Post content & earn content mining yield

placeholder

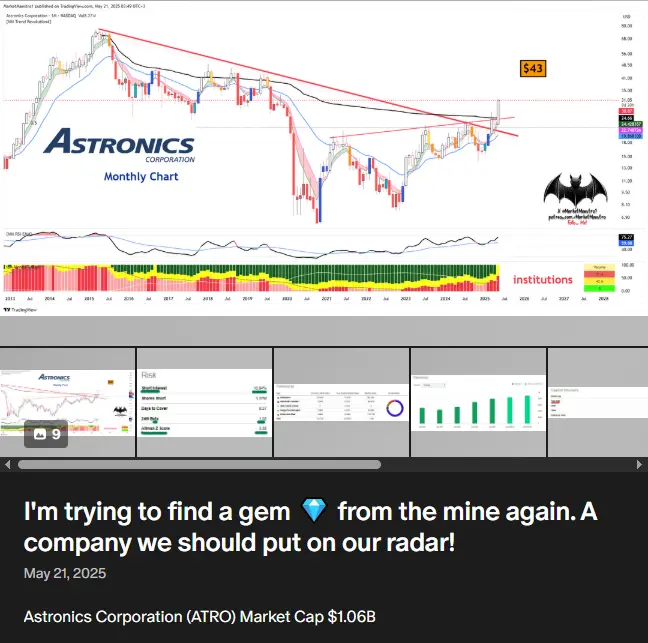

MarketMaestro

$ATRO 💎 👇

- Reward

- like

- Comment

- Repost

- Share

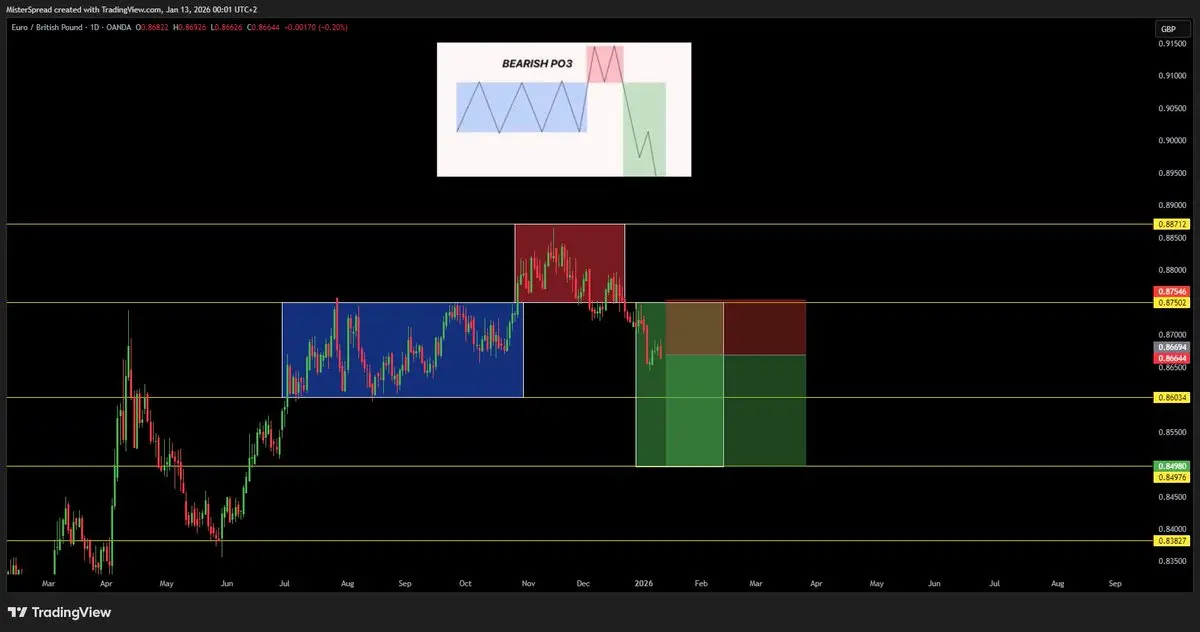

First FX trade of 2026 - $EURGBP bearish PO3

Half size for now, since I'm still warming up

2RR

Invalidation if we get back above 0.8755

Half size for now, since I'm still warming up

2RR

Invalidation if we get back above 0.8755

- Reward

- like

- Comment

- Repost

- Share

#PowellUnderCriminalInvestigation Headline Risk and Market Psychology

As of 12 January 2026, unconfirmed reports and market speculation surrounding U.S. Federal Reserve Chair Jerome Powell and the possibility of a criminal investigation have introduced a new layer of uncertainty into global financial markets. It is essential to emphasize that no official charges, verified legal actions, or formal statements have been issued. However, in modern markets, perception often moves faster than confirmation, and even speculative headlines involving key policymakers can influence short-term price behav

As of 12 January 2026, unconfirmed reports and market speculation surrounding U.S. Federal Reserve Chair Jerome Powell and the possibility of a criminal investigation have introduced a new layer of uncertainty into global financial markets. It is essential to emphasize that no official charges, verified legal actions, or formal statements have been issued. However, in modern markets, perception often moves faster than confirmation, and even speculative headlines involving key policymakers can influence short-term price behav

BTC0,36%

- Reward

- like

- Comment

- Repost

- Share

G

格局

Created By@It'sNotEasyToMakeMoney.

Subscription Progress

0.00%

MC:

$0

Create My Token

🚨 Breaking News! President Trump will implement 25% tariffs on any country that doing business with Iran.

#Iran #Trump

#Iran #Trump

- Reward

- like

- Comment

- Repost

- Share

$EBAY - I like the plays you don't see a lot talking about. They are expected to have the highest revenue in company history this quarter. YOY growth expected to beat in every quarter next year for both revenue and earnings. Expect a double beat on earnings in February.

- Reward

- like

- Comment

- Repost

- Share

Good morning

Just over 100 more followers to reach 5,000. Keep it up!

View OriginalJust over 100 more followers to reach 5,000. Keep it up!

- Reward

- like

- Comment

- Repost

- Share

1 RMB = 1 USD

Zhima recommends excellent Chinese coins! As long as you dare to come, it dares to go to spot trading!

RMB comes with a halo, about to go public and make a splash, if you haven't bought in yet, grab the opportunity! 10U 20U is not too little, 100U 200U is not too much! If we go into spot trading, it will be fun! Just go for it confidently! If you like it, buy some and hold! For no other reason, hold onto your RMB, by 2026 everything you see will be RMB, and everything you earn will be RMB. The official team is here to give some support! We want to play spot RMB!

Zhima recommends excellent Chinese coins! As long as you dare to come, it dares to go to spot trading!

RMB comes with a halo, about to go public and make a splash, if you haven't bought in yet, grab the opportunity! 10U 20U is not too little, 100U 200U is not too much! If we go into spot trading, it will be fun! Just go for it confidently! If you like it, buy some and hold! For no other reason, hold onto your RMB, by 2026 everything you see will be RMB, and everything you earn will be RMB. The official team is here to give some support! We want to play spot RMB!

BTC0,36%

MC:$20.7KHolders:3

52.38%

- Reward

- like

- Comment

- Repost

- Share

1.13 Morning trading strategy, last night suggested reducing long positions around 917-92000, with a high of around 922 and a pullback to the current price of 912. Recommended to go long on Bitcoin around 905-91000, targeting 925-93 around #Gate储备金报告

View Original

- Reward

- 1

- 3

- Repost

- Share

ASmallForceToMoveAGreatWeight :

:

Just go for it💪View More

Gold rises above 4630 then pulls back, can the bullish trend continue?

Author: Gold Miner Old Cat

Today’s spot gold opened at 4523.05, yesterday’s close was 4509.93, reaching a high of 4630.21, a low of 4513.23, and finally closing at 4596.85, up 1.93%. After a one-hour rally, it slightly retreated and consolidated, with strong bullish momentum.

In the news, expectations of easing global monetary policy, weak economic data from major economies, and geopolitical tensions have driven safe-haven funds into gold. Coupled with a weakening US dollar index, these factors jointly contributed to a stro

View OriginalAuthor: Gold Miner Old Cat

Today’s spot gold opened at 4523.05, yesterday’s close was 4509.93, reaching a high of 4630.21, a low of 4513.23, and finally closing at 4596.85, up 1.93%. After a one-hour rally, it slightly retreated and consolidated, with strong bullish momentum.

In the news, expectations of easing global monetary policy, weak economic data from major economies, and geopolitical tensions have driven safe-haven funds into gold. Coupled with a weakening US dollar index, these factors jointly contributed to a stro

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

大傻币

大傻币

Created By@CurlyHairIsFine.

Listing Progress

0.00%

MC:

$3.55K

Create My Token

Bitcoin tried again to turn $91,200 into support, but is dumping below it again.

Tomorrow is CPI day, and we usually see some kind of sell-off in advance.

The plan remains the same: if we gain $91,200, we can look for a move to $94,000, but if we lose $89,800, a move back to the yearly open at $87,600 becomes likely.

#BTCMarketAnalysis

$BTC $ETH

Tomorrow is CPI day, and we usually see some kind of sell-off in advance.

The plan remains the same: if we gain $91,200, we can look for a move to $94,000, but if we lose $89,800, a move back to the yearly open at $87,600 becomes likely.

#BTCMarketAnalysis

$BTC $ETH

- Reward

- like

- Comment

- Repost

- Share

Remember, every penny you earn is a manifestation of your cognition, and every wave you withstand is a growth in your perspective. Keep a steady mindset, respect the risks, and the dawn of the next cycle will eventually illuminate the path for those who persevere. Looking back at the early morning, Bitcoin retraced from the 92283 level to around 90900 for consolidation, while Ethereum followed Bitcoin's trend, retracing from 3145 to around 3080 for consolidation!

Currently, on the four-hour chart, the overall trend appears slightly bullish. After a volume-driven surge in the previous K-line, i

View OriginalCurrently, on the four-hour chart, the overall trend appears slightly bullish. After a volume-driven surge in the previous K-line, i

- Reward

- like

- Comment

- Repost

- Share

I'm sick, the flu, taking a few days off, please do not send me private messages.

The market is active every day, opportunities are always there, but your chips are limited.

The market rewards traders who follow discipline and have patience,

while it also punishes those who are undisciplined, unplanned, and trade recklessly.

Long-term stable profits are more sustainable than bets made by luck once.

If you still see me at the table after a year, you'll understand what I mean.

Currently, we haven't broken out of this triangle pattern, and we're oscillating inside. Don't panic; once I recover and

The market is active every day, opportunities are always there, but your chips are limited.

The market rewards traders who follow discipline and have patience,

while it also punishes those who are undisciplined, unplanned, and trade recklessly.

Long-term stable profits are more sustainable than bets made by luck once.

If you still see me at the table after a year, you'll understand what I mean.

Currently, we haven't broken out of this triangle pattern, and we're oscillating inside. Don't panic; once I recover and

ETH-0,85%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 2

- Repost

- Share

HeavenlyThunderRollsThroughThe :

:

Experienced driver, guide me 📈View More

HUGE: President Trump announces a 25% tariff on countries doing business with Iran, effective immediately.

At first glance, it might not sound that big… but guess who Iran’s largest trading partner is?

China. 🇨🇳 Responsible for ~30% of Iran’s total foreign trade. This move indirectly escalates the ongoing trade tensions with China.

Markets hate tariff uncertainty, expect volatility.

At first glance, it might not sound that big… but guess who Iran’s largest trading partner is?

China. 🇨🇳 Responsible for ~30% of Iran’s total foreign trade. This move indirectly escalates the ongoing trade tensions with China.

Markets hate tariff uncertainty, expect volatility.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More13.12K Popularity

17.91K Popularity

55.78K Popularity

15.16K Popularity

94.52K Popularity

News

View MoreWilliams: Restoring the inflation rate to the 2% target is "completely feasible"

1 m

SEC Chair: Whether the U.S. will seize Venezuelan Bitcoin assets allegedly held "remains to be seen"

5 m

Data: 208.67 BTC transferred out from Fidelity Custody, worth approximately $19.02 million

9 m

Trump: Any country doing business with Iran will be subject to a 25% tariff by the United States

13 m

X Product Manager: May launch the Smart Asset Tag V1 version within the next month

16 m

Pin