Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

Tether Introduces Scudo as a New Unit of Account for Tether Gold

On 6 January 2026, Tether announced the launch of Scudo, a new unit of account for Tether Gold (XAU₮), designed to make gold usable as a practical means of payment for everyday transactions. The move comes as global interest in gold and its price reach record highs.

Record Gold Prices Highlight

ICOHOIDER·10h ago

Tether’s $13 Billion Profit Strategy: Why the Stablecoin Issuer Is Investing Billions in AI in 2026

Tether, the issuer of the world’s largest stablecoin USDT, generated an estimated \$13 billion in profit in 2024, largely driven by interest income from U.S. Treasury holdings.

CryptopulseElite·16h ago

Tether Backs SQRIL to Expand QR-Based Cross-Border Payments

Tether has invested in SQRIL, a QR-based cross-border payment platform, to enhance stablecoin usage in global transactions. This initiative aims to simplify payments, reduce costs, and connect banks with digital wallets, especially in high-remittance regions.

BTC-0,28%

CryptoNewsFlash·01-05 17:01

Not selling wallets or promoting USDT! Tether is simply investing in SQRIL. What makes this QR payment platform special?

Tether invests in SQRIL, betting on the cross-border QR payment infrastructure, not pushing USDT, with a long-term strategy and regulatory considerations for building banking infrastructure.

Not developing consumer-end products, Tether invests in the "underlying infrastructure" of payments

-------------------------

Stablecoin issuer Tether recently invested in Southeast Asia's cross-border payment startup SQRIL, drawing market attention. However, contrary to external expectations, this investment is not accompanied by any wallet products, $USDT traffic diversion, or consumer applications. Instead, Tether chooses to bet on a set of payment infrastructure that is "almost invisible to users."

Image source: SQRIL Stablecoin issuer Tether recently invested in Southeast Asia's cross-border payment startup SQRIL

SQRIL focuses on building

CryptoCity·01-05 08:00

What is the Petro of Venezuela? Understanding the oil-rich country that relies on encryption to resist sanctions, and the subsequent China-Russia influence

The event of Venezuelan President Maduro's arrest has refocused the international community on this South American oil-producing country. Venezuela has issued oil-backed tokens and used Tether to counter sanctions. After Maduro's detention, the US's desire to control its energy resources may impact the geopolitical landscape involving China, Russia, and Taiwan.

The arrest of President Maduro shocked the world—an overview of South America's oil nation

-----------------------

U.S. special forces raided the Venezuelan president's residence last weekend, successfully executing a "decapitation operation" that stunned the global audience.

Maduro's arrest has brought renewed attention to this South American oil-producing country. Since Maduro took office in 2013, facing increasingly severe US economic sanctions, the Venezuelan government has launched a series of financial experiments and geopolitical maneuvers to resist sanctions.

Venezuela's Path of Using Cryptocurrency to Counter Sanctions

--

CryptoCity·01-05 07:35

Tether Backs SQRIL to Expand QR-Based Cross-Border Payments

Tether has invested in SQRIL, a QR-based cross-border payment platform, to enhance stablecoin usage in global transactions. This initiative aims to simplify payments, reduce costs, and connect banks with digital wallets, especially in high-remittance regions.

BTC-0,28%

CryptoNewsFlash·01-04 16:55

Tether Backs SQRIL to Expand Stablecoin-Based Cross-Border Payments

_Tether invests in SQRIL to enhance real-time stablecoin-based QR code payment infrastructure across Asia, Africa, and Latin America._

Stablecoin issuer Tether has announced an investment in SQRIL, a platform focused on real-time cross-border QR code payments. However, the exact amount has not b

BTC-0,28%

LiveBTCNews·01-03 06:01

Tether Expands Bitcoin Holdings With $780 Million BTC Purchase

Tether started 2026 by acquiring 8,888.88 BTC, raising its total holdings to over 96,000 BTC. This reflects their ongoing strategy of allocating a portion of profits to Bitcoin, enhancing its position as a major corporate holder.

BTC-0,28%

Moon5labs·01-02 16:01

Tether 2026 Kickoff Adds 8,888 BTC and Builds Reserves

Tether added 8,888 BTC to its reserves in early 2026, continuing a strategy of steady Bitcoin accumulation. This brings their total holdings to around 96,000 BTC, positioning Tether among the world's largest Bitcoin wallets and reinforcing its role as a significant player in asset-backed reserves.

CryptoNewsFlash·01-02 13:25

Tether Purchases 8,888 BTC as 2026 Starts, Total Holdings Cross 96,000 BTC

Tether acquired 8,888 BTC at the start of 2026, raising its total to over 96,000 BTC, solidifying its position among top private holders. This move reflects Tether's long-term confidence in Bitcoin as part of its reserve diversification strategy.

BTC-0,28%

TheNewsCrypto·01-02 08:21

Big news! Tether buys another 8,888 Bitcoins, approaching a total holding of nearly 100,000!

Stablecoin leader Tether CEO Paolo Ardoino confirmed that the company will buy an additional 8,888 BTC in Q4 2025. This will bring Tether's total Bitcoin holdings to 96,185 BTC, worth over $8.5 billion.

"Big Prosperity," Tether announces purchase of 8888 Bitcoins

Tether has a special fondness for the auspicious number "8888," consistently buying similar amounts of Bitcoin across multiple quarters. This is a friendly signal aimed at the Asian market (especially the Chinese community), using the pun of "8=prosperity" to turn serious asset allocation into a community marketing effort.

This aligns with its policy established in 2023, which allocates 15% of quarterly realized operating profits to purchasing Bitcoin as a long-term reserve asset diversification.

BTC-0,28%

ChainNewsAbmedia·01-01 23:53

Tether extends Bitcoin bet with 8,888 BTC Q4 purchase above $96k

Tether acquired 8,888 BTC in Q4 2025, raising its total to over 96,000 bitcoins. Following a policy to allocate 15% of profits to BTC, it positions Bitcoin as a key reserve asset, despite U.S. Treasuries making up the majority.

BTC-0,28%

Cryptonews·01-01 10:24

Ark 2026 Stablecoin Outlook: Tether and Circle Maintain Market Share Advantage, Innovation Momentum Shifts to Emerging Markets

Ark Investment (ARK Invest) Digital Asset Research Director Lorenzo Valente stated in a recent video that stablecoins have entered a development stage vastly different from the past. From transaction volume scale and institutionalization to their linkage with the U.S. bond system, the positioning of stablecoins is no longer just an extension of annual performance but is beginning to be incorporated into the core discussions of the global financial architecture in 2026.

Transaction volume continues to expand steadily, and structural growth trends are taking shape

Valente indicated that by the end of 2025, the monthly transfer volume of stablecoins has stabilized at 2 – 2.5 trillion USD, with no significant decline since the beginning of the year. He pointed out that this continued expansion of monthly scale, despite a high baseline, demonstrates that stablecoins have entered a phase of structural growth rather than short-term cycles.

Against this backdrop, market focus has shifted from "whether it surpasses Visa" to stable

ChainNewsAbmedia·2025-12-31 03:14

2025 Cryptocurrency Mining Focus News: Bitcoin Hashrate Breaks 1 ZH/s, Trump Family and Tether Enter the Market

In 2025, Bitcoin hash power surpasses 1 ZH/s, but mining costs soar to $137,000 forcing industry transformation. CoreWeave acquires Core Scientific for $9 billion, IREN signs a $9.7 billion GPU agreement with Microsoft. Trump's second son founded American Bitcoin Corp, Bhutan's reserves account for 40% of GDP, Tether is deploying the OCEAN mining pool.

MarketWhisper·2025-12-31 00:54

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-30 20:30

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-29 20:26

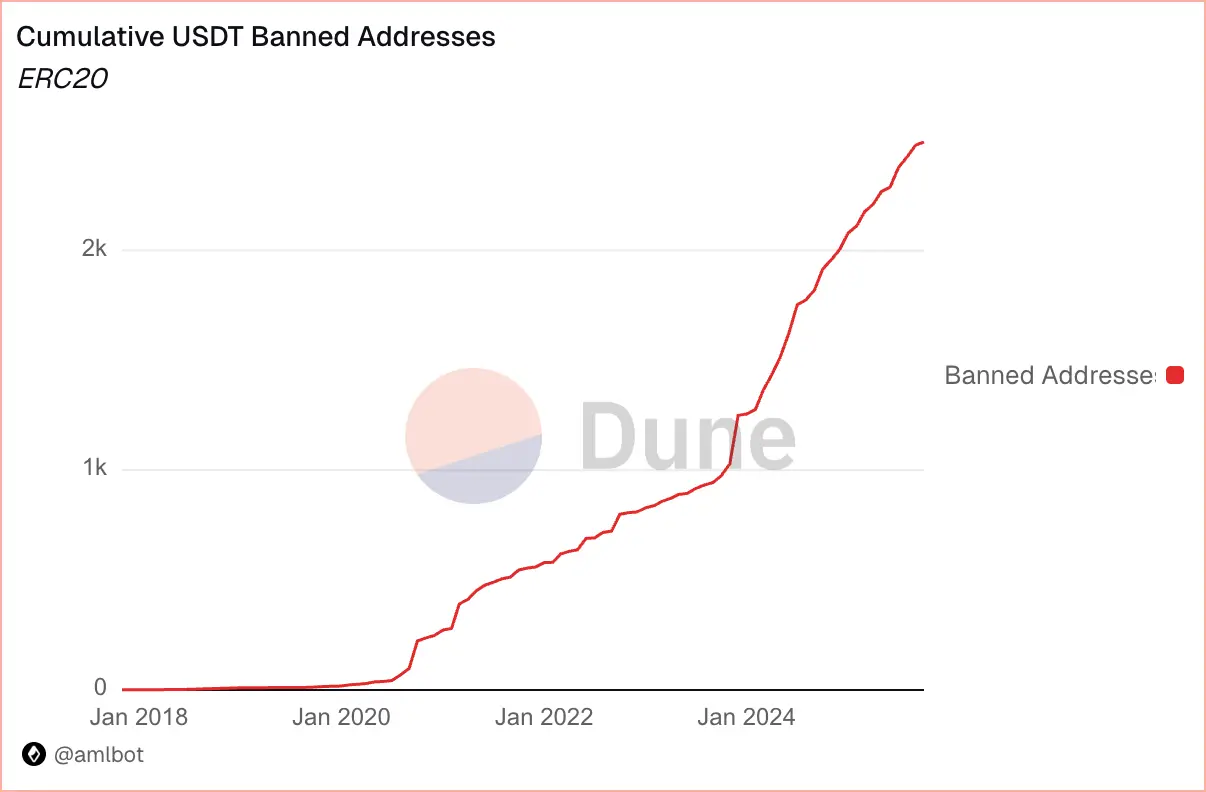

Tether freezes over 3.29 billion USDT, a contrasting approach to Circle

A recent AMLBot study reveals that from 2023 to 2025, Tether froze over $3.29 billion USDT across Ethereum and Tron, blacklisting 7,268 addresses, significantly outpacing Circle's USDC. This highlights contrasting enforcement philosophies shaping the stablecoin market.

TapChiBitcoin·2025-12-29 02:34

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-28 20:25

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-27 20:21

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-26 20:21

Top 15 Projects By Total Revenue in 2025: Tether and Circle Remain Forefront

LunarCrush's analysis for 2025 highlights Tether as the top revenue-generating crypto project with $5.2B, followed by Circle and Hyperliquid. Other notable projects include Pump Fun, Ethena, and Aave, with varying active addresses and total value locked (TVL).

HYPE5,17%

BlockChainReporter·2025-12-26 01:03

From Tether to the Trump-Backed USD1: The 7 Fastest-Moving Stablecoins of 2025

In brief

The stablecoin supply jumped $100 billion to a total of $314 billion in 2025.

Tether leads in transaction activity, followed by Ripple's RLUSD and Circle's USDC.

The Trump-backed USD1 reached the top 5 just months after April launch.

This was a defining year for

Decrypt·2025-12-25 20:15

Why Tether Froze 30x More Crypto Than Circle: AMLBot Report

_Tether froze $3.3B in crypto assets, 30x more than Circle’s $109M, using proactive methods like freeze, burn, and reissue._

A recent AMLBot report shows that Tether froze around $3.3 billion in crypto assets between 2023 and 2025. This is in stark contrast to Circle’s $109 million.

Tether’s a

LiveBTCNews·2025-12-25 13:35

Tether freezes 30x more value than Circle as stablecoin blacklists surge

Tether and Circle have starkly different policies on freezing stablecoin addresses, with Tether freezing $3.3 billion across 7,268 addresses, while Circle froze $109 million across 372 addresses. Tether's proactive model contrasts with Circle's more restrained legal approach.

Cryptonews·2025-12-25 10:12

Stablecoins are making huge profits, Crypto is diverging! Top Venture Capitalists Reveal the 2025 Winners List

After a year of regulatory changes and uneven market performance, crypto investors are reassessing the value accumulation trajectory for 2025. Stablecoin companies, existing players like Robinhood, and forecasted markets are the areas expected to perform best this year. Conversely, Terraform Labs co-founder Do Kwon and the SEC in the Biden era have become the biggest losers, revealing the valuation restructuring logic of the crypto industry following policy shifts.

MarketWhisper·2025-12-25 02:16

Tether Releases QVAC Genesis II

22 December, 2025 – Tether Data’s AI research division, QVAC, today announced the release of QVAC Genesis II, a major expansion of the world’s largest publicly available synthetic educational dataset for artificial intelligence pre-training. With the addition of 107 billion new tokens, the

CryptoDaily·2025-12-23 13:15

Tether-Linked Entities Reportedly Bought Northern Data’s Bitcoin Mining Unit

Companies controlled by senior executives at Tether were reportedly among the buyers of Peak Mining, the bitcoin mining arm sold by Northern Data, which is majority owned by the stablecoin giant.

This article is from Theminermag, a trade publication for the cryptocurrency mining industry,

BTC-0,28%

Coinpedia·2025-12-23 12:36

Tether Partners with Da Nang to Advance Blockchain Amid Vietnam's Mixed Crypto Regulations

Tether has formalized a strategic collaboration with the Da Nang People’s Committee through a Memorandum of Understanding (MoU) signed on November 5, 2025, aimed at fostering blockchain adoption, policy innovation, and educational initiatives in the Vietnamese city.

CryptopulseElite·2025-12-23 09:58

Taiwan's Central Bank: The US Dollar stablecoin may become a shadow forex market, impacting the New Taiwan Dollar exchange rate.

The Central Bank of Taiwan recently issued a stern warning regarding the US dollar stablecoin, pointing out that if widely circulated, it would form a "shadow forex market," allowing businesses or individuals to circumvent the current Exchange Settlement reporting mechanism, weakening the Central Bank's control over cross-border capital movements, and thus impacting the stability of the New Taiwan Dollar Exchange Rate. In a recent speech, Central Bank Governor Yang Jinlong compared stablecoins to a modern version of "wildcat banking," implying their private issuance, regulatory Arbitrage, and potential instability.

MarketWhisper·2025-12-23 07:50

Tether Execs Acquire Northern Data’s Miner Arm in Major Industry Move

Northern Data Sells Bitcoin Mining Business to Tether-Linked Entities in Complex Deal

In a recent development, Northern Data, a data center operator backed by Tether, has divested its Bitcoin mining division, Peak Mining, selling it to three companies associated with Tether executives. The

BTC-0,28%

CryptoDaily·2025-12-23 06:30

Tether will launch an encryption Wallet App! Integrating a local AI assistant, it will only support Bitcoin and 3 types of stablecoins.

Tether plans to launch a hosted wallet that supports only Bitcoin and three stablecoins. The wallet integrates a local AI assistant, combining payment and privacy security, showcasing the ambition of vertically integrating the encryption ecosystem.

CryptoCity·2025-12-23 01:15

Tether Releases QVAC Genesis II

22 December, 2025 – Tether Data’s AI research division, QVAC, today announced the release of QVAC Genesis II, a major expansion of the world’s largest publicly available synthetic educational dataset for artificial intelligence pre-training. With the addition of 107 billion new tokens, the

CryptoDaily·2025-12-22 13:10

Tether divests from Bitcoin mining! Northern Data sells from left hand to right hand to executives, what is the mystery behind the 200 million dollar transaction?

Tether executives purchased Northern Data's mining division for $200 million, raising concerns about related transactions and regulatory scrutiny.

(Previous summary: Bloomberg: Tether plans to raise $20 billion and is considering "tokenizing stocks", halting shareholder sell-offs to protect a $500 billion valuation)

(Background: Tether intends to acquire the Italian Juventus Football Club for 1.1 billion euros, potentially becoming the largest sports merger in Web3 history)

Table of Contents

Related structure: Three companies act as "white gloves"

Time Pressure: Double Blow from Tax Investigation and Rumble Acquisition

Capital circulation: Stablecoin cash flow supports the "blood transfusion loop"

Transforming the Chessboard: From Stablecoins to Power Empires

Asset divestiture is often interpreted on Wall Street as streamlining focus, but stablecoin issuer Tether

動區BlockTempo·2025-12-22 07:30

Tether Execs Acquire Northern Data’s Miner Arm in Major Industry Move

Northern Data Sells Bitcoin Mining Business to Tether-Linked Entities in Complex Deal

In a recent development, Northern Data, a data center operator backed by Tether, has divested its Bitcoin mining division, Peak Mining, selling it to three companies associated with Tether executives. The

BTC-0,28%

CryptoDaily·2025-12-22 06:25

Load More