovery.

CURRENT MARKET SNAPSHOT (JANUARY 2026)

Bitcoin price is trading around 89,500–89,800 USD, struggling to reclaim the 90,000 level after recent pullbacks.

Gold price is hovering between 4,900 and 4,990 USD per ounce, making fresh all-time highs driven by safe-haven demand.

BTC/Gold ratio is near 18.5, a two-year low last seen in late 2023 and early 2024.

From the December 2024 peak, the ratio has declined by approximately 55%, showing a clear divergence between Bitcoin and gold performance.

HISTORICAL CONTEXT: WHAT PAST CYCLES SHOW

History suggests that extreme BTC/Gold drawdowns often create opportunity, but not without volatility.

In the 2022 bear market, the ratio dropped to around 12–13, a 70–80% drawdown from highs.

During the 2018 crypto winter, the ratio fell by more than 80% before finally bottoming.

In the current cycle, the 55% decline is severe but still above previous cycle lows.

The breakdown below the 200-week moving average is notable. In prior cycles, similar breaks often led to additional downside before a long-term bottom formed, with the ratio sometimes testing the 14–16 zone.

TECHNICAL VIEW: BELOW THE 200-WEEK MOVING AVERAGE

The 200-week moving average remains one of the most important long-term indicators.

Current BTC/Gold ratio is near 18.5.

200-week moving average sits around 22.

This places the ratio roughly 17% below its long-term mean.

Historically, such deep deviations have marked long-term accumulation zones for Bitcoin relative to gold, often followed by strong mean-reversion rallies. However, price action since late 2024 remains bearish, with a clear descending channel and repeated failed rebounds.

MACRO DRIVERS: WHY GOLD IS OUTPERFORMING

Gold continues to outperform due to central bank accumulation, geopolitical risks, rising debt concerns, and persistent inflation fears. In contrast, Bitcoin is facing ETF outflows, regulatory uncertainty, and broader risk-off sentiment. Over the past five years, gold has slightly outperformed Bitcoin, challenging the short-term “digital gold” narrative.

FINAL TAKE

The BTC/Gold ratio is historically oversold and approaching levels that have previously offered strong long-term opportunities for patient investors. However, history also shows that such conditions can persist, and further downside remains possible before a true reversal.

This setup favors disciplined accumulation over aggressive positioning.

QUESTION FOR THE COMMUNITY

Are you accumulating Bitcoin at these levels, or waiting for confirmation while gold continues to dominate?