# japan

114.59K

CryptoZeno

#JAPAN WILL CRASH THE MARKET IN 3 DAYS

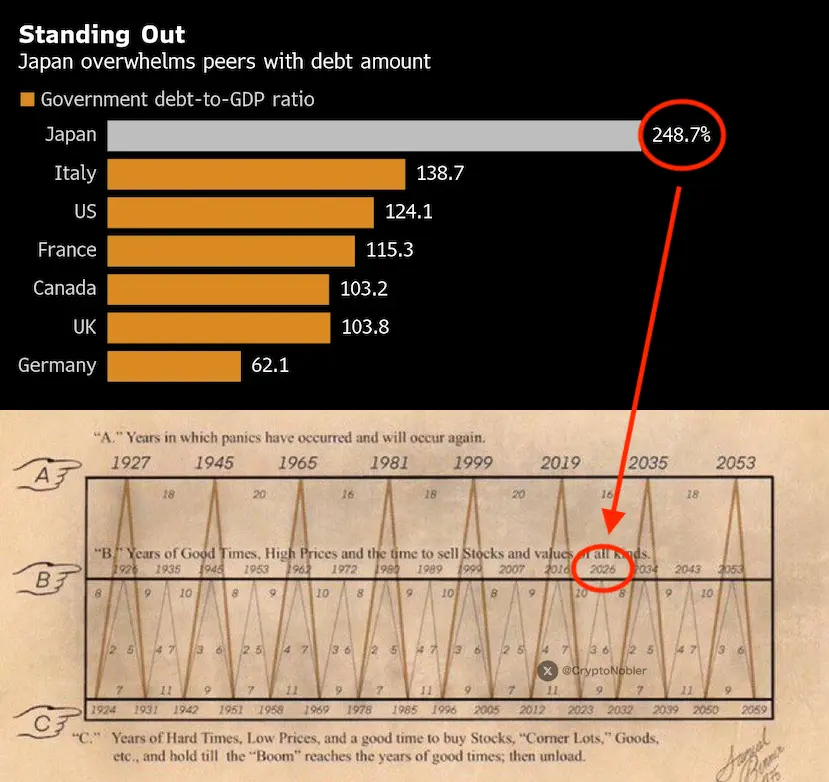

Japan is sitting on 10 trillion USD in debt and JGB yields just hit record highs.

They are preparing to sell 500 billion USD in US stocks to stabilize a system that is starting to break.

Japan survived only because rates were near zero. Now yields rise, debt payments explode and interest eats revenue.

No advanced economy escapes cleanly through default, restructuring or inflation.

The global risk comes from their foreign holdings.

Japan owns trillions abroad including more than 1 trillion USD in US Treasuries and massive equity positions.

When JGBs final

Japan is sitting on 10 trillion USD in debt and JGB yields just hit record highs.

They are preparing to sell 500 billion USD in US stocks to stabilize a system that is starting to break.

Japan survived only because rates were near zero. Now yields rise, debt payments explode and interest eats revenue.

No advanced economy escapes cleanly through default, restructuring or inflation.

The global risk comes from their foreign holdings.

Japan owns trillions abroad including more than 1 trillion USD in US Treasuries and massive equity positions.

When JGBs final

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Great update for everyone View More

$BCH $BTC

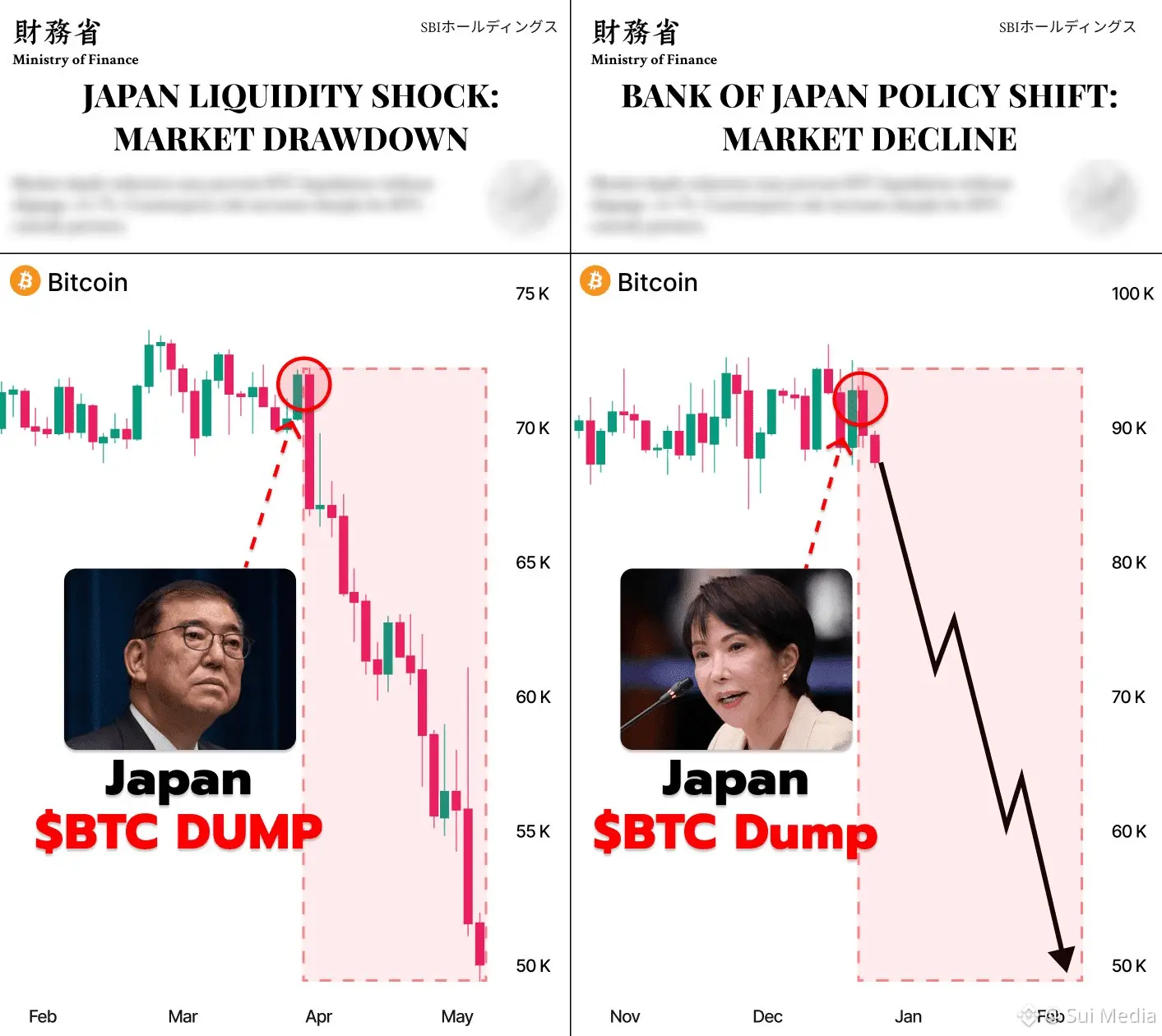

🇯🇵 Japan → Why it matters for BTC

Japan impacts global liquidity more than it looks because of:

JPY carry trade

Global bond & FX liquidity

Risk asset correlation

1️⃣ Japan Liquidity Shock (Left chart)

Tight liquidity / funding stress

Yen strengthens → carry trades unwind

Risk assets (BTC, stocks) sell off fast

Result: Sharp BTC dump (75k → 50k)

2️⃣ BoJ Policy Shift (Right chart – Projection)

Rate normalization / tightening signal

Market reprices risk before confirmation

BTC loses high-timeframe support

Projection aligns with 90k → 50–60k zone

---

📉 Technical + Macro Confluence

HT

🇯🇵 Japan → Why it matters for BTC

Japan impacts global liquidity more than it looks because of:

JPY carry trade

Global bond & FX liquidity

Risk asset correlation

1️⃣ Japan Liquidity Shock (Left chart)

Tight liquidity / funding stress

Yen strengthens → carry trades unwind

Risk assets (BTC, stocks) sell off fast

Result: Sharp BTC dump (75k → 50k)

2️⃣ BoJ Policy Shift (Right chart – Projection)

Rate normalization / tightening signal

Market reprices risk before confirmation

BTC loses high-timeframe support

Projection aligns with 90k → 50–60k zone

---

📉 Technical + Macro Confluence

HT

MC:$3.43KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

JUST IN: JAPAN TURNS UP THE HEAT ON BANKS

Japan’s Financial Services Agency (FSA) has begun closely monitoring regional banks, especially those heavily exposed to the rapidly growing real estate market.

📌 Why this matters:

Rising property prices + easy credit = hidden risk

Regulators fear stress could quietly build inside the banking system

Oversight is tightening before problems surface publicly

🌍 Global context:

Around the world, regulators are becoming more cautious as markets remain hot and capital moves quickly. This trend aligns with a broader pro-growth, business-friendly environment

Japan’s Financial Services Agency (FSA) has begun closely monitoring regional banks, especially those heavily exposed to the rapidly growing real estate market.

📌 Why this matters:

Rising property prices + easy credit = hidden risk

Regulators fear stress could quietly build inside the banking system

Oversight is tightening before problems surface publicly

🌍 Global context:

Around the world, regulators are becoming more cautious as markets remain hot and capital moves quickly. This trend aligns with a broader pro-growth, business-friendly environment

- Reward

- like

- Comment

- Repost

- Share

💥BREAKING:

🇯🇵 Bank of Japan hikes interest rates to 0.75%, highest in 30 years.

#Japan #INTERESTRATE #HasTheMarketDipped? #CryptoMarketWatch #AreYouBullishOrBearishToday? $BTC $ETH $XRP

🇯🇵 Bank of Japan hikes interest rates to 0.75%, highest in 30 years.

#Japan #INTERESTRATE #HasTheMarketDipped? #CryptoMarketWatch #AreYouBullishOrBearishToday? $BTC $ETH $XRP

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

Watching Closely 🔍View More

Trump puts a 25% tax on goods from Japan and South Korea, starting August 1, 2025 🇺🇸.

#trump #southkorea #japan

#trump #southkorea #japan

TRUMP-2,03%

- Reward

- 3

- Comment

- Repost

- Share

Metaplanet Expands Bitcoin Influence with Japanese Bitcoin Magazine Launch:

the newly launched Bitcoin magazine Japan will use high-quality content and community initiatives to guide over 1 million Japanese residents to understand and actively participate in the Bitcoin ecosystem.

#metaplanet

#japan #BTC

#gate.io

the newly launched Bitcoin magazine Japan will use high-quality content and community initiatives to guide over 1 million Japanese residents to understand and actively participate in the Bitcoin ecosystem.

#metaplanet

#japan #BTC

#gate.io

- Reward

- 10

- 3

- Repost

- Share

CRYPTOApU :

:

To Da Moon 🌕View More

Japan’s first and only publicly listed #Bitcoin Treasury Company, Metaplanet, reports $36M in unrealized gains for 2024 and plans to acquire up to 21,000 $BTC by 2026.

#Gate.io Has Officially Partnered with Oracle Red Bull Racing #Which Altcoin ETF Could be Approved First? #BTC Market Trend Analysis #BTC #japan

#Gate.io Has Officially Partnered with Oracle Red Bull Racing #Which Altcoin ETF Could be Approved First? #BTC Market Trend Analysis #BTC #japan

BTC-0,81%

- Reward

- 1

- 1

- Repost

- Share

Crypto_News :

:

Bull Run 🐂Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

60.75K Popularity

39.31K Popularity

23.55K Popularity

65.46K Popularity

347.76K Popularity

13.04K Popularity

11.62K Popularity

20.43K Popularity

110.3K Popularity

24.57K Popularity

210.65K Popularity

21.6K Popularity

6.97K Popularity

17.48K Popularity

157.12K Popularity

News

View MoreData: 524 million SKY tokens transferred from anonymous addresses, worth approximately $35.02 million

8 m

Intel's after-hours stock price drops over 4%

16 m

The three major U.S. stock indices closed higher, with Alibaba up 5%.

18 m

Data: 175 million SKY tokens transferred from anonymous addresses, worth approximately $11.67 million

19 m

US Dollar Index DXY drops over 0.5% intraday, currently at 98.3

36 m

Pin