#EthereumL2Outlook

📊 Core Highlights: Ethereum L2 Outlook 2026

What It Means for Ethereum’s Market, Demand, and Long-Term Value

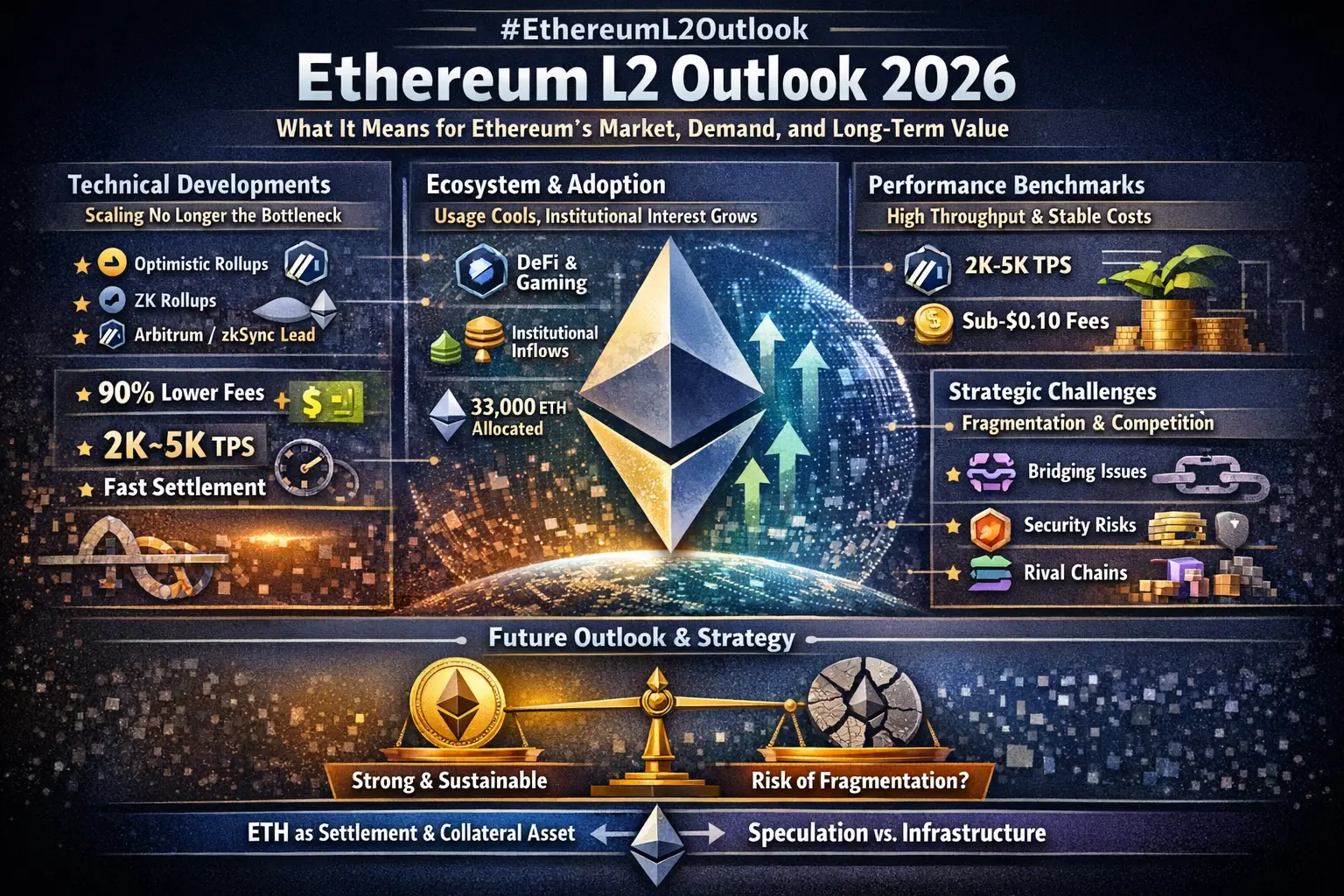

Ethereum Layer 2 (L2) scaling solutions sit at the core of Ethereum’s roadmap toward higher throughput, lower transaction costs, and global adoption. As we move through 2026, the L2 ecosystem presents a mixed but critical inflection point: major technical progress on one side, and growing challenges around user engagement, fragmentation, and competition on the other.

Most importantly, the success or failure of L2s now directly shapes Ethereum’s market performance and future valuation.

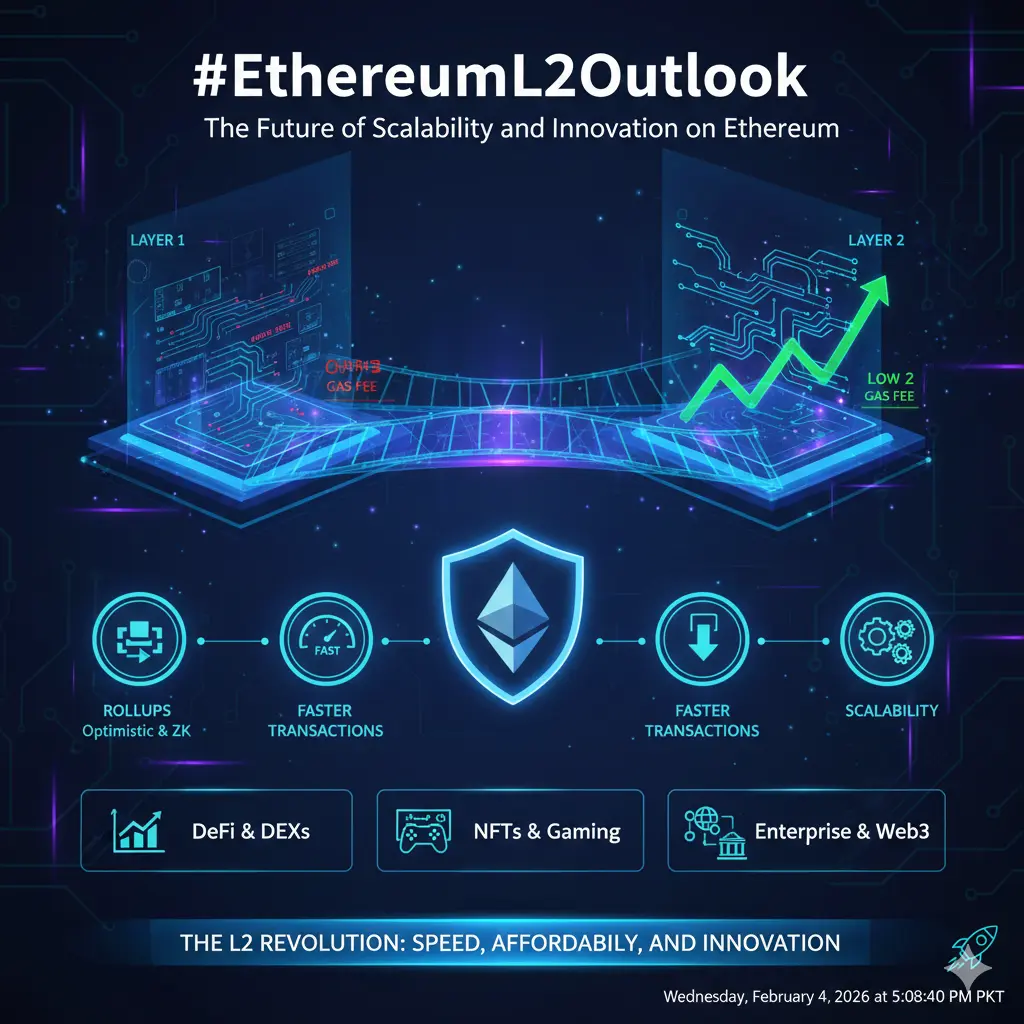

1. ⚙️ Technical Developments: Scaling Is No Longer the Bottleneck

Ethereum’s scaling narrative has shifted decisively toward Layer 2 execution.

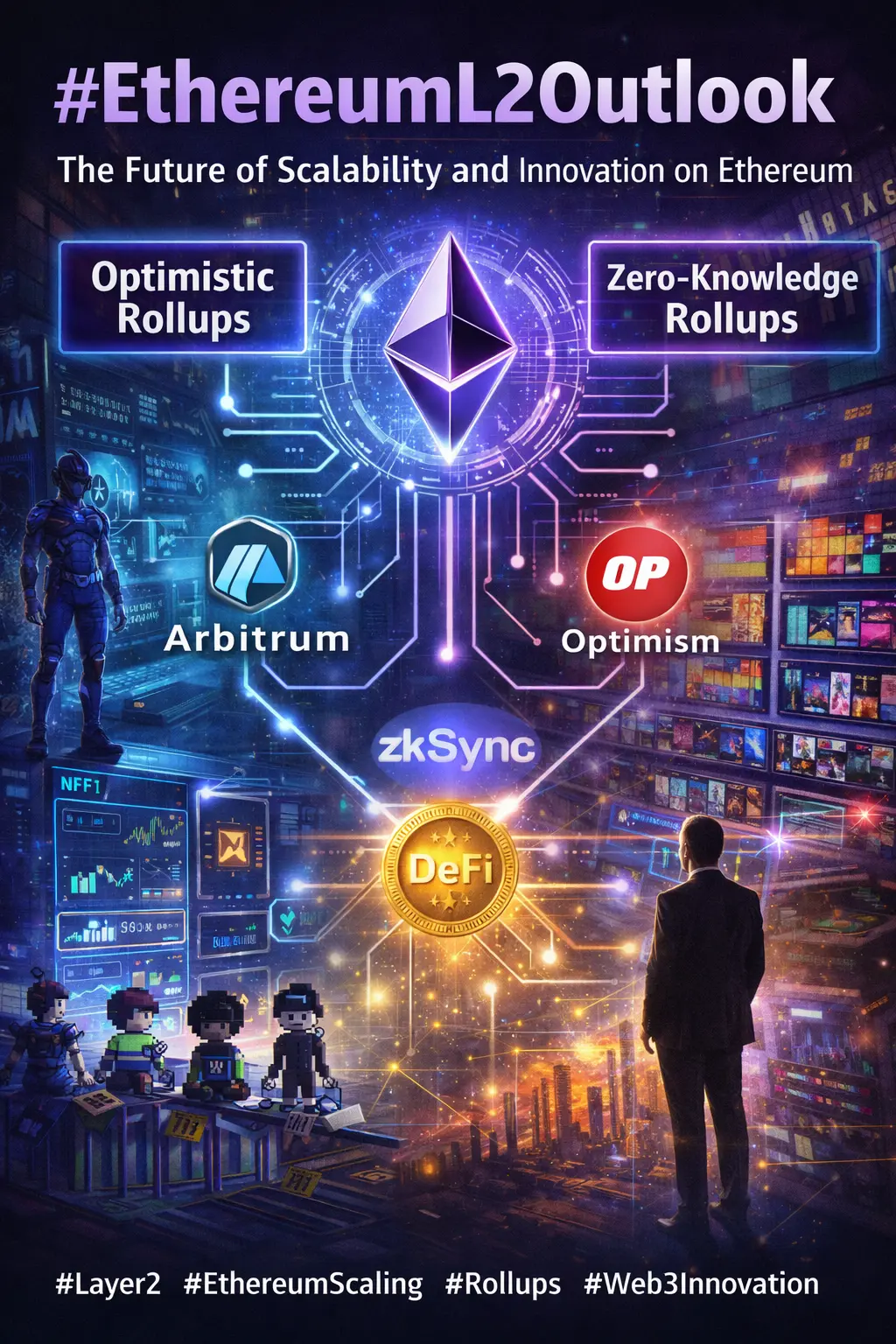

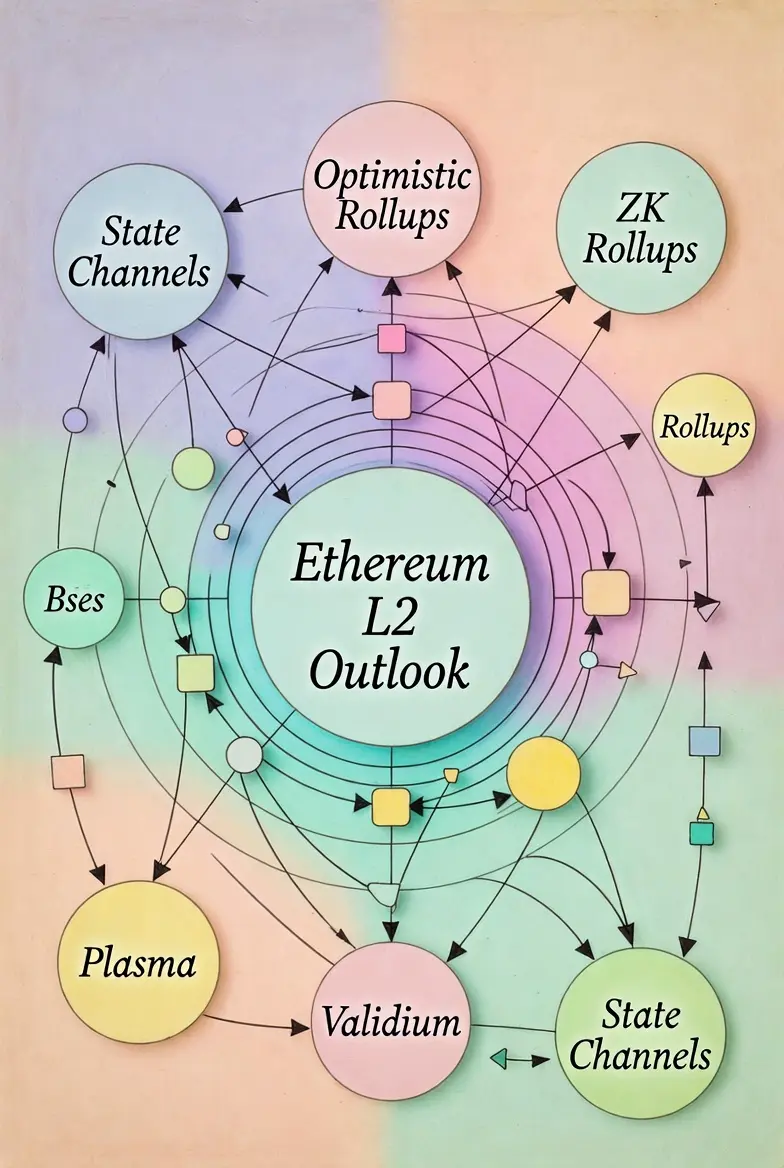

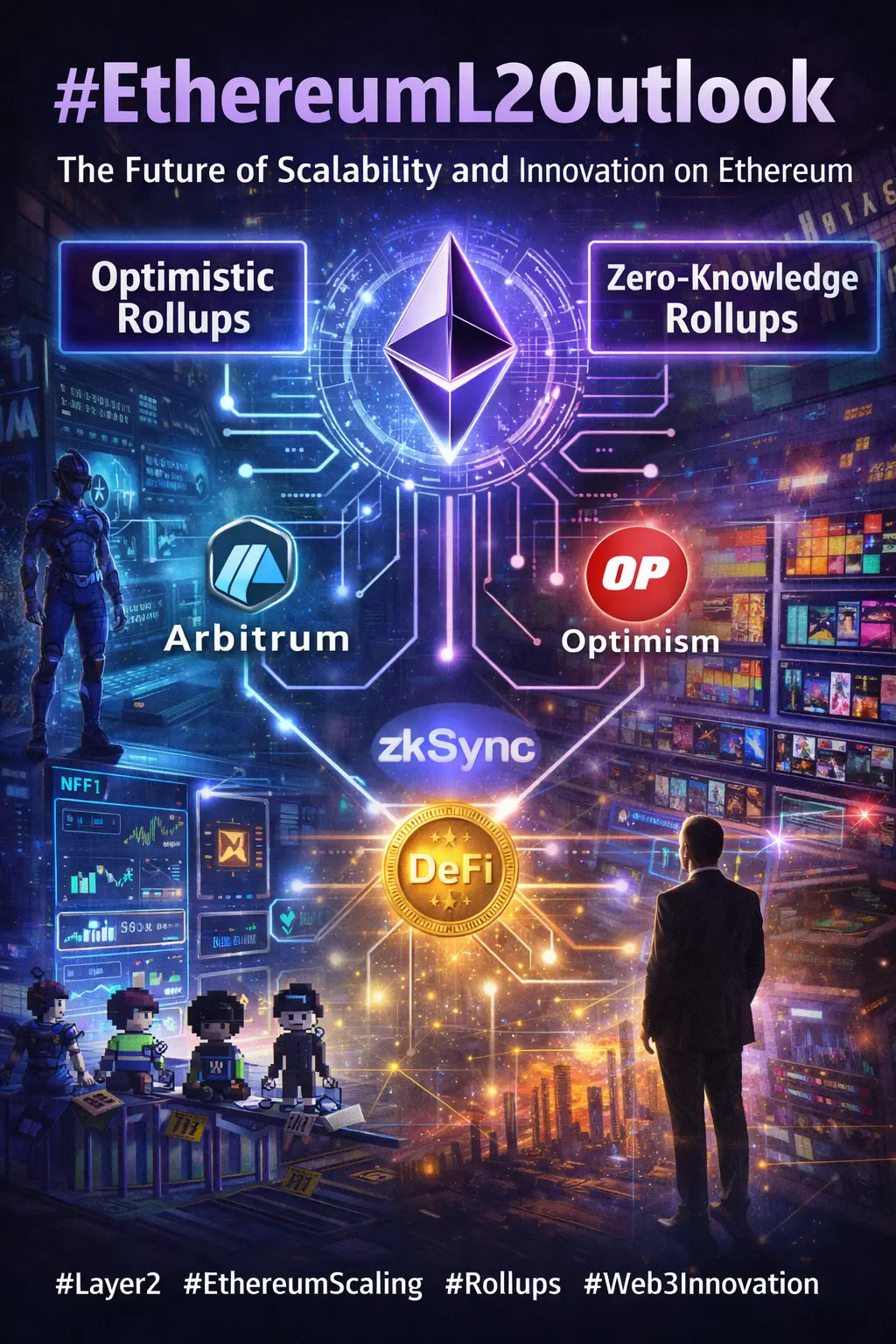

Primary L2 Architectures

Optimistic Rollups

Zero-Knowledge (ZK) Rollups

Validiums

State Channels

Leading Networks Arbitrum, Optimism, zkSync, Starknet, and Scroll dominate activity, with dozens of second-tier and app-specific L2s emerging.

Efficiency Trends

L2s have reduced Ethereum transaction costs by up to ~90%, with many transfers averaging below $0.10 under normal network conditions.

Independent benchmarks (OSL 2026 L2 comparisons) consistently place Arbitrum and zkSync among efficiency leaders.

ZK rollups are increasingly favored for high-volume, latency-sensitive use cases due to faster settlement and stronger cryptographic guarantees.

🔹 Market Impact on ETH:

Lower execution costs increase on-chain activity, but they also shift value capture from gas fees to ETH’s role as a settlement and collateral asset. Ethereum’s market narrative is evolving from “fee generator” to global settlement layer.

2. 🌐 Ecosystem & Adoption: Usage Cools, Infrastructure Matures

User Activity TokenTerminal data indicates active L2 addresses declined from roughly 58.4 million in mid-2025 to around 30 million by early 2026. This suggests:

User fatigue after rapid L2 expansion

Migration to alternative ecosystems

Or consolidation toward fewer dominant networks

Builder & Institutional Interest Despite softer retail metrics, institutional engagement is accelerating:

Large ETH treasury inflows (e.g., ~33,000 ETH allocated in late 2025 for L2 expansion)

Long-term infrastructure investments rather than short-term speculation

Utility Expansion

Payments and microtransactions

Gaming and NFT infrastructure

DeFi scaling and capital-efficient protocols

DePIN and real-world integrations

Arbitrum and Optimism maintain strong developer mindshare, while ZK rollups continue to gain ground in privacy-sensitive and cross-chain use cases.

🔹 Market Impact on ETH:

Institutional usage strengthens ETH’s role as collateral, staking asset, and settlement token, even if retail activity fluctuates. This supports structural demand, not speculative hype.

3. 🚀 Performance Benchmarks: Execution Is No Longer the Problem

Throughput

Major L2s consistently reach 2,000–5,000 TPS in stress-test environments.

Settlement Speed

ZK rollups provide near-instant confirmation.

Optimistic rollups remain constrained by fraud-proof windows, typically minutes to hours.

Cost Stability

Fees remain sub-dollar across most L2s, with relative stability compared to Ethereum mainnet.

🔹 Market Impact on ETH:

As execution moves off-chain, Ethereum increasingly functions as high-value infrastructure, similar to how TCP/IP underpins the internet. ETH’s valuation becomes more tied to network trust and economic security than raw transaction counts.

4. 💡 Strategic Challenges: Where Ethereum Faces Pressure

User Drop-Off Declining active addresses point toward saturation and rising competition from:

Solana’s monolithic, high-throughput design

Modular and alternative execution environments

Fragmentation & UX

Bridging across dozens of L2s creates friction

Liquidity fragmentation complicates onboarding

UX complexity remains a major adoption barrier

Security Risks

Bridges and cross-chain contracts remain high-value attack surfaces

Recent exploits highlight ongoing operational security risks

🔹 Market Impact on ETH:

If fragmentation and UX challenges persist, value and users may leak to simpler ecosystems, limiting ETH’s upside even with strong infrastructure.

5. 🔎 Future Outlook & Innovation Path

Vitalik Buterin’s Direction Vitalik has emphasized a shift in priorities:

Less focus on fragmented scaling experiments

More emphasis on seamless UX, safety, and interoperability

Upgrade Path

Danksharding and data-availability improvements are expected to further compress L2 costs

L2s increasingly evolve into app-specific blockchains rather than general-purpose networks

Competitive Landscape

Solana’s native scaling and integrated UX

Hybrid L1+L2 ecosystems

These remain serious competitors, especially if Ethereum fails to abstract complexity for users.

🔹 Market Impact on ETH:

Ethereum’s long-term value depends on whether it becomes invisible infrastructure that users don’t have to think about — while ETH remains the asset securing it all.

🎯 Investment & Participation Strategy

Builders

Focus on real-world demand: payments, gaming, DePIN, financial infrastructure

Users

Prioritize L2s with proven security, deep liquidity, and mature ecosystems (Arbitrum, Optimism, zkSync)

Investors

Track ecosystem funds, institutional ETH allocations, and long-term partnerships

Watch whether L2 growth translates into ETH staking, lockups, and settlement demand

⚠️ Risks & Warnings

Ongoing fragmentation may dilute value capture

Bridging remains a non-trivial smart contract risk

Regulatory clarity around L2s is still uncertain

ETH price may remain volatile and macro-sensitive despite strong fundamentals

🧠 Final Takeaway: What This Means for ETH’s Market

Ethereum’s future is no longer about block space alone — it’s about economic gravity.

If L2s succeed → ETH strengthens as a settlement, staking, and collateral asset

If UX and fragmentation persist → users and value migrate elsewhere

Ethereum is transitioning from a speculative network into foundational digital infrastructure.

That transition is slower — but potentially far more durable.

📊 Core Highlights: Ethereum L2 Outlook 2026

What It Means for Ethereum’s Market, Demand, and Long-Term Value

Ethereum Layer 2 (L2) scaling solutions sit at the core of Ethereum’s roadmap toward higher throughput, lower transaction costs, and global adoption. As we move through 2026, the L2 ecosystem presents a mixed but critical inflection point: major technical progress on one side, and growing challenges around user engagement, fragmentation, and competition on the other.

Most importantly, the success or failure of L2s now directly shapes Ethereum’s market performance and future valuation.

1. ⚙️ Technical Developments: Scaling Is No Longer the Bottleneck

Ethereum’s scaling narrative has shifted decisively toward Layer 2 execution.

Primary L2 Architectures

Optimistic Rollups

Zero-Knowledge (ZK) Rollups

Validiums

State Channels

Leading Networks Arbitrum, Optimism, zkSync, Starknet, and Scroll dominate activity, with dozens of second-tier and app-specific L2s emerging.

Efficiency Trends

L2s have reduced Ethereum transaction costs by up to ~90%, with many transfers averaging below $0.10 under normal network conditions.

Independent benchmarks (OSL 2026 L2 comparisons) consistently place Arbitrum and zkSync among efficiency leaders.

ZK rollups are increasingly favored for high-volume, latency-sensitive use cases due to faster settlement and stronger cryptographic guarantees.

🔹 Market Impact on ETH:

Lower execution costs increase on-chain activity, but they also shift value capture from gas fees to ETH’s role as a settlement and collateral asset. Ethereum’s market narrative is evolving from “fee generator” to global settlement layer.

2. 🌐 Ecosystem & Adoption: Usage Cools, Infrastructure Matures

User Activity TokenTerminal data indicates active L2 addresses declined from roughly 58.4 million in mid-2025 to around 30 million by early 2026. This suggests:

User fatigue after rapid L2 expansion

Migration to alternative ecosystems

Or consolidation toward fewer dominant networks

Builder & Institutional Interest Despite softer retail metrics, institutional engagement is accelerating:

Large ETH treasury inflows (e.g., ~33,000 ETH allocated in late 2025 for L2 expansion)

Long-term infrastructure investments rather than short-term speculation

Utility Expansion

Payments and microtransactions

Gaming and NFT infrastructure

DeFi scaling and capital-efficient protocols

DePIN and real-world integrations

Arbitrum and Optimism maintain strong developer mindshare, while ZK rollups continue to gain ground in privacy-sensitive and cross-chain use cases.

🔹 Market Impact on ETH:

Institutional usage strengthens ETH’s role as collateral, staking asset, and settlement token, even if retail activity fluctuates. This supports structural demand, not speculative hype.

3. 🚀 Performance Benchmarks: Execution Is No Longer the Problem

Throughput

Major L2s consistently reach 2,000–5,000 TPS in stress-test environments.

Settlement Speed

ZK rollups provide near-instant confirmation.

Optimistic rollups remain constrained by fraud-proof windows, typically minutes to hours.

Cost Stability

Fees remain sub-dollar across most L2s, with relative stability compared to Ethereum mainnet.

🔹 Market Impact on ETH:

As execution moves off-chain, Ethereum increasingly functions as high-value infrastructure, similar to how TCP/IP underpins the internet. ETH’s valuation becomes more tied to network trust and economic security than raw transaction counts.

4. 💡 Strategic Challenges: Where Ethereum Faces Pressure

User Drop-Off Declining active addresses point toward saturation and rising competition from:

Solana’s monolithic, high-throughput design

Modular and alternative execution environments

Fragmentation & UX

Bridging across dozens of L2s creates friction

Liquidity fragmentation complicates onboarding

UX complexity remains a major adoption barrier

Security Risks

Bridges and cross-chain contracts remain high-value attack surfaces

Recent exploits highlight ongoing operational security risks

🔹 Market Impact on ETH:

If fragmentation and UX challenges persist, value and users may leak to simpler ecosystems, limiting ETH’s upside even with strong infrastructure.

5. 🔎 Future Outlook & Innovation Path

Vitalik Buterin’s Direction Vitalik has emphasized a shift in priorities:

Less focus on fragmented scaling experiments

More emphasis on seamless UX, safety, and interoperability

Upgrade Path

Danksharding and data-availability improvements are expected to further compress L2 costs

L2s increasingly evolve into app-specific blockchains rather than general-purpose networks

Competitive Landscape

Solana’s native scaling and integrated UX

Hybrid L1+L2 ecosystems

These remain serious competitors, especially if Ethereum fails to abstract complexity for users.

🔹 Market Impact on ETH:

Ethereum’s long-term value depends on whether it becomes invisible infrastructure that users don’t have to think about — while ETH remains the asset securing it all.

🎯 Investment & Participation Strategy

Builders

Focus on real-world demand: payments, gaming, DePIN, financial infrastructure

Users

Prioritize L2s with proven security, deep liquidity, and mature ecosystems (Arbitrum, Optimism, zkSync)

Investors

Track ecosystem funds, institutional ETH allocations, and long-term partnerships

Watch whether L2 growth translates into ETH staking, lockups, and settlement demand

⚠️ Risks & Warnings

Ongoing fragmentation may dilute value capture

Bridging remains a non-trivial smart contract risk

Regulatory clarity around L2s is still uncertain

ETH price may remain volatile and macro-sensitive despite strong fundamentals

🧠 Final Takeaway: What This Means for ETH’s Market

Ethereum’s future is no longer about block space alone — it’s about economic gravity.

If L2s succeed → ETH strengthens as a settlement, staking, and collateral asset

If UX and fragmentation persist → users and value migrate elsewhere

Ethereum is transitioning from a speculative network into foundational digital infrastructure.

That transition is slower — but potentially far more durable.