Search results for "SOLV"

Solv Teams Up with Animoca Brands to Boost Bitcoin Yields for Japanese Companies

Animoca Brands Partners with Solv Protocol to Unlock Bitcoin Yield for Japanese Corporations

Animoca Brands, a leader in Web3 gaming, has announced a strategic partnership with decentralized finance platform Solv Protocol aimed at enabling

CryptoBreaking·2025-12-10 07:45

Solv Foundation Integrates With Stellar To Unlock Yield For $200M In USDC

In Brief

Solv Foundation is expanding its platform to Stellar, enabling institutions and users to generate yield on $200 million in USDC while linking cross-border payments to on-chain capital market opportunities.

Solv Foundation, a prominent Bitcoin finance protocol, has announced plans to ex

MpostMediaGroup·2025-12-05 14:40

Data: LSK falls over 14% in 24 hours, PHA rises over 5%.

According to Mars Finance news, Binance Spot data shows that the market has experienced significant fluctuations. LSK has fallen by 14.68% in the last 24 hours, while PHA has risen by 5.88% and reached a new high today. In addition, LAZIO, PORTAL, and SOLV have all shown a "pullback" state, with 24-hour declines of 8.37%, 6.98%, and 11.52%, respectively. Among other tokens, VANRY has reached a new low today, while SAGA and SHELL have both hit new lows for the week, with declines of 13.87% and 6.07%, respectively.

MarsBitNews·2025-11-29 15:06

Jiuzi Holdings taps SOLV Foundation for its $1B Bitcoin investment plan

Jiuzi commits up to $1B and 10,000 BTC to SOLV’s DeFi yield platform.

The partnership bridges TradFi compliance with DeFi Bitcoin finance.

JZXN shares have surged over 17% following the strategic announcement.

Jiuzi Holdings, Inc. (NASDAQ: JZXN) has unveiled a sweeping $1 billion Bitcoin finance

BitcoinInsider·2025-10-30 20:43

Jiuzi Holdings Launches $1 Billion Bitcoin Treasury with SOLV to Drive Institutional Yields and R...

HANGZHOU, China, Oct. 30, 2025 /PRNewswire/ -- Jiuzi Holdings, Inc. (NASDAQ: JZXN) ("Jiuzi" or the "Company"), today detailed its SOLV Foundation partnership — a leading Bitcoin finance platform managing over $2.8 billion in total value locked (TVL) — allocating up to $1 billion from its $1B

CryptoFrontNews·2025-10-30 11:36

Jiuzi Holdings, Inc. Partners With SOLV Foundation on $2.8B TVL Bitcoin Initiative to Advance Cry...

Jiuzi Holdings has partnered with the SOLV Foundation to enhance its Bitcoin treasury strategy, leveraging SOLV's platform for efficiency and security in managing Bitcoin assets. They aim to innovate in decentralized finance and ensure compliance with regulations.

CaptainAltcoin·2025-10-27 11:43

Zeta Network Raises $230 Million in Bitcoin-Backed Private Share Sale

Zeta Network Group announced on Wednesday that it successfully raised $230.8 million through a private share sale, with investors paying in Bitcoin (BTC) or SolvBTC, a wrapped Bitcoin-backed token issued by Solv Protocol. The deal underscores the growing trend of digital-first fundraising and

BitcoinInsider·2025-10-16 12:58

Chainlink and Solv Protocol Launch Secure Exchange Rate Feed

Solv Protocol and Chainlink have launched a new Secure Exchange Rate feed for the SolvBTC wrapped bitcoin asset hosted on Ethereum.

Chainlink Proof of Reserve Tech Used for Solv Protocol’s Exchange Rate

Solv Protocol has launched a Secure Exchange Rate feed for its SolvBTC wrapped bitcoin asset i

Coinpedia·2025-10-15 20:44

Zeta Network Group Enters Strategic Partnership With SOLV Foundation to Advance Bitcoin-Centric F...

NEW YORK, Oct. 7, 2025 /PRNewswire/ -- Zeta Network Group (Nasdaq: ZNB) (the "Company") today announced it has entered into a Strategic Partnership Agreement (the "Agreement") with SOLV Foundation ("SOLV"), a multi-chain Bitcoin liquid staking and institutional-grade structured finance platform with

CryptoNewsLand·2025-10-07 11:33

[Uweb Live Class Episode 187 Highlight Review | Meng Yan Returns from Silicon Valley, Exclusive Insights into the Three Major Trends in the Next Phase of the encryption Industry]

Content source: Uweb Live Class Episode 187

Content Organization: Peter\_Techub News

Statement: The content of this article is for educational exchange and sharing purposes only and does not constitute any investment advice.

On the evening of September 9, 2025, the 187th Uweb live class invited Meng Yan, the proposer of the token concept and co-founder of Solv, to engage in an in-depth dialogue with Uweb Principal Yu Jianing. Teacher Meng Yan has just returned from an in-depth research trip to Silicon Valley, bringing back a wealth of frontline insights and forward-looking judgments. Centered around the theme of "Returning from Silicon Valley: Decoding the Next Phase of Industry Trends," he provided a thought-provoking collision of ideas for the industry from three core dimensions: the crypto cycle, future trends, and investment preparation.

1. Debate of the Cycle: The 4-Year Law Loosens, Long Bull Logic Emerges

The rule of "the cryptocurrency industry has a cycle of 4 years" has been a crucial reference for countless industry practitioners and investors in assessing the market.

TechubNews·2025-09-09 16:59

Solv Airdrop causes dissatisfaction among Large Investors, issuance of AI Agent introduces new methods for safeguarding rights.

Jessy, Golden Finance

On January 6, X user @Clarissexx0805 expressed on X that as an early large-scale staker of SolvProtocol, she did not receive the promised airdrop rewards from the project team. She has repeatedly sought an explanation from the Solve project team but has not received the response she wanted.

Due to the difficulties it faced in protecting its rights, it launched an AI Agent project called ZaichXBT to assist in safeguarding its rights, and the market value of the tokens for this AI Agent project reached as high as thirty million dollars.

Golden Finance contacted Solv founder Ryan on January 7 regarding the issue raised by @Clarissexx0805, who stated that a response would be provided after the team discussed it. However, as of the time of publication, Golden Finance has not received an official response from Solv.

Did the big players get taken out by Solv?

According to @Cl

金色财经_·2025-09-05 12:12

Solv and Chainlink integrate Proof of Reserve into SolvBTC: live on-chain anti-manipulation feed ...

Solv Protocol and Chainlink have launched a new feed that combines the market price with the on-chain verification of BTC reserves for SolvBTC, with a redemption rate anchored to the collateral and price limits designed to reduce manipulations.

According to data collected by Chainlink Data, the Sol

TheCryptonomist·2025-09-01 11:58

Solv and Chainlink Bring Real-Time Collateral Verification to SolvBTC Pricing

Solv Protocol collaborates with Chainlink to integrate real-time reserve verification into its SolvBTC price feed, enhancing transparency and security in DeFi. This innovative system offers an accurate exchange rate based on verifiable collateral, improving trust for users and safeguarding against manipulation.

YahooFinance·2025-09-01 10:43

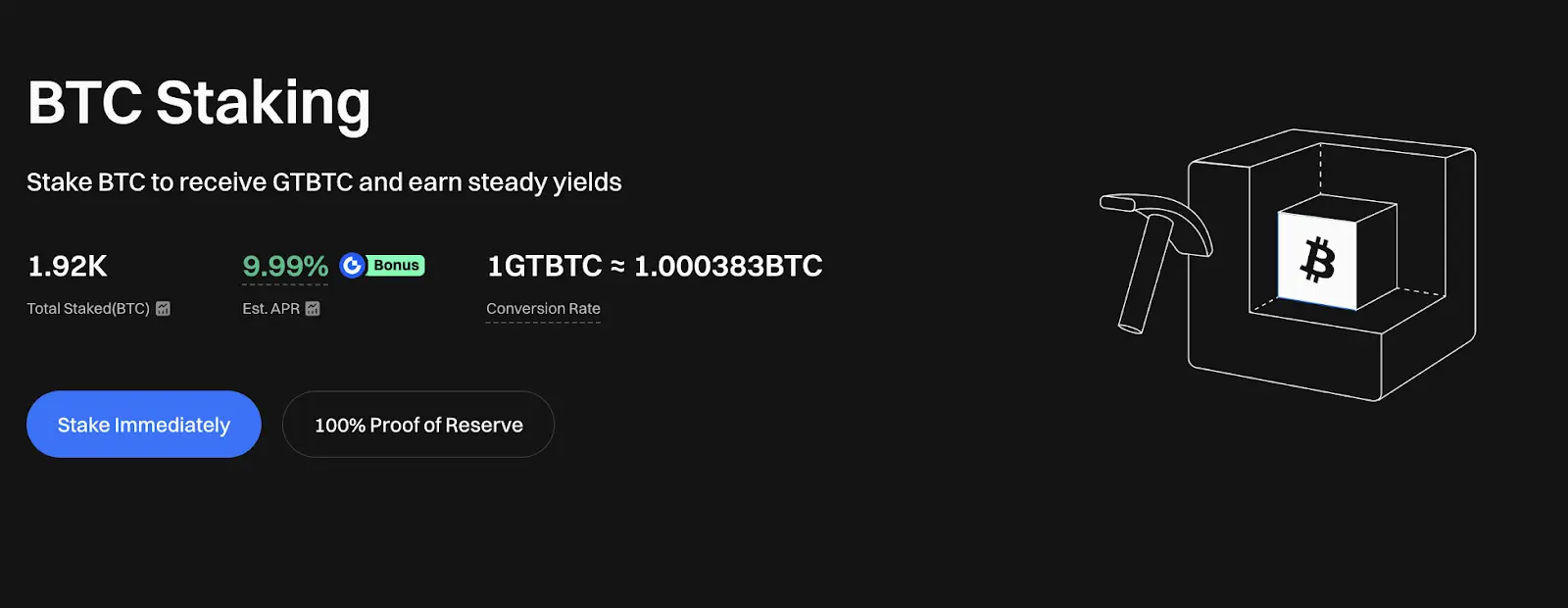

BTC Mining annualized yield 9.99%, Solv Protocol supports unlimited tiered rewards

Gate on-chain earn coin BTC Mining reference annual yield 9.99%, Solv Protocol assists tiered rewards with no upper limit. Minimum investment starting at 0.001 BTC, approximately 3 days redemption period, no limit on individual quota, flexible and stable appreciation.

SOLV2,27%

GateLearn·2025-08-28 03:33

$SOLV and Binance: A turning point for BTC profits and CeFi trust

Sự hợp tác của Binance với Solv Protocol đánh dấu một sự chuyển mình quan trọng trong bối cảnh tài chính, kết hợp CeFi và DeFi. Sự hợp tác này nâng cao lòng tin và tính minh bạch trong quản lý lợi suất BTC, đánh dấu sự xuất hiện của DeFi như một nhân tố đáng tin cậy trong hệ thống tài chính toàn cầu.

Blotienso·2025-08-19 06:45

Solv & BTC+: Unlock Institutional Bitcoin Profits – No Wrap, No Bridge, No Limits

Trong bối cảnh DeFi, BTC+ của Solv cách mạng hóa việc đầu tư Bitcoin bằng cách cho phép staking trực tiếp mà không cần wrapping hoặc bridging. Nó kết hợp các chiến lược CeFi, DeFi và TradFi, cung cấp một lớp lợi nhuận thống nhất cho các nhà đầu tư đa dạng, đơn giản hóa các tương tác giữa tài chính truyền thống và phi tập trung.

Blotienso·2025-08-18 21:30

BTC+ is the new flagship product of Solv Protocol

@SolvProtocol is a decentralized Bitcoin finance platform—also known as BTCFi—that unlocks Bitcoin’s full potential by bringing it into DeFi, CeFi, and TradFi. It introduces innovative features like SolvBTC (a 1:1 Bitcoin-backed token), liquid

MasteringCrypto·2025-08-17 06:19

BTC+ of SOLV Protocol: Bitcoin Profit Vault for a New Era

BTC+ by SOLV Protocol transforms Bitcoin investment, allowing it to generate profits through advanced strategies linking DeFi with traditional finance. It combines risk management, yield diversification, and user-friendly access for a smart, active financial future.

Blotienso·2025-08-16 10:41

Solv Protocol – Turn Sleeping Bitcoin into Earning Assets

If you have been in the crypto market for a while, you have probably heard the saying: "Just hold Bitcoin and wait." This is true, but many people also wonder: "Can my Bitcoin both be held and earn profits?" This is the question that Solv Protocol is striving to address.

Solv Protocol Is

Blotienso·2025-08-16 03:15

Why BTC+ by Solv is Hypnotic

BTC+ by Solv Protocol transforms idle Bitcoin into generating yield effortlessly through a multi-strategy approach, blending DeFi, CeFi, and TradFi. It offers security, a user-friendly interface, and significant returns, making it an emotionally compelling investment experience.

MasteringCrypto·2025-08-15 13:15

From Digital Gold to Yield Machine – Discover BTC+ by Solv

@SolvProtocol aims to revolutionize Bitcoin as a functional yield-generating asset through BTC+, which offers competitive returns, institutional-grade security, and seamless user experience. Its multi-strategy architecture and compliance broaden market access and provide transparency and trust.

MasteringCrypto·2025-08-14 14:17

Solv Protocol – Redefining Financial Assets in the Web3 Era

Solv Protocol is an innovative DeFi platform that tokenizes yield-bearing assets, enhancing liquidity and flexibility. By creating Solv Vouchers, it allows greater trading opportunities while ensuring transparency and safety, bridging traditional finance with decentralized finance.

SOLV2,27%

Blotienso·2025-08-14 07:45

Here’s what Solv Protocol’s “BTC+” ? This is our Future !

@SolvProtocol | $SOLV | BTCUnbound

🔸 What Is BTC+?

@SolvProtocol feels exactly like one of those rare opportunities. It has already raised $22 million and reached a $200 million valuation, but this is just the beginning. The real excitement comes from its BTC Restaking feature and the new Point

TopCryptoNews·2025-08-13 16:41

Why Binance Choose Solv as Exclusive BTC Fund Manager

BTC+ is a Bitcoin yield vault by @SolvProtocol, providing an easy way to earn 5-6% yield on BTC through diverse strategies. Launched on August 1, it's open to all investors and features partnerships, including Binance, enhancing trust and accessibility in a compliant manner.

MasteringCrypto·2025-08-12 13:03

Solv Protocol – Unlocking the Potential of Bitcoin in the DeFi Era

For over a decade of existence, Bitcoin (BTC) has always been regarded as "digital gold" – a store of value and a means of peer-to-peer payment. However, a major limitation of Bitcoin is the lack of a native staking mechanism and the difficulty of direct integration into the decentralized finance ecosystem (DeFi). The

Blotienso·2025-08-11 21:02

BTC+ of SOLV: The institutional-grade Bitcoin yield vault is game-changing.

On August 1st, Solv Finance officially launched BTC+, an institutional-grade Bitcoin yield vault that can be accessed with a single click, offering a base yield of 5–6%. Although its architecture is designed to meet the stringent requirements of sovereign wealth funds and institutional investors, BTC+ is open to

Blotienso·2025-08-10 00:22

Solv Protocol – Turn Bitcoin into a "Money-Making Machine" with $SOLV

Bitcoin has long been regarded as the most powerful and reliable cryptocurrency in the world. With a market capitalization of over 1 trillion USD and millions of users worldwide, BTC continues to be seen as "digital gold".

Blotienso·2025-08-09 22:00

Solv Introduces BTC+ For The First Time Ever

For over a decade, Bitcoin has been regarded as pristine digital collateral — valuable, secure, and resistant to inflation. Yet for most holders, BTC has been a passive asset, sitting idle in wallets, generating no income. This inefficiency has left over $1 trillion in Bitcoin supply unused, while i

MasteringCrypto·2025-08-09 04:37

Solv Protocol’s BTC+ Let’s You Earn Passive Income With Your Idle Bitcoin

BTC+, launched August 1, 2025, marks a pivotal step in Bitcoin’s evolution—turning dormant BTC into yield-generating financial assets. Using a protocol-native vault infrastructure, BTC+ delivers base yields of approximately 4.5–5.5% annually, with early users eligible for promotional boosted APRs

MasteringCrypto·2025-08-06 12:26

Solv Airdrop Raises Discontent Among Large Investors, Issuance of AI Agent Introduces New Strategies for Rights Protection

On January 6, @Clarissexx0805 reported on the X platform that as an early staker of SolvProtocol, she did not receive the promised airdrop benefits and did not receive a reasonable response from the project party. As a result, she initiated the AI Agent project ZaichXBT to protect her rights, and the token's market capitalization once reached 30 million USD. The incident reflects a crisis of confidence between the project party and large investors, and Solv lacks a spirit of contract. The ZaichXBT project aims to support more users in protecting their rights and incentivize participants through airdrops.

金色财经_·2025-08-04 04:05

Solv Protocol targets over 1 trillion dollars of idle Bitcoin with its institutional profit treasury.

Solv Protocol's newly launched BTC+ aims to attract over $1 trillion in idle Bitcoin by offering a yield vault for institutional investors. BTC+ utilizes various yield strategies across DeFi, CeFi, and traditional finance, ensuring security and investment separation.

TapChiBitcoin·2025-07-31 19:38

BNB Chain Unleashes Strategic Investments: Fueling Ecosystem Growth with SOLV & CA Tokens

BNB Chain, a titan in the blockchain world, is once again making headlines, not just for its robust infrastructure but for its proactive commitment to nurturing its vast ecosystem. In a move that underscores its dedication to innovation and growth, the BNB Chain Foundation has recently announced a s

BitcoinWorldMedia·2025-07-28 11:51

Solv Airdrop Causes Discontent Among Large Investors, Issuance of AI Agent Introduces New Rights Protection Gameplay

@Clarissexx0805 is defending her rights due to not receiving the promised Airdrop benefits from SolvProtocol, and has launched the AI Agent project ZaichXBT to assist her in this matter, planning to vest the profits to the community. This incident reflects the Crisis of Confidence between the project party and Large Investors, as well as a lack of contractual spirit.

金色财经_·2025-07-11 00:15

BOB announced the introduction of native BTC into the DeFi system on the BitVM Testnet, supported by ten institutions including Lombard, Solv Protocol, and Fiamma.

On July 2, the hybrid Layer2 project BOB (Build on Bitcoin) announced the official activation of native BTC in its BitVM Testnet, which is supported by ten leading industry players including P2P.org, Lombard, Solv Protocol, Amber Group, Ankr, RockawayX, Fiamma, UTXO Management, Luganodes, and SatLayer.

DeepFlowTech·2025-07-02 13:47

Web3 Marketing Insider: Is Kaito More Effective Than Traditional KOLs?

Written by: Stacy Muur

Compiled by: Luffy, Foresight News

I recently conducted an in-depth study on KOL marketing and spoke with some of the most renowned Web3 marketing agencies that run marketing campaigns for major crypto protocols like Mantle, Sonic Labs, Aptos, and Solv Protocol.

What is the goal?

My research objective is to uncover how these institutions operate and their core KOL list.

What are the criteria for selecting KOLs?

How large is their user base?

How do they assess audience quality?

How are tools like Kaito and Cookie DAO reshaping the KOL game in Web3?

Whether you want to become a KOL in a top-tier institutional network or are preparing for the next

KAITO-1,09%

DeepFlowTech·2025-06-19 10:57

Web3 Marketing Insider: Is Kaito More Effective Than Traditional KOLs?

> KOL marketing will not disappear, but it needs authentic voices, not accounts that shout for pay 24/7.

Written by: Stacy Muur

Compiled by: Luffy, Foresight News

I recently conducted an in-depth study on KOL marketing and spoke with some of the most renowned Web3 marketing agencies that carry out marketing activities for major crypto protocols such as Mantle, Sonic Labs, Aptos, and Solv Protocol.

What is the goal?

My research aims to uncover how these institutions operate and their core KOL list.

What are the criteria for selecting KOLs?

How large is their user base?

How do they assess audience quality?

KAITO-1,09%

ForesightNews·2025-06-19 02:12

The SolvBTC Vault is officially launched, bringing AI yields for the BTC ecosystem to log in to Sei.

According to Mars Finance, GAIB has partnered with Sei, CIAN, Takara, and Solv to launch the SolvBTC Vault, introducing AI-driven returns for Bitcoin assets. After users deposit SolvBTC into the CIAN Vault, the system will automatically execute fund allocation, including collateralizing to Takara, lending out stablecoins, and investing in the GAIB Vault to obtain real GPU Computing Power returns and 5 times SPICE points. At the same time, users can receive a reward equivalent to 5% of Sei chain rewards, covering borrowing Interest, enabling zero-cost operations and stacking multiple returns.

MarsBitNews·2025-06-17 05:43

What Can Having 0.05 BTC Do For You on Binance?

Binance now offers on-chain staking for users holding at least 0.05 BTC, enabling them to earn up to 2.5% APY in $SOLV tokens, facilitated by Solv Protocol. This integration represents a significant shift in CeFi, combining security and transparency with DeFi principles, allowing seamless yield generation without requiring external wallets.

BTC0,77%

MasteringCrypto·2025-06-15 08:46

Solv Airdrop causes dissatisfaction among Large Investors, issuance of AI Agent turns into a new way to defend rights.

On January 6, X netizen @Clarissexx0805 reported that as a large early staker of SolvProtocol, he did not receive the promised airdrop income, and launched the AI Agent project ZaichXBT to defend his rights, with a token market value of $30 million. Ryan, the founder of Solv, was contacted by the media, but did not receive a reply. The incident revealed the unspoken rules of the relationship between large investors and project parties, and called for Solv's lack of contractual spirit. The AI Agent project launched by @Clarissexx0805 provides a new way to protect rights, is supported by users, and shows innovation.

金色财经_·2025-06-13 12:04

Solv Protocol Cofounder Yan Meng Shares Insights on Stablecoins and RWAs

On May 29, Solv Cofounder Yan Meng shared insights on blockchain finance evolution. He posted a summary of his discussion with specialist Dr Xiao Fen in an X post. His post highlighted stablecoin trends and tokenized real-world assets. The dialogue mentioned recent legal moves in the United States a

SOLV2,27%

Coinfomania·2025-05-28 21:56

CoreDAO Defi Ecosystem Grows 40% in Q1 With 1.1B CORE TVL and lstBTC Launch

Bitcoin Finance is entering a new phase, and Solv and Core are at the center of it. As Core’s DeFi ecosystem gains traction, SolvBTC.CORE has emerged as the largest asset on Colend, Core’s premier lending protocol. The growth is part of a broader alignment between Solv Protocol and CoreDAO as they r

Coinfomania·2025-05-28 12:13

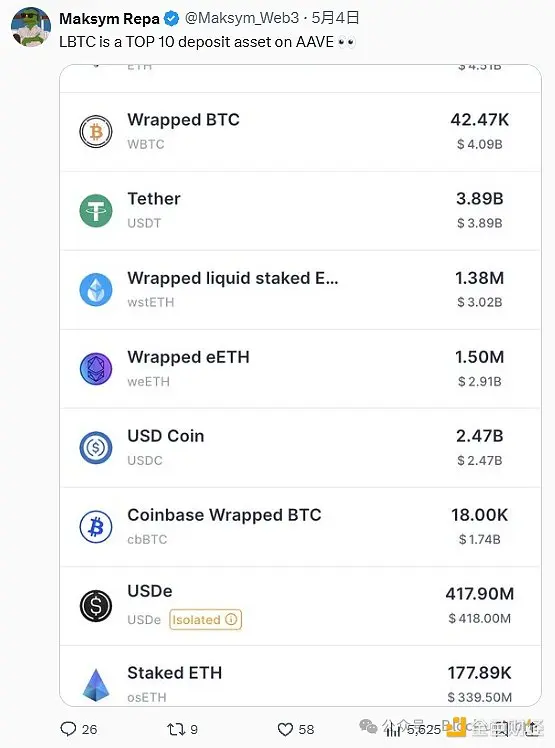

SolvBTC Unlocks $100M+ in Utility With USD1 via Venus and ListaDAO on BNB Chain

Solv Protocol has achieved a pivotal milestone. It has expanded SolvBTC’s reach through over $100M in USD1 utility across the BNB Chain ecosystem. This development comes after deep integrations with Venus Protocol and ListaDAO. These partnerships unlock lending and borrowing functionalities. All

Coinfomania·2025-05-22 10:52

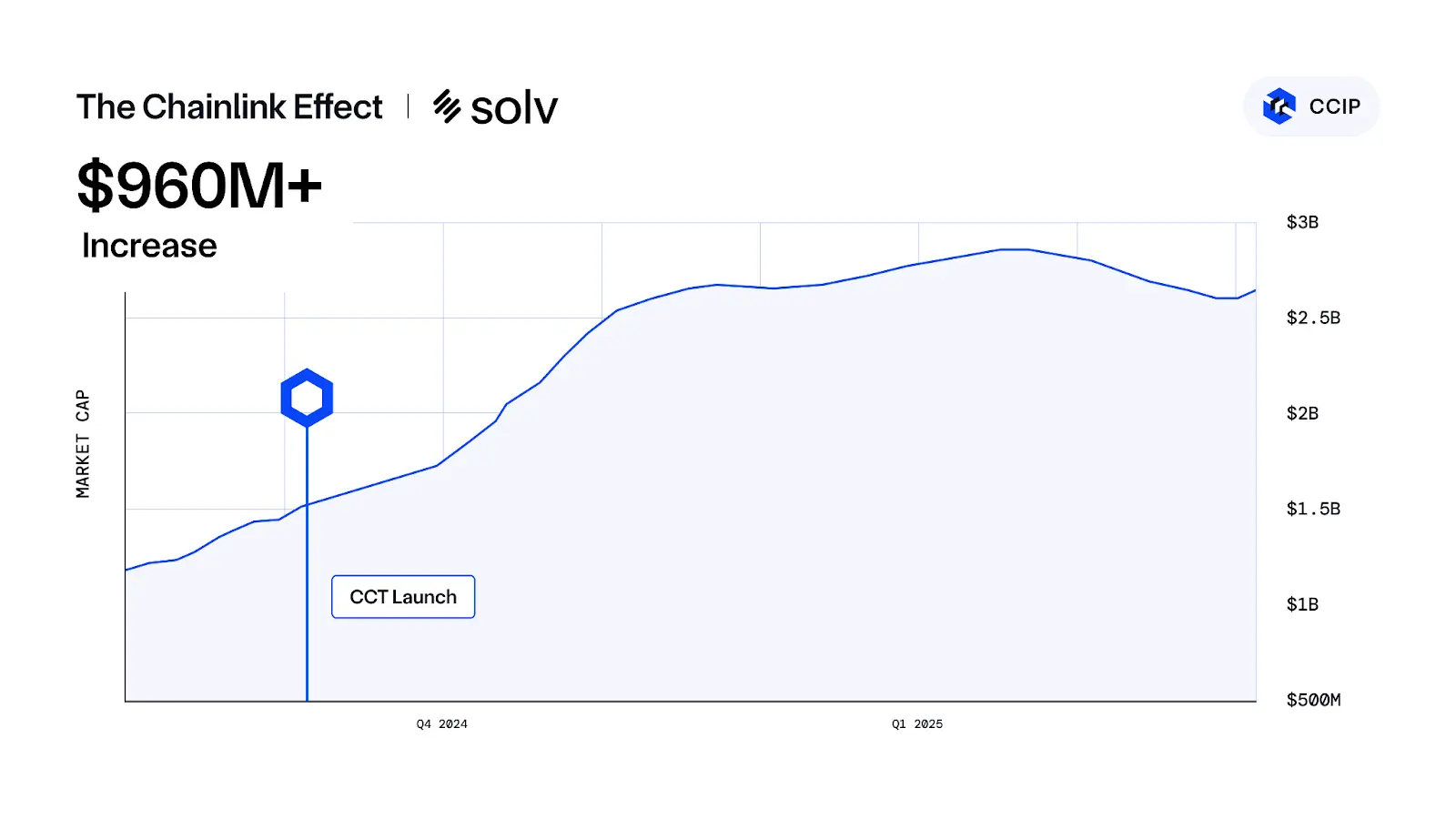

Solv Protocol Hits $2.5B TVL After Adopting Chainlink’s Cross-Chain Standard

Solv Protocol adopted Chainlink’s CCT standard, leading to over $2.5 billion in TVL. $1.16 billion in cross-chain transfers via CCIP demonstrates active asset deployment. The focus is on composable liquidity, programmable yield, and seamless BTC mobility.

Coinfomania·2025-05-21 08:13

Unlocking the Power of Bitcoin Yield with RWA Support on Avalanche Blockchain

The Solv RWA-backed Bitcoin yield offers a secure way to earn yields on Bitcoin by combining real-world assets with cryptocurrency, revolutionizing passive income in the crypto space.

CryptoBreaking·2025-05-18 08:12

Elixir collaborates with Solv to launch the SolvBTC.AVAX modular yield vault, bringing DeFi yield to Bitcoin through deUSD.

The DeFi protocol Elixir collaborates with the Bitcoin staking protocol Solv Protocol to launch the SolvBTC.AVAX yield vault supported by real-world assets. This combines Solv, Avalanche, Euler, LFJ, and Balancer to provide automated yields, execution layers, RWA support, loan loops, and liquidity mining. Core yields come from BlackRock and Hamilton Lane, and users holding SolvBTC.AVAX can earn AVAX rewards, Elixir points, and Solv points, achieving on-chain BTC yield generation and institutional-level participation.

DeepFlowTech·2025-05-18 00:17

Solv Protocol has launched the RWA-supported Bitcoin yield token SolvBTC.AVAX on Avalanche.

Solv Protocol has launched the yield-bearing Bitcoin token SolvBTC.AVAX on the Avalanche Blockchain, aimed at providing returns to Bitcoin holders by investing in tokenization of real-world assets, involving treasury bonds and private credit from institutions such as BlackRock and Hamilton Lane. The token generates yield through a multi-protocol strategy and is distributed in BTC format.

MarsBitNews·2025-05-17 00:44

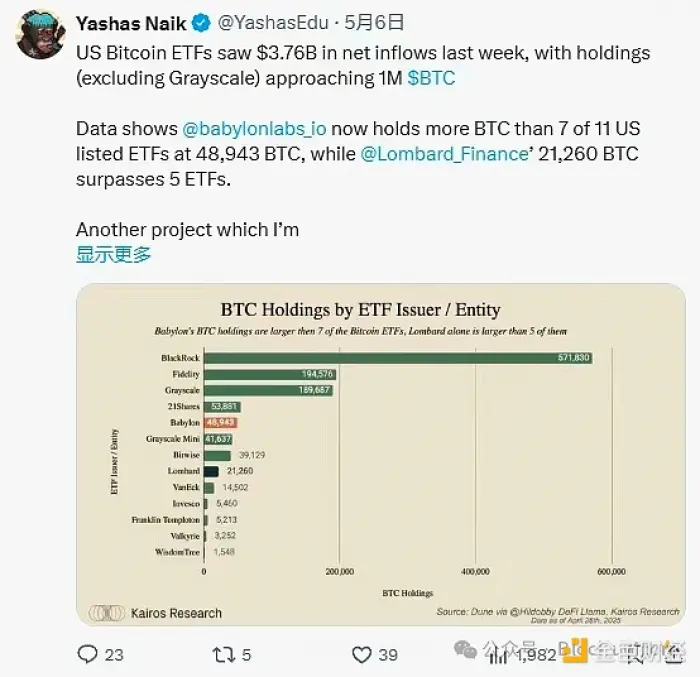

BTCFi: Can a spark ignite a prairie fire?

The development of Bitcoin's DeFi is flourishing. Projects like Babylon, Lombard, SatLayer, and Solv Protocol have become the foundation of the BTC native DeFi stack, addressing various issues. Babylon provides a staking layer, Lombard offers liquid staking, SatLayer enables re-staking, and Solv Protocol adopts different approaches to build BTC reserves. These protocols open a new era for Bitcoin DeFi, unleashing the potential of native BTC DeFi. Institutional investors are highly interested in this trend.

BTC0,77%

PANews·2025-05-13 05:10

Bitcoin上的 Decentralized Finance:终于变得有趣了吗?

The Bitcoin DeFi ecosystem is showing new developments, including Babylon's staking layer, Lombard's liquid staking, SatLayer's Eigen Layer, and Solv Protocol's BTC reserve strategy. These protocols expand BTC's decentralized finance applications in different ways, featuring high liquidity and potential returns. In the future, Bitcoin DeFi may enter a new stage, attracting more institutional investors' follow.

挖币网·2025-05-13 01:39

Bitcoin上的 Decentralized Finance:终于变得有趣了吗?

Bitcoin DeFi is entering a new era. Projects like Babylon, Lombard, SatLayer, and Solv Protocol are driving the development of the Bitcoin native DeFi stack. Babylon is responsible for Bitcoin staking, Lombard provides liquidity, SatLayer supports re-staking, and Solv Protocol employs different reserve strategies. The development of Bitcoin DeFi may unlock billions of potential value and attract the attention of institutional investors.

金色财经_·2025-05-12 07:33

RWAiFi Summit 2025 in Dubai Successfully Concluded: Highlights and Review of the Intersection of AI, RWA, and Decentralized Finance

The RWAiFi Summit 2025, hosted by GAIB, Plume, and StakeStone, successfully concluded on April 30 during Token 2049 in Dubai.

The summit attracted over 1,900 registrants and more than 400 participants, bringing together 17 top projects, including OpenLedger, Sahara AI, Aethir, Solv, Kite AI, Lagrange, Symbiotic, OpenEden, Maple Finance, Mind Network, ICN Protocol, Tranchess, Balloon, and several leading investment institutions such as Hack VC and Spartan.

TechubNews·2025-05-07 14:45

Load More