Search results for "BLS"

New Patent Highlights Chainlink CCIP’s Role in Auditable Hybrid Finance Systems

U.S. patent thread links Intel SGX off-chain computation to on-chain delivery using Chainlink CCIP plus BLS threshold signatures.

The thread says the design uses BLS threshold signatures, so a quorum must

CryptoNewsFlash·01-01 13:14

Bitcoin keeps falling through $85,000! The Bank of Japan is expected to raise interest rates today; watch out for arbitrage closing and another wave of selling.

The US November CPI data shows inflation cooling down. Initially, cryptocurrencies and US stocks surged, but they were soon met with fierce selling. BTC briefly dropped to $84,456 in the early morning, and Ethereum (ETH) also temporarily fell below $2,800.

(Background: Bloomberg analyst: Bitcoin may fall below 84,000! Bulls caught off guard by "hawkish rate hikes," Christmas rally spoiled)

(Additional context: Where's the anticipated rate cut celebration? Interpreting the Federal Reserve's "hawkish rate hikes" and the non-QE balance sheet expansion bond purchases)

The US Bureau of Labor Statistics (BLS) released the November 2025 Consumer Price Index (CPI) last night (18th). This is the first inflation report since the October data collection was interrupted due to the federal government shutdown lasting 43 days this year, and the October CPI report was canceled.

Compared to November 2024, the entire

動區BlockTempo·2025-12-19 02:05

How to interpret complex signals from the unexpectedly strong US employment data and Bitcoin prices?

The latest data from the U.S. Bureau of Labor Statistics (BLS) shows that non-farm employment increased by 64,000 in November, far exceeding market expectations of 50,000, but the unemployment rate rose to 4.6%, reaching a new high since September 2021. After this employment report, which sends mixed signals, Bitcoin experienced intense volatility, initially surging above $87,000, then pulling back, and attempting again to break the $88,000 mark. This is the first major macroeconomic report since the Federal Reserve cut interest rates last week, highlighting the market's difficult balancing act between strong employment data and potential economic cracks, making the upcoming CPI inflation data even more critical.

BTC-1,94%

MarketWhisper·2025-12-17 02:26

The Future of the U.S. Economy Under Inflation Fission

For several years, the US inflation indicators and commodity price trends have been highly synchronized, forming a relatively stable economic signal. However, since the outbreak of the COVID-19 pandemic in 2020, this pattern has shown a significant divergence for the first time. According to data from the U.S. Bureau of Labor Statistics (BLS), as of September 2025, the Consumer Price Index (CPI) year-over-year increase was 3.0%, down from the 9.1% peak in 2022 to near pre-pandemic levels (about 2%~3%). Meanwhile, the Bloomberg Commodity Index (BCOM) shows that prices for key commodities such as oil, wheat, natural gas, soybeans, and coffee remain on average about 50% higher than before the pandemic. This divergence reveals a core issue in the current economy: official data indicate inflation is cooling, but actual living costs remain high, highlighting the limitations of the CPI as an annual year-over-year change indicator — it captures the speed of price changes but ignores the fact that absolute price levels have been permanently elevated.

金色财经_·2025-12-15 01:38

How the soft U.S. labor market puts pressure on the Crypto Assets market

Author: Bradley Peak, Source: Cointelegraph, Translated by: Shaw Jincai Finance

1. The job market is "weak rather than collapsed," and the crypto market shows signs of fatigue.

After reaching a new high in 2025, Bitcoin has struggled to maintain its upward momentum for several weeks in late November. Meanwhile, the U.S. labor market data has begun to issue another warning, not of a sudden drop in jobs, but of a clear cooling.

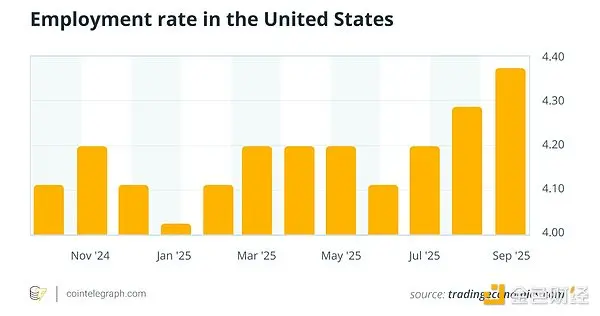

The unemployment rate in the United States has climbed from around 3% in 2022-2023 to about 4%, reaching its highest level in recent years. Data from the U.S. Bureau of Labor Statistics (BLS) and the Federal Reserve Economic Data (FRED) series show that the monthly growth in non-farm employment has slowed from pandemic levels to a more moderate six-figure increase. Job vacancies and the number of resignations have also decreased from their peaks in 2021 to 2022.

U.S. employment rate

For stocks

金色财经_·2025-12-02 04:15

AI reshapes the labor market, the top ten growing jobs for the future are out!

The rapid development of artificial intelligence is reshaping the global labor market. Although the employment growth rate has slowed compared to the past decade, according to the latest employment forecast report from the U.S. Bureau of Labor Statistics (BLS), it is expected that from 2024 to 2034, the U.S. economy will add 5.2 million job opportunities, many of which offer annual salaries reaching six figures.

The healthcare and computer mathematics fields are growing the fastest.

According to the report from the Bureau of Labor Statistics, by 2034, the fastest-growing industry will be healthcare and social assistance, with an expected growth rate of 8.4%. This includes positions such as nurse practitioners and physician assistants, primarily driven by the aging population and the rising prevalence of chronic diseases.

The demand for systems based on artificial intelligence (AI), data processing, and software development will drive a 7.5% growth in the workforce of professional, scientific, and technical services, such as data scientists and engineers.

ChainNewsAbmedia·2025-12-01 01:34

The Current Predicament of the US Economy: Escalating Tariffs, AI Bubble, and Policy Narrative Disconnection

The U.S. economy presents a highly divided picture. On one hand, the official narrative emphasizes strong growth, near full employment, and stabilized inflation; on the other hand, residents' actual purchasing power continues to decline, manufacturing employment has seen negative growth for several months, consumer confidence is approaching historical lows, and core goods and energy prices are accelerating upward again. This phenomenon of "two realities" coexisting stems from the significantly upgraded comprehensive tariff policy since April 2025, as well as the decision-makers' systematic underestimation and redefinition of the facts of inflation. The latest data shows that the CPI in September rose to 3.0% year-on-year, a clear increase from April's 2.3%, while the October data has been postponed due to the government shutdown, further exacerbating market uncertainty.

1. Inflation Reality: Continuous upward pressure from 2.3% to 3.0%

According to data from the U.S. Bureau of Labor Statistics (BLS), after the full implementation of tariffs in April 2025, the CPI year-on-year rose from 2.3% to 9.

金色财经_·2025-11-27 00:17

Bitcoin Traders Brace for Turbulence as Fed Faces “Data Blackout” After Delayed Jobs Report

The U.S. just entered a rare monetary fog, and for crypto, that is a massive volatility trigger.

The Bureau of Labor Statistics (BLS) has finally released the Sept

BTC-1,94%

BitcoinInsider·2025-11-20 15:43

The U.S. economy dances between "prosperity and unemployment"

In contemporary American economy, a striking phenomenon is quietly unfolding: total corporate sales continue to reach new highs, while the unemployment rate shows a rare rise trend. This divergence is not coincidental, but rather a result of the interplay between technological advancements and labor market dynamics. According to data from the U.S. Bureau of Labor Statistics (BLS), as of August 2025, the unemployment rate in the U.S. rose to 4.3%, a slight increase from 4.2% in July, while the Chicago Fed's preliminary estimate for October indicates that this figure could climb further to 4.35%. Meanwhile, total sales for U.S. manufacturers reached $608.27 billion in August 2025, with a month-on-month rise of 0.88% and a year-on-year rise of 1.8%. This comparison highlights the structural transformation within the economy: productivity and sales are rapidly rising under the drive of technology, yet employment positions have not been able to keep pace.

This article will analyze the causes of this divergence based on historical data and the latest statistics.

金色财经_·2025-10-31 00:22

BLS accelerates the release of delayed CPI data

Cục Thống kê Lao động Hoa Kỳ dự kiến sẽ công bố dữ liệu Chỉ số Giá tiêu dùng (CPI) cho tháng Chín bất chấp việc chính phủ liên bang đóng cửa, nhấn mạnh tầm quan trọng của nó đối với các đánh giá lạm phát và dự báo kinh tế trong bối cảnh khả năng biến động thị trường.

BTC-1,94%

TapChiBitcoin·2025-10-10 00:29

The weakness in the U.S. labor market and the rise in global bond yields

In early September 2025, U.S. economic data once again drew market attention. Over the past week, U.S. labor market data showed signs of continued slowdown, with the Non-Farm Payroll report (NFP) becoming the focal point. Despite the S&P 500 index briefly reaching an all-time high, it subsequently experienced a noticeable pullback, reflecting investors' concerns about the economic outlook. At the same time, gold prices continued to rise, breaking through the $3600/ounce mark, while global long-term bond yields showed an upward trend, particularly for 30-year bonds. These two major themes—the weakness of the labor market and the dumping in the bond market—intertwined, highlighting the uncertainty in the macroeconomy. This article provides an objective analysis of these phenomena based on the latest data and explores their potential impacts. The analysis primarily references sources such as the U.S. Bureau of Labor Statistics (BLS), ADP reports, and dynamics in the global bond market.

U.S. Labor Market: Slowdown Trend Intensifies

The US labor market in 202

金色财经_·2025-09-24 01:10

BLS Delays Key Consumer Report After Trump Fires Agency Head

The U.S. Bureau of Labor Statistics (BLS) has come under fire after President Donald Trump dismissed Commissioner Erika McEntarfer just hours after the release of a weak July jobs report and major downward revisions to earlier data. Shortly afterward, the agency quietly postponed its annual

Moon5labs·2025-09-22 08:01

U.S. Treasury Secretary Bessent: Fed data is seriously distorted, Powell should accelerate rate cuts.

U.S. Treasury Secretary Scott Bessent ( stated in an interview this morning on 9/11 that the economic data relied upon by The Federal Reserve (FED) is severely distorted, suggesting that this month's interest rate meeting should be recalibrated and consider a rate cut of more than 50 basis points. At the same time, he also discussed the current Trump administration's plans regarding Fed personnel adjustments, interest rate policies, and the upcoming strategies in the trade war.

Criticize the distortion of Fed data, please recalibrate the interest rate cut.

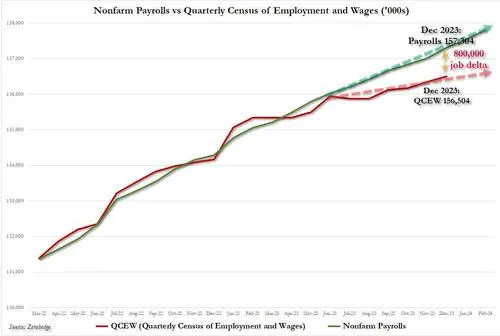

Besant was the first to criticize the U.S. Bureau of Labor Statistics )BLS( for data distortion, pointing out that the current response rate for the survey is only 30% – 40%, meaning that a lot of data is missing, and subsequently, estimates are used to "hard supplement," turning quantitative data into "guessing based on intuition."

He bluntly stated that the data itself is inaccurate, but the Fed still insists on relying on data to make decisions, so it needs to consider "cutting interest rates" to correct its policy.

Besant

ChainNewsAbmedia·2025-09-11 02:33

US PPI Data: Inflation Cools Down, But Market Reaction is Tepid

Farzam Ehsani, co-founder and CEO of VALR, has exclusively provided some comments and analysis. He made these remarks just before the report was published.

New PPI Data of the United States

The Bureau of Labor Statistics (BLS) publishes a report on the Consumer Price Index (CPI) of the United States every few months,

BTC-1,94%

Blotienso·2025-09-11 00:01

The U.S. August PPI was far below expectations, and the core PPI recorded the largest monthly decline in nearly a decade! Trump: There is no inflation, and Powell should immediately make large interest rate cuts.

The U.S. August PPI data falling below expectations indicates controlled inflation, thereby raising the Federal Reserve's expectations for interest rate cuts, with Bitcoin and Ethereum responding with a rise. (Background: U.S. August non-farm employment was 'far below expectations'! The market bets on continuous rate cuts by the Fed, gold reaching historic highs, Bitcoin experiencing fluctuations...) (Additional context: Gold breaking through the $3600 new high 'experts say it will keep rising', U.S. unemployment rate collapsing, will rate cuts provide favorable information for Bitcoin?) The U.S. Bureau of Labor Statistics (BLS) released the August Producer Price Index (PPI) report on the evening of September 10, showing that the PPI data fell below expectations, indicating that U.S. inflation is still slowing down. Specifically, the U.S. August PPI data is as follows: Overall PPI year-on-year: rise of 2.6%, lower than the market expectation of 3.3%, and also lower than the previous value of 3.3%, indicating a slowdown in the year-on-year growth rate of producer prices.

ETH-3,19%

動區BlockTempo·2025-09-10 14:01

U.S. Job Growth Overstated by 911,000 in Major Revision. Trump: “I Was Right From the Start”

The U.S. Bureau of Labor Statistics (BLS) has admitted to a massive error in its employment data. A new report shows that between March 2024 and March 2025, the government overstated job growth by 911,000 positions. It marks the largest revision since 2002 and appears to validate what Donald Trump h

Moon5labs·2025-09-10 06:00

What are the highlights of the streamlined Ethereum minimal zkVM proposed by Vitalik?

The roadmap for Ethereum's simplified consensus demonstrates the determination to transition from POW to POS, abandoning BLS signatures in pursuit of a ZK-Native transformation. At the same time, the exploration of six zkVM technology routes aims to optimize signature aggregation, while improvements in staking thresholds and block generation speed indicate performance optimization. However, this may impact general Layer 2 solutions, potentially leading to a shift towards specific chain models in the future. Overall, although Ethereum has made progress in technological innovation, it will still require a considerable amount of time to resolve technical debt.

ETH-3,19%

TechubNews·2025-09-09 09:39

A Brief Analysis of the "Streamlined Consensus" Roadmap: How Ethereum Can Outperform Generalization Challenges with Specialized Tracks?

The streamlined consensus roadmap of Ethereum demonstrates its determination for reconstruction, including the abandonment of BLS signatures, the exploration of six zkVM technology routes to optimize signature aggregation, the drop in staking thresholds, and the reduction of block time to enhance performance. At the same time, technical debt still requires 4-5 years for reconstruction. The overall goal is to improve the efficiency and competitiveness of Ethereum.

ETH-3,19%

PANews·2025-09-08 06:07

A brief review of the Ethereum streamlined consensus roadmap, is it time to start over?

The roadmap for Ethereum's streamlined consensus demonstrates its determination for significant reforms aimed at fundamentally improving technical debt and performance. Abandoning BLS signatures, shifting to hash signatures, exploring six zkVM technology routes, lowering the staking threshold, and increasing block generation speed are all intended to achieve ZK-Native features. However, this also poses challenges for traditional general-purpose Layer 2 solutions, which may become more reliant on dedicated chain models in the future. Overall, this series of improvements is similar to other blockchain projects, but Ethereum's technical debt will still take years to resolve.

ETH-3,19%

TechubNews·2025-09-08 05:13

U.S. employment data "explodes": Trump has little time left.

"Wait till next year!" This slogan has been the rallying cry for all the losing teams from the minor leagues to the NFL since legendary sportswriter Grantland Rice first coined it over a century ago.

Now, U.S. President Trump has also joined this ranks.

In August, the U.S. economy added only 22,000 jobs, far below the economists' prediction of 76,500. In addition to the dismal job growth, there are two other important reasons in the employment report released on Friday that deserve attention.

First, this is the first employment data released by the Bureau of Labor Statistics (BLS) since Trump fired the director for "data falsification" a month ago. After the BLS revised down the employment data for May and June, reducing tens of thousands of jobs, Trump reacted to former director Erica McEntyre.

TRUMP-0,98%

金色财经_·2025-09-06 13:01

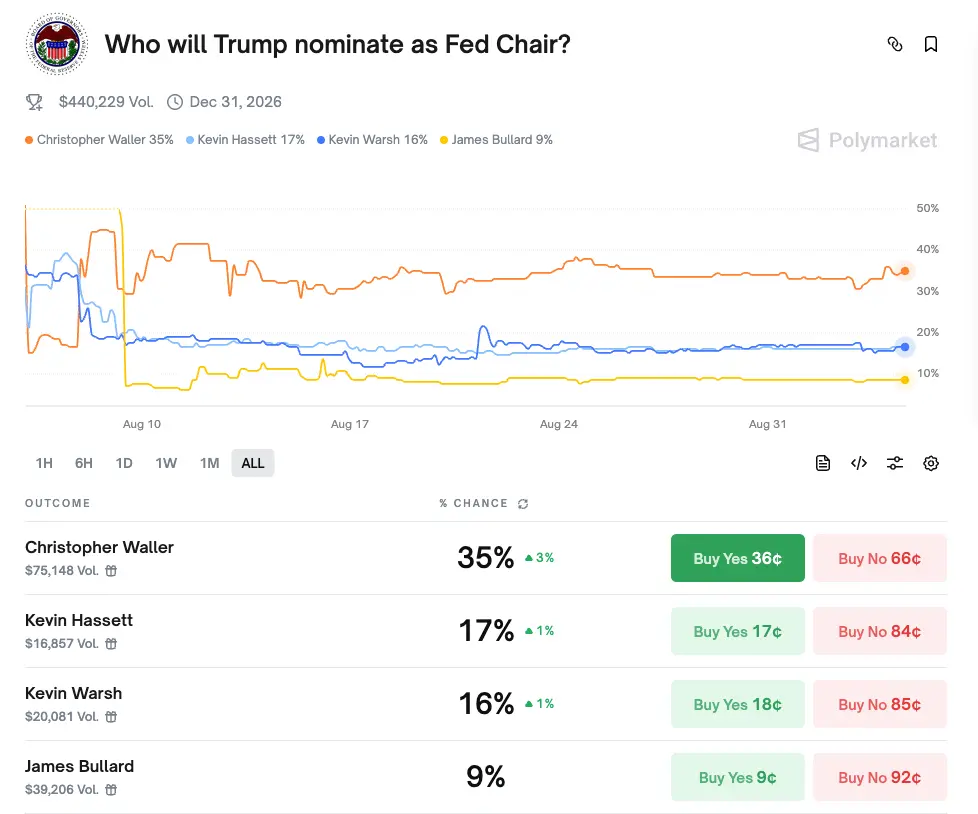

Today, the interviews for 11 candidates for the Fed chair position begin. How will Trump choose?

Written by: BUBBLE

At the beginning of September, the personnel and power landscape surrounding the Federal Reserve continued to accelerate its evolution.

On September 3, it was reported that the White House has made it clear that it will finalize the selection of the next Federal Reserve Chair as soon as possible. Treasury Secretary Scott Bessenet has initiated the interview process with 11 candidates and will begin a series of interviews this Friday, continuing for a week.

Meanwhile, there has been an increasing number of personnel and power moves surrounding the "smooth transition." On one hand, Trump previously dismissed the director of the Bureau of Labor Statistics (BLS), raising market concerns about the independence of official data. On the other hand, Federal Reserve Board member Adriana Kugler officially submitted her resignation at the beginning of August to make room for a new member.

The newly appointed Federal Reserve Board member, Stephen Miran, who was nominated by Trump, previously served as the chairman of the White House Council of Economic Advisers (CEA).

TRUMP-0,98%

TechubNews·2025-09-05 06:06

Fed "Election Day": 11 chairman candidates interview kicks off, who does the encryption circle most hope will take office?

In early September, the personnel and power landscape surrounding the Fed continued to evolve rapidly.

On September 3, it was reported that the White House has made it clear that it will finalize the next Fed chair candidate as soon as possible. Treasury Secretary Scott Bessenet has initiated the interview process for 11 candidates, which will start on Friday and continue for a week.

Meanwhile, personnel and power actions surrounding the "smooth transition" are increasing. On one hand, Trump previously removed the Director of the Bureau of Labor Statistics (BLS), raising concerns in the market about the independence of official data. On the other hand, Federal Reserve Governor Adrianna Kugler officially submitted her resignation in early August, making room for a new governor. The newly appointed Federal Reserve governor, Stephen Miran, former chair of the White House Council of Economic Advisers (CEA), was nominated by Trump and attended the Senate Banking Committee on September 4.

TRUMP-0,98%

GateUser-6bbdc2fc·2025-09-05 05:15

Will 800,000 jobs "evaporate" again? Wall Street bets that Powell will cut rates by 50 basis points in September.

The U.S. Bureau of Labor Statistics (BLS) is set to release the latest annual non-farm employment Benchmark revision on September 9, with the market highly skeptical that there will be a repeat of the situation where hundreds of thousands of jobs "vanish into thin air."

BLS-7,73%

MarketWhisper·2025-09-01 02:18

Trump fired the BLS chief. Argentina has a lesson for him

Earlier this month, President Donald Trump accused a civil servant of sabotaging him without evidence and summarily fired her. In doing so, he stole a page from an emerging market that cycles through inflation surges and debt crises as if it were a national sport. Enter Argentina.

Danish

YahooFinance·2025-08-23 17:04

Former Labor Statistics Bureau Director: Suggests pausing the U.S. non-farm payroll monthly report, Wall Street overwhelmingly opposes: a path to self-destruction.

Trump's nominee for the director of the U.S. Bureau of Labor Statistics (BLS) recently suggested pausing the monthly employment report, causing Wall Street to question if it will lose the most immediate pulse of the economy, worrying that both policy adjustments and market transactions will be shrouded in fog. (Background: The Federal Reserve's Daly: The timing for rate cuts is approaching, with the possibility of more than two this year (September probability nearing 95%)) (Context: Market observation》Trump's strong push for encryption Federal Reserve Board of Governors, is a September rate cut a foregone conclusion?) Without the monthly employment report in the U.S. financial markets, it would be like a doctor trying to feel a pulse in the dark, making it difficult to diagnose immediately whether the economy is feverish or not. E.J. Antoni, the nominee for the new director of the Bureau of Labor Statistics (BLS) nominated by President Trump, recently suggested temporarily "freezing" the monthly employment data, reasoning that it is "inaccurate." Upon hearing the news, Wall Street and the policy circle immediately became alert: would losing this indicator, known as the "heartbeat of the economy," come at a price greater than data inaccuracies?

動區BlockTempo·2025-08-13 03:31

The US July CPI report is out "Prices hit a new high in June", Trump pressures Powell: Tariffs did not exacerbate inflation, Fed needs to cut interest rates in September.

The Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) report for July yesterday evening (12th). After the data was published, the market increased its bets on a rate cut in September, while U.S. President Trump also reiterated his call for Fed Chairman Powell to lower interest rates. (Background: Federal Reserve's Daly: The timing for a rate cut is approaching, and there may be more than two cuts this year (with September's probability nearing 95%)) (Context: Market Observation: Trump strongly pushes for encryption Federal Reserve Board of Governors, is a September rate cut a foregone conclusion?) The U.S. Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) report for July yesterday evening (12th), revealing the latest trends in U.S. inflation. The report showed that the overall CPI year-on-year growth rate for July was 2.7%, unchanged from June, but lower than the market expectation of 2.8%; the month-on-month growth rate was 0.2%, slightly lower than June's 0.3%.

TRUMP-0,98%

動區BlockTempo·2025-08-13 02:34

Trump Moves to Replace Fed and BLS Chiefs Amid Economic Shake-Up, Crypto Market Rallies

Story Highlights Trump moves to replace Fed Governor and BLS Chief and pro-rate-cut replacements are expected to be announced soon.

September Fed rate cut odds surge above 80%, Crypto market rallies to $3.83 trillion as rate cut hopes and U.S.–E.U. trade deal boost

BitcoincomNews·2025-08-04 07:42

Economist Peter Schiff Dismisses June Job Gains, Sparking Debate Over Labor Market Health

Economist Peter Schiff sharply criticized the latest U.S. Bureau of Labor Statistics (BLS) report, contending that 92% of the 147,000 jobs created in June were in “non-productive” government, health, or social services sectors.

Non-Productive Jobs and the U.S. Debt

Economist Peter Schiff has

OVER-1,4%

Coinpedia·2025-07-04 05:37

3 US Economic Indicators With Crypto Implications This Week

Following the Bureau of Labor Statistics’ (BLS) report on the US CPI (Consumer Price Index) last week, crypto traders and investors are still monitoring the country’s economic calendar.

BLS-7,73%

BeInCrypto·2025-06-16 00:30

Bitcoin Price Surges in Response to US CPI Data Showing Inflation Has Cooled to 2.3%

The Bureau of Labor Statistics (BLS) released the CPI report on Tuesday, showing that inflation slowed down in April. Bitcoin prices had a modest reaction as this change affects the Federal Reserve's (Fed) interest rate path.

US CPI data: Bitcoin prices fluctuate amid decreasing inflation

BL

Blotienso·2025-05-13 18:01

US inflation falls to 2.8%, lower than expectations

Inflation in the United States came in lower than expected in February, as prices for goods and services increased at a slower rate than virtually all economists had predicted.

The Bureau of Labor Statistics (BLS) reported Wednesday that the consumer price index (CPI), which tracks the

BLS-7,73%

CryptosHeadlines·2025-03-13 01:59

The U.S. CPI exceeded expectations. Trump shouted: interest rates must be cut, Putin agreed to initiate ceasefire negotiations, and BTCRebound broke through 98,000 U.S. dollars

The US Department of Labor announced last night that the latest consumer price index (CPI) in January exceeded market expectations, causing BTC price to drop to 94000 at one point. However, perhaps due to Trump's insistence on interest rate cuts and his disclosure that Putin has agreed to immediately start ceasefire negotiations, BTC once again broke through $98000. (Background: Fed Powell will pause rate cuts as the Federal Reserve tariff becomes a source of inflation pressure) The US Bureau of Labor Statistics (BLS) announced at 21:30 last night that the year-on-year growth rate of the latest consumer price index (CPI) in January was 3.%, higher than the market's expected and previous value of 2.9%; monthly increase of 0.5%, also higher than the market's expected 0.3% and previous value of 0.4%. The hot data shows that US inflation remains high.

動區BlockTempo·2025-02-13 01:23

US Inflation Surges 3% in January: Increasing Pressure on Fed and Political Tensions

In the context of a world economy full of fluctuations, the latest data shows that US inflation has risen to 3% in January, far exceeding initial forecasts and raising concerns about monetary policy in the future.

Latest Economic Data

Report from the US Bureau of Labor Statistics (BLS) released

Blotienso·2025-02-12 23:39

BLS' Jan '25 CPI shows potential inflation impact on Wall Street.

The US CPI data, released by the BLS, impacted leading cryptocurrencies negatively. Bitcoin, Ethereum, and XRP dropped by about -2.74%, -3.27%, and -2.45% respectively. The Consumer Price Index for January 2025 was 0.1%, lower than the expected 0.3%. The data and Fed comments will influence future interest rates in the US.

CompassInvestments·2025-02-12 19:12

CPI Data January 2025: Detailed Information on Inflation and Crypto Market Reaction

The US Bureau of Labor Statistics (BLS) has just released the highly anticipated Consumer Price Index (CPI) report for January 2025. This report is crucial as it provides key detailed information on inflation trends, potential changes in monetary policy, and their direct impact on the market.

Blotienso·2025-02-12 16:49

U.S. CPI Data Released: What’s the Impact on Crypto Market?

Story Highlights The U.S. Bureau of Labor Statistics (BLS) has released the numbers for CPI.

Top cryptocurrencies including Bitcoin, Ethereum, and XRP see a change of -2.74%, -3.27%, and -2.45%.

BitcoincomNews·2025-02-12 05:37

Meter L1 Launches Supernova Core Framework for Cosmos Ecosystem

Blockchain network Meter introduces Supernova Core, a Cosmos SDK consensus framework designed to increase efficiency, performance and decentralisation for developers on the Cosmos ecosystem. The framework offers BLS signature aggregation, advanced consensus protocols, and a more efficient network communication layer to improve scalability and performance. It also supports parallel EVM execution and an optimised database to enhance performance further and offer better potential for Ethereum-Cosmos cross-chain development.

UToday·2025-01-16 16:53

Today, the Bureau of Labor Statistics (BLS) released a key inflation indicator, the Consumer Price

US inflation rose to 2.9%, in line with expectations, while the core CPI was slightly below the forecast at 3.2%. The news caused a bullish market in the cryptocurrency industry, with BTC rising by USD 1K and other altcoins also seeing gains. The Federal Reserve raised concerns over inflation risks and their potential impact on the economy. The upcoming FOMC meeting on January 29th could lead to a bitcoin price jump.

CompassInvestments·2025-01-15 16:02

U.S CPI Data Released: Inflation Rate Rises To 2.9% , Crypto Market Turn Bullish

US CPI report for December released by BLS, may boost USD but expected to have no immediate impact on Fed's monetary policy.

BitcoincomNews·2025-01-15 13:47

December Jobs Report Signals Labor Market Shift Under Trump

NAIROBI (CoinChapter.com)—The latest Jobs Report from the U.S. Bureau of Labor Statistics (BLS), set for release Friday, is expected to highlight a cooling labor market as job growth stabilizes at pre-pandemic levels. Economists anticipate modest hiring gains for December, marking a shift in labor

CoinChapter·2025-01-10 23:21

US economic data slumped the currency market! The pace of interest rate cuts may slow down, and the rise without falling may end the CryptocurrencyBull Market?

By 2025, the global economic situation remains complex, especially with the recent strong performance of the US economic data, which has triggered a reassessment of the future Intrerest Rate policy of the Federal Reserve (Fed). At the same time, the price of Bitcoin has also experienced dramatic Fluctuation, all of which have had a profound impact on the Crypto Assets market.

First of all, the Job Openings and Labor Turnover Survey (JOLTS) data released today by the U.S. Bureau of Labor Statistics (BLS) showed that the number of job vacancies in November 2024 unexpectedly increased to 8.098 million, far exceeding market expectations of 7.7 million. The job vacancy rate rose to 4.8% in November, and the quit rate declined, with the number of voluntary quits decreasing from 3.28 million in October to 3.06 million.

This data indicates that the US labor market remains tight and economic activity continues to expand. Companies may be waiting to see the direction of Trump's policies, including tax cuts, increased import tariffs, and expulsion.

LinkFocus·2025-01-08 10:25

MICA Daily | US job data better than expected, Fed rate cut probability greatly reduced

The Bureau of Labor Statistics (BLS) released data from the Job Openings and Labor Turnover Survey (JOLTS) in November of last year, showing that the number of job openings reached 8.09 million, higher than the economists' forecast of 7.7 million. The job vacancy rate rose to 4.8% in November and the quit rate decreased. The number of voluntary quits decreased from 3.28 million in October to 3.06 million, which is stronger than the expected employment market report, re-boosting the market's expectation of the Fed maintaining the current Interest Rate policy unchanged, triggering dumping of risk assets and price declines.

The increase in job vacancies is mainly concentrated in small businesses, with an increase of 273,000 positions in the professional and business services sector, an increase of 105,000 in the finance and insurance sector, and an increase of 38,800 in the private education services sector. However, the number of job vacancies in the software technology industry has decreased by 8.9.

BLS-7,73%

Blockee·2025-01-08 02:13

US Inflation Climbs to 2.7%, Putting the Federal Reserve in a Bind

Inflation in the United States accelerated in November, with consumer prices rising 2.7% over the past year. Monthly, the consumer price index (CPI) increased by 0.3%, according to the Bureau of Labor Statistics (BLS).

Core inflation, which excludes volatile food and energy prices, held steady at

Cryptopolitan·2024-12-11 19:13

How to remove Relay

MEV-Boost largely relies on centralized participants, such as Relay. Paradigm has proposed an alternative architecture that enables direct, privacy-preserving communication between builders and proposers. This is based on a novel, non-interactive 'silent' threshold encryption form, which can leverage the existing BLS keys of validators.

BLS-7,73%

GateResearch·2024-10-14 08:20

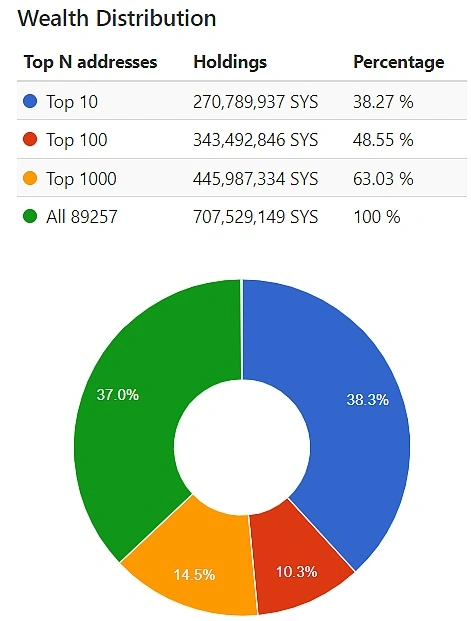

Project Research | Scalable PoW EVM Blockchain Syscoin

1. Project Introduction

Syscoin is a full-stack modular PoW blockchain solution merged with Bitcoin mining. Its underlying Syscoin native (UTXO) blockchain network, which provides data availability and finality, runs in conjunction with an Ethereum Virtual Machine (EVM) called NEVM (Network Enhanced Virtual Machine), which provides the Ethereum equivalent , while inheriting this chain to enhance security and provide scalability through Rollup.

Syscoin makes Rollup more secure through Bitcoin merged mining settlement, multi-swarm BLS signature finality, and proof of data availability. As an enhancement on top of the Satoshi consensus, Syscoin adds resistance to selfish mining and maintains the chain's resiliency in the face of non-final scenarios by enabling the protocol to resolve. Unlike Ethereum's Casper, in these cases...

金色财经_·2023-09-25 13:07

Load More