Search results for "SSV"

SSV Staking: The Best Choice for Ethereum Investors to Increase Returns in 2025

The revolutionary technology in today’s Ethereum ecosystem, SSV staking technology, is leading the trend in staking solutions. Through the innovative application of distributed validators, the SSV network demonstrates significant advantages, providing investors with stable Ethereum staking yields and leveraging the diverse utilities of the SSV token to strengthen network governance and participant incentive mechanisms. This Web3 staking solution not only lowers the technical entry barriers but also enhances overall security, making it the ideal tool of choice for investors.

SSV staking technology represents an important innovation within the Ethereum ecosystem, opening up new earning opportunities for investors through Distributed Validator Technology (DVT). According to the latest data, the SSV token experienced significant growth in early 2025, rising from around $10 at the beginning of January to $40.59 on February 23, an increase of over 300%, reflecting the market’s continued recognition of the SSV staking solution. This growth trajectory indicates

幣圈動態·2025-12-07 02:07

Institutions must stake Ether on decentralized infrastructure

Opinion by: Alon Muroch, founder of SSV Labs

A green light for institutional staking alone will not signal a long-term future for Ethereum. As institutions enter the Web3 ecosystem, they need to recognize that ETH isn’t an asset that can be fit into existing TradFi molds; it’s the World Computer.

ETH1,68%

Cointelegraph·2025-11-13 12:42

SSV Network DAO Rolls Out ‘Compose’, Unifying Ethereum’s Fragmented Rollups

In Brief

SSV Network has launched Compose, a first-of-its-kind interoperability layer that enables seamless, atomic cross-rollup transactions on Ethereum while expanding validator roles and supporting a unified, decentralized ecosystem.

Ethereum staking provider, SSV Network announced that it h

MpostMediaGroup·2025-10-21 13:11

CEO of SSV Labs dismisses concerns, the slashing incident due to external key management error.

SSV Labs attributes recent Ethereum validator slashing incidents to external key management errors, not protocol flaws. CEO Alon Muroch assures that SSV Network remains secure. The major issue affected 39 validators from Ankr due to a configuration error. SSV's staking infrastructure is designed to minimize slashing risks if keys are fully contained within their system.

TapChiBitcoin·2025-09-11 10:03

Ethereum faces a rare large-scale slashing: 39 validators were penalized due to operational errors.

According to data from the blockchain explorer Beaconcha.in, Ethereum experienced a rare large-scale slashing event on September 10, with up to 39 validators being slashed due to operational errors related to the SSV Network. This incident was not the result of a malicious attack or protocol error, but rather due to improper maintenance of the operator's infrastructure, highlighting that even with advanced technology support, human error remains a significant vulnerability in staking.

MarketWhisper·2025-09-11 05:25

Kraken Becomes First Major Exchange To Fully Integrate Distributed Validator Technology For Ethereum Staking Via SSV Network

Kraken has integrated SSV Network’s Distributed Validator Technology for Ethereum staking, becoming the first major exchange to do so, enhancing security, scalability, and resilience in validator operations. Additionally, Kraken partnered with OpenPayd for real-time fiat payments in the UK and Europe.

MpostMediaGroup·2025-08-22 14:52

After reaching a historic high, Bitcoin experienced a big dump of 7000 dollars. This article analyzes three reasons for this pullback.

Written by: White55, Mars Finance

The Bitcoin market experienced a shocking scene on August 15th. Just hours after hitting a historic high of $124,500, the price of Bitcoin suddenly reversed and rapidly fell below the key support level of $117,500, with a daily decline of 4.24%, reaching a low of $117,000. This plunge of up to $7,000 was like a bucket of cold water, dousing the market's recently ignited frenzy.

This flash crash is not an isolated event. The total market capitalization of the crypto market evaporated by 3.9% within 24 hours, falling to $4.09 trillion. Ethereum followed Bitcoin's lead, dropping below the $4,500 mark, now reported at $4,568.

Even more tragic is the altcoin market, with Ethereum-based coins like REZ, SSV, and ORDI.

BTC0,72%

TechubNews·2025-08-15 05:55

SSV Network Steps Closer to Ethereum Level Resilience with Anchor

SSV Network has launched Anchor, a Rust-based Distributed Validator Technology client, in collaboration with Sigma Prime. Inspired by Ethereum's diverse client approach, Anchor enhances security, resilience, and decentralization, marking a significant step towards improved Ethereum consensus.

MpostMediaGroup·2025-08-14 23:46

Why SSV Is the Hidden Hero of Ethereum Staking

In Brief

What began as a research experiment is now reality—SSV Labs’ Alon Muroch explains how Distributed Validator Technology is transforming Ethereum staking through secure, collaborative infrastructure.

A few years ago, the idea of running an Ethereum validator across multiple independent o

MpostMediaGroup·2025-08-05 05:42

How SSV Plans to Bring Value Back to Ethereum

In Brief

SSV Network is helping Ethereum reclaim value for its native token by enabling validator-driven Based Rollups that reconnect economic activity to Layer 1 and restore ETH’s central role in the ecosystem.

Ethereum remains the leading blockchain globally, supporting billions in on-chain a

MpostMediaGroup·2025-07-31 05:28

Santiment Warned About These Four Altcoins! "Whales Are On The Move!"

Bitcoin is expected to reach new heights in 2025, while altcoins await their rally. Santiment reports significant recent transfers to exchanges for four altcoins: PayPal USD, SSV, Threshold, and ImmutableX, which may indicate potential selling pressure.

Bitcoinsistemi·2025-06-04 23:45

Ethereum’s SSV Network Unveils New Project To Bring bApps

SSV Network recently revealed SSV 2.0, a new bootstrapping model to bring “Based” Applications (bApps) to Ethereum. The new infrastructure framework aims to enhance the network’s security and enable “truly decentralized” bApps without compromising Ethereum’s core values.

Related Reading: ‘We Send

Bitcoinistcom·2025-01-28 08:01

What is SSV Coin? ssv.network Price Predictions

SSV Network represents a significant innovation in the crypto world, especially in the Ethereum staking field. This platform is shaping the future of distributed staking applications by providing a decentralized validator infrastructure. By using Secret Shared Validators (SSV) technology, Ethereum

Kriptokoin·2024-06-16 00:18

Daily Analysis: BTC, ETH, SSV, LDO, DAO

Markets are facing corrections after fake news of an ETF approval sent cryptos pumping. This came as the SEC website was hacked, giving out unauthorized news of an ETF approval. The global market cap has declined by 0.9% from its previous 24-hour mark in the unfolding of this event.

Bitcoin Price

BlockchainReporter·2024-01-10 03:36

SSV.Network Breaks Ground with DVT-Powered Ethereum Staking Eco_, Surpasses $140M TVL

Ethereum’s staking landscape is experiencing a paradigm shift as SSV.Network’s groundbreaking Distributed Validator Technology (DVT) achieves remarkable success, with over $140 million in Ethereum locked within its staking eco. The SSV infrastructure protocol has emerged as a frontrunner, setting a

BlockchainReporter·2023-12-22 13:46

BTC broke through $40,000 ETH the mysterious retreat of the big whale SSV became the focus

Recently BTC situation with ETFs has been unpredictable. Today we're going to dive into this topic and find out what's going on.

First of all, the exciting news is that the SEC announced on Wednesday that it had extended Franklin's ETF, which was really unexpected. The exact booking time was booked early next year, but it was brought forward. This means that there may be a major change in the application that is about to take place. Strikingly, the final decision date for the BTC spot ETF is January 10 next year. If the SEC only announces the results on the same day, even if it is approved, it may face the risk of the market being exhausted and triggering an overall correction. Of course, this is in line with the speculation they approved, and the official announcement was made before the January 10th issue.

Next, to share...

币小白_·2023-12-02 06:21

As long as there is volatility in the market, then there will be a chance, how should it be done now?

This month is coming to an end, from the monthly point of view, some of the standards have doubled, such as IMX, ETHW, SEI, BLUR, etc., and some are even several times, such as USTC, ORDI, etc., the increase of more than 50 points is a lot, such as SSV, ROSE, etc., if at present, you have not caught all of the above, then don't chase the rise, the market funds are limited, the current environment is not suitable for a comprehensive general rise, but a rotation rise, so, instead of chasing those projects that have risen a lot, it is better to ambush some of the current monthly line has not risen much, valuable varieties!

At present, it is obvious that it cannot be regarded as a big bull market, and it is certainly not a big bear market, after all, there is still a money-making effect, and the volatility is much larger than the deep bear market, as long as there is volatility in the market, then there is an opportunity to make money, whether you are long or short, you have the opportunity to earn the profits you want, and as a spot player, when...

币小白_·2023-11-29 04:06

What Aphla investment opportunities are contained in the Ethereum Cancun upgrade?

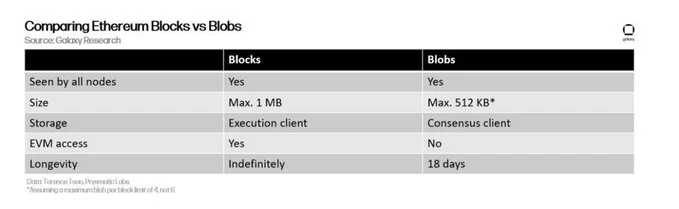

The Cancun upgrade (Dencun) is another major mainnet upgrade after the Ethereum Shanghai upgrade.

We know that the Shanghai upgrade successfully deployed to the main network in March this year gave birth to a wave of LSD and LSDfi super market. $LDO $RPL $SSV $LBR $PENDLE and other investment targets have become Aphla opportunities to outperform the market.

Therefore, the market will naturally have expectations, and the Cancun upgrade will also bring some Aphla investment opportunities.

But before discussing what Aphla investment opportunities are, let’s take a brief look at Cancun Upgrade.

1. What is Cancun Upgrade?

The upcoming Cancun upgrade is divided into two parts: Deneb focuses on the consensus layer (CL), and Cancun targets the execution layer (EL).

According to Ethereum core developer Tim Beko...

金色财经_·2023-09-25 02:39

Crypto Market Outlook for August: Layer 2 and Hot Project Catalysts

A lot will happen in August, but for the sake of brevity, I will only talk about the events and analysis and corresponding opportunities that are rated as S in my heart.

This content will mention:

-Basechain

-SHIB Layer2

-GNS

-Frax v3、RWA、frxETH v2

-SEI&CYBER、LTC、GMX、EVMOS、SSV、SPARTA、LOOT、APE

Basechain

The launch of Basechain was unexpected. However, due to the conclusion I drew in the previous Pauly incident—the risk of the earth dog is getting bigger and bigger, I did not actively participate in the earth dog on Basechain, and I once envied the earth dog players who got rich. But in the end I wasn't involved.

My expectation for Basechain is still $OP $VELO, and...

金色财经_·2023-08-02 09:27

Load More