Search results for "DOT"

US December ADP employment data shows a modest rebound "slightly below expectations," Bitcoin weakens and falls below $92,000, Ethereum drops below $3200

US December ADP "Small Non-Farm" Employment Data Shows Private Sector Employment Slightly Rebounded, but Overall Growth Remains Below Market Expectations, Indicating Limited Labor Market Recovery and Continuing Investor Focus on How Upcoming Official Non-Farm Data Will Influence Rate Cut Expectations.

(Background: Where's the anticipated rate cut celebration? Interpreting the Fed's "Hawkish Rate Cut" and the distinction from QE bond purchases)

(Additional context: The Fed's 1 basis point rate cut meets expectations! The dot plot indicates only a 1 basis point cut in 2026, Bitcoin and Ethereum fluctuate wildly, and US stocks see intraday gains)

Table of Contents

ADP Employment Rebounds but Momentum Remains Weak

Cryptocurrency Weakens

Next Focus: Non-Farm Employment

ETH-2.79%

動區BlockTempo·19h ago

Experts predict Polkadot's price will reach $11 as signs of recovery emerge

Polkadot (DOT) price recorded a 2.24% increase for the day, bringing short-term optimism to the market and improving investor sentiment. However, overall, the outlook remains quite bleak as the DOT price is currently about 73% below its all-time high.

Buying pressure has not yet become truly strong, as indicated by the s

DOT-3.65%

TapChiBitcoin·01-05 05:05

Polkadot price rises 12% after Kusama upgrade: Will this rally last?

Today, the price of Polkadot (DOT) has recorded an impressive increase of about 12% in just one day, surprising many traders. The main driver comes from a major upgrade on Kusama – a network closely linked to Polkadot. This event has helped improve short-term sentiment across the entire Polkadot ecosystem.

TapChiBitcoin·01-03 01:02

Federal Reserve December Meeting Minutes: Internal disagreements over rate cuts have intensified, and they are ready to purchase short-term government bonds at any time.

The Federal Reserve meeting minutes show that most officials support a rate cut in December and expect further rate cuts in the future, but some policymakers believe that rate cuts should be paused "for a period of time," reflecting the Fed's cautious attitude toward rate cuts early next year, with significant internal disagreements. This article is sourced from a Wall Street Journal article, organized, translated, and written by Foresight News.

(Previous summary: The Fed's rate cut by 1 basis point is in line with expectations! The dot plot shows only a 1 basis point cut in 2026, Bitcoin and Ethereum fluctuate wildly, and US stocks see intraday gains)

(Additional background: The printing press is running again! The US Federal Reserve has launched the "Reserve Management Purchase Program," and starting from 12/12, it will buy $40 billion worth of short-term government bonds within 30 days)

Table of Contents

"Most" participants support a rate cut in December

Most participants believe that rate cuts help prevent labor market deterioration

動區BlockTempo·2025-12-31 02:55

3 Altcoins Poised to Thrive in the Next Bull Market: HBAR, LTC, and DOT

Hedera benefits from enterprise partnerships, fast transactions, and strong network reliability for growth.

Litecoin offers speed, low fees, and proven liquidity to support bullish momentum.

Polkadot enables cross-chain interoperability, scalable applications, and robust governance for lo

CryptoNewsLand·2025-12-30 14:36

Polkadot (DOT) can surpass the $2 mark: Opportunities only arise when…

Polkadot (DOT) has shown a 4.41% increase recently despite a long-term downtrend since March 2025. Short-term bullish momentum is evident, but risks from the broader market, particularly Bitcoin (BTC), persist. Traders should be cautious while considering potential profits.

TapChiBitcoin·2025-12-29 14:31

How to Choose AI Technology Stocks? Understanding Dan Ives's Market Perspective on the Tech Bull Run

American well-known tech bull and Wedbush Securities analyst Dan Ives recently shared his core reasons for long-term optimism about AI topics during an interview on the "Master Investor Podcast." He recounted his personal investment experience during the 1990s tech bubble, extended to key areas such as AI chips, cloud computing, data centers, and enterprise applications, and further explained his thinking behind selecting tech stocks, as well as how he maintains investment discipline and conviction amid market volatility.

From the 1990s to today, why choose to embrace tech and AI stocks

Dan Ives stated that he has been researching tech stocks since the late 1990s, having experienced the dot-com bubble and financial crises. However, he believes that the current transformation brought by AI is different from past speculative bubbles. He described that the current AI development

ChainNewsAbmedia·2025-12-26 08:54

From CryptoQuant data, the Bitcoin Bear Market: the Crypto Assets bubble burst in 2021.

Bitcoin has fallen back after reaching an all-time high in October. In a recent report, CryptoQuant pointed out that BTC has officially entered a Bear Market and warned that the demand zone could see prices dip to $56,000. However, Simon Dedic, a partner at Moonrock Capital, views it from a long-term perspective, believing that the crypto market is now in a late stage similar to the 'dot-com bubble', ushering in unprecedented investment opportunities.

CryptoQuant Report: ETF Outflows Expose BTC Demand Gap

ETF inflow reversal

CryptoQuant data shows that U.S. Bitcoin spot ETFs reduced their holdings by approximately 24,000 BTC in Q4 2025, amounting to about 2.1 billion dollars, terminating the continuous accumulation trend of the past year.

BTC-1.73%

ChainNewsAbmedia·2025-12-22 09:14

Michael Saylor once again calls for Bitcoin to reach a million, ten million dollars: waiting for the day when Strategy controls 5% and 7% of the total BTC supply.

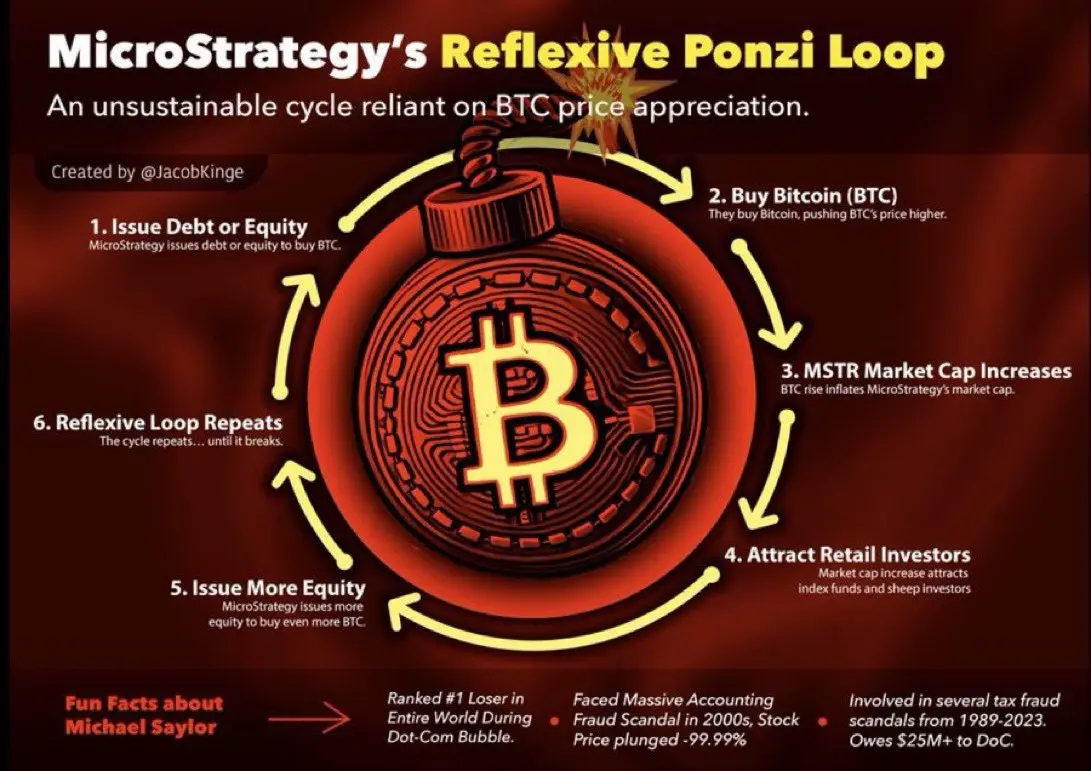

MicroStrategy has once again issued the "orange dot" signal, and CEO Michael Saylor believes that if Bitcoin holdings reach 7% of the supply, the price could soar to 10 million dollars; however, the stock price's 50% slump, ETF competition, and regulatory pressure are testing the limits of this infinite buying machine.

(Previous Summary: SEC Privacy Meeting Warning: Financial Regulations Have Become a Blockchain Prison, with a Primary Focus on Protecting Human Rights and Technological Neutrality)

(Background Information: Nasdaq applies to the SEC for a new 5×23 trading system, with U.S. stock market "never closing" expected to be implemented in the second half of 2026.)

Table of Contents

The quantitative gambling behind the orange dot

How the Capital Market Arbitrage Flywheel Drives

Stock price 50% Slump exposes leverage weakness

The aftermath of the Trump era?

Michael Saylor on December 2

BTC-1.73%

動區BlockTempo·2025-12-22 04:40

Michael Saylor sends another "green dot" signal: Strategy may increase the position in Bitcoin, indicating a counterattack?

Michael Saylor, the executive chairman of MicroStrategy (now renamed Strategy), once again sent signals to the market about a possible large-scale increase in Bitcoin holdings through a mysterious tweet titled "Green Dot Guiding Orange Dot" on December 21. This move comes at a time when the company's stock price (MSTR) has fallen by 43% within the year 2025 and is at risk of being removed from the MSCI global index, which could trigger over $11.6 billion in dumping. If Saylor's hints ultimately materialize, it aims to lower the company's average holdings cost of Bitcoin on one hand, and on the other hand, to demonstrate to the market that its strategy of "fully betting on Bitcoin" remains unwavering in the face of the current severe liquidity crisis and regulatory scrutiny.

MarketWhisper·2025-12-22 01:28

US lawmakers propose tax relief for stablecoins, ETH community foundation responds to USDT attacks.

Headline

▌U.S. lawmakers propose tax breaks for small stablecoin payments and staking rewards.

U.S. lawmakers have proposed a discussion draft that aims to alleviate the tax burden on ordinary cryptocurrency users by exempting capital gains tax on small stablecoin transactions, including a $200 tax exemption for stablecoin payments and new deferral options for staking and mining rewards. According to the draft, if the stablecoin is issued by an issuer authorized under the GENIUS Act, is pegged to the U.S. dollar, and the transaction price remains within a narrow range around $1, users will not need to report gains or losses on transactions not exceeding $200.

▌Ethereum Community Fund responds to "50 million USDT phishing attack": The practice of truncating addresses with a dot should be stopped.

Regarding the "50 million USDT phishing attack" incident, the Ethereum Community Fund issued a statement on the X platform.

ETH-2.79%

金色财经_·2025-12-21 23:58

Altcoin Season Loading? Bitcoin Dominance Flashes Bearish Signal as 5 Altcoins Line Up for a Breakout

Bitcoin dominance’s monthly MACD bearish cross has historically preceded major altcoin rotations.

DOGE, LTC, HBAR, DOT, and SUI are forming long-term consolidation structures.

Current conditions reflect early transition signals, not a confirmed altcoin season.

Bitcoin dominance ha

CryptoNewsLand·2025-12-18 00:46

Interest rate cuts lead to a crash? The Federal Reserve, Bank of Japan, and Christmas holiday form a "deadly triangle trap"

BTC has fallen from $95,000 to $85,000, with over 200,000 traders liquidated in the past 24 hours, and $600 million wiped out.

Everyone is asking: Weren't we told a few days ago that rate cuts are good for the market?

The answer lies in three dates: December 11 (Federal Reserve rate cut), December 19 (Japan rate hike), December 23 (Christmas holiday).

01. The Federal Reserve's "Rate Cut + Hawkish" Combo

On the 11th, the Federal Reserve cut interest rates by 25 basis points as scheduled. However, the dot plot indicates that in 2026, there may be only one rate cut, far below market expectations of 2-3 cuts.

The market wants "continuous liquidity injection," but Powell is offering a "symbolic rate cut + future tightening."

What's more concerning is that among the 12 voting members, 3 oppose the rate cut, with 2 advocating to keep rates unchanged. This shows that the Fed's internal vigilance against inflation exceeds market expectations.

Rate cuts should have released liquidity, but hawkish signals are emerging.

BTC-1.73%

PANews·2025-12-17 00:04

The Federal Reserve initiates monthly purchases of $40 billion in government bonds RMP, and quantitative easing(QE) is different?

The Federal Reserve announces a monthly purchase of $40 billion in US Treasuries, which the market interprets as quantitative easing. However, this is actually a Reserve Management Purchase Plan (RMP), aimed at preventing operational issues in the financial system rather than stimulating the economy. This article analyzes the fundamental differences between RMP and QE and their market impacts. The content is based on an article by Krüger, organized, translated, and written by Techflow.

(Previous context: The Fed cutting interest rates by 1 basis point meets expectations! The dot plot indicates only a 1 basis point cut in 2026. Bitcoin and Ethereum are volatile, and US stocks are rising intraday.)

(Additional background: The printing press is turned on again! The US Federal Reserve has launched the "Reserve Management Purchase Plan," purchasing $40 billion in short-term government bonds within 12/12 for the next 30 days.)

Table of Contents

What is Quantitative Easing (QE)?

The three major mechanisms

ETH-2.79%

動區BlockTempo·2025-12-13 07:30

Polkadot Reaches Long-Term Support Zone as Market Tests the $2 Range

Polkadot trades near $2 as traders monitor long-term structural support and cyclical behavior.

Intraday weakness in DOT reflects steady selling pressure with limited short-term recovery interest.

Market data aligns with a multi-cycle support range that traders have tracked since early markdown

DOT-3.65%

CryptoFrontNews·2025-12-11 09:17

Where is the anticipated celebration of rate cuts? Analyzing the Federal Reserve's "hawkish rate cut" and the expansion of balance sheet through bond purchases that are not QE

The Federal Reserve Bank cut interest rates by 25 basis points as scheduled, but internal decision-making showed the largest disagreement in six years, hinting that next year the pace of action will slow down and recent moves may pause. This article is sourced from Wall Street Insights, organized, translated, and written by Techflow.

(Background recap: The Fed's 1 basis point rate cut was in line with expectations! The dot plot shows only a 1 basis point cut in 2026, Bitcoin and Ethereum surged and then retreated, and U.S. stocks saw intraday gains)

(Additional background: The printing press is running again! The U.S. Federal Reserve has launched the "Reserve Management Purchase Program," and starting from 12/12, will buy $40 billion in short-term government bonds within 30 days)

The Federal Reserve Bank cut interest rates by 25 basis points as scheduled, still expecting to cut rates once next year, initiating the RMP to buy $40 billion in short-term bonds. However, it revealed the largest disagreement among voting policymakers in six years, hinting that next year the pace of action will slow down and recent moves may pause. The Federal Reserve has also, as...

ETH-2.79%

動區BlockTempo·2025-12-11 07:09

Federal Reserve's "hawkish rate cut" tears apart consensus; Bitcoin's 2026 liquidity narrative faces a challenge

Beijing Time December 10, the Federal Reserve completed its third rate cut of the year amid serious internal disagreements, lowering the federal funds rate target range by 25 basis points to 3.50% - 3.75%. This decision was passed with a rare 9-3 split vote and sent a strong signal of policy shift: according to the latest "dot plot" forecast, the pace of future rate cuts will be extremely slow, with possibly only one cut each in 2026 and 2027. For the crypto market, which has fully priced in easing expectations, this "dovish with hawkish signals" decision indicates that macro liquidity-driven logic is weakening. Bitcoin's key battle near $92,000 will rely more on its technical structure and market sentiment.

BTC-1.73%

MarketWhisper·2025-12-11 05:26

XRP Today's News: ETF Funding Drops Suddenly Amid Federal Reserve's "Hawkish Rate Cut," $2 Threshold Becomes a Life-or-Death Line

In a week of intense competition between macro and micro factors, XRP price movement has become stuck in a stalemate. On one hand, the Federal Reserve cut interest rates by 25 basis points as expected, temporarily pushing XRP up to $2.1097; on the other hand, the single-day net inflow of XRP spot ETFs decreased from $38.04 million to $8.73 million, indicating a shift towards caution among institutional investors. More importantly, the Fed's published “dot plot” suggests that future rate cuts will slow significantly, and this “hawkish rate cut” stance has dampened risk assets. Although technical analysis shows XRP remains below key 50-day and 200-day moving averages, strong overall ETF demand and potential regulatory benefits still leave room for a mid-term target of $2.35 to $2.50.

MarketWhisper·2025-12-11 05:21

Mitsubishi UFJ: The Federal Reserve's policy in the second half of next year will become more complicated due to leadership changes

Mitsubishi UFJ reports that the Federal Reserve voted 9 to 3 to cut interest rates by 25 basis points, acknowledging a cooling labor market, with Powell warning of downside risks. Inflation may peak in 2026, and the dot plot indicates a smaller rate cut than market expectations. Future policy prospects are becoming more complicated due to changes in the Federal Reserve leadership.

DeepFlowTech·2025-12-11 03:11

XRP Today's News: Federal Reserve interest rate cut pushes price up to $2.1, ETF slowdown shows zero inflow for the first time

The Federal Reserve announced a 25 basis point cut to 3.50% to 3.75%, and XRP price briefly surged to a high of $2.1097. However, the dot plot indicates only one rate cut in 2026, which is more hawkish than the September forecast, causing XRP to give up its gains. On December 9, US XRP spot ETF net inflows plummeted to $8.73 million, and the Franklin XRP ETF experienced its first zero inflow.

XRP-5.77%

MarketWhisper·2025-12-11 02:42

December rate cut of 25 basis points! Fed internal disagreements intensify, marking a macro turning point in Bitcoin's battle to reach the "hundred thousand mark"

Beijing Time December 10th, the Federal Reserve announced a 25 basis point cut in the federal funds rate target range to 3.50%-3.75%, completing the third rate cut of the year. However, this decision revealed rare and deep disagreements within the Federal Open Market Committee, with a 9-3 voting result, the most divided since 2019. More importantly, the latest "dot plot" indicates that the future rate cuts will be extremely slow and limited, with only one cut each expected in 2026 and 2027. For markets that have fully priced in rate cut expectations, this "dovish with hawkish undertones" decision is more like a tightening warning, which could reshape the short-term liquidity environment for all risk assets, including Bitcoin.

BTC-1.73%

MarketWhisper·2025-12-11 02:27

"I'll Sing a Dove for Everyone" — December FOMC Commentary + Press Conference Minutes

A one-sentence review: The 25bps rate cut itself was in line with expectations, but the dot plot and press conference signals were more dovish than market expectations. This dovish stance is reflected in three aspects. First, the "hawkish dot plot" (such as no rate cuts in 2026) the market worried about did not appear; instead, the dot plot significantly upwardly adjusted the economic growth outlook for 2026-2027, lowered inflation expectations, and maintained the expectation of one rate cut per year, presenting a Goldilocks scenario. Second, the press conference was more dovish than expected; Powell seemed to revert to the August Jackson Hole meeting, repeatedly emphasizing the risks of a deteriorating labor market and downplaying inflation upside risks. Third, starting December 12, the technical balance sheet expansion (RMP) will begin, with an initial purchase amount of 40 billion per month, slightly exceeding expectations in both volume and timing.

1. Five comments on the FOMC

1. What are the reasons and disagreements for the 25bps rate cut?

During the press conference, Powell explicitly stated that the softening labor market and inflation's "as expected" decline

金色财经_·2025-12-11 00:42

Micro-strategy buying coins to manipulate public opinion? Analysts reveal Saylor's dark history of dot-com bubble fraud

Analyst Jacob King questioned MicroStrategy's recent purchase of 10,624 Bitcoins (approximately $10 billion), claiming that the move had a perceived impact but had no real impact. King pointed out that this acquisition is more of a manipulation of public opinion. He reiterated Saylor's settlement agreement with the SEC during the dot-com bubble, when Saylor paid $830k for falsely reported income.

MarketWhisper·2025-12-10 05:14

Bitcoin surged to 94K ahead of the Fed's rate decision, with a spike in short liquidations.

Traders are eagerly awaiting the upcoming interest rate decision from the Federal Reserve. Bitcoin (BTC) surged above 94K last night, while Ethereum (ETH) climbed back to $3,300, driving the overall crypto market capitalization higher. In the past 24 hours, short positions have been liquidated for more than $300 million.

Market eagerly awaits Federal Reserve rate decision

Traders are eagerly awaiting the imminent interest rate decision from the Federal Reserve. This year’s final rate decision will be announced at 3 a.m. Taiwan time on 12/11, followed by a press conference with Chairman Powell. The market expects the Fed to cut rates by another 25 basis points. According to CME Group’s FedWatch Tool, the probability of a rate cut is about 87%, up from 67% a month ago. The dot plot and economic projections released this time, along with Chairman Powell’s remarks, will have a major impact on market trends.

Driven by market expectations of a rate cut

ETH-2.79%

ChainNewsAbmedia·2025-12-10 00:14

3 Altcoins to Watch for the Next Market Rally: DOT, AVAX, and LUNA

Polkadot: Multi-chain architecture enables interoperability and custom blockchain development with seamless upgrades.

Avalanche: High-speed, scalable platform supports dApps, DeFi, and near-instant transactions at low cost.

Terra Luna: Stablecoin-focused ecosystem ensures financial stability,

CryptoNewsLand·2025-12-09 15:43

FOMC meeting today: What to expect and how the crypto market could react

As the FOMC meeting kicks off, markets are focused on a likely rate cut and how it could possibly sway crypto market volatility.

Summary

FOMC meets Dec. 9--10 to review U.S. economic data and monetary policy.

Markets expect a 25-basis-point cut and updated dot plot projections.

Crypto could m

Cryptonews·2025-12-09 07:36

Philippine digital bank GoTyme launches cryptocurrency services, supporting 11 assets including BTC, ETH, SOL, and more

According to TechFlow on December 8, as reported by Cointelegraph, Philippine digital bank GoTyme has launched cryptocurrency services. The bank, which has 6.5 million customers, has integrated crypto features into its banking app through a partnership with US fintech company Alpaca.

Users can now purchase and store 11 types of crypto assets through the app, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Polkadot (DOT), and others. The system supports automatic conversion from Philippine Peso to US Dollar for transactions.

GoTyme CEO Nate

DeepFlowTech·2025-12-08 05:42

The "orange dot" reappears! Michael Saylor hints that MicroStrategy may buy up Bitcoin again

Michael Saylor, Executive Chairman of MicroStrategy and the most well-known corporate holder of Bitcoin, has once again sent a key signal on social media. He posted a chart tracking the company’s Bitcoin holdings with the caption “Back to orange dot?”, which has been widely interpreted by the market as a prelude to a new round of purchases. Currently, MicroStrategy holds a total of 650,000 Bitcoins, valued at approximately $57.8 billion, with an average cost of $74,436 per Bitcoin. Meanwhile, on-chain data shows that the hash ribbon indicator has turned bearish again, putting pressure on miners. The weekly report on public companies’ Bitcoin holdings shows that eight companies, including Cango Inc. and ABTC, increased their Bitcoin holdings last week. Saylor’s hint, coupled with continued institutional accumulation, provides a key psychological and data anchor for investors to judge the market bottom in the context of overall market pressure.

BTC-1.73%

MarketWhisper·2025-12-08 02:46

Analyst: Labor data may signal the end of the Fed's "hawkish rate cut" era

Analyst Daniel Loughney expects the Federal Reserve to cut the federal funds target range by 25 basis points in December due to a soft labor market. He mentioned that this rate cut might be dovish, with market focus on the FOMC members' interest rate projections and economic forecast summaries to capture the Federal Reserve's policy changes.

DeepFlowTech·2025-12-05 06:38

DOJ Seizes Scam Domain Linked to Burma Crypto Fraud Scheme

The DOJ seized the tickmilleas(dot)com domain linked to a Burma-based crypto scam.

Fraudulent mobile apps and social media accounts connected to the scam were taken down by FBI and tech companies.

Crypto fraud continues to grow, with the FBI recording $5.8 billion in losses from scams in 2024.

Th

CryptoNewsLand·2025-12-04 12:15

Fed Liquidity Boost Sends Bitcoin Higher

The Federal Reserve has pumped $13.5 billion into the U.S. banking system through overnight repos, marking the second-largest liquidity injection since the pandemic and surpassing even interventions seen during the Dot-Com Bubble

The move aims to stabilize credit markets and boost investor

BTC-1.73%

DailyCoin·2025-12-03 12:08

Michael Saylor sends another "green dot" signal: is Bitcoin bullish or a sell warning?

MicroStrategy Executive Chairman Michael Saylor released a mysterious "green dot" hint on social media last weekend, which immediately sparked widespread speculation and fluctuation in the crypto market. Previously, similar signals from Saylor often indicated that the company would increase its Bitcoin holdings the next day, but this time the context is entirely different: MicroStrategy's stock price has fallen about 60% from its peak, and its market net worth ratio has also dropped below 1. This article will deeply decode the financial implications behind the "green dot," analyze the multiple pressures currently facing MicroStrategy, and explore the potential far-reaching impacts its actions may have on the Bitcoin market.

BTC-1.73%

MarketWhisper·2025-12-02 08:08

MicroStrategy hints at continuing to increase the position! Saylor insists on buying the dip, CEO reveals the only condition for selling coins.

Michael Saylor hinted at a new Bitcoin purchase by MicroStrategy in a post with a "green dot". The chart shows that MicroStrategy's Bitcoin portfolio is worth approximately $59 billion, with a total of 649,870 Bitcoins purchased over 87 transactions. MicroStrategy CEO Phong Le stated that the company will only sell coins when mNAV falls below net asset value and cannot obtain new funds.

BTC-1.73%

MarketWhisper·2025-12-01 05:30

Bitcoin flash crash 7% falls below $87,000, does MicroStrategy's "green dot" signal hide a secret?

On December 1, Bitcoin experienced a sudden flash crash, with prices rapidly falling below the $87,000 mark, resulting in a single-day big dump of over 7%, erasing all gains for the week and triggering $400 million in leveraged positions to get liquidated. At the same time, MicroStrategy Executive Chairman Michael Saylor posted a mysterious "green dot" tweet, suggesting the possibility of starting a new round of Bitcoin accumulation, while the company’s CEO acknowledged for the first time that they might sell their Bitcoin holdings under extreme circumstances. The market is caught in a dilemma of technical breakdowns and conflicting institutional signals, with investors closely monitoring the defense situation at the key support level of $80,000.

MarketWhisper·2025-12-01 03:48

Michael Saylor hints at a new round of Bitcoin accumulation, with MicroStrategy's Holdings value exceeding $59 billion.

MicroStrategy's Executive Chairman Michael Saylor hinted at a possible new round of Bitcoin purchases through a "Green Dot" tweet. The company currently holds 649,870 Bitcoins, valued at approximately $59 billion. CEO Phong Le clearly stated that they would only consider selling Bitcoin in the event of extreme market deterioration, while the company's newly launched dashboard shows that its financial structure is sufficient to support decades of dividend payments. Against the backdrop of increasing fluctuations in Bitcoin prices, MicroStrategy's ongoing accumulation strategy is becoming an important market barometer.

BTC-1.73%

MarketWhisper·2025-12-01 02:27

3 Promising Altcoins to Accumulate in November — ADA, DOT, and LTC

Cardano: Sustainable blockchain with smart contracts, strong growth, and proof-of-stake efficiency.

Polkadot: Connects multiple chains via parachains, enabling seamless token and data transfer.

Litecoin: Fast, reliable transactions with proven long-term performance and capped supply.

November

CryptoNewsLand·2025-11-30 15:46

DOT Price Prediction: Targeting $2.36-$2.40 Within Two Weeks as Technical Indicators Suggest Recovery

Alvin Lang

Nov 28, 2025 08:10

DOT price prediction shows potential 3-5% upside to $2.36-$2.40 over the next two weeks, with key resistance at $2.39 and critical support holding at $2.30.

Polkadot (DOT) is showing signs

DOT-3.65%

AsiaTokenFund·2025-11-28 11:02

100x Crypto News: LivLive Surges With BLACK300 Bonus While DOT Falls Toward $2.05 and UNI Sees Ma...

The 100x crypto narrative has returned stronger than ever in Q4 2025 as new real utility projects begin outshining older narrative coins. The market is transforming quickly, and attention is shifting toward tokens that connect physical activity with digital rewards.

This shift has directed

CaptainAltcoin·2025-11-26 12:36

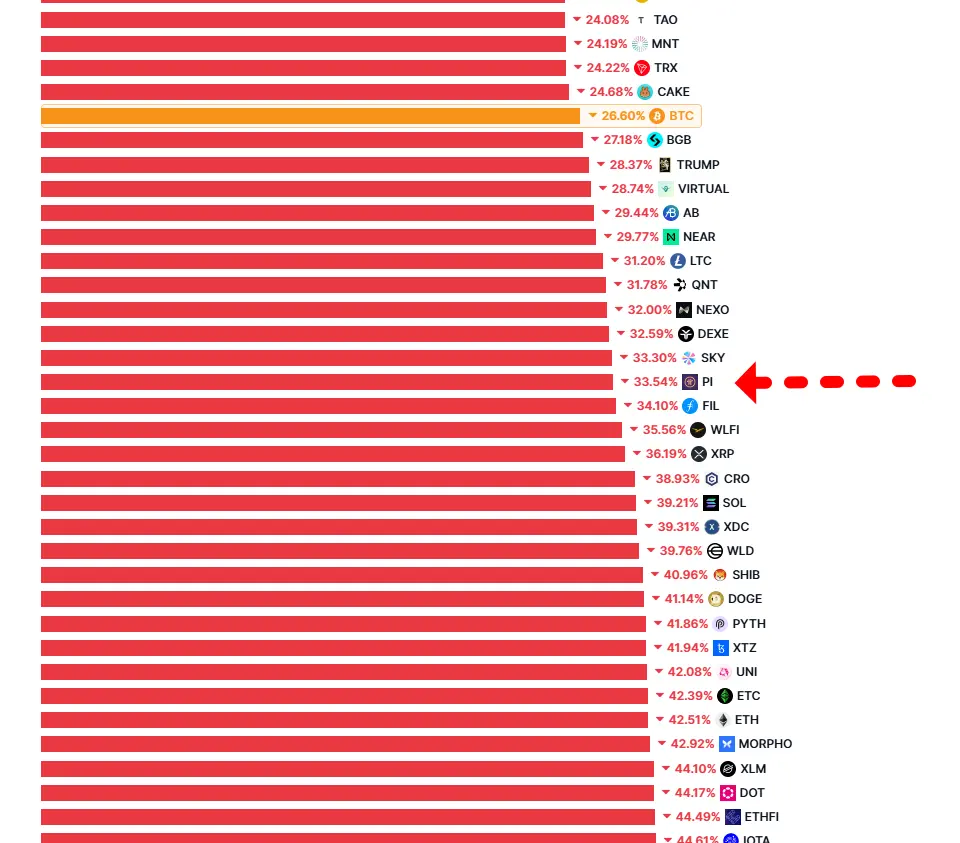

PI coin plunges 33% but outperforms DOT and MATIC! Oversold bottom recovery imminent

Pi Network's native token, PI, has dropped 33.5% over the past 90 days, but it has outperformed dozens of major altcoins such as IOTA, DOT, MATIC, and ETHFI. Analysis indicates that after being in an oversold region for a long time, Pi coin is showing signs of positive performance, with its chart beginning to level off rather than decline, which is usually a signal of weakening selling pressure.

MarketWhisper·2025-11-24 02:03

Polkadot (DOT) Price to $5? Analysts Weigh in

The DOT price has been stuck in a slow grind for months, drifting lower and struggling to spark any real bullish momentum. But things are getting interesting again

DOT has returned to levels that have repeatedly stopped the bleeding, a setup analysts are now wondering could mark the beginning of a

CaptainAltcoin·2025-11-22 21:04

Trump threatens to fire Powell again: He is so incompetent that he should be prosecuted, Basant if you don't handle it, I'll fire you.

Trump publicly threatened to fire Powell and Bostic at the Saudi Investment Forum, affecting the independence of the Federal Reserve, with the Supreme Court becoming the next battleground. (Background: Trump has already decided on the next Federal Reserve Chair candidate: to be announced before Christmas, wants to replace Powell but is being obstructed by someone.) (Additional background: Musk returned to the White House for a "handshake and reconciliation with Trump," attending a dinner with Tim Cook, Cristiano Ronaldo, and Jen-Hsun Huang.) This week, U.S. President Trump’s spontaneous threat of "firing" at the Saudi Investment Forum set off alarm bells on Wall Street. This was not just an emotional statement, but a direct blow to the independence of the Federal Reserve, forcing the market to shift its focus from the interest rate dot plot to the power struggle between the White House and the Supreme Court. The "firing" warning under Washington's spotlight. The Federal Open Market Committee (FOMC) had lowered the overnight interest rate to a range of 3.75% - 4% in October, yet it was still criticized by Trump as "far from enough." He harshly criticized on stage.

動區BlockTempo·2025-11-20 02:48

Polkadot Price: Can DOT Hold The Line?

Polkadot's daily chart indicates a pivotal moment due to a recent Structure Shift, typically signaling bullish trends, accompanied by a critical demand zone where prior buying activity occurred.

DOT-3.65%

BitcoinInsider·2025-11-18 15:40

Crypto Price Analysis 11-17: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, POLKADOT: DOT, APTOS: APT

The cryptocurrency market has started the week in bearish territory with Bitcoin (BTC), Ethereum (ETH), and other tokens trading in the red. However, prices have registered a marginal recovery on the hourly timescale. BTC has reclaimed $95,000 after falling to a low of $92,985. However, the

CryptoDaily·2025-11-17 14:04

Polkadot DAO implements a supply cap of 2.1 billion DOT, starting a Halving issuance model in 2026.

On October 18, 2025, the Polkadot Decentralized Autonomous Organization (DAO) approved a historic economic model reform through referendum No. 1710 with an 81% support rate, permanently capping the total supply of DOT at 2.1 billion, and initiating a Halving issuance mechanism every two years starting from March 14, 2026.

This transition has transformed DOT from a high-inflation token with an annual inflation rate of 10% into a scarce asset, directly mimicking Bitcoin's scarcity narrative. Currently, the circulating supply of DOT is 1.63 billion, with a trading price of $2.87 and a market capitalization of approximately $4.69 billion. The market has not yet fully priced in the long-term value reassessment potential brought about by this structural change.

MarketWhisper·2025-11-17 05:25

The probability of a Fed interest rate cut in December cools down as cracks appear in the AI narrative.

As of November 15, 2025, the global financial markets have experienced significant fluctuations this week. The U.S. federal government has undergone the longest shutdown in history (from October 1 to November 12, 2025, lasting 43 days), resulting in the permanent absence of key data such as October non-farm payrolls and October CPI, with the market trading in a data vacuum and emotions fluctuating.

1. The probability of the Federal Reserve lowering interest rates in December has dropped significantly to below 50%.

After the September FOMC meeting, the market initially priced a 100% chance of a 25bp rate cut in December, mainly based on the dot plot from that month, which showed that a majority of officials expected the median federal funds rate at the end of 2025 to fall within the range of 4.25-4.50% (which means another cut of 50bp, with one in December). However, the minutes from the October meeting and statements from several Federal Reserve officials since November have completely changed this expectation.

1. Latest statements from key officials (November 4-14, 2025)

金色财经_·2025-11-17 00:28

Experts Tout Decentralized AI Efficiency Gains as GPU Shortages and Energy Limits Loom

The global market volatility, including a drop in assets like Bitcoin, is thought to have been fueled by growing fears that the artificial intelligence hype cycle is unsustainable and poses a dot-com-era bubble risk.

Infrastructure, Not Capital, is the New Constraint

In recent weeks, investor

BTC-1.73%

Coinpedia·2025-11-15 12:35

Fully Built and Ready: Zero Knowledge Proof Outshines Pi and DOT As the Top Crypto for 2025

The constant buzz around the Pi network (PI) price contrasts sharply with the growing uncertainty following the Polkadot (DOT) price drop. Together, these trends show how the market still leans on future promises rather than working utility. But what if a project flipped that pattern

CryptoNewsLand·2025-11-14 09:04

Zero Knowledge Proof (ZKP) Builds Real Enterprise AI Utility That Lasts While Polkadot Stalls & Z...

The crypto space continues to mix progress and volatility, with Polkadot (DOT) and Zcash (ZEC) reflecting contrasting trends. Polkadot’s price remains trapped near multi-year lows despite notable developments like its Asset Hub migration and the upcoming JAM integration

In contrast, Zcash

CryptoNewsLand·2025-11-13 20:04

Forget HBAR & DOT Patterns: Why Zero Knowledge Proof Could Be the 1000x Play

While market analysis fixates on the Hedera (HBAR) price recovery or deciphers the Polkadot (DOT) price pattern, the debate over the best crypto right now misses a far more telling signal. It is a question of capital conviction. Why would a project deploy over $100 million on development and

CryptoDaily·2025-11-13 17:03

Load More