# BItcoin

6.64M

Luna_Star

#BuyTheDipOrWaitNow?

📅 Date: 11 February 2026

The market is once again at a critical decision point. After every correction, the same question comes back: Buy the dip or wait for confirmation?

Let’s break down today’s structure step by step

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ Current Market Structure

Bitcoin and major altcoins have pulled back from recent highs. On lower timeframes, price is forming lower highs signaling short-term weakness. However, on the higher timeframe (weekly), the broader structure is not fully bearish yet.

This means we’re in a risk-off phase, but not necessarily in a confirm

📅 Date: 11 February 2026

The market is once again at a critical decision point. After every correction, the same question comes back: Buy the dip or wait for confirmation?

Let’s break down today’s structure step by step

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ Current Market Structure

Bitcoin and major altcoins have pulled back from recent highs. On lower timeframes, price is forming lower highs signaling short-term weakness. However, on the higher timeframe (weekly), the broader structure is not fully bearish yet.

This means we’re in a risk-off phase, but not necessarily in a confirm

BTC-2,86%

- Reward

- like

- Comment

- Repost

- Share

--FUTURE OF CRYPTO--

The crypto market is in deep pain right now — BTC hovering around **$69K** (down roughly 1% today, -21% year-to-date, and more than 45% off the October 2025 all-time high near $126K). Ethereum and most altcoins are bleeding even harder. The Fear & Greed Index sits firmly in extreme fear territory, a zone we haven’t seen sustained since the darkest days of 2022. A lot of people were positioned for a massive Trump-era rally throughout 2026… instead, we’ve been hit with a vicious deleveraging cycle that has shaken out leverage, weak hands, and even some institutional position

The crypto market is in deep pain right now — BTC hovering around **$69K** (down roughly 1% today, -21% year-to-date, and more than 45% off the October 2025 all-time high near $126K). Ethereum and most altcoins are bleeding even harder. The Fear & Greed Index sits firmly in extreme fear territory, a zone we haven’t seen sustained since the darkest days of 2022. A lot of people were positioned for a massive Trump-era rally throughout 2026… instead, we’ve been hit with a vicious deleveraging cycle that has shaken out leverage, weak hands, and even some institutional position

BTC-2,86%

- Reward

- like

- Comment

- Repost

- Share

#StrategyBuys1,142BTC #StrategyBuys1,142BTC 🚀🐂

Big news from the crypto markets! Strategy has just purchased 1,142 BTC, a significant accumulation that signals strong bullish sentiment. Here's what this could mean:

🔹 Scale of the Buy: 1,142 BTC is worth millions in today’s market — a move that shows serious confidence.

🔹 Market Implications: Large buys like this often precede upward price momentum. Traders may see this as a signal to watch BTC closely.

🔹 Why It Matters: Accumulation by strategic investors suggests belief in long-term growth, potentially indicating a trend reversal or majo

Big news from the crypto markets! Strategy has just purchased 1,142 BTC, a significant accumulation that signals strong bullish sentiment. Here's what this could mean:

🔹 Scale of the Buy: 1,142 BTC is worth millions in today’s market — a move that shows serious confidence.

🔹 Market Implications: Large buys like this often precede upward price momentum. Traders may see this as a signal to watch BTC closely.

🔹 Why It Matters: Accumulation by strategic investors suggests belief in long-term growth, potentially indicating a trend reversal or majo

BTC-2,86%

- Reward

- 2

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

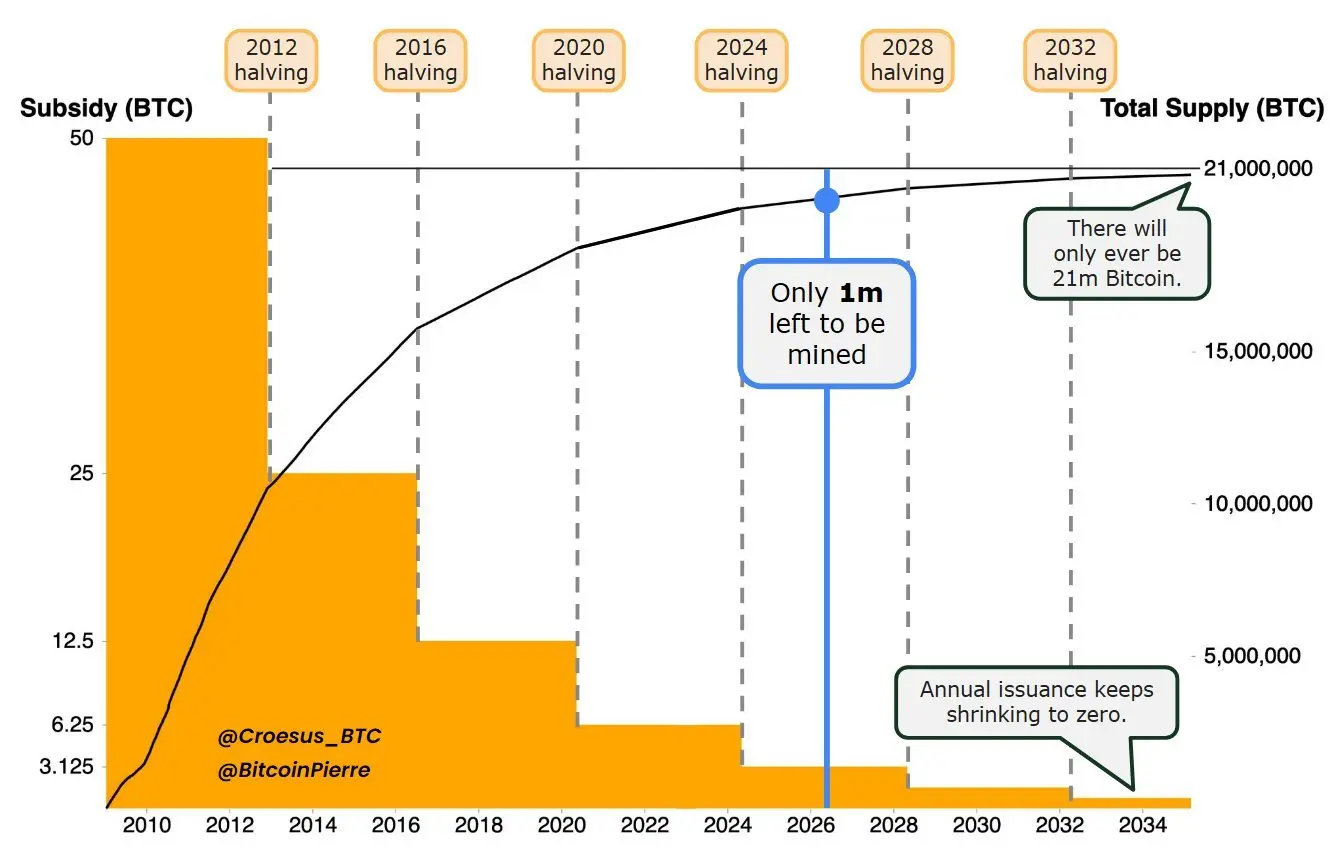

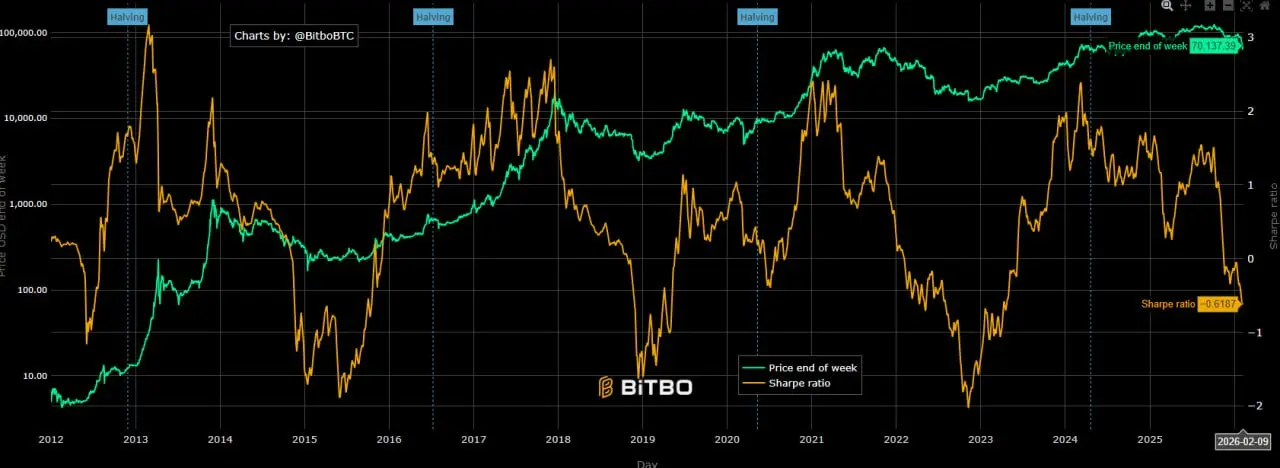

Bitcoin doesn’t top on price — it tops on risk.

The Sharpe Ratio has rolled over near every major cycle peak, long before price actually breaks down. Price can stay high, but returns become inefficient and volatility starts working against you.

Halvings spark upside.

Risk-adjusted returns fade first.

This isn’t the end of the cycle — it’s the phase where discipline matters more than conviction.

#Bitcoin #GoldRebounds #WhiteHouseTalksStablecoinYields #GateSpringFestivalHorseRacingEvent

The Sharpe Ratio has rolled over near every major cycle peak, long before price actually breaks down. Price can stay high, but returns become inefficient and volatility starts working against you.

Halvings spark upside.

Risk-adjusted returns fade first.

This isn’t the end of the cycle — it’s the phase where discipline matters more than conviction.

#Bitcoin #GoldRebounds #WhiteHouseTalksStablecoinYields #GateSpringFestivalHorseRacingEvent

BTC-2,86%

- Reward

- like

- Comment

- Repost

- Share

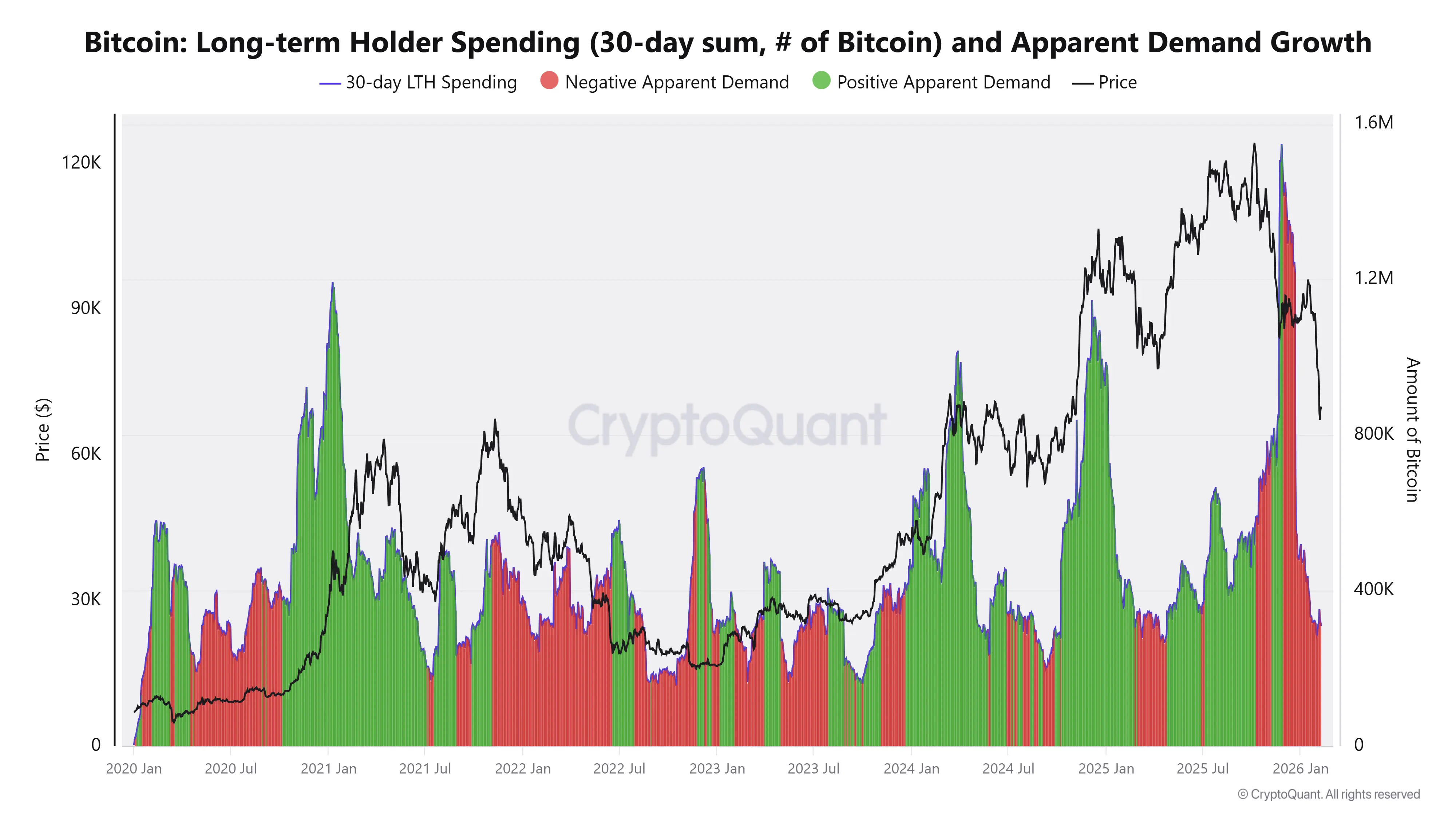

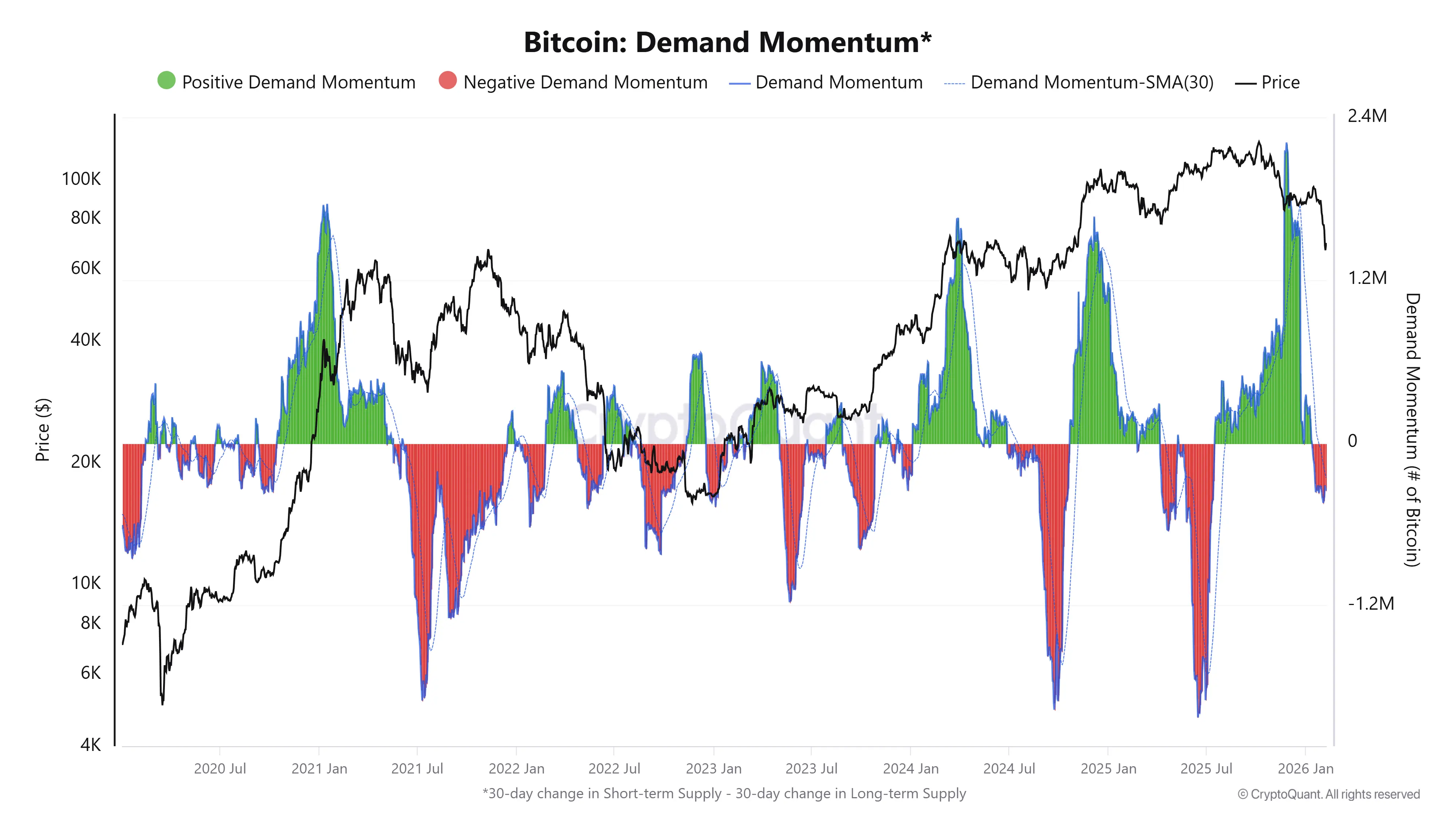

Rising Long-Term Holder Spending Meets Fading Demand - #Bitcoin Enters Redistribution Territory

On-chain data is beginning to reflect a structural shift as Long-Term Holder (LTH) spending accelerates sharply. The 30-day cumulative outflow from this cohort has climbed toward cycle highs, a pattern historically associated with late-stage bullish environments. Rather than accumulating, seasoned investors appear to be distributing into market strength, transferring supply to newer participants as price trades near elevated levels.

What makes the current setup more nuanced is the simultaneous deter

On-chain data is beginning to reflect a structural shift as Long-Term Holder (LTH) spending accelerates sharply. The 30-day cumulative outflow from this cohort has climbed toward cycle highs, a pattern historically associated with late-stage bullish environments. Rather than accumulating, seasoned investors appear to be distributing into market strength, transferring supply to newer participants as price trades near elevated levels.

What makes the current setup more nuanced is the simultaneous deter

BTC-2,86%

- Reward

- 2

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

🔄 #BuyTheDipOrWaitNow — Crypto Strategy Update (10 Feb 2026)

The crypto market is still in a volatile range today as Bitcoin struggles around key levels after recent swings. BTC has moved below and near the $70,000 zone, with volume shrinking and traders watching direction carefully.

📉 Where Things Stand:

• Bitcoin is trading near $69,600–$70,000, showing hesitation after recent rebounds.

• Trading volume has dropped significantly, suggesting reduced conviction and cautious positioning.

• Crypto prices broadly remain under pressure amid macro uncertainty and lack of fresh catalysts.

This

The crypto market is still in a volatile range today as Bitcoin struggles around key levels after recent swings. BTC has moved below and near the $70,000 zone, with volume shrinking and traders watching direction carefully.

📉 Where Things Stand:

• Bitcoin is trading near $69,600–$70,000, showing hesitation after recent rebounds.

• Trading volume has dropped significantly, suggesting reduced conviction and cautious positioning.

• Crypto prices broadly remain under pressure amid macro uncertainty and lack of fresh catalysts.

This

BTC-2,86%

- Reward

- like

- Comment

- Repost

- Share

🇺🇸🗽 On Feb. 9 (ET), U.S. #Bitcoin spot ETFs recorded total net inflows of $145 million, led by Grayscale with $131 million in net inflows. #Ethereum spot ETFs saw total net inflows of $57.05 million, marking the first net inflow after three consecutive days of net outflows. #CryptoRecovery

$BTC $ETH

$BTC $ETH

- Reward

- 1

- Comment

- Repost

- Share

🇺🇸🗽 On Feb. 9 (ET), U.S. #Bitcoin spot ETFs recorded total net inflows of $145 million, led by Grayscale with $131 million in net inflows. #Ethereum spot ETFs saw total net inflows of $57.05 million, marking the first net inflow after three consecutive days of net outflows. #CryptoRecovery

$BTC $ETH

$BTC $ETH

- Reward

- like

- Comment

- Repost

- Share

📉🔥 #BuyTheDipOrWaitNow?

Bitcoin is trading near $69,000, holding a critical support zone after recent volatility.

Now the real question:

Is this a smart accumulation zone… or is another drop coming?

🔎 Key Levels:

• 🟢 Support: $68,000 – $69,000

• 🔴 Major Support: $66,500

• 🚀 Resistance: $70,500 – $71,000

If BTC holds above $68K with increasing volume, we could see a recovery toward $70K+.

But if $68K breaks with strong selling pressure, a deeper pullback may follow.

💡 Smart move:

Wait for confirmation. Let the market show direction before committing heavy positions.

At $69K — are you buy

Bitcoin is trading near $69,000, holding a critical support zone after recent volatility.

Now the real question:

Is this a smart accumulation zone… or is another drop coming?

🔎 Key Levels:

• 🟢 Support: $68,000 – $69,000

• 🔴 Major Support: $66,500

• 🚀 Resistance: $70,500 – $71,000

If BTC holds above $68K with increasing volume, we could see a recovery toward $70K+.

But if $68K breaks with strong selling pressure, a deeper pullback may follow.

💡 Smart move:

Wait for confirmation. Let the market show direction before committing heavy positions.

At $69K — are you buy

BTC-2,86%

- Reward

- 11

- 17

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

220.48K Popularity

30.8K Popularity

14.91K Popularity

13.81K Popularity

6.91K Popularity

76.64K Popularity

5.05K Popularity

7.06K Popularity

6.16K Popularity

3.19K Popularity

4.1K Popularity

13.92K Popularity

3.6K Popularity

20.36K Popularity

11.24K Popularity

News

View MoreData: 649.45 BTC transferred from an anonymous address, worth approximately 43.97 million USD

1 m

Decisive Non-Farm Battle! White House officials intensively "give a heads-up": 50,000 new cases may be normal

2 m

Sei Labs Co-founder Jayendra Jog: The stablecoin yield model has great potential and will surpass the revenue model relying on transaction fees.

3 m

Hong Kong advances perpetual contract innovation, allowing institutional investors to access Bitcoin and Ethereum financing opportunities

5 m

Japan's Financial Services Agency releases "Draft Guidelines for Strengthening Cybersecurity for Crypto Exchanges" and opens for public comments

10 m

Pin