Search results for "MMT"

The Deadly Trap Behind Profitable IPOs: How Retail Investors Can Use a "Chain Trap" to Fight Back Against Market Makers' Sniping?

With the issuance of new-generation cryptocurrencies such as Monad, MMT, MegaETH, and others, many retail investors participating in new coin offerings face a common dilemma: how to secure their substantial paper profits.

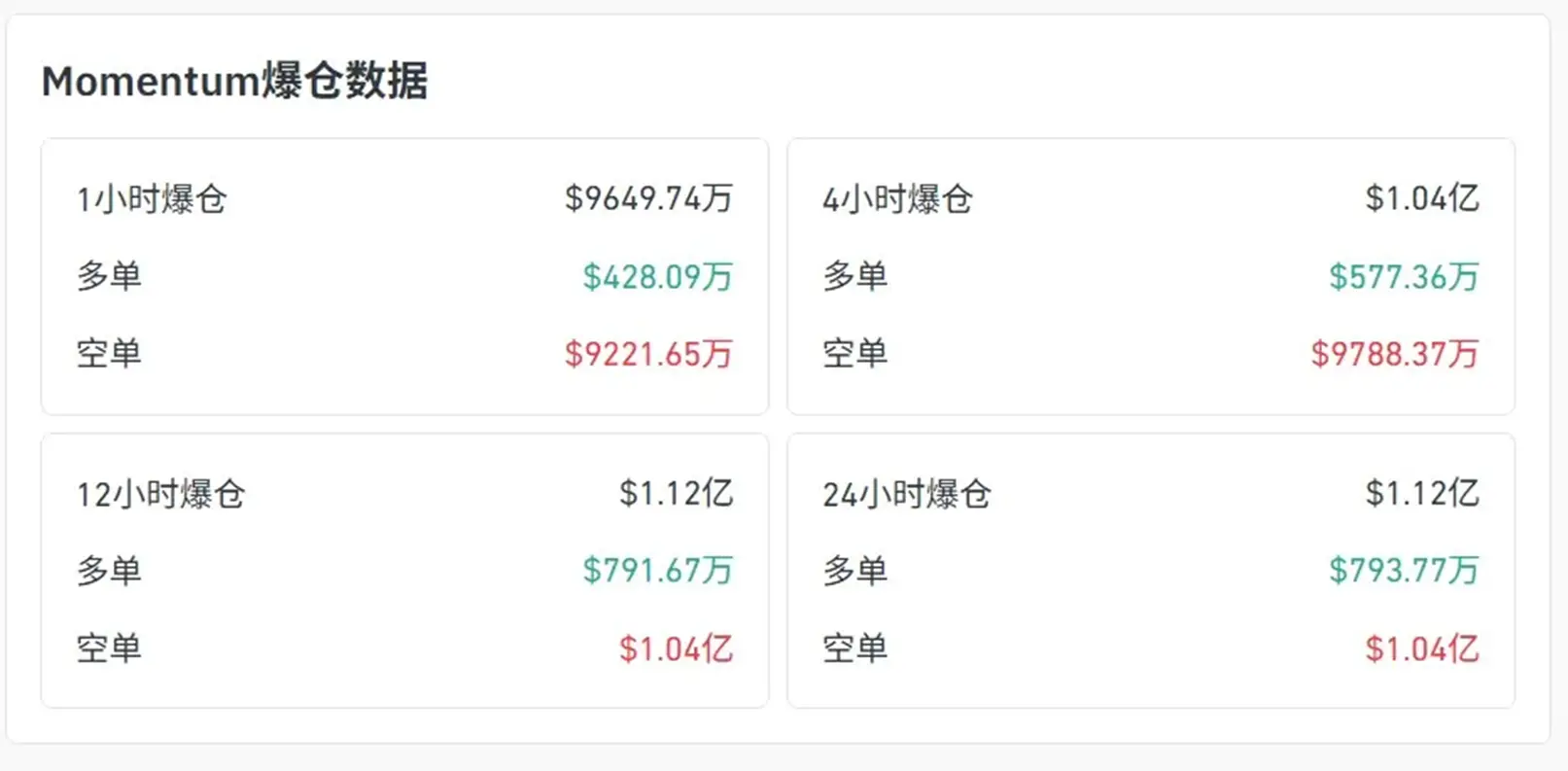

A common hedging strategy is to hold the spot asset and open equivalent short positions in the futures market to lock in profits. However, this approach often becomes a "trap" for retail investors in new tokens. Due to poor liquidity in new coin futures and the presence of numerous locked-up chips in the market, "malicious actors" can exploit high leverage, high funding rates, and precise market manipulation to forcibly liquidate retail investors' short positions, erasing their profits. For retail investors lacking bargaining power and OTC channels, this is almost an unsolvable game of cat and mouse.

In the face of market makers' sniper attacks, retail investors must abandon the traditional 100% precise hedging and instead adopt diversified, low-leverage defensive strategies: (from a mindset of managing returns to managing risks)

Cross-exchange arbitrage

PANews·2025-11-21 07:02

Liquidity shortage in new coin trap hedging games: A new way for retail investors to earn from IPOs?

Author: danny; Source: X, @agintender

With the issuance of the new generation of cryptocurrencies such as Monad, MMT, and MegaETH, many retail investors participating in the initial offerings face a common dilemma: how to secure substantial paper profits?

The general hedging strategy is to open an equivalent short position in the futures market after acquiring the spot asset, in order to lock in profits. However, this strategy often becomes a "trap" for retail investors with new cryptocurrencies. Due to poor liquidity in new coin contracts and a large amount of tokens waiting to be unlocked in the market, "insiders" can use high leverage, high funding rates, and precise market manipulation to force the liquidation of retail investors' short positions, causing their profits to drop to zero. For retail investors lacking bargaining power and OTC channels, this is almost an unsolvable game.

In the face of the dealer's attacks, retail investors must abandon the traditional 100% precise hedging and instead adopt a diversified, low-leverage defensive strategy.

金色财经_·2025-11-19 02:36

Binance VIP borrowing coins has added BFUSD as collateral assets, and added KITE, MMT, and SAPIEN as Borrowable Assets.

According to Mars Finance news on November 12, the official announcement states that Binance VIP borrowing now includes BFUSD as a collateral asset. In addition, Binance VIP borrowing has also added Kite (KITE), Momentum (MMT), and Sapien (SAPIEN) as borrowable assets.

MarsBitNews·2025-11-12 03:50

Momentum (MMT) initially surged by 885%, with over-subscription of 376 times, betting on the Sui ecosystem.

On November 4, 2025, the Momentum (MMT) token officially launched on trading, with its price soaring 885% within a few hours to $0.8859, setting a new record for the best first-day performance of the year for a token issuance.

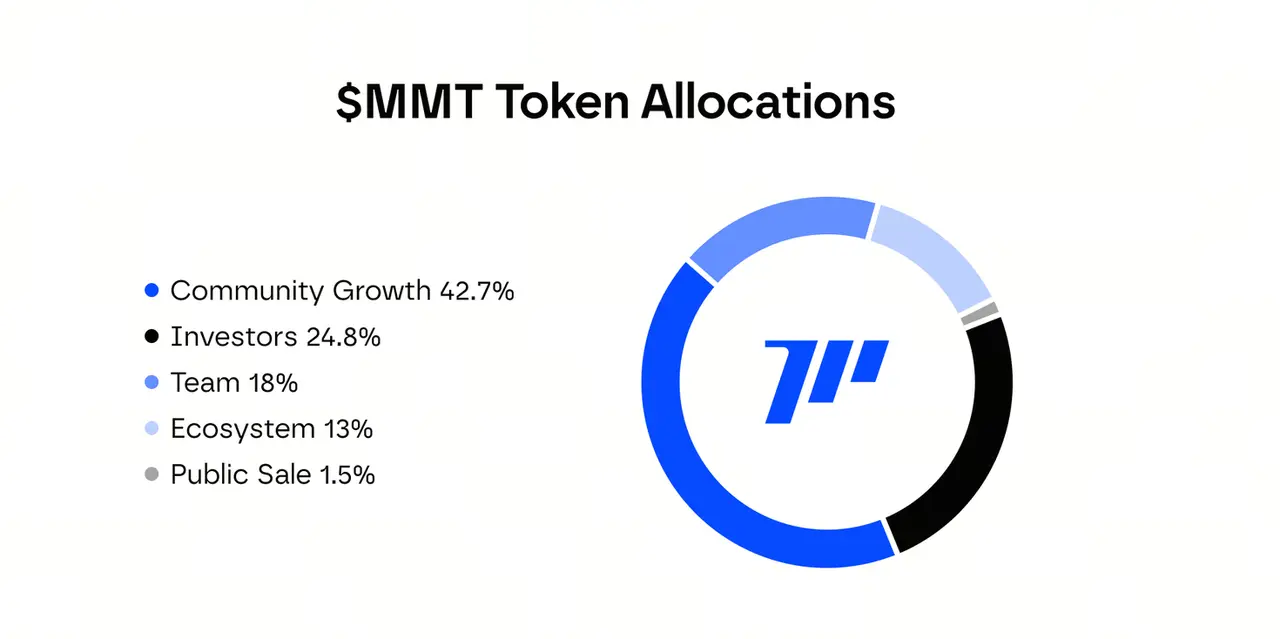

MMT adopts a unique hybrid token economic model, with a total supply of 1 billion tokens. Of these, 42.7% are allocated to community development, 24.78% belong to early supporters, and 18% are held by the founding team. The project does not set a maximum supply limit but commits to using 20% of market fees and 15% of quarterly profits for token buybacks and burns. Additionally, it plans to conduct airdrops on the Sui blockchain to expand the cross-chain ecosystem.

MarketWhisper·2025-11-11 09:27

Momentum (MMT) surges 800%, market cap hits 5.2 billion. The next DeFi king?

Momentum (MMT) skyrocketed from relative obscurity to a giant with a market cap of $5.18 billion within a week after oversubscribing in the Binance Prime Sale. After launching on Binance on November 4, the price surged nearly 800% within just a few hours, reaching a high of $0.8859. On November 5, it briefly exceeded $4.40.

MarketWhisper·2025-11-11 02:45

What is Momentum (MMT)? Sui DeFi's new star TGE skyrockets 4000%

What is Momentum (MMT)? Momentum is a decentralized finance (DeFi) hub based on the Sui blockchain, providing trading, staking, and asset management services within a unified ecosystem. MMT is the native token of the protocol, and after the TGE, its price surged from $0.39 to a historical high of $4.47, an increase of over 4000%.

MarketWhisper·2025-11-10 02:37

MMT Short Squeeze Event Review: A Carefully Crafted Money-raising Game - ChainCatcher

The MMT short squeeze event revealed market manipulation and a trust crisis. KOLs and speculators faced huge losses due to high leverage short positions, with the price plummeting almost erasing all evaporated capital. This incident serves as a reminder for investors to exercise caution and control risks in uncertain markets to avoid repeating the same mistakes.

MMT-0,08%

链捕手·2025-11-07 11:33

MMT short squeeze event review: a meticulously designed money-making game

The MMT short squeeze event triggered market fluctuations, causing losses for KOLs and retail investors, exposing industry manipulation and a crisis of confidence. After receiving investment, the MMT Token subscription was hot, but on the first day of listing, the price fell below the issue price, leading to a large number of investors getting liquidated. This event warns investors to be cautious of the risks associated with Futures Trading.

MMT-0,08%

MarsBitNews·2025-11-07 11:16

The Momentum team (MMT) has transferred 38 million MMT to Binance.

According to data from Suiscan, the wallet 0xe7cd…7a88a4 related to the Momentum team (MMT) transferred 38 million MMT ( equivalent to approximately 45.6 million USD) to Binance at 16:00 on November 5th (UTC+8). This amount of tokens came from the second largest wallet of MMT (0x1b4d2…7355c8), holding 18.57% of the total supply. From 18:41 on November 4th to 00:12 on

MMT-0,08%

TapChiBitcoin·2025-11-06 10:08

This Cryptocurrency Rallied 255% in 24 Hours After Binance Listing

Momentum (MMT) has surged 255.7% recently, hitting a $1 billion valuation, despite a broader crypto market crash. Listing on major exchanges like Binance boosted its appeal, but ongoing economic issues and a US government shutdown may threaten its rally.

IN3,75%

TheBitTimesCom·2025-11-06 05:06

The suspected Momentum team address transferred 38 million MMT to Binance, and after the token was listed, it rose to 4.4 USD and has now fallen to 0.66 USD.

On November 5th, an address suspected to be associated with the Momentum team transferred 38 million MMT to Binance, worth approximately 45.6 million USD. The MMT originated from the second largest holder, who transferred nearly 89.5 million MMT to multiple addresses the day before. The price of MMT surged dramatically at the launch, followed by a significant drop.

MMT-0,08%

WuSaidBlockchainW·2025-11-06 04:35

Recap: Momentum $MMT Suddenly Attacks Air Force in the Middle of the Night, Then Sharp Drop! The Details of Retail Investors Liquidating $109 Million

On the day of the Momentum (MMT) TGE in the Sui ecosystem's DeFi flagship, the price surged from $0.34 to $4.40 before sharply dropping. This was accompanied by a liquidation cascade totaling approximately $109 million and a squeeze on high-leverage shorts, causing significant losses for derivative shorts and retail traders chasing high prices. (Background recap: Retail investors poured $1.4 billion into "shaking out" altcoins; MegaETH, zkPass, and Momentum ICOs exceeded expectations.) (Additional context: x402 boom—tutorials on new coin minting, ecosystem browser, real-time trading tracking… comprehensive toolset overview.) On November 4th, Momentum (MMT) was simultaneously listed on multiple exchanges, triggering a rapid interaction between futures and spot trading. The price climbed from a low of $0.34 to a peak of $4.40, then quickly...

MMT-0,08%

動區BlockTempo·2025-11-05 23:11

Bitget has launched a new contract new coin event, trading MMT to unlock USDT Airdrop.

Bitget launched a new Futures Trading coin event on November 5, attracting both new and old users to participate. New users who complete their first Futures Trading will receive a reward of 10 USDT; the top 1000 users by trading volume will collectively unlock 20,000 USDT, with an individual maximum of 3,000 USDT. The event will end on November 12, and detailed rules can be found on the official platform.

MMT-0,08%

DeepFlowTech·2025-11-05 11:40

Understand Momentum in One Article: $10 Million Financing, Leading DEXs Compete to Launch, Surged Over 255% in a Single Day, FDV Breaks $1.2 Billion

What is Momentum? It is a decentralized exchange and liquidity protocol based on the Sui blockchain, dedicated to building the next-generation global financial operating system and achieving full asset on-chain trading through a three-phase strategy. This article provides an in-depth analysis of its core product ecosystem and MMT token economy model, revealing how it achieves a perfect combination of governance and incentives through the innovative veMMT mechanism.

MarketWhisper·2025-11-05 05:50

Momentum (MMT) Price Analysis: Today's Surge and Key Trends

Momentum (MMT), the governance token powering the Momentum ecosystem on the Sui blockchain, is experiencing a dramatic rally today, surging over 400% to $2.47, amid heightened trading activity and ecosystem milestones.

MMT-0,08%

CryptopulseElite·2025-11-05 05:27

What is Momentum (MMT)? An in-depth analysis of the operation of the DeFi center on the Sui chain.

Momentum is an integrated Decentralized Finance (DeFi) center built on the Sui Blockchain, offering trading, staking, and asset management within a unified ecosystem. The platform features the Momentum DEX for centralized liquidity trading, xSUI for liquid staking, and MSafe for secure multisignature fund management. MMT is its native Token, used for governance through voting custody, community rewards, and other privileged access.

MarketWhisper·2025-11-05 02:16

MMT rose to above $0.88 after opening, with a maximum increase of 885% compared to the Binance TGE price.

According to Mars Finance news on November 4, after opening, Momentum(MMT) continued to pump and rose above $0.8, reaching a high of $0.8859, with a rise of 488% in the first hour after being listed. As of 22:10, the rise since the opening reached 800%. In addition, its intraday high point rose by a maximum of 885% compared to the Binance TGE price, and increased by a maximum of 254% compared to the Buidlpad community round price.

MMT-0,08%

MarsBitNews·2025-11-04 14:28

UPBIT lists Momentum (MMT) and supports BTC, USDT trading.

According to Mars Finance, UPBIT will open trading support for Momentum (MMT) at 21:30 on November 4, 2023, supporting BTC and USDT markets. Users can make deposits within 2 hours after the announcement is published, and deposits must be made through the Sui network.

MarsBitNews·2025-11-04 09:56

What is Momentum (MMT)? Sui's Liquidity Engine for Tokenized Finance

Momentum (MMT) is a strategic DeFi infrastructure suite on the Sui blockchain, designed as the operating system for the tokenized economy, where crypto assets and real-world assets (RWAs) trade seamlessly on a single platform.

CryptopulseElite·2025-11-04 07:58

Hotcoin will launch PLAI, MMT, and TRUST from November 4 to 5.

Hotcoin will launch the three major projects PLAI, MMT, and TRUST from November 4 to 5, 2025, providing Spot and Futures Trading, and will introduce a 72-hour zero-fee activity to create a convenient trading experience for users.

MMT-0,08%

DeepFlowTech·2025-11-04 03:06

Binance HODLer Airdrops launched project number 56: Momentum (MMT)

Binance has announced its 56th project, Momentum (MMT), a comprehensive DeFi platform on Sui blockchain. Users holding BNB can receive MMT airdrops. Trading begins on 4/11/2025, with a total supply of 1 billion MMT.

MMT-0,08%

TapChiBitcoin·2025-11-03 08:42

Binance HODLer Airdrop launched Momentum (MMT)

Binance HODLer Airdrop Phase 56 project Momentum (MMT) is launched. Users can use BNB to purchase principal-protected coins during a specific time period to receive an Airdrop. Detailed information is expected to be announced within 24 hours.

MMT-0,08%

MarsBitNews·2025-11-03 08:37

Binance Wallet MMT Pre-TGE open investment, over-subscribed by 132 times in 10 minutes.

According to Deep Tide TechFlow news on October 31, the official page shows that Binance Wallet MMT Pre-TGE has opened for investment, with a 132 times oversubscription within 10 minutes.

MMT-0,08%

DeepFlowTech·2025-10-31 09:18

MMT Token Oversubscription and Sui Ecosystem Surge: 2025 DeFi Momentum

In the rapidly evolving landscape of decentralized finance (DeFi), Momentum (MMT), the leading DEX on the Sui blockchain, has achieved a remarkable milestone with its community offering oversubscribed 20 times, raising over $2 million in a matter of hours.

CryptopulseElite·2025-10-22 08:15

Momentum Token MMT's Buidlpad community sale subscription application guide

Source: Buidlpad Official, Translated by: Shaw Jinse Finance

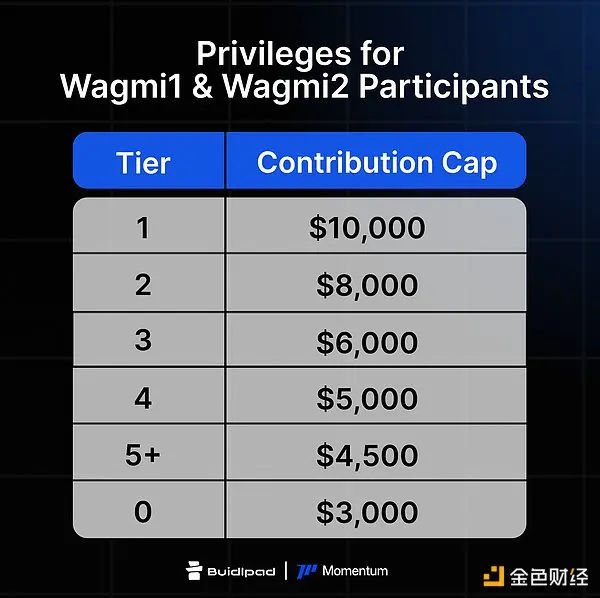

The Buidlpad official community sales platform has announced that the community sale of the MMT token in collaboration with Momentum Finance has been launched on Buidlpad.

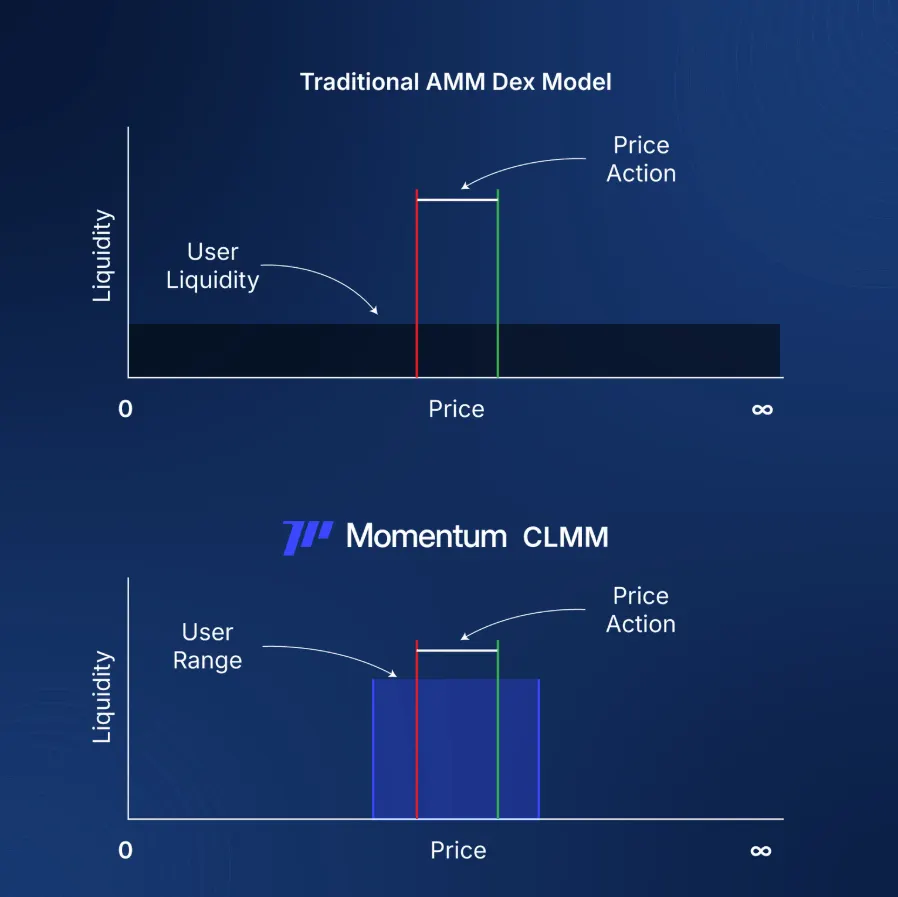

Momentum is the leading concentrated liquidity market maker on Sui (CLMM) DEX, providing liquidity providers (LP) with a higher annual percentage rate (APR), aiming to be the core liquidity engine of the Sui ecosystem. Momentum has accumulated a trading volume of over $18 billion, with a total value locked (TVL).

MMT-0,08%

金色财经_·2025-10-10 04:22

Momentum log in Buidlpad, start MMT community subscription

According to Mars Finance, Momentum announced on the X platform that it will log in to Buidlpad today to launch the MMT community subscription. This community subscription plan aims to raise 4.5 million USD, with an FDV of 350 million USD. For eligible early participants, Momentum will offer a discounted valuation of 250 million USD FDV. All tokens obtained through this round of issuance will be 100% unlocked at the TGE (token generation event), and community participants do not need to have a lock-up position or set a vesting period.

MMT-0,08%

MarsBitNews·2025-10-10 03:15

Understand Momentum Finance ( MMT ) at a glance: Sui network Liquidity engine, HODL Yield event ignites the eve of TGE.

Momentum Finance ($MMT) is the flagship Decentralized Finance platform on the Sui network, and its recently launched HODL Yield Campaign attracted over $30 million in deposits within the first hour, pushing the TVL to soar to $210 million, with cumulative volume surpassing $12 billion. Currently, it holds the position of liquidity leader in the Sui ecosystem, with its "sustainable returns + community-driven" narrative standing out in the 2025 DeFi recovery wave, especially against the backdrop of the Sui TVL reaching $2.55 billion. The project locks in user loyalty through high APY (up to 155%) and Bricks rewards mechanism, indicating that the TGE (expected in October) will trigger a new round of rise.

MarketWhisper·2025-09-28 02:26

Load More