#NextFedChairPredictions

Next Fed Chair Predictions: Who Will Lead, and How Could Markets React?

The question of who will become the next U.S. Federal Reserve Chair is drawing intense attention from investors, economists, and policymakers worldwide. The Fed Chair’s decisions shape monetary policy, interest rates, inflation expectations, and overall market sentiment, meaning that this appointment will have far-reaching consequences for equities, bonds, commodities, and even cryptocurrencies. Markets are already speculating on the potential candidates, weighing their policy philosophies, track records, and likely approach to economic growth and inflation.

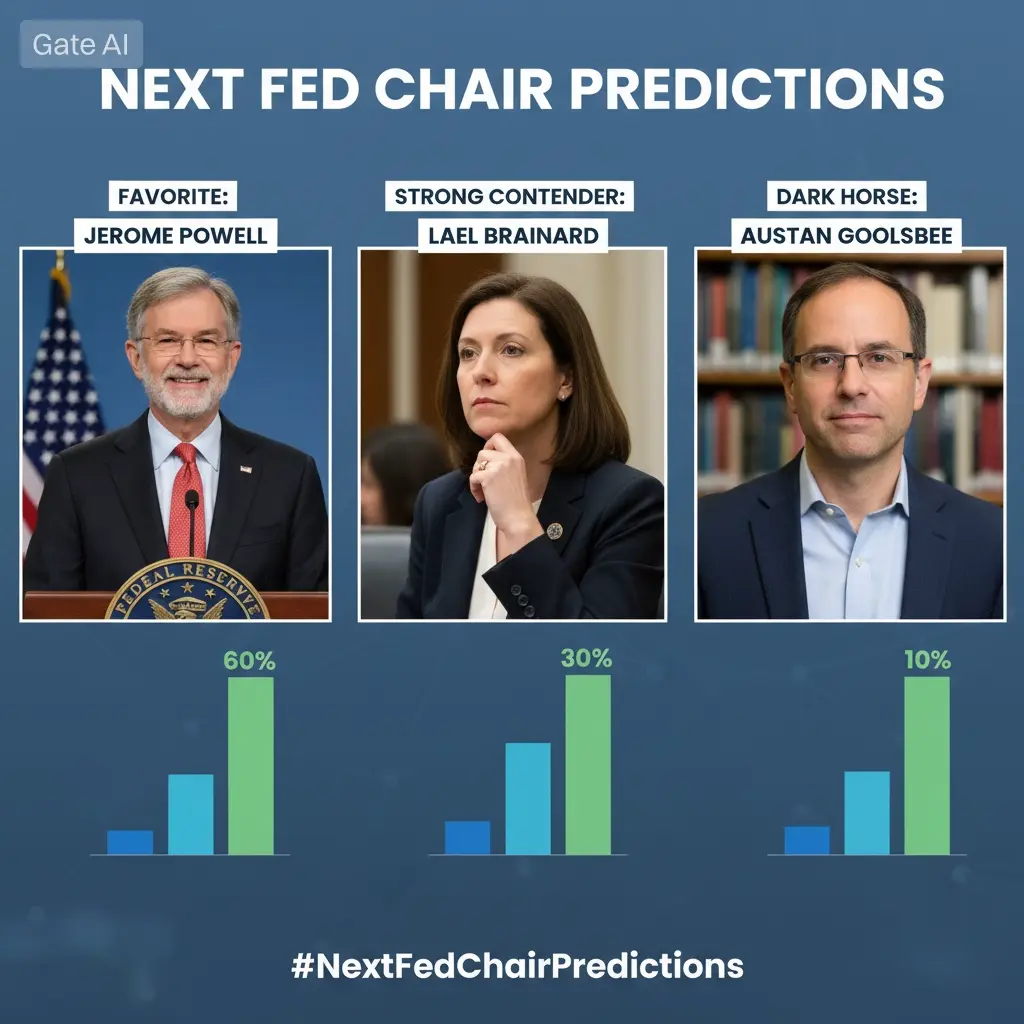

Among the leading contenders is Kevin Warsh, a former Fed Governor known for his close ties to both markets and policymakers. Warsh is often viewed as market-friendly with a moderate hawkish tilt, likely to support measured rate adjustments aimed at balancing inflation control and economic growth. Another strong candidate is Lael Brainard, a current Fed Governor with a reputation for data-driven decision-making and regulatory focus. Brainard could emphasize financial stability and cautious monetary policy, which may favor accommodative conditions for longer periods. Other potential candidates from academia, international finance, and former central banks bring unique perspectives that could dramatically influence the Fed’s policy direction, depending on the administration’s priorities.

The appointment of the next Fed Chair has immediate implications for markets. A hawkish Chair may accelerate interest rate hikes, strengthen the U.S. dollar, and tighten financial conditions, potentially prompting a risk-off response across equities and crypto markets. Conversely, a dovish Chair may maintain low rates and abundant liquidity, supporting risk-on sentiment and encouraging inflows into growth-oriented assets, including major altcoins. Bond markets will also react strongly, as any shift in anticipated Fed policy can lead to re-pricing of Treasury yields, duration risk, and emerging market debt exposures.

From a technical and strategic standpoint, investors should monitor several key signals. Public statements, voting history, and commentary on inflation, employment, and growth provide valuable insights into a candidate’s likely policy stance. Additionally, macroeconomic data releases such as CPI, PCE, employment figures, and GDP growth will influence market expectations, potentially creating short-term volatility opportunities. Traders may consider hedging strategies using options or treasury futures, while long-term investors may adjust portfolio allocations to balance risk and opportunity during the transition.

Investor psychology also plays a critical role. The uncertainty around the Fed Chair selection can amplify market swings, particularly in highly sensitive assets like equities, high-yield debt, and cryptocurrencies. BTC and other digital assets may experience temporary decoupling, but historically, risk-on/risk-off sentiment driven by monetary policy decisions has a measurable impact on crypto markets, especially when large institutional participants react to anticipated policy shifts.

In my perspective, the next Fed Chair is likely to define the trajectory of risk assets over the coming months. A hawkish appointment could trigger short-term volatility, USD strength, and cautious positioning in equities and crypto, while a dovish candidate may extend accommodative conditions, supporting continued inflows into growth assets. Regardless of the outcome, disciplined investors should combine macro awareness, technical insight, and risk management to navigate potential swings. Scaling positions, using tactical entries, and monitoring both on-chain and off-chain signals will be key for crypto traders, while traditional market participants should focus on interest rate-sensitive sectors, fixed-income positioning, and global diversification.

Discussion Prompts:

Who do you think is the most likely candidate for Fed Chair, and why?

How would a hawkish vs. dovish Fed Chair affect your portfolio allocation or trading strategy?

Do you expect crypto markets to react sharply, or decouple from traditional risk sentiment?

Are you considering adjusting exposure now ahead of the appointment, or waiting for clarity?

Which sectors or assets do you see as winners or losers under each potential scenario?

Bottom Line:

The selection of the next Fed Chair is a critical event for markets, with the potential to influence interest rates, inflation expectations, and risk appetite across traditional and crypto assets. Investors and traders who combine careful analysis of candidate profiles, macroeconomic data, and strategic risk management can position themselves effectively for both short-term volatility and long-term opportunities. The coming weeks will likely be pivotal in shaping market sentiment, and staying informed, disciplined, and proactive will be essential.

Next Fed Chair Predictions: Who Will Lead, and How Could Markets React?

The question of who will become the next U.S. Federal Reserve Chair is drawing intense attention from investors, economists, and policymakers worldwide. The Fed Chair’s decisions shape monetary policy, interest rates, inflation expectations, and overall market sentiment, meaning that this appointment will have far-reaching consequences for equities, bonds, commodities, and even cryptocurrencies. Markets are already speculating on the potential candidates, weighing their policy philosophies, track records, and likely approach to economic growth and inflation.

Among the leading contenders is Kevin Warsh, a former Fed Governor known for his close ties to both markets and policymakers. Warsh is often viewed as market-friendly with a moderate hawkish tilt, likely to support measured rate adjustments aimed at balancing inflation control and economic growth. Another strong candidate is Lael Brainard, a current Fed Governor with a reputation for data-driven decision-making and regulatory focus. Brainard could emphasize financial stability and cautious monetary policy, which may favor accommodative conditions for longer periods. Other potential candidates from academia, international finance, and former central banks bring unique perspectives that could dramatically influence the Fed’s policy direction, depending on the administration’s priorities.

The appointment of the next Fed Chair has immediate implications for markets. A hawkish Chair may accelerate interest rate hikes, strengthen the U.S. dollar, and tighten financial conditions, potentially prompting a risk-off response across equities and crypto markets. Conversely, a dovish Chair may maintain low rates and abundant liquidity, supporting risk-on sentiment and encouraging inflows into growth-oriented assets, including major altcoins. Bond markets will also react strongly, as any shift in anticipated Fed policy can lead to re-pricing of Treasury yields, duration risk, and emerging market debt exposures.

From a technical and strategic standpoint, investors should monitor several key signals. Public statements, voting history, and commentary on inflation, employment, and growth provide valuable insights into a candidate’s likely policy stance. Additionally, macroeconomic data releases such as CPI, PCE, employment figures, and GDP growth will influence market expectations, potentially creating short-term volatility opportunities. Traders may consider hedging strategies using options or treasury futures, while long-term investors may adjust portfolio allocations to balance risk and opportunity during the transition.

Investor psychology also plays a critical role. The uncertainty around the Fed Chair selection can amplify market swings, particularly in highly sensitive assets like equities, high-yield debt, and cryptocurrencies. BTC and other digital assets may experience temporary decoupling, but historically, risk-on/risk-off sentiment driven by monetary policy decisions has a measurable impact on crypto markets, especially when large institutional participants react to anticipated policy shifts.

In my perspective, the next Fed Chair is likely to define the trajectory of risk assets over the coming months. A hawkish appointment could trigger short-term volatility, USD strength, and cautious positioning in equities and crypto, while a dovish candidate may extend accommodative conditions, supporting continued inflows into growth assets. Regardless of the outcome, disciplined investors should combine macro awareness, technical insight, and risk management to navigate potential swings. Scaling positions, using tactical entries, and monitoring both on-chain and off-chain signals will be key for crypto traders, while traditional market participants should focus on interest rate-sensitive sectors, fixed-income positioning, and global diversification.

Discussion Prompts:

Who do you think is the most likely candidate for Fed Chair, and why?

How would a hawkish vs. dovish Fed Chair affect your portfolio allocation or trading strategy?

Do you expect crypto markets to react sharply, or decouple from traditional risk sentiment?

Are you considering adjusting exposure now ahead of the appointment, or waiting for clarity?

Which sectors or assets do you see as winners or losers under each potential scenario?

Bottom Line:

The selection of the next Fed Chair is a critical event for markets, with the potential to influence interest rates, inflation expectations, and risk appetite across traditional and crypto assets. Investors and traders who combine careful analysis of candidate profiles, macroeconomic data, and strategic risk management can position themselves effectively for both short-term volatility and long-term opportunities. The coming weeks will likely be pivotal in shaping market sentiment, and staying informed, disciplined, and proactive will be essential.