Post content & earn content mining yield

placeholder

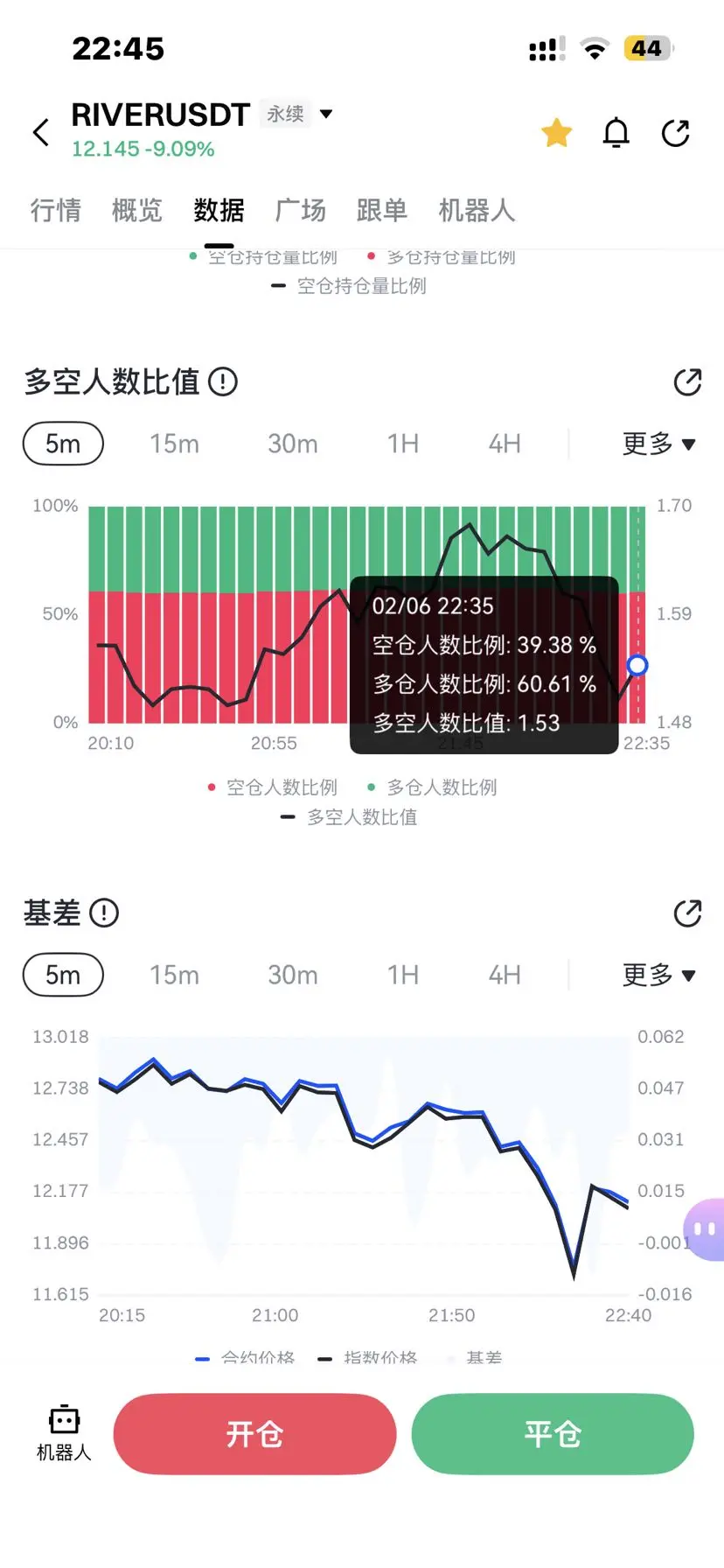

TradingKingGaoYuliang

The market experienced a significant upward movement in the evening, with Bitcoin showing relative strength. Ethereum is still oscillating near its previous high. US stocks pre-market rose by 0.7%. Tonight's short-term market may accelerate higher after the US stock market opens, which is a technical rebound. The surge is likely to fall back, so try not to chase the highs. The daily resistance levels to watch are 71,000 and 2,100 points#当前行情抄底还是观望?

View Original

- Reward

- like

- 4

- Repost

- Share

Self-DisciplineBrother :

:

Ethereum 1939 has been trapped. If it opens higher, at what level can I add another position? SecretaryView More

Bitcoin Market Outlook

The cyclical bottom for Bitcoin has clearly emerged.

The 59,000 level has formed a strong support, and a rebound of several thousand points occurred immediately after hitting the bottom.

The probability of breaking below 60,000 in the next one or two months is very low.

It is expected that the next two days will see a recovery trend, with oscillations and upward movement, followed by consolidation around 70,000.

The risk of entering long positions has significantly decreased, and everyone can consider strategic positioning.

The cyclical bottom for Bitcoin has clearly emerged.

The 59,000 level has formed a strong support, and a rebound of several thousand points occurred immediately after hitting the bottom.

The probability of breaking below 60,000 in the next one or two months is very low.

It is expected that the next two days will see a recovery trend, with oscillations and upward movement, followed by consolidation around 70,000.

The risk of entering long positions has significantly decreased, and everyone can consider strategic positioning.

BTC0,02%

- Reward

- 1

- Comment

- Repost

- Share

💲

黄金10000

Created By@_WithBillionsOfPeople

Subscription Progress

0.00%

MC:

$0

Create My Token

#Web3FebruaryFocus

As we step into February, the spotlight firmly shines on Web3, a revolutionary shift that continues to redefine the digital landscape. This month, the conversation is all about innovation, decentralization, and the transformative potential of blockchain technologies. Web3 is no longer just a buzzword it is becoming the backbone of new economic models, digital ownership, and community-driven ecosystems.

One of the most exciting aspects of Web3 is the empowerment of users. Unlike traditional centralized systems, where platforms hold control over data, assets, and interactions

As we step into February, the spotlight firmly shines on Web3, a revolutionary shift that continues to redefine the digital landscape. This month, the conversation is all about innovation, decentralization, and the transformative potential of blockchain technologies. Web3 is no longer just a buzzword it is becoming the backbone of new economic models, digital ownership, and community-driven ecosystems.

One of the most exciting aspects of Web3 is the empowerment of users. Unlike traditional centralized systems, where platforms hold control over data, assets, and interactions

DEFI-5,4%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 2

- Repost

- Share

StarPathProsperityContinuesTo :

:

Hurry up and run, continue to the waterfallView More

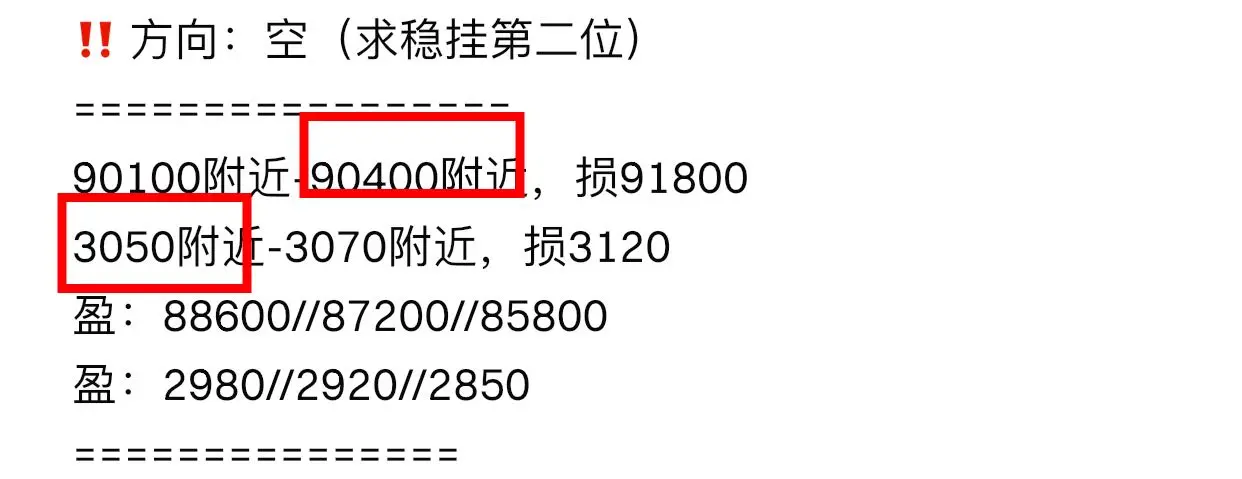

‼️Second order⬇️

‼️Direction: Long

Around 63,950 - 63,650, loss at 62,250

Around 1,825 - 1,805, loss at 1,755

Profit: 66,000 // 68,000 // 70,500

Profit: 1,880 // 1,950 // 2,030

#Gate1月透明度报告

View Original‼️Direction: Long

Around 63,950 - 63,650, loss at 62,250

Around 1,825 - 1,805, loss at 1,755

Profit: 66,000 // 68,000 // 70,500

Profit: 1,880 // 1,950 // 2,030

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

$HOODIt returned to the old neckline. the green zone is the old neckline retest zone. It shouldn’t lose this area

- Reward

- like

- 1

- Repost

- Share

makhanaky :

:

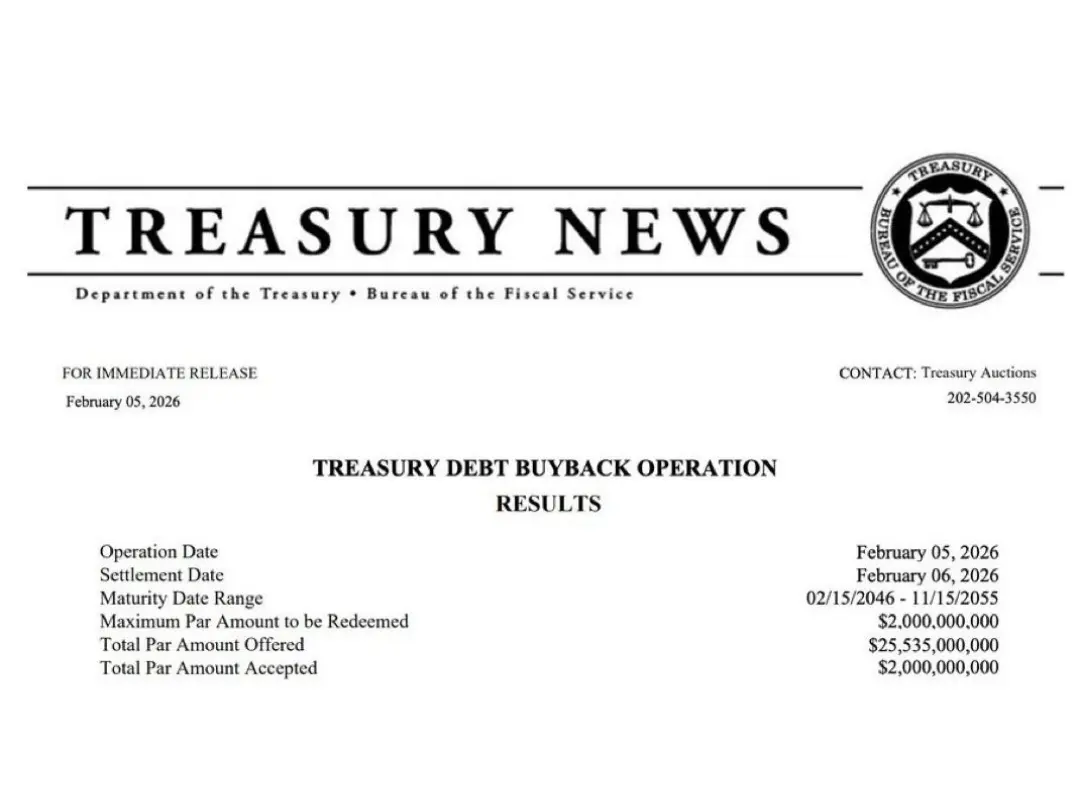

sir which I when to buy#عاجل🚨🚨🚨 : U.S. Treasury Department repurchases an additional $2 billion in debt

The U.S. Treasury Department completed an additional $2 billion debt buyback on February 6, injecting liquidity that can be redirected to broader financial markets.

Early signs of liquidity support could pave the way for a return to quantitative easing if this trend continues.

Join us for more technical analysis, important news, key market events, discussions, and much more – click follow on our official page.

#CryptoMarketPullback

$SOL

$XRP

$GT

View OriginalThe U.S. Treasury Department completed an additional $2 billion debt buyback on February 6, injecting liquidity that can be redirected to broader financial markets.

Early signs of liquidity support could pave the way for a return to quantitative easing if this trend continues.

Join us for more technical analysis, important news, key market events, discussions, and much more – click follow on our official page.

#CryptoMarketPullback

$SOL

$XRP

$GT

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Early signals of liquidity support could pave the way for the resumption of quantitative easing if this trend continues.#当前行情抄底还是观望? I prefer to wait and see, looking for clearer signals. This market-wide decline is driven by the Fed delaying interest rate cuts, combined with the synchronized downturn of global risk assets. From Bitcoin's trend, although it dipped to the $60,000 level, there is currently no strong buying support. In this macro and technical bearish environment, I will stay patient and not rush to buy the dip. I will wait until the market digests the negative news and shows signs of stabilization before considering phased positioning.

BTC0,02%

- Reward

- like

- Comment

- Repost

- Share

$PI Whether success or failure, this will be the last coin I guard in my life. Unconsciously, I have been in this circle for over 8 years. When I first met you, I immediately developed a strong interest. I couldn't put you down. In my heart, you are the best, and you are our beautiful future's childhood dream. The night will turn into the road we came from. This road is rugged and bittersweet, dark yet wonderful, full of doubt yet firm. Actually, each of us is working hard, with a common goal. Confused but self-aware, accepting their cold eyes and ridicule—none of this matters. It will become

PI-0,44%

- Reward

- 3

- 1

- Repost

- Share

GateUser-b8aad5cb :

:

2026 Go Go Go 👊QDH

QDH

Created By@ChiangMaiKunGe

Subscription Progress

0.00%

MC:

$0

Create My Token

$RIOTIt held the $12.66–$13.30 range, the order block zone. The green zone. . It shouldn’t lose this support and it shouldn’t break back below the red diagonal resistance it already broke. .

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF Institutional adoption in cryptocurrency markets is now extending beyond Bitcoin and Ethereum toward the core infrastructure of decentralized finance. Following the success of spot BTC and ETH ETFs, Bitwise Asset Management’s filing for a spot Uniswap (UNI) ETF represents a strategic milestone — signaling that DeFi governance assets are entering the regulatory and institutional mainstream.

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

- Reward

- 1

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

New Year Wealth Explosion 🤑After the crash, further downside or a rebound? Smart money appears ready to flip long

- Reward

- 1

- Comment

- Repost

- Share

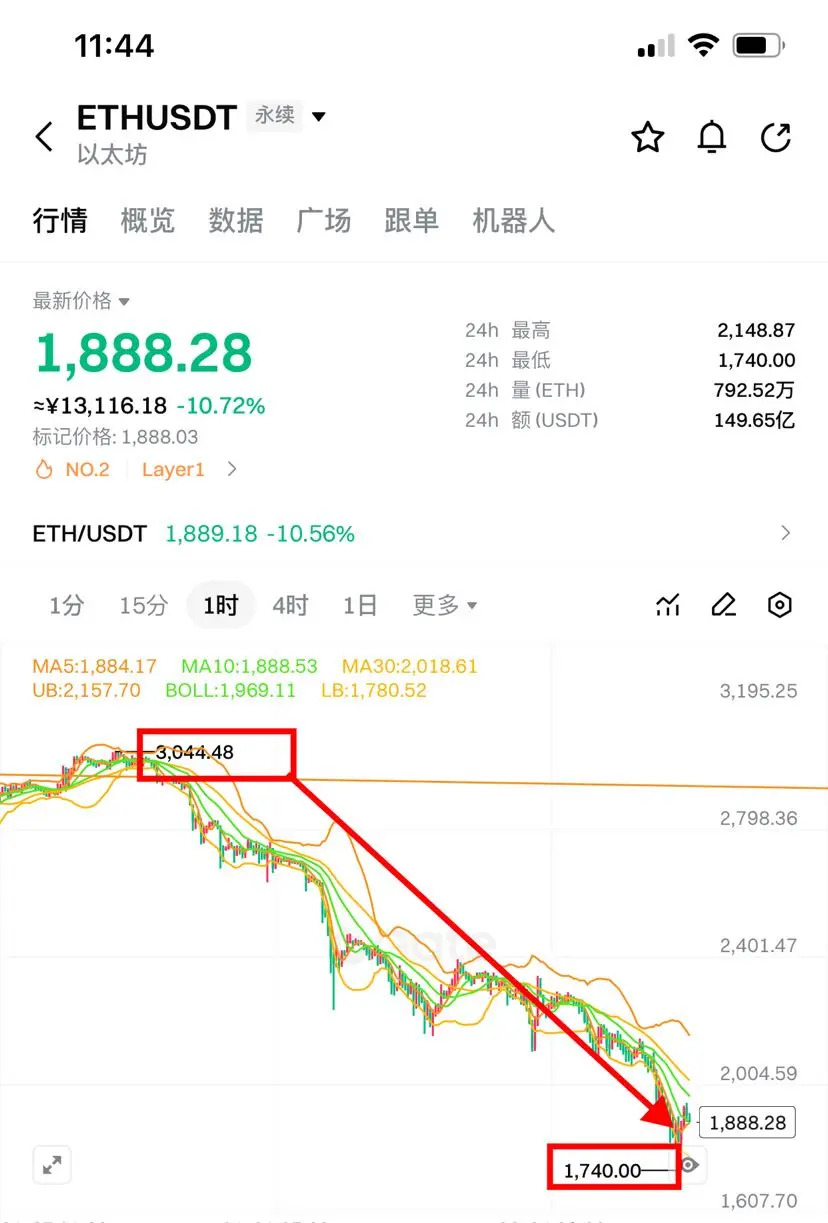

#ETH/USDT ANALYSIS$ETH is rebounding from the support trendline of the ascending triangle pattern, with the Ichimoku Cloud acting as a resistance barrier. Holding this level could lead to further upside, while a breakdown below the support trendline may result in additional correction. #crypto

ETH-1,36%

- Reward

- like

- Comment

- Repost

- Share

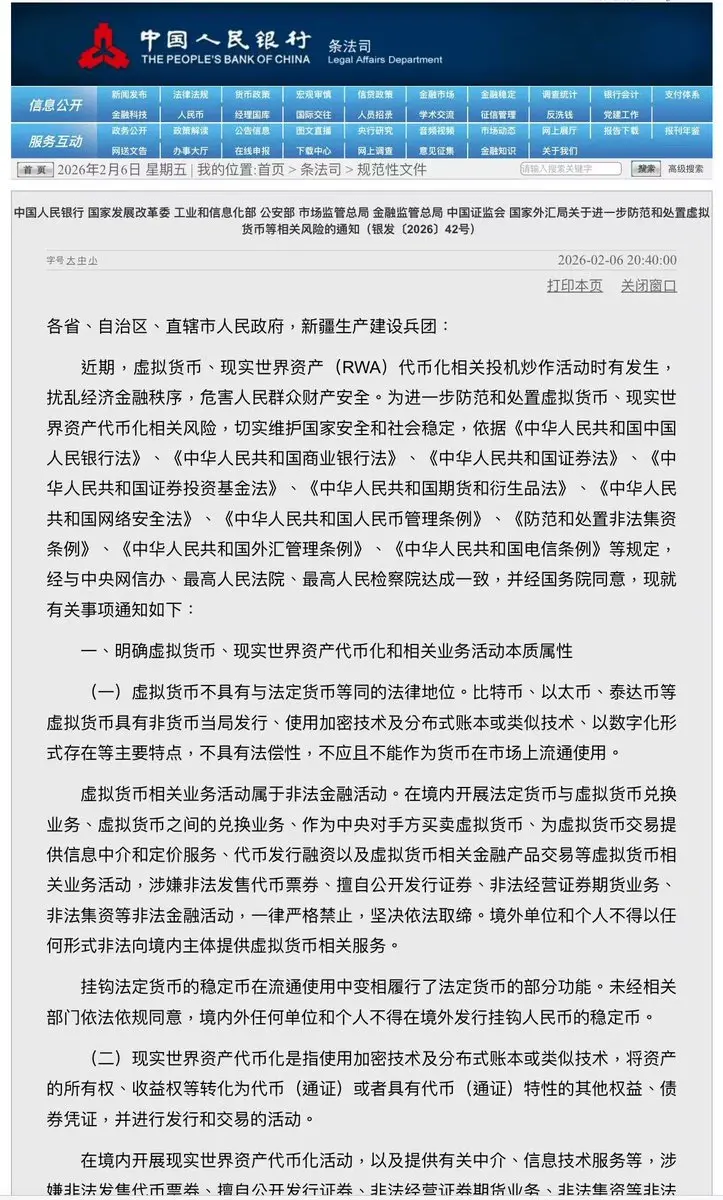

The new policy, mainland China is once again cracking down on cryptocurrencies. Does this count as a positive for 😂😂?

View Original

- Reward

- like

- Comment

- Repost

- Share

$POL is pulling back after a sharp rejection from local highs, with price now consolidating near a key intraday support zone.

Structure remains neutral to bullish as buyers continue to defend the range and volatility compresses.

EP

0.0940-0.0980

TP

TP1 0.1030

TP2 0.1120

TP3 0.1250

SL

0.0895

Liquidity was cleared on the downside with a quick sweep toward the lows, followed by tight consolidation. Price holding above support suggests absorption rather than breakdown, keeping continuation potential intact if momentum shifts back to buyers.

Let’s go $POL

Structure remains neutral to bullish as buyers continue to defend the range and volatility compresses.

EP

0.0940-0.0980

TP

TP1 0.1030

TP2 0.1120

TP3 0.1250

SL

0.0895

Liquidity was cleared on the downside with a quick sweep toward the lows, followed by tight consolidation. Price holding above support suggests absorption rather than breakdown, keeping continuation potential intact if momentum shifts back to buyers.

Let’s go $POL

POL-3,3%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More106.8K Popularity

18.75K Popularity

387.81K Popularity

6.4K Popularity

3.79K Popularity

Hot Gate Fun

View More- MC:$2.33KHolders:10.00%

- MC:$2.36KHolders:00.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

News

View MoreU.S. Marshals' cryptocurrency wallet stolen by internal personnel, $24.9 million

3 m

MegaETH announces that TGE will occur 7 days after achieving any KPI, and MEGA will have buyback and bidding functions.

10 m

U.S. Treasury Secretary Yellen: Signing the "Crypto Market Structure Act" into law is crucial

12 m

Data: 407.73 PAXG tokens have been transferred to Paxos, with an approximate value of $2 million USD.

19 m

U.S. February one-year inflation expectation initial value 3.5%, expected 4%

20 m

Pin