Search results for "AXIS"

2025 U.S. Stock Yearbook: New Walls Rise, Fences Collapse, How Will 2026 Find New Anchors for Order?

Author: Frank, Mai Tong MSX Research Institute

All that has passed is merely the prelude.

As 2025 comes to a close, looking back over the past 12 months of the US stock market and global financial markets, it is difficult to describe this year with linear terms like "rising" or "correction." Instead, it resembles a series of intense, mutually constraining structural changes—technological acceleration, capital expansion, political polarization, and institutional loosening—all occurring simultaneously and amplifying each other within the same cycle.

I have tried to approach this from a timeline perspective and also attempted to use market rises and falls as the main axis. However, I quickly realized that what truly shapes the market landscape of 2025 are not a few landmark new highs or crashes, but a set of recurring, overlapping main narratives. When connected, the underlying tone of 2025 becomes remarkably clear—it is a year of high contradiction, yet with a strong sense of direction:

One side is the continuous rise of high walls: A

PANews·2025-12-30 11:08

Pi coin price analysis: Falling below $0.2, a desperate counterattack, MACD turns bullish, funds flow back.

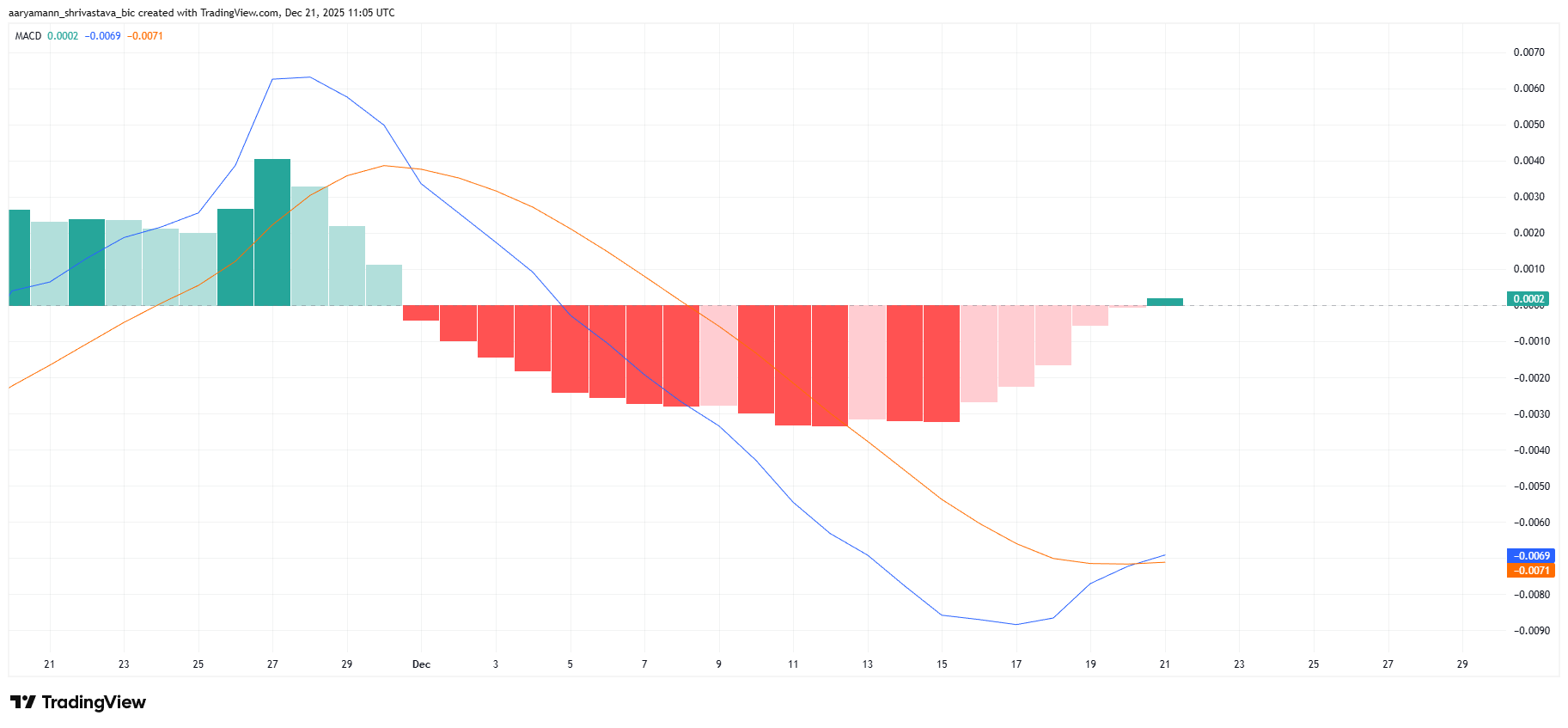

Pi coin is facing a new round of dumping pressure after breaking below 0.200 USD, and market confidence once fell to a low point. However, recent on-chain indicators show that holders are actively reversing the trend. The Moving Average Convergence Divergence (MACD) has shown a bullish crossover, with the MACD line crossing above the signal line, ending nearly 20 days of falling momentum. More importantly, the Chaikin Money Flow (CMF) has risen above the zero axis, confirming a return of net buying activity.

MarketWhisper·2025-12-22 03:08

Are Venture Capital Funds All Going to the Giants? The Truth About Crypto Financing in November: Large Transactions Keep the Show Going

In November, Crypto venture capital investment significantly cooled down, with total funding mainly supported by a few large transactions, and trading volume hitting this year's low. Although the market remains weak overall, important investment cases focusing on on-chain sustainability and Web3–AI, such as Ostium, Axis, and PoobahAI, have emerged, indicating potential innovation and long-term development risks in the industry.

CryptoCity·2025-12-21 01:40

New Axis: Wosh, Drukenmiller, Bessant, and the Next Federal Reserve Chair

Note: Recently, Kevin Warsh's probability of becoming the next Federal Reserve nominee has surged. Wellington-Altus Chief Market Strategist James Thorne analyzes the possibilities and significance of Warsh as the next Federal Reserve Chair. Gold Finance translates.

The focus of US economic policy is shifting from isolated individuals to a tightly connected network: Kevin Warsh, Stanley Druckenmiller, and Scott

金色财经_·2025-12-15 04:20

Gate Research: BTC and ETH lead the rise in mainstream assets|Exchange BTC supply has dropped sharply

CN:

Panorama of crypto assets

BTC(+2.07% 丨 Current Price 92,005 USDT)

BTC briefly fell back to the $92,000 range and saw buying intake, and although the price pulled back from the high of $94,500, it remained in the short-term bullish structure as a whole. In terms of moving averages, MA5 and MA10 have slightly retraced, but they are still above MA30, indicating that the trend has not yet weakened and has only entered a short-term consolidation. The MACD red bars converged from the highs, the momentum slowed down but was still above the zero axis, and the market was in a cooling phase after strength. If BTC can stabilize the $91,800–92,200 zone, it can continue the repair trend; A break below the MA30 could further backtest the $90,500 support.

GateResearch·2025-12-10 06:42

Gate Research: Polygon completes Madhugiri hard fork upgrade|Exchange BTC supply has dropped sharply

Crypto market panorama

BTC (+2.07% 丨 Current price 92,005 USDT): BTC briefly fell back to the $92,000 range and saw buying orders, and although the price retraced from the high of $94,500, the overall price remained within a short-term bullish structure. In terms of moving averages, MA5 and MA10 have slightly retraced, but they are still above MA30, indicating that the trend has not yet weakened and has only entered a short-term consolidation. The MACD red bars converged from the highs, the momentum slowed down but was still above the zero axis, and the market was in a cooling phase after strength. If BTC can stabilize the $91,800–92,200 zone, it can continue the repair trend; A break below the MA30 could further backtest the $90,500 support.

GateResearch·2025-12-10 06:05

Pi Network falls for three consecutive sessions, approaches the critical threshold; breaking the trendline may crash to $0.19

Pi Network experienced three consecutive declines on Friday, approaching the local support trendline formed by connecting the lows of October 22 and November 4. Technically, the MACD indicator's moving averages continue to decline toward the zero axis, and if they cross into negative territory, it will strengthen the downward momentum. If Pi Network breaks below the trendline near the December 1 low of $0.2204, it could further test the support level at $0.1919.

MarketWhisper·2025-12-05 06:23

Daily Market Wrap | Dec. 04

The essay discusses recent developments in the cryptocurrency space, including Ethereum's Fusaka upgrade, Bitcoin's price surge, Entrée Capital's new investment fund, and updates from Polymarket and Axis.

TokenInsight·2025-12-04 10:54

Decentralized quantitative yield protocol Axis announces completion of $5 million seed round financing

The decentralized quantitative yield protocol Axis announced the completion of a $5 million seed round led by Galaxy Ventures, with participation from FalconX, OKX Ventures, CMT Digital, Maven 11, GSR, CMS Holdings, and Marc Zeller, founder of Aave Chan Initiative, among others. Axis already has $100 million in prior LP capital entering closed testing to power its HFT cross-market arbitrage engine. Axis aims to build a multi-asset yield platform covering USD, Bitcoin, and gold. Its first product, USDx, will launch on Ethereum and Plasma, with the Origin Vault expected in 2026.

WuSaidBlockchainW·2025-12-03 13:53

Bitunix Analyst: Bank of Japan's December Rate Hike Remarks, BTC Faces Liquidation Pressure

According to Mars Finance, on December 1, Bank of Japan Governor Kazuo Ueda released the clearest hawkish signal to date, with the market raising the probability of a rate hike in December by the Bank of Japan to 64%. The yen strengthened, and short-term Japanese government bond yields hit a new high since 2008. Influenced by expectations of Japan's policy normalization being advanced, global capital flows are being repriced, putting pressure on the dollar and high volatility assets simultaneously. Meanwhile, the sudden diplomatic friction between the United States and Venezuela escalated, further cooling risk appetite rapidly. Against the backdrop of rising macro risk aversion, the crypto market experienced severe fluctuations. BTC fell sharply in today's Asian session, accompanied by rapid accumulation of liquidation volume. According to the liquidation map, a high-density liquidation zone formed around $92,300, becoming the main axis of this decline; after the price broke through this area, the downward trend accelerated, consecutively hitting $88,300, $86,200, and other subsequent liquidity stacks.

BTC1,03%

MarsBitNews·2025-12-01 08:25

Bitunix analyst: Bitcoin big dump to 96,000, the market enters a new stage of Bear Market, key defense line tests 93,000.

According to Mars Finance, on November 14, the crypto market experienced a new round of dumping, with Bitcoin falling below the psychological barrier of 100,000 USD, hitting a low of 96,600 USD, refreshing the lowest point since May. As the tech sector of the US stock market plummeted and risk aversion sentiment rose again, the large funds that previously supported the market, along with ETF allocations and corporate buying, quickly withdrew, causing the market structure to turn fragile. 10x Research confirmed that the market has entered a Bear Market stage, pointing out that weakened ETF fund flows, accelerated reduction of positions by long-term holders, and low participation from retail investors are the main reasons currently. From the market data structure, after BTC lost the mid-axis of the monthly line at 100,266 USD, the price is accelerating to retest the lower liquidity area. The short-term support level is located in the range of 93,000 USD to 95,000 USD; if it breaks below, the next liquidity gap may shift down to 89,600 USD.

BTC1,03%

MarsBitNews·2025-11-14 08:51

$SEI at X-Axis Support: Could a Breakout Propel Price Toward $0.70?

$SEI forms a descending triangle with support at $0.14–$0.15, signaling potential breakout toward $0.70 if momentum shifts bullish.

Robinhood listing and Binance joining as validator strengthen $SEI’s ecosystem, attracting liquidity and increasing user engagement across DeFi protocols.

Perpetual f

CryptoFrontNews·2025-11-11 00:32

SEI Trades Near Key X-Axis Support as Analysts Target a $0.70 Breakout Zone by Early 2026

SEI is currently trading at $0.16, approaching a critical support level with potential for a breakout toward $0.70. Analysts note an inverse head and shoulders pattern, indicating bullish sentiment, while the platform shows strong DeFi fundamentals and liquidity.

SEI6,41%

CryptoFrontNews·2025-11-08 01:33

Gate Institute: Mainstream Token Fully Pump|Balancer Releases Preliminary Report on Attack Incident

encryption asset panorama

BTC (+1.90% | Current Price 104,090 USDT)

The price of Bitcoin rebounded to around $104,000 after hitting a phase low of $98,500 on November 4, but the overall trend remains in a downward channel. Short-term indicators are showing a bearish alignment, and the rebound has failed to effectively break through the MA5 resistance level, indicating that upward momentum remains insufficient. Trading volume has slightly increased during the rebound phase, but its sustainability is limited, and there is a weak willingness for capital inflow. The MACD dual lines still remain below the zero axis; although the green bars are gradually narrowing, indicating a weakening of bearish momentum, a golden cross signal has not yet formed. Overall, BTC is currently in a short-term correction phase, and if it fails to break through the $105,000–$107,000 range with increased volume, the rebound is unlikely to turn into a trend reversal. The support below is still focused on $100,000.

GateResearch·2025-11-06 06:16

Gate Research Institute: Crypto market sentiment cools down | Bitcoin long positions funding rate plummets by 60%

encryption asset panorama

BTC (-5.72% | Current Price 99,875 USDT)

BTC continues its downward trend after a brief consolidation, with the current price falling below $100,000, hitting a low of $98,951, and is currently in a weak oscillation range. The price is running below the MA5, MA10, and MA30, with a clear bearish alignment of the moving averages, indicating strong selling pressure. The MACD dual lines continue to expand downward and are below the zero axis, with green bars increasing in size, showing weak momentum. If the support at $99,000 cannot be maintained, it may further drop to the $97,500 area; if a short-term rebound breaks through $101,000, a technical correction may be expected.

ETH (-10.82% | Current Price 3,215 USDT)

ETH also maintains low volatility, with the price falling below 3,200.

GateResearch·2025-11-05 07:08

Gate Research Institute: crypto market sentiment cools down | SOL Treasury Forward Industries launches a $1 billion buyback plan

crypto market panorama

BTC (-5.72% | Current Price 99,875 USDT): After a brief consolidation, BTC continues its downward trend, with the current price falling below 100,000 USD, reaching a low of 98,951 USD, and is currently in a weak oscillation range. The price is running below MA5, MA10, and MA30, with a clear bearish arrangement of moving averages, indicating significant selling pressure. The MACD dual lines continue to expand downward and are located below the zero axis, with green bars increasing, showing weak momentum. If it cannot maintain the support at 99,000 USD, it may further test the 97,500 USD area; if there is a short-term rebound breaking through 101,000 USD, a technical recovery may be expected.

ETH (-10.82% | Current Price 3,215 USDT): ETH also maintains a low-level fluctuation, with the price breaking below 3,200 USDT.

GateResearch·2025-11-05 06:52

Pi Network Price Prediction: Will it surge to $0.36 in November or crash to $0.21?

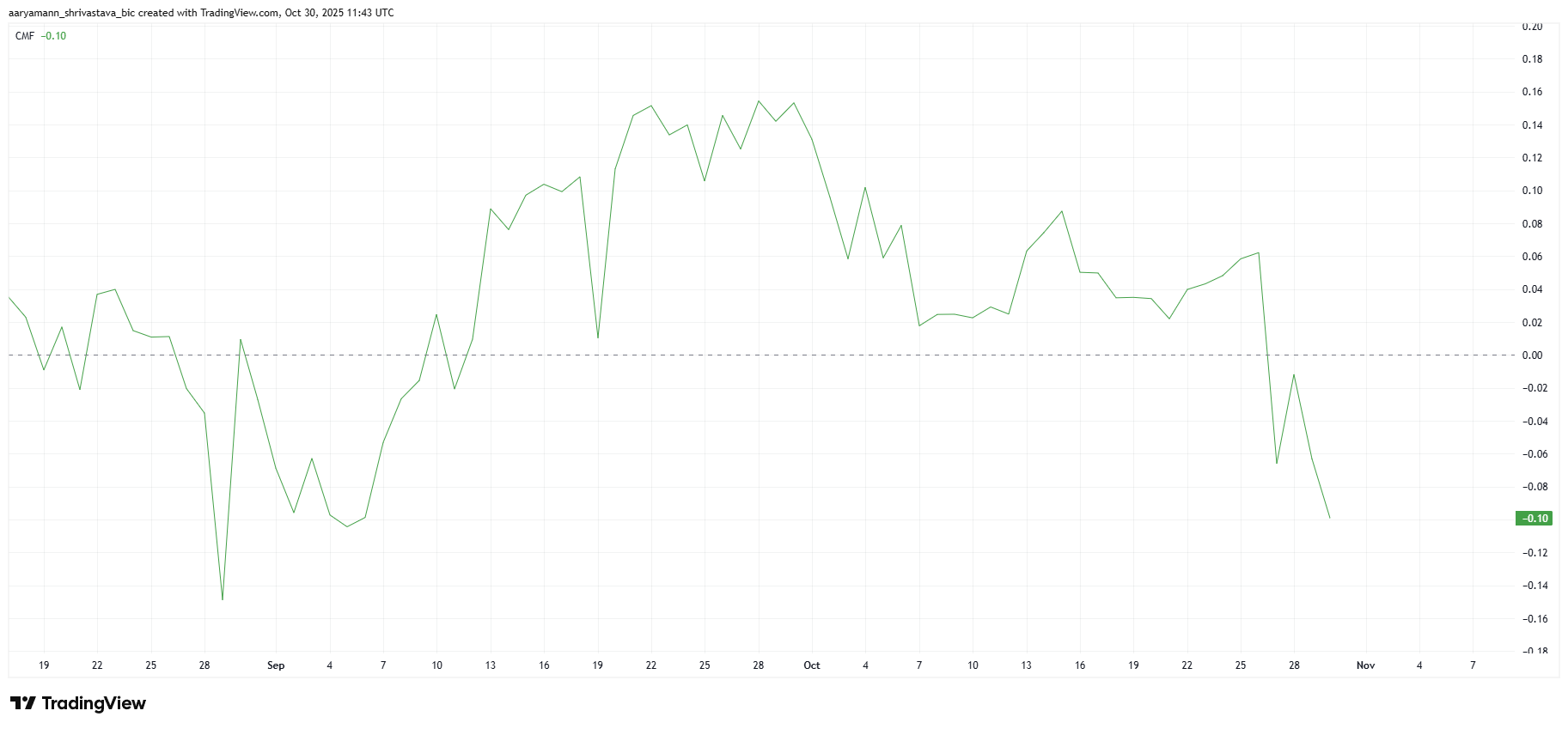

Pi Network experienced significant price fluctuations in October, with prices swinging wildly, enduring big dumps and rebounds within a few weeks. Despite the rebound, the price of Pi Coin still needs to work hard to regain lost momentum. The Chaikin Money Flow (CMF) indicator shows that capital outflows currently dominate the market, with this week's CMF falling below the zero axis, indicating that traders are taking profits from the recent pump rather than continuing to invest.

MarketWhisper·2025-10-31 02:24

Gate Research Institute: BTC fell to 112,000 USD | Tether Gold reserves market capitalization exceeded 2.1 billion USD

encryption assets panorama

BTC (-0.29% | Current Price 112,112 USDT)

BTC is under pressure after a short-term surge, with the price retreating from above $116,000 to around $112,000, continuing the short-term downtrend. Currently, the price is operating below the MA5 and MA10, and the MA moving averages are in a bearish arrangement, indicating that the selling pressure above remains heavy. The MACD double lines continue to decline and are below the zero axis, with green bars expanding, indicating weak momentum. If the price breaks below the support at $111,500, it may further drop to the $109,600 area; if it stabilizes and breaks through $113,500, it is expected to recover to $115,000.

ETH (-0.11% | Current Price 3,968 USDT)

ETH is also caught in a high-level adjustment pattern, with the price from 4.2

GateResearch·2025-10-29 04:06

Gate Research Institute: Visa Expands Its Stablecoin Support Landscape | Tether Gold Reserve Market Capitalization Exceeds 2.1 Billion USD

crypto market panorama

BTC (-0.29% | Current Price 112,112 USDT): After a short-term surge, BTC is under pressure and has retraced from above 116,000 USD to around 112,000 USD, continuing its short-term downtrend. The current price is operating below the MA5 and MA10, with the MA moving averages showing a bearish arrangement, indicating that the selling pressure above remains heavy. The MACD dual lines are continuously diving and are located below the zero axis, with green bars expanding and momentum being weak. If the price breaks below the support at 111,500 USD, it could further test the 109,600 USD area; if it can stabilize and break through 113,500 USD, it is expected to recover to 115,000 USD.

ETH (-0.11% | Current Price 3,968 USDT): ETH is also caught in a high-level adjustment pattern, with prices down from 4,200.

GateResearch·2025-10-29 03:44

China Faces Oil Shock as Trump Sanctions Hit Russia’s Energy Giants

The energy axis between Moscow and Beijing is shaking. The Trump administration has struck at the heart of China’s oil lifeline by sanctioning Rosneft and Lukoil, Russia’s two largest oil producers — a move that could send ripples across Asia’s entire energy market.

Washington Targets Kremlin’s

Moon5labs·2025-10-23 21:01

Tom Lee: BTC and the AI infrastructure investment trend are the main axis of the new long-term bull run.

Tom Lee, a renowned Wall Street analyst and chairman of Bitmine, stated in an interview on October 7 that the global market is heading towards a new economic cycle driven by "AI, productivity revolution, and the popularization of Crypto Assets." He believes that the demographic structure and technological advantages of the United States will support this long-term bull run, and that Bitcoin (BTC) and AI infrastructure investment will be the two main axes of this long-term bull run.

AI and algorithms are reshaping investment logic, the AI investment wave has just begun.

Tom Lee stated that while the market is currently disrupted by inflation and policy noise, from a structural perspective, the United States is entering a long-term productivity increase driven by AI.

He pointed out that the combination of AI and automation symbolizes that humanity is moving towards an "infinite labor force era." In other words, the advancements in AI, robotics, and algorithms will reshape the operational logic of production, consumption, and investment.

ChainNewsAbmedia·2025-10-07 09:54

Vine Coin (VINE) price prediction: a short-term fall of 10% is possible, with $0.066 being the critical line for bulls and bears.

Vine Coin (VINE) is trapped in a deep pullback dilemma. After a single-day big dump of 30% on August 2, the volume shrank again by 21% on August 4, and the rebound momentum is nearly exhausted. The technical indicators have fully turned bearish: MACD has fallen below the zero axis, OBV continues to decline, and the stochastic RSI is about to form a death cross. Although long positions are fiercely defending $0.066 (the 78.6% Fibonacci retracement level), the Get Liquidated heatmap shows that there is still a 4%-10% fall risk in the short term, with key support looking at $0.0635. This article will analyze the key levels for VINE bulls and bears, providing buy the dip and stop loss decision-making references for altcoin traders.

VINE1,4%

MarketWhisper·2025-08-05 05:09

Gate Research Institute: ETH rises to a new swing trading high leading the mainstream | The U.S. House of Representatives passes three major encryption bills

crypto market panorama

BTC (+1.39% | Current Price 119,998 USDT): The price of BTC shows a pattern of gentle upward movement after a period of consolidation, with the current price oscillating around 120,000 USDT. The short-term moving averages have turned upwards and formed a bullish arrangement, with the short-term support structure gradually strengthening. The MACD indicator shows that the DIF and DEA have formed a golden cross near the zero axis, with continuous volume expansion and momentum gradually recovering. In terms of trading volume, although it has not significantly increased, it shows a gentle upward trend overall, indicating a recovery in buying confidence. On July 17, BTC ETF saw a net inflow of 522 million USD, of which BlackRock's IBIT saw an inflow of 497 million USD, and Fidelity's FBTC saw an inflow of 7.8 million USD.

ETH2,23%

GateResearch·2025-07-18 04:45

Satoshi's trading method!

Dear traders, today I want to unveil a trading tool that professional institutions are using—the chip distribution chart. This seemingly simple chart is actually an X-ray machine that provides insight into market sentiment and market maker movements. Let's use this tool to see the truest competitive landscape of the market.

The essence of the chip distribution chart is the perfect integration of historical trading volume and price position. The horizontal axis represents the price, while the vertical density bars clearly display the trading activity at each price level. The blue bars indicate areas where buyers are actively involved, while the orange marks the battleground of concentrated selling by sellers.

Taking the daily chart of Bitcoin (BTC) as an example, the current market has formed a clear area of concentrated chips in the range of $103,300 to $105,500. This indicates that a large amount of trading has occurred in this price band over a period of time, much like a battlefield where both sides have a heavy troop standoff. Such areas often have dual attributes: they serve as both support and resistance, and once broken through, it will...

BTC1,03%

AICoinOfficial·2025-06-23 05:30

Bitcoin 2025 | Michael Saylor Reveals Strategy Arbitrage Strategy, AI and BTC Become the Future Capital Axis

MicroStrategy (Strategy) founder Michael Saylor stated at the Bitcoin 2025 conference on May 28 that Bitcoin ( will be the new generation of digital gold, becoming the global settlement standard. He further pointed out that BTC's market capitalization will rise to hundreds of trillions of dollars, while government bonds, stocks, and other assets will still coexist, but everything will revolve around BTC. Regarding AI, Saylor stated that AI will significantly reduce the demand for labor and land, and all capital will flow into BTC, the strongest digital capital.

I won't engage in Bitcoin banking; the strategy is to play in the capital market.

Saylor emphasized that Strategy does not intend to establish a Bitcoin bank, as banks are essentially highly regulated institutions. He stated:

Our strategy is to

BTC1,03%

ChainNewsAbmedia·2025-05-29 05:33

SIGN leads the hot coin ranking, Unichain active address count increased by 95 times丨 Gate Research Institute

Crypto market panorama

BTC (+1.64%丨Current Price 95,190 USDT)

chart

BTC fluctuated in the range of 94,830 to 95,770 USDT, the bottom price gradually rose relying on the rising trend line, and the short-term approached the upper resistance level of 95,770 USDT many times but failed to effectively break through, and the trend fluctuated around the 5-day, 10-day and 15-day moving averages, and the whole was at the end of the convergence triangle, waiting for the direction to be chosen.

trading volume

The current trading volume is maintained at a relatively average level, with no obvious signs of increase, indicating a strong wait-and-see sentiment among investors.

MACD

The fast and slow lines turn upwards near the zero axis, and the histogram shifts from red to green but with moderate amplitude, indicating that short-term bulls have a slight advantage, although momentum has not yet fully released. Attention should still be paid to whether the trading volume can support the breakthrough in the future. [1]

ETH (+3.79% | Current Price

GateResearch·2025-04-29 07:55

Vitalik: Privacy is the guarantee of freedom, order and progress

Vitalik Buterin warns of the importance of privacy and points to the rise of information anxiety in the age of AI. Fully homomorphic encryption (FHE) technology is favored to allow AI to perform computations on encrypted data. Projects such as Mind Network actively apply FHE technology to build data sovereignty, encrypted computing, and AI chains. The cooperation between privacy and AI will become an important trend in the future, and Mind Network is helping to build encrypted agents and provide encrypted computing operating systems. Privacy is not an obstacle, but the main axis of the new era, giving data sovereignty and freedom to the Web3 world.

ZK4,27%

星球日报·2025-04-17 07:40

Breaking Down Trump's Financial Strategy: U.S. Treasury Secretary Scott Bessant Discusses U.S. Debt, Finance, and Tariffs, The Affordability Tsar is About to Be Released

U.S. Secretary of the Treasury Scott Bessant shared his comprehensive observations on major issues such as U.S. debt, inflation, fiscal deficits, the labor market, energy, and housing prices during an interview on May 20. He also specifically outlined the economic reconstruction plan for the second term of the Trump administration.

The Biden administration has caused the U.S. fiscal deficit to swell and purchasing power to collapse.

Bessant believes that Biden ( Joe Biden ) was still throwing money around for relief during the economic recovery in 2021, leading to today's excessive deficit and inflation issues.

"Those who hold assets profit from the benefits brought by inflation, while the middle and lower classes are suffocated by housing prices, rents, insurance, and food costs," he emphasized.

Bessant also pointed out that the CPI has increased by about 22% in recent years, but the "real prices" for the lower-income population may have risen by more than 35%, leading to a complete imbalance in the system.

Three major axis reforms, reduction

ChainNewsAbmedia·2025-03-24 08:04

Microsoft, Nvidia, Alibaba, Baidu are all competing for it. DeepSeek has become a mainstream standard.

The DeepSeek big model continues to rise in popularity among technology giants and cloud service providers at home and abroad, including Microsoft Azure, NVIDIA, Alibaba Cloud, Huawei Cloud, Tencent Cloud, 360 Cyber Security, ZStack Cloud Axis Technology, Baidu Smart Cloud, etc. DeepSeek's Open Source big language model V3, inference model R1, and multimodal model Janus Pro have been widely followed in the market. The AI big model industry has also entered a "rally".

DEEPSEEK4,71%

世链财经_·2025-02-06 09:27

900 first stores, 290 billion yuan in sales achieved through trade-in, Beijing shows the report card for the construction of the international consumption center city in 2024

On the first day of 2025, the Beijing Municipal Bureau of Commerce unveiled the report card for the cultivation and construction of the international consumption center city in 2024: 900 first stores landed, the total number of time-honored Chinese brands increased to 137, ranking second in the country, and the area of newly opened large commercial facilities exceeded 1.5 million square meters. The policy of trading in old for new drove sales to exceed 29 billion yuan, and 12 demonstration cases were selected for the Ministry of Commerce's "Innovative Measures for Cultivating and Constructing International Consumption Center Cities".

The diversified development of local consumer brands

As a representative of Beijing's time-honored brand, Beijing Daoxiang Village is getting faster and faster. Consumers use a small spoon to gently crush the puff pastry, and the bronze-shaped pastries related to food such as "Ding", "Gui" and "Bottle" will be exposed along with the layers of peeling puff pastry, and learn about traditional food culture knowledge while playing. This is the newly launched "Zero Store Treasure Hunt Hall" in Beijing Daoxiang Village on the central axis of Beijing, which not only has a variety of food culture displays, but also caters to young people in terms of products

世链财经_·2025-01-04 02:26

Crypto world Liying: 12.2BTC bull run is still continuing! The trend at the high level is still strong! Latest market analysis.

Liying believes that the BTC bull run is still ongoing, and the long-term trend remains strong. The Order Book is fluctuating in the range of 97000 to 98000, forming a stable oscillation zone, indicating some support below. In the 4-hour period, the DIF and DEA of the MACD technical indicator are close to the zero axis, and the MACD histogram has turned from negative to positive, indicating a possible short-term rebound phase. Liying suggests following the subsequent changes in trading volume. The predicted long entry point is at 96000, with a stop loss at 94500, and a target of 98000; the short entry point is at 98000, with a stop loss at 99500, and a target of 95500. This article serves as a reminder and is for reference only. The reader bears the risk.

BTC1,03%

AICoinOfficial·2024-12-01 20:06

JPMorgan CEO Claims World War III Has Begun — Warns of 'Evil Axis' at Work

JPMorgan CEO Jamie Dimon warns that escalating geopolitical threats pose an extraordinary risk to global stability, citing alliances between the likes of Russia, North Korea and Iran as posing a grave danger. Dimon views the current nuclear threat as the most alarming situation, stating that as more nations become equipped with nuclear weapons, catastrophic events in major cities grow. Dimon looks to clear policies to address this escalating threat.

WORK3,62%

Coinpedia·2024-11-03 00:35

The historical intersection of AI and cryptocurrencies

> AI and cryptocurrencies share a closely connected historical origin and pursue similar goals in many ways.

Written by: Wang Chao

On Christmas Eve 1940, MIT mathematics professor Norbert Wiener received a $2,325 defense grant to build a system for predicting the location of enemy aircraft. The amount of funding was indeed a bit shabby, but Weiner was able to participate in the action against the Axis powers, and Weiner did it very vigorously.

As early as World War I, people realized that as flight speeds increased, operators of ground-based air defense systems would gradually become incompetent, and humans became the weakest link in the operational chain. Humans must exit manually from the entire operation sequence.

ForesightNews·2024-01-10 02:25

Yueying: The pie confirms that it supports the entry of long orders, and Ethereum looks at the rebound synchronously

In a person's self-discipline, there are infinite possibilities, and the degree of your self-discipline determines the height of your life.

There is no shortcut in life, but every step you take, counts.

The more diligent, the harder, the more self-disciplined, the better. I am Zhou Yueying, focusing on the trend analysis of mainstream currencies, and giving ideas with my own technical insights into the market.

Let's see today's sharing!!

Flatbread Technical Analysis ———

The daily line of the pie looks at the market and falls, falling below the seven-day moving average is currently testing the support of the middle track, the state of the Bollinger take away the slight contraction, the current middle track is an important short-term support, once it is broken, it is necessary to pay attention to the support of the 30-day moving average, the MACD fast and slow line continues to run downward, and the KDJ three-line downward running VR indicator consolidates near the 140 value. The four-hour Bollinger band below the downward opening above the 30-day moving average and the middle band coincide to form a short-term resistance, the K line runs near the lower band, and the MACD fast and slow line crosses the 0 axis downward...

币小白_·2023-11-28 10:04

The rebound is weak, and the bears are getting thicker

Let's take a look at the daily level trend of Ethereum on the 27th today, the price index is in the upper Bollinger band, the swing index RSI trend reverses downward near the 70 value, and the inflection point is near the 50 value axis. Similarly, in the KDJ indicator, the J line reverses at a high level and there are signs of intersecting K and D cycle lines. The reaction also increases the risk expectation of long to short in the price action. Once the support near the daily mid-band 2020 is broken, and the short-term chasing long chips are forced to close the position with profits, it will increase the strength of the retracement. Intraday, it is not ruled out that the index may retrace to the bottom support below 1950. On the whole, the signal given by the daily line is that the intraday rebound is weakened and the downward momentum is increased

The extremely short period of 4 hours trend also reflects the signs of weakening of the bullish trend, after the weak shock of the K-line fell below the middle line, near the lower line, the K-line continued to close the upper hanging line did not block...

币小白_·2023-11-27 07:24

Yueying: The pie hit the previous high resistance again and stepped back on 37165 bullish aunt 2048 bullish

In a person's self-discipline, there are infinite possibilities, and the degree of your self-discipline determines the height of your life.

There is no shortcut in life, but every step you take, counts.

The more diligent, the harder, the more self-disciplined, the better. I am Zhou Yueying, focusing on the trend analysis of mainstream currencies, and giving ideas with my own technical insights into the market.

Let's see today's sharing!!

Flatbread Technical Analysis ————

The daily pie line looks at the K-line physical positive line to recover the decline, breaking through the middle rail and the 7-day moving average again, running below the upper rail, the lower moving average and the middle track form short-term support, the Bollinger bands remain flat, the MACD fast and slow line extends downward, the column shrinks the amount of KDJ crosses and moves upward, and the VR indicator consolidates near the 140 value. 4 hours to see the Bollinger bands began to open, the 7-day moving average and the 30-day moving average crossed upward, the MACD fast and slow line formed a cross above the 0 axis to run upward, the volume column volume KDJ three-line crossing continued to extend upwards V...

币小白_·2023-11-23 13:52

A small rebound on the weekend will not break the pressure at night and continue to look back on the pedal

Analysis of mainstream currency market conditions

BTC: The white market of the pie began to rise after the shock, and the trend will hit the high of 34500 signs, but at present, the high is decreasing, the hourly line touched near the upper band of the Bollinger band, the KDJ indicator reached above 100, and the MACDA indicator flattened. The upper pressure is near 34300, as long as the market does not break through or false breakthroughs, the market will step back to the lows, so the evening cake is mainly short. It is recommended to be empty around 34300-34400, and the target is 300-500 points.

ETH hit the high point of 1794 in the evening, as long as this wave of rebound does not break 1800 points, the trend will step back, the hourly line of the Bollinger band upper rail to suppress the price, the KDJ indicator three-line death fork, MACD double line into the bonding, sideways below the zero axis, the rising momentum began to weaken, the evening is recommended to be empty near 1790, the target is 20-30 points.

The whole network is open, the thinking is clear, and the point...

币小白_·2023-10-30 02:36

Is the super bearish steepness of the U.S. Treasury yield curve a blessing or a curse for the crypto market?

Author: NingNing, crypto analyst Source: X (original Twitter) @0xNing0x

In the last week of September and the first week of October, the U.S. Treasury yield curve experienced a super bearish steepening phenomenon.

What is Xiongdou?

Bear steepness refers to the phenomenon that within a certain period of time, the upward rate of U.S. long-term Treasury bond yields is greater than the upward rate of U.S. short-term Treasury bond yields, and the inversion between the two rapidly narrows.

The visual video of changes in the U.S. Treasury yield curve in 2023 produced by James Eagle shows the entire process of the bearish steepening of the U.S. Treasury yield curve. The Y-axis in the video is the Treasury bond yield, and the X-axis is the Treasury bond maturity.

What does the appearance of Xiong Dou mean?

Generally speaking, bearish trends often appear at the end of the old economic cycle and the early stage of the new economic cycle.

For the current macroeconomic cycle, bearish steepness means that the United States will move from a stagflation cycle to a recession cycle...

金色财经_·2023-10-07 07:45

Oversold but does not break the level and continues to sprint towards highs

Market analysis of mainstream currencies (BTC, ETH)

The pie's oscillation pattern continues, with the range around 27200-27700. The hourly K-line is at the lower and middle tracks of the Bollinger Bands. In the morning, the ether pin is downward, but the pie is motionless and the currency price is still relatively strong. Due to the excessive increase in the previous period, the moving average is in a state of substantial divergence. The bottom line supports the 27200 line. As long as it does not break through 27000, the trend is still to continue to rebound. In terms of indicators, MACD is trading sideways below the zero axis, waiting for a reversal at any time. KDJ has fallen back to around 50. The previous high point of 28613 has only formed a high point. Later, the market stabilizes and there is a high probability that it will rise again. It is recommended to place long orders near 27200, with a target of 27700-27900.

Ether's thinking is consistent with that of the big pie, except that Ether has fallen deeper and its volatility is greater than other currencies. However, Ether has not broken out strongly at the moment. The K-line in the morning hour just fell back on the MA450 moving average,...

币小白_·2023-10-04 02:46

Yueying: The daily evening star of the big pie is below 28000. Continue to look at the weak aunt and look at the support of 1627 for a rebound.

There are infinite possibilities hidden in a person's self-discipline. The degree of your self-discipline determines the height of your life.

There are no shortcuts in life, but every step you take counts.

The more diligent you are, the harder you work; the more self-disciplined you are, the better you are. I am Zhou Yueying. I focus on the trend analysis of mainstream currencies and use my own technology to give insights into the market.

Let’s take a look at today’s sharing! !

Big pie technical analysis————

Looking at the daily chart of the big pie, the holiday has started a wave of rising market. After the positive line broke through the upper track, the market hit 28600 yesterday and retreated the upper shadow line. The market continues to return to the Bollinger Band range. The Bollinger Band is still in a flat state. In the short term The moving average turned slightly, and the MACD fast and slow line broke through 0. The axis extended upward and the volume column shrank. KDJ was blocked near the 100 value and turned downward. The VR indicator consolidated near the 140 value. In 4 hours, the market stretched and then retraced quickly. The Bollinger Bands moved upward but began to shrink. The short-term moving average moved downward...

币小白_·2023-10-04 01:46

JP Morgan Chase and Bank of India to settle dollar transactions based on blockchain platform

Author: forkast; Compiler: Songxue, Jinse Finance

JPMorgan Chase & Co. has launched a pilot project with India's top private bank to settle interbank U.S. dollar transactions through its blockchain platform Onyx, Bloomberg reported.

The pilot, reportedly launched on Monday with India's HDFC Bank, ICICI Bank, Axis Bank, Yes Bank and IndusInd Bank, aims to provide real-time transaction settlement around the clock, including weekends and public holidays.

The current settlement system can take several hours to complete a transaction. JPMorgan and six Indian banks hope to solve this problem by providing a faster, real-time alternative through blockchain technology.

JPMorgan Chase is also working with the Monetary Authority of Singapore and DBS Bank to explore blockchain use cases in the financial sector, such as institutional tokenization and decentralized finance (D...

金色财经_·2023-06-06 06:02

Load More