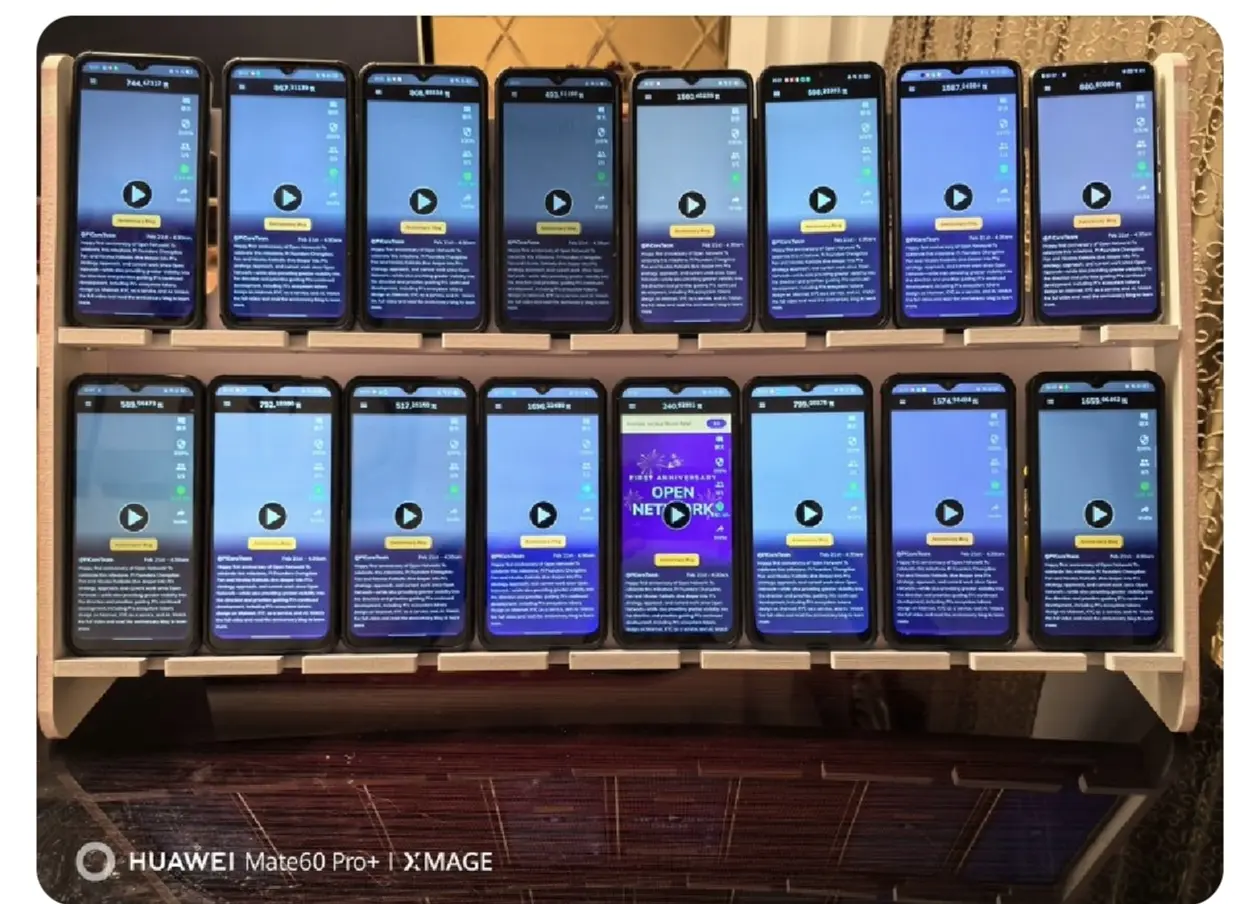

Post content & earn content mining yield

placeholder

EleventhQuantification

【$DENT Signal】Pullback on confirmation of secondary dip + 1H level retest, betting on a second surge

$DENT The 1H level experienced a 45% surge yesterday and is now undergoing a healthy correction. The price retested the 1H EMA50 (~0.000345) for initial support. The 4H level remains in a strong upward channel. The current consolidation with reduced volume is an excellent opportunity for a second entry.

🎯Direction: Long (Long)

🎯Entry/Order: 0.000345 - 0.000350

🛑Stop Loss: 0.000328 (below yesterday’s 4H low)

🚀Target 1: 0.000390 (previous high resistance zone)

🚀Target 2: 0.000430 (breakthrou

View Original$DENT The 1H level experienced a 45% surge yesterday and is now undergoing a healthy correction. The price retested the 1H EMA50 (~0.000345) for initial support. The 4H level remains in a strong upward channel. The current consolidation with reduced volume is an excellent opportunity for a second entry.

🎯Direction: Long (Long)

🎯Entry/Order: 0.000345 - 0.000350

🛑Stop Loss: 0.000328 (below yesterday’s 4H low)

🚀Target 1: 0.000390 (previous high resistance zone)

🚀Target 2: 0.000430 (breakthrou

- Reward

- like

- Comment

- Repost

- Share

Crypto market analysis

- Reward

- like

- Comment

- Repost

- Share

On Friday, the bulls' momentum has run out, and the range is still downward.

Did everyone catch the 68500 level yesterday? There is also a 2000-point short-term space. Currently, there is heavy resistance above, and there are signs of pullback and downward movement within the range. Therefore, intraday trading should mainly focus on short positions, with 68000 as the entry point for shorts.

Ethereum is moving in sync, with short positions around 2050-2030. First, see if the overnight low of 1975 can be effectively broken. If it breaks, look toward 1900. There might be a one-way decline today,

Did everyone catch the 68500 level yesterday? There is also a 2000-point short-term space. Currently, there is heavy resistance above, and there are signs of pullback and downward movement within the range. Therefore, intraday trading should mainly focus on short positions, with 68000 as the entry point for shorts.

Ethereum is moving in sync, with short positions around 2050-2030. First, see if the overnight low of 1975 can be effectively broken. If it breaks, look toward 1900. There might be a one-way decline today,

ETH-1,32%

- Reward

- like

- Comment

- Repost

- Share

FPT

Fan punk token

Created By@gatefunuser_773c

Listing Progress

0.00%

MC:

$2.49K

More Tokens

【$BTC Signal】Pullback Long + 1H Level Momentum Reversion and 4H Strong Support Resonance

$BTC The 1H level stabilizes above EMA20 (67536), just completing a test of yesterday’s high (68188), currently pulling back with decreasing volume. The 4H level price is oscillating tightly above EMA50 (66880), which has been a dense trading zone over the past week, forming a strong support. Under a negative funding rate environment (-0.0072%), open interest remains stable with no signs of panic selling. The current decline is more likely a shakeout caused by long liquidation rather than main force distri

View Original$BTC The 1H level stabilizes above EMA20 (67536), just completing a test of yesterday’s high (68188), currently pulling back with decreasing volume. The 4H level price is oscillating tightly above EMA50 (66880), which has been a dense trading zone over the past week, forming a strong support. Under a negative funding rate environment (-0.0072%), open interest remains stable with no signs of panic selling. The current decline is more likely a shakeout caused by long liquidation rather than main force distri

- Reward

- like

- Comment

- Repost

- Share

BTC Ecosystem odin.dun Platform Bitcoin Chain Odin Balance⚖️🫶🫶🫶

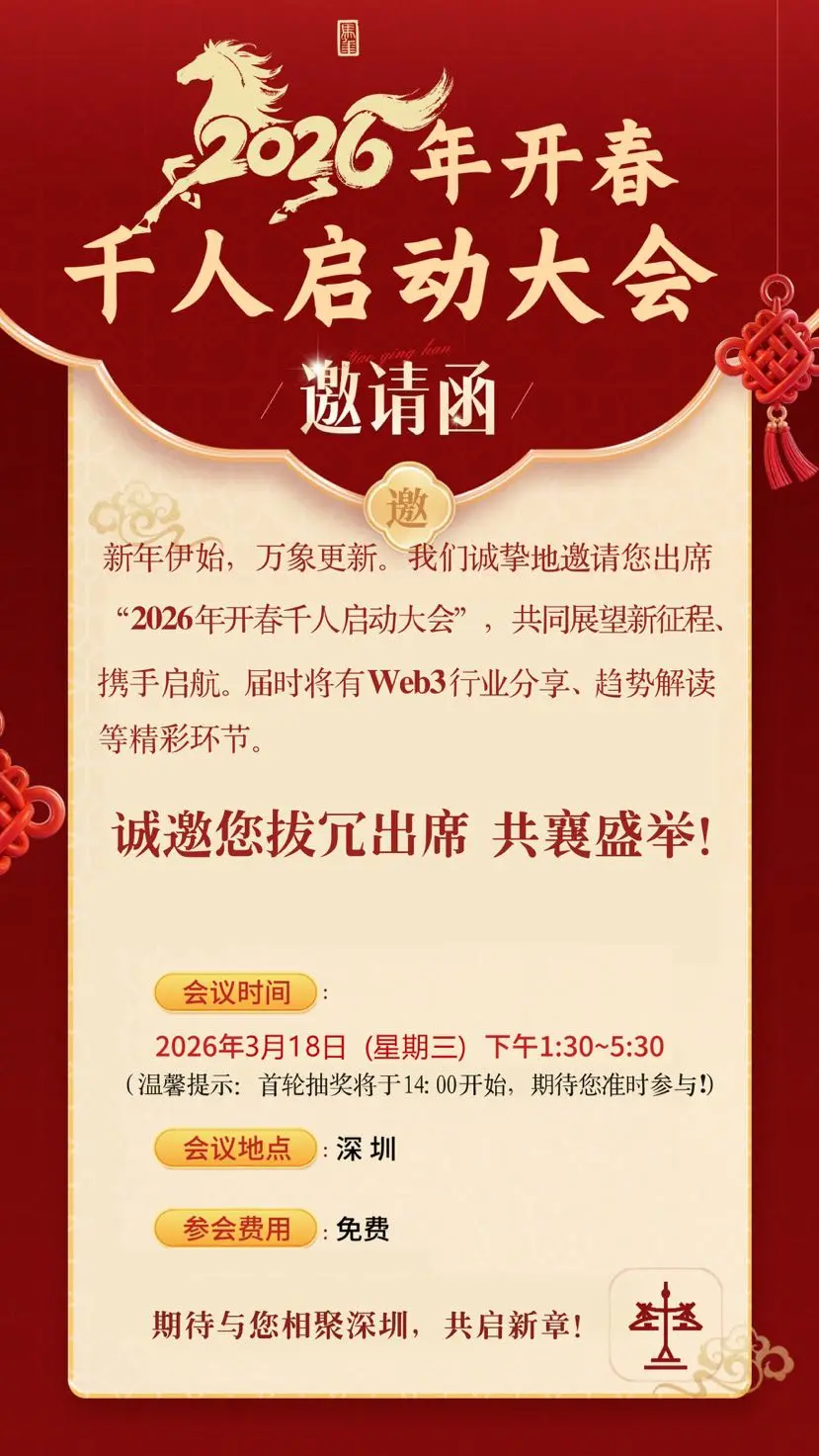

March Global🌐 Thousands Conference

April Global🌐 Anniversary Celebration

May Global🌐 Consensus Meeting

June, July, August, September, October, November, December

Odin Balance⚖️ Has plans and directions to promote every month,

By 2026, the Balance⚖️ will be a big golden dog, aiming for $150 by the end of the year!🔥🔥🔥

March Global🌐 Thousands Conference

April Global🌐 Anniversary Celebration

May Global🌐 Consensus Meeting

June, July, August, September, October, November, December

Odin Balance⚖️ Has plans and directions to promote every month,

By 2026, the Balance⚖️ will be a big golden dog, aiming for $150 by the end of the year!🔥🔥🔥

BTC-0,71%

- Reward

- 1

- Comment

- Repost

- Share

🔹 Bitcoin returns to $70,000 is this a rebound or the start of a reversal?

- Reward

- like

- Comment

- Repost

- Share

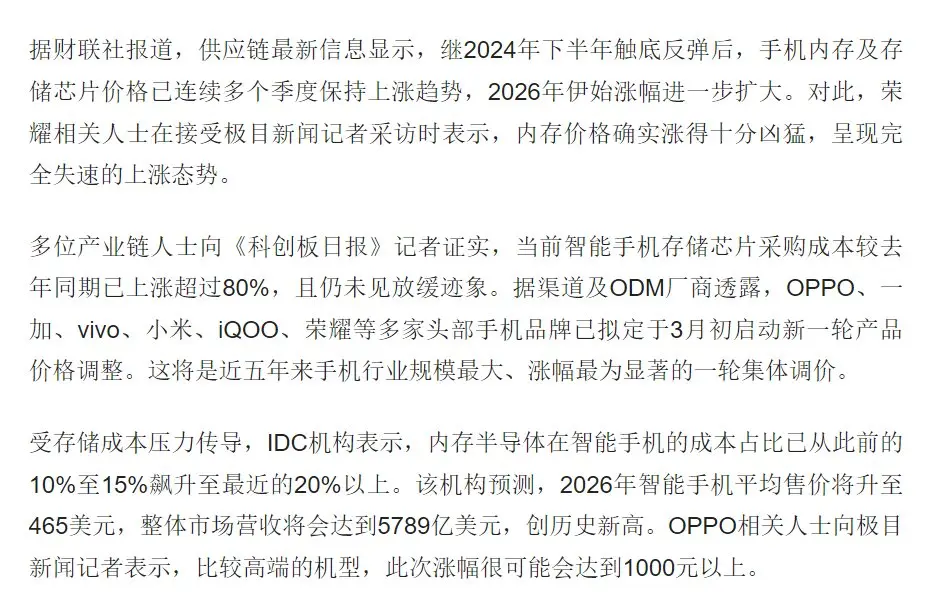

OPPO, OnePlus, vivo, Xiaomi, iQOO, Honor, and other leading smartphone brands have planned to initiate a new round of product price adjustments in early March 2026. This will be the largest industry-wide price increase in nearly five years, with the most significant overall price hike.

Damn, I still want to change my phone this year...

View OriginalDamn, I still want to change my phone this year...

- Reward

- 2

- Comment

- Repost

- Share

Last night's AMA hosted by Cat Brother has concluded.

The core theme boils down to two words:

Survival.

X rules are changing, the Web3 cycle is cooling. How to survive?

We talked for about an hour.

Recap of the on-site comments 👇

Cat Brother @yqgyx123

Give up illusions, focus on survival.

What’s lacking now isn’t projects,

but a new narrative that ordinary people can understand and trust.

Jiutian @bigenaiwang

Find the next wave of opportunities.

Prediction markets + World Cup trends.

AQiang @Mr_qiang777

If crypto doesn’t work, switch to US stocks or A-shares.

Money isn’t limited by sectors. F

View OriginalThe core theme boils down to two words:

Survival.

X rules are changing, the Web3 cycle is cooling. How to survive?

We talked for about an hour.

Recap of the on-site comments 👇

Cat Brother @yqgyx123

Give up illusions, focus on survival.

What’s lacking now isn’t projects,

but a new narrative that ordinary people can understand and trust.

Jiutian @bigenaiwang

Find the next wave of opportunities.

Prediction markets + World Cup trends.

AQiang @Mr_qiang777

If crypto doesn’t work, switch to US stocks or A-shares.

Money isn’t limited by sectors. F

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 6

- Repost

- Share

WangGonggong :

:

Just mapped over 3000 today. On the mining homepage, there's suddenly a 200% lock-up prompt, which is the mapping notification. I have one machine and one account. Sometimes I use my own network, but most of the time I share the same WiFi with other mining accounts. As long as I operate correctly, just wait.View More

XAUT/USDT

$XAUT

Price: $5,179.1 (+0.20%) | At 24h High

Pattern

Sharp drop to 5,150 support mid-session → strong bounce/recovery

Current candles at highs with small bodies = slight indecision at resistance

Indicators

MA5 > MA10 > MA30 — all aligned bullish ✅

MACD: DIF (2.8) > DEA (1.9), histogram positive = bullish momentum

Bias

Bullish — but trading at 24h highs. Watch for consolidation or pullback to 5,167–5,173 before next leg up. Break above 5,182 opens further upside.

$XAUT

Price: $5,179.1 (+0.20%) | At 24h High

Pattern

Sharp drop to 5,150 support mid-session → strong bounce/recovery

Current candles at highs with small bodies = slight indecision at resistance

Indicators

MA5 > MA10 > MA30 — all aligned bullish ✅

MACD: DIF (2.8) > DEA (1.9), histogram positive = bullish momentum

Bias

Bullish — but trading at 24h highs. Watch for consolidation or pullback to 5,167–5,173 before next leg up. Break above 5,182 opens further upside.

XAUT0,1%

- Reward

- like

- 2

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#DeepCreationCamp

Artificial Intelligence Tokens in Crypto Markets

A Comprehensive Sector Deep Dive

---

1. Introduction — The Structural Convergence of AI and Blockchain

Artificial Intelligence and blockchain technology represent two of the most powerful technological paradigms of the 21st century. Individually, each has reshaped industries, altered economic models, and introduced new frameworks for value creation. Together, they form a powerful convergence that is beginning to redefine digital infrastructure itself.

Artificial Intelligence brings predictive capability, automation, and decisi

Artificial Intelligence Tokens in Crypto Markets

A Comprehensive Sector Deep Dive

---

1. Introduction — The Structural Convergence of AI and Blockchain

Artificial Intelligence and blockchain technology represent two of the most powerful technological paradigms of the 21st century. Individually, each has reshaped industries, altered economic models, and introduced new frameworks for value creation. Together, they form a powerful convergence that is beginning to redefine digital infrastructure itself.

Artificial Intelligence brings predictive capability, automation, and decisi

- Reward

- 5

- 7

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

TKM

TANK COMBAT MEME

Created By@gatefunuser_773c

Listing Progress

0.00%

MC:

$2.49K

More Tokens

In 2000, Michael Saylor lived to see his stock decline in value by -99.8%. His stock went from $333 a share, to $0.42.

Until death, all defeat is psychological.

Until death, all defeat is psychological.

- Reward

- like

- Comment

- Repost

- Share

【$SOL Signal】Long and short battle, 1H breakout imminent, ambush breakout order

$SOL The 1H timeframe is strongly consolidating above EMA20 (86.57), with the price closely approaching the current 4H high of 88.26 to gather strength. The 1H RSI (61.41) is healthy, and the bid-ask depth ratio (bid_ask_ratio_depth: 1.20) favors buyers, indicating active support from bulls at a critical level. Although the 4H cycle remains in a consolidation range (84.25-88.64), the 1H has formed a small upward structure, and the latest 4H candlestick closed bullish, showing signs of momentum turning. Negative f

$SOL The 1H timeframe is strongly consolidating above EMA20 (86.57), with the price closely approaching the current 4H high of 88.26 to gather strength. The 1H RSI (61.41) is healthy, and the bid-ask depth ratio (bid_ask_ratio_depth: 1.20) favors buyers, indicating active support from bulls at a critical level. Although the 4H cycle remains in a consolidation range (84.25-88.64), the 1H has formed a small upward structure, and the latest 4H candlestick closed bullish, showing signs of momentum turning. Negative f

- Reward

- 7

- 7

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

XAUT/USDT

$XAUT

Price: $5,179.1 (+0.20%) | At 24h High

Pattern

Sharp drop to 5,150 support mid-session → strong bounce/recovery

Current candles at highs with small bodies = slight indecision at resistance

Indicators

MA5 > MA10 > MA30 — all aligned bullish ✅

MACD: DIF (2.8) > DEA (1.9), histogram positive = bullish momentum

Bias

Bullish — but trading at 24h highs. Watch for consolidation or pullback to 5,167–5,173 before next leg up. Break above 5,182 opens further upside.

$XAUT

Price: $5,179.1 (+0.20%) | At 24h High

Pattern

Sharp drop to 5,150 support mid-session → strong bounce/recovery

Current candles at highs with small bodies = slight indecision at resistance

Indicators

MA5 > MA10 > MA30 — all aligned bullish ✅

MACD: DIF (2.8) > DEA (1.9), histogram positive = bullish momentum

Bias

Bullish — but trading at 24h highs. Watch for consolidation or pullback to 5,167–5,173 before next leg up. Break above 5,182 opens further upside.

XAUT0,1%

- Reward

- 1

- Comment

- Repost

- Share

#DeepCreationCamp | 2026–2027 Macro Outlook

RWA Moves From Crypto Narrative to Institutional Financial Infrastructure

Real-World Asset (RWA) tokenization has crossed a point of no return.

What once existed as experimental blockchain representations of off-chain assets has now matured into regulated, compliance-native financial infrastructure. By 2026, RWA is no longer discussed as a “crypto use case.” It is increasingly framed as capital market modernization — a digital extension of traditional finance rails.

This shift is not ideological.

It is structural.

The defining theme of this cycle is

RWA Moves From Crypto Narrative to Institutional Financial Infrastructure

Real-World Asset (RWA) tokenization has crossed a point of no return.

What once existed as experimental blockchain representations of off-chain assets has now matured into regulated, compliance-native financial infrastructure. By 2026, RWA is no longer discussed as a “crypto use case.” It is increasingly framed as capital market modernization — a digital extension of traditional finance rails.

This shift is not ideological.

It is structural.

The defining theme of this cycle is

- Reward

- 2

- 5

- Repost

- Share

Good_Girl :

:

Ape In 🚀View More

- Reward

- 1

- 1

- Repost

- Share

CryptoRover44 :

:

Bitcoin spot ETFs recorded a net inflow of $254.4M. Good Morning 🌅

GM TO EVERYONE ☀️

Its finally friday again!

Remember to touch grass this weekend.

Its finally friday again!

Remember to touch grass this weekend.

- Reward

- 1

- Comment

- Repost

- Share

The current Middle East situation remains tense. Although indirect negotiations between the US and Iran have entered a framework consultation stage, core disagreements remain unresolved: the US demands Iran permanently dismantle nuclear facilities and cease uranium enrichment, while Iran only agrees to a short-term suspension, leading to increased standoffs. The US military has deployed dual aircraft carrier groups to the Persian Gulf, Iran has strengthened military alertness and warned of possible blockade of the Strait of Hormuz. Risks to Red Sea shipping continue to rise, causing significan

ETH-1,32%

- Reward

- 4

- 8

- Repost

- Share

ShuiJinshanLooksBack :

:

Wishing you great wealth in the Year of the Horse 🐴View More

$DN 3 long green candlestics making bullish momentum.

Current Price Action

Price: $0.1524 (+2.56% 24h)

Timeframe: 15-minute candles

Range: 0.1435 – 0.1545

Candlestick Patterns Observed

Left Side (00:15 – 06:30) — Bullish Push then Reversal

Strong green marubozu candles early on → aggressive buying

Price hit 0.1545 resistance with a shooting star/doji top → rejection signal

Follow-through red candles confirmed bearish reversal

Mid Section (06:30 – 09:00) — Downtrend

Series of bearish engulfing candles

Wicks on top = sellers in control

Price dropped to 0.1440 support

Right Side (09:00 – 09:45

Current Price Action

Price: $0.1524 (+2.56% 24h)

Timeframe: 15-minute candles

Range: 0.1435 – 0.1545

Candlestick Patterns Observed

Left Side (00:15 – 06:30) — Bullish Push then Reversal

Strong green marubozu candles early on → aggressive buying

Price hit 0.1545 resistance with a shooting star/doji top → rejection signal

Follow-through red candles confirmed bearish reversal

Mid Section (06:30 – 09:00) — Downtrend

Series of bearish engulfing candles

Wicks on top = sellers in control

Price dropped to 0.1440 support

Right Side (09:00 – 09:45

DN1,41%

- Reward

- like

- 1

- Repost

- Share

Vortex_King :

:

To The Moon 🌕Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More348K Popularity

10.35K Popularity

48.56K Popularity

10.09K Popularity

460.62K Popularity

Hot Gate Fun

View More- MC:$2.48KHolders:10.01%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.49KHolders:20.00%

News

View MoreData, Analyst: Long-term Bitcoin holders' net position continues to increase, market turnover rate decreases

3 m

An address deposited $8.16 million worth of SIREN to Gate.

11 m

Feng Bo strongly supports Haseeb: he is the backbone of Dragonfly and the "brightest star" among the investors I know.

19 m

MYX (MYX Finance) increased by 27.58% in the last 24 hours

24 m

Cardone Capital aims to enter the tokenized real estate sector and is seeking the best Layer 2 partner

27 m

Pin