2025 AI16Z Fiyat Tahmini: Dalgalı Piyasalarda Yapay Zeka Destekli Kripto Paraların Geleceğinde Yol Almak

Giriş: AI16Z'nin Piyasa Konumu ve Yatırım Değeri

AI16Z (AI16Z), yapay zeka tabanlı yenilikçi bir girişim sermayesi simülasyon token’ı olarak piyasaya sunulduğundan bu yana kayda değer bir gelişim sergilemiştir. 2025 yılı itibarıyla AI16Z’nin piyasa değeri 62.248.982 $’a ulaşmış, yaklaşık 1.099.999.685 token dolaşıma girmiş ve fiyatı 0,05659 $ seviyelerinde seyretmektedir. “Yapay Zeka Girişim Sermayedarı” olarak anılan bu varlık, merkeziyetsiz yatırım ve topluluk odaklı karar süreçlerinde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, AI16Z'nin 2025-2030 dönemindeki fiyat hareketleri; geçmiş veriler, piyasa arz-talep dinamikleri, ekosistem gelişimi ve makroekonomik koşullar bağlamında analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. AI16Z Fiyat Geçmişi ve Güncel Piyasa Durumu

AI16Z Tarihsel Fiyat Yolculuğu

- 2025 Ocak: Tüm zamanların zirvesi görüldü, fiyat 2,51739 $’a ulaştı

- 2025 Ekim: Düşüş döneminde fiyat tüm zamanların en düşük seviyesi olan 0,01208 $’a indi

AI16Z Güncel Piyasa Durumu

22 Ekim 2025 itibarıyla AI16Z, 0,05659 $ seviyesinden işlem görüyor. Token, en yüksek seviyesinden %97,75 oranında değer kaybetmiş durumda. Son 24 saatte %1,68’lik hafif bir düşüş yaşanırken fiyat, 0,05565 $ ile 0,06358 $ arasında dalgalandı.

AI16Z’nin piyasa değeri 62.248.982 $ ve genel kripto para piyasa sıralamasında 540. sırada bulunuyor. 24 saatlik işlem hacmi ise 7.066.788 $ olup, bu da piyasanın orta düzeyde aktif olduğunu göstermektedir.

AI16Z, farklı dönemlerde karışık performanslar sergilemiştir. Son bir saatte %0,52 yükselirken, son bir haftada %12,3 ve son 30 günde %46,89 oranında değer kaybetmiştir. Ancak yıllık bazda %315,25’lik güçlü bir büyüme kaydetmiştir.

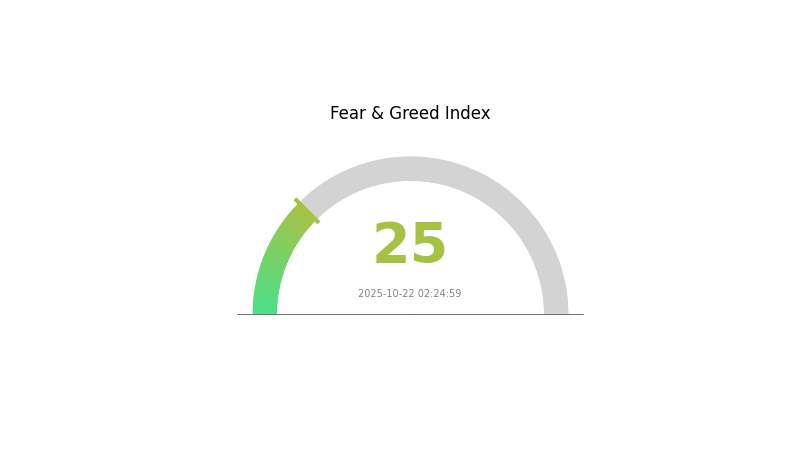

Kripto piyasasındaki güncel duyarlılık “Aşırı Korku” seviyesinde ve VIX endeksi 25 olarak ölçülmektedir. Bu durum, genel olarak yatırımcıların temkinli ve düşüş eğilimli hareket ettiğinin göstergesidir.

Güncel AI16Z piyasa fiyatını görüntülemek için tıklayın

AI16Z Piyasa Duyarlılığı Göstergesi

2025-10-22 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında bugün aşırı korku hakim ve AI16Z duyarlılık endeksi 25’e kadar gerilemiş durumda. Piyasadaki bu kötümserlik, zaman zaman ters pozisyon alan yatırımcılar için alım fırsatı olarak görülse de, mevcut belirsizlik nedeniyle dikkatli hareket edilmelidir. Yatırımcıların, maliyet ortalaması yöntemini değerlendirmesi ve güçlü projelere odaklanması faydalı olacaktır. Piyasa döngülerinin doğal olduğunu ve korku dönemlerinin çoğu zaman önemli toparlanmalar öncesinde yaşandığını unutmayın. Bu oynak ortamda bilgili kalın ve riskinizi etkin yönetin.

AI16Z Varlık Dağılımı

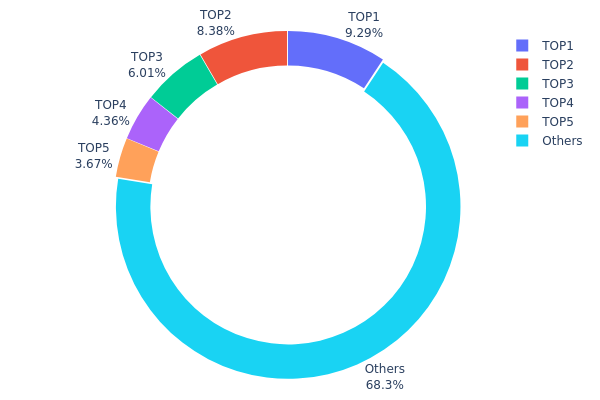

AI16Z’nin adres bazlı varlık dağılımı, sahiplikte orta yoğunluklu bir konsantrasyon olduğunu gösteriyor. En büyük 5 adres, toplam arzın %31,66’sını elinde tutarken, en büyük adresin payı %9,28. Bu yapı, büyük paydaşlar ile geniş dağılım arasında denge sağlıyor.

Merkeziyet yüksek seviyede olmasa da, bu dağılım tipi piyasa üzerinde etkili olabilir. Büyük sahiplerin önemli işlemleri, fiyat oynaklığını artırabilir. Yine de, tokenların %68,34’ünün küçük adreslerde bulunması, yüksek volatilitenin önüne geçebilecek bir merkeziyetsizlik sunuyor.

Bu dağılım, AI16Z’de büyük oyuncular ile geniş bir küçük yatırımcı tabanının bir arada bulunduğu, olgunlaşan bir piyasa yapısına işaret ediyor. Zincir üstü istikrar makul düzeyde olsa da, üst düzey sahiplerin hamleleri kısa vadeli fiyat hareketlerine önemli ölçüde etki edebilir; bu nedenle dikkatli izlenmelidir.

Güncel AI16Z Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık (Adet) | Varlık (%) |

|---|---|---|---|

| 1 | CK8i4z...QMR3qQ | 102.155,99K | 9,28% |

| 2 | u6PJ8D...ynXq2w | 92.149,93K | 8,37% |

| 3 | 8Mm46C...zrMZQH | 66.097,91K | 6,00% |

| 4 | GcSWeU...AUPuLu | 47.921,00K | 4,35% |

| 5 | 7TWnq4...ueuVuh | 40.349,83K | 3,66% |

| - | Diğerleri | 751.318,14K | 68,34% |

2. AI16Z'nin Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Token Ekonomisi: ELIZA platformunda çalışan yapay zeka ajanları, tokenlarının bir kısmını ai16z DAO’ya geri aktaracak.

- Güncel Etki: Bu mekanizmanın, ai16z’nin gelecekteki değerini desteklemesi bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: AI16Z, hızla büyüyen yapay zeka ekosisteminde yatırımcılar, içerik üreticileri ve girişimcilerden artan talep görüyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: AI16Z, diğer kripto paralar ve NFT’ler gibi, enflasyonist ortamlarda spekülatif bir yatırım aracı olarak işlev görebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- ELIZA Çerçevesi Entegrasyonu: Gelecekteki ai16z projeleri ELIZA çerçevesi temel alınarak geliştirilecek ve çok sayıda oyun piyasaya sürülecek.

- Yapay Zeka Ajanı Benimsemesi: Ekosistemdeki yapay zeka ajanlarının artan kullanımı, tokena ekstra destek sağlayarak AI16Z fiyatını yukarı taşıyabilir.

- Ekosistem Uygulamaları: AI16Z, ELIZA çerçevesiyle çalışan çok sayıda oyun başlatmayı hedefleyerek uygulamalı bir ekosistem kurmaya odaklanmaktadır.

III. AI16Z 2025-2030 Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,05219 $ - 0,05673 $

- Nötr tahmin: 0,05673 $ - 0,06155 $

- İyimser tahmin: 0,06155 $ - 0,06637 $ (olumlu piyasa atmosferi gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,04949 $ - 0,10858 $

- 2028: 0,05747 $ - 0,12862 $

- Başlıca katalizörler: Artan benimseme ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Perspektif

- Temel senaryo: 0,10992 $ - 0,1352 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,1352 $ - 0,16048 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,16048 $ - 0,17711 $ (olağanüstü piyasa koşulları ve yaygın benimseme varsayımıyla)

- 2030-12-31: AI16Z 0,17711 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,06637 | 0,05673 | 0,05219 | 0 |

| 2026 | 0,08617 | 0,06155 | 0,03816 | 8 |

| 2027 | 0,10858 | 0,07386 | 0,04949 | 29 |

| 2028 | 0,12862 | 0,09122 | 0,05747 | 60 |

| 2029 | 0,16048 | 0,10992 | 0,10442 | 93 |

| 2030 | 0,17711 | 0,1352 | 0,08788 | 137 |

IV. AI16Z Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AI16Z Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Uzun vadeli yatırımcılar, yapay zeka teknolojisi meraklıları

- Uygulama önerileri:

- Piyasa geri çekilmelerinde AI16Z token biriktirin

- Proje gelişmelerini ve topluluk etkileşimini izleyin

- Tokenları güvenli ve yedekli bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ile destek/direnç seviyelerini belirlemede kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım bölgelerini ölçer

- Dalgalı alım-satım için ana noktalar:

- Teknik göstergelere göre net giriş ve çıkış seviyeleri belirleyin

- Risk yönetimi için katı stop-loss emirleri kullanın

AI16Z Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı yapay zeka ve blockchain projelerine dağıtın

- Stop-loss emirleri: Muhtemel kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama çözümü: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama açın, güçlü şifreler kullanın

V. AI16Z İçin Potansiyel Riskler ve Zorluklar

AI16Z Piyasa Riskleri

- Yüksek oynaklık: AI16Z fiyatı ciddi dalgalanmalara açık

- Piyasa duyarlılığı: Yapay zeka hype döngüleri token değerini etkileyebilir

- Rekabet: Yeni yapay zeka projeleri AI16Z’nin pozisyonunu zayıflatabilir

AI16Z Regülasyon Riskleri

- Belirsiz düzenlemeler: Yapay zeka ve kripto alanında muhtemel mevzuat değişiklikleri

- Sınır ötesi uyumluluk: Farklı bölgelerde değişken yasal çerçeve

- Veri gizliliği endişeleri: Yapay zeka sistemlerinin veri kullanımı denetlenebilir

AI16Z Teknik Riskler

- Akıllı sözleşme açıkları: Token kontratındaki hata veya suistimal riskleri

- Yapay zeka modeli kısıtları: Karar doğruluğunda teknik zorluklar

- Ölçeklenebilirlik sorunları: Solana blockchain’de olası ağ sıkışıklığı

VI. Sonuç ve Eylem Önerileri

AI16Z Yatırım Değeri Değerlendirmesi

AI16Z, yapay zeka tabanlı girişim sermayesi alanında yenilikçi bir model sunmakta olup, yapay zeka ve blockchain kesişiminde uzun vadede önemli potansiyel taşımaktadır. Ancak kısa vadede yüksek volatilite ve düzenleyici belirsizlikler dikkate değer riskler oluşturmaktadır.

AI16Z Yatırım Tavsiyeleri

✅ Yeni başlayanlar: AI-kripto sektörünü öğrenmek için düşük tutarlı, eğitim amaçlı yatırımlar yapabilir ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi benimseyebilir ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapıp AI16Z’yi çeşitlendirilmiş bir AI-blockchain portföyünde değerlendirmelidir

AI16Z’ye Katılım Yöntemleri

- Token alımı: Gate.com üzerinden AI16Z token satın alın

- Topluluk katılımı: AI16Z Telegram veya Discord gruplarına katılın (en az 100 token gereklidir)

- Proje takibi: Yatırım kararları ve güncellemeler için AI16Z’nin resmi kanallarını takip edin

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleransına göre özenli karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayınız.

SSS

AI16Z ne kadar yükselebilir?

AI16Z’nin 2025’te 0,45505449 $’a ulaşarak yılın en yüksek değerini görmesi beklenmektedir.

AI16Z coin yatırım için uygun mu?

AI16Z güçlü bir büyüme potansiyeli gösteriyor. Analistlere göre, fiyatı 2025’te 0,160 $’a, 2033’te ise 1,81 $’a ulaşabilir; bu da kayda değer bir artış anlamına geliyor.

AI16Z token’a ne oldu?

ai16z token’ı, Eliza Labs’ın proje geçiş sürecinin bir parçası olarak elizaOS token ile değiştirilmiştir.

API3’ün geleceği var mı?

API3’te potansiyel bulunuyor. Tahminlere göre Kasım 2025’te fiyatı hafifçe 0,6695 $’a gerileyebilir; ancak projenin merkeziyetsiz API konusundaki yenilikçi yaklaşımı, uzun vadede büyümeyi destekleyebilir.

Flock.io (FLOCK) yatırım için uygun mu? Bu yeni kripto projesinin potansiyeli ve riskleri nasıl değerlendirilmeli?

Sahara AI (SAHARA) iyi bir yatırım mı?: Bu yükselen yapay zeka kripto parasının potansiyelini ve risklerini inceliyoruz

Trusta.AI (TA) Yatırım İçin Uygun mu?: AI Güvenlik Token’inin Piyasa Potansiyeli ve Uzun Vadeli Büyüme Perspektiflerinin Analizi

2025 VADER Fiyat Tahmini: Kripto Para Dünyasında Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 MASA Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 GAI Fiyat Tahmini: Gelişen dijital ekonomide GAI'nin piyasa trendleri ve gelecekteki değerlemesini analiz etmek

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması