Post content & earn content mining yield

placeholder

Jack23

how it feels to hit a 20x in this market:

- Reward

- like

- Comment

- Repost

- Share

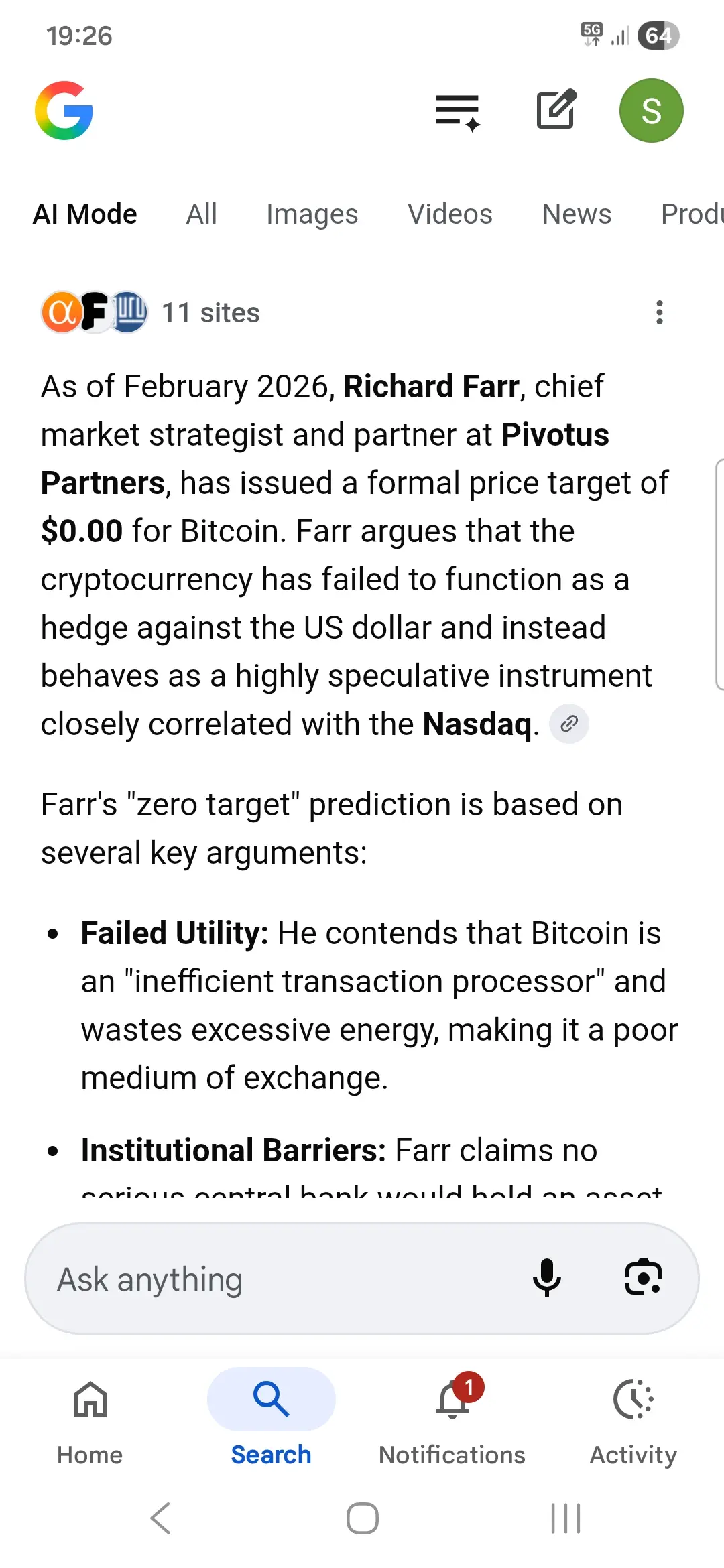

Bitcoin extends its rally, briefly breaking above $70,000 overnight — How will the weekend trend unfold?

- Reward

- like

- Comment

- Repost

- Share

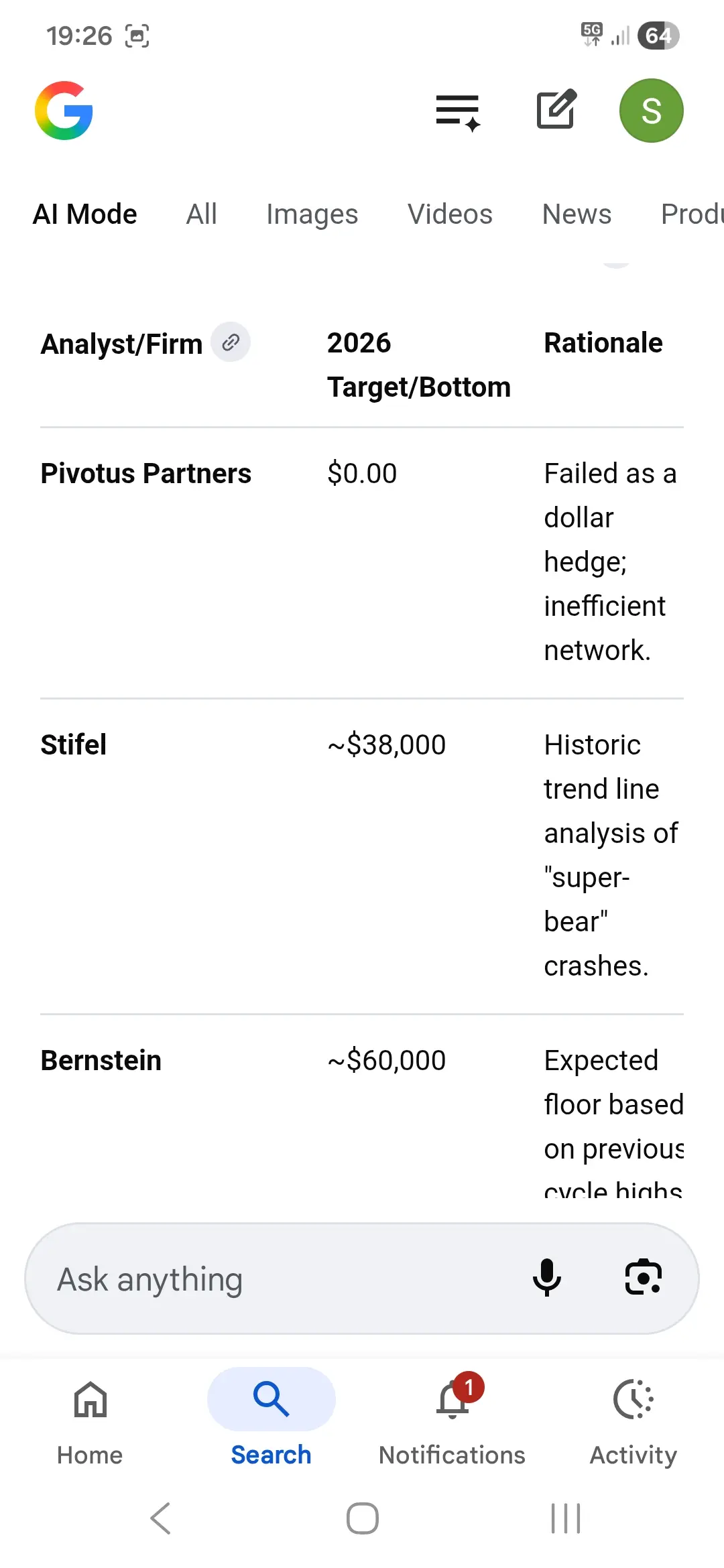

I am not necessarily bullish on Hyperlend, but do some people really think it\'s going to trade sub 20M FDV?

- Reward

- like

- Comment

- Repost

- Share

MORPH

METAMORPH

Created By@GateUser-a92a1b14

Listing Progress

0.14%

MC:

$2.42K

Create My Token

【$BREV Signal】Long | Healthy Cool-down After Breakout with Volume Surge

$BREV After a massive rally, the price enters a high-level consolidation phase. This is a typical healthy cool-down after a breakout, not a top distribution.

🎯Direction: Long

🎯Entry: 0.1620 - 0.1640

🛑Stop Loss: 0.1550 (Rigid Stop Loss)

🚀Target 1: 0.1800

🚀Target 2: 0.2000

Logical Core: On the 4H chart, volume surged over 30%, breaking above the previous high of 0.1573, confirming momentum. Despite the price rally, open interest remains stable and funding rates stay negative, indicating that bears are still resisting, f

View Original$BREV After a massive rally, the price enters a high-level consolidation phase. This is a typical healthy cool-down after a breakout, not a top distribution.

🎯Direction: Long

🎯Entry: 0.1620 - 0.1640

🛑Stop Loss: 0.1550 (Rigid Stop Loss)

🚀Target 1: 0.1800

🚀Target 2: 0.2000

Logical Core: On the 4H chart, volume surged over 30%, breaking above the previous high of 0.1573, confirming momentum. Despite the price rally, open interest remains stable and funding rates stay negative, indicating that bears are still resisting, f

- Reward

- like

- Comment

- Repost

- Share

15 years ago, Satoshi Nakamoto logged off and hasn’t returned.What happens if he returns and sells it all?

- Reward

- like

- Comment

- Repost

- Share

$PERCOLATOR It’s currently sitting at 1.5M marketcap, I bought some. Looking to sell at 6-7 M

- Reward

- like

- Comment

- Repost

- Share

Today market update

- Reward

- like

- Comment

- Repost

- Share

EU Hits TikTok Hard Over Addiction Features - - #beuc #eu #mep

- Reward

- like

- Comment

- Repost

- Share

Happy Saturday ☀️How are you spending your day off?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

What\'s your guys plan for the day? I am getting some yoga in right now

- Reward

- like

- Comment

- Repost

- Share

Li-jian

工机

Created By@GateUser-e65975dc

Listing Progress

0.00%

MC:

$2.43K

Create My Token

Stay away from the second pancake; he can be defeated in countless ways.

View Original

- Reward

- like

- Comment

- Repost

- Share

🔥 $BEAT Bears Taking Control 🔥

$BEAT is losing its grip on local highs and the tape is screaming weakness.

Buyers are exhausted, momentum has flipped, and smart money looks done distributing. 📉

$BEAT — SHORT SETUP

🎯 Entry: 0.19 – 0.197

🛑 SL: 0.205

Take Profits:

✅ TP1: 0.170

✅ TP2: 0.159

✅ TP3: 0.155

Why this works 👇

🔻 Failed break above structural resistance

🔻 Clear bearish FVG left behind

🔻 Internal buy-side liquidity swept & trapped

🔻 Sharp downside displacement = order flow flip

There’s a heavy pool of sell-side liquidity resting below, still untouched. Price looks primed to ble

$BEAT is losing its grip on local highs and the tape is screaming weakness.

Buyers are exhausted, momentum has flipped, and smart money looks done distributing. 📉

$BEAT — SHORT SETUP

🎯 Entry: 0.19 – 0.197

🛑 SL: 0.205

Take Profits:

✅ TP1: 0.170

✅ TP2: 0.159

✅ TP3: 0.155

Why this works 👇

🔻 Failed break above structural resistance

🔻 Clear bearish FVG left behind

🔻 Internal buy-side liquidity swept & trapped

🔻 Sharp downside displacement = order flow flip

There’s a heavy pool of sell-side liquidity resting below, still untouched. Price looks primed to ble

BEAT5,47%

- Reward

- like

- Comment

- Repost

- Share

VC coins are continuously inflationary, unlocking every month; other memecoins are fully circulating for a lifetime, with no barriers besides popularity; Snowball coins are continuously deflationary, being repurchased and burned every minute, making the supply increasingly scarce, and the community builders are growing more and more; so, which one will you buy ❓#雪球 $BNB #FLAP

View Original

- Reward

- like

- Comment

- Repost

- Share

【$ETH Signal】Short Position + Downtrend Consolidation

$ETH enters a weak consolidation after a sharp decline, with price action indicating a downtrend continuation. In the 4H timeframe, the price rebound is weak and consistently suppressed by VWAP. Key data reveals the truth: Taker Volume shows net selling, the funding rate is negative but with a very small absolute value, indicating that the main short sellers have not exited the market. Stable open interest suggests a brief balance between bulls and bears, serving as a buildup before the next downward move.

🎯 Direction: Short

Market logic

View Original$ETH enters a weak consolidation after a sharp decline, with price action indicating a downtrend continuation. In the 4H timeframe, the price rebound is weak and consistently suppressed by VWAP. Key data reveals the truth: Taker Volume shows net selling, the funding rate is negative but with a very small absolute value, indicating that the main short sellers have not exited the market. Stable open interest suggests a brief balance between bulls and bears, serving as a buildup before the next downward move.

🎯 Direction: Short

Market logic

- Reward

- like

- Comment

- Repost

- Share

Something extremely wrong just happened 🚨ETH USDT moved violently within secondsOver 100 dollar swings repeated over 40 timesLarge short and long positions got completely liquidated.Price was clearly forced into liquidation levelsManipulator profits unknown.

ETH2,27%

- Reward

- like

- Comment

- Repost

- Share

$Percolator Percolator99.5K → 6.4M in 8 minutesI called it.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More139.6K Popularity

31.17K Popularity

391.96K Popularity

13.01K Popularity

12.07K Popularity

News

View MoreETH Breaks Through 2100 USDT

16 m

Data: If BTC breaks through $72,700, the total liquidation strength of mainstream CEX short positions will reach $1.252 billion.

21 m

Market maker grid strategy anomaly has caused fluctuations in ETH prices, leading to abnormal market conditions and increased volatility.

2 h

A newly created wallet withdraws 60,000 ETH from CEX and then deposits it into Aave V3.

2 h

ETH drops below 2050 USDT

2 h

Pin