# MiddleEastTensionsEscalate

13.6K

Rising U.S.–Iran tensions have driven gold above the $5,000 milestone, while Bitcoin has pulled back and market sentiment turns cautious. Would you allocate to gold now, or look for a BTC dip?

HighAmbition

#MiddleEastTensionsEscalate

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

- Reward

- 20

- 57

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#MiddleEastTensionsEscalate

The Middle East is experiencing a dangerous convergence of open military threats, internal unrest, and digital disinformation campaigns. This report provides a detailed assessment of the key flashpoints shaping the regional landscape as of January 27, 2026.

🔥 Immediate Flashpoint: U.S.-Iran Military & Rhetorical Escalation

The most urgent threat to regional stability is the rapidly escalating confrontation between the United States and Iran.

· U.S. Military Posture: President Donald Trump announced on January 27 that the United States now has a "big armada next to

The Middle East is experiencing a dangerous convergence of open military threats, internal unrest, and digital disinformation campaigns. This report provides a detailed assessment of the key flashpoints shaping the regional landscape as of January 27, 2026.

🔥 Immediate Flashpoint: U.S.-Iran Military & Rhetorical Escalation

The most urgent threat to regional stability is the rapidly escalating confrontation between the United States and Iran.

· U.S. Military Posture: President Donald Trump announced on January 27 that the United States now has a "big armada next to

- Reward

- 5

- 14

- Repost

- Share

repanzal :

:

1000x VIbes 🤑View More

#MiddleEastTensionsEscalate The current geopolitical escalation in the Middle East is casting a heavy shadow over the global financial landscape, and the cryptocurrency market is not immune to its effects. With rising tensions in the region, crypto markets are grappling with heightened volatility, erratic liquidity flows, and drastic swings in investor sentiment. In particular, we are seeing a marked shift in the behavior of both institutional and retail investors, as they navigate this uncertain environment. The intersection of geopolitical risks and financial markets has pushed cryptocurrenc

- Reward

- 7

- 9

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

The recent escalation of tensions in the Middle East has captured global attention as geopolitical risks rise. Conflicts in this region not only have immediate security implications but also ripple through international markets, affecting oil prices, currency volatility, and investor sentiment worldwide. As the Middle East remains a critical hub for energy exports, any disruption in supply chains or trade routes directly impacts global commodity markets.

Oil and Energy Markets 🛢️

The Middle East is home to some of the largest oil-producing nations. Heightened tens

The recent escalation of tensions in the Middle East has captured global attention as geopolitical risks rise. Conflicts in this region not only have immediate security implications but also ripple through international markets, affecting oil prices, currency volatility, and investor sentiment worldwide. As the Middle East remains a critical hub for energy exports, any disruption in supply chains or trade routes directly impacts global commodity markets.

Oil and Energy Markets 🛢️

The Middle East is home to some of the largest oil-producing nations. Heightened tens

- Reward

- 6

- 10

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#中东局势升级 Gold and Bitcoin, who is the king of safe haven?

Amidst the intertwining of inflation and geopolitical risks, "how to choose safe assets" has become a topic circulating in streets and alleys. Gold, as the "big brother" that has lasted for thousands of years, sits steadily on the throne of traditional safe havens; while Bitcoin, this "digital newcomer" that raises the slogan of "decentralization," has launched a strong attack. But who is the true king of safe haven?

Inflation Resistance: Is Gold the "Hard Currency" or Is Bitcoin Still "Tested"?

When it comes to resisting inflation, gol

View OriginalAmidst the intertwining of inflation and geopolitical risks, "how to choose safe assets" has become a topic circulating in streets and alleys. Gold, as the "big brother" that has lasted for thousands of years, sits steadily on the throne of traditional safe havens; while Bitcoin, this "digital newcomer" that raises the slogan of "decentralization," has launched a strong attack. But who is the true king of safe haven?

Inflation Resistance: Is Gold the "Hard Currency" or Is Bitcoin Still "Tested"?

When it comes to resisting inflation, gol

- Reward

- 1

- 5

- Repost

- Share

Moathalmahdi :

:

Hold tight to 💪View More

#MiddleEastTensionsEscalate

The early 2026 macro environment is presenting a stark divergence between traditional safe havens and digital assets. Gold has breached the $5,000 per ounce threshold, reaching highs not seen in decades, while Bitcoin languishes in the $85,000–$90,000 range.

This divergence is more than a market quirk it reflects a flight-to-safety mindset among both institutional and retail capital, driven by geopolitical uncertainty, maximum-pressure trade policies, and ongoing military posturing in the Middle East.

Investors now face a classic strategic dilemma:

Should one fav

The early 2026 macro environment is presenting a stark divergence between traditional safe havens and digital assets. Gold has breached the $5,000 per ounce threshold, reaching highs not seen in decades, while Bitcoin languishes in the $85,000–$90,000 range.

This divergence is more than a market quirk it reflects a flight-to-safety mindset among both institutional and retail capital, driven by geopolitical uncertainty, maximum-pressure trade policies, and ongoing military posturing in the Middle East.

Investors now face a classic strategic dilemma:

Should one fav

BTC-0,04%

- Reward

- 11

- 13

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#MiddleEastTensionsEscalate

As tensions rise, gold pushes past $5,000 while BTC cools off under pressure.

Classic risk-off behavior — capital hides in safety before returning to growth.

I’m watching whether this is a temporary fear spike or a longer geopolitical wave.

Gold strength vs BTC weakness is giving clear signals about sentiment.

If panic fades, BTC dips may become opportunity zones.

Are you allocating to gold here, or preparing to buy the BTC pullback?

As tensions rise, gold pushes past $5,000 while BTC cools off under pressure.

Classic risk-off behavior — capital hides in safety before returning to growth.

I’m watching whether this is a temporary fear spike or a longer geopolitical wave.

Gold strength vs BTC weakness is giving clear signals about sentiment.

If panic fades, BTC dips may become opportunity zones.

Are you allocating to gold here, or preparing to buy the BTC pullback?

BTC-0,04%

- Reward

- 11

- 16

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate 🌍

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

- Reward

- 5

- 5

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

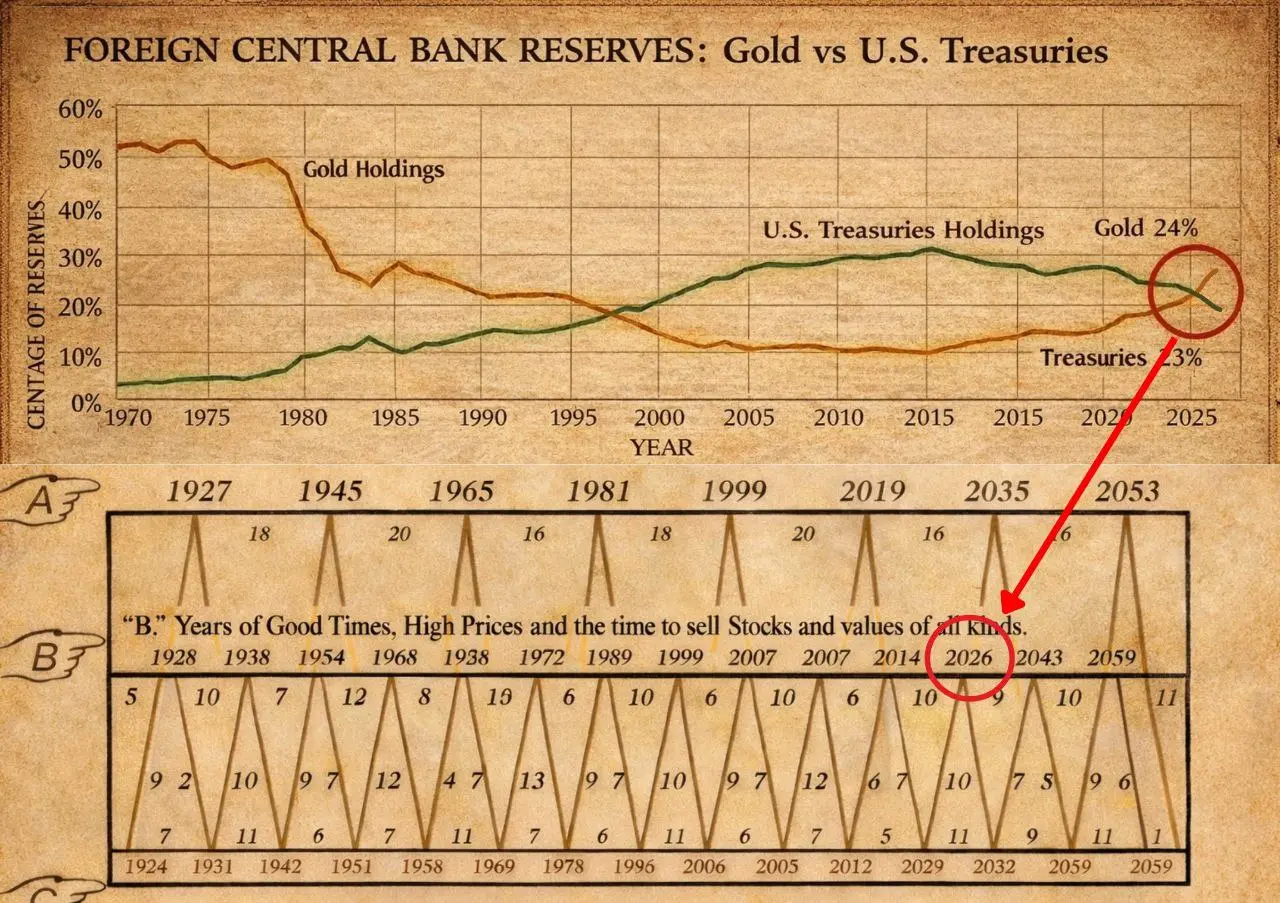

#GoldandSilverHitNewHighs

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 10

- 13

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate 🌍

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

- Reward

- 5

- 6

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

50.33K Popularity

13.6K Popularity

9.86K Popularity

4.5K Popularity

3.84K Popularity

3.9K Popularity

3.37K Popularity

3.22K Popularity

69.52K Popularity

112.06K Popularity

77.98K Popularity

20.06K Popularity

45.56K Popularity

37.53K Popularity

176.23K Popularity

News

View MoreData: If BTC breaks through $92,200, the total liquidation strength of mainstream CEX short positions will reach $1.523 billion.

1 m

Data: 24,646,700 TRX transferred from anonymous addresses, worth approximately $7,236,200.

1 m

Data: 36,400 SOL transferred from an anonymous address, worth approximately $4.5 million

21 m

Data: 130 BTC transferred from multiple anonymous addresses to Wintermute, worth approximately $11.17 million

1 h

Trump hopes the Federal Reserve will lower interest rates

1 h

Pin