Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

TradFi

Gold

Trade global traditional assets with USDT in one place

Options

Hot

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

New

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Affiliate

Enjoy exclusive commissions and earn high returns

Gate Booster

Expand your influence and enjoy massive airdrops

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

Trending Topics

View More273.66K Popularity

882.93K Popularity

10.64M Popularity

104.9K Popularity

563.44K Popularity

Pin

Japanese and South Korean stock markets open higher and continue to rise, with Samsung Electronics up 5%, and the FTSE China A50 Index futures opening up 0.13%.

On February 19, driven by a rebound in technology stocks and positive U.S. economic data, U.S. stocks performed well overnight, leading to a general rise in Asian markets. Geopolitical tensions pushed oil prices higher, and after posting the largest single-day gain since October last year, crude oil continued its upward momentum.

Australian and Japanese stock markets strengthened, with South Korea’s benchmark index reaching a new all-time high. The previous trading day saw major Wall Street indices close higher, with the S&P 500 up 0.6% and the tech-heavy Nasdaq 100 up 0.8%.

The strong rebound in the technology sector indicates that market concerns over the disruptive impact of artificial intelligence are gradually easing, and investors are entering the market at lows to seize opportunities in stocks with valuations returning to reasonable levels. Paul Stanley, managing partner at Granite Bay Wealth Management, said that the sell-off in software stocks may be “excessive,” as it is largely an instinctive reaction where investors are trying to determine which companies in AI will win and which will lose. He stated:

In the currency markets, the dollar rebounded from recent lows, while the yen remained under pressure. The latest Federal Reserve meeting minutes showed clear disagreements among policymakers regarding the future path of interest rates. The minutes hinted that even with the new chair taking office in May, pushing for rate cuts could face significant resistance.

Corpay Asia-Pacific currency strategist Peter Dragicevic said:

Key market movements are as follows:

The Seoul Composite in South Korea rose 3%, hitting a record high. Samsung Electronics surged over 4%, with reports of negotiations for HBM4 at $700 per unit.

Dragged down by the recent decline in U.S. Treasuries, Japanese government bond futures continued to weaken. The traditional correlation between the two markets makes it difficult for Japan to shake off external pressures.

Investors are closely watching the upcoming 20-year government bond auction later today, with a scale of about 800 billion yen. Citi strategist Tomohisa Fujiki believes that the upside for ultra-long-term bonds is limited, and demand may only be a short-term phenomenon, expected to gradually fade by the end of March.

The dollar continues to strengthen, putting pressure on the yen. During Thursday’s Asian session, USD/JPY stabilized around 154.6, down from the overwhelming victory in the recent election by Prime Minister Fumio Kishida, which saw the pair at around 152.

On the news front, the Trump administration announced a $36 billion investment project, the first of Japan’s previously pledged $550 billion investment plan to the U.S.

For a long time, the yen has remained weak due to low domestic interest rates and concerns over fiscal deficits. However, recent market optimism about Japan’s economic growth prospects has provided some support for the yen.

ING Global Research Director Chris Turner said:

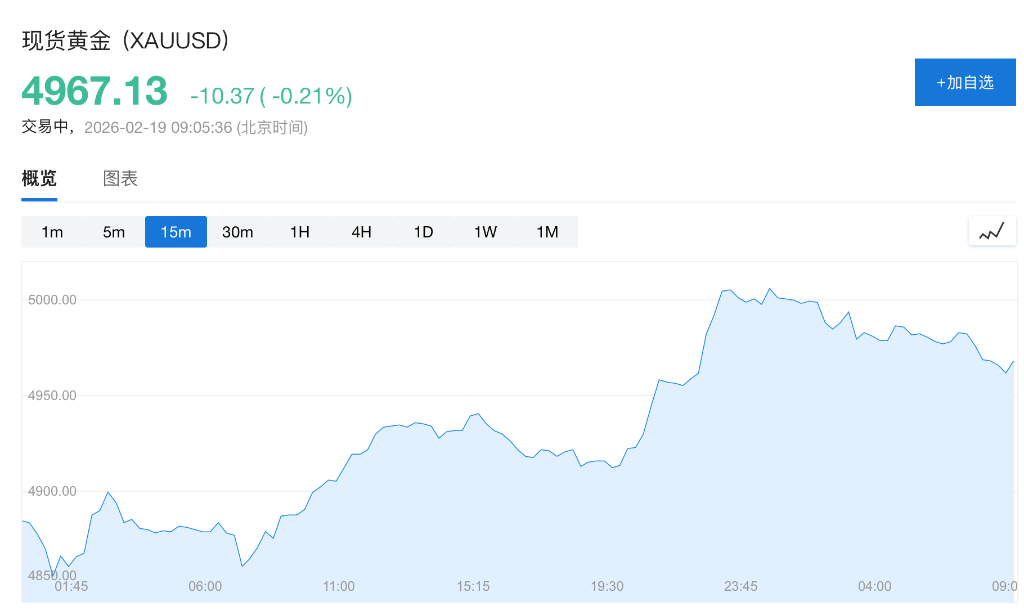

Due to escalating risks of conflict between the U.S. and Iran, gold’s appeal as a safe-haven asset has increased, with prices edging higher in Asian morning trading. Spot gold rose briefly by 0.2%, reaching $4,986 per ounce.

InTouch Capital Markets analysts noted that concerns about a potential U.S.-Iran war are heating up again. Citing media reports, they said that given the bleak prospects for a deal, the Trump administration might prefer conflict with Iran, with the possibility of joint action with Israel being the most likely scenario.

Geopolitical tensions have intensified, and oil prices surged then stabilized. Reports earlier indicated that U.S. military intervention in Iran could occur sooner than expected, reigniting supply concerns.

Wednesday’s close data showed WTI crude oil rose 4.6% to above $65, while Brent crude returned to the $70 mark, reaching a more than two-week high. Axios reported that U.S. military operations could last for several weeks, and Israel is actively pushing plans to overthrow the Iranian regime. The rapid escalation of geopolitical risks is now a dominant short-term driver of oil prices.

Risk Disclaimer and Terms of Liability

Market risks are inherent; please invest cautiously. This article does not constitute personal investment advice and does not consider individual users’ specific investment goals, financial situations, or needs. Users should consider whether any opinions, views, or conclusions herein are suitable for their particular circumstances. Investment is at your own risk.