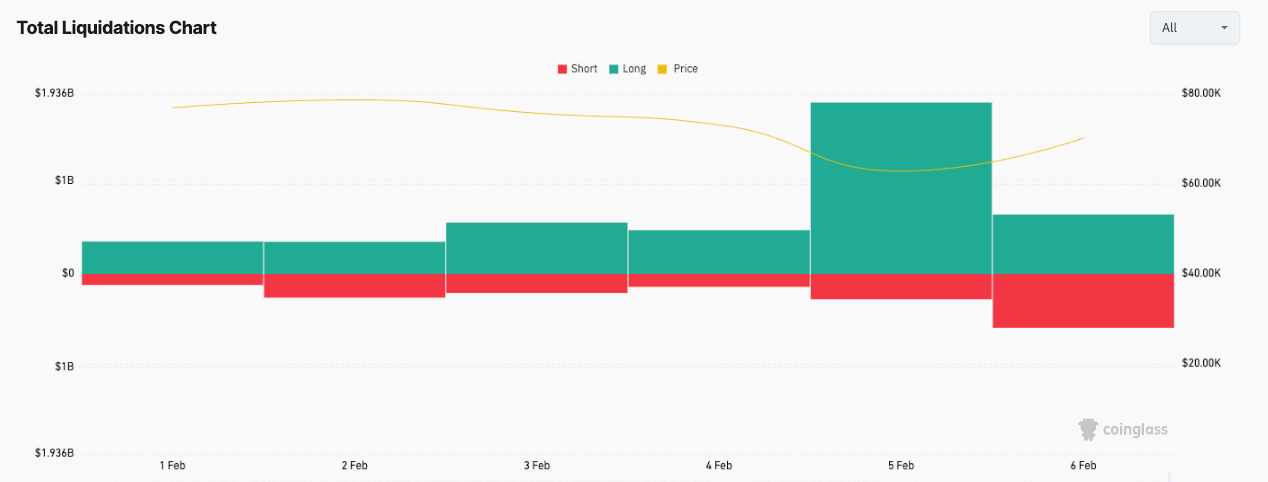

Data: In the past 24 hours, the entire network has liquidated $227 million, with long positions liquidated at $156 million and short positions at $71.47 million.

ChainCatcher reports that, according to Coinglass data, the total liquidations across the entire network in the past 24 hours reached $227 million, with long positions liquidated at $156 million and short positions at $71.47 million. Among these, Bitcoin long positions were liquidated at $57.36 million, Bitcoin short positions at $28.94 million, Ethereum long positions at $49.03 million, and Ethereum short positions at $16.90 million.

GateNewsBot·4h ago