Search results for "SNX"

SYN Stabilizes Near Key Support as Accumulation Signals Surface on Binance

SYN trades near balance levels, where fading sell pressure suggests controlled accumulation activity.

Clearly defined support and resistance zones frame disciplined short-term trading conditions.

SNX intraday strength reflects cautious rotation interest

CryptoFrontNews·2025-12-23 07:11

SNX Holds $0.5447 Support After 11.2% Weekly Drop As Price Tests $0.5981 Resistance

SNX trades at $0.5859 after an 11.2% weekly decline while holding above its key support at $0.5447.

The token moves within a narrow $0.5447–$0.5981 range as price tests resistance after crossing a long trendline.

SNX posts gains of 1.5% against BTC and 2.8% against ETH despite its broader dollar-b

CryptoNewsLand·2025-11-29 17:35

Binance Altcoin Netflow Shows Mixed Trends as Traders Shift Between Selling and Holding

Binance records large UNI and SNX inflows, showing traders are increasing exchange balances while preparing for heightened short-term activity across both assets.

Strong outflows in 1INCH, SHIB, CRV, and LINK show traders steadily removing tokens from Binance to reduce available supply and

CryptoFrontNews·2025-11-26 07:16

Data: DCR falls over 13% in 24 hours, VOXEL falls over 15%

According to Mars Finance news, data from Binance Spot shows that the market has experienced significant fluctuations. DCR has fallen by 13.12% in the last 24 hours, and VOXEL has fallen by 15.82%, showing a "high and then low" state. In addition, HBAR, RAY, SNX, and FLUX also exhibited a "high and then low" state, with declines of 7.97%, 7.15%, 11.45%, and 8.17%, respectively. Meanwhile, NTRN has seen a slight rise within 5 minutes, with an increase of 3.37%.

MarsBitNews·2025-11-24 14:45

DeFi Eyes a Comeback: Will AAVE, SNX & COMP Rally After Uniswap’s 30% Surge?

AAVE and COMP are driving the DeFi recovery with strong gains, while SNX shows high-beta potential. The resurgence of UNI highlights DeFi's potential, contingent on protocol upgrades, TVL growth, and macro-liquidity.

BitcoincomNews·2025-11-11 10:56

Data: EUL rise over 15%, FIS rise over 8%

According to Mars Finance, Binance Spot data shows that the market has experienced significant fluctuations. The 24-hour rise of EUL reached 15.52%, and FIS hit a new high for today, rising by 8.33%. Meanwhile, QTUM, AUCTION, and EIGEN have all shown a "high-to-low" state, with falls of 5.56%, 9%, and 7.45%, respectively. SNX reached a new low for the week, falling by 15.31%. The other tokens, PERP and FLM, also saw slight declines, with falls of 3.09% and 3.16%, respectively.

MarsBitNews·2025-10-30 08:24

Synthetix (SNX) hits new records in fees amid trading activity resurgence

As the cryptocurrency market turns green, the decentralized perp futures trading platform took it to X to report impressive trading activity the previous week, generating roughly $233,897 in fees from over 100 traders.

BitcoinInsider·2025-10-28 16:06

Why is the crypto market rising? Bitcoin breaks through $110,000 leading the rise, with a market capitalization increase of over $60 billion in a single day.

As the week begins, the crypto market returns to the green. After finding support at the critical support level of $3.59 trillion, the total market capitalization of Crypto Assets (TOTAL) has climbed to $3.69 trillion, with a rise of over $60 billion in 24 hours. Bitcoin (BTC) leads the way with a pump of nearly 3%, breaking through $110,000 and confirming a bullish divergence signal, indicating that bullish sentiment may be returning after two weeks of correction. Synthetix (SNX) has performed strongly, breaking through a bullish flag pattern with a daily rise of nearly 16%.

MarketWhisper·2025-10-20 07:58

Global markets focus on tech stocks and gold! Bitcoin falls below $112,000, $63 billion in encryption market capitalization evaporates.

After being dominated by the threat of the US-China trade war for most of the week, Asian stock markets shifted focus to technology stocks, pushing regional indices up more than 1.1%. Meanwhile, gold surged over 4242 dollars per ounce due to trade friction and expectations of interest rate cuts, with an increase of more than 60% this year. The Crypto Assets market, however, faced a new wave of bearish pressure, with total market capitalization dropping 63 billion dollars in the past 24 hours to 3.74 trillion dollars. Bitcoin struggled to hold the key psychological support level of 110000 dollars, but Synthetix (SNX) plummeted nearly 20% due to a significant outflow of funds.

MarketWhisper·2025-10-16 05:56

Abandoning L2 to return to the Mainnet, Synthetix V3 ignites the Perp DEX war.

On October 13, after the avalanche in the crypto market, Synthetix launched a strong recovery, with the Token SNX breaking through the key price level of 2 dollars in a short time, reaching a peak of 2.53 dollars, setting a new high for the year, with a 24-hour rise exceeding 100% at one point.

The recent surge of SNX is a reassessment by the market of the future value capture ability of the established DeFi infrastructure Synthetix after its fundamental reconstruction. The main driving force comes from the decentralized perpetual contract exchange (Perp DEX) that Synthetix is set to launch on the Ethereum mainnet in the fourth quarter of 2025. However, whether it can regain vitality in the trillion-dollar derivatives track still requires the test of time.

CEX reserves continue to flow out, whales double their holdings.

The explosive rise in SNX prices is accompanied by strong on-chain trading activity, demonstrating the overwhelming buying power in the market, and the structure of capital inflows is also changing.

PANews·2025-10-15 09:57

SNX Price Rebounds 250% as Synthetix Gears Up for $1M Trading Competition and DEX Launch

The SNX price is reclaiming investor attention as Synthetix prepares for one of its most significant quarters yet. The protocol is set to debut the first perpetual DEX on the Ethereum mainnet in Q4 2025, a milestone that could reshape its role in decentralized derivatives

BitcoincomNews·2025-10-14 13:33

Here’s why Synthetix (SNX) has fallen after 130% rally

, one of the most prominent names in decentralised finance (DeFi), has taken a sharp turn after an explosive rally that saw its price soar more than 130% earlier this month.

The cryptocurrency, which recently hit a 10-month high of $2.27, has plunged 16.3% in the past 24 hours as traders rushed to

BitcoinInsider·2025-10-14 13:31

Gate Research Institute: SNX weekly rise exceeds 94%, Ethereum Layer2 capital inflow accelerates |Gate VIP Weekly Report

Highlights of last week's market overview:

Alpha Digging: BTC broke through $126,000, reaching a new phase high, and then experienced a sharp correction, dipping to a low of $102,100; ETH fell significantly after breaking through $4,700, with a low that once dropped to $3,400, marking a recent low. Among altcoins, SNX surged over 94.48%, becoming the most notable token; DASH and TAO also recorded increases of 48% and 22% respectively, rising against the trend in the short term.

On-chain funds: Ethereum Layer 2 capital inflow accelerates, Arbitrum maintains its leading advantage with a net inflow of $873 million in a single week, OP Mainnet, Unichain, and Polygon PoS.

GateResearch·2025-10-14 10:23

SNX Price Rockets 24% on Perpetuals Launch Hype: Pullback Risks Ahead in 2025 DeFi Surge

On October 14, 2025, Synthetix's native token SNX has skyrocketed 24% in the last 24 hours to $2.11, outpacing a slumping broader cryptocurrency market and emerging as the top altcoin performer. This explosive rally stems from mounting excitement over the upcoming Ethereum-based perpetuals DEX launch and a $1 million trading contest kicking off on October 20.

CryptopulseElite·2025-10-14 09:04

Data: Today's Crypto Assets market capitalization top 100 Tokens rise and fall

According to Mars Finance, data from Coinmarketcap shows the performance of the top 100 Crypto Assets by market capitalization. The top five gainers are: Synthetix (SNX) rising 101.91%, current price $2.37; Story IP (IP) rising 22.99%, current price $6.82; Bittensor (TAO) rising 17.62%, current price $415.5; Render (RENDER) rising 14.21%, current price $2.88; Pyth Network (PYTH) rising 13.14%, current price $0.1292. The top five losers are: Zcash (ZEC) falling 5.64%, current price $240.68; Artificial Superintelligence

MarsBitNews·2025-10-13 19:44

Here’s Why Synthetix (SNX) Price Is Exploding

Synthetix is absolutely on the move right now, breaking through key resistance levels and finally waking up after years of sideways action

SNX price just crossed $2.20, and traders everywhere are asking the same thing: what’s driving this rally?

The Big Catalyst – A New Perpetuals DEX on

CaptainAltcoin·2025-10-13 18:34

Synthetix Roars Back With 150% Rally as DeFi Dinosaurs Reclaim Their Throne

Synthetix's native token SNX soared over 150% to $2.51, driven by a surge in trading volume and excitement over a new perpetual DEX launch on Ethereum. This revival reflects renewed investor confidence and a strategic multi-chain approach.

TheNewsCrypto·2025-10-13 12:00

SNX surged over 120% to its highest level in 10 months.

SNX, the native token of the Synthetix protocol, has recorded a rise to the sky, reaching its highest peak in the past 10 months, as expectations grow for the launch of a permanent decentralized exchange on the Ethereum (ETH).

The impressive recovery of SNX is taking place against the backdrop of the cryptocurrency market experiencing a x

TapChiBitcoin·2025-10-13 10:24

SNX Explodes 100%: Ethereum's First Mainnet Perp DEX Launch Fuels Massive Rally in October 2025

On October 13, 2025, Synthetix (SNX) rocketed over 100% in 24 hours, surging from $0.85 to highs near $1.70 amid explosive volumes hitting $626 million—up 834% daily—while open interest (OI) skyrocketed.

CryptopulseElite·2025-10-13 07:58

Synthetix Q4 Launches Perp DEX Igniting Market Enthusiasm: SNX Price Rises to 10-Month High

The native token SNX of the Synthetix protocol has performed particularly well recently against the backdrop of an overall recovery in the crypto market, soaring to its highest point in 10 months. The main driving force behind this strong rebound is the huge anticipation for its upcoming perpetual decentralized exchange (Perp DEX), set to launch on the Ethereum mainnet in the fourth quarter of 2025. Although SNX briefly fell to a nearly three-month low during last Friday's market flash crash, it rebounded significantly, with SNX rising by as much as 98%, surpassing mainstream crypto assets. Currently, SNX has risen over 80% within 24 hours, and trading volume has surged by 834%, but analysts have mixed views on its sustainability.

SNX8,88%

MarketWhisper·2025-10-13 07:29

Synthetix Price Recovers Sharply After Market Crash & Enters Top 100 -Can it Make it to $5 in 2025?

Synthetic price has risen nearly 100% in 24 hours, showcasing a significant recovery after a recent market crash. Experts predict SNX could break the $4.8 resistance and reach above $5 by 2025.

SNX8,88%

BitcoincomNews·2025-10-13 06:43

Epic rebound! The total market capitalization of encryption returns to 4 trillion USD, SNX rises over 100%, and market optimism returns.

The cryptocurrency market has experienced a strong rebound after last Friday's nearly $500 billion market capitalization big dump. Last Sunday, the total market capitalization surged back to over $4 trillion. This round of rebound was led by mainstream blue-chip coins: Ethereum (ETH), BNB, and Dogecoin all saw daily rises of over 10%. Among them, Synthetix (SNX) even surged over 100%, breaking the price before the big dump and setting a new high for 2025. The trigger for this big dump was U.S. President Trump announcing a 100% tariff on Chinese goods. However, after Trump stated "not to worry about China," market sentiment quickly eased, and analysts are generally optimistic that this lays the foundation for Bitcoin to surge towards $200,000 by the end of 2025.

MarketWhisper·2025-10-13 01:24

Perp DEX makes a strong push: Weekly review of new assets on Huobi HTX

In the past week, the crypto market has seen a rise in activity, with the Perp DEX sector performing exceptionally well, as ASTER's weekly increase reached 96%. The overall DeFi activity has been vibrant, with established projects like SNX rising by 55%. New AI and public chain coins SQD and XPL rose by 48% and 47%, respectively. Huobi HTX covers diverse sectors, providing users with a rich variety of trading options.

金色财经_·2025-10-05 05:44

Binance has launched AEVO/USDC, ME/USDC, and SNX/USDC Spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the AEVO/USDC, ME/USDC, and SNX/USDC spot trading pairs on September 30, 2025, at 16:00, and will open bot services for these trading pairs. In addition, Binance will provide spot grid and spot Dollar Cost Averaging services for PUMP/USDC. Users must complete account verification to participate in trading these new trading pairs.

MarsBitNews·2025-09-29 07:24

Synthetix’s SNX Bounces Back Strong Ahead of Ethereum Perpetual DEX Launch

SNX respected its ascending trendline at $0.62–$0.63, bouncing sharply and reclaiming key moving averages.

SNX is trading near critical resistance at the 50-day SMA, bulls are eyeing a breakout as trading activity increases.

Synthetix will launch its first perpetual DEX on Ethereum in Q4,

CryptoFrontNews·2025-09-26 12:38

Synthetix price soars 20% amid volume spike: here’s why

Synthetix’s native token SNX spiked more than 20% in 24 hours to hit $0.79.

Daily volume rocketed 700% to over $147 million, with Synthetix benefiting from a broader crypto bounce.

The Synthetix network’s move to launch its perps DEX on the Ethereum mainnet has helped SNX price.

Synthetix (SNX),

BitcoinInsider·2025-08-27 12:30

Grayscale Q3 Top 20 Crypto Assets list is out: new additions AVAX, MORPHO, while LDO and OP have been eliminated.

In the third quarter of 2025, Grayscale's "treasure map" has quietly adjusted: the rising stars Avalanche (AVAX) and Morpho (MORPHO) have made their way onto the list, while former giants Lido DAO (LDO) and Layer 2 hopeful Optimism (OP) have unfortunately exited. Amidst this ebb and flow, what shifts in the crypto market are hidden? This article is derived from a piece by MarsBit News, organized and written by Foresight News. (Background recap: Grayscale Research Report: Stack, a leading Bitcoin scaling trap solution) (Background supplement: Altcoin beacon? Grayscale added SUI, CRV, ADA, LPT in the fourth quarter, removing SNX, AVAX) As the fog clears, where is Grayscale's list pointing? In the rapidly changing world of encryption.

動區BlockTempo·2025-06-28 07:33

Bithumb adjusts trading alert stocks, Felaz is warned, Synthetix warning lifted

According to Mars Finance, Bithumb announced that, in accordance with the "Virtual Asset Trading Warning Stock Designation Guidelines", Felaz (FLZ) will be designated as a warning stock starting from June 27, 2025, at 15:00, and its deposit services will be suspended due to difficulties in confirming its utility and project performance, as well as poor on-chain activity and trading conditions. At the same time, Synthetix (SNX) has resolved the issues that led to its warning stock designation, and its deposit services will be restored. Bithumb will continue to monitor virtual assets and communicate with external experts and foundations to maintain the trading environment.

SNX8,88%

MarsBitNews·2025-06-27 06:56

Top TokenSoft IDO Performers Revealed – Projects Gained Between 15x and 90x ROI

TokenSoft IDs GRT, SNX, HBAR, and MANTA for strong utility and profits.

The tokens surged 15x–90x due to ecosystem growth and utility.

TokenSoft’s careful vetting highlights its ability to back high-yield projects.

The latest data from TokenSoft highlights a remarkable rise in the value of

CryptoNewsLand·2025-06-17 02:33

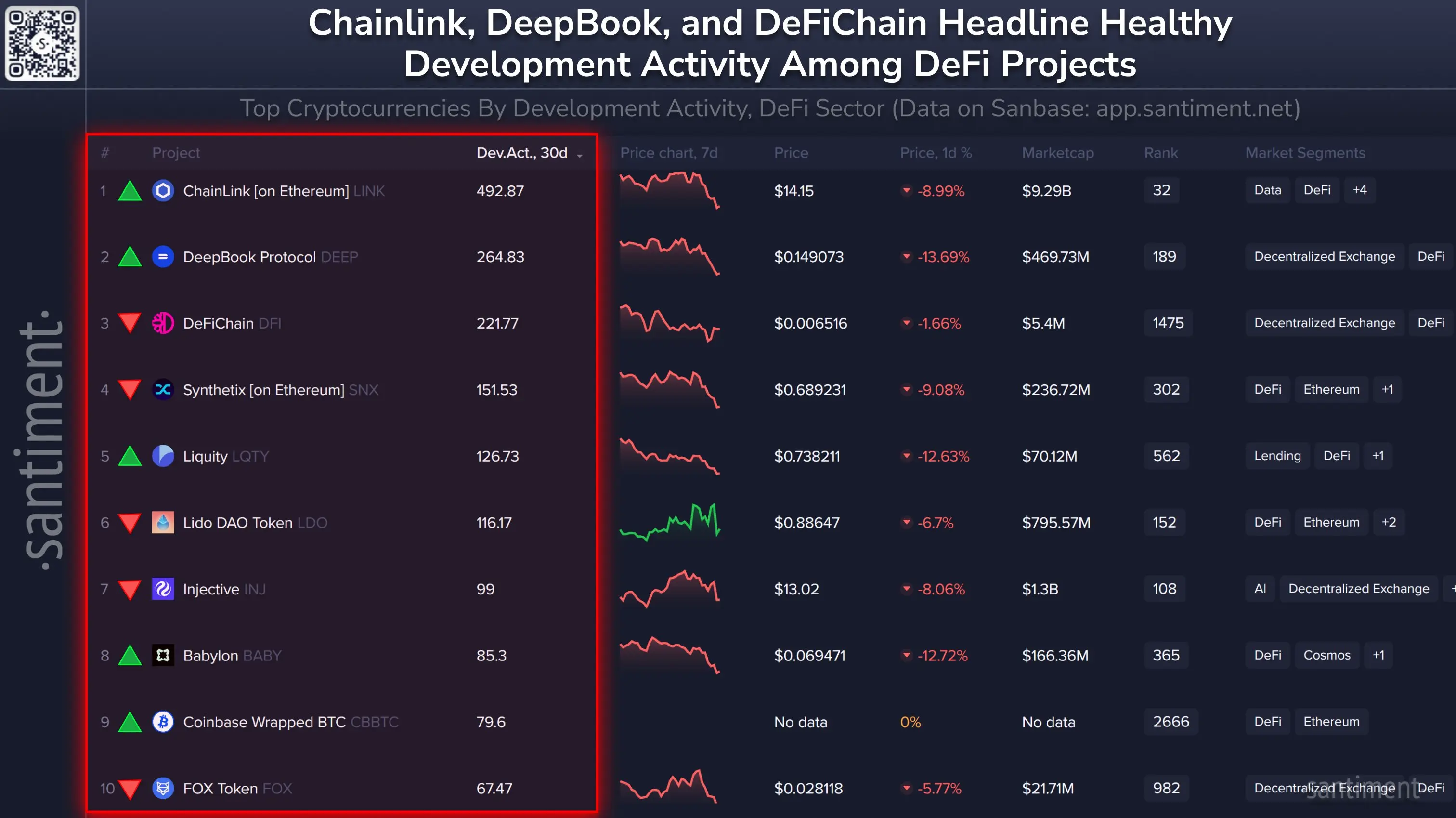

Chainlink is leading the DeFi development rankings on GitHub.

Chainlink (LINK) leads DeFi development on GitHub with a score of 492.87 in the past 30 days, followed by DEEP and DFI. DFI's presence in the top 3 despite its small market cap highlights open-source development efforts. Familiar projects like SNX, LDO, and INJ also contribute, reflecting strong technical appeal in DeFi. Santiment ensures transparency by filtering out fake updates.

TapChiBitcoin·2025-06-01 02:11

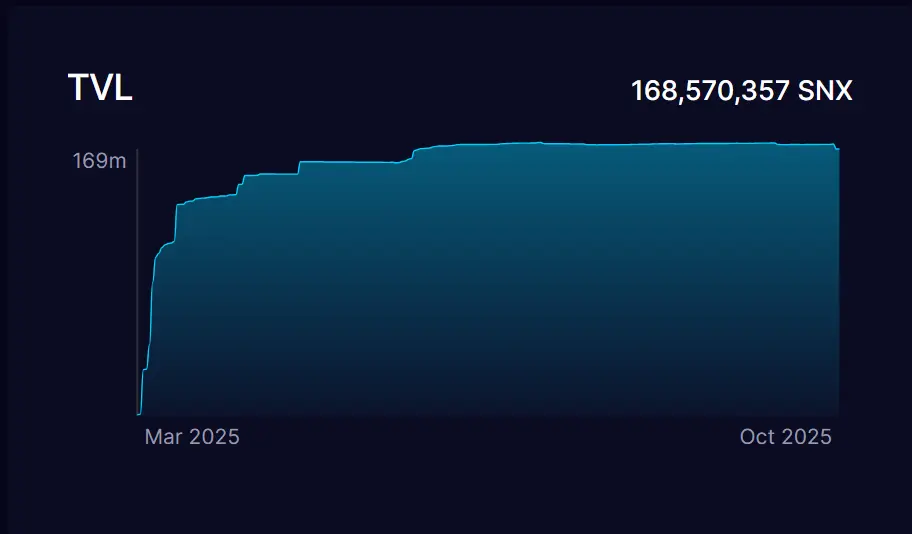

Synthetix reintroduces the SNX and sUSD stake incentive program, with a total reward of 10 million SNX.

Synthetix has relaunched the SN staking mechanism, allowing users to stake SNX in the 420 pool on the Ethereum Mainnet and share a reward of 5 million SNX. Rewards will start accumulating from May 28 and will be unlocked after the lock-up period ends. The new mechanism has lowered the participation threshold and provides flexible principal withdrawals, but early exits will result in loss of rewards. The sUSD staking channel has also been opened, with a reward pool of 5 million SNX, but the staked funds will be fully locked for 12 months.

TechubNews·2025-05-23 11:27

Synthetix proposed to acquire the Derive Options protocol in exchange for $27 million worth of Tokens.

Contributors of Synthetix proposed to acquire Derive through the exchange of SNX for DRV tokens, valuing it at $27 million, with an exchange rate of 27 DRV for 1 SNX. The acquisition will strengthen Synthetix's protocol capabilities on the Ethereum Mainnet, and DRV holders will receive SNX according to the vesting terms, locked up for 3 months, with a linear release over 9 months. To this end, 29.3 million SNX tokens will be issued. This acquisition is part of Synthetix's broader ecosystem integration strategy and may drive the launch of a derivatives trading exchange.

TokenInsight·2025-05-15 04:04

sUSD has fallen below $0.8, and the "depeg situation has worsened." Synthetix founder threatens SNX stakers: don't think you can run without making contributions.

Synthetix's stablecoin sUSD was questioned due to decoupling issues, and founder @kaiynne launched a new staking mechanism to return to anchoring, but sUSD still fell below $0.8 again. According to the update, the new mechanism needs to be operated manually for the time being, which is flashy. @kaiynne At the same time, stress to stakers that progress needs to be driven and pressure exerted. The sUSD price fell again, by 11.1%. These challenges require the SNX community to actively address them.

動區BlockTempo·2025-04-22 02:52

SNX Price Soars 7% as Synthetix Founder Talks Tough on sUSD Depeg Fix | Coinspeaker

Key Notes

Synthetix (SNX) has skyrocketed 7% in the past day, reaching a daily high of $0.6851.

SNX has formed a falling wedge pattern on the daily chart, suggesting a breakout to $1.82.

Overall, SNX is down more than 21% in the past week after the depeg of sUSD stablecoin.

The price of Synthe

Coinspeaker·2025-04-21 14:32

sUSD depeg expands and breaks $0.6! The official offers 5 million SNX rewards to fight for it, is the cure still opium?

The DeFi protocol Synthetix, which allows users to create and trade synthetic assets, announced late yesterday (18th) the official launch of the 420 Pool to address the sUSD depeg crisis. The goal is to incentivize SNX stakers to deposit sUSD by offering high rewards to increase the demand for sUSD and promote the price to return to the $1 peg. (Background: sUSD stablecoin depegged by 16%: Is it a case of mechanism failure or a buying opportunity?) (Additional context: Another stablecoin has depegged! Synthetix's sUSD once plummeted to $0.925, what happened?) Since the depeg situation arose at the end of March, the stablecoin sUSD under the DeFi protocol Synthetix, which allows users to create and trade synthetic assets, has now been more than two weeks.

動區BlockTempo·2025-04-19 03:02

Recent Reflections on DeFi: DeFi Deregulation, Repeal of the Broker Act, etc

> DeFi deregulation, the repeal of the Broker Act, the CAKE governance attack, and the continued de-pegging of sUSD, resuming recent thinking on DeFi.

Written by: Chen Mo

1/ sUSD keeps de-anchoring, why hasn't it been fixed?

Since the adoption of the SIP-420 proposal at the beginning of the year, sUSD has been de-anchored, and has recently entered a serious de-anchoring range of less than $0.9, and the key change in this proposal is the introduction of "delegation pools", which are designed to encourage users to mint sUSD through this mechanism, and the benefits are

The 200% collateral ratio ( was originally designed at 500%+)

Debt can be transferred linearly to the agreement

After the full transfer, the user does not need to pay back

The protocol dissolves the debt through profitable means and $SNX appreciation

The advantages are obvious, elevated

ForesightNews·2025-04-16 07:30

Synthetix Stablecoin (sUSD) Depegs, Drops to $0.83

sUSD, issued by Synthetix, has dropped below $1 peg, reaching $0.83 due to oversupply concerns and peg restoration mechanisms in transition. Synthetix founder reassures stability despite sUSD's poor performance and SNX token accumulation.

CryptoPotato·2025-04-10 06:46

Token buybacks cannot save coin prices! Messari analysts: Sustainable protocol revenue is the key.

The cryptocurrency market has experienced turbulence, and many protocols have adopted token buybacks as a measure to stabilize stablecoin prices. However, Messari analysts and community perspectives indicate that buybacks are merely an auxiliary means and not a long-term solution.

Buybacks are not a panacea: Messari analyzes two major risks

Messari analyst Monk tweeted yesterday that programmatic Token buybacks do not effectively prevent coin price declines, and may instead lead to capital misallocation. He listed two major issues: "High-price buybacks during bull markets lead to cash depletion" and "During bear markets, the lack of funds results in a loss of innovative flexibility":.

RAY, GMX, GNS and SNX have

ChainNewsAbmedia·2025-03-21 07:14

Messari: Why Buybacks Can't Stop Token Prices from Falling Sharply

Messari analyst DeFi MONK found that token buybacks could not stop the price from falling. He pointed out that RAY, GMX, GNS, and SNX buyback tokens, but the present value is much lower than the buyback price. Buybacks are not about price, but about revenue and narrative. When the income is good, the project party may not be able to buy back, and when the income is bad, it may lack investment. Buybacks are considered poor capital allocation and should prioritize growth or distribution of real value to holders.

金色财经_·2025-03-21 05:12

Messari researcher: The current token buyback strategies of cryptocurrency projects are mostly "capital misallocation" and it is recommended to distribute actual value to holders in the form of stablecoins/Mainstream Tokens.

The article points out that some encryption projects such as RAY, GMX, GNS, and SNX have repurchased millions of dollars worth of tokens programmatically, but the value of the tokens has significantly fallen. Researcher MONK believes there are fallacies in this repurchase, including being unrelated to price movement and depleting cash reserves. It is suggested that projects should prudently repurchase tokens, focusing on rise or allocating actual value to holders.

DeepFlowTech·2025-03-21 02:39

SNX & YFI Losing Steam? BitLemons ($BLEM) Emerges As the Next Major GambleFi Opportunity

By TokenIntel on February 11, 2025 | Market Insights

The crypto market has witnessed significant volatility lately, with established DeFi protocols Synthetix (SNX) and yearn.finance (YFI) facing headwinds. Meanwhile, BitLemons ($BLEM) continues to make waves in the GambleFi sector, having already

CryptoNewsLand·2025-02-11 15:21

37 Million Dollar Hack Allegation in Major Cryptocurrency Exchange! Here Are the Affected Altcoins!

Cyvers Alerts, a blockchain security firm, detected suspicious withdrawals of about $29 million from Singapore-based cryptocurrency exchange Phemex's hot wallet. The company stated that there were multiple suspicious transactions in multiple altcoins and the funds were exchanged for Ethereum (ETH). Several altcoins, including SNX, LDO, ARKM, PORTAL, LADYS, and WLD, were affected by the withdrawals. Phemex confirmed the incident and reported that BTC and TRON blockchains were also impacted, with an estimated total loss of approximately $37 million. Phemex CEO Federico Variola assured that their cold wallets were safe, and further updates would be released soon.

S8,64%

Bitcoinsistemi·2025-01-23 14:05

Altcoin bright lights? In the fourth quarter, SUI, CRV, ADA, and LPT were added, while SNX and AVAX were removed.

Cryptocurrency asset management giant Grayscale recently updated the allocation and weights of its 4 funds, adding four Tokens: SUI, CRV, ADA, LPT, and removing SNX, AVAX. (Background: lying in ambush altcoin signal? Grayscale's average holding assets surged over 200% in the past month) With the altcoin season approaching, the well-established cryptocurrency asset management company Grayscale recently updated the allocation and weights of its 4 funds, adding SUI, CRV, ADA, and LPT, sparking community follow-up. This may indicate a trend change behind leading Tokens recognized by industry institutions in different fields.

動區BlockTempo·2025-01-09 06:45

Top 10 RWA Altcoins for 10x Profit In 2025!

Story Highlights Discover the top 10 undervalued Real-world altcoins with the potential for exponential growth in 2025.

Projects such as Reserve Rights and Maker promise massive returns in this altcoin market.

Altcoins like HBAR, SNX, and LAND are under the radar for impressive price

BitcoincomNews·2024-12-25 12:14

Grayscale updates Decentralized Finance fund Holdings data: UNI accounts for 55.84%, AAVE accounts for 24.54%.

Shen Chao TechFlow news, on December 18th, the latest data disclosed by Grayscale shows that as of December 17th, its Decentralized Finance Fund (DEFG) managed the specific allocation of 5 Tokens:

DEX leader Uniswap (UNI) holds 55.84% of the position;

Lending protocol Aave (AAVE) holds a 24.54% share;

Liquidity staking protocol Lido DAO (LDO) has a share of 8.43% in the portfolio;

Decentralized stablecoin protocol Maker (MKR) holds a 7.17% share of the total positions.

Synthetic asset protocol Synthetix (SNX) holds a 4.02% share.

The fund is one of the first pure Decentralized Finance

DeepFlowTech·2024-12-18 14:23

Synthetix (SNX) and Terra Classic (LUNC) Complete Retests Post-Major Breakouts: What To Expect Ahead

Date: Wed, Dec 11, 2024, 11:45 AM GMT

The cryptocurrency market is beginning to stabilize after a sharp two-day correction that caused notable drops across major altcoins.

Amid this slight recovery, Synthetix (SNX) and Terra Classic (LUNC) are are showing signs of reversal, bouncing back from their

CoinsProbe·2024-12-11 12:24

Santiment Reveals the Top 10 Altcoins Developers Have Focused on in the Last 30 Days! This Altcoin is Once Again in First Place! - "Not Ethereum!"

Cryptocurrency analysis firm Santiment has released a list based on the focus of developers in ERC-20 altcoins. Chainlink (LINK) tops the list, followed by Susd (SUSD) and Synthetix (SNX). Interestingly, Ethereum (ETH) does not make it to the top three, but ranks fourth on the list. The ERC-20 altcoins that developers have focused on the most in the past month are ranked as follows: Chainlink (LINK), Susd (SUSD), Synthetix (SNX), Ethereum (ETH), Ethstatus (SNT), Decentraland (MANA), Holo (HOT), Injective (INJ), Request Network (REQ), and Graph Protocol (GRT).

Bitcoinsistemi·2024-12-09 05:06

MINA and SNX Poised for Key Breakouts: Are Bigger Rallies On The Horizon?

Bitcoin hits $100K milestone as altcoins shine. Mina and Synthetix show bullish momentum with potential gains of up to 355% and 150%, respectively, if critical resistance levels are cleared.

CoinsProbe·2024-12-06 07:33

Load More