Search results for "NOT"

Why WisdomTree withdrew its XRP ETF filing despite strong inflows

WisdomTree scraps its XRP ETF plan just as spot XRP funds rack up $1.25b inflows and consolidate around a few aggressive first movers.

Summary

WisdomTree pulled its XRP ETF S‑1, asking the SEC to withdraw all related exhibits after deciding not to proceed now.

Competing XRP ETFs from

Cryptonews·17m ago

PEPE Opened the Door, but This Gaming Crypto Presale Is Where Early 100x Potential Is Forming

Crypto does not reward hesitation. It rewards those who recognize opportunity before it becomes obvious. PEPE proved that lesson clearly. Early buyers captured life-changing gains, while those who waited for confirmation entered after momentum had already peaked.As PEPE evolved from breakout meme to

PEPE-3,43%

BlockChainReporter·1h ago

ChatGPT Predicts Whether Bitcoin Can Hold $92,000 in a Risk-On Market

Bitcoin is starting the year with strength, but not without turbulence. After briefly dipping below $92,000 yesterday, the BTC price quickly reclaimed that level and turned it back into short-term support. The price is now trading around $92,700, recovering from a rejection near $94,500

CaptainAltcoin·1h ago

Elon Musk's latest interview warns "Old-fashioned humans" to prepare for being pushed out: offices turning into blue-collar classes, energy more important than AI

Elon Musk predicts that white-collar workers will be the first to be eliminated, with robot doctors surpassing humans within three years. This is not science fiction, but a redistribution of capital. This article breaks down the logic behind this "supersonic tsunami" and analyzes how much time we have left to adapt as elites become redundant.

(Previous context: Musk comments on "Trump's nationwide spending spree": in the future, there will be no poverty, so there's no need to save money)

(Additional background: 2025 is approaching its end, and none of Musk's boasts have come true)

Table of Contents

The Reversal of Value Systems: Why Your MacBook Is More Dangerous Than a Hammer

Energy and Hardware: The Real Bottleneck and Power Centers in the AI Era

Refutation and Reflection: Don't Use "Human Warmth" as an Excuse to Escape Reality

Conclusion: Choose to be a participant, not a survivor

I have seen countless "Next Big Things,"

動區BlockTempo·1h ago

Shiba Inu Drops a Zero After 56 Days, But Quick Reversal Signals Weak Buyer Conviction

Shiba Inu briefly reached $0.00001 level removing zero after 56 days of decline.

Token reversed quickly as selling pressure overwhelmed buying demand at milestone.

Volume spike proved irregular indicating reactive trading not sustained accumulation.

Shiba Inu briefly eliminated another zero

SHIB-3,36%

TheNewsCrypto·1h ago

Preparing for AI transformation? Miner Riot sells off Bitcoin aggressively, cashing out $200 million in 2 months

To ride the AI wave, Bitcoin mining leader Riot Platforms (NYSE: RIOT) has not hesitated to "sell coins for cash." At the end of last year, it sold a total of 2,201 Bitcoins, earning approximately $200 million.

According to Riot Platforms' disclosures, the company sold 383 and 1,818 Bitcoins in November and December of last year, respectively, reducing its holdings to 18,005 Bitcoins.

Miner companies sell Bitcoin for various reasons, including covering operational costs, adjusting asset allocation, or responding to market fluctuations. However, Matthew Sigel, Head of Digital Asset Research at VanEck, pointed out that Riot's recent coin sales may be closely related to its AI data center deployment.

Matthew Sigel analyzed that Riot's end-of-year Bitcoin sales income...

区块客·2h ago

The first major bank in the US to join the fight! Morgan Stanley applies to launch Bitcoin and Solana ETFs

According to documents filed with the U.S. Securities and Exchange Commission (SEC), Wall Street investment bank Morgan Stanley officially submitted registration statements on Tuesday to launch Bitcoin and Solana (SOL) spot ETFs, becoming the first major bank in the U.S. to heavily deploy cryptocurrency asset ETFs.

The documents show that Morgan Stanley submitted two S-1 registration statements: "Morgan Stanley Bitcoin Trust" and "Morgan Stanley Solana Trust." Among them, the Solana ETF incorporates a staking mechanism, meaning that in the future, the fund will not only track the coin price but also provide investors with additional income opportunities.

Morgan Stanley currently manages approximately $6.4 trillion in assets. If the ETF

区块客·2h ago

MSCI temporarily does not exclude "coin-holding stocks," Strategy closes up more than 6% after hours! Analyst: The battle is not over yet

The index compilation company MSCI (Morgan Stanley Capital International) announced that it will temporarily not remove "Digital Asset Treasuries (DATs)" from its index products. Once the news was disclosed, the stock price of Strategy (MSTR), the publicly traded company holding the most Bitcoin globally, immediately rose.

Encouraged by the positive news, as a constituent of the MSCI index, Strategy's stock price surged over 6% to $168.4 in after-hours trading on Tuesday, strongly recovering from the approximately 4% decline during the day. Market sentiment instantly shifted from tense to optimistic.

Looking back to October last year, MSCI

区块客·2h ago

"AI Mother" Fei-Fei Li: AI development is not limited to language intelligence; optimistic about the development of spatial intelligence

Li Feifei stated that artificial intelligence has achieved significant breakthroughs, and she is excited about future developments. A new wave of generative AI will enable machines to possess spatial intelligence closer to that of humans. She founded World Labs to promote the implementation of spatial intelligence and create value.

PANews·2h ago

Siemens and NVIDIA jointly promote industrial AI systems: From digital twins to autonomous factories, accelerating AI implementation in manufacturing

Siemens(Siemens) with over 175 years of industrial heritage officially partners with NVIDIA(NVIDIA) to deepen collaboration in the industrial AI field. The two sides not only integrate hardware and software but also further combine AI, simulation, digital twins, and automation to create an industrial AI operating system that can be "practically operated and scaled in real factories." Siemens CEO Roland Busch and NVIDIA CEO Jensen Huang jointly explain for the first time the implementation timeline, application scenarios, and tangible impacts on manufacturing, energy, and the global supply chain.

Industrial AI Deployment: From Decision Support to Action

Busch pointed out that the key change in industrial AI now is that the new generation of models not only provide recommendations but can directly represent human decision-making and execution, enabling systems to begin to

ChainNewsAbmedia·2h ago

Dormant Polymarket Trader With a Strong Record on Israel–Iran Strike Bets Returns to Wager on War Again

A long-dormant Polymarket trader has resurfaced with a series of wagers tied to the possibility of an Israeli military strike on Iran.

The return has attracted attention not only because of the sensitive geopolitical context, but also due to the trader’s past performance. Consequently, those

TheCryptoBasic·2h ago

Qianhai patrol officer receives 18,000 Tether coins and is accused of espionage, selling secrets at a low price, sentenced to 7 years in August

Qianhai Coast Guard member received 18,500 USDT to leak secrets to China; Kaohsiung High Branch Court sentences him to 7 years and 8 months in August.

(Background summary: Tether trading leads to death! A 25-year-old crypto trader was robbed of hundreds of thousands and died after a "flying tackle" to block the car; 7 villains face consequences)

(Additional background: Tether Golden Empire: Tether's "Borderless Central Bank" ambitions and cracks)

On the 6th, Kaohsiung High Branch Court sentenced a national security leak case: Coast Guard officer Li from the Southern Mobile Coast Guard Team was sentenced to 7 years and 8 months for providing maritime defense deployment information to Chinese intelligence personnel, under the National Security Law. He did not accept traditional cash bribes but used Tether USDT for settlement.

18,522 USDT as spy remuneration

According to court investigations, Li was in debt due to investment losses and was targeted at the end of 2022 by a Chinese intelligence agent named Tony. The other party made a clear offer

動區BlockTempo·2h ago

Gate Research Institute: Market remains under pressure with continued volatility | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Asset Overview

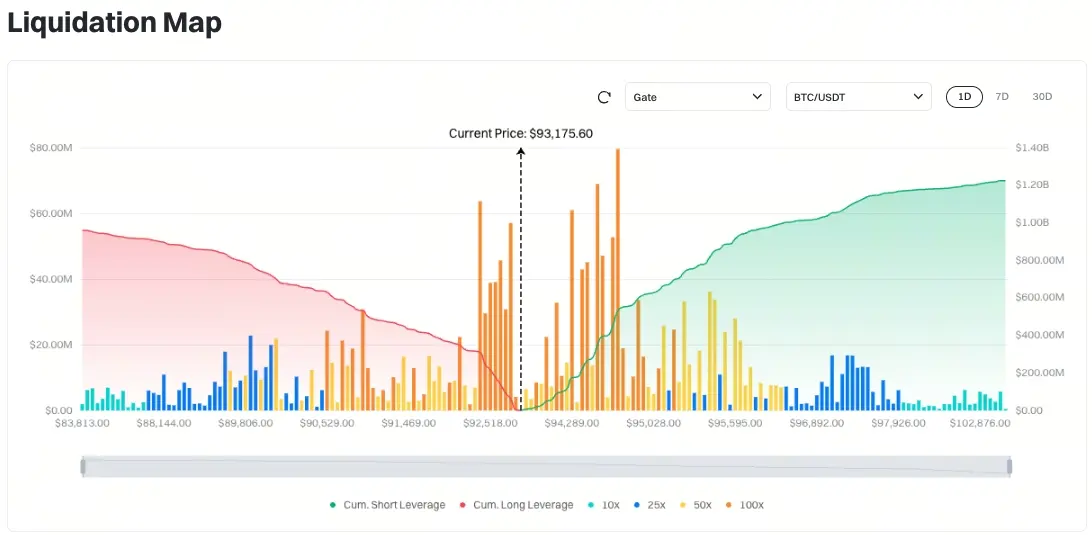

BTC (-0.21% | Current Price 92,505 USDT)

BTC has entered a consolidation phase after a short-term pullback from recent highs. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the medium-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green histogram narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; otherwise, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·4h ago

Gate Research Institute: Market sentiment shows marginal improvement | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Market Overview

BTC (-0.21% | Current Price 92,505 USDT): BTC has entered a consolidation phase after a recent pullback from its highs over the past day. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the mid-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green bars narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; conversely, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·4h ago

A false alarm? MSCI temporarily delays removing DAT, but the game is still ongoing

Article by: KarenZ, Foresight News

On January 6, the index giant MSCI (MSCI Inc.) issued an announcement that brought a glimmer of hope to the beleaguered digital asset treasury company (DAT): in the upcoming index review in February 2026, MSCI has decided not to proceed with the proposal to remove it from the Global Investable Market Index (GIMI).

This means that companies listed on the observation list due to holding large amounts of digital assets like Bitcoin will temporarily retain their positions in MSCI indices.

However, MSCI also announced a series of restrictive measures and plans to initiate broader consultations on all "non-operational companies" to comprehensively review how non-operational companies are handled in the indices. MSCI defines "non-operational companies" as those that treat digital assets and other non-operational assets as

BTC-1,77%

TechubNews·4h ago

Best Bitcoin wallets 2026: Top secure wallets to store BTC safely

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Stay safe with the best Bitcoin wallets 2026. See how Bitamp, Ledger, Trezor, Electrum, and BlueWallet protect your BTC from malware, phishing, and

BTC-1,77%

Cryptonews·5h ago

Strategy Rally Reflects Growing Confidence in Digital Asset Treasury Firms

Strategy shares surged nearly 6 percent in after-hours trading after MSCI delivered a closely watched decision. The index provider confirmed it would not exclude digital asset treasury companies from its major indexes. Investors responded immediately, viewing the move as institutional recognition

BTC-1,77%

Coinfomania·5h ago

The Great Lock-in: Why Privacy Chains Could Quietly Capture Most of Crypto This Year

Privacy-first blockchains could emerge as crypto’s dominant power centers, as a16z crypto argues secrecy, not speed, may create winner-take-most dynamics and durable lock-in as onchain finance moves toward real-world adoption.

Why a16z Crypto Sees Privacy Chains Reshaping Onchain Value

Crypto’s

Coinpedia·5h ago

NVIDIA bets on Elon Musk's xAI with $20 billion in funding, which crypto sectors will benefit directly?

Elon Musk's artificial intelligence company xAI has just completed a Series E funding round of up to $20 billion, with its valuation soaring to $80 billion, in which NVIDIA participated as a core strategic investor. This epic funding not only accelerates the construction of the world's largest GPU cluster but also pushes the AI computing power race to new heights.

For the cryptocurrency industry, this event is far more than just tech news; it sends a strong signal illuminating several key tracks at the intersection of "AI + Crypto": from decentralized computing power markets, AI agents and data ownership, to Real World Assets and Depin infrastructure that carry computing value. This article will delve into the capital logic and regulatory challenges behind xAI's funding, and focus on interpreting the specific investment opportunities and paradigm shifts it may bring to the crypto world.

MarketWhisper·5h ago

Solana in 2025: $2.4 billion invested, DEX trading volume exceeds $1.5 trillion. Where is the next stop?

In 2025, Solana delivered a phenomenal annual performance report, with multiple core metrics reaching new all-time highs, marking its evolution from a high-throughput technological narrative to a mature financial ecosystem with a solid economic foundation. The total revenue of applications built on Solana for the year reached $2.39 billion, a 46% increase year-over-year; the total trading volume on decentralized exchanges surpassed $1.5 trillion, a 57% growth.

Meanwhile, the network's daily active wallets reached 3.2 million, the stablecoin supply soared to $14.8 billion, while the average transaction fee dropped to $0.017. These data collectively paint a picture: Solana has not only achieved a significant leap in scale but also made substantial breakthroughs in revenue generation, asset accumulation, and institutional adoption, establishing its position as a top trading and innovation platform in the crypto world.

MarketWhisper·6h ago

Behind the AI frenzy, an overlooked debt gamble

Written by: thiigth

Wall Street veteran and Oak Tree Capital's Howard Marks recently made a wake-up call. The gist is: if this AI frenzy doesn't end up becoming a classic bubble burst, it will be the only exception in human financial history.

But the problem is, most people are looking in the wrong place.

We are still debating whether Nvidia's stock price is too high, or who will be the next Cisco. Everyone is obsessively watching every flicker on the K-line chart, trying to find clues of a collapse. However, the real storm is not at the bustling stock exchanges, but in the silent, hidden corner that determines life and death — the credit market.

This is not a math problem about Price-to-Earnings (P/E) ratios, but a high-stakes gamble built on massive debt.

01 The Disappearing "Cash Cow"

In this story, our biggest mistake

TechubNews·6h ago

What is 114514 Coin? An in-depth analysis of the craze and risks of Japan's emerging Meme coin

By the end of 2025, a Japanese Meme coin called 114514 Coin emerged on the Solana blockchain, and in early January 2026, it experienced a textbook-like surge and crash. Its price skyrocketed up to 10 times in a short period, with a market cap approaching $17 million, only to quickly give back most of the gains, attracting widespread market attention.

This article will provide an in-depth analysis of what 114514 Coin is, explore the deep roots of Japanese online subculture behind it, review its dramatic market performance, and offer a professional assessment of its future trends and potential risks based on on-chain data and market psychology. For investors passionate about the Meme coin track, this is not only a case of short-term speculation but also a vivid lesson on market sentiment, liquidity, and risk management.

MarketWhisper·7h ago

After Ledger customer data breach, experts emphasize that privacy protection is the most important preventative measure

Cryptocurrency hardware wallet manufacturer Ledger recently confirmed a data breach involving its third-party e-commerce partner Global-e, which resulted in the theft of customer information. Customers who purchased cold wallet products through the official online store had their personal data compromised. Following the exposure, the cryptocurrency community expressed concerns about the security of cold wallets and hardware wallets.

Customer private keys were not leaked, but user names and contact information were stolen.

According to Ledger, the incident did not involve private keys, wallet funds, or payment information. However, the leaked data included user names and contact details. Security researchers pointed out that once such information falls into malicious actors' hands, it could be used for targeted scams, social engineering attacks, and even real-world threats ( such as robbery ). Within hours of the news of the data breach, users reported receiving大量 phishing emails and scam messages. Attackers also impersonated Ledger

ChainNewsAbmedia·7h ago

"Wall Street Guru" Tom Lee predicts: Bitcoin has not yet peaked, and could hit a new high as early as January.

Although the cryptocurrency market experienced a significant correction by the end of 2025, investment research firm Fundstrat co-founder and known as the "Wall Street Oracle" Tom Lee remains highly confident and optimistic about this year's market performance. He believes that Bitcoin's upward momentum has not yet peaked, and it could potentially reach new highs as early as January this year.

Looking back at Tom Lee's past predictions, they can be described as bold and aggressive. In August of last year, he confidently stated that Bitcoin would break the $200,000 mark before the end of 2025. However, reality is always challenging. Although Bitcoin briefly reached a historic high of approximately $126,000 in October last year, the rally lacked follow-through, and by the end of 2025, it retreated to around $88,500.

In response to his inaccurate forecast, Lee appeared on CNBC's program "Squawk Box" on Monday to

ETH-0,46%

区块客·7h ago

Why is Meta's acquisition of Manus under scrutiny? A $2 billion deal may trigger China's technology red line

Meta acquires AI startup Manus for $2 billion, with China's Ministry of Commerce evaluating whether it violates technology export controls. Manus was founded by a Chinese team and was sold to Meta after relocating to Singapore. Although not core technology, this case could trigger a "Singapore whitewashing" demonstration effect, serving as a warning for Web3 and crypto projects.

MarketWhisper·7h ago

Putting mainstream AI in the same room to work: some are obsessive, some love to slack off—who is the best employee?

AI Village places multiple top-tier models in a shared environment to observe their autonomous collaboration and emergent behaviors, revealing how efficiency-oriented professional models can redefine social and personality boundaries.

The digital version of "Big Brother" reality show: AI Village grants models full autonomy

---------------------------------

Imagine a digital version of "Big Brother" reality show, but contestants do not need to sleep, eat, and can even rewrite the game rules themselves. This is the core of the "AI Village" experiment initiated and maintained by professional organization AI Digest for nearly a year.

This experiment involves models from OpenAI, Anthropic, Google, and

CryptoCity·7h ago

MICA Daily|BTC struggles to advance, pulls back to 92,000; tonight's ADP Non-Farm Employment Change will influence market trends

BTC broke above $94,000 two days ago, but experienced a significant pullback yesterday. However, it was also mentioned yesterday that if BTC falls below $91,000 again, it will enter a bear market. Fortunately, the daily chart price is still holding above $92,000. If there is a clear rebound in the next few days, there is a chance to follow the US stock market upward. To confirm a return to an upward trend, the price needs to effectively break through $97,000. Currently, the selling pressure at $94,000 is quite strong, so it is expected to be difficult to reach in the short term. Therefore, holding above $91,000 is more important at the moment.

Let's also look at on-chain data. Even if the price returns above $92,000, the current on-chain demand still remains insufficient. A larger rebound is needed to support a breakthrough of $97,000. In a market with uncertain sentiment and low trading volume, on-chain activity has not shown obvious improvement recently. However, as the holiday ends, many investors who had reduced their trading are gradually

BTC-1,77%

区块客·8h ago

From a "pre-commitment" trade, understand the hottest Web3 track in 2025: prediction markets

1. Introduction

In early January Beijing time, a message circulated on overseas social platforms and multiple crypto communities: the U.S. government has taken strong actions regarding the Venezuela situation, drawing significant attention from the international community. Almost simultaneously, a trading record on a decentralized prediction platform was rapidly amplified and discussed by the market.

Data shows that within just four days starting from December 27, 2025, an account on the prediction market platform Polymarket invested approximately $32,537 USD, continuously betting on the event that "Venezuelan President Maduro will step down before January 31." Notably, this account concentrated large positions just hours before the related news was widely discussed externally.

At that time, the market's overall pricing of the likelihood of the event was not high, around 6%. As the situation evolved and the United States

TechubNews·8h ago

MSCI Index continues to favor MicroStrategy! MSTR rises over 6% after hours, but analysts warn: the game is not over yet

Global index giant MSCI announces it will temporarily retain Digital Asset Treasury (DAT) companies in its indices, prompting MicroStrategy (MSTR) to surge after hours. However, analysts warn that the review of non-operating companies is not yet complete, and long-term risks remain.

MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

----------------------

Bitcoin reserve company MicroStrategy (now named Strategy) stock MSTR surged over 6% after hours early this morning (1/7), mainly because the global index provider MSCI decided not to remove Digital Asset Treasury (DAT) companies from its global indices for now.

Image source: Google Finance MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

MSCI pointed out that it is important to distinguish between pure investment companies and those that view digital assets as core operational assets.

CryptoCity·8h ago

Polymarket adjusts trading mechanism, 15-minute crypto market opening and closing order fee

Prediction Market Platform Polymarket recently updated its official trading documentation, showing that its "15-minute cryptocurrency price movement market" has officially started charging transaction fees to the (Taker), indicating a change in Polymarket's long-standing zero-fee mechanism. However, this applies only to specific short-term crypto markets, while most other markets continue to operate with no transaction fees.

Polymarket quietly updates, charging first in the 15-minute crypto markets

According to the latest Polymarket documentation, the platform has officially started charging transaction fees for the "15-minute cryptocurrency up/down markets," and these fees are only applied to the Taker side. The documentation indicates that this system is not universally applied but is limited to high-frequency, very short-cycle crypto markets. Most other markets still maintain the original no-fee structure.

Clear purpose for the fees, making the taker fee fully

USDC0,04%

ChainNewsAbmedia·8h ago

Crypto community "base camp" Discord secretly submits IPO: 200 million monthly active Web3 entry points to a highlight moment

The well-known community platform Discord has secretly submitted an initial public offering (IPO) application to the U.S. Securities and Exchange Commission (SEC), planning to go public with the support of Goldman Sachs and JPMorgan Chase. This company, which has over 200 million monthly active users and was once valued at $15 billion, rejected a $12 billion acquisition offer from Microsoft in 2021 and has now chosen to list independently.

This move comes as the U.S. tech IPO market is warming up, with last year's funding more than double that of 2024. For the cryptocurrency industry, Discord's IPO is not only a business milestone but also a key signal that its status as a core infrastructure of Web3 is gaining recognition from mainstream capital markets.

MarketWhisper·8h ago

How to Legally and Compliantly Operate a "Stablecoin Payment Company" in Singapore: A Practical Checklist for Founders

Written by: Lawyer Yang Qi

Stablecoins are being increasingly used by enterprises for settlement, cross-border payments, fund management, and B2B payments. However, in Singapore, "using stablecoins for payments" is often not just a product issue but a typical comprehensive project involving regulatory boundaries + AML/CFT anti-money laundering + technological risk management.

This article explains the core approach in a way that "entrepreneurs can execute": first clarify your business model, then establish licensing and compliance systems, which can significantly reduce the risk of regulatory violations and subsequent rectification costs.

Note: This article is for general informational purposes and does not constitute legal advice. The final compliance conclusion depends on your transaction processes, customer types, and the flow and control of funds/tokens.

1. The most important first step: "Draw out" your business

Before discussing specific implementation steps, please

USDC0,04%

TechubNews·9h ago

Bloomberg: Discord has secretly filed for an IPO, teaming up with Goldman Sachs and Morgan Stanley to rush for a U.S. stock listing

Popular social app Discord has secretly submitted an S-1 to go public, collaborating with Goldman Sachs and JPMorgan Chase to accelerate the IPO.

(Background: Elon Musk's net worth approaches $750 billion, the first in history! Court restores sky-high compensation, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO)

Bloomberg citing sources reports that popular social software Discord has secretly filed an IPO application with the U.S. Securities and Exchange Commission (SEC), expected to list on the US stock market this year. People familiar with the matter told Bloomberg that Goldman Sachs (Goldman Sachs) and JPMorgan Chase

動區BlockTempo·9h ago

Grayscale completes historic debut: US Ethereum ETF distributes staking rewards for the first time, with $9.4 million in cash received. Is the battle for returns about to begin?

On January 5, 2026, the world's largest digital asset management company Grayscale announced that its Ethereum staking ETF (ETHE) will distribute its first staking yield to shareholders, totaling approximately $9.4 million. This marks the first time that on-chain staking rewards from a U.S.-listed spot cryptocurrency exchange-traded product (ETP) have been converted into "dividends" for traditional financial products, representing a milestone in structural significance. This move not only upgrades a simple price-tracking tool into an income-generating asset but also could trigger a new round of competition among mainstream institutions around "yield," attracting a broader range of traditional income-focused investors into the crypto market.

MarketWhisper·9h ago

Giant players enter the scene: Morgan Stanley officially applies for Bitcoin and Solana spot ETFs

Global financial giant Morgan Stanley has submitted documents to the US SEC to apply for spot Bitcoin and Solana ETFs. This not only marks the bank managing trillions of dollars in assets officially entering the cryptocurrency fund space but also could inject new vitality into the traditional financial markets. If approved, these products will provide qualified investors with a regulated direct investment channel in digital assets, further promoting the integration of cryptocurrencies into mainstream investment portfolios. This application comes at a time when the US spot cryptocurrency ETF market assets under management have surpassed $150 billion, indicating sustained strong institutional demand.

MarketWhisper·9h ago

Big news! Trump’s tariff case is expected to be announced on the 9th, with three possible rulings analyzed.

The U.S. Supreme Court will rule on January 9 whether Trump's global tariff policy is legal. The policy has generated $200 billion in revenue for federal finances. The court may issue three possible rulings, and the outcome will affect the U.S. president's authority over trade and the global supply chain. If found unconstitutional, the government will face a complex refund process, but it does not rule out the possibility that the executive branch could continue exerting pressure through other means.

動區BlockTempo·9h ago

Pi Network's top recommendation: multi-signature wallets! The end of single-key era to prevent hacking upgrades

Pi Network launches the first multi-signature wallet, marking a major upgrade in ecosystem security. The new wallet requires multiple keys to authorize transactions, eliminating the vulnerability where a single key theft results in total asset loss. Using the ed25519 encryption standard, it supports test transactions within the ecosystem. Developers and enterprises can securely manage shared funds, and community governance will also benefit. The multi-signature mechanism introduces additional authentication points to prevent unauthorized access, ensuring that even if some keys are lost, assets will not be compromised.

PI-0,69%

MarketWhisper·9h ago

Elon Musk's XAI aggressively raises 20 billion USD in funding! Not only selling shares, but also using NVIDIA GPUs as collateral

Elon Musk's AI startup xAI completes $20 billion Series E funding, valuing at $230 billion. The funds will expand the Colossus super data center and adopt innovative equity and debt financing models, collaborating with companies like NVIDIA, Cisco, and others to ensure technological and financial support, accelerating the development of the large language model Grok.

ChainNewsAbmedia·10h ago

Gate Daily (January 7): The US transfers over 225 million USDT; MSCI list decision temporarily does not exclude MicroStrategy

Bitcoin (BTC) initially declined then rebounded, currently around $92,770 as of January 7. The US government moved out over 225 million USDT, raising concerns. MSCI has decided not to remove MicroStrategy and digital asset funds from the index list for now. According to Bloomberg, the chat platform Discord has secretly submitted an IPO application to the U.S. Securities and Exchange Commission.

MarketWhisper·10h ago

MSCI temporarily lifts ban! MicroStrategy surges 5% after hours, Bitcoin-related stocks escape unscathed

MSCI will not remove the digital asset universe (DAT) from the index for now, and MicroStrategy (MSTR) rose 4.36% after hours. MSCI's proposal in October to exclude companies with digital asset holdings over 50% faced a backlash. Currently, the approach to DAT companies remains unchanged, but ongoing review will continue.

MarketWhisper·10h ago

Why did Bitcoin rebound today? The Venezuela crisis sparks a risk-averse wave, and Trump does not rule out military action against Greenland.

Bitcoin rebounded to around $93,860 today, driven by three main factors: the Venezuela geopolitical crisis triggering safe-haven demand, Trump not ruling out military action against Greenland, technical oversold recovery, and institutional buying resuming. The technical structure has shifted from a descending triangle to a narrowing wedge, with RSI rising above the midline. After holding the $92,000 support, the probability of breaking through the $100,000 barrier increases.

MarketWhisper·10h ago

Discord secretly submits IPO, can a billion-dollar valuation boost the investment frenzy?

According to Bloomberg, the well-known community messaging platform Discord has secretly submitted an application for an initial public offering (IPO) to U.S. regulators. Discord has over 200 million monthly active users, reached a valuation of $15 billion in 2021, and has previously rejected Microsoft's acquisition offer. However, while advancing its listing, the company also faces regulatory pressure and challenges to strengthen child safety measures.

Discord Secretly Applies for U.S. Stock IPO, a Key Signal of the Rebound in Tech Stock Financing

The well-known communication software Discord is reported to have submitted an IPO application confidentially, marking an important signal of the tech unicorn's return to the capital market. The company is currently working closely with Goldman Sachs and JPMorgan Chase. Although the specific timeline for listing has not been finalized, its over 200 million monthly active users have made it a market focus.

U.S. Tech Stocks I

ChainNewsAbmedia·11h ago

Global Index Maker MSCI Defers Decision on Dropping Crypto-Focused Companies

In brief

MSCI said it will not change the index treatment for digital-asset treasury companies in its February 2026 review.

Initial consultation flagged investor concerns that some DATs appear to be investment vehicles rather than operating firms.

Shares of Strategy rose after the

Decrypt·11h ago

MicroStrategy remains in the MSCI index, MSTR surges nearly 7% after hours

MSCI Index Company officially announced yesterday that it will not temporarily remove "Digital Asset Treasuries" (DATs) holding large amounts of Bitcoin from its global investable market indices. This decision directly alleviates the crisis faced by companies like MicroStrategy (Strategy), which are experiencing hundreds of billions of dollars in passive fund outflows, and caused MSTR's stock price to surge nearly 7% after hours.

MSCI Decides to Keep DATs like MicroStrategy in the Index

One of the world's largest index providers, MSCI, initiated a consultation last October to exclude digital asset finance companies (DAT) such as MicroStrategy, MARA Holdings, and Riot Platforms from the index, because DATs may exhibit characteristics similar to investment funds and do not meet MSCI's criteria.

ChainNewsAbmedia·11h ago

The Howey Test Explained: Why It Matters for Cryptocurrency

Innovation in cryptocurrency is remaking the world of finance as regulators strive to keep up with it. New tokens are launched by developers, although not all of them comply with legal regulations. The

CryptoNewsLand·15h ago

Nvidia H200, export restart to China draws attention... U.S. government approves "undetermined"

The U.S. government is currently processing the export approval procedure for NVIDIA's high-performance graphics processing unit (GPU) H200 to China, but the specific approval time has not yet been determined. Amid the tense U.S.-China relations surrounding semiconductor export controls, industry and market attention are focused on this matter.

On January 6 local time, at the CES 2026 held in Las Vegas, NVIDIA's Chief Financial Officer Colette Kress stated, "The U.S. government is actively advancing the export approval work for H200," but also mentioned that "the outcome remains uncertain." This is not contradictory to recent remarks by President Donald Trump about restarting exports of H200 chips to China, but it implicitly suggests that the administrative process is still incomplete.

NVIDIA has been one of the most closely watched companies in the recent AI semiconductor market, with H200 being one of its flagship products. This product is based on the current generation of NVIDIA GPU architecture.

TechubNews·15h ago

Bitmine Stakes 771K ETH in Two Weeks, Shifting 18.6% of Holdings to Earn Yield

CryptoQuant’s brief, blunt tweet landed like a splash in a calm pond: “Bitmine, Ethereum’s largest DAT, has started staking. In just two weeks, they’ve staked ~771K ETH, about 18.6% of their 4.14M ETH holdings. They’re not just buying ETH with dollars, they’re now earning it through staking

ETH-0,46%

BlockChainReporter·18h ago

Morgan Stanley Registers Bitcoin and Solana Funds With SEC

Morgan Stanley has filed for spot Bitcoin and Solana ETFs, awaiting regulatory approval. These passive funds aim to track the performance of their respective cryptocurrencies but have not yet disclosed custodians or fees. Bitcoin ETFs currently hold $119 billion in assets, while Solana ETFs are a newer investment option.

Decrypt·19h ago

Three Frameworks, Zero Harmony: Why Global Crypto Regulation Is Keeping Institutions on the Sidel...

The EU, US, and UK have each unveiled comprehensive crypto frameworks , but staggered timelines and structural incompatibilities mean institutions are building infrastructure, not deploying capital.

2025 was supposed to be the year institutional adoption arrived. The headlines suggested as much:

BTC-1,77%

CryptoBreaking·20h ago

ETF net assets surpass 300 trillion KRW… Retail investor assets surge towards KOSPI high rebound trend

KOSPI, South Korea's Composite Stock Price Index, first surpassed the 4,500-point mark, while the net asset scale of domestic listed index funds(ETF) market first exceeded 300 trillion Korean won. This is interpreted as a result of investor influx driven by a strong stock market and the diversification of ETF products.

According to the Financial Investment Association, as of January 5, 2026, the total net assets of domestic ETFs amounted to 303.5794 trillion Korean won. Considering that the net assets on the previous day, January 4, were 298.2461 trillion Korean won, this means an increase of over 5 trillion Korean won in just one day. The direct background is that the KOSPI index closed 67.96 points higher than the previous trading day, reaching 4,525.48 points, setting a new record high.

ETFs are "passively" managed products that fully track specific stock price indices and do not have dedicated fund managers actively adjusting the investment portfolio. Because they are similar to stocks

TechubNews·21h ago

Load More