Post content & earn content mining yield

placeholder

HighAmbition

#RussiaStudiesNationalStablecoin

In mid-February 2026, Russia's Central Bank (Bank of Russia) made headlines by announcing a major policy reassessment: it will conduct a formal feasibility study throughout 2026 on the potential creation and issuance of a national stablecoin pegged to the Russian ruble.

This announcement came directly from First Deputy Governor Vladimir Chistyukhin during the Alfa Talk conference in Moscow (around February 12–13, 2026), as reported by official sources like TASS and echoed across crypto media outlets.

What is a National Stablecoin?

A stablecoin is a type of cry

In mid-February 2026, Russia's Central Bank (Bank of Russia) made headlines by announcing a major policy reassessment: it will conduct a formal feasibility study throughout 2026 on the potential creation and issuance of a national stablecoin pegged to the Russian ruble.

This announcement came directly from First Deputy Governor Vladimir Chistyukhin during the Alfa Talk conference in Moscow (around February 12–13, 2026), as reported by official sources like TASS and echoed across crypto media outlets.

What is a National Stablecoin?

A stablecoin is a type of cry

BTC-2,89%

- Reward

- 6

- 6

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

$RIVER Contract, to put it bluntly, it's gambling. If you lose, just admit it. It's fine. Going long loses money, going short makes money. The unrealized loss is almost $3000. Are you saying you're making money from fees? Aren't you just fooling yourself? Holding the position is just holding the position. Don't really think you're doing long-term investing.

View Original

- Reward

- like

- Comment

- Repost

- Share

No. 1 team, 1 week of practice, 1 month of fear, still couldn’t play him

- Reward

- like

- Comment

- Repost

- Share

BML

白龙马

Created By@LittleWhiteDragon

Subscription Progress

0.10%

MC:

$71.41

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VgBGVQwL

View Original

- Reward

- like

- Comment

- Repost

- Share

Based on the DOGE/USDT 30-minute chart, the current price is trading at **0.10734**, below the **EMA44 0.10990** but above the **SMA100 0.10425**.

Here is the chart analysis:

- **Position & Price Trend:** The current price is in a consolidation phase after a recent downtrend. It is respecting the EMA44 as a dynamic resistance, having rejected it multiple times in recent candles, while the SMA100 below is acting as a strong support level.

- **Key Levels:**

- **Resistance:** Immediate resistance is the EMA44 at **0.10990**. Breaking this level could signal a trend reversal or a stron

Here is the chart analysis:

- **Position & Price Trend:** The current price is in a consolidation phase after a recent downtrend. It is respecting the EMA44 as a dynamic resistance, having rejected it multiple times in recent candles, while the SMA100 below is acting as a strong support level.

- **Key Levels:**

- **Resistance:** Immediate resistance is the EMA44 at **0.10990**. Breaking this level could signal a trend reversal or a stron

DOGE-12,47%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQBMV1sJ

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VlhGVlpW

View Original

- Reward

- like

- Comment

- Repost

- Share

🗞️Crypto Daily | 02/16/2026

1. Market Developments

• Bitcoin (BTC): $68,988.13 USD (−1.1% / 24h)

BTC corrects after failing to hold the $70,000 mark.

• Ethereum (ETH): $1,975.43 USD (−5.4% / 24h)

ETH faces stronger selling pressure compared to the overall market.

• XRP: ~1.55 USD (+5% / 24h)

Contrarian market movement thanks to buy-the-dip momentum.

• Liquidity: Approximately $736 million USD in short positions liquidated as BTC tests the $70k zone → Significant volatility during the day.

2. Macroeconomic Factors & Capital Flows

• US Inflation (CPI): January at 2.4% YoY, below forecast → Expe

View Original1. Market Developments

• Bitcoin (BTC): $68,988.13 USD (−1.1% / 24h)

BTC corrects after failing to hold the $70,000 mark.

• Ethereum (ETH): $1,975.43 USD (−5.4% / 24h)

ETH faces stronger selling pressure compared to the overall market.

• XRP: ~1.55 USD (+5% / 24h)

Contrarian market movement thanks to buy-the-dip momentum.

• Liquidity: Approximately $736 million USD in short positions liquidated as BTC tests the $70k zone → Significant volatility during the day.

2. Macroeconomic Factors & Capital Flows

• US Inflation (CPI): January at 2.4% YoY, below forecast → Expe

- Reward

- like

- Comment

- Repost

- Share

⚡️ Eric Trump says big banks are trying everything to delay or block pro-crypto laws — because when crypto wins, financial power shifts to the people.

- Reward

- 1

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVMB1BDCQ

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$11.6K

More Tokens

🚨 US SEC Advances Crypto Reform! 🚨

The U.S. Securities and Exchange Commission (SEC) is moving forward with significant reforms aimed at strengthening oversight and regulation in the cryptocurrency space. These changes could bring more clarity to the market, enhance investor protection, and pave the way for more institutional participation in digital assets.

Key highlights:

Increased transparency requirements for crypto exchanges and projects

Stricter rules on digital asset offerings and trading practices

Measures to protect investors from fraud and market manipulation

Potentially smoother p

The U.S. Securities and Exchange Commission (SEC) is moving forward with significant reforms aimed at strengthening oversight and regulation in the cryptocurrency space. These changes could bring more clarity to the market, enhance investor protection, and pave the way for more institutional participation in digital assets.

Key highlights:

Increased transparency requirements for crypto exchanges and projects

Stricter rules on digital asset offerings and trading practices

Measures to protect investors from fraud and market manipulation

Potentially smoother p

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

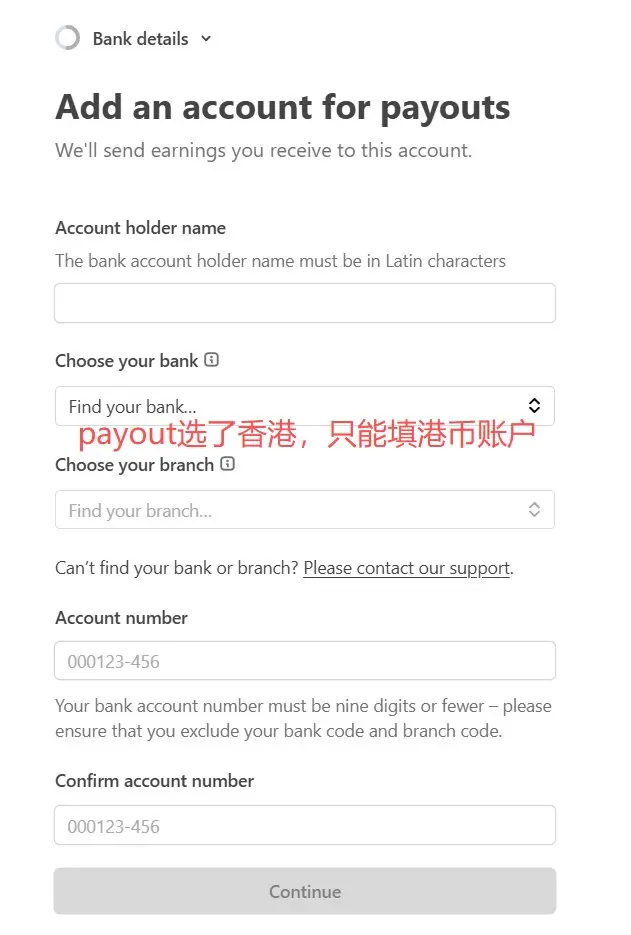

To The Moon 🌕Wise does not require a passport for verification!!

If you want to open a Hong Kong account in Wise, remember to use your ID card to open it first.

This way, you can have both a HKD account and a USD account in Wise.

I initially used my passport to open a Wise USD account, which prevented me from obtaining a Wise HKD account because the HKD account can only be verified with an ID card.

Wise also does not support adding another ID card for identity verification.

So I still don't have a HKD account, which has caused me to reach 5 million in exposure but get stuck on the Stripe account linking pa

View OriginalIf you want to open a Hong Kong account in Wise, remember to use your ID card to open it first.

This way, you can have both a HKD account and a USD account in Wise.

I initially used my passport to open a Wise USD account, which prevented me from obtaining a Wise HKD account because the HKD account can only be verified with an ID card.

Wise also does not support adding another ID card for identity verification.

So I still don't have a HKD account, which has caused me to reach 5 million in exposure but get stuck on the Stripe account linking pa

- Reward

- like

- Comment

- Repost

- Share

Vietnam Crypto Crash Shocks Startups, 17 Million Investors Affected - #bidv #sec #vietnam

View Original

- Reward

- like

- Comment

- Repost

- Share

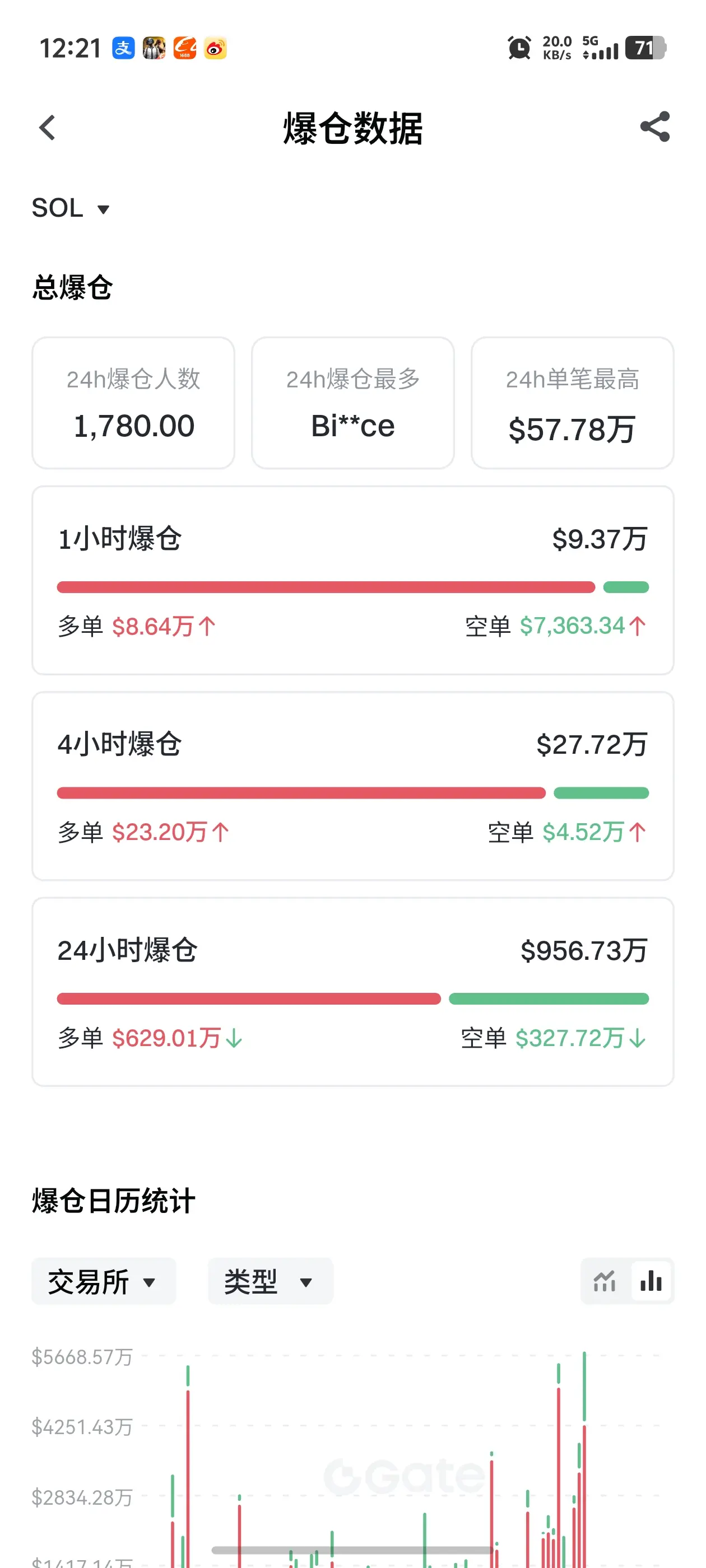

Network-wide Data Analysis: Bulls Are Still Being Continuously Liquidated, Bearish Trend Remains Unchanged

1. Liquidation Data: Bulls Dominating Liquidations

- Total liquidations over the past 24 hours amount to $9.5673 million, with long positions accounting for $6.2901 million, over 65%; within 1 hour, long liquidations are $86,400, far exceeding short liquidations of $7,363, indicating that during price declines, a large number of high-leverage longs are forcibly closed, which is a direct manifestation of “bull trap.”

- Liquidation details show that longs are mainly liquidated in the $85-$8

1. Liquidation Data: Bulls Dominating Liquidations

- Total liquidations over the past 24 hours amount to $9.5673 million, with long positions accounting for $6.2901 million, over 65%; within 1 hour, long liquidations are $86,400, far exceeding short liquidations of $7,363, indicating that during price declines, a large number of high-leverage longs are forcibly closed, which is a direct manifestation of “bull trap.”

- Liquidation details show that longs are mainly liquidated in the $85-$8

BTC-2,89%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Spot gold and silver gap lower with wider intraday volatility

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

🚀 Hong Kong is stepping up its Virtual Asset game!

The Securities and Futures Commission (SFC) has unveiled new guidelines for virtual asset trading, allowing licensed brokers to offer margin and leveraged products to professional investors. This is a major step in building Hong Kong as a global VA hub while keeping investor protection strong.

💡 Key Points:

Licensed brokers can now provide VA financing to qualified clients

Frameworks for leveraged VA products are now clearer

Expanded licensing for VA custody, advisory, and management services coming in 2026

Hong Kong’s goal? Innovation, grow

The Securities and Futures Commission (SFC) has unveiled new guidelines for virtual asset trading, allowing licensed brokers to offer margin and leveraged products to professional investors. This is a major step in building Hong Kong as a global VA hub while keeping investor protection strong.

💡 Key Points:

Licensed brokers can now provide VA financing to qualified clients

Frameworks for leveraged VA products are now clearer

Expanded licensing for VA custody, advisory, and management services coming in 2026

Hong Kong’s goal? Innovation, grow

- Reward

- 3

- 3

- Repost

- Share

Yunna :

:

Hold tight 💪View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVLFA1GLVA

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More128.94K Popularity

22.81K Popularity

20.34K Popularity

65.18K Popularity

9.57K Popularity

News

View MoreEthereum Foundation Co-Executive Director: Ethereum can become a chain driven by large language models, currently with natural advantages

2 m

Willy Woo: The market has pre-priced the quantum threat with 4 million sell pressure, and BTC price performance will continue to be overshadowed by gloomy conditions

15 m

Data: 60 BTC transferred out from Cumberland DRW, worth approximately $4.1 million

33 m

An address containing 1,430 ETH pre-mined coins was activated after being dormant for over 10 years.

46 m

Spot gold falls below $4,970 per ounce, declining 1.53% intraday

47 m

Pin