小木论

1.12 Monday Bitcoin and Ethereum Evening Analysis

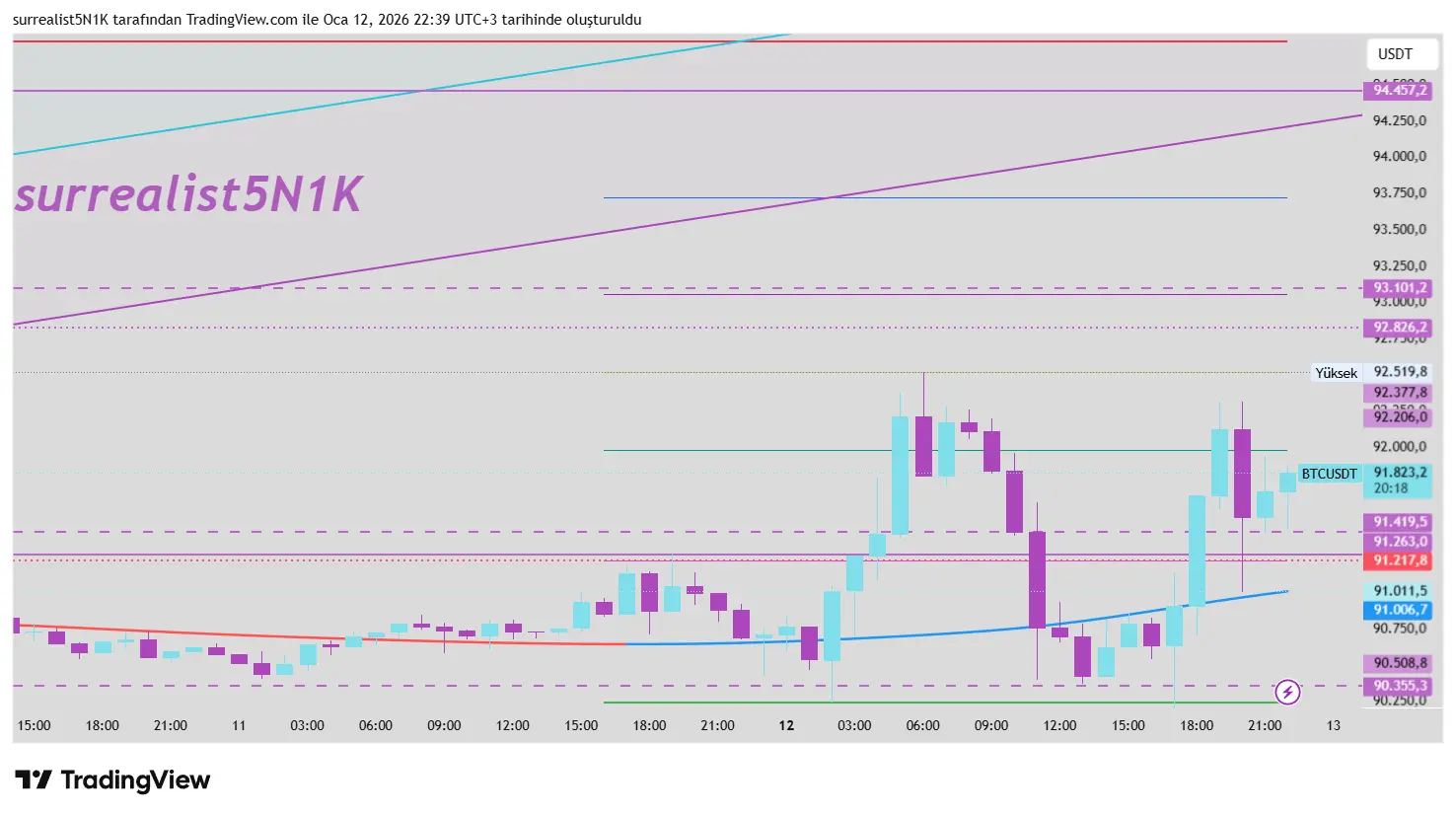

The current market overall shows a weak trend, with support below and resistance above, indicating a oscillating downward movement.

Although there has been a slight rebound, it remains under pressure from multiple moving averages, with clearly insufficient upward momentum.

Bitcoin around 90800 looks at 89500, Ethereum around 3110 looks at 3000.

View OriginalThe current market overall shows a weak trend, with support below and resistance above, indicating a oscillating downward movement.

Although there has been a slight rebound, it remains under pressure from multiple moving averages, with clearly insufficient upward momentum.

Bitcoin around 90800 looks at 89500, Ethereum around 3110 looks at 3000.