Post content & earn content mining yield

placeholder

- Reward

- like

- Comment

- Repost

- Share

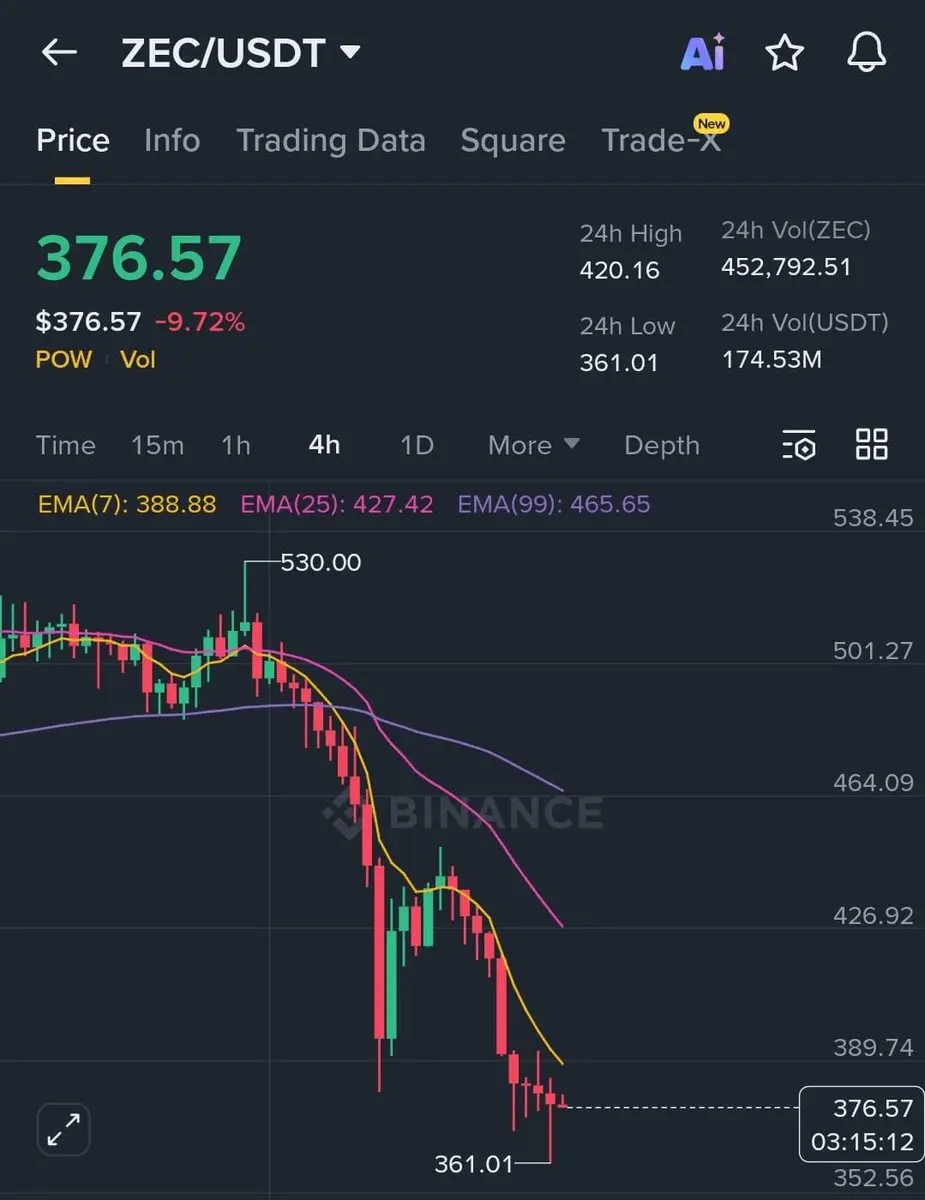

$I'm coming, a lot of people say they don't understand shanzhai. Here's my opinion. Without a big shot leading in this circle, it's better not to play. It's okay to gamble a little, spending a few tens of dollars is harmless.

我踏马来了134,9%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

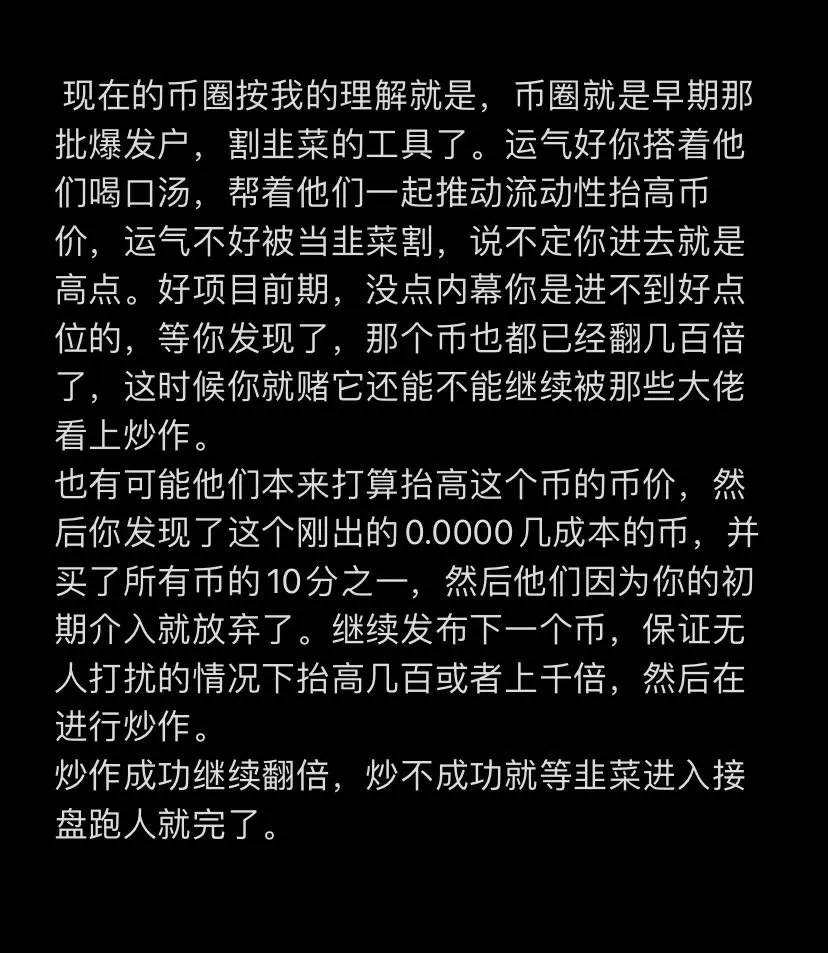

There are many out there grave dancing on alts right now.

And that's expected.

Alts have been dominated by Bitcoin for years in a liquidity strapped environment.

But this is how the emotional curve of investing ruins people.

Let me explain...

You have Asset A at the highs, and asset B at the lows.

Owners of asset A are euphoric, and they victory lap their own asset and grave dance on Asset B to make themselves feel superior.

Owners of Asset B are sad and emotional, and seeing all of the FUD about their asset and the green candles of Asset A.... they capitulate ad chase, hungry to get a win.

Se

And that's expected.

Alts have been dominated by Bitcoin for years in a liquidity strapped environment.

But this is how the emotional curve of investing ruins people.

Let me explain...

You have Asset A at the highs, and asset B at the lows.

Owners of asset A are euphoric, and they victory lap their own asset and grave dance on Asset B to make themselves feel superior.

Owners of Asset B are sad and emotional, and seeing all of the FUD about their asset and the green candles of Asset A.... they capitulate ad chase, hungry to get a win.

Se

BTC-0,13%

- Reward

- like

- Comment

- Repost

- Share

It's about to rise, brothers, let's reach a consensus. We've already eliminated the first 0. Let's aim to eliminate 4 zeros. Those without vision, don't buy. Buy 5 USDT, 10 USDT to gamble. Just launched and steadily rising. Let's see if there's a chance to reach 500 USDT, 5000 USDT, 50000 USDT. Brothers, don't sell. Anyone who sells is brain-dead. Let's reach a consensus. Everyone become the market maker, make money together. Brothers, share and spread to build consensus.

BTC-0,13%

MC:$13.98KHolders:2

36.92%

- Reward

- 1

- Comment

- Repost

- Share

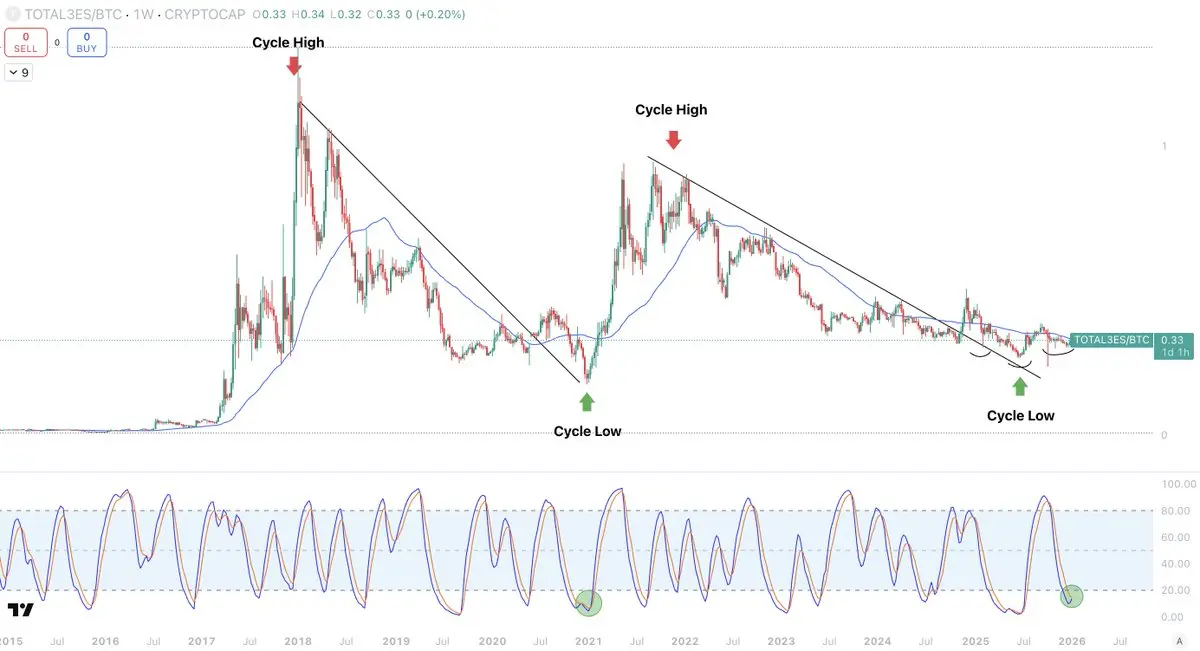

Who is buying #LifeKLine

Yesterday, I bought two packages with 5M and 6M, half of my position. I wanted a pullback to add the other half because there was a big spike and it might pull back.

After a good sleep, both packages made 60,000 U, is this what liquidity feels like!

View OriginalYesterday, I bought two packages with 5M and 6M, half of my position. I wanted a pullback to add the other half because there was a big spike and it might pull back.

After a good sleep, both packages made 60,000 U, is this what liquidity feels like!

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is shifting from a "defensive stance" to "preparing for an attack"

Just finished reading Glassnode's early-year research report.

Honestly, it was a bit of a grind.

The full title is Clearing the Decks,

Sounds cool, but the content density is off the charts.

If you really go through it page by page,

You'll find it's not meant for ordinary retail investors,

But for institutions, market makers, and derivatives traders.

But the point is

What it discusses is precisely the most important change in the current market.

So I’ve read the most difficult part of this report for you,

Leaving only o

Just finished reading Glassnode's early-year research report.

Honestly, it was a bit of a grind.

The full title is Clearing the Decks,

Sounds cool, but the content density is off the charts.

If you really go through it page by page,

You'll find it's not meant for ordinary retail investors,

But for institutions, market makers, and derivatives traders.

But the point is

What it discusses is precisely the most important change in the current market.

So I’ve read the most difficult part of this report for you,

Leaving only o

BTC-0,13%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度帳單 and receive a 20 USDT position experience voucher https://www.gate.com/zh-tw/competition/your-year-in-review-2025?ref=VVZCUVHDUW&ref_type=126&shareUid=U1BHVV1cBgcO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度帳單 and receive a 20 USDT position experience voucher https://www.gate.com/zh-tw/competition/your-year-in-review-2025?ref=VVZCUVHDUW&ref_type=126&shareUid=U1BHVV1cBgcO0O0O

- Reward

- like

- Comment

- Repost

- Share

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VVURVFEJUG&refType=1&refUid=38672635&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VVURVFEJUG&refType=1&refUid=38672635&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

$SOL The "mining" strategy (for Solana )SOL( actually involves staking coins through a validator to earn passive income )5-8% annually(, using DeFi protocols )Raydium, Orca( to provide liquidity and participate in farming, as well as trading, including day trading, to profit from volatility. However, all of this requires purchasing SOL and choosing a reliable wallet and validator.

SOL-0,12%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$622.89KHolders:75123

100.00%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#ETHTrendWatch Ethereum Market Outlook

Ethereum (ETH) continues to command strong attention from traders, investors, and institutions as the market moves deeper into January 2026. Currently trading around the $3,100 level, ETH remains in a phase of controlled consolidation, reflecting balanced participation between buyers and sellers. This price behavior highlights a market that is neither overly speculative nor weak, but instead positioning itself for its next directional move. As liquidity remains steady and volatility moderate, ETH is demonstrating resilience despite broader macroeconomic u

Ethereum (ETH) continues to command strong attention from traders, investors, and institutions as the market moves deeper into January 2026. Currently trading around the $3,100 level, ETH remains in a phase of controlled consolidation, reflecting balanced participation between buyers and sellers. This price behavior highlights a market that is neither overly speculative nor weak, but instead positioning itself for its next directional move. As liquidity remains steady and volatility moderate, ETH is demonstrating resilience despite broader macroeconomic u

ETH-0,01%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More28.55K Popularity

55.43K Popularity

17.87K Popularity

12.43K Popularity

39.66K Popularity

News

View MoreData: 460 BTC transferred from an anonymous address, worth approximately $41.56 million

1 h

Data: 93.8 BTC transferred from an anonymous address to Wintermute, worth approximately $56.09 million

1 h

Data: 4000.9 ETH transferred out from Truebit Hacker, worth approximately $12.35 million

4 h

Data: 495.97 BTC transferred from anonymous addresses, worth approximately $44.86 million

5 h

Data: If BTC breaks through $94,492, the total liquidation strength of short positions on mainstream CEXs will reach $822 million.

5 h

Pin