Post content & earn content mining yield

placeholder

Gate Live · Refresh Season | Revamped App, Ignited Excitement https://www.gate.com/campaigns/3873?ref=VQBFUFLCBA&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

PrincessOfBitcoin :

:

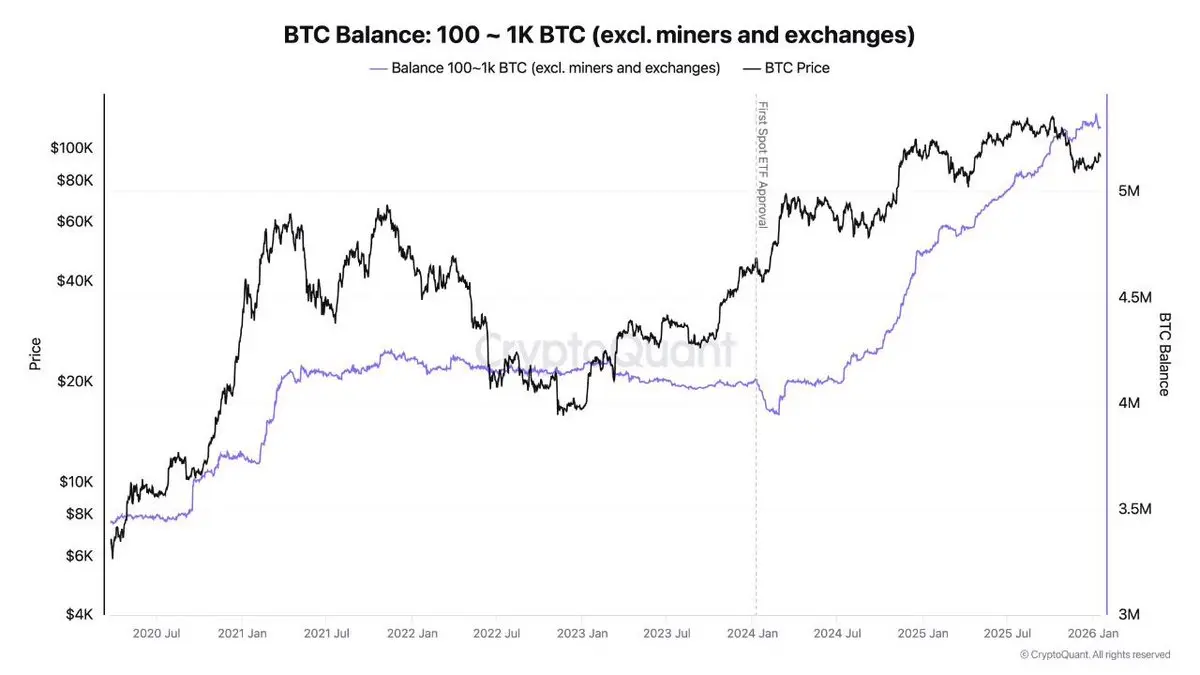

Buy To Earn 💎CEO CQ: Institutional demand for Bitcoin remains strong.

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in.

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in.

BTC-2,23%

- Reward

- like

- Comment

- Repost

- Share

庆庆马

庆庆马

Created By@VKidney

Listing Progress

1.85%

MC:

$3.82K

Create My Token

#Gate广场创作者新春激励

In early 2026, U.S. President Trump issued a "Greenland Tariff" threat, triggering tensions in US-Europe trade relations, leading to a 3% single-day drop in Bitcoin prices on January 18th, and causing the total market capitalization of cryptocurrencies to evaporate by hundreds of billions of dollars. So, what short-term and long-term impacts will this tariff war have on Bitcoin prices? How does this tariff war differ from the US-China tariff war in 2025? How should we respond? Here, Little Wealth God will guide you through:

1. Short-term Impact: Risk Asset Attributes Dominate

In early 2026, U.S. President Trump issued a "Greenland Tariff" threat, triggering tensions in US-Europe trade relations, leading to a 3% single-day drop in Bitcoin prices on January 18th, and causing the total market capitalization of cryptocurrencies to evaporate by hundreds of billions of dollars. So, what short-term and long-term impacts will this tariff war have on Bitcoin prices? How does this tariff war differ from the US-China tariff war in 2025? How should we respond? Here, Little Wealth God will guide you through:

1. Short-term Impact: Risk Asset Attributes Dominate

BTC-2,23%

- Reward

- 4

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Who Will Take Control of the Global "Money Printer"? The Ultimate Prediction for the Next Federal Reserve Chair

The dust is about to settle, and the suspense will be revealed next week!

View OriginalThe dust is about to settle, and the suspense will be revealed next week!

- Reward

- like

- Comment

- Repost

- Share

2026 MARKET Crypto Market Analysis

- Reward

- like

- Comment

- Repost

- Share

Can't laugh anymore 😂

The real New Year is here, and all kinds of monsters and ghosts are coming out 👻

This scammer's method is too primitive, never click on links, on Android it automatically downloads when opened

What's even funnier is that this guy is probably a newbie, he didn't even hide his phone number, using a domestic number to pretend to be a foreigner, don't blame me for exposing it

This must be a warning to everyone

I've only partially masked the website

And be sure to download the anti-fraud app haha

#反诈 # scammer

View OriginalThe real New Year is here, and all kinds of monsters and ghosts are coming out 👻

This scammer's method is too primitive, never click on links, on Android it automatically downloads when opened

What's even funnier is that this guy is probably a newbie, he didn't even hide his phone number, using a domestic number to pretend to be a foreigner, don't blame me for exposing it

This must be a warning to everyone

I've only partially masked the website

And be sure to download the anti-fraud app haha

#反诈 # scammer

- Reward

- like

- Comment

- Repost

- Share

1. Celebrate the horse coin, bring prosperity and good fortune

2. With celebration in hand, get rich in the Year of the Horse

3. Celebrate the new year, horse coin brings blessings No market maker dumping, all retail investors

View Original2. With celebration in hand, get rich in the Year of the Horse

3. Celebrate the new year, horse coin brings blessings No market maker dumping, all retail investors

[The user has shared his/her trading data. Go to the App to view more.]

MC:$7.2KHolders:173

16.72%

- Reward

- 1

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVIWA1BFAG&ref_type=126&shareUid=VFZAXV1XAAEO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVIWA1BFAG&ref_type=126&shareUid=VFZAXV1XAAEO0O0O

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVJGV1EKVQ&ref_type=126&shareUid=VFdMUVhYAQMO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVJGV1EKVQ&ref_type=126&shareUid=VFdMUVhYAQMO0O0O

- Reward

- like

- Comment

- Repost

- Share

Me After Loosing My Whole Salary In One Trade

- Reward

- like

- Comment

- Repost

- Share

Smart Leverage Event Is Live: Subsidy for New Users, Bigger Bonuses as You Trade https://www.gate.com/campaigns/3808?ref=VVEWAWHXCA&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

147258

逍遥仙宗

Created By@GateUser-3145cf0e

Listing Progress

0.05%

MC:

$3.5K

Create My Token

Following back to a dozen or so accounts at once will get you restricted,

so I will be following back gradually.

If you haven't been followed back yet, please leave a message to remind me, I will definitely follow back 🙏

#互關 # mutual follows will be followed back #mutualfo

View Originalso I will be following back gradually.

If you haven't been followed back yet, please leave a message to remind me, I will definitely follow back 🙏

#互關 # mutual follows will be followed back #mutualfo

- Reward

- like

- Comment

- Repost

- Share

Get gold on Gate App, receive 1g every 10 minutes

View Original

- Reward

- like

- Comment

- Repost

- Share

$RKLB $TSLA $SOFI $KTOS

A sharp open is waiting for us

A sharp open is waiting for us

- Reward

- like

- Comment

- Repost

- Share

If you don’t treat your lady like this — take notes. GM from the new apartment!

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3735?ch=O1onw3g2&ref=VVEWAWHXCA&ref_type=132

- Reward

- like

- 1

- Repost

- Share

GateUser-9ea22591 :

:

Happy New Year! 🤑Pricing concerns in Greenland, dollar tensions - - #cryptocurrency #bitcoin #altcoins

BTC-2,23%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More468 Popularity

30.82K Popularity

47.86K Popularity

9.58K Popularity

7.71K Popularity

Hot Gate Fun

View More- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.48KHolders:20.14%

- MC:$3.82KHolders:21.85%

News

View MoreCardone Capital discloses an additional purchase of $10 million worth of Bitcoin

1 m

A trader closed a 4-day ETH short position, earning a profit of $760,000.

13 m

XRP shows signs of a 2022 crash again? Three major historical patterns return, is breaking below $1 the focus?

15 m

On-chain HYPE main long whales are all deeply trapped, with the top holder in the position list "suspected of HYPE coin listing insider trading" showing an unrealized loss of $21.3 million.

17 m

Will UAE schools introduce Bitcoin courses? 2026 Cryptocurrency Education Rumors Spark Global Attention

19 m

Pin